[Updated on June 4, 2025.]

529 plans are for college savings. Although contributions to a 529 plan aren’t deductible from federal income tax, the earnings are tax-free when you take the money out for college expenses. 529 plans are sponsored by the states. Every state has a plan; some states have multiple plans. The investment options are different in each plan. When you set up a 529 plan account for a child, you first have to decide which state’s plan you are going to use.

Not Limited to the Home State

You are not limited to using a plan from your home state. My sister has a 529 plan account set up for my niece. I make a gift to her account every year. My sister lives in New Jersey but my niece’s 529 plan account is with a plan sponsored by Ohio.

You are also not limited to using the plan that you started with. If you already have a 529 plan account with one plan and you see a better plan elsewhere, you can move your account from one plan to another.

Some states offer a tax benefit for contributing to a 529 plan. Some states don’t. Some states limit the tax benefit to only in-state plans. Some states don’t have such restrictions. What your state does is an important factor when you decide which 529 plan you should use for your child.

Go Anywhere States

Some states don’t have a state income tax. Therefore the state tax benefit question is moot. Some states don’t offer any tax benefits for contributing to a 529 plan. Some states offer a tax benefit but they don’t care which state’s plan you use. If you live in any of these states, you are free to choose a 529 plan sponsored by any state in the country. I call these states “go anywhere” states.

There are 21 of them:

- Alaska

- Arizona

- California

- Delaware

- Florida

- Hawaii

- Kansas

- Kentucky

- Maine

- Minnesota

- Missouri

- Montana

- Nevada

- New Hampshire

- North Carolina

- Pennsylvania

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

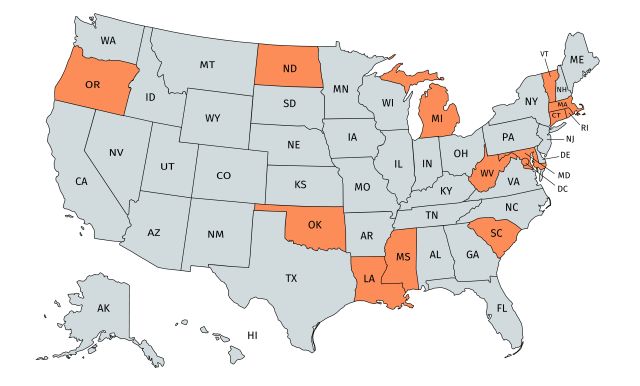

Deduct-and-Run States

Another 13 states plus Washington DC offer a state income tax benefit, and they limit the benefit to contributing only to a plan sponsored by the home state, but they don’t hold you there. After taking the state tax benefit, if you move the money out to a different plan later, you still get to keep the state tax benefit. I call it “deduct and run.”

These 13 states plus Washington DC will not claw back (“recapture”) state tax benefits you previously received if you transfer the money out to a different plan out of state:

- Connecticut

- Washington D.C. (after two years)

- Louisiana

- Maryland

- Massachusetts

- Michigan

- Mississippi

- North Dakota

- Oklahoma (after one year)

- Oregon

- Rhode Island (after two years)

- South Carolina

- Vermont

- West Virginia

If you live in these states, go ahead and start with a 529 plan from your home state for the state income tax benefit. Later if you think another plan elsewhere is better, you can move the account without losing the state income tax benefit you already received (in Oklahoma and Washington DC, only after satisfying the minimum stay requirement).

Use a Plan From the Home State

If live in the remaining 16 states, your state offers a state income tax benefit for contributing to a 529 plan, it limits the tax benefit to only its own plans, and if you move the money out, the state will claw back (“recapture”) the previous tax benefits. In such case, you may be better off staying with a plan sponsored by the home state.

However, the tax benefit usually has an upper limit, for instance, on contributions up to a set amount in a year. If you are contributing more than the upper limit, the additional contributions can still go to a 529 plan of your choice elsewhere. You can have multiple 529 plan accounts for one child.

