When the COVID pandemic hit and unemployment soared in 2020, Congress passed the CARES Act, which gave special tax treatment for eligible withdrawals from retirement accounts. The usual 10% penalty on early withdrawals before age 59-1/2 is waived. The withdrawals can be treated as spreading over three years, and no income tax will be owed if the withdrawal is repaid in three years. To be eligible, the withdrawals must have taken place between January 1, 2020 and December 30, 2020 (not December 31), and the total withdrawals must not exceed $100,000. An eligible withdrawal is called a coronavirus-related distribution (CRD).

Maybe you took the offer because you had to supplement your income. Maybe you took the opportunity to move $100,000 from the expensive retirement plan through your employer to your IRA. By now you should have received a 1099-R for your retirement account withdrawal. The 1099-R itself doesn’t say anything special about it being a coronavirus-related distribution. You’ll get the special tax treatment only if you do something different on your tax return. Tax software such as TurboTax and H&R Block can do it perfectly fine. Here’s how. We’ll use these two examples:

Example A: You were affected by the COVID-19 pandemic and you withdrew $30,000 from your workplace retirement plan between January 1, 2020 and December 30, 2020. It qualifies as a coronavirus-related distribution. You’d like to spread the withdrawal on your tax return over the next three years.

Example B: Same as Example A except you already repaid the withdrawal in full by putting the money into your IRA. You should owe no tax on it.

TurboTax

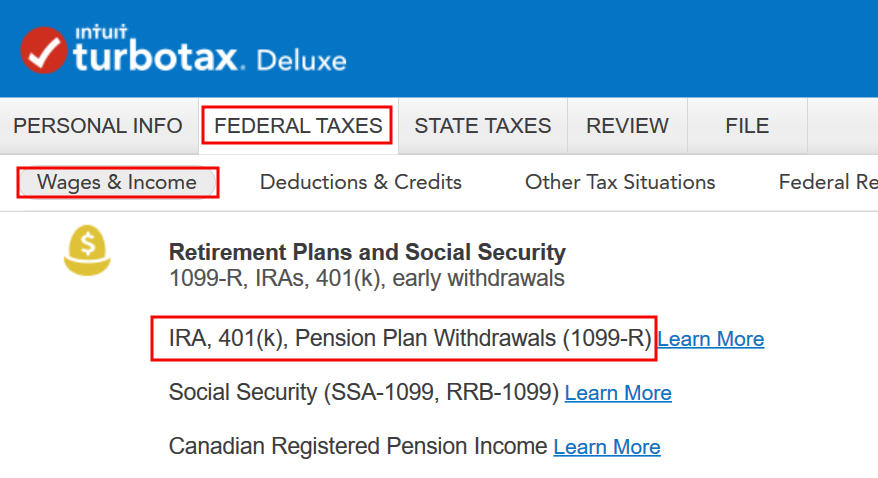

TurboTax has a place for all 1099-R’s. You enter the 1099-R into TurboTax as usual under Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

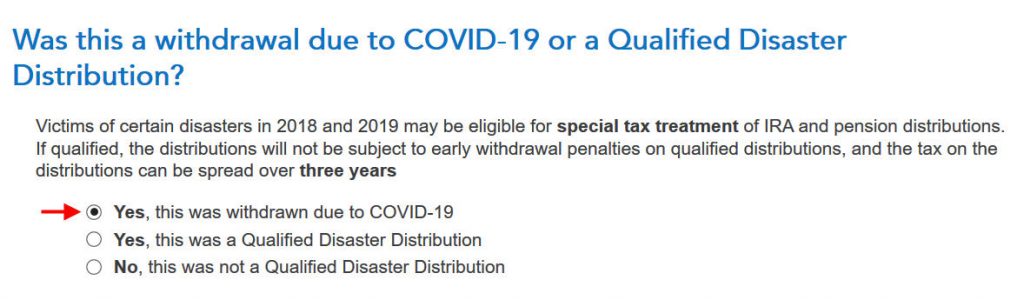

Right after you enter the 1099-R, TurboTax asks you whether it was a coronavirus-related distribution. You answer it was due to COVID-19.

