[Update in October 2015: BBVA changed the terms of the Build My Savings account. Accounts opened before July 2015 are still on the old terms described here. New accounts have a maximum transfer period of 12 months and a maximum match bonus of $50.]

I updated this post I first wrote a year ago. I received the match bonus as promised. The bank is still offering the same program. It also came out with a checking account that doesn’t require a $1,500 minimum balance or direct deposit, which makes the deal even better than a year ago.

BBVA is the second largest bank in Spain. It bought a number of smaller banks in the US, the largest being Compass Bank in Alabama. BBVA’s US operation is now under the BBVA Compass name. BBVA Compass has branches in Alabama, Arizona, California, Colorado, Florida, New Mexico and Texas. Deposits at the US branches are FDIC insured.

If you live within 60 miles of a BBVA Compass branch, BBVA Compass offers a unique product called Build My Savings. The bank encourages customers to save regularly in a savings account. The savings account itself doesn’t pay much interest but BBVA Compass will match a percentage of your savings. The maximum match is $250 per year per savings account and maximum 2 savings accounts per person.

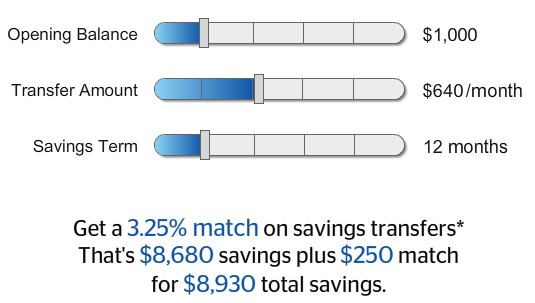

The match calculation uses three factors: the opening balance, the monthly savings, and the savings term. You can learn more about the match by reading this PDF document or by playing with the interactive calculator.

In the simplest form, you can open a checking account and two Build My Savings accounts with $1,000 each and automatically transfer $640 per month from the checking account into each savings account for 12 months. At the end of the term, you will get a $250 bonus in each savings account for a total of $500. The return is about 4.5% on an average balance of $5,200 in each of the two savings accounts. After a year, you start over.

If you are willing to do a little more work, the match can be easily managed to an effective return better than 6% a year for 3 years. Follow these steps I already figured out for you.

Action Steps

(1) If you don’t have one already, open a ClearConnect checking account at BBVA Compass. All transfers to the savings account must come from this checking account. The ClearConnect checking account doesn’t have a monthly fee when you opt-out of paper statements. It doesn’t require a minimum balance or direct deposit. Leaving $50 in the checking account will suffice.

(2) Add the new checking account as an external bank account at your own bank. Transfer $2,100 to it. Also set up a recurring monthly transfer of $1,050 to it for another 35 months starting next month.

(3) Open 2 Build My Savings accounts. Set up for each account: $500 opening balance, $525/month transfer from checking for 36 months. This will use up $2,050 from your checking account, leaving $50 in checking. Set the monthly transfer date at one week after the money is scheduled to arrive from your source account in (2).

(4) Now everything runs on autopilot. Every month, $1,050 arrives at checking; $525 each gets transferred into two savings accounts. After 12 months, BBVA will pay a 4% match on your monthly savings. $525 * 12 * 4% = $250 maximum match in each savings account.

(5) After the match is received, the balance in your savings account is now $7,050. Withdraw $6,540 from each savings account. Pay a $10 fee for the withdrawal. Keep the monthly transfers going as usual. After the withdrawal, the savings account is back to the $500 opening balance.

(6) Repeat (5) after the second year.

(7) After three years, withdraw everything from the two savings accounts and close the accounts. If the program is still offered by then and the 6% effective rate is still attractive, set up the savings accounts again.

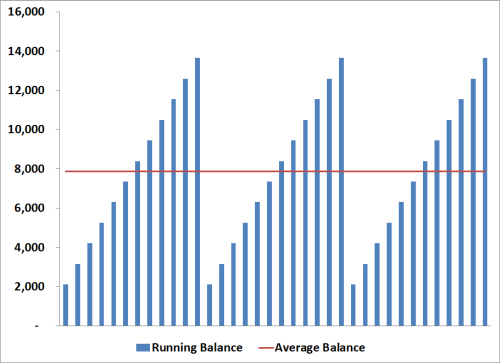

After taking into account the idle $50 in the checking account and all the monthly transfers, the combined average daily balance in all three accounts comes out to under $8,000. You earn $480 a year on this $8,000 in the first two years and $500 in the third year. That’s a return of 6% a year for 3 years.