The Best 529 Plans

If you can choose a 529 plan outside your home state, you can consult Morningstar or other resources for which plan is the best for you based on the investment options offered and the fees. These plans were rated Gold by Morningstar in 2024:

- my529 (UT)

- T. Rowe Price College Savings Plan (AK)

- PA 529 Investment Plan (PA)

- U.Fund College Investment Plan (MA)

- Bright Start College Savings Plan (IL)

Moving To a Different Plan

If you see a better plan elsewhere, moving your 529 plan account from one plan to another is quite simple. I did such a move before. See Rollover a 529 Account From One Plan To Another.

Before you choose a 529 plan from another state or move your 529 plan account, find out:

- whether your state offers tax benefits;

- whether it limits the tax benefits to a plan sponsored by itself; and

- whether it claws back the benefits if you move the money out to a plan from another state.

The maps here are based on my own research to the best I can. They may not be 100% accurate. State laws can and do change. Please always double-check with your state’s tax authority.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

KD says

I live in a “deduct and run” state. What happens when I move to a no state tax place and my federal tax bracket is zero and I make a nonqualified withdrawal? Just pay the 10% penalty for the earnings portion?

Harry Sit says

Yes just the 10% penalty on the earnings portion. If you do a partial withdrawal, it’s considered proportionally part principal part earnings.

Anita says

Since I’m a retiree with no kids needing college, I’m behind on understanding 529. Are you suggesting that since I live in WA, I can put aside money in my own name as “student” but NOT use the money for college, and instead send it “anywhere”. i.e. have it behave similar to an IRA, growing taxfree? not quite sure I know what you mean about sending it “anywhere”? Thanks for clarifying.

Harry Sit says

No I’m not suggesting that. 529 plan is for higher education. It can be for your kids, your grandkids, or yourself if you aspire to get an MBA or Ph.D. for example. The next sentence after “anywhere” explains what it means. If you don’t like your own state’s 529 plan you can send the money to a 529 plan sponsored by a different state. If you don’t need a 529 plan period, then obviously you don’t need it whether in your own state or anywhere.

Anita says

Thanks Harry. That answered my question. By the way, I am THRILLED to have learned thru you of the (complex several step idea) of

1. Bank of America Preferred rewards program PLUS

2. Bank of America Travel Rewards Credit Card PLUS

3. Merrill Edge bonus PLUS

4. Fidelity Rewards credit card

I combined all 4 of those, and just last week got my Merrill Edge Bonus. YAY. And now get 2.6% cashback on ALL purchases.

That was an amazing construct you put together. Good idea. Worked. Thanks.

Kris says

I have a Michigan account and it’s listed as ‘deduct and run’. The maximum I can deduct on taxes is $10,000/year. But, it’s calculated by contributions less withdrawals. So if I put the $10,000 in and move it elsewhere, I get $0 left to deduct. They may not go back and recapture the deduction, but unless you are no longer contributing, I don’t think this will work. Am I missing something?

Harry Sit says

If you normally contribute less than the max $10k a year, bunching would work. For example contribute $10k in years 1-3 and do the rollover in the 4th year. If the netting is done per kid, rotating between multiple kids can also work. Contribute $10k to kid 1’s account, do the rollover in kid 2’s account, next year reverse. I see it can be a problem if you contribute the max $10k every year and you have only one kid.

CLF says

So if I live in the remaining 16 states (RI) I understand that I’ll receive a tax benefit and only if I keep the money in my home states account (if I take that road), however does that mean that I cannot get a 529 plan in another state separately or instead of using RI’s plan? I’m just beginning to look into a college fund for my son and really dont have much knowledge on the subject overall.

Thanks!!

Harry Sit says

You sure can. You just don’t get any state tax benefit for the out-of-state plan. The federal tax benefits are the same everywhere.

