The previous post Converting to Roth and Harvesting Capital Gains Under Obamacare Premium Subsidy shows when you are getting a premium subsidy for buying health insurance on the exchange under Obamacare, you face a marginal tax rate of about 25-30% for ordinary income and 10-15% for long-term capital gains, when normally ordinary income would be taxed at 15% and long-term capital gains would be tax free.

| MAGI | Ordinary Income | Long-Term Capital Gains |

|---|---|---|

| Below 300% FPL | ~25-30% | ~15% |

| 300% – 400% FPL | 24.5% | 9.5% |

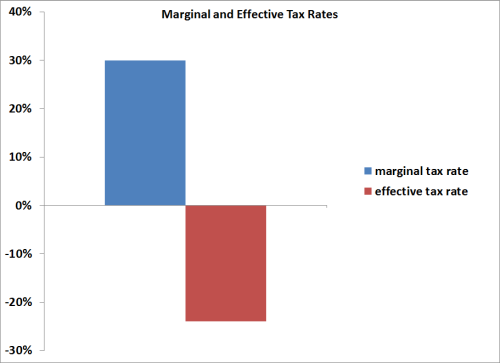

Before anyone complains about such high marginal tax rates at modest income levels, we should note that the marginal tax rate alone tells a very distorted story. The true measure of tax burden is the effective tax rate, in other words, the total tax paid on the total income received.

Marginal tax rate means the tax rate on the last dollar earned. Suppose I make $50k but I don’t pay tax on the first $49k. It doesn’t matter if I have to pay 90% tax on the last $1,000. I’m still only paying $900, or less than 2% of my income as tax, and I get to keep 98% of what I make. That 2% number is my effective tax rate.

Sure a very high marginal tax rate reduces my incentive to make more money, but it doesn’t mean I should complain about high taxes if I’m satisfied with what I keep ($49k in the hypothetical). One should complain only when the effective tax rate is high, not when the marginal tax rate is high.

When you get a premium subsidy for buying health insurance under Obamacare, your effective tax rate is often negative. Additional income will push that negative number up, from “very negative” to “not so negative.” It is a 25-30% marginal tax rate alright but it’s hardly something worth complaining about.

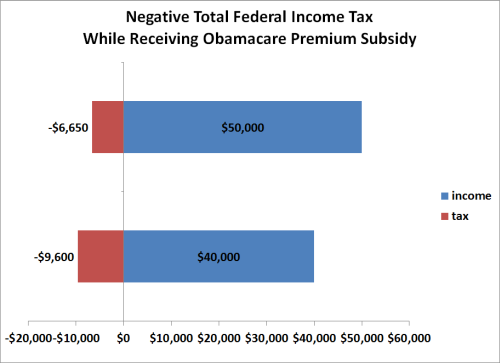

For instance, suppose a married couple retired at age 60 on $40k of income from pre-tax IRA withdrawals. Suppose the cost of second least expensive Silver plan on the exchange costs $1,500 a month for the two of them. They will receive a $14,700 tax credit for buying health insurance. Their federal income tax before the tax credit is $5,100. After the tax credit, they are paying negative $9,600 in federal income tax.

Now they decide to convert $10k from traditional IRA to Roth. Their tax credit goes down to $13,250. Their tax before the tax credit goes up to $6,600. After the tax credit, they are still paying negative $6,650 in federal income tax.

From negative $9,600 to negative $6,650, that’s a massive tax increase of nearly $3,000, for a marginal tax rate of 30% on the additional $10k income. If you look at the overall picture though, you would agree that paying negative $9,600 in tax on $40k income is pretty awesome.

Say No To Management Fees

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.

Maxx says

So you did a Roth Conversion of 10k, and you lost/paid 30% tax. I bet you did not pay that rate when you put the money into the Trad IRA, likley 25%. and now you pull it out at 30%… does not sound good to me (?)

Harry Sit says

If it doesn’t sound good then don’t do it. Nobody is forcing you to do the Roth conversion.

Greg says

Thanks, this was very helpful to me. I would love to see updates on this series after the Tax Cut and Jobs Act!

Richard J Hughes says

That’s one perspective. However, I prefer to concentrate on taxes actually paid and you’re looking at $6,600 vs $5,100, i.e., 15% tax on that $10,000 conversion. As for the federal tax credit, that’s a subsidy on what is ludicrously expensive health insurance. I recently discovered that my ACA Silver plan doesn’t even cover me away from home, e.g., in Oregon, unless I have a life-threatening medical problem. If you feel that you’re getting value for money from your ACA medical plan, then that’s great. I, however, believe that medical insurance is ridiculously over-priced. Looking at this another way you’re talking about paying $1,500×12 + $5,100 ($23,100) on $40,000 in income, a 58% tax rate in federal and health tax alone (before the ACA contribution), which is crazy.