I had my credit frozen at big three credit bureaus after the burglary event two years ago (see Lessons After A Burglary: Physical Security). I don’t subscribe to any credit monitoring service like Credit Karma. Two banks that I have a credit card with — Bank of America and Barclays — give monthly updated FICO scores for free. I only look at them very infrequently.

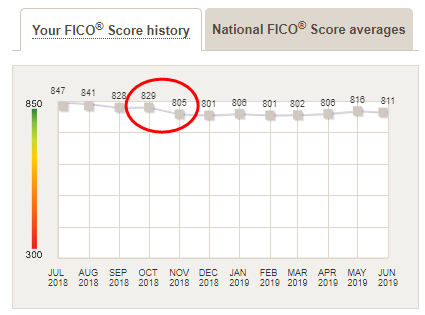

When I checked my credit score last week, I saw a large drop in November 2018. That was when I paid off my mortgage (see I Paid Off My Mortgage But My Housing Cost Didn’t Go Down). The graph below was from Bank of America. My FICO score dropped 24 points from 829 to 805 right after I paid off the mortgage. It stayed around there since then. The latest score was 811.

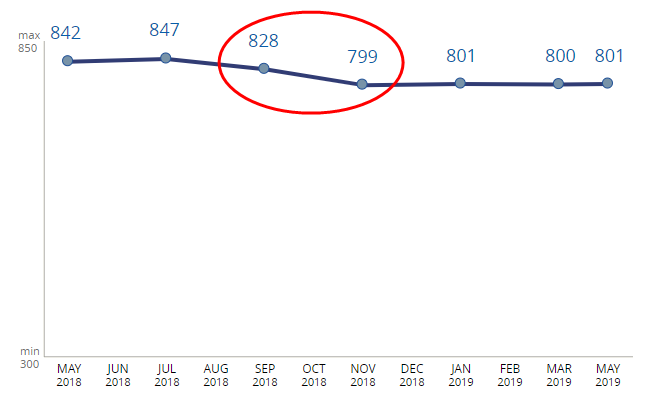

I also checked on Barclays. The FICO score history graph there showed the same thing. My score dropped 29 points from 828 to 799 after I paid off my mortgage. The score also stayed there since then.

Both places also showed a drop of about 20 points between July and September 2018. I made large principal payments toward the mortgage during that time. If I also include that effect, the total drop from paying off the mortgage would be 42 points and 48 points from my two sources.

The banks also gave the reasons for why my credit score wasn’t higher. The No.1 reason given was:

Proportion of loan balances to loan amounts is too high

FICO® Scores weigh the balances of mortgage and non-mortgage installment loans (such as auto or student loans) against the original loan amounts shown on a person’s credit report. Your score was impacted because your proportion of installment loan balances to the original loan amounts is too high.

When you read reasons like this, you can’t read them too literally. It’s not saying my current loan balance is really “too high.” It just means if the proportion of my loan balances to the original loan amounts was lower, my credit score could be higher. After I paid off my mortgage, I still have a 0% car loan (see Buy a New Car Easily Without Using a Service). The 5-year loan was taken out in December 2017. So I still have a balance of 70% of the original loan amount. This is now flagged when that 70% number looks high. It wasn’t an issue when my outstanding balance on the mortgage was low relative to the original loan amount.

Altogether I would call it drop of 20-50 points from paying off the mortgage. It doesn’t bother me because I’m not looking for more credit. Because my credit score is still good afterwards, it doesn’t affect anything. The credit score should really be called a credit grade. As long as your score still belongs to the excellent grade, it makes zero difference whether the score is 801, 829, or 847. It matters only when the drop kicks you below a cutoff. Usually any score above mid-700 will be considered as good credit.

Say No To Management Fees

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.

JoeTaxpayer says

And yet, seeing that 850 on my FICO score (Also from Bank of America) just brings me joy.

I still have 7 years until the mortgage is gone. I’ll know what to expect now.

Shawn says

Paying off a mortgage can also cause a drop in score because it alters your “Credit Mix.”

My mortgage was recently sold/transferred to a different bank. During this process there was about a month of time where the original loan was now listed as “Closed/Paid” but the new bank hadn’t reported the account yet. So this would be similar to me paying it off from the report standpoint.

During this time my score went from TU:826 & EF:824 down to TU:813 &EF:797.

So TransUnion dropped 13 and Equifax dropped 27 points because I no longer had an active home loan.