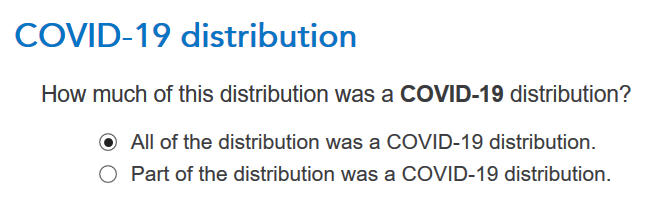

100% of the withdrawal was a COVID-19 distribution in our example. If you had a mix of COVID and non-COVID distribution during the year, you break it down in the software.

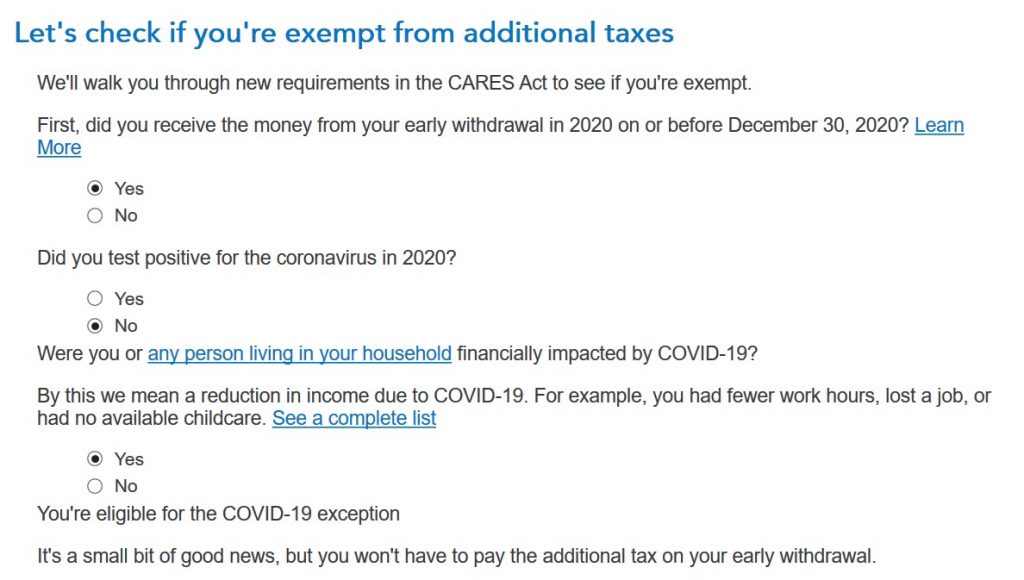

TurboTax checks additional eligibility, including the date of the withdrawal and how you were affected by COVID.

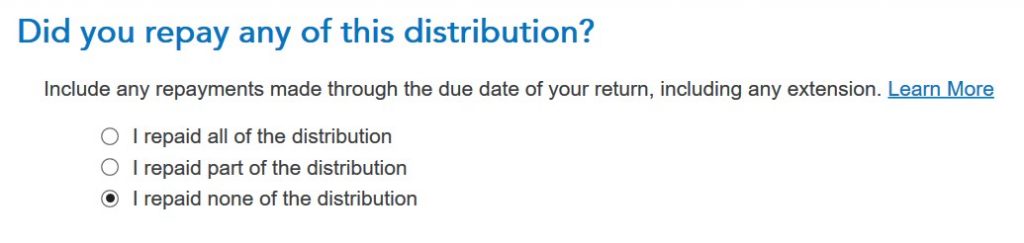

Now it asks you whether you repaid the withdrawal. We didn’t repay in our Example A. We repaid all of it in our Example B. Choose the option that applies to you.

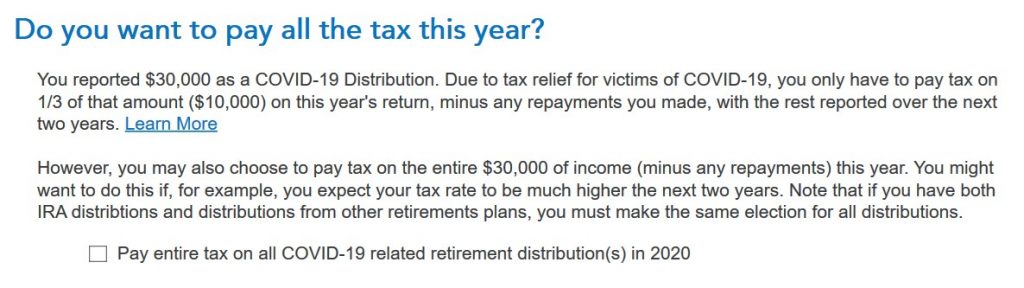

If you didn’t repay, you can spread the distribution on your tax return over three years, which is the default. If you’d like to forego the spreading option and add it all to 2020, check that small box at the bottom.