6% a year on $8,000 in FDIC insured bank accounts for 3 years is better than I Bonds, better than EE Bonds, better than CDs or bond funds, and better than a reward checking account which requires 10 or more debit card charges every month.

In a risky variation, you can tweak the return to 9.8% on an average daily balance of $5,000, although the total match in dollars received is still the same. It involves funding each savings account with $5,000 opening balance and $350 monthly transfers for 36 months but withdrawing the opening balance shortly after the transfers are going.

If you don’t know what you are doing, I don’t recommend pushing the envelope. A 6% return is easy enough and good enough. Some might say even the 4.5% return from resetting annually instead of doing a 3-year deal with annual withdrawals is easy enough and good enough.

This is not a short-lived promotion. According to reader comments, this program has been running for at least several years.

If you happen to live within 60 miles of a BBVA Compass branch (branch locator), it’s an easy extra $1,000+ over 3 years compared to other alternatives. Here’s the match bonus after one year. I received two of these for my two savings accounts.

[Photo credit: Flickr user Dystopos]

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Sad Sam says

Tried and got rejected. While I am a Florida resident, they said I live

too far from their branches in the northern part of the state.

Harry says

Sorry to hear that. I heard there is a 60-mile radius requirement.

TJ says

Any concern they will change the terms before the 3 years are up?

Harry says

Once you sign up, the terms for this installment savings program are fixed, like a CD. I’m not concerned about mid-course changes. However, I’m concerned that the program itself may be discontinued or scaled down after a term ends. That’s why I chose the 3-year term instead of rolling over after 1 year. They used to allow 5 Build My Savings accounts per customer. Now they only allow 2.

Doug says

This interests me, Harry. Thank you.

But, if we are to go through the trouble of opening these new accounts with the goal of locking in these rates, it seems to me that it would be best to optimize the return.

Can you give us more detail on the “expert” version?

It seems to me that the match is maximized when the opening balance is 5k and the monthly transfer is $350. I’m trying to understand why you mention $380.

Also, with regards to the the opening balance:

1) Is it available for withdrawal immediately after the monthly transfers begin? (I understand that at $10 charge will apply.)

2) Is the opening balance (i.e. 5k) applicable for the entire 3 year term? Or, is the formula recalculated on each anniversary using the current balance?

Thank you for the work you put into this blog, Harry. I enjoy learning from you.

Harry says

Doug – Good catch. I looked at my spreadsheet again. Yes it should be $350/month not $380 for a $5,000 opening balance. $380 is the transfer amount required for a $3,000 opening balance.

As I understand from reading the terms, the opening balance is only looked at once at the beginning of a 3-year term. So in the “expert” version you would fund two accounts with $5,000 each, withdraw $4,990 after one month, withdraw the account down to $25 at each anniversary after you get the match bonus. But if that reading is wrong, it will ruin a good thing for pushing it. It also seems to violate the spirit of the opening balance.

The bonus is the same $250 a year regardless. The only difference is how much capital you use to drive it. The opportunity cost for the extra capital isn’t much anyway. So I opted for the moderate version: keep the opening balance in the account at all times and only withdraw the transfers and bonus once a year.

Kyle says

According to the Build-to-Order checking terms (https://www.bbvacompass.com/checking-accounts/compare-checking-accounts.jsp), one of the requirements to avoid the $10.95 monthly charge is Preferred Client PLUS (http://www.bbvacompass.com/preferred-client/), which requires $100,000 in accounts at BBVA. Am I reading that wrong, or are you including the monthly fee in your calculations?

Harry says

The requirements are OR not AND. I meet the requirements by keeping $1,500 in the checking account. The return percentages already take the $1,500 into account.

TJ says

FYI, no need to go in branch anymore. I did it online and was called by a telebanker on the other side of the country to confirm some information. You can only apply for 1 build my savings at a time when you apply online, but easy enough to apply for a 2nd after it’s set up.

Kyle says

Regarding 2) Add the new checking account as an external bank account at your own bank

My bank doesn’t allow this, and neither does BBVA. Would I have to use a bill pay from my own bank to BBVA?

Harry says

Kyle – You will have to find a bank that does outgoing ACH. ING DIRECT does. Ally does. So do many other banks.

Jeanette says

I’ve been participating in the “Build my Savings” program for a few years now. They DO allow you to set up several accounts (as I currently have 6 running at once right now). Just talk to your banker at Compass and they’re glad to help.

