Note from the Editor: This is a guest post from long-time reader Horton. As an actuary, he’s the real pro in crunching numbers!

***

While corporate pension plans are on target to follow the way of the dinosaur, many people approaching retirement are still eligible for such a benefit. Pension plans offer a number of advantages for employees, preeminent among them is that the plan sponsor manages all investment, interest rate, and longevity risk. The only risk remaining for employees is inflation risk (except for those lucky few with an inflation-adjusted pension).

That said, there are a few challenges that employees face with pension benefits. One such challenge is how to decide when to take the monthly payments and in what form. Compounding the challenge is that you only have one chance to make the decision and you may be under time constraints to do so.

In this article, we will explore two helpful tools to evaluate your options.

Pension Options

To begin, let’s use the following example. Bob is single and 60 years old. He ran an estimate of his pension benefit assuming he starts it immediately. He received the following figures:

| Form of Payment | Amount |

|---|---|

| Single Life Annuity | $3,000 per month |

| Lump Sum | $554,686 |

How does Bob choose between a lifetime payment and a pot of money?

The simplest way to help make the decision is to convert each option into the same unit of measurement. Bob’s pension election paperwork will likely include what’s called a relative value comparison, which attempts to show the value of the options on an apples-to-apples basis. We can also generate our own relative value comparison by converting the monthly payments into a lump sum, or vice versa.

But, how do we do that? The challenge is that you have to discount for both interest and mortality.

Insured Annuities

The easiest approach to evaluate pension payment options is to see what the insurance market will give Bob for the pension lump sum.

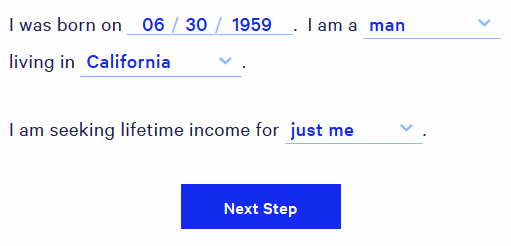

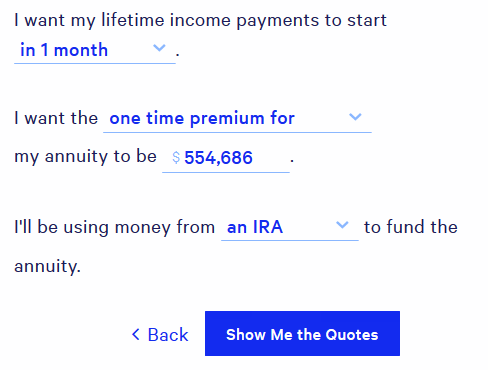

The Blueprint Income site offers a user-friendly resource to get insured annuity quotes. As shown below, the inputs are very simple. Bob just needs to provide:

- demographic information (e.g., date of birth, gender, state, and, if applicable, spousal information);

- the value of the one-time premium (i.e., his lump sum amount), funding source (assume an IRA in this case), and start date;

The results for the top three quotes as of Jun. 30, 2019 are shown below.

In all cases, Bob would get less from an insured annuity ($2,500 – $2,545 per month) than he would get if he took his pension benefit as an annuity ($3,000 per month).

That said, your situation may look significantly different. The purpose of the example is not to advocate that the monthly pension benefits are always the best option, but instead to provide a tool to help you determine what’s right for you and your family.

