If you buy an expensive product at a discount, is it still a discount? What if you can buy the same product at pretty much the same price everywhere else without a coupon or a special link? Is it still a discount?

I’m talking about the “discounted” TurboTax offered through financial institutions like Vanguard or Fidelity.

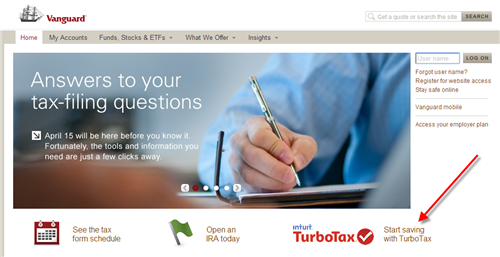

Vanguard prominently features a TurboTax discount on the homepage.

Why do they do that? To help their customers save some money through a negotiated deal? Nah. The only logical reason would be that TurboTax/Intuit pays them for sending customers.

I wouldn’t mind letting Vanguard or Fidelity earn the marketing dollars from TurboTax if customers actually get a discount. When you think you are getting a 25% discount, you actually just get pretty much the same price you get everywhere else. That price is also substantially higher than the price on a comparable product from its closest competitor.

I looked at prices for TurboTax Deluxe plus one state return (prices as of Feb. 19, 2014):

| Federal | State | Total | |

| Online @ TurboTax.com | $30 | $37 | $67 |

| Online via Vanguard or Fidelity | $20 | $37 | $57 |

| Download @ TurboTax.com | $60 | included | $60 |

| Download via Vanguard or Fidelity | $50 | included | $50 |

| Download from Amazon | $50 | included | $50 |

| CD from Walmart | $50 | included | $50 |

| CD from OfficeMax | $50 | included | $50 |

| H&R Block Deluxe + State from Amazon | $29 | included | $29 |

You can buy TurboTax Deluxe + State from Amazon, Walmart, or OfficeMax for the same $50 price as you buy with the discount through Vanguard or Fidelity. Online actually costs more. Meanwhile you can buy the competing product H&R Block Deluxe + State from Amazon for $29. Sometimes you can buy it on sale under $25.

Only Flagship customers with $1 million or more at Vanguard used to get a true deal. They got TurboTax Deluxe + State for free. For 2015 tax year and forward, even Flagship customers don’t get a deal any more. See Vanguard ends customer discounts for TurboTax products.

[Photo credit: Flickr user Quinn Dombrowski]

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

jennypenny says

Do you like H&R block’s software? I use it now, but I’ve always been tempted to use both one year and compare the results.

Harry Sit says

I used both and moved back and forth in the past. They are comparable. When I used both in the same year, they gave the same results. I wouldn’t pay double the price for one than the other.

nickel says

It’s not really a fake discount, it’s just no better than the discount you’ll get elsewhere. Note that Amazon shows the MSRP with a strikethrough, and then their price. No, they don’t explicitly turn it into a percentage, but it’s the same thing. As for why they don’t market the H&R Block software, I have no idea, but you’re probably right.

I’ve never actually used the H&R Block software (TaxCut?) so I can’t compare. I’ve used TurboTax and liked it, but if I were to experiment, I’d probably try TaxACT.

Also, from your table, it appears that you can get the discount on just the Federal version, which could be handy for those in states with no income tax. With the other alternatives (Amazon, etc.) the state is included so you have no choice but to buy it.

Harry Sit says

@nickel – Yes H&R Block At Home is the new name for TaxCut. The table in the post compared 1 federal + 1 state. There are also federal-only editions so you don’t have to pay for state if you don’t have state income tax or if you want to just use the state’s website to file for state. Amazon sells TurboTax Deluxe federal-only for $25. Through the Vanguard or Fidelity “discount” you get TurboTax Deluxe federal-only for $22.45. It’s still a small discount off the street price, but not close to what they make it sound like.

dd says

I’m just grateful that there are easy and inexpensive software programs available to do taxes. Now that I am familiar with one brand, it would be hard to change.

Joe Morgan says

I’ve got one for you…

This past week I saw a Staples flyer advertising TurboTax deluxe for *$10 more* than Walmart, Best Buy and Office Depot.. what made me laugh out loud (literally) was the graphic had a big sign that read: “Free $10 gift card with purchase!”

Harry Sit says

@dd – It’s easier to change than you think. I switched at least three times in the past. Every time it went seamlessly because they import each other’s files. Like almost everyone else I started with TurboTax because it was the well known brand. I switched to TaxCut when TurboTax came with some nasty DRM stuff. I switched back from TaxCut to TurboTax when TaxCut required logging in as an admin. I switched again after TaxCut (now H&R Block) no longer required logging in as an admin. If are OK with paying twice as much for your comfort, of course it’s your call but do realize switching is quite easy. The import will carry over the info in your last year’s file.

Mike says

Haven’t found anything better than TaxACT online. $13.95 including e-file for federal / state for returning customers (ultimate version). $17.95 for new customers.

