[Updated on January 30, 2025 for the 2024 tax year.]

When I was ready to e-file my tax returns through TurboTax downloaded software, it said that federal e-file was free and I could pay another $25 to e-file the state tax return at the same time. Considering that I paid only $30 for the software that includes all the complex logic to prepare both the federal and the state tax returns, $25 for simply transmitting the data and only for the state portion seems outrageous.

It isn’t just TurboTax. H&R Block does the same. Federal e-file is free but you must pay extra if you also want to e-file the state return. Only New York bans tax software vendors from charging extra for e-filing the state return.

No doubt many people relent and just pay the $25. Tax software vendors know it, and they’re counting on this for their revenue. I can afford $25. I would have no problem with it if they included it in the price upfront and sold the software for $55 as opposed to $30. I just hate this sneaky tactic.

Printing and mailing the state return isn’t necessarily the only alternative though. Many states accept e-filing directly on the state revenue agency’s website. E-filing a return on the state’s website only takes a few minutes when you already have the completed forms from the tax software.

The web form on my state’s website is just an interactive representation of the same paper form. Besides personal information, I basically entered two numbers from my federal tax return – the AGI and the standard deduction. All the rest were automatically calculated.

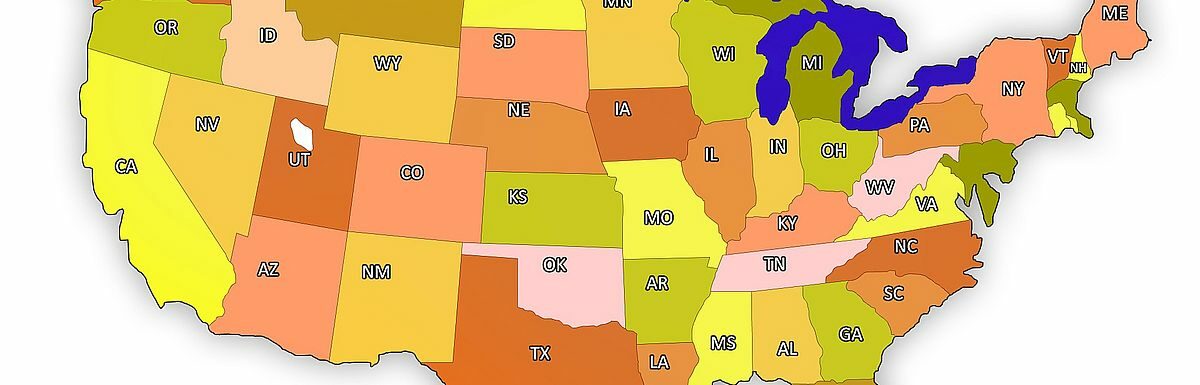

Here I collected the available direct e-file links for all 50 states and Washington, DC. Please let me know if I missed any.

If your state offers direct e-file, at least try it once. You can always go back to paying $25 if you don’t like e-filing directly. If your state doesn’t offer direct e-file, printing and mailing isn’t that bad either. States don’t have a big backlog of paper returns as the IRS does. When I lived in California, they didn’t allow direct e-file if you had an HSA. I had mailed my state tax return for many years and I never had any problems.

You save $25, and more importantly, you feel good about not falling prey to a big corporation’s pricing game. You get the better product when you use downloaded tax software and you pay nearly half the price than using the software online.

