Ken at DepositAccounts.com reported that SmartyPig cut its interest rate from 1.1% to 0.7%. SmartyPig is this online service that lets you stash money in accounts designated for specific goals. Instead of identifying your account by a number, you label the account by a goal: vacation, Christmas, wedding, etc. When you reach a goal, you can withdraw the money or buy gift cards at a discount.

When SmartyPig first started, it offered a high interest rate with some serious fee traps. Later it got smarter and turned itself into a high yield savings account for up to $50k only to those who don’t mind the extra steps of opening and closing goals.

SmartyPig was able to keep its rate at the top of the leader board for 3-1/2 years, beating ING DIRECT, Ally, and list of other high yield savings accounts. Now it’s signaling it can’t keep it up any more. For the first time, SmartyPig’s rate drops below ING’s, which isn’t the highest to begin with. Without the high rate, is SmartyPig becoming just a place to buy discounted gift cards? After all, you can open subaccounts for specific goals just as easily at ING.

SmartyPig, PerkStreet, and the upcoming Simple are next-generation virtual banks. They market banking services to consumers but they are not banks themselves. They use other banks to perform the underlying banking services. The idea is that through marketing, incentives, and new-age user interface, these virtual banks are able to gather deposits less expensively for their bank partners.

In order to drive consumer adoption, the newcomers often offer an incentive. For SmartyPig, it was high interest rate. At the time when industry leader ING DIRECT was paying 3.0%, SmartyPig paid 4.3%. Over time, the gap shrank but SmartyPig had always offered a higher rate than ING — until now.

For PerkStreet, the incentive is the debit card rewards. When other banks offered 0.25% reward on debit card purchases, PerkStreet offered 1-2%. When other banks including reputable USAA discontinued debit card reward programs, PerkStreet stood the ground.

How long are they able to maintain the incentive is the question. SmartyPig hang in there for 3-1/2 years. Not bad. PerkStreet started offering debit card rewards in 2009. It will probably continue for a while when it still has money from venture capital. I doubt it will be able maintain it long term.

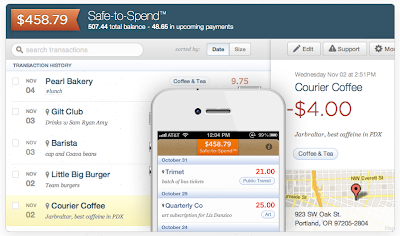

Simple uses a different approach. It’s not offering financial incentives such as high interest rate or rewards. Instead it promises “no surprise fees” and better online and mobile tools for managing a checking account. I see from this screenshot on its website that the user interface is indeed more elegantly designed. It automatically categorizes your transactions. You can also search, tag, and add notes to your transaction entries.

Will “no surprise fees” be enough to make customers switch? I hope, but I’m not optimistic. Credit unions have been saying they are more customer friendly for years. They only have limited success with that message. You’d think with the huge backlash against big banks lately everybody would have switched to credit unions and smaller banks already. But no, most people stayed put with big banks.

What about Simple’s fancy tools? To be honest I don’t care about them that much. I’m OK with boring. I category on my own in Microsoft Money software, which includes all my accounts, not just checking. I’m sure some others will like those tools though. It remains to be seen whether “no surprise fees” and novel tools will attract more customers than high rates or rewards.

But it doesn’t matter. It’s a huge market. There’s room for everybody. People who prefer a large number of local branches will stay with big national or regional banks. People who want friendly local service will use a community bank or credit union. People who want a higher interest rate will go with an online bank or credit union (Ally, ING DIRECT, Alliant CU, …). If “no surprise fees” and fancy money management tools are your thing, try Simple.

We should thank the venture capital firms backing these virtual banks. SmartyPig customers got 3-1/2 years of high interest rate. PerkStreet customers are still getting good rewards on their debit card purchases after two years. Simple customers will soon enjoy fair treatment and elegant design. Some will fade. Some will stick. New players will come in the future. It’s great for the customers.

Say No To Management Fees

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.

Leave a Reply