Annuity Factor Calculator

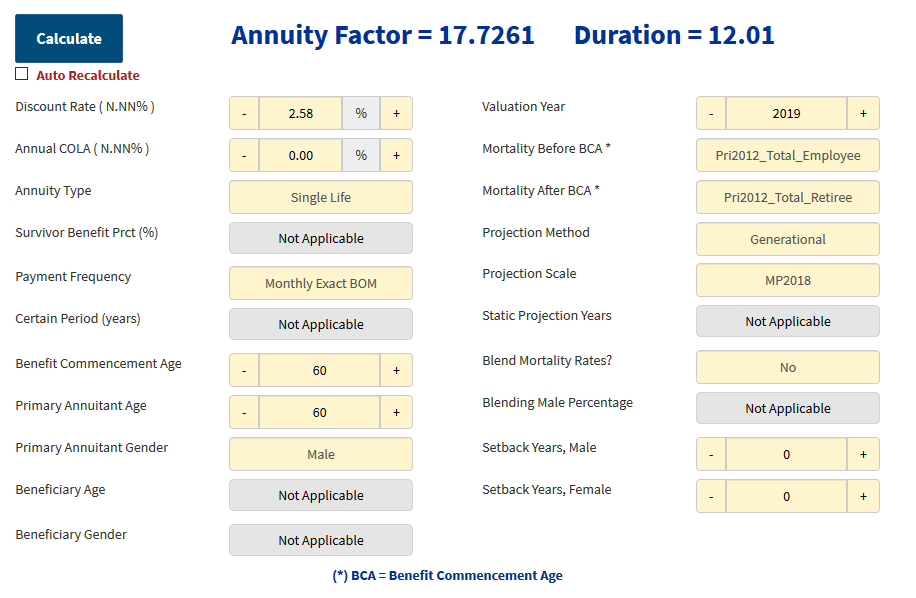

If you are interested in another tool and enjoy getting into the weeds, then the Annuity Factor Calculator from Society of Actuaries is a great resource. The inputs are a bit daunting, but, using Bob as our example, I will show how you can use it to compare the present value of monthly pension benefits to the lump sum option you are offered.

The Discount Rate is the interest rate used to determine the present value. We have a lot of reasonable options: Treasury rates, the expected return of our portfolio, or corporate bond rates. If I was a plan sponsor or a life insurer with a pool of lives, I would use a corporate bond yield curve. However, as an individual investor, I am more inclined to determine the present value of the annuity using a safer assumption. For our analysis, I will use the SEC yield as of Jun. 27 for the Vanguard Total Bond Market Index Fund of 2.58%.

The Annual COLA is the cost-of-living-adjustment (COLA) applied to the annual annuity payments. Bob’s pension does not have a COLA feature, so we will use 0%.

The Annuity Type is the form of payment. Bob is single, so we will select Single Life. If Bob was married, he could easily model a Joint and Survivor benefit by entering the Beneficiary Age, Beneficiary Gender, and the appropriate Survivor Benefit Prct (e.g., 50%, 75%, or 100%).

Bob will use age 60 for the Primary Annuitant Age and Benefit Commencement Age. If he wants to evaluate other starting dates, then he would change the Benefit Commencement Age but keep the Primary Annuitant Age unchanged.

He will select male as the Primary Annuitant Gender.

Last, we get to the complicated topic of mortality. I am going to keep this very simple, but you can refer to SOA’s mortality resources if you are interested. Long story short, there are two primary inputs – the mortality table that estimates mortality as of a particular point in time and the mortality projection assumption that estimates improvement in future mortality (i.e., people are assumed to live longer in the future).

Select the Valuation Year based on when the pension benefit will start – in our case it will be 2019.

For Mortality Before/After BCA, Bob will select the newly released Pri2012 tables (Pri2012_Total_Employee for Mortality Before BCA; Pri2012_Total_Retiree for Mortality After BCA). Again, many other viable options exist, but you probably don’t need to get bogged down in the details.

Select Generational as the Projection Method. By doing so we are assuming that the general population will continue to live longer in the future. Bob, at age 60, expects to live longer than his father did at age 60.

Select MP2018 as the Projection Scale to use the most recent data published by the Society of Actuaries.

For simplicity, I wouldn’t worry about any of the other inputs.

The inputs and outputs for the single life pension are shown below.