Smart Money MD says

If you over contribute to your kid’s fund (ie their college expenses end up being less than what you’ve built up), what options do I have? From what I’ve read, you can (1) designate the account to another child or grandchild (2) withdraw the leftovers and have the state tax savings recaptured (3) send it all to the school, and have your kid “waste” the money on extra campus food/equipment…etc.

Am I missing anything else here?

Harry Sit says

If the child received any scholarships you can withdraw an amount equal to the scholarships received (earnings are still taxed but there’s no penalty). If you change beneficiary, the new beneficiary isn’t limited to just another child or grandchild. There’s a long list of “a member of beneficiary’s family.”

The White Coat Investor says

Great post. Love the phrase “deduct and run.” I’m in one of the 17 “unlucky” states, but since it’s perhaps the only one with low costs, DFA funds, Vanguard funds AND a state tax benefit, I guess I won’t complain. 🙂

john smith says

(May 17, 2013) – Montana Governor Steve Bullock has signed into law a bill (SB 117) that makes a Montana taxpayer’s contributions to a non-Montana 529 plan eligible for a state income tax deduction. The maximum annual Montana deduction is $3,000 by an individual and $6,000 for a married couple filing jointly. Montana joins a small handful of states in adopting tax “parity” for 529-plan contributions. The change is effective retroactively to the beginning of 2013

Harry Sit says

John – Thank you. That puts Montana on the first map. I will update it shortly.

Bill Olmstead says

Is this list of states that do not recapture taxes still accurate ?

Rad says

I have my home state (AZ) which I claim the max deduction for. I also file non-resident tax returns for other states as well. Can you you claim additional 529 tax deductions for those states in addition to your home state, or only your resident state? Thank you!

Harry Sit says

Each state sets their own rules. You will have to look into the rules in each state in question. For example your neighboring state Utah still allows a prorated deduction for non-residents, but only if you contribute to Utah’s My529 plan.

M says

I’m confused by some of the wording here. I live in Illinois (and have no plans to move out of state), and I created and contribute to a 529 plan I set up for a child niece who currently lives in Arizona. My plan is in New York. I’ve been contributing to it monthly for about three years now. I understand I don’t get any tax benefit from it. Is this totally unwise?

Harry Sit says

Illinois gives a tax deduction only for contributions to the Illinois plan. Its Bright Start College Savings plan won a gold rating from Morningstar. I would say it’s unwise to choose an out-of-state plan and forego the tax deduction when the in-state plan is already very good. Depending on how much you already contributed and how much you are contributing now, rolling over from the New York plan to the Illinois plan will regain some of the tax deduction you missed.

Mike says

I live in WA state, don’t plan to move out of the state, and would like to use 529K plan for my child who also lives in WA, which does not have state tax. I have several questions:

1. Is it wise to select out-of-state New York’s 529 Direct Plan or it is better to choose in-state plan?

2. If I choose out-of-state New York’s 529 Direct Plan, will I have to pay New Your State tax on non-qualified distributions?

Harry Sit says

If by in-state plan you are referring to Washington’s GET plan, it’s a prepaid plan, which is quite a different animal than the NY 529 Direct Plan. The NY 529 Direct Plan is rated as Silver by Morningstar, whereas Washington’s DreamAhead plan didn’t get any medal rating. So yes the NY 529 plan is better than the DreamAhead plan but it’s not directly comparable to the GET plan.

When you are not a NY resident you won’t pay NY state tax on non-qualified distributions.

Sarah says

Hi! I am a SC resident with no plans to move out of state. I want to start a 529 plan for my infant son. We have family in WV and PA that would like to contribute to his college savings. My husband also has USAA and said they have a 529 plan – I’m not sure if/how this is different than the state plan. Would it be better to a) open USAA 529, b) open SC Future Scholar’s 529 and have everyone contribute, c) open 529 in each of the 3 states? Thank you!

Harry Sit says

USAA’s plan is through the state of Nevada. Based on the maps, both WV and SC are “deduct and run” states, which means if you want a tax deduction from the state income tax, you have to contribute to the WV and SC plan respectively, but if you move the money to a different plan later, the states don’t take back the deductions.

