This is part of the TFB Awards for Best In Class in Financial Services series.

The Vanguard LifeStrategy Moderate Growth Fund (VSMGX) wins the award in the category of Best Mutual Fund for Investing More Than $3,000. This fund (hereinafter LS Moderate) requires a minimum investment of $3,000. If you are investing $1,000 – $3,000, the Vanguard STAR Fund wins the TFB Award in that category. Like the STAR fund, LS Moderate also invests in other Vanguard funds. It’s even less expensive than the already inexpensive STAR Fund. It’s more straight-forward and it more broadly diversified. The expense ratio on LS Moderate is 0.25% a year. This means that if you invest $3,000, you pay a management fee of $7.50 for the entire year for Vanguard to manage your investment. For this $7.50, you get to invest in these funds:

- Vanguard Total Stock Market Index Fund (VTSMX): 3,736 stocks

- Vanguard Total Bond Market Index Fund (VBMFX): 2,733 bonds

- Vanguard Asset Allocation Fund (VAAPX): overlapping stocks and bonds with 2 funds above

- Vanguard Total International Stock Index Fund (VGTSX): 2,053 stocks

All together 5,789 stocks, both U.S. and international, and 2,733 bonds! That’s almost everything under the sun. With the broad coverage, you capture the return from the entire market. If someone tells you about a hot stock, be it Google or Cristalerias de Chile, you can nod your head and tell them “I’m already in it.”

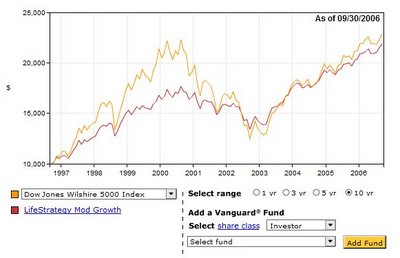

LS Moderate follows a classic moderate allocation. It invests roughly 60% in stocks, 40% in bonds. Stocks include both U.S. (80%) and international (20%). Bonds include different issuer types (government, corporate) and maturities. It is therefore well balanced. The Vanguard Asset Allocation Fund component adds a small swing factor to the asset allocation. Right now the stock percentage is 70%, not 60%, but it’s a minor issue, nothing to sweat about. Over the last 10 years as of 9/30/2006, the average annual return on LS Moderate is 8.28%, only slightly less than the 8.56% return from the U.S. stock market over the same period. In other words, the LS Moderate achieved almost as good a return with only 60% in stocks as the stock market as a whole (100% stocks). Look at the picture below. It didn’t go up as high when the stock market was in bubble and it didn’t go down as much when the stock market crashed.

References:

Runner Up: Vanguard STAR Fund

The Vanguard STAR Fund is a TFB award winner for Best Mutual Fund for Investing Less Than $3,000. It is still pretty good if you are investing more than $3,000 or if you started with STAR and wish to stay there. All the reasons for giving it the TFB Award for the other category are still valid. Its return in the last 10 years was higher than award winner LS Moderate, but the higher recent performance shouldn’t be a dominating factor because it could be due to pure luck. I didn’t give the TFB Award to STAR for this category because LS Moderate is less expensive and more broadly diversified.

References:

Both funds are fine choices, despite slight differences. You won’t go wrong with either of them.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Dogberry says

You mention the expense would only be $7.50 for a $3,000 investment. But doesn’t Vanguard charge a separate $10 fee if you have less than 10k in a fund?

Still sounds like a good idea so you don’t have to pay two or three $10 fees to do the asset allocation yourself.

Dogberry

Money & Investing Dogberry Patch

Harry Sit says

No, the $10 fee is only on index funds. LS Moderate and STAR are not index funds although LS Moderate invests in index funds. If you only have $3,000 in an IRA, there is a $10 fee for the IRA, but if you have $3,000 in a regular account in either LS Moderate or STAR, there is no fee.