[Updated on January 30, 2025 with screenshots from TurboTax, H&R Block, and FreeTaxUSA for the 2024 tax year.]

Many homeowners refinanced to a sub-3% mortgage when interest rates were low a few years ago. The mortgage interest most people pay isn’t large enough to make them itemize their deductions. They just take the standard deduction. Those who can still deduct their mortgage interest tend to have a large mortgage.

Limit on Deduction

The Tax Cuts and Jobs Act reduced the limit on the mortgage balance on which you can deduct the mortgage interest from $1 million to $750,000. The lower limit applies to homes acquired after December 15, 2017. The large increase in home prices in recent years makes recently bought homes in high-price areas more likely to exceed the $750,000 limit.

However, lenders still report 100% of the mortgage interest paid on the 1098 form without adjusting for either the old $1 million limit or the new $750,000 limit. If your mortgage balance is over the limit, deducting the mortgage interest is more complicated than just using the number from the 1098 form.

It isn’t simply multiplying $750,000 by your interest rate either when your mortgage balance started above $750,000 and ended below $750,000 or when you took out the loan in the middle of the year.

Average Mortgage Balance

A key concept is your average mortgage balance during the year. When your average mortgage balance exceeds the limit, your deductible mortgage interest is:

Loan Limit / Average Mortgage Balance * Actual Mortage Interest Paid

If you paid $30,000 in mortgage interest on an average mortgage balance of $1,000,000 and you’re subject to the $750,000 limit, your deductible mortgage interest is pro-rated to:

$750,000 / $1,000,000 * $30,000 = $22,500

IRS Publication 936 gives several ways to calculate your average mortgage balance:

- Average of first and last balance method

- Interest paid divided by interest rate method

- Mortgage statements method

The first method is simpler and it gives you a slightly larger deduction but you can use it only if you didn’t prepay more than one month’s principal during the year.

Here’s how it works in TurboTax, H&R Block, and FreeTaxUSA tax software.

TurboTax

The screenshots below are taken from TurboTax Deluxe downloaded software. The TurboTax downloaded software is both less expensive and more powerful than TurboTax online software. If you haven’t paid for your TurboTax online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax online to TurboTax download (see instructions for how to make the switch from TurboTax).

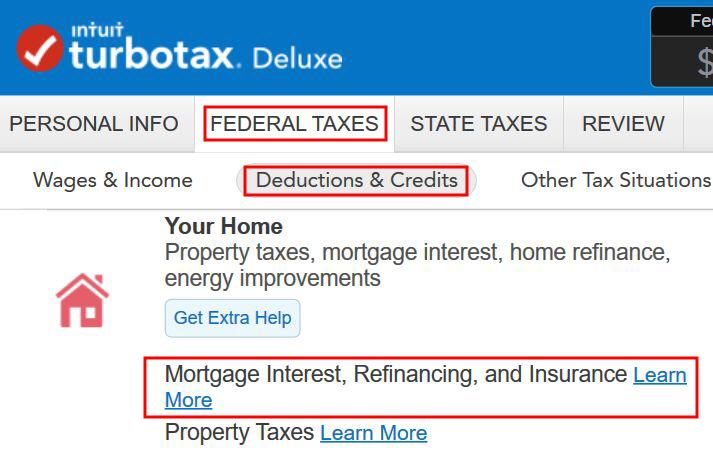

Find the mortgage interest topic in the Your Home section under Federal Taxes -> Deduction & Credits.

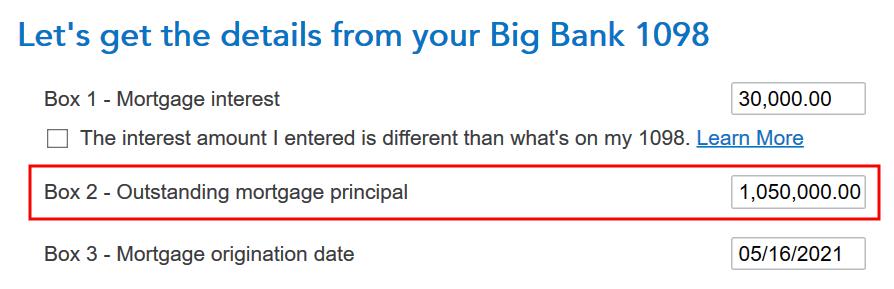

Form 1098

When it asks you to enter information from your 1098 form, enter the numbers as they appear on your form. If Box 2 is blank on your 1098, enter the mortgage balance at the beginning of the year (or your beginning loan balance if you took out the loan during the year).