After updating the inputs and hitting Calculate, the SOA calculator gives the annuity factor on the top in blue. Multiply this number by 12 and again by the monthly pension number to get the present value. Write this number down and prepare the following table to compare different options:

| Form of Payment | Amount (A) | Annuity Factor (B) | Present Value (A) x (B) x 12 |

|---|---|---|---|

| Single Life Annuity | $3,000 per month | 17.7261 | $638,140 |

| Lump Sum | $554,686 | n/a | $554,686 |

The end result shows that the present value of the monthly pension is greater than the lump sum using the inputs selected. This is consistent with what we saw in the insured annuity quotes as well, providing additional insight that the monthly pension may be the favorable option.

In Conclusion

Bob should also consider the qualitative elements of this decision. Such as:

- What are his retirement income goals? If he wants a secure income for his lifetime, then the annuity may be the best choice.

- What if inflation increases significantly? His pension annuity does not increase with inflation, so that is a risk. Although, research shows that retirees’ cost of living tends to decrease as they age.

- What is his health status? If he expects that he will not live as long as the average 60-year-old, then he may prefer the lump sum. Bob can use the Longevity Illustrator to get a sense for life expectancies, and he could also adjust the Annuity Factor Calculator to use a mortality table that assumes better or poorer health.

- If he is not sure how to manage a lump sum to generate retirement income, then it may not be suitable to select the lump sum regardless of the present value.

Hopefully these tools provide a helpful method to evaluate pension payment options. Choosing a payment option may be a difficult decision, but consider yourself fortunate to have a pension benefit!

Note: Pension lump sums are generally determined using an interest rate and mortality basis prescribed by the IRS under code section 417(e)(3). The interest rates are published online and are developed based on high-quality corporate bonds (AA or better). Similarly, the IRS prescribes a unisex mortality table and a specific projection scale for determining lump sums. For both the interest rate and mortality assumptions, the annuity factor shown in this article was produced on a more conservative economic basis for an individual and is therefore higher than the annuity factor used to determine the lump sum. Nothing in this article should be construed as implying that the plan sponsor has determined the lump sum value incorrectly.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

David Cantor says

There is another factor to consider in the annuity vs. lump sum decision: What are the odds that the company sponsoring the annuity will be solvent throughout your retirement? The federal pension guarantee is limited and may well be less than your corporate pension.

Harry Sit says

PBGC’s maximum guarantee amounts for pensions starting at different ages:

https://www.pbgc.gov/wr/benefits/guaranteed-benefits/maximum-guarantee

$5,600/month in 2019 for single-life at 65. If your pension is below this amount, you don’t have to worry about it.

John Craig says

I suppose this may be obvious, but everyone should convert retirement pension benefits that they receive to lump sum (using the simple method) in order to get a correct picture of their equity-fixed asset mix.

GMShedd says

I’m not certain whether you are referring to cash-balance pension plans, or something else, but in my own case I had a cash-balance pension plan at a company I took early retirement from at the age of 55. The default decision date at which I would either have to begin drawing benefits, or receive a lump sum was my 65th birthday, so I had 10 years to think about it. As time went on, the (modest) cash balance increased at a steady rate, and the calculated monthly benefits did as well, due to the larger balance, and my increasing age. Each month or so, I tracked the benefits by using the pension calculator to calculate what my cash balance was projected to be at age 65, age 64, and other birthdays closer to my (then) current age. I then used those projected cash balance amounts to ask the calculator what my pension payments would be if I were currently 65 with the projected age-65 cash balance, and if I were currently 64 with the age-64 cash balance, or 63, or whatever my actual age was at the time. By doing this I determined that the payout ratio changed with interest rates. Roughly it tracked the 30-year Treasury yield with a lag of 1-2 months. So, as time went on, my projected age-65 pension fluctuated, but for the most part, the age-65 pension benefit remained the best choice due to the joint impacts of accrual and aging. However, this changed in the months preceding my 63rd birthday. For whatever reason, the calculator began showing that if I waited another few months for my 63rd birthday I would get a lower pension than if I took the benefit immediately. Moreover, if I waited until my 64th birthday, the payout ratio would be the same same (or lower) than if I took the benefit immediately. The age-65 payout ratio remained slightly better than the age 64 (and 62.9) payout ratio, but then, in the last month before my 63rd birthday, even the age-65 payout ratio dropped to the same as my current payout ratio, so I pulled the ripcord.

