After I have the core asset classes covered in my investment portfolio — US stocks, international stocks, and fixed income — if I’m looking for a good asset class for diversification, REIT and Precious Metal Equity (PME) are two good candidates.

Real Estate Investment Trust (REIT)

Yale endowment Chief Investment Officer David Swensen had REITs at 20% of equities in his revised model portfolio (down from nearly 30% of equities in the original model portfolio from his book Unconventional Success).

Princeton professor Burton Malkiel also put 20% of equities in REITs in his model portfolio for age mid-50’s who invest roughly 60% in equities.

Investment advisor and author Larry Swedroe had real estate as No. 1 in the list of "the good" in his book on alternative investments.

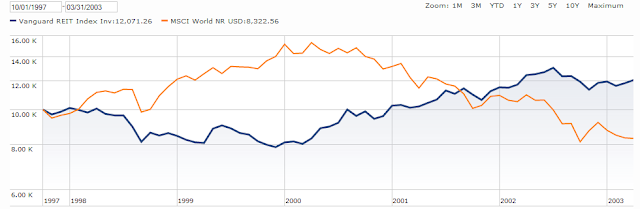

REITs demonstrated its low correlation to the stock market in late 1990s through the bottom of the dot com bubble. When stocks (orange line) were up 50%, REITs (blue line) went down 20%. When stocks dropped 40%, REITs went up 50%. It was truly a dream diversifier: equity-like returns with low correlation to equities.

Since then, however, it stopped doing that. From 2003 to 2013, REITs (blue line) went up more when the stock market (orange line) went up; REITs went down more when the stock market went down. You don’t see as much diversification benefit as before.

Precious Metal Equity (PME)

Precious metals equity is related to gold, silver, and other precious metals, but it’s not the price movements of those metals themselves. It’s the stocks of companies that produce precious metals.

Investment advisor and author William Bernstein mentioned precious metals equity as a diversifying asset class in his book The Intelligent Asset Allocator, more or less along the lines of this article he wrote in 1997: The Expected Return of Precious Metals Equity.

Larry Swedroe put PME in the "flawed" category in his book. He gave the reasons in this article on IndexUniverse.

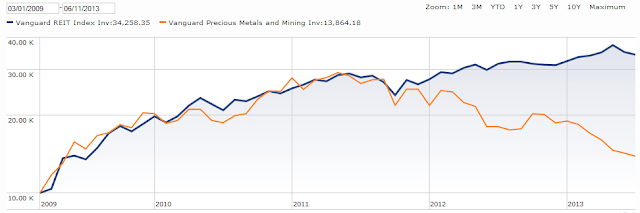

PME also did very poorly in the late 1990s, very well in the early 2000s bear market, very well leading up to the top in 2007, very badly in the 2008-2009 financial crisis. It recovered well with the stock market from 2009 to 2011.

However, since 2011, it diverged from the stock market again. From 2011 to June 2013, the stock market went up 20%. The Vanguard Precious Metals and Mining Fund (VGPMX) went down 50%. I think now the gap between the two diversifiers is large enough that I’m willing to start making a switch from REIT to PME. In the chart below, the blue line is REITs, the orange line PME.

I’m sure it won’t snap back just because I bought it. So don’t buy it. You will lose money.

[Photo credit: Flickr user Rantes]

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Jim T says

My thought has been that PME seems to follow the Vanguard Emerging Markets fund, which is already a part of my portfolio. I felt adding PME is more like doubling down on Emerging Markets.

Harry says

I should note that the Vanguard Precious Metals and Mining Fund (VGPMX) invests very little in emerging markets. The top five countries, which make up 87% of the fund, are Canada, Australia, UK, USA, and Belgium. Of course the mining companies in those countries have their mines all over the world, including many emerging market countries.

Matt Becker says

What exactly is it that you would like to achieve by adding one of these two classes? It is simply meant to smooth your portfolio or are you hoping that in combination with rebalancing you can increase returns? I personally haven’t included either of these asset classes, though I’ve considered it, because I don’t think they will increase my returns and I don’t feel the need smooth things out any more than my portfolio already theoretically should with my allocation to treasury bonds.

Harry says

Matt – Both. Although Treasuries smooth OK, their low expected returns drag down the returns of the portfolio. The ideal candidate offers “equity-like” returns on its own and has negative or low correlation to the stock market. Of course the ideal doesn’t exist. Here’s hoping REIT or PME comes close to that ideal.

Sammy_M says

Why select PME over CCF (commodities futures fund)?

http://thefinancebuff.com/diversifying-portfolio-with-commodities-futures-fund.html

Harry says

Sammy_M – Thank you for remembering that one from almost 4-1/2 years ago. Looking back, my entry into that commodities fund in December 2008 was pretty good. I sold at the end of 2010 because I thought it had run its course. I didn’t buy at the exact bottom nor sell at the exact top but it was close enough. I’m not going back to it because (a) the PIMCO commodities fund is more expensive; and (b) I don’t think commodities’ under-performance against the stock market provides a large enough margin of safety yet.

Gold price is said to be going to $1,000, or $800; if it’s going there, why isn’t it there now? I think plenty of pessimism is priced into PME. I could be wrong. That’s why I said don’t buy it.

indexfundfan says

Note that Vanguard’s VGPMX is no longer the precious metal fund that the good doctor wrote about. He said this himself in on a post on the Diehards forum when VGPMX changes its name and investment mandate.

Two “pure” PME funds I know of are BGEIX and GDX.

Scott @ Youthfulinvestor says

It makes me happy to see that I am in good company as far as investing in REITs are concerned. Intentionally, I actually have 0% in precious metals. REITs represent almost 18% of my holdings.

BARBARA FRIEDBERG says

We have allocation to REIT and international REIT indexes in our portfolios. We have avoided precious metals and commodities and believe have enough exposure to those assets through our other U. S. and International investments.

We also have a large allocation to peer to peer lending (Prosper and Lending Club) for diversification and increased returns. (This is not for the inexperienced investor and best for a large portfolio).

Brandon Batzel says

Harry, I’m fairly young, just out of college, and most of my investments are in Vanguard’s Total Stock Index Etf- which has done great. But with the market rising so quickly, I’m also looking at REITs and Mining equity funds for the low correlation benefits (you didn’t mention it but another reason I’ve considered mining etfs over investing in precious metals themselves is because commodity funds are taxed at a higher rate than capital gains from equity in mining companies, which is why I would prefer the latter even if mining returns roughly track returns on precious metals themselves). So my question is what percentage of your overall portfolio do you allocate to REITS and PME?

Harry Sit says

No REITs now. 2% of portfolio in PME.

indexfundfan says

It looks like VGPMX dropped another 40% compared to a year ago.