I didn’t post last week because I was here:

My wife and I visited that same place about 15 years ago. I remember we had a great time. I remember the surreal bamboo forest we walked in when it was raining. I remember the quiet black sand beach that had only the two of us. I remember after seeing the fish that mate for life we vowed to do the same.

When we visited the same place this second time 15 years later, we have more money and we spent more money. Instead of sleeping in a dusty wood cabin at the state park, we stayed in a suite that cost $250 a night. We had a good time but I was disappointed in many ways. The bamboo forest that I remember so vividly is actually very small. The quiet beach wasn’t quiet any more. There were bus loads of people.

Spending more money clearly didn’t buy happiness. I was just as happy if not happier 15 years ago. What did the money buy then? Convenience.

The $250/night suite has a kitchen. I was able to cook a enjoyable meal. I remember last time we just ate crackers. The suite has a comfortable bed. I remember the bed in the state park cabin was dirty and uncomfortable.

At a different hotel I was offered to park the rental car on premise for $5/night or park it at an unattended lot nearby for free. I chose to pay the $5 because it was more convenient.

On a boat tour, the 6:30 a.m. departure would be $10 less than the 9:00 a.m. departure. I chose 9:00 a.m. because it was more convenient.

15 years ago we splurged $73 on a dinner. We remember it to this day because it was the most expensive meal we ever ate by then and for a long time after that. Although this time we didn’t spend as much on a single meal, I’m sure we spent more on meals this time.

Having realized money buys convenience, I have two takeaways:

1) If you want the convenience, you can’t complain about the price because that’s exactly what money buys. Inconvenience is always a choice if you don’t like the price. Wanting the convenience but not wanting to pay isn’t an option.

If you want the convenience of walking into a bank branch, you will have to pay the bank somehow: low interest rate or fees on this or that. If you want the convenience of using just one credit card for everything, you will pay more because you will forego some rewards. If you want all your investments in one place, you won’t get the better rate or FDIC insurance on CDs.

2) Choosing inconvenience will save a lot of money while maintaining happiness.

Eating crackers and sleeping in the state park cabin wasn’t that bad. I remember I was happy. The best part of our recent trip was free. We had the entire dormant volcano crater to ourselves. Admission was free. Sleeping was free. We only had to walk. It wasn’t as convenient as taking a helicopter tour but we were happy to see birds on the endangered species list, including a pair of adults with four babies. You can’t see that on a helicopter!

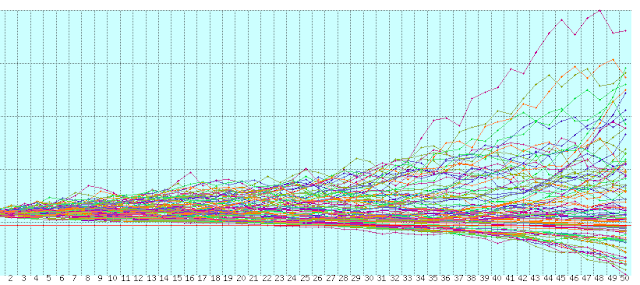

For this reason, one’s need for money is very elastic. If you have more money, you will have more convenience. Less money, less convenience but you can still be happy. Back to the Monte Carlo hairball chart I was looking at last time:

Instead of adhering to a “safe” withdrawal rate and leaving a lot of money behind 90% of the time, I’d rather use an “average” withdrawal rate but be prepared to dial down the convenience when the market isn’t cooperating.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Financial Samurai says

Where was the place Harry!

Money buys freedom, security, and options. With those three things, it’s easier to find happiness.

S

Harry @ PF Pro says

Black Sand Beach in Maui! Nice, I recognized the picture as soon as I saw it as I have a very similar one. I completely agree. My fiancee is more about four seasons and crap like that when we travel. I have just as much fun staying at the Honua Kai with an ocean view(still 250/night! haha). But I’m slowly converting her.

John says

Can you not buy a SPIA with your portfolio when planning to retire instead of worrying about withdrawal rate?. That way you will always be “safe”

Harry says

John – Yes, if interest rates are high enough at that time or if I only buy with money I intend to invest in bonds. At current rates, SPIA payout is very low. I suspect it’s because the insurance company is only allowed to invest primarily in bonds when they are obligated to pay the SPIA. When you invest 90% in bonds, you just can’t generate much income. See this recent discussion on Bogleheads forum: Is the ‘SWR’ of an SPIA really around 3.8% ?……