Whether it’s important to take the state tax deduction depends on how much you will contribute. A 5% deduction on $200 contribution in a year won’t be much. A 5% deduction on $5,000 contribution in a year makes it worth it. If you will contribute more than the other family members, maybe go with (b) open SC Future Scholar’s 529 and have everyone contribute. When you build up a more substantial amount in the SC plan, consider moving to a better plan elsewhere.

Erez says

This article is from June 2018. As of January 2020, is Massachusetts still a “go anywhere” state? Other resources suggest differently.

Thanks for the clarification.

Harry Sit says

Massachusetts is no longer a “go anywhere” state. I removed it from the list and updated the map. Thank you for asking.

C says

So because I live in one if the remaining 16 states (RI), does that mean I cannot get a plan from another state? – or is it just highly not recommended? I understand that there is a penalty for rolling the money over to another state too. I’m brand new to this search.

Thanks!!

Harry Sit says

You sure can. You just don’t get any state tax benefits for the out-of-state plan. The federal tax benefits are the same everywhere. You just have to figure out how much the state tax benefits are worth to you and whether an out-of-state plan is sufficiently better than the in-state plan to overcome the lack of state tax benefits.

Binh says

I live in California. I understand that I won’t get state tax deduction for the contribution to 529. I don’t understand tax clearly. Does it mean I can contribute to an out of state 529 plan and get deducted in CA?

Secondly, what are investment options of 529 plan from CA? Should I open ScholarShare or open 529 plan on Vanguard website instead? If I open from Vanguard website is it in state or out of state plan? Hope to hear from you soon!!! Thank you so much!!!

Harry Sit says

You don’t get any tax benefits regardless which plan you use. If you like another plan better you can use it. ScholarShare website lists the investment options. The Vanguard plan is sponsored by Nevada. Investment research company Morningstar rated ScholarShare as Gold and the Vanguard Nevada plan as Silver.

Michelle says

If I live in Illinois and I open/contribute to the Illinois 529 plan, are there any penalties, claw backs, or restrictions on using the funds for a college outside of Illinois if my kids end up deciding to go out of state later?

Harry Sit says

All 529 savings plans cover expenses at colleges nationwide without restriction. You get the tax benefits when you put the money into a plan. Any clawbacks are only on rolling over the money out of a plan to a different plan and on non-qualified withdrawals, not on paying qualified expenses.

Binh says

I know all investing is subject to risk, if you were me which one you would choose. Scholarshare, Vanguard 529 plan sponsored by Nevada or Ohio 529 plan which feature Vanguard investment options. From your old post, you chose Ohio 529 plan, I’m wondering if you’re still using it or you rollover or change to a different plan at the moment. I live in CA like you so I hope I can follow your steps whatever the result is. I don’t have any knowledge in investments, just found out your great website. Hope to hear from you soon. Thank you so much!!!

Harry Sit says

Choosing among several already very good plans isn’t as important as just going with one and starting the contributions. I’m still using the Ohio plan. Even though I may choose a different one if I start fresh today, the difference isn’t large enough to make it worth moving at this point. If I start fresh I will probably choose California’s ScholarShare and use the Passive Age-Based Investment Portfolio Option there, only because I live in California and the plan from the home state is already good enough to get a Gold rating from Morningstar.

Binh says

Thank you so much. I have 1 child 9 years old and the other one is only 6 months. To diversify I should choose 2 different 529 plans right. I saw an old post of you said that aged-based investment option doesn’t make sense so I’m wondering why you would choose scholarshare passive aged-base option. I’d like to educate myself so I hope I can hear back from you again. Thank you!

Harry Sit says

Binh – The Passive Age-Based Investment Portfolio Option is already diversified. It’s not necessarily to diversify with 2 different 529 plans. Age-based options improved in recent years. The good ones such as those in California’s ScholarShare plan transition more smoothly with the beneficiary’s age. They no longer make abrupt changes in their allocation.