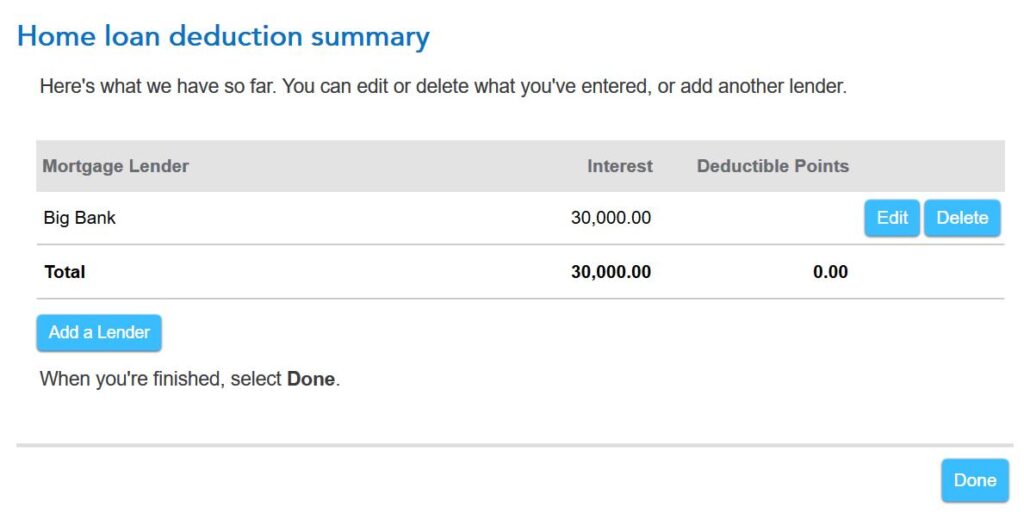

You get to this summary after you answer a few more questions. Click on Done but you’re not done yet.

Purchase Date and Ending Balance

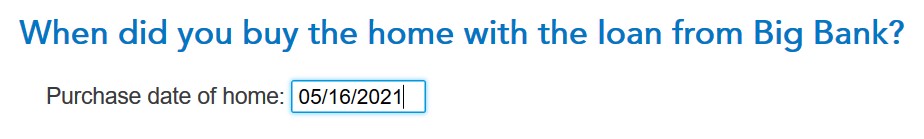

The purchase date of the home determines whether you have a $1 million limit or a $750,000 limit for the mortgage interest deduction. If this mortgage was from a refinance, you still enter the date when you originally bought the home.

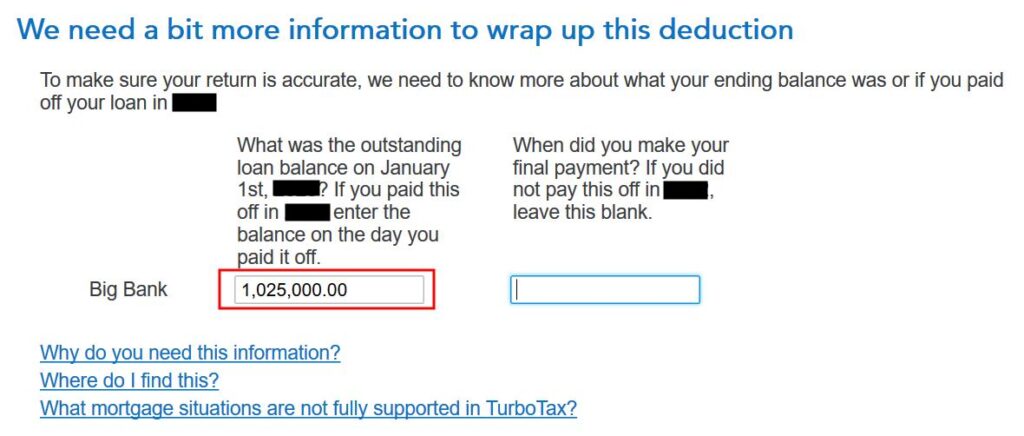

TurboTax asks for the balance as of January 1 of the following year because it uses the “average of first and last balance method” to calculate your average mortgage balance for the year. This works when you didn’t make extra principal payments during the year.

