Attention self-employed individuals and rental property owners, if you have an LLC, S-Corp, partnership, C-Corp, or other state-registered entity, your entity has a new federal reporting requirement starting on January 1, 2024.

It’s called the FinCEN Beneficial Ownership Information (BOI) report. This report is mandated by the Corporate Transparency Act passed by Congress in 2021. Basically your state-registered entity must tell the federal government who’s behind that entity.

Filing the report itself isn’t too difficult only if you know you must do it. Not filing the report by the deadline can incur civil penalties of up to $500 per day (!) or up to two years of prison time.

Who Must File the Report

Most small LLCs, S-Corps, partnerships, C-Corps, or other state-registered entities must file the report. Some entities are exempt but you should assume that your entity must report unless you see a clear exemption in the Small Entity Compliance Guide.

Sole proprietorships with only a DBA don’t need to file the report. From the FAQs:

C. 6. Is a sole proprietorship a reporting company?

No, unless a sole proprietorship was created (or, if a foreign sole proprietorship, registered to do business) in the United States by filing a document with a secretary of state or similar office. An entity is a reporting company only if it was created (or, if a foreign company, registered to do business) in the United States by filing such a document. Filing a document with a government agency to obtain (1) an IRS employer identification number, (2) a fictitious business name, or (3) a professional or occupational license does not create a new entity, and therefore does not make a sole proprietorship filing such a document a reporting company.

When to File the Report

Existing entities created before January 1, 2024 must file the report by January 1, 2025. Because it’s easy to forget and the penalties are heavy if you don’t do it, you should file the report ASAP.

A new entity formed in 2024 must file the report within 90 days of its formation. If you form a new entity after January 1, 2025, the new entity must file the report within 30 days of its formation.

After you file the initial report, you don’t have to do it every year. The entity must file an updated report within 30 days only when the previously reported information changes. This includes when the company or a reported beneficial owner moves or gets a new driver’s license or passport.

How to File the Report

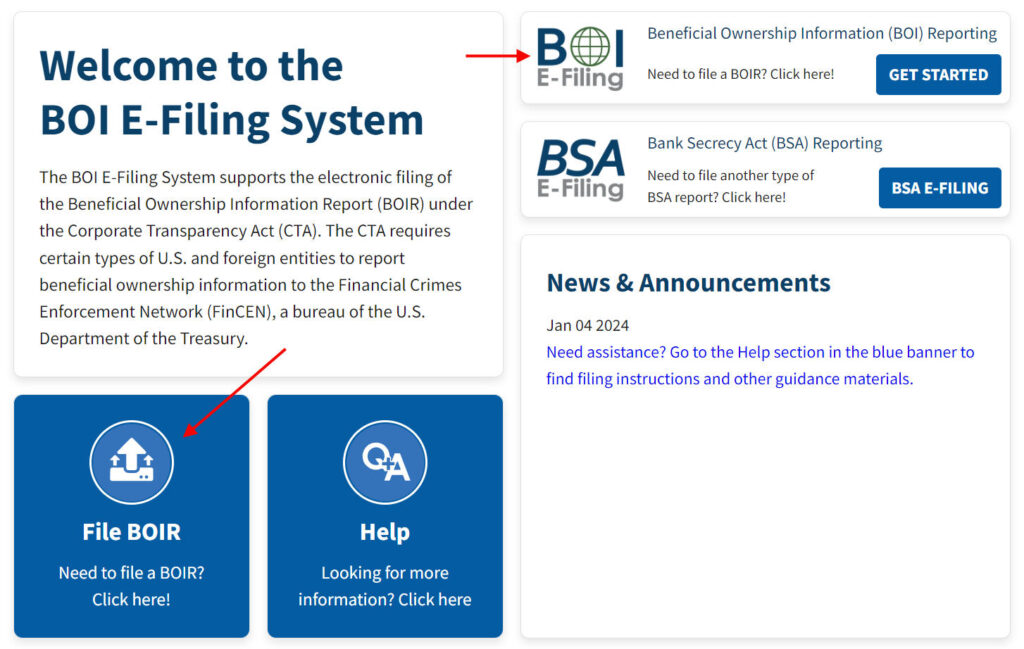

You file the report electronically with the Financial Crimes Enforcement Network (FinCEN), which is a bureau of the U.S. Department of the Treasury. You can submit a filled-out PDF file or use FinCEN’s online form.

There’s no fee for filing the report.

Go to FinCEN’s BOI E-Filing System. Either button will get you started.

What’s In the Report

The report itself is quite straightforward. It’s basically the company’s name, address, tax ID, and each beneficial owner’s name, address, date of birth, driver’s license or passport number, and an image of the driver’s license or passport.

A beneficial owner doesn’t necessarily have to have ownership in the company. Senior officers with substantial control must also be included even if they don’t have ownership.

The information filed in the report won’t be made available to the general public.

Each entity files a report separately. If you have multiple entities, you can obtain a FinCEN ID with your personal information and reference the FinCEN ID in each entity’s report without having to repeat your personal information in each report. This also makes it easier to update the information when you move or get a new driver’s license or passport.

For More Information

Please read FinCEN’s BOI FAQs and Small Entity Compliance Guide. If you don’t find the answer there, submit your question to FinCEN via their contact form.

***

The most important thing about this FinCEN BOI report is to know that your LLC or S-Corp is required to file the report. Filing the report only takes 15 minutes. As with any other law, not knowing the law’s existence doesn’t get you out of a penalty. I would much prefer not to have this chore but it is what it is. If you have an LLC, S-Corp, or other state-registered entity, presumably you have a good reason to have it. This new reporting requirement has just become a part of the deal.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Todd B says

Thanks so much for this information. Was completely unaware. Filed and forgotten…

Vinay says

Woah! Thanks Harry so much for this information. I was completely unaware of this.

How do you stay informed with this kind of info. I am afraid some folks (incl. me) might remain unaware and face hefty consequences if they do not have a trustworthy dude on the internet.

I hope the tax prep software have this reminder built into it.

FINCEN had another requirement of filing FBAR for people who have bank accounts in foreign countries – which lot of immigrants do. I was aware but one of my friends was not and not even his CPA who filed his taxes. He eventually had to pay a HUGE fine and 3 years of IRS/FINCEN hell.

Jeff says

What if my LLC is in existence as of now, however I dissolve that LLC later in this year, would I still have to file this? Thanks

Harry Sit says

I don’t know. You can read their FAQs and guide or submit your question to FinCEN but it takes less time to just file the report anyway. You’re still covered that way if you end up keeping your LLC beyond the end of this year.

Evan says

My wife has a sole proprietorship/DBA in Texas, and she did file an “assumed name certificate” with the county for it. Does that trigger the filing requirement? The wording is really unclear.

Secondarily, if you file but you don’t actually need to, there’s no penalty or drawback for that, right? (Assuming you are truthful.)

Harry Sit says

If you’re not clear about the answer after reading their FAQs and the compliance guide, please contact FinCEN. I added the link to their contact form in the “For More Information” section.

I don’t see a downside in filing the report when an entity isn’t required to file other than disclosing some information to the government. I don’t have a problem with it but I understand that some people are against it.

Drew Ward says

I have tried to submit multiple times and each time it indicates the picture I am submitting is corrupt – which is just a simple, small jpg file with everything right side up. Any one else having this problem?

Harry Sit says

I didn’t have that problem but I used a good quality scanned image. Try a different image?

Drew Ward says

I switched from taking a picture on my iPhone to using my flat bed scanner and that did the trick.