Alex G says

This is a unique breakdown of how you should pick a 529 account, which is usually done just by utilizing our home state’s plan. I wish I had found this article last month before setting up my 3 child’s plans through research on other sites like savingforcollege.com and 529-planning.com

Kristy C says

If I live in Illinois, have a 529 out of Illinois, but my daughter chooses a school in Michigan, can we still use our 529 savings towards her tuition there? Thank you

Harry Sit says

Yes. Money in any 529 plan can pay expenses for going to any accredited school in the country.

Kristy C says

Thank you very much

Trent says

I live in Georgia and have had the Wisconsin 529b since 2001. My son has a scholarship to a private school in North Carolina. My out of pocket is 2200 a year. Will Georgia tax me each time I withdraw?

Harry Sit says

No federal or state tax on withdrawing qualified education expenses. If you son is enrolled at least half-time, qualified education expenses also include up to the college’s allowance for room and board on top of tuition and fees.

Denise says

I have 2 children ages 11 and 5. Is it best to have 1 529 plan and just have both as beneficiaries or better for both to have their own 529 account? I live in Colorado and their plans don’t seem to be the best ratings wise but do offer tax benefits if I used in state 529 plan. Do you think it’s better to open the California/Ohio 529 (Out of state) or should I stick to Colorado 529? Lastly, concerned if I open accounts for both and one chooses Military route that I might have money left over not being used for college. Is it better to have them on the same 529 plan? How much would you recommend ever putting into a 529 by time they start college? I assume some put to little and some people put way to much and end up getting penalized on what isn’t used when they take money back out. Thanks

deepa ganeshan says

My husband pays NY non- resident taxes ( he works for a company located in NY ) but we live in Texas. Can we claim NY 529 deduction while filing NY taxes ?

Harry Sit says

The NY 529 plan says you can.

https://www.nysaves.org/home/why-ny-529-direct-plan/out-of-state-savers.html

Brian says

My mother lives in Florida but I live in Indiana. If she wants to contribute to the Indiana 529, will she receive any tax benefit? I know Indiana’s is 20% back up to 5,000 contributed, but will the out of state contribution help her during tax season?

Harry Sit says

She won’t. The state tax benefits are only for those who file a state income tax return with that state.

Brian says

What if she started one for my daughter in Florida (her state of residence)? Would there be any tax benefit to her?

Harry Sit says

Florida doesn’t have a state income tax. They have no additional state tax benefit to give out.

Brian says

I appreciate you taking the time to answer my questions

CD says

If I rollover a 529 account based in RI to IL (present residence). Do I have to pay any taxes to RI (never lived in RI)?

Harry Sit says

If you otherwise don’t file a tax return with RI, no.

CD says

great, thanks for the quick response

Michael Gorman says

I have a Wisconsin 529 account for my grandkids. I no longer live in Wisconsin. I now live in Arizona. Are there any tax benefits for me since I no longer file Wisconsin taxes? Are there any benefits on my Arizona taxes?

Harry Sit says

Arizona is listed under “Go Anywhere” states. Contributing to the Wisconsin 529 or any other state’s 529 will give you the same tax benefits from Arizona (a tax deduction of up to $2,000 per year for single; up to $4,000 per year for married filing jointly). If you see a better 529 plan elsewhere, you can move the account from the Wisconsin 529 plan to that better plan.

