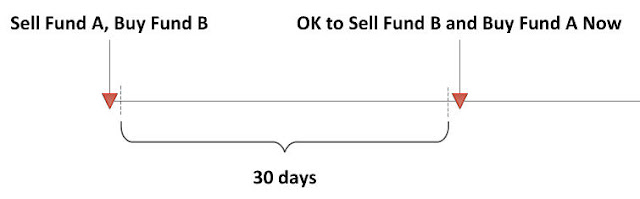

When you harvest a tax loss, you sell fund A at a loss and buy fund B. You can’t buy back fund A for 30 days, or else you create a wash sale which negates the loss you took. After you clear the 30 days, then what?

Fund B Is Down

If fund B is down, it’s easy. You sell fund B at a loss again and buy fund A. You add to your harvested tax loss.

Fund B Is Up

What if fund B is up? If it’s up a lot, more than the loss you took from fund A, you stay in fund B. Going back to fund A now will defeat your tax loss harvesting move. What if fund B is up some, but not enough to completely wipe out the loss you harvested?

You can stay in fund B and wait for it to turn a loss. It may never happen. If fund B keeps going up you are stuck with it.

Or you can complete your round trip and call it a day. You realize a small short-term capital gain on fund B, which offsets some of your harvested loss from selling fund A.

Dividend From Fund B

Dividends also get in the way. If while holding fund B you receive a dividend from it, selling fund B within 60 days from buying it will turn an otherwise qualified dividend into a non-qualified (“ordinary”) dividend. Ordinary dividends are taxed at a higher rate than qualified dividends.

I’m in this situation now. I sold fund A at a loss and bought fund B. The 30-day window cleared. Fund B was up some, but not a lot. I also received a dividend from it during that window.

Should I sell fund B and get back to fund A now?

Selling fund B now will make me lose some of the harvested loss from selling fund A. It will also increase the tax rate on the dividend received from fund B. Selling after another month to keep the dividend qualified may make me lose more of the harvested loss. Would that be penny-wise pound-foolish? Or should I forget about going back to fund A and just stay in fund B?

I decided to wait until the dividend gets qualified. I don’t want to lose the bird in hand (loss aversion bias). Let’s see what happens in another month.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

jb82 says

Thank you for this. I never thought about the qualifying/non-qualifying part – just thought that turning off automatic investments would take care of any dividend issues.

Y.G. says

Good point about dividends — thank you for this reminder.

A very quick SWAG: for each 1% dividends that the fund pays, holding till qualified saves the difference between qualified dividend/long-term gain and ordinary income/short-term gain. Let’s call it half the tax rate, for round numbers. On the other hand, each 1% that the fund gains can be effectively taxed either at full STCG/ordinary income rate (if gain reduces short-term loss or increases ordinary income) or at LTCG rate (if it reduces LTCG offset from losses). So depending on the tax situation and other capital gains in the same year, 1% in dividend may be ~equivalent to either 0.5% or 1.0% in capital gain for tax purposes. Now one just needs to (1) determine which tax situation applies and (2) estimate whether fund B is likely to gain as much (or twice as much) as it paid in dividends before the 60 days are out.

Does it sound about right?

Harry Sit says

That’s about right. Because keeping fund B indefinitely is always an option, and it may very well turn a loss when the 60-day window clears, I didn’t want to incur an uncompensated cost just to get back to fund A.

Matrix says

What if Fund B is lower before the dividend gets qualified?

Harry Sit says

Your call, but I will probably still wait for the reason stated above.

MATRIX says

But I would be compensated by taking the additional loss of selling Fund B now since it is a decent amount lower than when I originally bought it over 30 days ago so I think the decision comes down to it is this better tax-wise than what I lose by not waiting the 60 days for the dividend to be qualified OR do I feel lucky that I could realize a win-win by waiting as Fund B could go go even lower by the end of 60 days.

Harry Sit says

True, that’s why I said it’s your call. It also depends on how much loss carryover you already have. I already have plenty of it. Adding more or less to the pile makes little difference to me. It’s not going to affect my taxes this year, next year, or in the near future. Whatever loss I don’t get to take in this round potentially can be caught up in the next round. On the other hand, not holding fund B long enough to get the dividend qualified is irreversible.

Steve says

If you have carryover why are you bothering to harvest the capital loss in the first place?

Harry Sit says

Squirrel away for the future.

Fiby says

You could instead choose a fund B that is similar enough that you’d be perfectly fine with holding forever.

For example, VTSAX for VFIAX and VEXMX {80/20}. And VTIAX for VFWAX and VSS {90/10}.

Jess says

Hi Harry,

Thanks for this post – I enjoy learning from your website. I’m new to taxable account, and read online that buying a “substantially identical” investment in my IRA as the one in taxable account within 30 days of the sale will result in a wash sale.