Louis says

From BBVA:

“The monthly Service Charge will not apply for statement cycles during which one or more of the following requirements are met:

There is at least one Direct Deposit transaction (ACH credit) of $300 or more from an unrelated 3rd party (such as an employer or Social Security), OR

The account has an average daily collected balance of at least $1,500, OR

The primary accountholder is enrolled in the BBVA Compass Preferred Client Program* and maintains Preferred Client or Preferred Client PLUS status (subject to eligibility), OR

The primary accountholder applies and is approved for student status (active student ID required), the monthly service charge will not apply for a period of up to 5 years, or until the primary accountholder reaches age 25, OR

The primary accountholder applies and qualifies for everyday hero status.”

Everyday hero means:

“(1) a certified teacher or administrator of an accredited or state-recognized public or private school; (2) a sworn member of a law enforcement department that is responsible for crime detection, prevention, law enforcement or incarceration; (3) a sworn member of a fire department involved in fire suppression or prevention, emergency medical response, hazardous materials response, terrorism response or management; (4) a health care worker who is certified, accredited or licensed to work in the health care industry as a nurse, pharmacist or medical technician; or (5) a person who has served or is currently serving in the U.S. Military: active, retired and reserved duty. ID or other verification required. BBVA Compass reserves the right to review everyday hero status on a periodic basis. Build-to-Order terms and conditions, including everyday hero promotional pricing, are subject to change at any time, at the discretion of BBVA Compass.”

So, this is even a better deal if you meet the hero category because you don’t need to meet the daily balance requirement.

John says

Harry, what is the “after 3 bill payments of $50 each,” in step 3? Why is it needed and is that a one time bill pay or recurring?

Harry Sit says

They are needed only if BBVA is still offering $100 bonus for opening a checking account and you want to qualify for it. It doesn’t matter whether they are one-time or recurring. You can stop them after 3. Say pay a credit card $50 3 times 4 days apart and you are done.

TJ says

Is the ClearConnect accout new? I have had $1500 in my checking account, and I can’t seem to remember why.

Harry says

Yes it’s new since October 2013. Previously the checking account required $1,500 or direct deposit to waive the monthly fee.

TJ says

Were you able to convert your existing checking account to ClearConnect?

Harry says

I didn’t bother. The cost of tying up $1,500 is very low. It’s not worth the risk of upsetting the already working setup that’s paying me $500 a year.

john says

Harry, I did the 3 year setup following your earlier post. So even if BBVA Compass changes things around we should still be grandfathered for 3 years based on the automated setup and get our 5+% interest, correct?

Harry says

That’s my assumption.

TJ says

My first bonus posted. Need some direction on the best way to withdraw. Can I ACH pull from the savings account directly to Alliant?

Or do I need to transfer from the BBVA savings account to the BBVA checking account first? I attempted to do this, but they did not mention anything about a fee. I don’t want to screw up the match for next year…

Harry says

I transferred from savings to checking before pulling the money out by ACH. I wasn’t charged the $10. The safest way to ensure the match next year would be closing the savings accounts and starting fresh with a new term. I’m willing to take a chance.

David Jiang says

I just opened 2 Build my savings accounts with 36 month term, 5k initial deposit and $350 monthly transfer. There is currently $5,350 in each account right now (first month transfer just went through) was wondering if I can transfer all $5,350 out of the savings account and still qualify for the match bonus…

if so, how are they going to charge me the $10 fee if I withdraw everything?

Thanks in advance 😀

David Jiang says

Sorry, looks like I only have a couple minutes to edit my post before it doesn’t let me anymore.

I was wondering why you withdraw all but $25 after each anniversary after getting the match bonus instead of withdrawing everything? Or at least only leaving $10 in there for the fee?

Harry Sit says

$25 is the minimum amount to open a savings account. The theory is that keeping $25 will keep the account open. Note in the reply to TJ’s comment above yours there’s a risk to withdrawing after year 1. Some bank employees told customers the bonus is off after one withdrawal from savings. I don’t see it in the written terms though. If you want to be absolutely sure to get the bonus every year you would close the savings accounts and start over every year. I will see what happens come October 2014.

John says

Harry, I am assuming the only reason for withdrawing from the Savings account or closure is to ensure the %returns are high. Else if the funds are left in the account the returns are lower?

Harry Sit says

Yes. If you are able to earn the bonus anyway with recurring transfers to savings, there’s no point in leaving the extra $6,500 in the account earning nothing.

John says

Does setting up this bank account create a hard pull. Noticed a hard pull on my transunion report.

Also the funny part is I remember the branch manager and the associate mentioned it would apply for a CREDIT card by default even when I said I did not want one which sounds riduclous to me.

Is it only my branch or did others experience a similar hard pull?