Michis says

Hello Harry,

Thanks a million for this post. I am trying to learn about 529 plans and ready to invest in the best option for my kiddos. I have done some research and would love to know what you recommend for us. We live in FL and for that I know that I can choose to open 529 plans wherever but for performance purposes, what would you recommend for our family? We have looked into the Vanguard 529, Ohio College Advantage and our State’s ran 529 through the Florida College Board. For the Florida’s 529 (Called Florida prepaid – although not a prepaid plan in this case), they charge a 0.075% fee, for Vanguard there is an annual expense ration of 0.15% to 0.49% as it can be more heavily managed with the later rate. For the Ohio plan, I have no idea, I have been trying to get them on the phone but it is difficult to speak to anyone there right now due to Covid 19. In your experience, how often do you need to talk to someone or have anyone call you back with feedback performance or just questions? Vanguard is spot on great with customer service but they charge more than the Florida sponsored one. I would appreciate your opinion on this and if you were in my shoes, what do you recommend? My children are 9, 6 and 4 years of age. Thanks so much!

Dennis says

I appreciate all the info here. I want to make sure I understand my particular situation. We live in Colorado and have CO 529 accounts for our kids. My father lives in Illinois and opened an IL 529 accounts for our kids. For a variety of issues, we would like to roll over the IL accounts into the CO accounts. If I understand this all, if we do this, my father would have to pay a claw back to IL. Is this correct?

Harry Sit says

That’s correct. The total Illinois state income tax deductions he took over the years will be added as income to his Illinois tax return in the year he rolls over the account outside Illinois.

Elliot says

Definitely glad I saw this.

We just moved to CA from OH, and were considering moving the kids 529s here. One of our kids is on the OH Blackrock plan, the other in the CollegeAdvantage (long story).

Sounds like if we rolled over funds to the ScholarShare 529 (the CA plan), OH would claw back the tax benefits we’ve received over the previous 5 years. I assume they would re-assess if we rolled over a few years down the line? Didn’t even think this might be the case.

Given your recommendation of the CollegeAdvantage plan and that there is no deduction here in CA anyway, and assuming that recommendation hasn’t changed too much, sounds like the best move is to leave it there, and keep contributing there. If we rolled over the Blackrock account into an OH CollegeAdvantage account, I assume there wouldn’t be a tax clawback?

Also, are you aware of if contributions made to an OH plan would still be eligible for a deduction for this year, if it was made after we officially left OH. ie, for a contribution made, say, today, when we reside in CA, but in a year when we still file OH taxes since we lived there for half the year.

Harry Sit says

The recapture is an extra tax imposed on the state’s taxpayers. If you’re no longer subject to the OH state income tax, the recapture doesn’t affect you. You’re still a part-year taxpayer in the year you move. So if you’re going to roll over the 529 plan, wait until the following year. Continuing with the OH CollegeAdvantage plan is perfectly fine as well when the plan is already good enough.

You still get a tax deduction for contributing to Ohio’s 529 plan when you’re part-year resident. The exact date of the contribution doesn’t matter as long as it’s within the calendar year.

ChuckY says

We moved to TN (a no income tax state) from NY ten years ago. I still have our 529 plans in NY where we had received the tax benefits while living there. If I removed the monies from NY completely, to the best of your knowledge would they clawback any tax benefit I received while living there and contributing to the 529 plans, and also impose a penalty if the monies are not used for higher education?

Harry Sit says

See reply to comment #30. The federal penalty for distribution not used for higher education still applies though.

ChuckY says

Thank you, sir, for confirming!

Aks says

I have 529 plans in IL state. Can I retain tax benefits if the beneficiary chooses to study outside the United State?

Harry Sit says

For the expenses to qualify as qualified education expenses, the educational institution located outside the United States must be on this list published by the U.S. Department of Education:

https://ifap.ed.gov/ilibrary/document-types/federal-school-code-list

If the school is on the list, you can retain the tax benefits.

Caroline says

Hello Harry,

I have 529 plans in Oregon and they recently changed how much we can deduct from our state taxes from ~$4k (filing jointly) to now about $300 limited by income. I’m not a fan of the giant decrease in how much we can deduct from our state income taxes, so what would be a good option for us going forward?

I looked over some of the different plans but I do not understand how the deductions would apply for a plan in say Arizona to my state’s (Oregon) income taxes. If we open/contribute to a 529 plan in Arizona, would we then be able to deduct up to $4k from our Oregon state income taxes?

