I should give an update for my experiment with selling cash-secured put options.

Back in June 2012, when the percentage of my portfolio invested in stocks was close to reach a trigger point for rebalancing, I wrote this post: Sell Cash-Secured Puts: Get Paid for Your Rebalancing Commitment. The gist was that by announcing to the market your firm commitment to rebalance, you receive a payment from the other market participants for your commitment. If you just keep the commitment to yourself and not tell anybody, you get nothing.

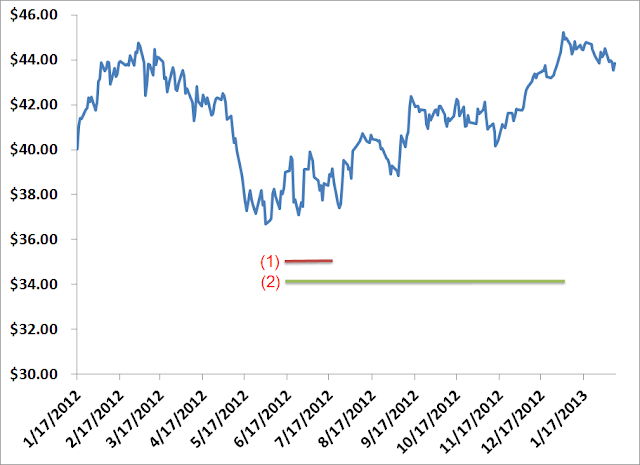

I did follow through with real money. My investments in emerging markets were closest to the trigger point. So I sold 2 put options on iShares Emerging Markets ETF (ticker EEM) with a strike price at $35 expiring in 45 days for $150. EEM was selling at $38 at that time. I said if emerging markets dropped another 8% I would buy.

EEM did not drop to $35. The lowest it ever got after I sold the put options was $37. The put options expired worthless. I kept the $150 option premium, which came out to 2% on the $7,000 cash I set aside for 45 days. Because I was committed to buy anyway, the 2% option premium was just extra money for announcing it. Earning 2% in 45 days was much better than earning 1% in a full year in a savings account.

I also sold 4 put options on EEM at $34 expiring in six months. I received $840 in option premiums, or 6% of the price of the underlying security. EEM never got to $34. I kept the 6% for making the commitment for six months.

(1) Committed to buy at $35 until July 22, 2012.

(2) Committed to buy at $34 until December 22, 2012

Altogether, I made close to $1,000 for something I was planning to do anyway: buy more if prices go down. Announcing the plan made the difference. I provided value to the market. The market paid me for it.

It would be better to buy emerging markets outright when EEM was at $38 — today it’s selling at $44, a 15% gain — but at that point it hadn’t triggered rebalancing just yet. Buying at $38 would be taking a different kind of risk than committing to buy at $34 or $35.

My takeaway from this experiment:

1) Selling cash-secured put options works best when the price is close to trigger a buy to rebalance but not quite yet. Fearful investors are willing to pay a good price to have a committed buyer.

2) Use this strategy only when you are truly committed to buy at the set price. Don’t speculate.

3) Selling longer-term options is more profitable than selling shorter-term options but it’s also more risky. Had the price gone below the strike price but the puts didn’t get exercised, I would have missed the opportunity to rebalance.

4) It works best in a sideways market. When prices fluctuate sideways, you just keep collecting the premiums; meanwhile a traditional long-only portfolio doesn’t go anywhere. Now that stock prices are up quite a bit, the opportunity to sell put options at that low strike price no longer exists.

Again I’m not recommending this to anyone. It was just an experiment. Luckily it worked out well.

[Photo credit: Flickr user SalFalko]

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Evan says

Although I have done exactly what you did on a couple occasions years ago – selling naked puts on stocks I was planning to buy anyway. I now think it to be a pretty worthless strategy and avoid options altogether.

Why? Because the only important point is your #4. The only real positive result under your scenario is with a mostly sideways market, otherwise the outcome is poor. By committing to buy, you have already accepted nearly all the downside of a falling stock price (with the exception of your small option premium), without getting any of the upside for a rising stock price.

If I am going to commit to buy $7000 of any security, thereby putting almost the whole amount at risk to the downside, I want the large potential upside as well, and not just a few percentage points of option premium if the price stays relatively steady.

Charlie says

On #3: Isn’t it potentially more profitable to sell shorter-term options? The extrinsic value decays faster as you get closer to expiration date, so I would think your return would be higher by selling more frequently.

I have been considering another options strategy. The idea is to basically generate TLH opportunities in a taxable account by writing naked calls, while simultaneously being long a similar ETF. For example, long VWO, sell calls for EEM. I haven’t done it yet, but I’m simulating it on TD Ameritrade’s thinkorswim platform using the paperMoney option. I got the idea from a thread on Bogleheads. Perhaps an idea for another blog post?

I’m trying it by writing calls at one price below the first in the money strike. If prices fall, I exit both positions before I am out of the money. If they rise, then I have losses on the option contract and unrealized capital gains. Close to the money the extrinsic value is higher and B/A spreads are smaller. Theoretically, you earn the cash rate. One issue is that if prices do fall, the extrinsic value rises, so repurchasing the contract you could still lose. I also thought it would be best to sell contracts with a closer expiration for the fast cash decay.

Harry says

Charlie – Potentially only if prices stay level. As you see in the actual chart, after the July option expires, selling again at $35 strike price would get very little in option premium. If I want to collect the same amount in premiums, I would have to sell at $37 strike, $40 strike, etc. But I wasn’t willing to step in and buy more at $37, $40, etc. because I already have enough exposure to emerging markets from my existing holdings.

Your other strategies get into territories I don’t fully understand. I can’t comment one way or the other.

Chris @ StockMonkeys.com says

Very informative article for some of the intricacies of options. I always get confused the buying and selling options as I don’t want to be on the hook for delivering the underlying securities. Still way over my head though articles like this help.

Sai says

Target date funds make a commitment to rebalance.

Does target date funds use this technique to get additional money ?

Because it is much easier to buy target date funds than do this manually.

Thanks.