Guest says

Search for TurboTax on the Bank of America website. No need to be a customer of BofA, but the discount is better than Amazon, Vanguard, or Fidelity.

nickel says

What if you’ve used the online version of, say, TurboTax in the past. Can H&R Block easily import from that? (or vice versa)

Harry Sit says

I’ve never tried it because I don’t use the online version, but on the hrblock.com home page, it says:

NEW! Import last year’s tax data from TurboTax® and TaxACT® online.

I should add that maintaining control over your data for portability is one more reason to use an installed program as opposed to online.

White Coat Investor says

I’m not sure what I’m missing here, but the product I use (basic online) was significantly cheaper through Vanguard than directly from intuit, and cheaper than the comparable H&R Block product.

Intuit $20 + $40 = $60

Vanguard $15 + $28 = $43

H&R Block Basic $20 + $35 = $55 (you can get it for $37 through links on affiliate blogs)

If you really want to save a few bucks here, you need to go with Taxact. Only $18 total.

Disclosure: I have affiliate links for turbotax and H&R block on my blog.

White Coat Investor says

TFB- How come you use the deluxe versions? I haven’t found anything yet I couldn’t do with the basic version.

Harry Sit says

@White Coat – Because downloaded Deluxe + State program includes state at no extra charge. All the prices you posted above are significantly higher than the current $25 price for HR Block Deluxe + State at Amazon, or the $20 price I paid in January.

ajk says

Your screen capture of Fidelity shows “25% of (sic) TurboTax software.” Today, their website seems to have learned how to spell off. Were you just lucky to catch them on an of (sic) day?

ajk says

I have had different experiences with H&R Block and TT. In the past, while H&RB would import last year’s TT, TT would not import last year’s HRB (something about the big bully not worrying about number 2). Also, TT would handle some uncommon situations that HRB would not, e.g., make an estimated state payment in January; deduct state taxes on your return; get a state refund in April; figure out what part of your state refund is taxable the following year – HRB told me to follow the IRS instructions; TT did it for me.

David C says

Capital One Bank’s discount (“Save 35% on TurboTax Online Federal products”) seems to be pulling the same gimick as Vanguard and Fidelity (the prices are basically the same).

But it could be worse: Regions Bank customers do not get a “discount” at all and are presented the “regular” TurboTax.com prices. To be fair Regions’ website does not claim to offer a discount but still…

bucky says

I don’t see why that’s a fake discount. Vanguard, Fidelity, Amazon, Walmart, etc are all legitimately offering $10-15 discounts off the price you would pay had you bought it directly from TurboTax.

Does H&R block software automatically download your stock info? That’s a must-have for me. I tried TaxAct before and was happy with it, except that I had to manually enter my stock info. That was a deal breaker.

Harry Sit says

@bucky – Yes it does, but not from as many places. I have a post coming up next week about this.

dd says

I’m a bit peeved at TT, as it did not import bond information from 2010 (this is a tedious input if there are many bonds) and seems to have a jinx with the split taxes on a 2010 Roth conversion. No number to call, just forums where I need to register.

GSR says

Hi TFB,

The below are the rates I found on HR block website….. How did you got them free? can you help me understand what i am missing.

—————————————————————————————————————–

H&R Block At Home Online State Tax Programs

H&R Block At Home Free

state — $27.95 for each state return filed*

H&R Block At Home Basic

state — $34.95 for each state return filed*

H&R Block At Home Deluxe

state — $34.95 for each state return filed*

H&R Block Premium

state — $34.95 for each state return filed*

Harry Sit says

@GSR – The downloadable HR Block Deluxe + State program you buy from Amazon includes State (but not State e-filing).

Bob says

If you don’t need the state (and to be honest, many states are so easy to do yourself after you do the federal) then the discount is good. Oregon (where I live) even allows free e-filing for all filers through online forms. To be honest, the Oregon online forms are a bit of a pain to fill out, but may be worth it for many people.

desper-otto says

If you’re a Vanguard flagship member, you get Turbotax Deluxe + one state for free. I consider that to be a discount.

Harry says

From the article: “Only Flagship customers with $1 million or more at Vanguard get a true deal. They get TurboTax Deluxe + State for free.”

Alskar says

It doesn’t appear that anybody has mentioned the Costco discount on TurboTax yet. I paid $39.95 for TurboTax Deluxe. It includes free e-Filing and one state return as well.

Harry says

Same price on Amazon today. No coupon needed.

DD Langer says

For tax year 2013 Turbo Tax Online downgraded (Not So) Deluxe so it no longer supported capital gains form (Schedule D) and reduce some functionality on other Schedules C&E. Now for tax year 2014, TT Desktop is reducing the same functionality to make it consistent with the online version. Lots of great flame wars and 1-stars on the Amazon review pages.

For 2014, TC has an even bigger lead in price and functionality that TT. In the past, I found the only reason to upgrade from Basic to Deluxe was to get the state version, but if I’m going to need TT Premier for a single stock sale, I’m going back to TC.

scott m says

Not entirely relevant but I just want to add how disgusted I am by vanguard for throwing their obtrusive turbo tax ads in my face while Im trying to concentrate on my banking. vanguard has become a joke. They’ve done so many ridiculous things in the past couple years, I wouldnt recommend them to anyone, and I’ve been banking there since the 90s. They have no longer have any respect for their clients.