This is part of the TFB Awards for Best In Class in Financial Services series.

The Vanguard STAR Fund (VGSTX) wins the award in the category of Best Mutual Fund for Investing Less Than $3,000. If you read a few books on my Recommended Reading List, you will know that you should invest through mutual funds and not buy and sell individual stocks yourself. A good mutual fund gives you instant diversification at a very low cost. The expense ratio on the Vanguard STAR Fund is 0.36% a year. This means that if you invest $1,000, you pay a management fee of $3.60 for the entire year for Vanguard to manage your investment. What do you get for this $3.60? You get a bundle 11 other Vanguard mutual funds as a package. It’s like a flower bouquet. Rather buying individual flowers separately, you get a pre-arranged bundle arranged by a professional florist. And what are in those 11 other Vanguard funds? Here’s the list:

- Vanguard Windsor II Fund (VWNFX): 291 stocks

- Vanguard Long-Term Investment-Grade Fund (VWESX): 249 bonds

- Vanguard GNMA Fund (VFIIX): 25 bonds

- Vanguard Short-Term Investment-Grade Fund (VFSTX): 730 bonds

- Vanguard Windsor Fund (VWNDX): 136 stocks

- Vanguard PRIMECAP Fund (VPMCX): 125 stocks

- Vanguard U.S. Growth Fund (VWUSX): 72 stocks

- Vanguard Morgan Growth Fund (VMRGX): 345 stocks

- Vanguard International Value Fund (VTRIX): 227 stocks

- Vanguard International Growth Fund (VWIGX): 143 stocks

- Vanguard Explorer Fund (VEXPX): 1,110 stocks

All together, 2,449 stocks and 1,004 bonds! Granted there might be some overlaps but I think it’s safe to say you will have over 1,000 stocks, both U.S. and international, plus hundreds of bonds working for you, for paying a small fee of 0.36% or $3.60 per $1,000. You can’t get a better deal than this.

The Vanguard STAR Fund follows a classic moderate allocation. It invests roughly 60% in stocks, 40% in bonds. Stocks include both U.S. (80%) and international (20%). Bonds include both long-term (1/3), intermediate-term (1/3) and short-term (1/3). It is therefore well balanced. For investing a small amount, this is the best fund. Even as your assets grow, this is still one of the best choices.

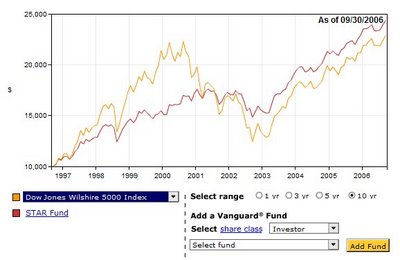

How did it perform? Very well. Over the last 10 years as of 9/30/2006, the average annual return is 9.29%. Compare that to the average 8.56% return from the U.S. stock market over the same period, the Vanguard STAR Fund achieved better return with 60% in stocks than the stock market as a whole (100% stocks). Look at the picture below. It didn’t go up as high when the stock market was in bubble and it didn’t go down as much when the stock market crashed.

References:

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Jay says

I heard this fund is not good in a taxable account, because it’s not tax efficient?

Harry Sit says

You found one of my posts from the very early days in 2006. Since then Vanguard lowered the minimum investment on all its Target Retirement funds to $1,000. Today the STAR fund won’t qualify as the best for investing less than $3,000. Instead, I would give it to one of the Vanguard Target Retirement funds.

Good or not good in a taxable account is all relative. It’s good enough when you consider that you don’t have to micro-manage when you go with an all-in-one fund.