1) Would the same principle apply to buying “substantially identical” fund in 401(k) from the fund in taxable account? (Or what about HSA?)

2) If yes, I have another question. Currently I invest in the following:

IRA: Vanguard Total Stock Market Index (VTSAX)

401(k) and Mega Backdoor Roth IRA: Fidelity 500 Index (FXAIX)

HSA: Fidelity Total Stock Market Index (FSKAX)

For my taxable account, is it then advisable to invest into a “substantially different” fund from any of the above 3 index funds, so that if I ever “tax loss harvest” in the future, I could still continue to regularly contribute and buy into the above 3 funds/accounts within 30 days to ensure no violation of “wash sale” rule?

Thank you so much in advance for your insight.

Harry Sit says

The IRS didn’t say anything about 401k or HSA. Some say if it’s not mentioned explicitly it must be OK. I would still avoid it just to make the question moot. Because tax efficiency is more relevant in a taxable account, I would give the taxable account the first priority in fund selection and pick the most tax efficient fund for it, such as the Vanguard Total Stock Market Index fund. The 401k, IRA, and HSA can yield and use something else. Finally, most people just contribute to the IRA and the HSA in one lump sum. That will also make it easier not to trigger a wash sale.

Jess says

Hi Harry, thanks for your helpful answer above. Have a follow-up question. Yes, I’ll contribute to Vanguard Total Stock Market Index (VTSAX) under my IRA in one lump sum. I plan to buy VTSAX under my taxable account. Question:

1) If tax loss harvesting, I plan to exchange VTSAX to Vanguard 500 Index; after 30 days, I’ll switch back to VTSAX. Meanwhile within those 30 days, I’ll still contribute to Fidelity 500 Index under 401(k) throughout the year. Would this trigger wash sale? I ask because Vanguard 500 Index and Fidelity 500 Index are substantially identical and if not mistaken, a wash sale is a purchase of identical or “substantially identical” replacement shares of an asset you sold at a loss during that 61-day (30 days BEFORE and 30 days AFTER, plus the day of the sale) timeframe.

2) I tried to turn off dividend auto-reinvestment, and received the following message:

“•Changing from “Reinvest” to “Transfer to settlement fund” will only apply to new purchases and will not impact your current holdings.

•To change dividend and capital gains elections on existing holdings, from the My Accounts dropdown, go to Account maintenance. Under Account profile, select Dividends/Capital gains elections and follow the instructions.”

Should I proceed with the above 2nd bullet point on existing holdings or just new purchases?

Thanks for any insight – much appreciated.

Jess says

Hi Harry, I appreciate your posts! I’m trying to sell my Restricted Stock Units for MSFT. I heard the best path is to sell shares with the greatest cost basis first; and if more than one lot has the same price, the lot with the earliest acquisition date is sold first (due to lower tax rate on long-term capital gain).

I need to sell some of my MSFT shares from RSU. I’m thinking to sell the slot with greatest cost basis (short-term holding). However, I also participate in my employer’s ESPP plan where I purchase MSFT via bi-weekly paychecks. Since I’ll sell my RSU for MSFT at a loss, can I get tax loss harvesting or will I violate “wash sale” rule since I buy MSFT via ESPP every 2 weeks per paycheck? The RSU vests once every quarter. Thanks in advance for your insight!

Harry Sit says

Are you really buying stock under the ESPP every two weeks or do you only have payroll deduction every two weeks? Do you see shares deposited into your account every two weeks? Or are the payroll deductions set aside and used to buy shares more infrequently, say every six months? If it’s the latter, you only need to time your sale far away from the ESPP scheduled purchase dates.

Jess says

Thank you, Harry! Thanks for the helpful follow-up. I realized after sending my above question that it is true I only have payroll deduction every two weeks into ESPP plan, and I see my ESPP shares deposited into my account at the beginning of each quarter.

On another note, I’ve never done tax loss harvesting before, though I know it involves selling an investment that has lost value, replacing it with a reasonably similar investment, and then using the investment sold at a loss to offset any realized gains. In my current scenario, I just decided I won’t replace it with a similar investment since I’ll need to spend it for expenses, hence no tax loss harvest. In such case, let’s say I sell $5,000 worth of MSFT, would it be smarter to sell the greatest cost basis (in this case, short-term) that’s higher than MSFT’s selling price (e.g. pay zero taxes due to no earning). OR sell the oldest long-term acquisition date, OR the latest LONG-term with highest cost basis? The Fidelity representative told me over the phone that I should sell the lot with the LOWEST cost basis (lower than selling price) because she thinks “you should not sell at a loss”. I thought it seems better to sell the lot with higher cost basis at a loss since I’m still getting the same $5,000 without taxes versus her suggestion where I get $5,000 but pay taxes. Would appreciate your thoughts.