When you do your taxes in tax software, the software sometimes calculates an underpayment penalty. It thinks you owe the penalty when your tax withholding plus any estimated tax payments were below a certain threshold (the “safe harbor“):

- Within $1,000 of your tax obligation (by withholding only); or

- 90% of your current year’s tax obligation; or

- 100% of your previous year’s tax obligation (110% if your AGI in the previous year was $150,000 or more)

If your income was uneven throughout the year, you can try to get out of paying the underpayment penalty through a complicated exercise using the “Annualized Income Installment Method.” It basically comes down to doing your taxes four times by separating your income and deductions into four sub-periods within the year and calculating your taxes for each sub-period.

I don’t know about you but I don’t have any appetite for doing my taxes four times.

There’s a much better way. The tax software is only trying to be helpful in calculating the underpayment penalty for you. You can decline its help and let the IRS calculate the penalty and bill you if they decide to assess a penalty.

The IRS actually often doesn’t assess a penalty when the tax software thinks you owe a penalty. You don’t have to volunteer the penalty now.

Here’s how to opt out of calculating the underpayment penalty in TurboTax and H&R Block software.

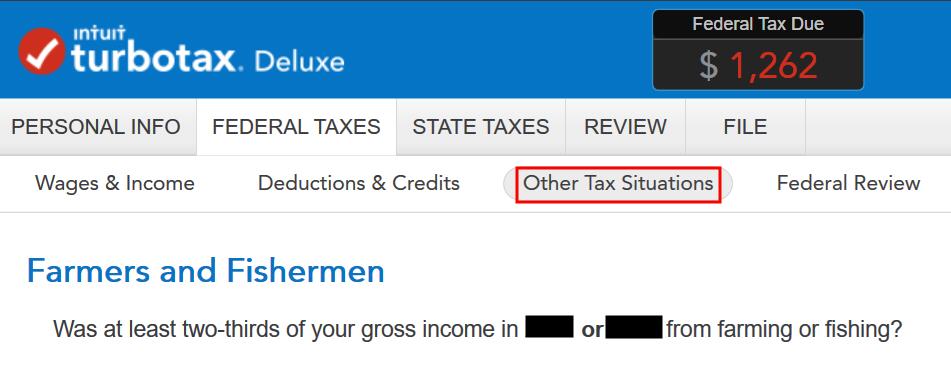

TurboTax

I’m using TurboTax downloaded software. TurboTax downloaded software is both more powerful and less expensive than TurboTax online software.

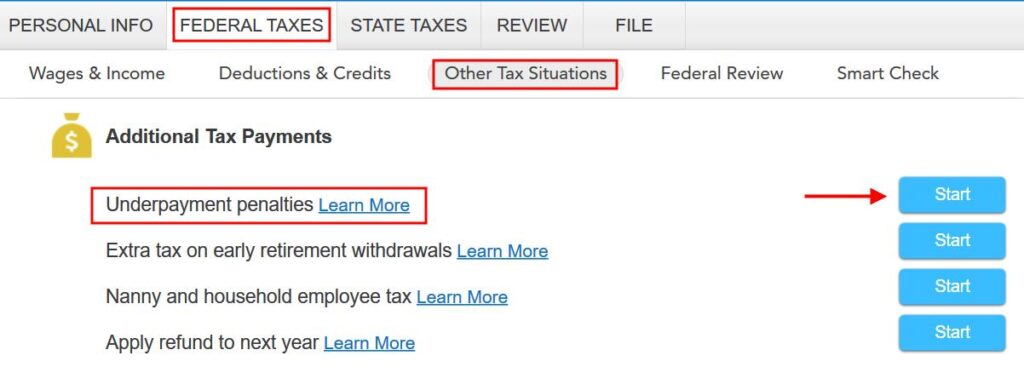

Find “Underpayment penalties” under Federal Taxes -> Other Tax Situations. Click on Start.