TurboTax calculates a deduction using the “average of first and last balance method” but you can’t legally use that method if you prepaid more than one month’s principal during the year. You must calculate your average mortgage balance in a different way and give the pro-rated deductible mortgage interest to TurboTax.

If You Prepaid Principal

If you had the mortgage for all 12 months and your interest rate didn’t change during the year, which is the case for most people with a fixed-rate mortgage, you can use the “interest paid divided by interest rate method” to calculate your average mortgage balance. Suppose you paid $30,000 in mortgage interest and your rate is 2.875%, your average mortgage balance is:

$30,000 / 0.02875 = $1,043,478

Your deductible mortgage interest is:

$750,000 / $1,043,478 * $30,000 = $21,562

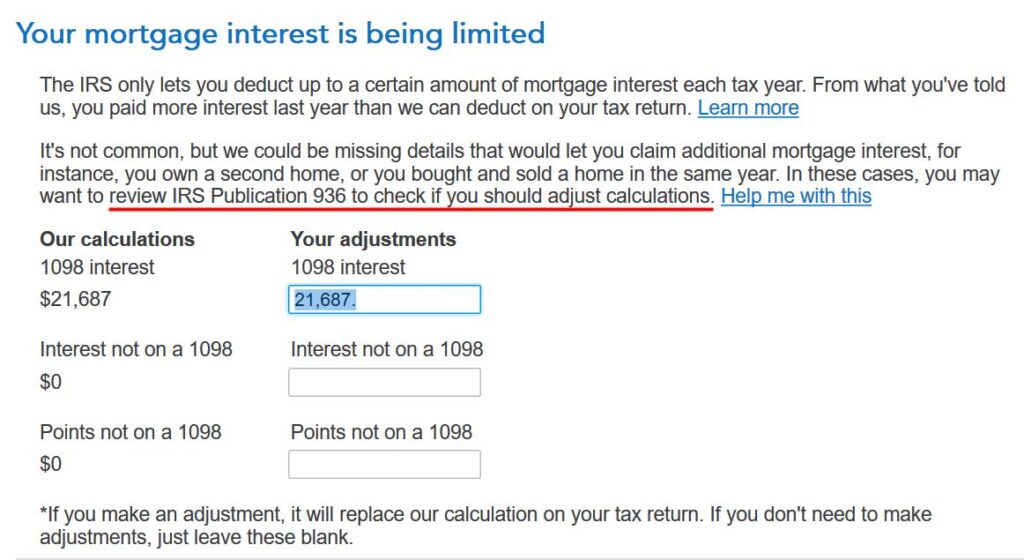

If your interest changed during the year, you’re better off using the “mortgage statements method.” Download the monthly statements from your lender. Add up your balance from January to December and divide by 12. That’s your average mortgage balance during the year. Use that number to calculate your pro-rated deductible mortgage interest and give it to TurboTax:

Loan Limit / Average Mortgage Balance * Actual Mortage Interest Paid

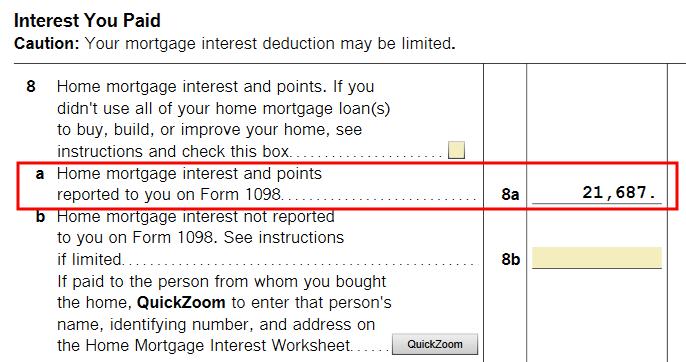

Verify on Schedule A

To confirm how much mortgage interest deduction you’re getting, click on Forms on the top right and find Schedule A in the list of forms in the left panel.

