Social Security has a flat 6.2% tax rate, up to the maximum wages covered by Social Security ($176,100 in 2025). Social Security benefits bear some positive relationship with your covered wages and the amount of taxes you paid on those wages. The higher your covered wages, and the higher the 6.2% Social Security taxes you paid, the higher your benefits.

Social Security calculates benefits using your average earnings over 35 years. If you work less than 35 years, the rest of the years will be filled with zero. Therefore, up to 35 years, the more years you work, the higher your average earnings. Retiring early, before you have 35 years of working history, means that your Social Security benefits will be lower.

The Second Bend Point

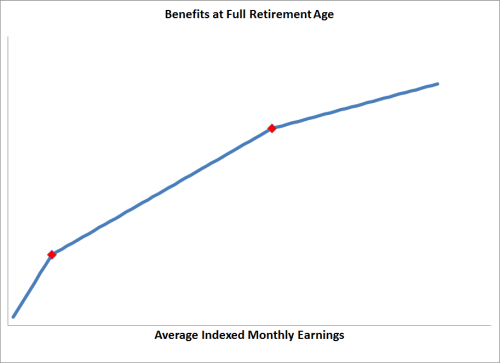

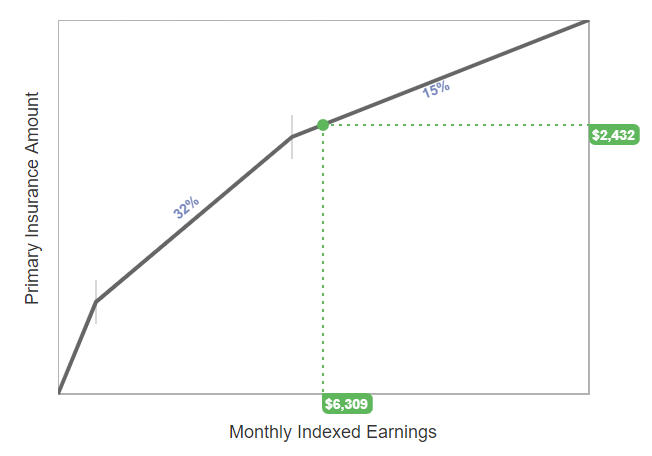

However, it’s not a straight line. You get more credit for your earnings at the lower end than you do at the higher end. The points at which the crediting percentage changes are called bend points.

There are two bend points. The first one is set low ($1,226/month in 2025). For most people, the second point is the more meaningful one ($7,391/month in 2025). After your average earnings over 35 years reach the second bend point, for each dollar in additional average earnings, you get less than half as much in Social Security benefits as before (15% vs 32%).

Think of these bend points as similar to tax brackets. If your extra income gets into a 70% tax bracket as there once existed, you don’t have much incentive to earn the extra income. Similarly, if your earnings history already put you beyond the second bend point, you are not getting as much bang for your additional years of work, as far as your Social Security benefits are concerned. If you think of your Social Security tax as forced savings for your own retirement, which it isn’t, after you reach the second bend point, you are definitely paying for other people’s retirement for the most part.

If you stop working after you reach the second bend point, even if your future earnings are zero, you are not losing much in Social Security benefits. If you retire before you reach the second bend point, you are losing twice as much in Social Security benefits.

So the question is, when will you reach the second bend point?

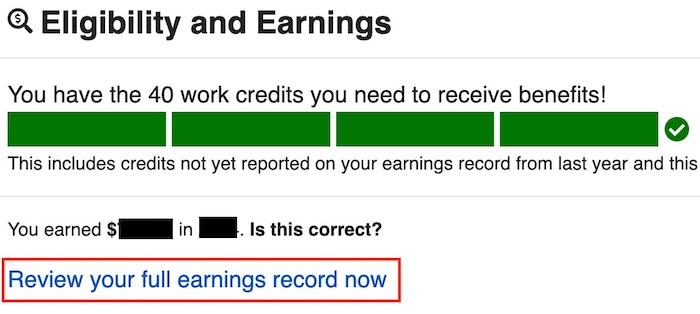

my Social Security Account

To make that calculation, you first need your Social Security earnings history. You can create a my Social Security account with the Social Security Administration, which uses login.gov or ID.me for login security. If you are married, each of you must set up your own separate my Social Security account.