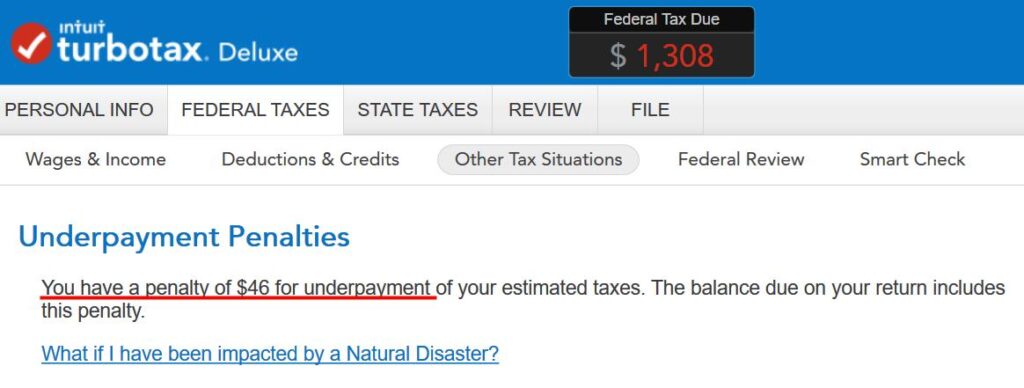

If TurboTax says you have a penalty for underpayment. Click on Continue.

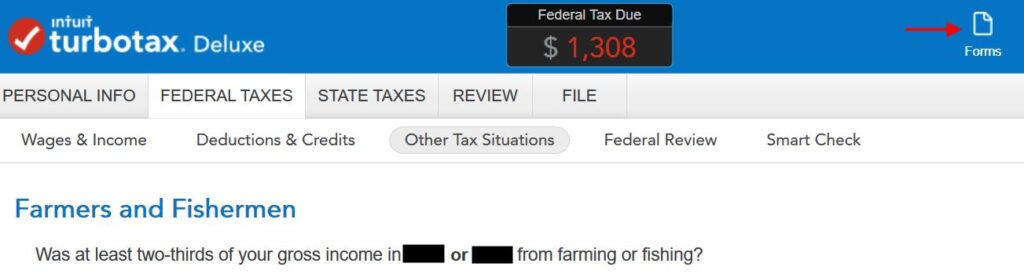

TurboTax asks you about farming or fishing, which doesn’t apply to most people.

You can continue the confusing interview with more hoops to jump through but it’s much quicker if you switch to the Forms mode now by clicking on Forms on the top right.

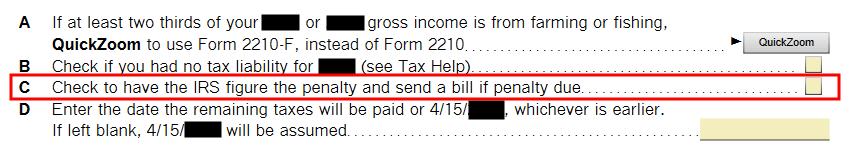

TurboTax opens a form. Check the box next to item C to have the IRS calculate the penalty and send a bill if necessary. Chances are they won’t.

The underpayment penalty calculated by TurboTax is removed immediately after you check that box. Note in our example the tax owed meter dropped from $1,308 to $1,262 after we checked the box.

Click on Step-by-Step to return to the interview.

You’re back to the screen about farming and fishing. Click on “Other Tax Situations” in the sub-menu to exit this section.