Scroll down to the middle and find Line 8. You’ll see the mortgage interest deduction.

H&R Block

Mortgage interest deduction works differently in the H&R Block software.

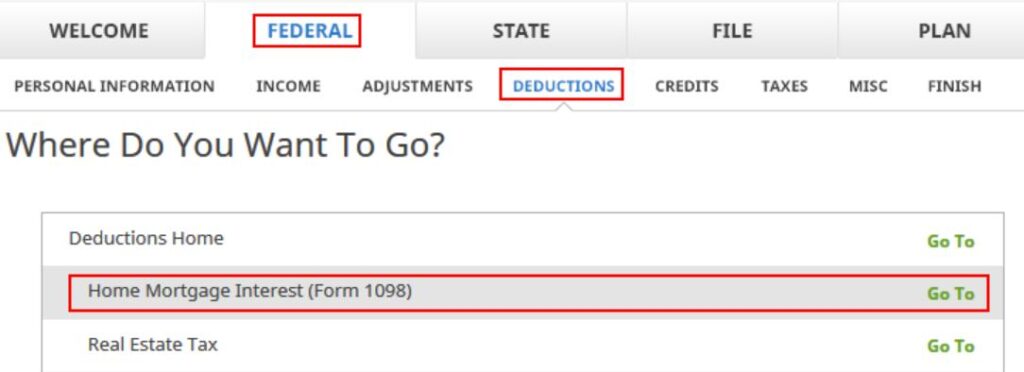

Find “Home Mortgage Interest (Form 1098)” under Federal -> Deductions.

1098 Entries

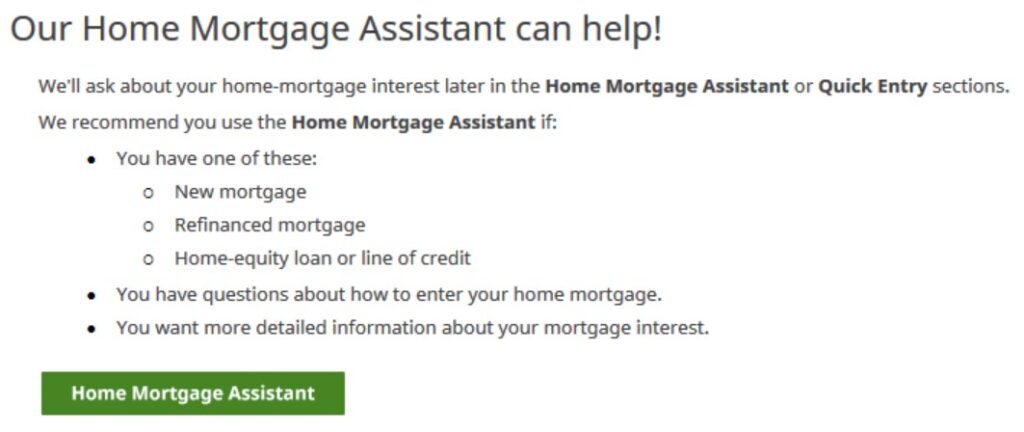

H&R Block offers a Home Mortgage Assistant. Click on that.