After you log in successfully, you will see a section for eligibility and earnings.

Click on “Review your full earnings record now.” Your earnings record provides the key to seeing where you are relative to the bending points and what your estimated benefits will be if you don’t work all the years until you claim Social Security. Use your mouse to highlight the entire table of your earnings history and copy all the data.

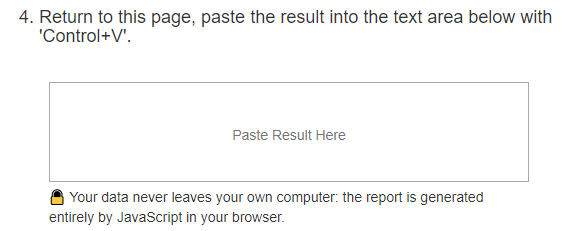

ssa.tools

Now, open a new tab in your browser and go to ssa.tools. This website runs completely locally in your browser. The data you enter does not go to anyone else. It has an area to copy and paste your earnings record from your Social Security account.

Scroll up to the top after you paste your earning record. You will see a question “Is this the same table you copied from ssa.gov?” with Yes and No buttons. After you click on Yes to confirm it’s correct, you will be asked to select your birth date. Then it will do the calculation. You will see two sliders:

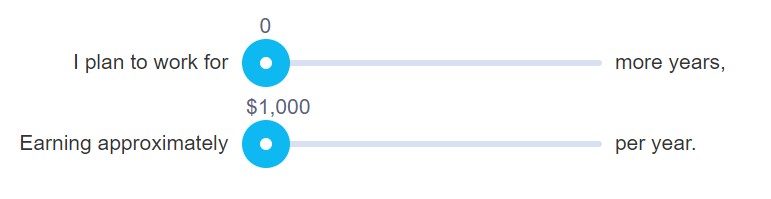

If you’d like to see where you are now, just leave them at the default positions. Further down, you will see a familiar graph:

It shows I already passed the second bend point. Earning more will still increase my Social Security benefits, but it will do so at the slowest pace. I passed the second bend point after about 20 years of full-time work. You would reach that point sooner if you had higher incomes than I did.

If you haven’t yet passed the second bend point but you’d like to see when you will, move the two sliders to say how many more years you will work and how much you will earn per year. If you’ve already passed it, you can also see how much your benefits will increase as you work additional years.

The number shown on the vertical axis is your Primary Insurance Amount. This is the critical input when you need a strategy for when to file for Social Security benefits. Feed it into the other great tool Open Social Security. See previous post Social Security Claiming Strategy Calculators Compared.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

bn says

Would it be possible to also add a first bend point to your spreadsheet? Would be helpful for those who moved here later in life and don’t have as many working years before retirement or who worked in jobs that don’t pay SS.

Harry Sit says

Also remember it usually requires 10 years of work covered by Social Security. I would think one easily goes over the first bend point after 10 years.

http://www.ssa.gov/oact/progdata/insured.html

Benu says

So 10 years of low wages followed by many decades of 0’s should still get you past the first bend?

Harry Sit says

Of course it depends on how you define low wages and how a low wage worker is able to retire after working only 10 years. 10 years of $35k a year will get one over the first bend point.

bn says

10 years of working in private sector job paying into SS and 30 years in public sector job not paying into SS.