I still had an auto loan and credit cards, with credit cards all at a $0 balance.

(I pay off the current month balance a few days before the statement closing date so they always report as 0% utilization.)

Immediately after the new mortgage servicer reported the loan my scores returned exactly to 826 & 814.

Chris says

I had a credit score of 850 until I paid off my mortgage a couple of years ago. I haven’t had car debt in years. I have paid off my credit cards monthly, for years. My score dropped around 25 points and now tends to be around 818 to 825. My next big purchase will be a replacement car, but I’ll probably just pay cash. I don’t need FICO anymore: As a highly qualified engineer with strong statistical and math experience I find their techniques to be amateurish, at best. After all, why penalize the people who are the most capable of paying off a debt?

Elgo says

This just happened to me.

After I paid off my mortgage my FICO dropped from 845 to 811.

That’s a head scratcher. You’d think that now that I have less debt and proof that I can pay off a large account my FICO score would go up.

Tom says

I find this ridiculous, I have a mortgage also, pay $1500 over my monthly fee. I have an auto loan and one other loan which I pay every month. I have never missed a payment. My credit score was 823. Last month I charged $25 on my credit card and it came up on my credit report. I paid the charge one week after my purchase. My credit score “TransUnion” dropped my score to 803. Ridiculous.

Drew says

I paid off the remaining 13,000 on my mortgage and my score dropped by 30 points?!?! I have a great payment history and now have zero debt. How is this even possible? I expected my score to go up only to find a huge downturn instead. This is insane and only bolsters my opinion that the Credit Bureau is just another branch of organized crime. Unreal!

Laura says

I just received this unexpected change. Mine dropped 37 points! I, too had a perfect payment history !

wrotenwasp63 says

The credit bureau isn’t that legitimate. The same thing happened when I paid off my mortgage…those bastards dropped my score 30 pts. No credit cards, just debit, no car loan. When I saw that new score it just made me even more determined to keep paying cash for everything.

C. Spears says

Why did my credit score drop 38 points, after just one late mortgage payment (posted two days late!) ???

Stone says

@C Spears, being late on a mortgage is the worst late you can have, 38 points sounds about right.

Scammed by FICO says

Exact same situation here. Paid off mortgage, credit score (FICO) dropped by 26 points and has stayed there for last 2 months at 802. This highlights just what complete BS these credit scores are. Suddenly I’m a higher risk because I have *less* debt and have shown a consistent ability to pay off any all all debt? What kind of stupidity is this? There is something extremely wrong with their algorithms if this is what happens after years of maintaining a high credit score (825+). So I have to get myself into more debt to prove I am creditworthy, after decades of proving it already? Screw you.

Susan James says

Your story is almost identical to mine, except for the scores. I was at 850 for years. One credit card company had me at 871 which was strange because I thought 850 was the highest score you could get? Every single account I have or had has “exceptional” payment history noted. I sold my condo in Aug after living in it for 15 years and never missed a single payment. In fact, I pay all my bills 2 weeks before the due dates. 1 month later, I get an email from my bank saying “see your updated FICO score” which is normal. My score dropped 35 points!! I then check 2 other accounts and those also dropped 31-33 points. So now I’m being “punished” for not having a mortgage debt? WTF????

PK says

Exact same situation here. Paid off mortgage, credit score (FICO) dropped by 23 points. Suddenly I’m a higher risk because I have *less* debt and have shown a consistent ability to pay off any all all debt? None of this makes any sense. I really thought it would go up 23. Very baffling…

Paul says

Just paid off my mortgage after 31 years. Zero late fees on all my accounts and my credit score dropped. WTF?

Joseph says

Same here. I had 21,000 left in my mortgage I payed it in full and my account closed. My credit score dropped 74 points. You read that right. 74 points.

John Young says

When you pay off the biggest loan of your life and your credit score drops, that is not logical. But of course FICO is based in California where there seems to be a major deficit of logic these days.

Michael says

Wow, I just paid off my mortgage-I dropped close to 70 points. I see if you have no debt-pay all credit cards every month-you are a bad risk. HUMMMM Dave Ramsey said it best-I want a Zero credit score. Folks Im too old to care now but sad you would think people like us have a lower risk of default!!! LOL.