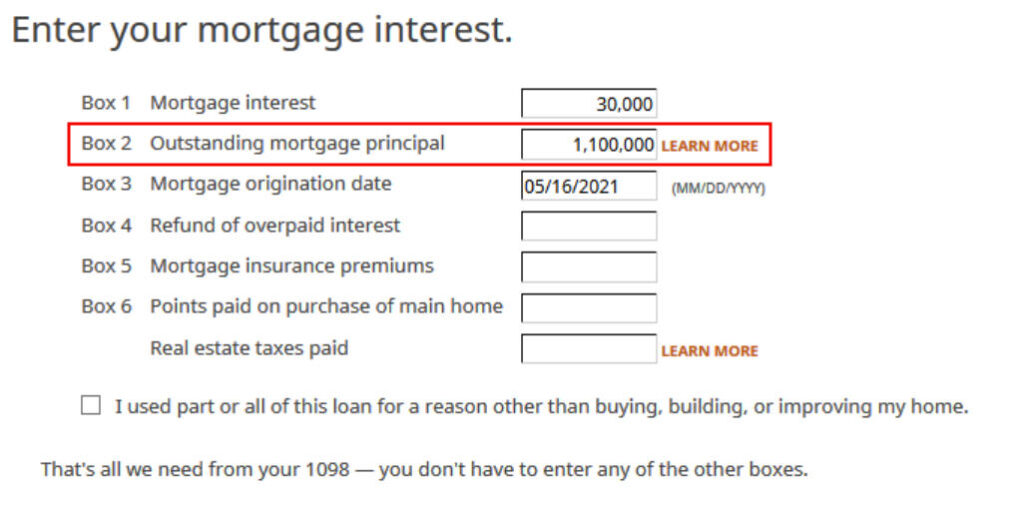

We come to this form to enter the numbers on the 1098 form after saying we have a 1098 form. The IRS instructs banks to put in Box 2 your mortgage balance as of the beginning of the year (or your beginning loan balance if you took out the loan during the year). This isn’t your average balance during the year.

You also need to enter the date when you purchased the home in Box 3. This date determines whether you have a $1 million limit or a $750,000 limit for the mortgage interest deduction. If this mortgage was from a refinance and the bank put the refinance date in Box 3, you should overwrite it with the date when you originally bought the home.

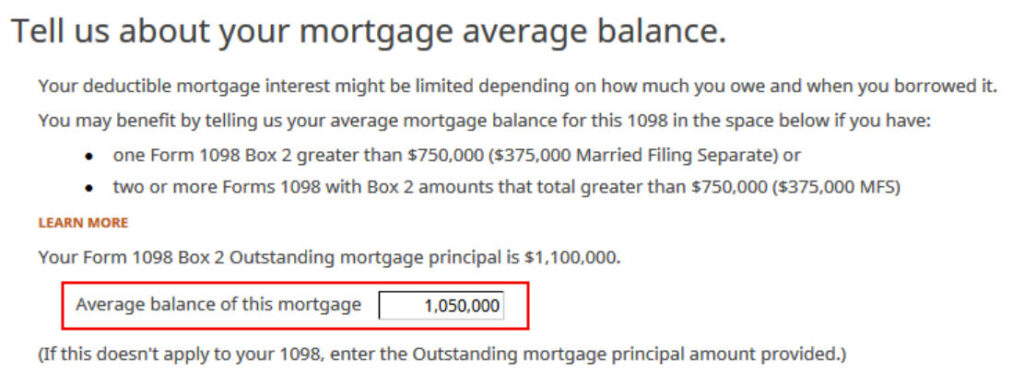

Calculate Average Mortgage Balance

Instead of asking for the mortgage balance as of the end of the year, H&R Block asks you to calculate the average balance yourself and put the number in this box.

- If you didn’t prepay more than one month’s principal, get the beginning balance and the ending balance. Take an average.

- If you prepaid more than one month’s principal but your interest rate didn’t change, divide the interest paid by your interest rate.

- If you prepaid more than one month’s principal and your interest rate changed during the year, get your balance as of the beginning of each month and take an average.

Suppose your beginning balance was $1,100,000 and your ending balance was $1,000,000, and you didn’t prepay more than one month’s principal during the year, your average balance using the first method is