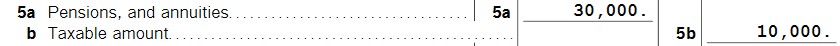

After you go through the interview, you can check your tax form to see if the software did it correctly. Click on Forms on the top right and then find “Form 1040” in the left navigation pane. Scroll down to find Line 5. The gross amount shows up on Line 5a. If you chose to spread the withdrawal over three years, 1/3 of it shows up on Line 5b. If you already repaid the withdrawal in full, Line 5b should show 0.

You see this is quite straightforward in TurboTax. You don’t need a tax professional for this at all.

H&R Block Software

It takes more work to do the same in H&R Block software. We’ll use the same examples.

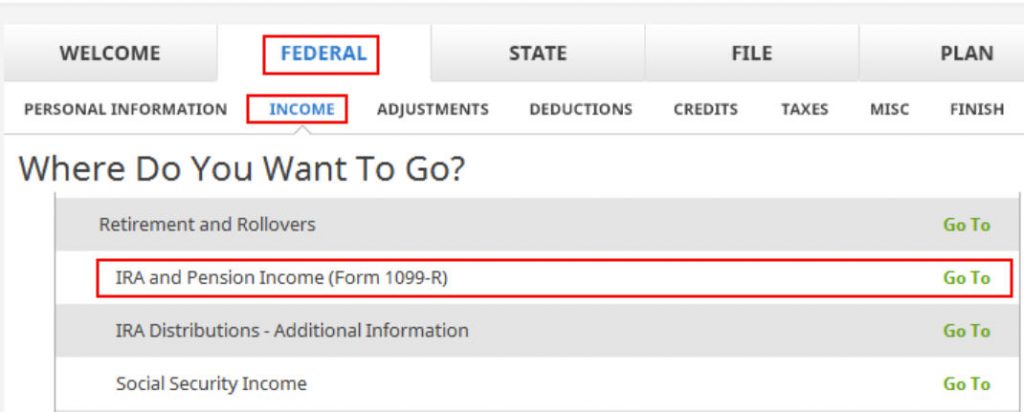

Enter the 1099-R you received for your withdrawal under Federal -> Income -> IRA and Pension Income (Form 1099-R). There’s nothing unusual here.

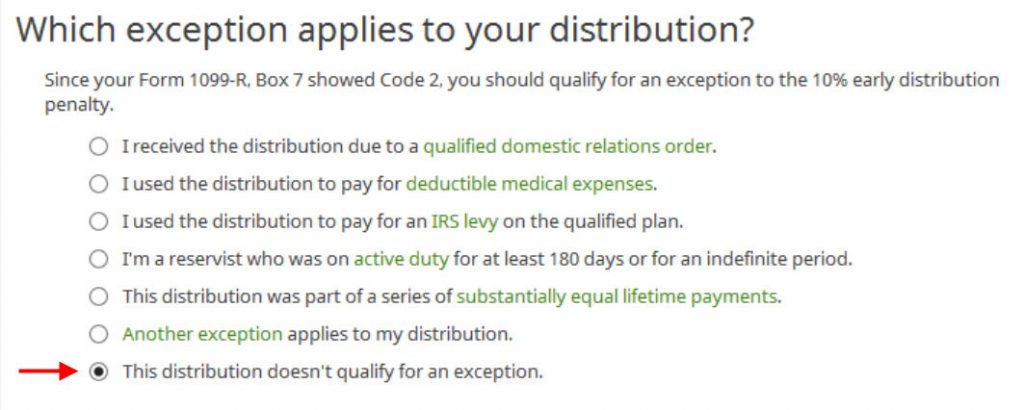

When it asks you which exception applies to your distribution, choose the last option for “no exceptions.” COVID-19 withdrawal is an exception but it’s not one of the exceptions listed here.

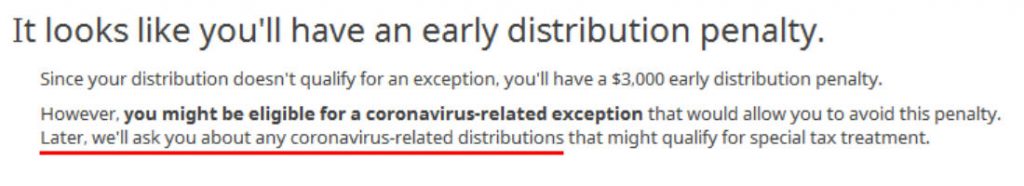

Although it says it looks like you’ll have a penalty, don’t freak out, because it says that coronavirus-related distributions are handled in a different part of the software later.