Authorized_User says

Same here. I paid off my mortgage 10 years early, and my score dropped from 850 to 830. I agree–it is insane to think that now that I’m not obligated to pay a recurring debt that I am more of a credit risk. I have been using credit karma which provides a weekly score update. The score from each bureau is sensitive to when in the monthly cycle they pull credit card balance data. Which doesn’t make a lot of sense either, given they are paid in full each month.

rvdbos says

I am in the same boat. Payed off ALL my debts: cars, mortgage etc. FICO dropped from 870-ish down to 830. Lost 40 points of creditworthiness 🙂 Apparently, credit score means how valuable you are to the banking industry – you have to pay them monthly interest to maintain the highest score. If you payoff your debts prematurely you are not making them any money. In Debt economy this is No Bueno.

ronald k hodgins says

this whole FICO score is the banking industriesplan to keep people in deb,t by forcing them to have credit. Pay off your bills, when you look for credit show your own payment proof. I paid my Mortgage I had for 30 years paid off my car my score dropped to a good rating because I only have a small credit card balance. It’s really just BS.

Eurydice says

Same boat, paid of 2 of my student loans and my car, my score dropped 76pts! Which is insane, my husband were looking to purchase a house soon and I’m worried this will negatively impact our rates.

Tim S. says

I had a near perfect FICO and then had a $47 past due on a closed overdrawn bank account that I wasn’t aware of. Paid this back even though bank had closed account. Got hit coming and going (past due/late payment) dropped my score over 100 pts. for $47!!! LOL!!! This was nearly 5 years ago, still have negative impact from this. Recently paid off mortgage, score dropped another 35 points. Carry zero debt, cards paid off monthly.

What a crock these score calculations are!!! Totally nonsensical!!

Erin says

I have TERRIBLE credit and have been working hard to repair it here I am think ohhh WOW I’ve paid my mortgage on time, etc. We sold our house, ready to buy a new house and BAM there goes my credit into the TANK because the mortgage was CLOSED and we paid it off….it’s like I was PUNISHED for doing a good thing, what gives? That makes NO sense. We paid off our vehicles, I’ve slowly lowered my cc debt – and darn it if I seriously thought paying off the BIGGEST bill in life would render me extra credit points in the world of FICO scores – it’s all a dang scam IMHO. I’m gonna did w terrible credit.

Bob says

Same story here. 30+ year history of no late payments, paying off credit card balances monthly, if not weekly. No recent auto loans. I had a multi-year history of perfect credit scores until I did two things: 1. Paid off my mortgage on an accelerated schedule. 2. Started paying credit cards ahead of anticipated charges to maintain a small yet consistent positive balance, so that I would never incur debt. After that, my credit rating fell 33 points. Go figure.

Another weird thing was that I applied for a lease on a GM economy car several years ago. Monthly rate would have been under $200. At the time, my total income was mid seven figures, net worth was eight figures, only debt was mid five figure mortgage, yet GM Financial turned me down, citing my credit score, which they reported back as three points shy of perfect.

On the other hand, I’ve known deadbeats with a history of repossessions, bankruptcies, and unemployment who seem to have no trouble getting leases, loans, and mortgages.

Chris Frankel says

Dito others comments. My score was 850. I paid off the mortgage when I sold my home and then paid cash for the new one. My score dropped to 831. I have multiple credit cards but if I use them I pay them within 2 weeks. No other debt at all. Seems crazy that it drops your score when you eliminated debt.

M. Brooks says

My mortgage was just sold to another bank and my score dropped 34 points! When I paid off a car loan, it dropped 14 points! THIS IS INSANITY! People who responsibly pay off debt on time should be REWARDED, not PUNISHED! This arcane Credit Score system needs a federal investigation. Why should a responsible person be penalized with higher insurance rates, etc. after they have a perfect 24-year long record of never missing a payment? This system is rotten to the core.

Ms. D says

The day my mortgage was marked “paid” my credit score dropped 42 points! I have no other debt, no late payments, no liens, judgments, etc. This is infuriating, and makes absolutely no sense!

ANN says

I CAN IDENTIFY WITH MOST ALL OF THESE ……… EXCELLENT PAYMENT HISTORY, NO LATE CHARGES, LOW IF ANY BALANCE ON CREDIT CARD. PAID OFF MY MORGTAGE AND DROP 30 POINTS IN MY CREDIT SCORE. MY REACTION WAS WHY AM I BEING PUNISHED FOR DOING EVERYTHING RIGHT? NOT JUST RIGHT BUT EVERYTHING THEY TELL YOU TO DO AND THEN BAM I AM SUDDENLY A BAD GUY? THEIR SYSTEM IS UNJUST TO SAY THE LEAST.