( $1,100,000 + $1,000,000 ) / 2 = $1,050,000

Mortgage Interest Deduction

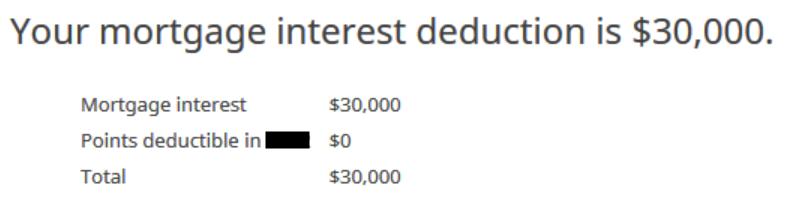

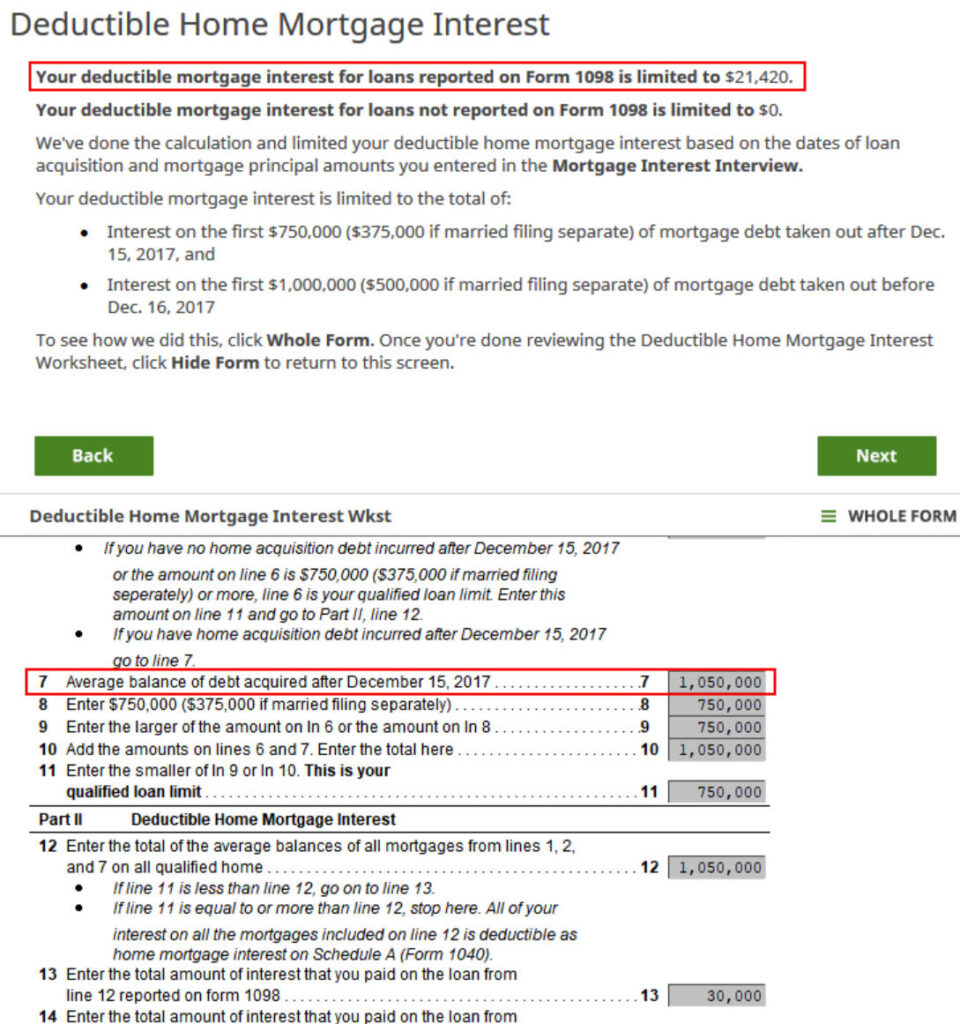

After answering more questions about points and mortgage insurance premiums, which we don’t have, H&R Block says our mortgage interest deduction is 100% of the mortgage interest paid. This isn’t accurate because the software hasn’t applied the loan limit yet.

You see this when you click on “Finished” after you’re done with all your 1098 forms. H&R Block calculates a mortgage interest deduction subject to the loan limit. You can see it’s using the average mortgage balance you entered.

FreeTaxUSA

I also checked how the online tax software FreeTaxUSA does it.

FreeTaxUSA puts a small question mark link next to the mortgage interest entry. Clicking on the question mark opens a pop-up, which says toward the end:

If your debt is higher than the limits, use Publication 936 to figure out your deductible home mortgage interest amount and reduce the mortgage interest you enter accordingly.

You’re on your own when you use FreeTaxUSA. It doesn’t tell you clearly that you must do some extra work. You would’ve claimed more deduction that you’re eligible for if you didn’t know to click on that question mark and read the whole pop-up.