I guess the message is, use your employer’s pension benefit calculator to track your age-65 pension, and keep an eye on interest rates. Also, check out the single vs. joint payouts. In my case, a 50% joint annuity cost me a hit of about 1% relative to the single life with full refund payout; the 100% joint annuity cost almost 9% in lower payments (or almost 8% for the second 50%). Your results may vary!

Harry Sit says

This is more about the traditional pension plan where your pension benefit is calculated by a formula, for instance the average of your highest 3 years of salary times your years of service times 1.5%. A lump sum calculated from the monthly pension may be offered as an optional form of benefit. Your Cash Balance Plan is different. Under a Cash Benefit Plan your benefit accrues at a pre-selected rate (for instance the 30-year Treasury yield), and then a monthly pension benefit calculated from the lump sum may be offered as an option.

GMShedd says

Yes, I thought maybe they were different, although there was more to accrual than interest. During employment, there were annual additions to the cash balance based on a formula that considered salary, age, and years of service, then the interest was based on the existing balance. After retirement, the cash balance accrued only interest.

Horton says

With cash balance pension plans you will likely be offered the option of selecting a lump sum or an annuity, so you can use the tools in the article to evaluate options for either cash balance or traditional pension formulas.

Joey D says

Timely article. My wife can start drawing from a former employer’s defined pension benefit starting next year when she turns 55. However, she can delay taking the benefit (either monthly payment or taken as a lump sum) until age 65. Over that 10 year period the benefit will increase.

The tools in the article can also help model whether it makes more sense to take pension benefits now or later. While we are still working, it would make little sense to take the monthly benefit as we would lose a lot to taxes….but there is a case to be made for taking the lump sum now (and rolling it into an IRA). Risks / rewards of managing a lump sum on your own for 10 years…and do you think you could do better than the increase based on the defined benefit calc.

Harry Sit says

Using the second tool (the Annuity Factor Calculator), for a female currently 54, a $1,000/month single-life pension starting at age 55 is worth $246,462 today. If the pension starts at 65, it has to pay at least $1,634/month. You can scale up these numbers to compare with the actual benefit offered. Because the pension is guaranteed, you can only compare with bond-like returns, not trying to beat it with stock-like returns or blended stocks + bonds returns. If you want to beat bond returns with stock returns, you can make the shift from bonds to stocks in your own investment portfolio (and of course increase your risk at the same time).

TJ says

With the Blue print Income screenshot, did the author submit his email address to maximize the quote options? my expereince with BluePrint income is that there were better rates if you gave them your name and email address etc vs just browsing without providing such info.

Horton says

Yes, I submitted my email address when pulling the quotes. In doing so, I get an email from them about once per month, but it’s often content that I find interesting. In my opinion, their site is much more user friendly than immediateannuities.com. Note – I am not affiliated with Blueprint Income in any way.

Kris says

Two Fortune 100 companies that I worked for will not let you take a lump sum if the amount is over $200K; you are forced into an annuity.

JCI says

My company sent me notice that I am able to choose a lump sum now or continue with pension at normal commencement age, which is 15 yrs from now. What additional factors should I consider when using the calculator to account for the long delay? If I chose lump sum, I would likely choose a more aggressive investment until closer to retirement. What discount rate would be appropriate? Also, how to factor in the fact that I may die prior to commencement? Is the calculator any less accurate when delaying so far out?

