When I looked at my 401k account for something else, I noticed this from the performance sheet:

My 401k plan offers two choices for intermediate-term bond funds: PIMCO Total Return Institutional and Vanguard Total Bond Market Index Fund Institutional. As of November 30, PIMCO Total Return squarely beat Vanguard Total Bond Market Index Fund in 2012: 10.09% vs 4.38%. That’s huge for a bond fund.

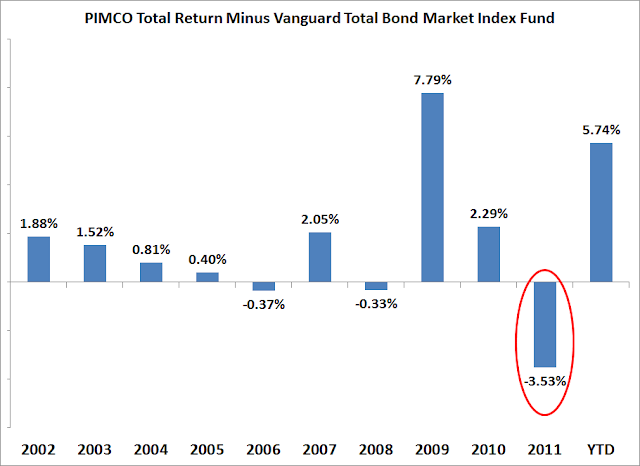

I remember vividly last year everybody piled on Bill Gross, the manager for PIMCO Total Return, when he sold Treasuries prematurely. PIMCO Total Return suffered from that decision in 2011. It underperformed the Vanguard fund by 3.5%. But It made it all back plus some more in 2012.

Here’s a chart showing the difference in annual returns between PIMCO Total Return and Vanguard Total Bond Market Index Fund.

Except in 2011, PIMCO Total Return beat Vanguard Total Bond Market Index Fund pretty much every year in the last 10 years. When it did worse in 2006 and 2008, it was only by a small amount, whereas when it did better in other years, it was often by a much larger margin.

How did Bill Gross and the PIMCO team do it? I don’t know. I’m sure if someone digs deeper under the hood, they will see Bill Gross took more risk. Some will also say Bill Gross got lucky. It is possible to get lucky for a long time. Bill Miller of Legg Mason is usually offered up as an example.

The thing is, we will never know whether Bill Gross was lucky or Bill Miller was unlucky. Knowing which risk to take, to what degree, and at what time, is of tremendous value. Some risks are worth taking; some are not; and the risks worth taking keep changing with time. You win some, you lose some, you never know whether one way is better than another. So even if Bill Gross took more risk, as long as it’s the right risks at the right times I don’t think the average 401k participants care. If luck gives more dollars in the account, they will go with luck.

Index funds beat actively managed funds on average. When it comes down to any specific fund X, it’s far from certain that an index fund will beat fund X next year or in the next 10 years. 10 years ago someone believing that an index fund is superior to an actively managed fund would have chosen the Vanguard index fund over PIMCO Total Return. Over the next 10 years this investor would see the Vanguard index fund doing worse than PIMCO Total Return almost every year, sometimes by a lot.

Back in 2002, PIMCO Total Return wasn’t a small obscure fund that nobody knew. It was already well known. Sometimes even chasing the star manager works. The fund manager can get lucky. You can’t beat luck. This is why investing is hard.

By the way I’m not in either of these two funds because I’m filling my tax deferred accounts with stock funds.

[Photo credit: Flickr user jessleecuizon]

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

joe says

Sometimes you get lucky. I am curious to see what Bill Gross did differently though. I think going forward 2013, it is going to be difficult to make money in bond funds. Maybe a little bit in 2013, and then the party is over. Yields are pretty low right now, maybe at historic lows.

Financial Samurai says

Nice pick up of the fund Harry! I think Bill is a rock star in general.

Happy holidays!