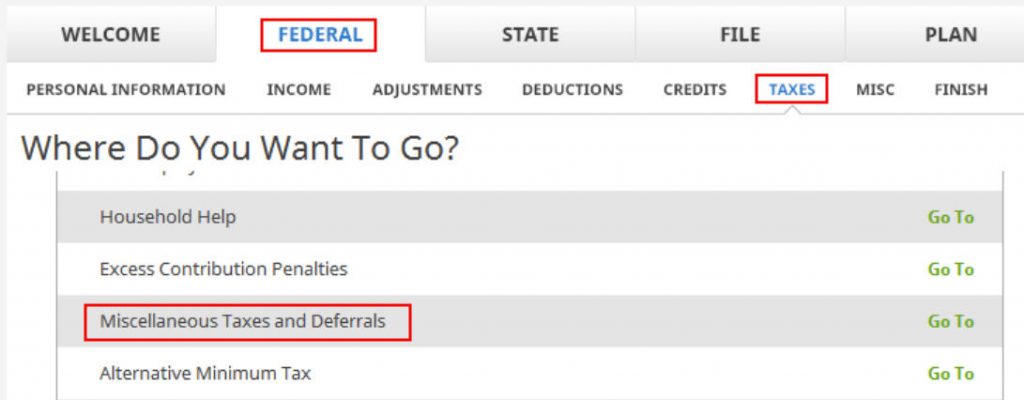

Continue with the rest of your interview in the software until you reach Federal -> Taxes -> Miscellaneous Taxes and Deferrals. Or you can jump ahead to that point now.

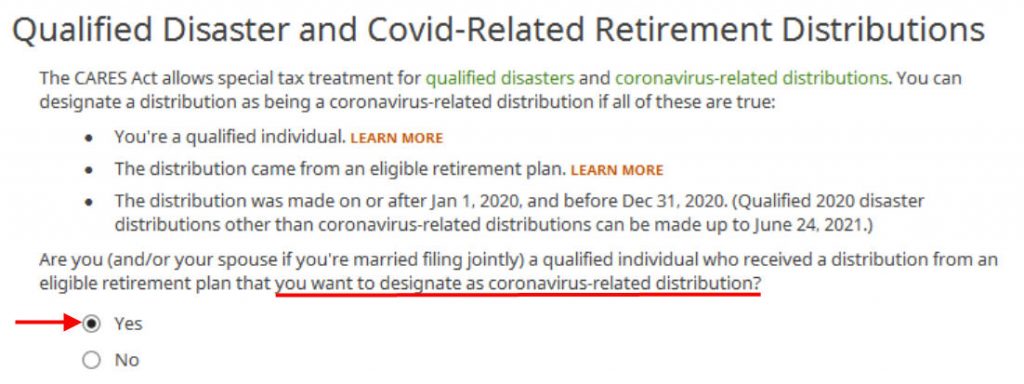

Choose ‘Yes’ when it asks you about COVID withdrawals.

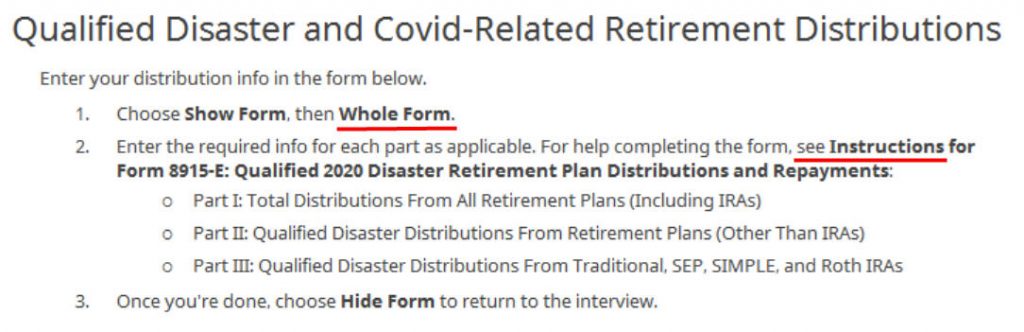

Here H&R Block software asks you to read the instructions and fill out a tax form yourself. That’s lazy. The point of using tax software is that you won’t have to mess with tax forms directly.