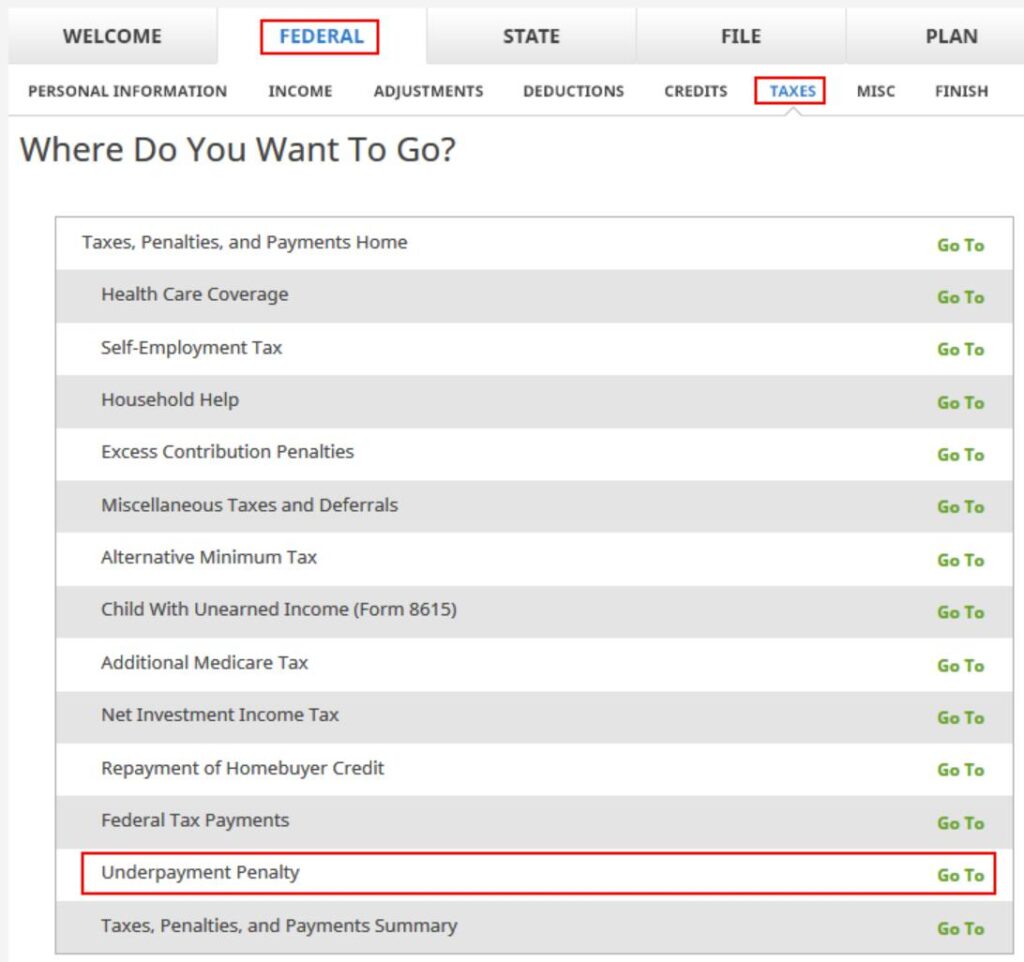

H&R Block

It’s much more straightforward in the H&R Block downloaded software. H&R Block download is also both more powerful and less expensive than H&R Block online software.

Find “Underpayment Penalty” under Federal -> Taxes. Click on Go To.

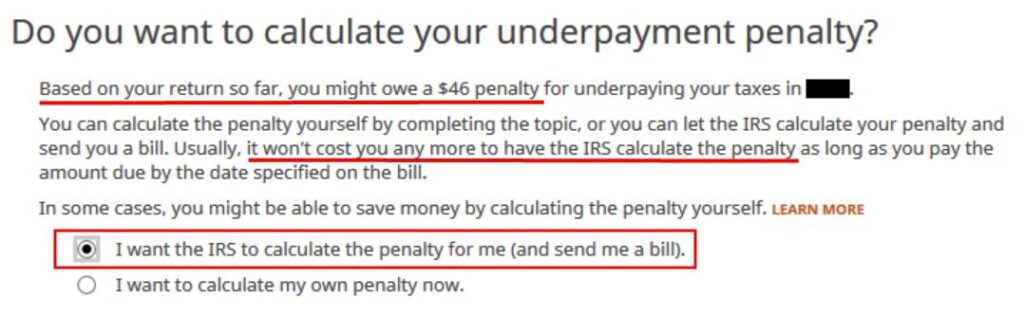

H&R Block offers the option to let the IRS calculate the penalty right away. The option is selected by default.

H&R Block explains that it won’t cost you any more to have the IRS calculate the penalty. It actually will cost you less when the IRS doesn’t assess a penalty.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Autumn says

Thanks for this information! I paid an under-payment penalty after my first year of retirement because my tax software told me to. It wasn’t large, but I didn’t know it was possible to have the IRS calculate the amount due. Since then I’ve learned about the Safe Harbor rule and taken great care to have enough withheld. Still, stuff happens, so if I accidentally under-withhold in the future I’ll have the IRS calculate the penalty.

I always enjoy your newsletters. Thank you.

Nick Lyons says

Saved me $29 (probably)–Thanks!

GeezerGeek says

Because I usually do a Roth conversion in December, the tax software often tells me I owe an under-payment penalty but both FreeTaxUSA and TaxAct allow you to use an annualized income method to override the penalty. Using that method, you do need to total your YTD income for three quarters but that is relatively simple for me to do with a Quicken report. You do have to total and report capital-gains/dividends separately from other income but I just copy and paste a Quicken report into an Excel spreadsheet and sum the YTD quarters there. (You don’t need to enter the YTD 4th quarter because the software already knows that is the total income for the year.) I’ve always assumed that if I did not report annualized income, the IRS, like the tax software, would calculate an under-payment penalty for me. With the Quicken reports, it just takes me a few minutes to sum and enter the annualized entries in the tax software so I think that it is well worth the effort required to avoid the IRS under-payment penalty.

