On my way to work I see a sign for a psychic. It’s been there forever. I wonder how a psychic stays in business. Low overhead, I guess.

When I hike during the weekend, I listen to The Clark Howard Show on podcast. Clark Howard is a personal finance guru on radio and television, based in Atlanta. He’s one of the good ones, I should say.

Clark used to be a travel agent. Although he hasn’t practiced that part of the business for 20 years, people planning a vacation overseas still ask him when they should buy tickets for their flight. Clark would give a time for when the price would be the lowest — “wait until April” for example. Callers would thank him and be happy.

Is Clark’s advice about when one should buy the flight tickets any good? It’s hard to say. Nobody is tracking to see if it’s better than random picking or a mechanical rule like “next week.” People want an answer; they get one from Clark.

I’m going on a short vacation soon. When I bought my ticket, it was $475. Two weeks before the departure date, it came down to $300. Bummer, but what do you do? Too bad Southwest doesn’t fly there. Otherwise I can rebook and keep the difference as a credit for another flight.

Knowing the future would really help, a lot, way more than a $175 difference in airfare. I have a bunch of questions for financial planning I want answers for: inflation, interest rates, tax rates, stock prices, salary growth, health care expenses, to name a few biggies. Not knowing these makes financial planning really hard. How much should I save for retirement? Changes in any one of those variables could make a number I pick today go from too much to too little or the other way around.

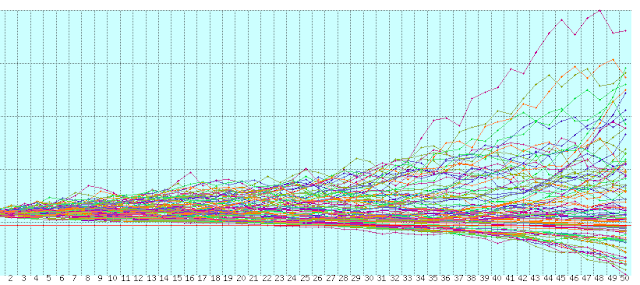

I play with the retirement calculator FIRECalc to see if we have enough to retire now. No matter what I do, I always get a hairball like this:

This chart says if we stop working now, we have a 66% chance of success, i.e. not ending up negative. When we actually land in those 66%, we end up with a lot of money, sometimes more than what we start with (the chart is in inflation-adjusted dollars).

If we reduce the withdrawals in order to push up the bottom and increase our chance of success, we end up with even more money most of the time. What’s the point of working hard, saving a lot, spending little for fear of running out of money, only to die with a boatload of money 90% of the time? Adhering to a so-called “safe withdrawal rate” basically guarantees that you will leave a boatload of money behind most of the time.

It’s a puzzle I don’t have a good answer for. At this time, I think it’ll have to be dealt with by insurance. Chop off both the top and the bottom and compress the range — we don’t need $25 million when we die but we don’t want to go negative with 20 more years to live either.

Any ideas?

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

The-Military-Guide says

Great post, Harry– the word “hairball” caught my eye.

Classic “loss aversion”, right? Almost everyone ignores the 95% success prediction and obsesses on the 5% failure. In our family, after a decade of retirement (and two recessions) it’s become clear that our finances are still going to generate more than enough.

Three suggestions, all of which pay a price for providing extra (“unnecessary”?) reassurance:

1. Work longer to save/invest more, and live off the interest/dividends without depleting the principal.

2. Reduce spending during bear markets. Bob Clyatt’s “4%/95%” system from “Work Less, Live More” is one example.

3. Social Security is part of the longevity “insurance” that chops off the bottom 5%. Add a single-premium immediate annuity to guarantee a minimum income, or even a (costly) deferred annuity to start 20-30 years after retirement.

Over a decade ago, William Bernstein suggested that any success rate higher than 80% was meaningless:

http://www.efficientfrontier.com/ef/901/hell3.htm

KD says

May be rerun the calculation with the idea of using home equity? (Assuming you can move to a lower cost place in retirement if needed) If the 66% changes to say 90% esp. bcoz you live in a high cost real estate area, then I think you are closer to being set. You will still need a mechanism to bridge the cash flow aspect aka creating liquidity from illiquid asset like home equity.

Dylan says

Planning should be like navigation. But tools like FIRE Calc should not be thought of as a compass, it’s more like a sextant and a timepiece. It tells you where you are so you can make good use of a compass.

Hundreds of years ago, before GPS and satellite navigation, mariners used to cross oceans and arrive at their targeted destinations. They did not just point their ship at a particular compass heading and hope for the best. Changing currents, winds, storms, pirates and other unknowns meant that merely following a compass heading could leave them hundreds of miles off course in either direction. This is much the same problem you’re referring to with financial planning.

To deal with this, the mariners would regularly check their position and make minor course corrections. As they continued toward their destination, making course corrections along the way, the distances for which they may be off from their intended destination got small as they got closer. Eventually, they arrive exactly where they intended.

The lesson is, when you are half-way across the ocean of retirement planning and just point your ship, it is normal that there should be a wide range of potential outcomes. That doesn’t mean you have to just chance it. Keep finding your bearings and course correcting as necessary, and you can nail your destination.

We sent men to the moon with slide rules. Explorers crossed oceans and found their way home with hourglasses. We can plan our retirements with MCS, spreadsheets and calculators. Just do what they did and keep checking your course.

Michael says

I think it has been one of the few points of agreement among economists that annuitizing wealth upon retirement is one of the best ways to deal with the biggest unknown – how long you will need money.

Michael says

Hmmm. I wrote a comment earlier but apparently failed to click submit. Anyhoo, I would imagine that FIRECalc is assuming that you won’t earn another penny (aside from investment income). Right? I would argue that a willingness to earn a few bucks along the way (if necessary) would allow you to adjust your course if things start to look bleak. And if that doesn’t wind up being necessary, then you’ll have successfully avoided working extra years only to wind up dying filthy rich.

There are no absolutes. And if you try to achieve anything close to certainty from the start, then you will most likely wind up way (way, way, way) overshooting the goal.

John says

SPIA would be my advice and what I am leaning towards. If I die sooner then I dont care but it would be better than not running out of money when you need it.

David says

This is the classic problem in personal finance (actually, probably business finance too). I think you hinted at the solution at the end: insurance. This is *exactly* what insurance is made for. Statistics are great, and people use those Monte Carlo simulations to get a “best guess” at what they need to retire. But, statistics don’t apply to individuals – they only apply to a large sample size. The larger, the better (hence the reason insurance contracts work very well for retirement planning).

Your best bet is to:

1) save more money and choose fixed-interest investments – very little guesswork

2) don’t save more money and use precious metals to provide a commodity-backing to your money to help fight inflation (though this doesn’t always work out so well)

3) buy some annuities and high cash value, participating, life insurance (assuming minimal insurance charges)

4) try to put together a complex hedging strategy yourself using bonds and index call options (bonds secure your principal and call options give you upside growth potential)

I think it’s probably better to overshoot than undershoot, whatever you do. When you get a whiff of death in your old age, you can always have a major blowout celebration with whatever you have left 🙂

Pam@Pennysaverblog says

If we all knew the future, I guess we could all become millionaires, but life remains unpredictable so all we can do is prepare for the worst while expecting the best. That philosophy works for more than just investing.