| State | Free Direct E-File |

|---|---|

| Alabama | My Alabama Taxes |

| Alaska | No state income tax |

| Arizona | No direct e-file |

| Arkansas | No direct e-file |

| California | CalFile |

| Colorado | Revenue Online |

| Connecticut | myconneCT |

| Delaware | Delaware Taxpayer Portal |

| District Of Columbia | MyTax DC |

| Florida | No state income tax |

| Georgia | No direct e-file |

| Hawaii | Hawaii Tax Online |

| Idaho | No direct e-file |

| Illinois | MyTax Illinois |

| Indiana | No direct e-file |

| Iowa | No direct e-file |

| Kansas | Kansas WebFile |

| Kentucky | KY File |

| Louisiana | Louisiana File and Pay Online |

| Maine | Maine Tax Portal (i-File) |

| Maryland | iFile Maryland |

| Massachusetts | MassTaxConnect |

| Michigan | No direct e-file |

| Minnesota | No direct e-file |

| Mississippi | No direct e-file |

| Missouri | MyTax Missouri |

| Montana | Montana TransAction Portal |

| Nebraska | NebFile |

| Nevada | No state income tax |

| New Hampshire | Granite Tax Connect |

| New Jersey | New Jersey Online Income Tax Filing |

| New Mexico | Taxpayer Access Point |

| New York | Software vendors can’t charge extra for e-file |

| North Carolina | No direct e-file |

| North Dakota | No direct e-file |

| Ohio | OH|TAX eServices |

| Oklahoma | OkTAP |

| Oregon | Revenue Online |

| Pennsylvania | myPATH |

| Rhode Island | No direct e-file |

| South Carolina | No direct e-file |

| South Dakota | No state income tax |

| Tennessee | No state income tax |

| Texas | No state income tax |

| Utah | Taxpayer Access Point |

| Vermont | No direct e-file |

| Virginia | No direct e-file |

| Washington | No state income tax |

| West Virginia | No direct e-file |

| Wisconsin | WisTax |

| Wyoming | No state income tax |

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Ryan says

This is the subject of a Boglegheads thread dating back to 2011 that attracts new comments every few years, including this year: https://www.bogleheads.org/forum/viewtopic.php?f=2&t=71425&newpost=6576716&view=unread#unread

Not surprisingly, viewpoints are varied. On the subject of direct filing, posters comment on the additional time required to complete direct filing and the risk of transposing numbers. State returns can be complex, with adjustments to federal AGI and credits, increasing the time required and transposition risk.

I have filed directly to avoid TurboTax’s state e-filing fee for years. This year, my state required that an account be set up on their website prior to direct filing. This seems like a sensible security enhancement. However, to set up an account, you must first request that the state send you a letter via paper mail with a security code. I can appreciate that this enhances security, but it certainly complicates and slows down the process, and disincentives people that are eager to complete the process when they are ready to file from using the direct file option.

I like the approach that New York takes to prohibit a state e-filing fee.

Harry Sit says

That’s why I suggested at least trying it once. If someone prefers to pay the $25, there’s always next year.

Transposing numbers seems a mere excuse for not wanting to try. When you have the completed return in hand, transposing numbers won’t match the bottom line result. You will detect it right away.

My state doesn’t require a login or password. Even if it does and it requires receiving a code by mail, it’s only a one-time setup. The login will work next year without delay.

If someone just doesn’t want to do it, they will always find an excuse. It’s their $25. If they want to tip Intuit or H&R Block with it, that’s certainly their choice. I’d rather cut out the middlemen. Because my state tax is so simple, I will buy the federal-only version of the software next year.

RE says

In a prior year the tax software I used erroneously filed a state form that should not have been filed. I was unaware that the software had filed this form. This event then caused the state to bill me for an unpaid tax bill.

So all that to say, I prefer to file the state form myself on the state web site. I can easily compare the unfiled return prepared by the application, with the online state return, before hitting that final submit button.

Vincent Cronin says

“My Financial Toolbox” and your other articles taught me a lot about frugality. I also resent being surprised by the $25 e-filing fee from TurboTax but Virginia does not offer direct e-filing. However, I decided to pay the fee rather than trust USPS to deliver my return. If it was not for “Informed Delivery”, a USPS free service that allows me to digitally preview my mail delivery, I would not know how much of my mail goes undelivered. This tax season, I was missing a 1099-R and IRS Letter 6475 but in the past many more time sensitive pieces were never delivered i.e. Jury Summons, Medical Bills, Rebate Checks to name a few.

I cringe when Social Security, Medicare or ACA require original documents. I use FedEx to send them but the government always returns my document by USPS.