Thank you for your help!

Harry Sit says

The $300 in Oregon is a tax credit, which reduces your Oregon state tax dollar for dollar. At the 9.9% tax rate, it’s equivalent to a $3,000 tax deduction. How much Arizona gives to its residents is not relevant to you when you’re an Oregon resident. When you’re an Oregon resident, you go by Oregon’s laws. Oregon says you will get a tax benefit only if you contribute to Oregon’s plan. You’ll get nothing if you contribute to Arizona’s plan.

Anand K says

Hello Harry,

Great post and loved the content. Appreciate all the information. We have Fidelity 529 for both our kids (opened couple of years back). Recently, my father in-law asked us to open Vanguard 529 accounts, so he can gift into their account. Is there a tax implication for him as a “gift-giver” towards these deposits? Is our understanding correct that you have limit of $30,000 per year for gift towards 529 account (2 kids)? My father in-law and our family live in New Jersey and he is a senior citizen.

Paul CHET says

Harry – this is a nice resource. By the way Connecticut just moved their 529 Chet program from self custodial to Fidelity Investments. I don’t like the fact that they only allow two transfers per calendar year between funds – is this standard practice?

Fidelity opened completely new funds to handle the CHET transfer seems really disingenuous to me. The same Fund managers were designated on all 37 new Chet funds and they also manage thousands of funds in the fidelity family. I find this a pigeon-holing move for some reason and think I will rollover my investments to a state that allows me more choices and better fees. Can I still contribute $10K annually to the CHET and rollover that 10K each year to capture the tax credit? Is that prudent?

Magic says

I have a PA 529 plan started when I lived in PA (PA has state income tax) but years ago we moved to WA (WA has no state income tax) Neither I nor my beneficiary live or work or even attend school in PA. If I take a nonqualified special withdrawal because of scholarships I understand The earnings portion is federally taxable but with no 10% penalty. But do I need to file a PA state tax return? And is there PA state tax I’ll owe?

Harry Sit says

You’re not subject to PA state tax when you aren’t a PA resident and you only have an account with a PA-sponsored 529 plan.

Lars says

I live in NYS, and have triplet nephews that currently live in NH. If I understand everything correctly believe I should open a NYS 529 plan for each of them so I can receive the NY deduction, but just want to make sure not missing anything prior to opening 3 separate acs. Thank you in advance!

Harry Sit says

That’s right. As a New York resident, you get a NY state tax deduction only if you contribute to a New York plan. The NY 529 Direct Plan was rated as one of the best in the country.

Daniel Eubank says

I live in Texas, my Daughter wants to go to school in Colorado.

If you were in my shoes, would you open a Colorado 529 plan?

Or another state 529 plan? Then move it to the Colorado plan at the time of her college.

Your help and advice is most kindly appreciated.

-Daniel

Alan Simpson says

I lived in Colorado for many years and set up 529 plans for my kids. We moved to Michigan in 2014. If I roll my CO plan to MI (CO is one of the recapture states), are we subject to the recapture? From other posts, I get the feeling that since I do not live in CO anymore, I do not have any tax liability. So, there’s no issue. Thank you!

Harry Sit says

The recapture is in the form of additional state income tax. You’re not subject to it when you aren’t a resident of the state (not even a part-year resident).

KSB says

My son who is a Michigan resident received 2 checks for 529 plan withdrawals and did not end up going to college. One was a Wisconsin Edvest 529 account (from which he received 1099-Q in his name/SSN). The other was a Tomorrows Scholar 529 owned by grandfather with my son as FBO. This one there has been no 1099-Q or any other forms received. Would he be required to file with Wisconsin and Michigan in addition to Federal? He has no other income. Any insight would be appreciated.

Harry Sit says

Being a Michigan resident, only receiving a distribution from a 529 plan sponsored by Wisconsin doesn’t make him subject to Wisconsin income tax. I don’t know whether Michigan exempts filing for income below a certain threshold but it can’t hurt to file a return even if you aren’t strictly required to do so.