The “Show Form” it talks about is under the “Next” button. After you click on that one, there’s another “Whole Form” button, which expands the form.

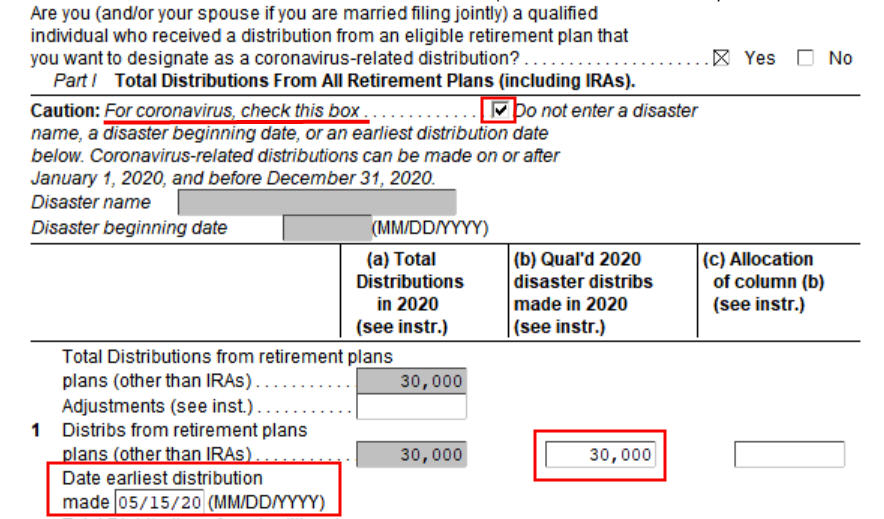

Example A – Withdrawal spread over three years

For our Example A, where you withdrew $30,000 from a workplace retirement plan and you’d like to spread it over three years, you only need to complete the parts called out in the red boxes. Check a box on the top to say it’s related to COVID. Enter the date of the earliest withdrawal and the gross withdrawal amount in Line 1, column b. If you withdrew from a pre-tax IRA, not from a workplace retirement plan, enter the date and the amount on Line 2 instead of Line 1. Click on “Hide Form” when you’re done.

Now you can check how much you’re taxed on this withdrawal. Click on the Forms button in the top menu bar and then open “Form 1040 and Schedule 1-3.” Scroll down the Line 5. Line 5b shows you’re taxed only on $10,000 instead of $30,000.

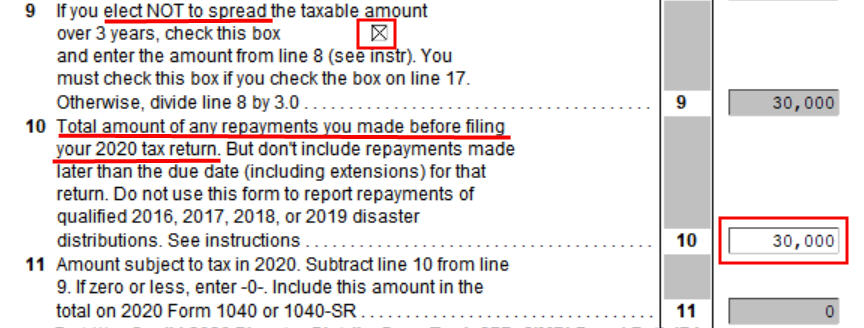

Example B – Full Repayment

For our Example B, where you withdrew $30,000 from a workplace retirement plan and you repaid it in full, in addition to filling out the same fields as in Example A, scroll down to Line 9 and Line 10. Enter the amount of your repayment on Line 10. If that represents 100% of your withdrawal, also check the box on Line 9 and be done with it. If you only made a partial repayment, leave the box in Line 9 unchecked. The difference between 1/3 of your withdrawal and your repayment will be taxable in 2020. If you repaid more than 1/3 of your withdrawal, the taxable amount in 2020 is zero.

Now you can verify you’re not taxed after you repaid all of it. Click on the Forms button in the top menu bar and then open “Form 1040 and Schedule 1-3.” Scroll down the Line 5. Line 5b shows that the taxable amount is $0.

There you have it. It’s a little more complicated in H&R Block software but it’s still not that difficult.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Serbeer says

RE: “Maybe you took the opportunity to move $100,000 from the expensive retirement plan through your employer to your IRA.”