I really have learned a lot from your articles and I appreciate the effort you have made in providing this information. I did purchase your “My Financial Toolbox” and I think it is an excellent summary of money management information that everyone should know. I would recommend it to anyone but it is especially valuable to young people who are just starting to manage their finances. Experience is the best teacher but it is a lot cheaper to learn from other peoples experiences than you own. Thanks!

mahamodol says

very nice post

S Jay says

In my experience, if you allow the IRS to do the ES Penalty calculation, it will assume that your income was evenly distributed throughout the year. But, if that was not the case, you are better off using the software to do the calculation yourself. For example, in 2021, a significant portion of my income was received in the last quarter of the year and I allowed the IRS to do the penalty calculation. The IRS assessed a $500 penalty. But when I did the calculation using the Annualized Income Installment Method, it was just $35. It took almost 12 months to get it corrected. The incompetence within the IRS was stunning. Eventually, I had to get help from the IRS, Office of the Taxpayer Advocate. But that office has considerable competency issues as well. It took 4 months for my assigned senior advocate to finally resolve the over assessment, even though my problem was not at all complex. By the way, I am a retired former IRS official. The last 15 years of my career was in IRS headquarters. I used H&R Block software to complete the Form 2210 using the Annualized Income Installment Method for 2021, and again this year for 2022. I don’t ever want a repeat of what I went through last year.

Marc Zehngut says

Error in the first paragraph: Only tax withheld is considered for the safe harbor determination. Estimated taxes paid are not considered. See line 6 on IRS Form 2210 https://www.irs.gov/pub/irs-pdf/f2210.pdf

Autumn says

I’m not at all a tax expert, but the instructions for form 2210 sound as if estimated taxes paid are considered. The instructions say:

Who Must Pay the Underpayment Penalty

In general, you may owe the penalty for 2022 if the total of your

withholding and timely estimated tax payments didn’t equal at least the

smaller of:

1. 90% of your 2022 tax, or

2. 100% of your 2021 tax. Your 2021 tax return must cover a 12-month period.

Marc Zehngut says

I think the key word in the IRS instructions is “timely.” The “safe harbor” is based on withholding alone meeting the tax payment requirements, and the timing of the withholding does not matter. If the safe harbor is not met, then the estimated taxes, and their timing, are considered in addition to the withholding to avoid an underpayment penalty. So I think the term “safe harbor” was misused in the article’s opening paragraph – no big deal.

Harry Sit says

Or maybe you just have a narrower definition of what constitutes the safe harbor than other people. Most other people will say that the thresholds are the safe harbor and that both withholding and timely estimated tax payments can satisfy the safe harbor but withholding is treated as having been made evenly throughout the year regardless of the actual timing. The safe harbor and the special treatment for withholding are two separate issues.

It does appear that the “within $1,000” safe harbor can only be satisfied by withholding. So thank you for pointing that out to me.

Marc Zehngut says

To Harry Sit: Thank you for the clarification (and education). I agree that my understanding of “safe harbor” was incorrect.

Nick Lyons says

You may owe it, but the IRS may not bill you for it. TurboTax calculates a $29 penalty for our return. Will the IRS send me a bill? If they do, I will of course pay it. Our tax return is unremarkable, and our income is not that much, so I’m not going to worry about it.

Kumar says

This was super useful. I hate it when Turbo tax does this and could not find how to fix it

Thanks!

Mike M. says

Last year I used H&R Block software and had to file paper returns because of their problems with the foreign tax credit. So this year I used TurboTax and they want me to pay a late payment penalty that I don’t owe (because of a big capital gain in Q4 that I paid estimated tax on). I went through their form 2210 rigmarole (about 10 times as hard as H&R Block) and it was unchanged. So I will follow Mr Sitt’s advice and hope the IRS neglects to charge me what I don’t owe. And TurboTax is so much harder to use than the H&R Block software.

So next year it is back to Block even if I have to do 1116 & schedule B manually and submit by snail mail. Maybe Block will fix that problem by next year. Aggravating.

The real problem is our insanely complex tax laws.

Many thanks to Harry Sitt for providing this excellent site.

