One reason that Vanguard received large in-flows of new investments in recent years is because of ETFs. Investors can buy Vanguard ETFs in their existing accounts at minimal commission, which is now zero at all major brokers for retail investors. Not having to open new accounts at Vanguard and still being able to buy Vanguard ETFs at zero commission gives investors the best of both worlds when they choose their investments and their accounts separately.

However, ETFs still have some inconveniences compared to index funds. If you’d like to put $3,000 into the Vanguard Total Stock Market ETF (VTI), when it’s $171.42 per share, you can buy 17 shares for $2,914.14 or you can buy 18 shares for $3,085.56, but not $3,000 exactly, unless you use a fintech startup. If you’d like to buy $500 worth of the ETF each month, it’s also not possible to automate the purchases on a preset schedule. You will have to remember to place the orders individually. If you buy an index fund instead, you can buy in dollars and the fund will give you the corresponding number of shares based on the days’ closing price, including fractional shares to three decimal places. You can also set up automatic purchases to buy on a schedule.

Charles Schwab mentioned in October 2019 they were working on supporting trading in fractional shares, but only in individual stocks, not ETFs. While Schwab is still working on this upcoming feature, Fidelity beat them to it by making the feature available to the general public sooner, and by including both individual stocks and ETFs.

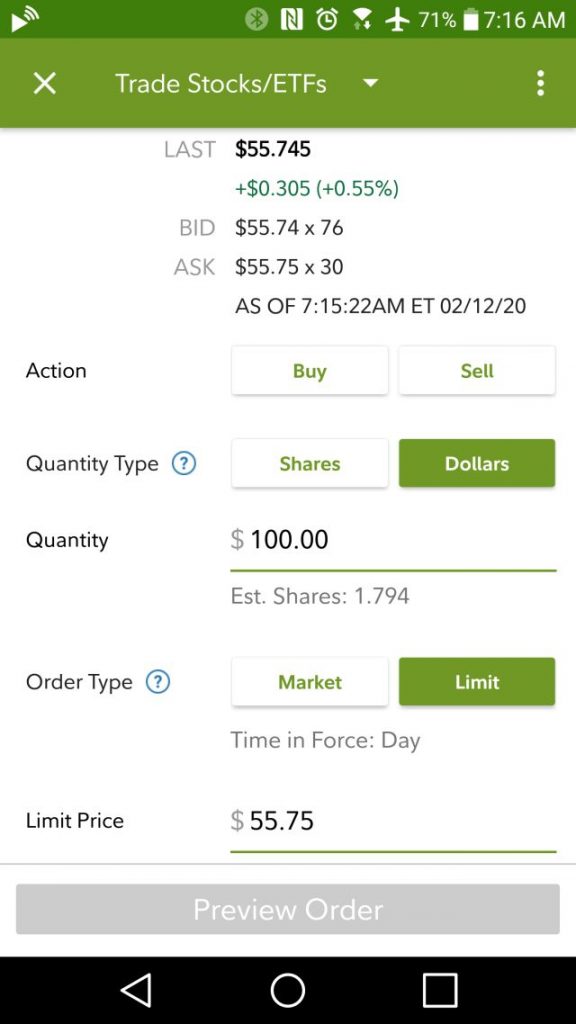

Fidelity’s new feature is currently limited to its mobile app. Here’s how it looks in my Android app:

You can place either a market order or a limit order. If you choose to buy or sell in dollars, the system will figure out how many shares it would be, rounded to the nearest 0.001 shares.

Because investors think more in dollars than in shares, it makes sense to place orders in dollars. I will use this feature when I buy or sell an ETF next time. While the feature is only in Fidelity’s mobile app right now, when the underlying system already supports it, making the feature available in the online interface shouldn’t be too hard. Supporting it in the underlying system also creates the foundation for supporting automatic investing in ETFs on a preset schedule.

I expect more brokers will support trading ETFs in dollars and automatic investing in ETFs in the near future.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Frugal Professor says

This inability to purchase partial ETFs is the reason why I’ve historically preferred index funds to ETFs. Your article indicates that the issue is solved. Great.

Any indication yet on whether dividend reinvestment could be automated to purchase fractional ETF shares as well? If so, it may be time for me to make the leap to ETFs.

Harry Sit says

Automatic dividend reinvestment has been able to purchase fractional shares in ETFs at all brokers since at least several years ago. Only direct buying and selling fractional shares is new (except at Fintech startups).

GaryK says

If I were investing a set amount regularly, I’d actually prefer the EOD certainty of getting a solid price @ true NAV, vs. intra-day volatility and an uncertain amount of premium/discount. I doubt that traders care about share-level rounding.

Also, I’d be concerned, particularly for less liquid ETF’s, as to whether these fractional-share orders will be restricted, as are ‘All or None’, etc., so not available to be displayed as best bid/ask. It would be interesting to try and determine whether the bid/ask slippage would justify the lower ETF expense ratio vs. index funds, particularly for orders with fractional shares.

Just today, for a decent-sized market order in a liquid iShares ETF where the bid/asked spread was .01, Vanguard immediately executed with a price improvement of .005, effectively splitting the spread.

That said, the ability to pick lots for sale which have fractional shares (resulting from DRIPs) is definitely a positive.