How would that work? You still cannot contribute to IRA above annual limit of $6-7K and rollover is not withdrawal, so eligibility for rollover would not covered by this I thought.

Harry Sit says

You’re allowed to repay in three years. The repayment can go back to the same place or go into your IRA. The repayment doesn’t count toward the annual contribution limit. If taxes were withheld from the withdrawal, you can make it up in the repayment. You’ll get the withheld taxes back as a tax refund.

Michele says

What if you took 200k rather than 100K due to COVID. I paid back the 100K in a matter of days, realizing I should not have taken the money out in the first place. Can I repay the other 100K?

Harry Sit says

It depends on how you took the money out and how you paid $100k back in a matter of days. Was it from your IRA or an employer plan? Did you take it as a normal withdrawal or a hardship withdrawal? If the distribution was eligible for a rollover and you paid it back as a rollover, you can count the amount paid back as an indirect rollover and count the remaining $100k as a COVID-related distribution. Then it’s eligible for the special rule of paying back in three years.

Michele says

I took it out from an IRA, I was able to return the 100k back as part of COVID Relief plan. I have been told that I can not return the other 100K as part of COVID though. So, I guess the other 100k would be considered a normal distribution. Are there any conditions that would allow me to return the other 100K?

Harry Sit says

Call them and see if they can re-code your repayment as a rollover, since it was done within 60 days. If not, you already used up your $100k COVID repayment, and the remaining $100k would be a normal distribution.

Harry Sit says

This blurb from the IRS says the repayment is treated as a rollover. So to the IRA, it is already a rollover. If you treat the first $100k as a normal rollover within 60 days, you still have your COVID special allowance to repay the remaining $100k within 3 years.

Q12. Is an eligible retirement plan required to accept repayment of a participant’s coronavirus-related distribution?

A12. In general, it is anticipated that eligible retirement plans will accept repayments of coronavirus-related distributions, which are to be treated as rollover contributions. However, eligible retirement plans generally are not required to accept rollover contributions. For example, if a plan does not accept any rollover contributions, the plan is not required to change its terms or procedures to accept repayments.

https://www.irs.gov/newsroom/coronavirus-related-relief-for-retirement-plans-and-iras-questions-and-answers

Michele says

Harry thank you. I contacted the the fund manager and was told that the initial 100k was treated as a rollover rather than a Covid special allowance, which gives me the opportunity to return the other 100K as a COVID special allowance.

Harry Sit says

Nice! Happy to hear it worked out for you.

Michele says

Hello Harry, I have since returned the 100K borrowed from my IRA for COVID related expenses. I included the income in my 2020 taxes filed with the IRS. I now what to amend my tax return. What steps should I take to amend it so I can to reflect the return of the distribution.

Harry Sit says

If you filed your original return using software, each software has a procedure to amend the return. It typically saves a snapshot of the return and then you start modifying the return as if you haven’t filed it yet. You change your answers on the distribution to part rollover, part COVID distribution. You rolled over the first piece within 60 days. You repaid all of the second piece before the tax filing deadline. The software will generate the amended return comparing your modified return with your original return.

Ross says

Hello!

I repaid 20k on a qualified COVID-19 withdrawal of 60k, so a 40k taxable withdrawal. I pre-paid taxes on the initial withdrawal plus 10% penalty. TurboTax is not giving me the option to pay all of the tax this year. Any insight? Thanks!

Ross says

I should add that it is indicating a refund, of course. But it seems a little too generous, don’t want to underpay.

Harry Sit says

After you answer “I repaid part of the distribution” and you give the amount you repaid, you check that box for “Pay entire tax on all COVID-19 related retirement distribution(s) in 2020.” It will make the remaining amount all taxable in 2020.

Ross says

Thanks foe the response! It seems my version had a bug and never asked me that question no matter what I tried. The workaround is to open up the “forms” version and manually check/uncheck the box on the 8915 form regarding tax payment preference. Appreciate the response!

Carson S Carroll says

This was a great walkthrough for 2020. Is there an update for how to account for deferred taxes on the distributions for 2021 and 2022. Turbo Tax doesn’t seem to be picking up the full 1099 from last year and there is no checkbox for indicating COVID relief. It appears due to this, you’re paying a penalty this year plus whatever delayed taxes are due.

Harry Sit says

TurboTax 2021 isn’t ready for this part yet. Wait for future updates.