When you have a joint account, either person on the account can transact in the account. As part of our estate planning package, my wife and I created a trust with both of us as co-trustees (see Will and Trust Through Employer Legal Plan). We stated in the trust that each trustee can act alone. Our trust account is set up as such, similar to a joint account.

No Joint IRA or Joint HSA

However, our IRAs and HSAs can only be in our individual names. It’s not possible to have a joint IRA or a joint HSA.

We have named each other as the beneficiary of our IRAs and HSAs, but the beneficiary only becomes relevant after the account owner dies. When your spouse is living, you don’t have any authority over their IRA or HSA unless they specifically grant you permission.

Power of Attorney May Not Be Recognized

We also executed a Durable Power of Attorney (DPOA) in our estate planning package. We granted the authority to act on behalf of each other in case we aren’t capable to act ourselves, but we also learned that financial institutions often don’t recognize these generic Powers of Attorney. They want their own language specific to accounts at their institution.

It’ll be a bummer if you’re only told they don’t accept your Power of Attorney when you really need to use it. Most financial institutions have a process to get authorization from someone to transact in their accounts. It’s better to be prepared and go through the process before you need to act on someone’s behalf.

Not Limited to Spouse

Although it’s most common to get authorization from your spouse, the authorization process doesn’t limit it to a spouse. The account owner can grant authorization to anyone — a sibling, an adult child, or even a non-family member.

Except for a married couple, it’s better in many situations to only get authorization to manage the accounts and not become a joint owner (you can’t be a joint owner of a retirement account anyway). You may be responsible for part of the taxes if you’re a joint owner.

No Sharing Login and Password

Going through the official authorization process is the right way to do it. Using another person’s login and password can weaken their protection from the financial institution. It can also put you in a position where you can be accused of identity theft or hacking.

After the account owner gives authorization, you should log in with your own username and password when you manage their accounts.

Vanguard

We have IRAs at Vanguard. Vanguard has a process for an account owner to authorize another person to act on their behalf over their accounts. They call it agent authorization or account permissions.

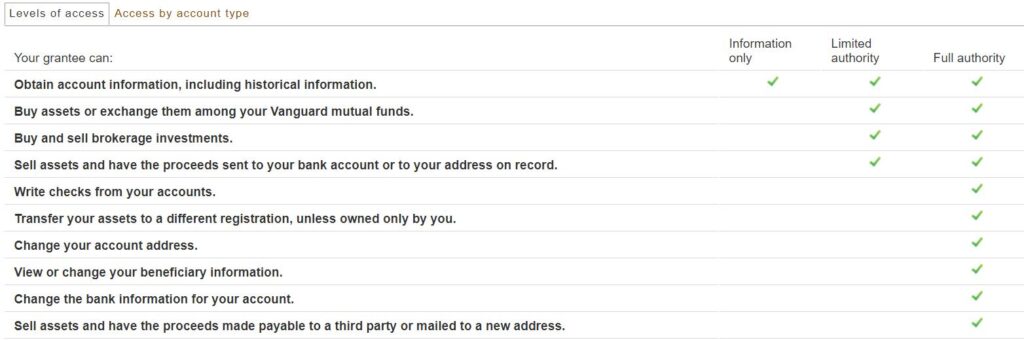

Vanguard allows three levels of access.

- If you have Information Only access, you can monitor the account but you can’t do anything.

- If you have Limited Authority, you can transact within the account or send money out to an already-linked bank account or the address on file.

- If you have Full Authority, you can do a number of other things.

The process has to be initiated by the account owner.

You can grant the Information Only or Limited Authority permission online. It’s not clear how you can grant Full Authority. It looks like there used to be an Agent Authorization form but all the links to the form are dead on Vanguard’s website. Please contact Vanguard customer service to get the form for Full Authority.

Here’s how to grant Information Only or Limited Authority permission online:

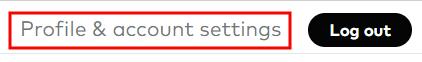

After logging in to Vanguard, click on “Profile & account settings” at the top. Then click on the Security tab and “Account permissions.”

The grantee must also have a Vanguard account. The account owner needs one of the grantee’s Vanguard account numbers. Vanguard will send an email to the grantee to confirm that they will accept the authorization. The permissions are effective only after the grantee accepts. The grantee will see additional accounts listed when they log in.

Fidelity

We also have IRAs and HSAs at Fidelity. Fidelity has a similar process for the account owner to grant permissions. They have a clear explanation and a video about their four levels of access:

The account owner can follow the link in the explainer above to start the process to authorize access to their accounts.

Similar to Vanguard, Fidelity will send an email to the person receiving the authorizations. The authorizations are effective only after the grantee accepts.

The grantee will see additional accounts listed when they log into their Fidelity account. The additional accounts will be under a separate account group. They can customize the display name of each account to something that makes more sense to them.

Bidirectional Permissions

If a married couple would like to grant permission to each other, they need to go through the process separately from each direction.

Notarized Signatures

Granting the highest level of authorization — Full Authority in Vanguard and Power of Attorney in Fidelity — requires notarized signatures from both parties and witnesses. If you’d like to grant access at the highest level, you can grant at the second-highest level online first while you work on the paperwork for the highest level.

New Accounts

The authorizations are for specific accounts. They don’t automatically apply to new accounts. Remember to go through the authorization process again for new accounts.