Mike M. says

I figured out why TortoiseTax (my name for the online version) calculated my late payment penalty wrong. It asked me to enter my tax credits for each of those 4 wonky “quarters”. It did not tell me the numbers needed to be annualized using the corresponding annualized income numbers which the software did NOT provide.

Harry Sitt wrote: “I don’t know about you but I don’t have any appetite for doing my taxes four times.” Indeed. But the software should do most of that for us. TortoiseTax doesn’t, I am pretty sure that the H&R Block software I used last year did.

Mike M. says

Off topic comment: Google blocks commenting on this site if you block Google from tracking you. Not good.

Allan says

Harry,

-There was an article in yesterday’s (2-12-2023) WSJ about paying a penalty to the IRS because of a Roth conversion and not filling in Schedule AI of Form 2210.

-I have had a CPA do my taxes since 2016 but he retired so I’m doing my own taxes again this year and I need to use Schedule AI. The CPA had to use Schedule AI 5 of the 7 years. I do my taxes without tax software. I want to understand the logic into what is being done in this Schedule.

-I understand how to fill in Form 2210 and all of Schedule AI, except Schedule AI line 1, boxes for columns a, b, and c. I understand what to put in column d. I have a pretty good understanding how to fill in line 1 boxes a, b and c by back calculating how my CPA got the numbers he put into a, b, and c.

-I have a problem to what the CPA doesn’t include in line 1 boxes a, b, and c., and why. He does include income, pensions, SS and dividends. He doesn’t include any dividends and CG’s until box d. The real tricky part comes with Roth conversions, and where and what to put in box a, b, or c.

-If I did a Roth conversion in January, he adds 1/4 of the conversion in box a, 5/12 of the conversion in b and 8/12 of the conversion in box c to the adjusted income/pension/SS amounts. I understand why it is done that way. If I did a Roth conversion in August he put 67.1% of that conversion in box c, and nothing in box a or b except the adjusted income/pension/SS amounts. If I do the Roth conversion in December, nothing goes into box a, b and c except the adjusted income/pension/SS amounts, and the total conversion goes into box d. I get this one.

-The rest of Schedule AI is easy. I don’t fully understand why the dividends aren’t put in until box d, but I can accept that. All CG’s go into box d and well. I get this.

-This is the most convoluted calculation I have ever come across with the IRS. I can see why even IRS people have a hard time figuring out Schedule AI. This was brought up in your comments section and the WSJ article.

GeezerGeek says

I have used FreeTaxUSA to complete this form several times. I also was flagged for an underpayment penalty by the FreeTaxUSA software because of a Roth conversion. The instructions in FreeTaxUSA for entering the data were rather simple but as you noted, you do have to break down different types of income by 3 quarters. You don’t have to enter income for fourth quarter because software already knows your total income for the year. I use Quicken so I was easily able to summarize the different types of quarterly income totals by running a Quicken report. It took a few minutes to complete, but the instructions were straight forward. After I entered the data, the software determined that I did not owe an underpayment penalty. Using FreeTaxUSA was a lot easier than the process you describe for completing Schedule AI (Annualized Income).

James says

Any update? Did the IRS send a bill? I find it hard to believe that the tax software would be incorrect about this.

Turbo Tax creates a worksheet that shows how it is calculated. You can owe taxes and Turbo tax will not assess a penalty, so long as you paid 90% of current year’s taxes, or 100%/110% of previous’ years taxes, or owe less than $1,000, so long you made all estimated payments on time. If you didn’t, it will calculate the penalty by the day based on the quarters the payments fell short.

W2 withholding are applied evenly to each estimated payment period regardless of when the money was withheld.

Harry Sit says

The IRS didn’t send a bill. Nor did it adjust the tax owed or the refund on the tax return.

David says

You saved me $285, thanx! So, then I decided to avoid the State penalty also and followed the TT advice below (must have missed it when I first did my taxes). Saved another $27. It all adds up.

(State) Underpayment Penalty:

Based on your entries so far, you may owe an underpayment penalty on your 2024 taxes.

We can see if you qualify for any exceptions to the penalty and then calculate your penalty and include it in your return. Or you can let the (State) Department of Taxation and Finance calculate it.

Select Skip if you want to let the (State) Department of Taxation and Finance

calculate the penalty and send you a bill.

David says

Update. Partially worked. Got a bill from IRS For $187, so saved $98.

Tonya says

This is an excellent article and very timely for adding value with clients!