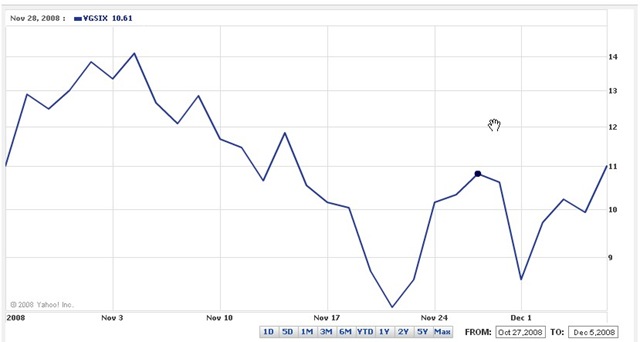

If the Vanguard REIT Index Fund (VGSIX, or its EFT share class VNQ) were a person, I’d say he must have bipolar. In the past few weeks, its prices changed from one end to another in rapid cycles. It could not make up its mind whether it wanted to go up or go down. One week it was in mania, up 30%; the next week it was in deep depression, down 30%; up again, down again, like crazy. Up or down 30% in a year would be quite volatile. To have it happen in a week, five weeks in a row, is just pure madness.

The REIT index fund’s standard deviation of daily price changes in the last few weeks was 9.3%. That’s even higher than the same on Vanguard sector funds Vanguard Precious Metal & Mining Fund (VGPMX) and Vanguard Energy Fund (VGENX). Although some people consider REIT to be a separate asset class, it is behaving like a sector fund lately.

Here are the recent Net Asset Value changes for the Vanguard REIT Index Fund (VGSIX):

| Dates | Trading Days | NAV Changes |

| 10/27/2008 – 11/4/2008 | 6 | +28% |

| 11/4/2008 – 11/12/2008 | 6 | -24% |

| 11/12/2008 – 11/13/2008 | 1 | +11% |

| 11/13/2008 – 11/20/2008 | 5 | -32% |

| 11/20/2008 – 11/26/2008 | 4 | +34% |

| 11/26/2008 – 12/1/2008 | 2 | -21% |

| 12/1/2008 – 12/5/2008 | 4 | +29% |

| 10/27/2008 – 12/5/2008 | 28 | 0% |

The funny thing is, after all the wild swings, the NAV is unchanged from what it was five weeks ago. It almost tempts you to become a trader: [dream on] buy low, sell high, buy low, sell high, buy low … … In a few weeks you more than double your money. [dream over]

Or is it called rebalancing? Who wants to bet it will be up or down another 20% again shortly?

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Mr. ToughMoneyLove says

Regardless of its present volatility, don’t you agree that REIT is an essential component of any well-balanced long term investment plan?

Harry Sit says

I agree. That’s why I have a 5% allocation to REIT in my portfolio.

zanon says

I also think REITs are key in a portfolio, but I actually think it should have 100% allocation to all young people just out of school.

think about it this way — you know you are going to buy a house someday, everyone needs a house, but for now you are saving money so you can afford it. You’re negatively impacted if houses prices go up, and positively impacted if they go down. This means you are, de facto, short housing.

Buying a REIT takes you to a neutral position.

Mr. ToughMoneyLove says

Zanon – Another way of looking at it is that a young person has the time to accumulate cash for a downpayment while waiting for the real estate market to go down (like now). He/she can then move in with that cash to grab a bargain. I don’t see how owning 100% REIT would assist in that strategy, if you assume that REIT valuations will also be down when the bargains are available.

zanon says

Mr ToughMoneyLove

Hah! The current situation is very unusual, usually, real estate goes (modestly) up. Also, note that the Government is doing all it can to get prices high again, including the new 4.5% mortgage.

If you graduated in the late 90s, you could be saving up for a downpayment like crazy, only to see appreciation keep you from ever having enough!

My point is that young people are intrinsically short realestate. to have a neutral position, they should have REITs

Ted says

You would have to trade it in the ETF, VNQ, because the fund has a 1 year redemption fee of 1%.