Thanks for another great article, Harry.

Harry Sit says

I also have Informed Delivery from USPS. I have better luck with receiving everything I’m expecting and not losing anything I send.

Mighty Investor says

This was handy. Thanks!

Old mariner says

H&R Block Deluxe 2021 charges $19.95 to file a 2021 state return (except New York, I guess). When I purchased the software, the product description was upfront about the $19.95 state e-file charge. Plus, I knew about the charge from my prior years usage of the software. I like the convenience and seamlessness of using Block, so I paid the $19.95.

Since I filed in California this year and will probably do so next year, I checked out your link to CalFile. Boy, that looked great on the first page. But then I looked at the “qualifications” necessary in order to qualify to use or not be allowed to use that service. The list of “do not qualify” is pretty long and includes such basic things as stock/bond sales. Also, Harry’s HSA would still be a “do not qualify”. Both of those issues plus a couple of others put me on the “do not qualify” for CalFile. It’s incomprehensible to me that there are any limitations whatsoever, but I’m sure some political genius will offer a myriad of reasons for them that will still make no sense to me.

Also, what’s with the word “qualifications”? It would be clearer if they used plain language and simply said “you are not eligible to use e-file if ….”.

Thanks for the list. Some day I might be living in a state where I’ll be eligible to try out that state’s e-file.

SS says

I went through this with CalFile for both 2020 and now with 2021. I have stock sales but the profit/loss is already accounted for in the AGI. I went ahead and ignored the “not qualified if you have stock sales” (which seems ridiculous as you imply) and put all the numbers in. My CA refund numbers *and* all the form CA-540 numbers matched up with what TurboTax has. Every single line in 540 was the same. So I went ahead and filed in 2020 (and got my refund) and intend to do the same with 2021 in the next day or two.

With my new employer, I now started a HSA in 2022, so that will definitely exclude me from CalFile for next year due to CA taxing HSA; I understand the legislature has a bill for tackling this but not holding my breath.

Anyways, I totally agree with Harry. I refuse to pay and extra $25 to Intuit especially with this lobbying efforts to make tax filings harder.

Bingoman says

According to the Department of Revenue, Alabama has a direct e-file option.

https://revenue.alabama.gov/individual-corporate/individual-income-tax/individual-income-tax-electronic-filing-options/

Harry Sit says

Thank you! I added the direct e-file link for Alabama.

Greg W says

Hi Harry,

I believe that North Carolina does indeed have an eFile option:

https://www.ncdor.gov/file-pay/efile-individuals

While I’ve never used the service, you’ve inspired me – I plan to give it a try.

Thank-you for all that you do!

Greg

Harry Sit says

It looks to me the options in NC are all through approved tax software vendors like the IRS Free File. I’m not sure whether those vendors will let you jump directly to the state portion when you already have your output from say TurboTax or they will have you prepare both federal and state and the state e-filing is just part of the package. I didn’t include them in direct e-file because you’re not filing directly with the state. Most of the approved vendors also have a maximum income to make it free.

Tom Martin says

This is good advice if you have a simple return. Here in CA, there are a lot of things that disqualify you from e-filing, including HSA distributions and capital gains or losses. So won’t work for me…

Harry Sit says

California has those stupid limitations. Other states are better. With regard to capital gains, as a former Californian I know that California doesn’t have a special rate for capital gains. It treats capital gains just as normal income. There are some rare scenarios where the state’s rules differ from the IRS rules on capital gains. Most people don’t run into those. You should be able to use CalFile if you only have normal capital gains. The HSA is still an issue. I never had any issue with mailing the return to the FTB though. It was always processed fast, even during COVID.

SS says

Please see my comment above to Old Mariner. Harry, as usual, has a clearer explanation than in my comment.

Tom Martin says

Thanks for the reply, I will take a look and maybe mail in CA. I have a HSA with distributions.