SADLY WHEN THEY DROPPED MY SCORE IT WAS JUST ENOUGH TO PUT ME IN ANOTHER (LOWER) BRACKET. YES VERY GOOD IS STILL GOOD BUT I WORKED HARD FOR MY EXCELLENT CREDIT RATING AND THEY JUST KILLD IT.

Tara Sullivan says

Yep! 30 point drop after paying off mortgage. Screw FICO.

Cindy says

I really don’t understand how this allowed to happen! Pay off your mortgage and your credit drops. Total bullshit. I feel it is just a way to keep us in debt. They want you to keep debt to have a credit score. It’s crazy. Some how there needs to be a way to stop this. We need to start fighting back. Get laws passed . Banks are totally making money off this.

Andrea says

Yes, my credit dropped FIFTY points when I paid off my mortgage in November 2020. I’m delaying buying a home due to COVID, and now have to get a new mortgage with that lower score. SO FRUSTRATING!!

ANN says

YES THIS IS INSANE. IT HAPPENS ALL THE TIME. I HAVE LEARNED THE HARD WAY THAT I DON’T PAY OFF MY MORTAGE UNTILL MY REFINANCE IS ALL IN PLACE. OF COURSE THIS DOES NOT HELP IF YOU PAY OFF IN CASH BEFORE REFINANCING. I THINK IT IS JUST A RACKET TO TRY TO GET YOU TO BUY INTO ALL THEIR CRAP. IT HURTS TO KNOW THAT THEY TAKE SUCH ADVANTAGE. IT MAKES NO SENCE THAT IF YOU PAY SOMTHING OFF THAT YOUR CREDIT RATE DROPS….. MAYBE IT SHOULD NOT GO UP RIGHT AWAY BUT IT SHOULD IN NO WAY GO DOWN.

Russell says

Received a Credit Alert Today “Down 40 Points” Because the Mortgage company I just paid off reported my account as “Account Closed” Not Paid in Full or ?

My credit score dropped 40 points! I have no other debt, no late payments, no liens, judgments, etc. This is infuriating, and makes absolutely no sense! Work Hard to Maintain a GREAT Credit Score !! WOW!!

SLM says

The worst thing you can do to your credit as far as your credit cards is totally pay it off. If you left a small balance, even if it was $2. your score would not have dropped. They want you to use it regularly and always have a balance. I learned this the hard way, trust me.

Al says

Always pay off credit card balances in full every month and paid off my mortgage 5 years early. I am totally debt free and FICO score went from 856 to 822. Why penalize people for practicing sound fiscal management? To say this is absurd is a colossal understatement. Something needs to be done.

JoeTaxpayer says

Respectfully, the maximum FICO score is 850.

FICO is a private company, do you really want the government dictating how they produce their scores?

Al says

Respectfully, it appears that the FICO maximum is 900 as shown below. Also, please tell where I said anything about the government getting involved. Private companies can make changes on their own.

Your FICO® Score History

862

JAN

856

FEB

856

MAR

856

APR

856

MAY

822

JUN

Score range is 250 to 900

Bob says

That is a Vantage Score, not FICO. Vantage goes to 900, FICO only 850. I had the same confusion

Al says

It appears you are still confused. FICO does have a model where scores range from 250-900. You are wrong about Vantage too.

Which credit bureau goes up to 900?

The newest versions of FICO’s credit scores that go up to 900 are FICO Auto Score 9 and FICO Bankcard Score 9. As for VantageScore, versions 1.0 and 2.0 – and their 501-990 range – have been retired. The newest models – VantageScore 3.0 and 4.0 – use the standard 300-850 range.

DAG999 says

This just shows you how wrong the system is. Yes, my credit score went from 870 down to 835 when I paid off my mortgage. I have less than $1,500 on credit cards at any given time (paid off monthly)…and have $30,000 of credit. I haven’t missed a payment in years (since everything is auto-payed from a checking account). I know its still a good credit score…but if it affects someone with GOOD CREDIT, imagine the blow it is for someone with less than good credit scores!

tarsul says

Yeah, that’s me. Right on the border of good and paying off the mortgage dropped me enough below good that I won’t be applying for any credit. Hope my seven year old car keeps running!

Melinda Sue Smith says

The same thing happened to me! I paid off my mortgage, and my score (848 the previous month (usually 850) dropped 41 points! The “fools” want to keep us in debt paying them interest.