Harry Sit says

Both calculators can give the value for deferred annuities. They consider mortality after the payments start. I don’t see why they would ignore it in the period before. If you’d like to invest more aggressively you can invest more aggressively with your current investments while leaving the pension alone. It’s not necessary to take a lump sum in order to invest more aggressively. I would still calculate the value of the pension. How to invest more aggressively is a separate question.

Brian says

Thank you for this article and the calculator link – as well as the “how to directions” and explanation. I have been struggling and searching for a tool to help me calculate not only Lump vs Annuity, but, the various Survivor Benefit percentages to a Lump Sum. This really was the Holy Grail for me, simple, great and trusted source, and ability to customize variables – much better than other tools, and NPV spreadsheets I have found to date. Thanks for this article and resource.

Ken Wilson says

Harry thank you for the rich information, wisdom and practical approach you share through all the resources you provide!

I’m using the information present here in 2019 to understand this decision I must make in the next few weeks.

To be sure about using the Annuity Factor Calculator:

The “Discount Rate” is the 30 Day SEC Yield from the VBTLX page

The updated “Present Value” is calculated by Annuity Factor X Duration X Monthly Payment.

Is that correct?

Harry Sit says

As Horton mentioned, you can choose different discount rates. He suggested using the 30-day SEC yield on that Vanguard bond fund. The annuity factor is annual. If you use a monthly payment amount, multiply it by 12 and then by the annuity factor. If you use an annual payment amount, multiply it by only the annuity factor.

Ustaad says

Very interesting article providing useful calculators for what-if exercises. I am lucky to have defined benefit plan. However, I live in a high tax state. So, if the author or Harry can throw some light on the consequences of taking a lump-sum payment would help. Can I roll it over into a Roth IRA? If not, can it be rolled over into a traditional IRA?

Harry Sit says

A lump sum payment from a pension can be rolled over to a Roth IRA but you will have to pay taxes on the entire lump sum. It can also be rolled over to a traditional IRA, from which you can choose to convert to a Roth IRA at your own pace.

Ustaad says

Thanks, Harry.

Kimo says

Great article and additional information provided in the comments section.

My former company just sent out a lump sum offer and I was hoping someone on this forum might be able to answer this:

The company offers a calculation tool that allows me to estimate my pension at different retirement ages. The tool allows me to even do so based on not starting my pension until my 80 and even 90’s.

I thought that all pensions had to be started (per IRS rules) by age 70.5 (now maybe 72.5?) which makes me wonder if what the online calculator options are in fact real options.

My pension is quite small (about 1,200 a month at 65) so the idea of perhaps instead using it as a form of longevity insurance and not taking it until a much later age is appealing to me. If I wait to say age 85 my pension is of course much much higher – allowing it to act as a real safety net should I live to 100 plus.

Does anyone know if one can in real life actually wait to take a defined benefit pension until a much older age? Or does the same IRS rules that require Req Minimum Distributions in IRAs and the like apply to defined benefit plans too thus making such an option not a reality? Any insight would be appreciated.

Kimo

Harry Sit says

Maybe the calculator assumes that the employee is still working for the employer until the given age? A pension must start at the RMD age similar to IRAs but there’s a “still working” exception. An employee working for the employer past the RMD age can postpone until termination of employment.

Kimo says

Thank you Harry. I really appreciate the info. Hopefully, my firm will adjust when I have to start collecting my pension to match the new Secure Act ages as then I will be able to wait until 75 as I understand it. But, I’m guessing the don’t need to amend the plan to do so and can leave the date at 70?

Brian says

Found this nice and simple free Schwab tool for a Lump Sum vs Pension ‘what if’ https://www.schwabmoneywise.com/resource-center/insights/monthly-pension-vs-lump-sum-payout-calculator – I thought it was great to play ‘want if’ and see in a simple way how variables impact my decision.

Harry, I would be interested in your opinion if you think this free calculator is legit and offering up good information on the Lump vs Monthly decision to be used in conjunction with the calculator in the article?