Harry Sit says

In such case the 90% crediting rate becomes 40%, which isn’t much higher than the second stretch.

http://www.socialsecurity.gov/pubs/EN-05-10045.pdf

DB says

To keep it consistent, 420 months (35 years) at $816 AIME is $342,720. So if you turned 60 in 2014 and had worked 10 years at $34,272/year ($659.08/wk or $16.48/hr assuming 40 hrs/wk) you would have maxed out the first bend point. That’s very doable and the most bang for your social security buck I suppose.

To max out the second $4917 bend point would have taken a little longer…420 months @ $4917 AIME was $2,065,140. At the maximum 2014 SS wage of $117k it would take around 18 years of near maximum earnings.

Obviously it will vary slightly based on the numbers in the year you turn 60, but 18-20 years of earnings over/near the SS max is the sweet spot in my mind. Working past the second bend point for a bigger SS benefit doesn’t make much sense to me.

Keith says

This looks interesting Harry. Unfortunately, after I copy the SSA earnings history into the tool nothing more happens. I’ve tried changing browsers (to Chrome) and copying the data into a txt doc (notepad) before copying into the tool but it stays on tool’s initial entry screen.

Harry Sit says

Keith – After you paste the data, scroll up to the top. You will see a question “Is this the same table you copied from ssa.gov?” with a Yes and a No button. When you have many years of earnings history, you may not see the question unless you scroll up to the top, depending on your screen resolution. To make sure your browser works, you can also test with just these two lines:

2018 $100,000

2017 $100,000

Keith McCarten says

Thanks Harry,

I tried again after making sure I had a text file in the format you suggested and everything worked fine. /Keith

POP says

Great post. Can you also do a post on how your social benefits will be affected if you are covered by a pension? I work for a publicly listed company which has pension . I wonder whether my SS benefits will be reduced because of this.

Harry Sit says

It won’t be reduced when the pension is from a private sector employer.

Emily says

In your August 22nd email to subscribers, you had the following comment about Social Security:

“Out of sight, out of mind. Everybody thinks it will be resolved eventually. When that day comes, I will be safe in the protected age group.”

What is the age range for the protected age group? I am 40 and my husband is 36, and I’m wondering if we are in that group.

Thanks!

Harry Sit says

Different proposals use different age cutoffs for the group whose benefits should be protected. Age 55 is commonly used.

BJS says

Don’t forget the WEP (Windfall Elimination Provision). It basically reduces your benefits if you work less than 30 years. Its meant to address people potentially covered by other pensions, but in practice it means you can’t have higher earnings for fewer years and get full benefits. In your specific example, working 20 years and trying to claim full benefits, it won’t happen. Your benefit will be reduced by about $400 a month.

Details are here: http://www.ssa.gov/retire2/wep.htm

It basically covers from 20 to 30 years of substantial earnings.

Harry Sit says

It says it applies only if you have a pension based on earnings not covered by Social Security? I don’t have such pension.

TJ says

This is the first I’ve heard of the WEP limiting benefits other than pensions. What is your source?

DB says

I was concerned for a minute too, but I don’t have a public pension so it wouldn’t apply to me either.

“The Windfall Elimination Provision can apply if:

• You reached 62 after 1985; or You became disabled after 1985; and

• You first became eligible for a monthly pension based on work where you didn’t pay Social Security taxes after 1985…”

calwatch says

The GPO covers those who are married to public sector workers, though.

B says

Cool spreadsheet! It said that my husband hit the second bend in 2007 and I hit it it 2012. That’s what I expected, since I had previously played around on a calculator and was very disappointed to see how little my SS benefit would go up by working more years — even at the max contribution! Basically, we can stop working now at 52 and 48 years old, and as long as we wait until full retirement age to collect, our benefit changes very little. I added on two columns to your speadsheet 1) to show the incremental $ increased in the PIA year-over-year 2) to show the % increase YOY. Whereas between bends 1 & 2 you are going up by 6% or so, once you hit the second bend, it is more like 2%.