Ranveer says

I live in a state with no state tax. If I take Utah/Illinois 529 and in case it doesn’t get used for college, only 10% of the earnings will be taxed at federal tax rate when withdrawn? Thanks!!

Harry Sit says

100% of the earnings will be taxed at the federal rate plus 10% of the earnings as a penalty.

Chris L says

I have a question about gift tax approach for contributions to a 529. I funded one of my children’s 529 plans above the annual gift tax limit of $16k. I understand I can do a 5 year election to spread it out, but would have to report it on a form 709 every year for the next five years. Wouldn’t it be simpler to just use the normal annual gift tax, then report the rest to my lifetime gift tax exclusion? I don’t expect to ever exceed the lifetime gift tax exclusion amount. Thanks.

Harry Sit says

The 5-year election preserves your lifetime limit. If you don’t mind using up the limit a little bit, that works too.

JB says

Beware! California 529 does not allow NON-QUALIFIED withdrawals to be reported on Beneficiary’s 1099Q. I found out the hard way. The Custodian / Account Owners will get the 1099Q and have to report the “income” and pay taxes (most likely at higher rate) on that withdrawal. Son got a scholarship and leftover 529 was direct deposited to him (for a car) and I got the 1099Q. Was told by two different Scholarshare reps that CA doesn’t allow it any other way. Many articles say your child can get that money and file that income at their current tax rate. Not so in California.

D Biy says

I have 3 children, one starting university in August, the other two are two and four years behind him. We live in Michigan and have contributed to the MESP 529 for the first two until 3 years ago. This first year of university we will pay cash.

1) can I move funds from existing MESP 529 to Utah 529? I believe they have an option to choose individual stocks?

2) Can I open a new MESP 529 for my youngest and take tax advantage while moving the older accounts out of state?

Harry Sit says

MESP 529 and Utah 529 are both highly rated. It isn’t really necessary to move from MESP 529 to Utah 529 but you can move if you really want to. Utah’s my529 plan offers mutual funds from Vanguard and Dimensional, a stable value fund from PIMCO, and FDIC-insured bank accounts, but it does not have the option to choose individual stocks. Your Michigan tax deduction is based on your contributions minus qualified withdrawals and rollovers but it’s calculated separately for each account. If you have a separate account for each of your three children, rolling over two accounts doesn’t affect your tax deduction from the contribution to the third account.

TJ says

How about an update on this post? Apparently one can make themselves the beneficiary of a 529and convert from a 529 plan to Roth IRA up to $35k total in one’s lifetime. This is 5 year’s wroth of Roth contributions.

It seems that this would be state tax deductible and grow tax free.

Any reason not to do this?

Ravin says

Harry,

I am looking to start a college education account for our grand daughter who is 1 month old 🙂 California resident where there are no tax benefits for 529 plan contributions. I understand any gains in this account will be tax free when used for college education. Does it still make sense to start a 529 plan account OR should I just open a brokerage account and have wider choice of ETFs to invest in?

Does Coverdell IRA have any advantage over 529 plan?

Thanks

Ravin

Jeff Bean says

It is not clear whether New Jersey is a “Go Anywhere” state. Your example at the top of the page and the map suggest that it is. However the list of 21 such states does not include New Jersey. Searching the New Jersey Division of Taxation website, it seems as if only contributions to the New Jersey NJBest program are deductible, but qualified distributions from any state plan are not taxable.

Harry Sit says

New Jersey used to be a “Go Anywhere” state before it added a deduction for the in-state plan a few years ago. However, the deduction has an income limit. If your income is above the limit, it’s still a Go Anywhere state. I’ll update the map and the example.

Richard says

I think Ohio is a go anywhere state. Morningstar says it is although other sites do not list it. The forms say contributions to an Ohio 529 but when youlook at the Ohio code it has no such limitation, it looks like any 529 will do.