Revoke Authorization

The account owner can revoke the permission at any time. Follow the same process of granting authorization to revoke prior authorizations.

Trusted Contacts

In light of elder financial abuse and scams, new regulations require financial institutions to offer the ability to designate trusted contacts. When a financial institution suspects that a customer is being scammed or the customer has displayed diminished mental capacity, they will reach out to the trusted contacts to make sure the transactions are legit or alert the trusted contacts of potential issues.

Adding a trusted contact by itself does not give the trusted contact any permission to access the accounts but it can be used in conjunction with account access permissions. For instance, if an elderly parent adds an adult child as the trusted contact in addition to giving the adult child permission to view the accounts, the adult child can monitor the parent’s accounts and receive alerts from the financial institution for suspicious activities.

To add trusted contacts:

- Fidelity: How to add a trusted contact

- Vanguard: Profile & account settings -> Trusted Contact

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Brian T says

Great info, I wasn’t previously aware of this. In attempting to do this today, there’s a catch on establishing full authority access if you have a certain type of account. Cutting and pasting from their site:

Account types eligible for inquiry access, limited authority, and full authority:

– Individual nonretirement

– Joint

– IRA

– Non-ERISA 403(b)(7)

Account types eligible for inquiry access and limited authority only:

– Individual 401(k)*

– Organization or corporate*

– Trust*

– UGMA/UTMA, custodial, or education savings

– Vanguard Retirement Investment program*

* These account types aren’t eligible for the online process. To add a grantee, submit an Agent Authorization Form.

The Agent Authorization Form requires a notarized signature, so it’s a little more involved but still worth pursuing.

Michael Jones says

I also wasn’t aware of this, previously having to login to both my and my wife’s Roth IRA acccounts individually which was annoying. However, she was not able to grant me anything other than Limited Authority either.

Great article, but Harry you need to update the Vanguard terms, as they now seem to match the Fidelity terms with the exception of POA. Rights aren’t quite the same between the 2 though it would appear.

Gordon Shedd says

I agree with the findings of others regarding Vanguard. Assigning “Information Only” and “Limited Agent” status can be done online (I assume–I didn’t complete the process because that’s not what I want). Assigning “Full Agent” status requires a notarized paper form (can be filled out online, then printed, signed, notarized, and mailed). At least that’s what I could access within my PC’s environment (Win 10 Pro, MS Edge browser).

Arlyn says

When my husband open a vanguard account for me , he lets me sign a form that i wasnt aware that its about him doing all the transactions, how can i revoked that form?

Harry Sit says

If you have online access to your Vanguard account, you can revoke the permissions under My Accounts -> Profile & account settings -> Account permissions. If you don’t have online access, call Vanguard at the phone number listed here:

https://about.vanguard.com/contact-us.html

Steve says

Even if you grant account permissions, there may be unanticipated problems.

“Full authority” for an IRA at Fidelity does not give the person with full authority to do online withdrawals from the other person’s IRA. When I called Fidelity about this, I was told that the person with full authority could do IRA withdrawals, but the transactions had to done on the phone. I have not tried using full authority for other person’s IRA withdrawals by telephone.

Harry Sit says

Thank you for sharing this detail. I agree doing it online would be more convenient than having to call.

Susan says

I have a question about your statement saying that, except for spouses, it may be better to not be a joint owner with somebody because you will be responsible for part of the taxes. I thought the 1099 went to the first person listed and that they are responsible for reporting the 1099 amount on their tax form. Can anyone speak to this?

Harry Sit says

From IRS Publication 550 (page 4):

“Joint accounts. If two or more persons hold property (such as a savings account, bond, or stock) as joint tenants, tenants by the entirety, or tenants in common, each person’s share of any interest or dividends from the property is determined by local law.”

So if local law says the two owners own 50:50, the joint owner still owes taxes on half the interest or dividends even though the 1099 form only lists the first owner.

Jack says

The Vanguard full authorization is onerous. I did it successfully for one family member years ago via paper forms. For another family member we failed. Vanguard required notarization AND 2 witnesses. They rejected the form because the witnesses were not unrelated. Fortunately the limited authorization was easy and sufficient for our purposes.

Harry Sit says

Full Authority is the highest level of authorization at Vanguard. Fidelity also requires notarized signatures and two witnesses for its highest level of authorization (POA).

Thomas says

I noticed you mentioned that Fidelity allows you to group the family member’s accounts differently than yours. Is that possible with Vanguard? Currently, my parents just show up in my “self directed” totals – which I’m kind of hating.

Harry Sit says

You can create account groups and assign accounts to each group under Portfolio Watch but Vanguard doesn’t use the account groups you create there in balances, holdings, or activities.

Jeff says

This is bothering me too–on the Balances page, I want to see them grouped separately with separate totals. It doesn’t appear possible.

Moe says

Is there this same possibility for Charles Schwab accounts?

Harry Sit says

Google shows this Trading and Withdrawal Authorization form for Schwab. It mentions Limited Trading Authority (LTA) and Full Trading Authority (FTA). I’m not sure whether the form is still current or whether you can grant the authorization online without a paper form. Please confirm with customer service.

Steve says

How does the owner of a Vanguard brokerage account see who else has authority to the account? I have looked through the website for my accounts and cannot find this shown. I know a relative has authority because we tested it.

Steve says

I found the answer: Profile and account settings > security > account permissions.