Sam

aua868s says

Vanguard Long Term Bond Index(VBLTX) beat PIMCO Total Return Institutional for different periods as follows.

last 1 year –

VBLTX 5.07% and PTTRX 4.51%

last 5 years

VBLTX 24.26% and PTTRX 7.08%

last 10 years

VBLTX 24.05% and PTTRX 6.67%

Harry says

Vanguard Long Term Bond Index is not an available option in my 401k plan. Even if it is, on what ground would one have chosen it 10 years ago? Respected author and financial advisor Larry Swedroe wrote in The Only Guide to a Winning Bond Strategy: “The rules of prudent fixed income investing are … Purchase assets with a maturity that is short- to intermediate-term, avoiding long-term bonds”

funancials says

Thanks for the analysis and sharing your 401(k) options.

I’m a huge fan of Bill Gross, and in my opinion, he makes investing extremely easy. Whether he’s lucky or good is debatable, but I would lean towards “good.” I don’t know exactly WHEN the bond bubble will burst, but when it does – I would prefer to have Bill Gross controlling them. Whether he’s underweight or shorting, I feel confident he’ll know what to do.

I must add that part of my infatuation is because he reminds me of David Spade.

aua868s says

Harry

I am sorry that your 401K does not allow Vanguard Long Term Bond Index. But to your other point “on what ground would one have chosen it 10 years ago? “, you need to understand that here we are not talking about a fancy Stock. We are talking about an index fund focused on Long Term Bonds from the reputable Vanguard family.

Regards

Harry says

Even when respected author and financial advisor said prudent investors should avoid long-term bonds? By the way the numbers in your previous comment were not correct. I get these for VBLTX as of November 30, 2012 from Vanguard’s website:

last 1 year 13.26%

last 5 years 10.23%

last 10 years 8.38%

Nowhere do I see 24%/year return for 10 years.

NervousCat says

I also have both mutual fund choices available in my 401k Plan, so I include both of them my retirement portfolio. I believe in index funds, but if you are lucky enough to get the lower expense ratio of 0.45% for institutional class shares of the PIMCO Total Return Fund, why not get both?

aua868s says

Oh Harry Oh Harry…what can I say ! I do not know where you looked. But I took at a look at Google Finance at the following link. In this link you can click on 1 yr, 5 yrs & 10 yrs. It might be off by a few 1/100 th of percentages because of the few days between my earlier posting and today’s, but it is all there for you to see! Enjoy!

http://www.google.com/finance?client=ob&q=MUTF:VBLTX

Regards

aua868s says

Way to go NervousCat…I like your approach rather that just shutting one’s eyes to reality (not to say just ignoring the facts right in front of us)

Regards

Harry says

aua868s – The numbers you see in Google Finance charts are (a) price only, not including distributions; and (b) cumulative, not annualized return. When you want accurate numbers, go to the source. Who has better numbers on Vanguard funds, Vanguard or Google Finance? Here’s what Vanguard says about its own fund:

https://personal.vanguard.com/us/funds/snapshot?FundId=0522&FundIntExt=INT#tab=1

aua868s says

Harry – Let us go with your numbers. Still VBLTX which is an Index Fund beats your “Bill Gross returns”! I would take VBLTX which has got better returns plus lower Expense Ratio. No luck needed here! Just pure plain Index Fund investing!

Regards

Harry says

If someone went with Vanguard Long-Term Bond Index Fund 10 years ago as their core bond holding and stayed with it for 10 years, I would put them in the same category as Bill Gross — “got lucky.” Experts are against actively managed funds, but Bill Gross delivered more dollars in the investors’ pockets. Experts said avoid long-term bonds, but long-term bonds delivered more dollars in the investors’ pockets, even more so than Bill Gross. Either experts are wrong or investors got lucky. When you get lucky, celebrate. It doesn’t mean the strategy is sound.

aua868s says

Harry – Agree with your last posting. I was kinda playing Devil’s Advocate. Good points! After your points against Long Term Bond fund investing, I have been reading around and I concur with your thoughts. I am moving my bond fund investments from Long Term to Intermediate Term. Based on my reading experts’ posts, they say that when interest rates rise, the Long Term bonds would get a heavy hit (and this is bound to happen soner or later).