Harry Sit says

I don’t know whether they did a hard pull or not (didn’t care). No credit card came with it.

Rod says

A helpful info for those that have to go to the branch to open the account (if you are not a US citizen or green card holder). When setting up the ‘Build My Savings’ account, assuming you already have the funds in your checking account, you have to provide the initial deposit _and_ the date and amount for the first transfer.

Warning: You can’t choose the first transfer to be on the date you open the account, you have to give it at least +1 day. E.g., if you are opening the account on July 01, you must tell BBVA to make your first transfer on July 02, otherwise, if you choose July 01, the first transfer will actually only happen on August 01, which delays the whole process by 1 month.

Harry, as a recent resident alien, your blog has been invaluable in helping me understand many of the financial, tax and smart ways of getting the most out of your hard earn money.

TJ says

@Harry – have you received the 2nd year bonus after taking the withdrawal? If it does not work, I’m wondering how to stop the automatic transfers.

Harry Sit says

Last year’s match bonus was paid in late October. I’ll give them until the end of the month. If I don’t get the match, I will visit the branch. Maybe they will do a manual adjustment because nowhere says the match won’t be paid if there is a withdrawal. If not, I will close the savings accounts and re-open two new ones with one-year contracts.

TJ says

Thanks for the update, mine was paid in mid-late November. Hopefully they will show up as anticipated. Unlike you, I ACHed directy from the savings account, but I doubt that would make a difference.

Harry Sit says

I received the match bonus for the second year.

TJ says

I also received the match bonus for the second year. I guess our next question will be if the automatic transfers end automatically after the 36th month. 😀

John says

TJ, isn’t your automatic transfer setup as a push from external bank to BBVA? Confused by your statement cause I was told BBVA does not have the ability to do a pull

Harry Sit says

The BMS terms already said the savings accounts will become regular savings accounts after the building period is over and that the automatic transfers will continue. You need to re-sign a new BMS term if you want to get the match bonus again. Not sure if you can reuse the existing savings accounts and just attach new BMS to them or you will have to close them and open new BMS accounts. I will ask after I get the 3rd match bonus.

John says

Harry, when you say “automatic transfers will continue” do you mean from BBVA checking to BBVA savings? Wouldn’t they have setup the transfers only based on the length of the Build My Savings term.

Would be good to validate rather than pay NSF fees

Harry Sit says

Yes, I meant the transfers from checking to savings. They want you to continue the habit of building your savings even without the match bonus.

“What happens to my account once I’ve reached my goal?

Once you’ve completed your plan, your account will revert to a Basic Savings account. Note: Your automatic transfer will continue until you cancel.”

https://www.bbvacompass.com/buildmysavings/faq/#q12

TJ says

John,

You’re totally right! BBVA does automatically transfer funds from the BBVA checking to the BBVA savings, but if I empty them both out after the last match is received – problem solved.

Ron says

Received an e-mail from their customer support when I asked about the Build My Savings plan and they said that you can open up to six accounts but each can only be for a 6 month or 12 month term, no longer terms available (even though the calculator on their site still allows for a 36 month term).

Has anyone confirmed this after your 36 month term has ended and you weren’t able to start a new one for the same term or has anyone attempted to open a new account and found this to be true?

Still sounds like a pretty good deal though even if it is for only a year.

Comments anyone?

TJ says

If that is accurate, they still have not updated the FAQ on their website.

Harry Sit says

Between maximum 2 accounts for 3 years and maximum 6 accounts for 1 year I much prefer the latter.

Jeanette says

Just last week I just opened 2 more BMS accounts for a 36 month period after my last 2 BMS 36 month accounts matured. I really think it depends on the teller/manager, how well educated they are about the program, and how willing they are to keep you as a customer. I basically had to walk the manager through the whole process since he wasn’t very familiar with BMS and it took 2 other bankers to assist him to figure it out. Whatever you do…..get the confirmation page printed with the terms and they HAVE to honor it! Hope that helps!

Ron says

Based on the e-mails I received from BBVA and some comments above, I thought I could sign up for a Build My Savings account over the phone but found out that you have to go into a branch to complete the process. This was after signing up for one of their checking accounts.

Since going to a branch is not an option for me (over 100 miles away), had to cancel everything and now going through the process of trying to get my initial deposit back.

Wish the website and their customer service was clear on this point- You have to go into the branch to open a Build My Savings account whether it’s one or three years!

Harry Sit says

You have to be within 60 miles from a branch. This is noted in the 3rd paragraph.