Adam says

Well, just adding a +1 here as it feels good. I received a special bonus at work and was able to pay off my 15-year mortgage, 7 years early. No other loans, no carried credit debt month-to-month. No missed or late payments in the last 15+ years.

If you’re reading this, you can imagine my shock when my score went down from its usual mid-800s into the 700 range for the first time in many years. It’s clear to me now, more than ever before, that the credit agency’s job isn’t to assess your ability to pay, but rather your ability to stay just barely afloat while maintaining large amounts of debt. Those of us who have access to liquid funds aren’t “worthy” of credit, because the point of giving someone credit is to collect the interest on the other side. The banks and credit agencies were never our friends, but it’s times like these when you see the ugly clarity of it all…

Jon says

I paid off my mortgage in Oct. 2021 and within one week, my FICO score dropped by 2 points. About 5 weeks after paying off the mortgage, my score dropped another 4 points, although it’s still in the 800s. I pay all bills on time, I frequently make credit card payments so that my card balances are always $0, and I have no other credit — no car loan, no construction loan, nothing at all. It makes sense: the financial industry makes money on loans and if you choose to be debt free, they penalize you.

John says

I worked my butt off to get my credit up enough to get a mortgage for a house for my family. Never missed a payment, never late. Sold my house, 60,000 more than owed. Payed cash for everything all my life up until that point. Credit score crashed to 554. How is it that we allow this to occur? I’m out. Bought off grid. The banker cabal can kiss my … you get my point.

Sunny says

Can anyone doubt that this is just the lending industry’s way of encouraging ppl to acquire and stay in debt?

Michael says

My score dropped in a similar fashion when I paid of my mortgage very suddenly. In general I don’t give a damn about what the credit bureau’s opinion is. I don’t generally monitor it either. So I found it really humorous when I recently did check for the first time in years only to find that it had dropped from “excellent” to a really high “very good”.

No car loans, no outstanding debts, no mortgage, no credit card debt, own a 1.2 million dollar property outright, have nearly another 200k in the bank, perfect payment history. “very good!” they say. Ha … let them keep their opinions. I don’t need them anyhow.

Jeffrey ludman says

Same boat as others. Paid off mortgage early. No credit card debt. Always paid any debt on time for over 20yrs. Score dropped by 20 points. Now 830. WTF.

Danielle says

My score dropped 24 points after my mortgage came off my credit as it was transferred and my other lender was not immediately placed on there. My payments have always been in good standing. How do I get those points back that’s a big drop from no fault of my own.

Kevin says

Happy New Year 2023 All,

Same, Dropping 35 points after paying off the mortgage.

This article has been running on Four years come July 9th.

FICO, What a scam. I’m thinking of dropping AMEX to balance

the score and get my 850 back. Don’t need this anyway

R, Mr. Stobbe

Kevin says

I took out a $200k mortgage 3 years ago when I built a new home. I paid chunks over the monthly payment for the past three years and the paid it off last week . . .a balance of $2193. My Experian score dropped 22 points, TransUnion 8 points, and Equifax 0 points. I have a credit limit of over $100k on five credit cards that I pay off monthly, have no history of late payments or new credit inquiries, own three cars that I paid cash for, and have substantial assets and over $600k in home equity . . .and I’m now a greater credit risk? Something isn’t right about this system. My 850 score is down (I figure Equifax hasn’t caught up yet) . . something I worked years to earn.

SUNSHYNE says

THESES CREDIT COMPANIES OUR WAY OFF BASE. I HAD AN EXCEPTIONAL CREDIT RATING TOO. PAID OFF MORTGAGE, PAY OFF CREDIT CARDS EVERY MONTH, NOTHING LATE, EXCELLENT PAYMENT HISTORY ETC……… MY CREDIT CARDS ARE MOSTLY THE SAME EVERY MONTH WITHIN ONE OR TWO HUNDERED DOLLARS, BASICLY NO CHANGES, I WILL GET AN URGENT EMAIL MY SCORE DROPPED 25 POINTS, A FEW MOTHS LATER IT GOES UP 10 WORKS LIKE A YO-YO……. THERE IS NO SANE REASON IT ALL SEEMS RANDOM. I AM OLD ENOUGH NOW IT DOESEN’T MATTER MUCH BUT IT IS SO VERY UNFAIR AND VERY UNDESERVING….. PEOPLE WORK HARD TO OBTAIN A GREAT SCORE ALL JUST TO HAVE IT DUMPED AT THE WHIM OF THE COMPANIES……….