Ocho Sin Coche says

In the past, I’ve used the fillable forms at https://virginia.statefillableforms.com/ to file in Virginia. It worked, even as of 2021. Surprise, surprise! This year that option isn’t available. Since I refuse to pay any amount of money to Intuit, I’ll probably just mail in my return this year.

It’s interesting to look at the WHOIS for statefillableforms.com. The page has lists “Intuit, Inc.” as the registrant. See https://lookup.icann.org/lookup?q=statefillableforms.com&t=a

Ryan says

New for this year, Illinois will not permit a return to be e-filed directly if it includes anything but the most common additions and subtractions to federal income. US government interest and contributions to the IL 529 plan now disqualify a return from direct e-filing! The website has accepted these subtractions for years. I begrudgingly paid $25 to TurboTax for state e-filing for the first time to avoid exposing sensitive tax data to identify theft in the mail.

Ann says

Thanks for this, Harry. I live in Maryland and we have always printed and mailed our state return rather than pay extra. I take the return into the post office and get a receipt. An added bonus is that we almost always owe the state, and they often take weeks to cash the check. In these days of higher money market interest, that saves us at least a few dollars.

Krishna says

My state California does not allow free E-filing if one has any capital gain or losses.

What a Bummer.

Harry Sit says

The state didn’t say it clearly. They should’ve said you can’t use CalFile if you have capital gain or loss that requires a California-specific adjustment. Most people don’t need such adjustment. You can still use CalFile if you only have normal capital gain or loss included in the Federal AGI.

Fred Redmon says

Illinois, to cumbersome to reenter data-they get a paper copy. Paying the cost of 1 or 2 stamps vs. 19.95. Seldom owe money, any refund is applied to next year, any balance is paid online.

JA SOULE says

No one has made it clear what is actually involved… is there any way to upload info from the Turbota (or other program) to a state on-line filing site (in my case, MA), or do you have to enter everything manually? thanks…

Harry Sit says

What is actually involved differs in each state. My state only needs two numbers from the federal tax return. Another state may need more than that. You’ll see what’s required when you try it once. You can always go back to paying $25 to TurboTax if you don’t like how the state does it. If the state lets you create a login, the second year will be easier when your name, address, and social security number prefill from the previous year.

MJM says

I am a retiree in California. I have an existing HSA account from my working years (now held at Fidelity). I do not make any contributions or take any distributions from the account. The HSA funds are invested in a money market fund. Interest is not taxable at the federal level but is in California. Can I still use CalFile since I don’t have contributions/distributions from the HSA as long as I account for the HSA interest on the California return?

Thank you.

Harry Sit says

The state only says you can’t do it if you have HSA deductions or distributions. Only holding an HSA doesn’t disqualify you. Try it!

Old mariner says

For 2023 tax forms, the state e-file fee for HR Block is $19.95. The state e-file fee for TurboTax is $20.00.

I agree that the fees are outsized for what seems like a simple transmission; however, I think that about most fees. It’s a quick and confirmed transmission with no further labor necessary.

Melody says

CA capital gains — is it disqualifying to Calfile with LT capital gains (adjustment) since Fed taxes it at a lower rate? Or for precious metals like gold (‘special collectible’, diff tax rate). I usually bring my letter to the post office counter to mail the return, but pay the tax amt owed online to make sure they get it on time. It is my understanding that there is not any $ penalty for non/late receival of tax returns if the IRS or FTB (for CA) receive the tax $ on time. That’s because the penalties are all a % of the outstanding tax money due — if you’ve paid off the return on time online, the outstanding amt due is ‘0’, and any% times 0 for the penalty is ‘0’. Is this correct?

Harry Sit says

It’s been several years since I left California but I don’t think CA distinguishes between captial gains on the federal tax return from any other income regardless of at what rate the IRS taxes those gains. The disqualifying capital gains for CalFile are only gains that are not on the federal tax return but are taxed by California. People normally don’t have any of those.

You’re probably right about the late filing penalty being zero when you don’t owe. Postmark on or before the due date counts as timely filing.