Ron says

But it doesn’t indicate that on their website, or in any e-mails I received or while on the phone with their customer support. In fact, while on the phone finding out that you have to go to a branch, they said that opening a Build My Savings account even though I’m 100 miles away (actually 80) would be no problem.

They just don’t seem to know what their actual policy is concerning the Build My Savings account. Even in this post you can see that some have been able to open an account online (I couldn’t), some by phone (I couldn’t) and some at the branch (I haven’t tried though maybe not because I live over 60 miles away).

Some have been able to open a three year account while I can’t seem to get anyone from BBVA to say that it is possible, maybe at the branch but again, that’s not an option for me at this time.

Appreciate the info from this post and those lucky enough to get a Build My Savings account for three years (or even a one year account) whether online, by phone or at a branch should feel good about it but BBVA does need to get their act together.

TJ says

I opened it up online 2.5 years ago. Was contacted by e-mail and by phone.

Ron says

There website alludes to the fact that you can open the account by phone (not online) but while their e-mail support confirms it can be opened by phone with no mention of having to go into a branch, their phone support says you have to go into a branch to open an account.

I just wish they’d get their stories straight to save a lot of headaches and time lost.

Interested to see if you can renew after your three years are up.

Jeanette says

As I mentioned earlier, you are able to open up additional 12, 24, or 36 month accounts BASED on how knowledgable the manager/teller is. I currently have 8 BMS accounts running at the same time . Only once a teller was hesitant to assist but opened another one for me when I threatened to take my $ elsewhere . And YES, they do need to get their act together but if I can get up to 6% interest/year….. Not going to complain!

Ron says

Glad to hear that you’re able to get into this without much hassle. Unfortunately due to a disability, I’m unable to travel to the nearest branch and take my chances that the manager/ teller knows what they are doing.

Don’t understand why these accounts cannot be opened online or by phone (or can they be based on some of the responses above if you get the right rep?) as long as you live in one of the states that BBVA operates.

Maybe once I’m able to, I’ll take a chance by calling first to confirm if there are any restrictions such as distance (that makes no sense to me either), limitations on number of months that can be opened (I was told only 12 month but you have opened 36 months), number of accounts (I was told 6 but you indicate you have 8) and then drive the distance to see what happens.

Yes, 6% a year is worth the hassle when you are able to put up with it.

Jeanette says

Good Luck Ron- hope they can help you!

Andre says

Is anyone withdrawing more than one time a year? I’m not looking to overdo it, but I’m looking at withdrawing every six months rather than at the end of year to free up some cash.

Thanks!

TJ says

haven’t bothered to try. once a year is enough for me.

Hans says

I’ve withdrawn multiple times in one year and never been charged the $10 fee and still received my match bonus. My first account just paid out the final bonus and I’ve closed it and will be opening a new one. The up to 6 accounts for 1 year sounds very attractive!

CT says

1) For those with more than 2 accounts, were you able to open more than 2 when you first opened your accounts or did you have to return later to open more accounts?

2) Can you open the checking account and the savings account on the same day if you fund the checking account with a check from another bank? Usually when I’ve opened a new checking account, the funds have been put on hold to clear before I can use them, so my question is would the funds in the checking account I just opened be available immediately to use to fund the savings account?

Jeanette says

Personally, the most I opened at 1 time were 4 BMS accounts along with 2 checking accounts all Compass and on the same day. I opened the extra 2 checking accounts as a way of saving for my kids. My SS#, but meant for them. I never have used “outside” $ so I never had a hold put on any funds.

Joseph says

Just found out BBVA Compass is temporarily discontinuing BMS accounts… my local branch posted this notice last week:

“Effective July 1, 2015, the current Build My Savings account will no longer be available. Look for a new Build My Savings account in the near future.”

One of the reps told me it was likely to be reintroduced in Q3 of 2015, but there’s no telling what the new account conditions will be.

Harry Sit says

Thank you for the heads-up. My 3-year term will end in October. I will see if they let me open some new accounts now before July 1.

Harry Sit says

I tried to open new accounts at a branch but I was turned down. They said they weren’t allowed to open new ones after June 15.

John says

Harry, I opened 2 accounts for 3 years today. Are you in the Bay Area? I can message you the branch

Harry Sit says

Yes please. Thank you!

John says

Done 🙂

Harry Sit says

Build My Savings accounts are back! But, but, the new accounts only get up to 12 months and 1% match up to $50. Be sure to close your account after your original term is up.

DB says

It looks like they are still only matching 1% up to $50 on a 1 year plan. 🙁

https://www.bbvacompass.com/savings/buildmysavings.html