Wealthfront, an online investment management service company, recently announced it reached $1 billion of assets under management in 2-1/2 years since it launched. Wealthfront’s competitors include Betterment, Personal Capital, and a number of other startup companies. Is investing at these companies better than investing at a traditional mutual fund company or brokerage firm?

Wealthfront

Wealthfront asks you 10 questions. Then it suggests a portfolio of 6 or 7 ETFs, most of which from Vanguard. If you think the recommended mix is too aggressive or too conservative, you can turn the risk score up or down for different mix.

You see the exact breakdown before you sign up. If you want you can take its suggestion and buy those 6-7 ETFs outside of Wealthfront. Wealthfront thinks you will like the convenience of buying the whole package in one shot and having them rebalanced for a small annual fee of 0.25% of assets (free for the fist $10k). There are no trading commissions. You also get tax loss harvesting service if you have $100k or more in a taxable account.

Betterment

Betterment provides a similar service. It asks you 2 questions and it suggests a portfolio of 12 or 13 ETFs, again mostly from Vanguard.

You can also adjust the risk level up or down and the suggested mix will change. Again you can take its suggested mix and do it outside Betterment. Betterment thinks you would prefer to pay it a small fee than taking on the headache yourself.

The fee is 0.25% if you invest between $10k and $100k. It’s 0.15% above $100k. There are no trading commissions. You get tax loss harvesting service if you have $50k or more in a taxable account.

Personal Capital

Personal Capital takes a different approach. It offers two distinct services. The online and mobile portfolio tracking application is like Mint for investment accounts. It downloads your holdings in different accounts, aggregates and analyzes them into nice tables and charts. This part is free. You keep your accounts. It just helps you view them in one place.

Then it offers to manage your investments for you. You don’t have to sign up for investment management in order to continue using the portfolio tracking app. If you only want the free portfolio tracking app, just tell them ‘no’ when they offer you investment management. If you do have them manage your portfolio, you get a live person as your advisor, which you don’t get from Wealthfront or Betterment. You also pay a higher price. The fee starts at 0.95% for the first $250k.

Good of Bad?

Whether something is good or bad depends on where you come from.

If your alternative is a big-four wirehouse (Morgan Stanley, Merrill Lynch, UBS, Wells Fargo), a smaller player such as Ameriprise, Edward Jones, or Raymond James, or the managed portfolio service by someone at a Fidelity or Schwab office, Wealthfront and Betterment are much less expensive.

If you buy index funds or ETFs on your own with a clear strategy, it’s simply a matter of cost versus convenience. If you like the convenience of deposit-and-forget, you pay the fee and have it taken care of for you. If you don’t mind placing orders yourself or setting up scheduled automatic investing, you keep doing it on your own.

The discipline and consistency provided by deposit-and-forget are very important but easy to overlook. Vanguard research showed that a large part of annual IRA contributions is left in cash for excessive period of time because many investors hesitate to follow through. P/E is high. Bond yield is low. It’s never clear whether now is the right time to invest. Making fewer decisions usually leads to better results than making more decisions.

Buying a target date fund will also give you the convenience of deposit-and-forget, and the discipline and consistency that come with it. You don’t get automated tax loss harvesting, which is not a big deal.

I went through the questionnaires. Out of the box both Wealthfront and Betterment suggested that I invest 90% in stocks. I could dial it down if I wanted. I ran them in Morningstar’s Instant X-Ray. Here are the results:

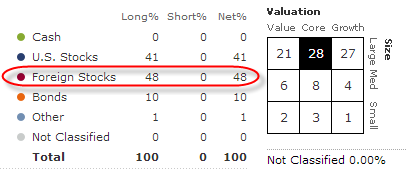

Wealthfront:

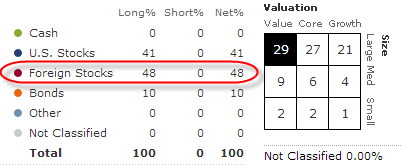

Betterment:

They are similar. Both put more than 50% of equities in international. Betterment’s mix tilts slightly more to value stocks.

If you are investing $100k or more and you don’t mind paying a fee to have it taken care of for you, you might as well get a human advisor from the Vanguard Personal Advisor Service. A human advisor can be much more thorough before recommending an allocation. He or she can also answer questions on other financial planning topics.

There is also a problem with tracking cost basis when you invest frequently in 6-7 or 12-13 ETFs in a taxable account. The broker is supposed to track it for you, but the ultimate responsibility stays with you. If you deposit-and-forget, it’s very easy to lose track of your cost basis in each position. It’s better if you do it in a retirement account.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Ben says

Great review. I signed up for one of these services and really liked it. However, I decided to pull the money out and re-direct my funds to maxing out my 401k and Roth IRA instead. Once I have more disposable income, I will probably restart my taxable investing again w one of these guys (big fan of the set and forget strategy).

The Wallet Doctor says

I wouldn’t be comfortable with completely jumping on the “deposit and forget” method. These things are important and totally forgetting about it doesn’t sounds like a safe strategy.

Technopeasant says

I had the conversation with PersonalCap and their recommendations so closely matched my existing allocation at virtual every measure that I couldn’t see the value in breaking my low-cost index fund/ETF portfolio up into dozens perhaps hundreds? of individual stocks just to get a slightly different sector emphasis.

Especially if after a year or so I wanted to take back the reins and reconstruct the portfolio using funds & ETF’s again.

not2late says

A few references on these “robo-advisors”:

http://www.kitces.com/blog/is-there-a-robo-advisor-bubble-wealthfront-betterment-learnvest-raise-95m-in-capital-in-two-weeks/

http://www.kitces.com/blog/how-to-run-a-financial-advisory-firm-like-a-robo-advisor/

http://www.kitces.com/blog/3-ways-financial-advisors-must-change-to-survive-the-commoditization-of-robo-advisors/

Tintin says

I’d used Personal Capital’s apps and on line finance software for over a year before I decided to give them a try. I changed jobs recently, and had a sizable (over $1M) 401K to roll over. I did this partially as a learning experience, to see how they allocated my funds and what the overall performance would be after a year. So far, I’ve been quite impressed by their services and educational materials. I’m afraid I found Wealthfront and Betterment too simplistic and limited for my preferences. I will be closely monitoring my performance with PC. If I switch, it would likely be to Schwab or Vanguard,

Alberto says

Hi Tintin, I am also a user of PC and I was wondering for what reasons you did find Wealthfront too simplistic compared to them. Thanks!

Iowan says

A lower cost alternative, which also gives you greater control and does not require you to disclose personal data, is to use recommendations from an analytics site like etftopportfolios.com and maintain your own account.

Bowie says

I’m debating harvesting some losses at Vanguard and moving more to Betterment. I’m short on time at this stage in life, so reluctantly willing to buy convenience. I’m unsure how losses from both will play nice from IRS stance however. I am going to be in an unusually higher bracket this year, so it may make sense. Is there any advice on figuring out the tax implications?

Harry Sit says

If some of the ETFs Betterment buys for you are the ETF share class of the same funds you sell for a loss at Vanguard, your loss on those funds will be disallowed. So match them up and only move funds that don’t overlap. If you want convenience, you can also just move into a Target Retirement fund and still stay at Vanguard.