TJ says

The spreadsheet is a bit depressing – I’d have to work until 2038 to hit the 2nd bend, 53. So much for early retirement (at least not without maximizing SS benefits as described in this blog). 😀

linda says

i notice you use zoho spreadsheet.

would you please tell me how you compare this with google spreadsheet?

thanks

Harry Sit says

I need to let the public enter their own numbers and play with it interactively but still not affect my master copy. I couldn’t figure out how to do that with Google spreadsheet or Microsoft’s Office Online. It seems either the spreadsheet is read-only (no playing) or the changes are saved (the next user sees your inputs). Maybe there is a way; it just wasn’t obvious to me.

If you don’t have this requirement, Google spreadsheet and Microsoft Office Online work just fine.

c says

On my Social Security Statement for 2013 under Your Estimated Benifits it states : “You have earned enough credits to qualify for benefits. At your current earnings rate, if you continue working until…

your full retirement age (67 years), your payment would be about………

age 70, your payment would be about……….

age 62, your payment would be about……….

My question is this- is there a calculator out there that could show me how much I would receive at age 62 if I stopped working now (age 52) verses working at my current rate until age 62.

Thanks

Harry Sit says

Try the calculator here: http://www.socialsecurity.gov/retire2/AnypiaApplet.html

Steve says

That link has moved to https://www.ssa.gov/planners/retire/AnypiaApplet.html

Robert says

What does PIA stand for on the spreadsheet?

Excellent work!

Harry Sit says

Primary Insurance Amount – The amount you would get if you start your benefits at full retirement age.

http://www.socialsecurity.gov/OACT/COLA/piaformula.html

larry whitworth says

If i retire early, but go back to work later, do i get credit for the additional SS i pay in?

Harry Sit says

If you haven’t worked 35 years, yes. If you already worked 35 years, it depends on how much you earn relative to what you earned previously indexed to inflation.

KD says

Mark Miller interviewed Stephen C. Goss, chief actuary of the Social Security Administration (SSA) here: http://news.morningstar.com/articlenet/article.aspx?id=684071&part=1

Could you please comment on it?

Quoting the interview:

Q: When you hear people discussing various Social Security reform proposals either to scrap or lift or adjust the cap on covered earnings, what are your thoughts about how you could calibrate those two sides of the equation?

A: Our office does estimates for policymakers on all kinds of changes, and as the actuaries, we are completely agnostic as to what would be the appropriate thing to do. A fairly popular proposal that has been put forth is to raise the taxable maximum just enough to get back to having 90% of all earnings covered under Social Security.

Q: What would that be?

A: That would be a little more than double our taxable maximum of $118,500–it would rise to around $240,000. Most proposals that have suggested this would do it on a very gradual basis. For example, the Simpson-Bowles commission proposed that, each year, when we index up that taxable maximum by the rate of growth in the average wage, we add an extra 2% to that growth rate until we get to the point where we are capturing 90%. That would take about 38 years.

Q: And that has been a general guiding theme in most changes to Social Security–they have been introduced in a very graduated way.

A: Absolutely. For instance, the increases in the full retirement age were phased in in a very graduated way; it’s the poster child for gradual. It was enacted in 1983 and didn’t even start to have any effect until the year 2000. Changes to the program have been gradual from one generation to the next; that has always been the case.

Harry Sit says

Just the quoted paragraphs don’t seem to have much impact on the topic in this post. If they raise the cap but still keep the same bend points, you just pay more in SS tax but you still only get credited at the low rate. I will go read the full interview.

Steve says

According to the existing calculations, even if you “front load” the income by reaching the cap every year for fewer years, you reach the second bend point. So if they doubled the cap, wouldn’t high earners reach the second bend point that much sooner?

Rpbert Penzel says

Is there a cap on how much SS benefits can be reduced due to work, or if you make enough will they take it all??

Harry Sit says

You get the reduction only if you take Social Security before your full retirement age and you work at the same time. There is no cap but the reduction isn’t truly lost. Your benefits are increased after you reach full retirement age. See http://www.socialsecurity.gov/pubs/EN-05-10069.pdf

TJ says

“If you retire before you reach the second bend point, you are losing twice as much in Social Security benefits.”