By the way, I recently stumbled on to this blog. This seems very informative…by the way, are you the owner of the blog?

Regards

Harry says

Yes I’m the owner of this blog. Thank you for reading.

Pete says

First of all, you are not comparing apples to apples. Pimco Total Return holds high yield bonds, Vanguard Total Bond doesn’t. Pimco holds foreign bonds, Vanguard doesn’t. The two funds are very, very different.

Harry says

Pete – I did it on purpose because these two choices are put in front of 401k participants. The average 401k participants don’t know or care about high yield bonds or foreign bonds. They just want more dollars in their accounts. Suppose ten years ago employees Jack and Jill joined the 401k plan with these two choices for bonds. Jack chose the PIMCO fund because he saw Bill Gross on TV. Jill chose the Vanguard fund because she learned from books that indexing is the way to go. Since then Jack got more money in his account than Jill almost every year. Jill says “You got high yield bonds and foreign bonds!” Jack shrugs, “Whatever makes money.”

Kurt says

Harry,

I read your blog and felt the need to commend you and let you know that your logic is spot on.

The poster who compared the Vanguard Long Term Index Fund to the Pimco Total Return fund is misinformed. No professional on earth would establish a Long Duration Bond Index for the Total Ret Strategy from Pimco, they would use the Barclays Aggregate which is an appropriate benchmark for Core Investment Grade Credit. If the poster would like to compare Mr Gross to his Long Duration Index Fund then he should compare a strategy that Bill Gross manages to a Long Duration Benchmark. If the poster took the time to conduct a suitable analysis he would see that Bill Gross pretty much destroyed his index fund. I have provided a similar total return summary from iShares website that shows the performance but unfortunately the data does not go back 10 years. Pimco launched the Long Duration strategy in July 2006:

Av Ret. St Dev CumRet. Inital Ending 11/30/12

iShares Core Total U.S. Bond Market ETF FI 6.22 3.42 46.54 $10,000.00 $14,654.36

PIMCO Total Return Fund;Admn 8.24 4.09 65.11 $10,000.00 $16,510.78

Vanguard Long-Term Bond Index Fund;Investor 10.13 10.21 84.26 $10,000.00 $18,425.96

PIMCO Long Duration Total Return Fund;Inst 11.00 9.85 93.63 $10,000.00 $19,362.62

It is a shame that an “Indexer” or a Vanguard lover cannot take the time to appreciate the contributions of one the greatest living money managers in Mr Gross. In most cases, individual investors do not have access to the very great managers of our time because most of them work for hedge funds so that they do not have to subject themselves to comments like the ones made by poster aua868s.

In regards to your question as to whether Mr Gross beat the index by taking on more risk, the answer is no! If you look at the returns, Mr Gross generated his returns with less annualized standard deviation (ie risk) versus the benchmark in both cases. In regards to picking one fund overall, I personally would prefer to have Bill Gross selecting where to apply risk in the bond market over an unmanaged index from Vanguard.

With all that said, the great thing about 401k investments is that you can pick them both!

Happy New Year!

Roger @ The Chicago Financial Planner says

The great South African golfer Gary Player once said “… the more I practice the luckier I get…” Gross and the group who provide analysis for PIMco Total Return are very smart and I perceive them to be hard workers in terms of the depth of their fixed income analysis. The results they have achieved are not the result of luck in my opinion. At this point I still consider this to be one of the better core bond funds available.

Tony says

My first day of Official Boglehead Member; my first link from the Boglehead Wiki.

Incredible!

Great post, very good comment quality (specious, retort, clarification, factual), I love it!

I’ll be saving your site on favorites. Great job!

(I’m in a variety of Pimco funds, including Total Return. While I drink the index fund Kool-Aid at Vanguard for equities, VTIP and VIPSX, I am a satisfied customer of higher fees and potential returns in Pimco’s process…

T