***

FreeTaxUSA is less expensive than TurboTax but it does less. It’s easy to file a wrong tax return if you don’t know to click on the small question mark. You’re instructed to read the IRS publication and calculate the deductible amount on your own. H&R Block applies the loan limit but it doesn’t help you calculate the average mortgage balance. Your deduction is reduced if you only use the beginning balance. You really have to know where it cuts corners when you use FreeTaxUSA and H&R Block. It works well only when those cut corners don’t affect you.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Brian Kansella says

Harry,

Thanks for all you do. I recently started reading everything I can find you’ve written on taxes. I want to try doing my own this year or next. I had begun to lean toward H&R Block’s download software, but after reading this post I’m thinking maybe I should start with TurboTax. Would you have a preference if you were trying to do your own taxes for the first time?

Thanks!

Harry Sit says

If your taxes are simple enough, either one works. TurboTax covers more corner cases than H&R Block. It doesn’t matter if those corner cases don’t apply to you. Sometimes being more thorough can be more confusing when the software asks questions you don’t know whether you should pay attention to or ignore. Since you’re doing it for the first time, I would suggest TurboTax only because it’s easier to find answers online when you’re not sure of something.

Gaurav says

This article is helpful. I did have a follow-up question though. I’m using H&R Block and my mortgage was transferred to a different lender in April 2023. So for 2023, I now have two 1098 mortgage interest statements, one from each lender. The tax software is treating my 1098 forms as independent mortgages, which then puts me above the $750,000 limit and then wrongly limits my interest deduction. It’s the same mortgage but on two separate 1098s from two separate lenders. It originated in 2021 and is well below that $750k limit. How would you go about fixing this issue? Or do I just need to go into an H&R Block office for help?

Harry Sit says

Leaving the mortgage balance blank on the second 1098 will stop the software from double counting the balance.

Gaurav says

I’ve tried leaving the mortgage balance blank on the 2nd 1098 but when it goes through the checks at the end, that shows up as a required hard stop.

I’m wondering if there’s a way to manually fill it out or to override the double counting.

Harry Sit says

Putting a zero in that field will remove the flag from the checks at the end but on second thought it’s better to prorate the average balance between the two lenders. Because we know H&R Block treats that field as the average mortgage balance and it adds two forms together, you can calculate the average balance yourself using one of the three allowed methods. Suppose it’s $500k and the first bank charged 60% of the interest, you give 60% of the $500k average balance ($300k) to the first bank and 40% to the second bank. When H&R Block adds the two 1098 forms together, you’re back to 100% of the interest paid and 100% of the average balance.

hbrocks says

To be clear – are we saying if you have sub $million mortgage…..and a sub 3% rate….don’t bother chasing a mortgage interest deduction?

Harry Sit says

Feel free to chase it. Just know that you may not get it when your total itemized deductions don’t exceed your standard deduction. Many people stop chasing it after seeing it’s futile to do so. You won’t know whether that’s the case for you unless you chase it at least once.

Gaurav says

Actually, what I did was use your first method of putting a ZERO in Box 2 of the first 1098. This was the company that sold my mortgage to the other company. So in reality, the mortgage balance for that company is zero, and since the payment histories transfer to the new company, the Box 2 of the current statement should be accurate. Doing that solved the issue. Your comment above and the link here also helped: https://ttlc.intuit.com/community/taxes/discussion/home-mortgage-interest-worksheet-errors/00/1129987

Michael says

How would you calculate the average mortgage balance if you sell a home (paying off a mortgage well under $750k) and buy a new home (with a new mortgage over $750k) mid-year?

Harry Sit says

Get the balance from the monthly statements. Add them up and divide by 12.

Jon says

HR Block released an update on 3/15/24 for the calculation of mortgage interest deduction limitation for balances >$750K. In my case I had to go back and redo their interview to get it right. It appears correctly done to me and I was able to file at last.

Harry Sit says

Thank you for the heads up. I updated the post with new screenshots from H&R Block. It doesn’t calculate the average mortgage balance for you but it added an input field for your own calculation.

zomboo says

I have noticed in the past few years and for 2023 on my returns, Turbo Tax does not actually used the beginning and ending averaging method to calculate the percentage of deductible interest. Turbo Tax doesn’t use an average at all, it simply uses the ending balances and then does not round the percentage to three decimal places as required by Pub 936 Table 1.