Can you better explain this concept?

If one has a career of 35 years making $50k which is a respectable salary, they are still going to be nowhere near the 2nd bend point, what benefits are they “losing”, I guess, in comparison to what? It seems the like the first bend point is really the most meaningful one as you are getting a lot more benefits for the income that is earned.

Harry Sit says

“Losing” as in “not earning” is the opportunity cost of voluntarily retiring early. For each $3,500 in earnings your $50k/year person gives up by retiring early, his or her Social Security benefits are reduced twice as much as another person whose earnings and work history put it above the second bend point.

If you would go above the second bend point only if you continue working but you decide to retire before such point, for each $3,500 in earnings you give up, you reduce your Social Security benefits at a rate twice as high as if you retire after you reach the second bend point.

TJ says

Unless I have corrupted the spreadsheet, it is impossible for a 50k/yr person to hit the second bend point because you do not get additonal pia for working more than 35 years. in other words, 35 years at an inflation adjusted 50k does not add up to the 5.5k PIA needed to hit the current 2nd bend.

Harry Sit says

That’s true. That’s why the comparison is with another person with higher earnings who is able to reach the second bend point. You don’t see a lot of people earning $50k retiring early unless they have a pension. Losing too much in Social Security benefits could be one reason.

J says

In the spreadsheet, do I enter $118,500 for 2015 if my income was actually higher? I wasn’t sure if needed actual income or capped income(subject to SS tax).

Harry Sit says

Capped.

Steve says

This is great to know when you’ll the second bend point and so paying SS taxes is far less valuable. But I don’t really get a sense of how valuable it is to keep working until you hit that point. What does the “32%” mean?

Steve says

To answer my own question – 32% is multiplied by your AIME (average indexed monthly earnings) to get your PIA. So if I understand correctly, up until 35 years of earnings, earning $1 increases your AIME by $1/(35 * 12) = .238 cents. Then up until the second bend point, that is multiplied by 32%, meaning your PIA increases by .076 cents. Another way to put it is that working one year at the max (as in the article) SS taxable income of 118,500 adds $90.28 per month to your PIA.

gmshedd says

Harry, based on the original post date, it’s interesting to see that you retired at least 4-5 years after you knew what all these numbers meant and how little impact future earnings would have on SSA benefits. That agrees with my own timeline. When the financial crisis hit in 2009, and early-retirement offers were being made, I had done my homework–Excel spreadsheets filled with the SS calculations, and annual expenses–and didn’t need to think very long about whether to accept. Of course they hired me back as a contractor a year later, but the baseline of acceptable future income had been determined before the decision point. Preparation for early retirement requires more than simply saving lots of money!

Harry Sit says

I agree preparing to leave a career takes some time. However, I don’t consider myself retired. I’m doing part-time self-employment work. The income from this work still plays a significant role in covering our living expenses. I only get to do the work on my own schedule, and do as much or as little as I desire.

Marc says

An empirical demonstration of the issue: I retired a few years ago (age 55) with 34 years of SS earnings but well north of the second bend point. This year, I decided to take a temporary job with the US Census Bureau that lasted 9 months. It turns out that all of that work will increase my PIA by a mere $7 per month. And that’s primarily because it replaced a “zero” year by giving me 35 years of earnings instead of 34. This certainly confirms my earlier decision to retire, particularly because I was self-employed at that time and was paying both halves of the SS tax for very little additional benefit.

bws92082 says

If you start early social security benefits at the beginning of the month, say May 2022, there is an earnings penalty if you exceed the monthly maximum amount of $1630. So does it make sense, if you are retiring, not to quit at the end of April, but instead work an extra few days in May as long as the amount doesn’t exceed the cap? And if you have a lot of unused vacation pay that is paid on your last day of work, is that counted as income from previous months, not for May?