[Completely rewritten on February 22, 2015 using new screenshots from TurboTax Online for 2014 tax year.]

One of the most popular posts on my blog is one I wrote four years ago about reporting tax on RSU. Although I try to do the best I can in deconstructing it, I still get many questions about it every year at tax time.

It’s a difficult topic because there can be many variations. Employers issuing the RSUs don’t help because they are afraid of liabilities. They just say “consult your tax advisor” as if everyone has one. Tax software doesn’t make it easy either. Although there are many variations, the software tends to go by just one. If your situation fits it, you may be able to muddle through. If it doesn’t, the software confuses you more than it helps you because your situation doesn’t match what it thinks you have.

For the longest time I only addressed the issue generically. I refused to work as free tech support for the software companies. If you paid for the software, they should help you with how to use it. Now I give up. I realize people are looking for step-by-step help and the software companies aren’t providing it.

The following is a sequence of screenshots taken from TurboTax Online. If you use the installed software, your screens may be different but similar. I show TurboTax only because it has the largest market share.

In this post I will use the most straight-forward case: Net Issuance. It’s probably the most common. I may do other variations in future posts.

In Net Issuance, the employer withholds a number of shares for taxes before giving the employee the remainder. For example suppose you have 100 shares vested but you only receive 60. You just don’t see the other 40 shares. The employer doesn’t use a broker to sell the 40 shares for taxes. It just keeps the 40 shares and puts some numbers on your W-2.

When to Report

Before you begin, be sure to understand when you need to report when you have RSU under Net Issuance. You report when you sell. If you only have some RSUs vested but you didn’t sell, there’s nothing to report yet.

Wait until you sell, but write down the per-share price when your shares vested. If you have multiple lots, write down for each lot the date, the closing price on the vested date, and the number of shares released to you. This information is very important when you sell.

Let’s use this example:

You had 100 shares vested on 8/1/2013. 40 shares were withheld for taxes. The closing price on the vesting date was $50/share.

You would write down:

| Vesting Date | Shares Received | Price Per Share |

|---|---|---|

| 8/1/2013 | 60 | $50 |

Keep this information until you sell.

1099-B

When you sell, you will receive a 1099-B from the broker in the following year. You will report your gain or loss using this 1099-B and the information you accumulated for each vesting.

Let’s continue our example:

You sold 60 shares from your vesting above on 2/10/2014 at $70 per share. After commission and fees, you netted $4,180. In 2015, you received a 1099-B from your broker showing a sales proceed of $4,180.

Now let’s account for it in TurboTax Online.

TurboTax

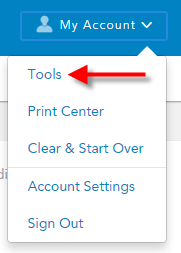

Click on My Account on the top, then Tools.

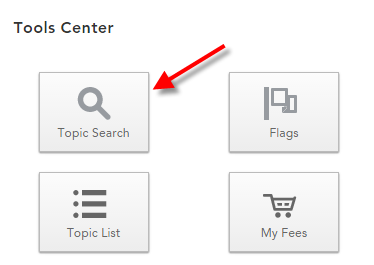

Click on Topic Search.

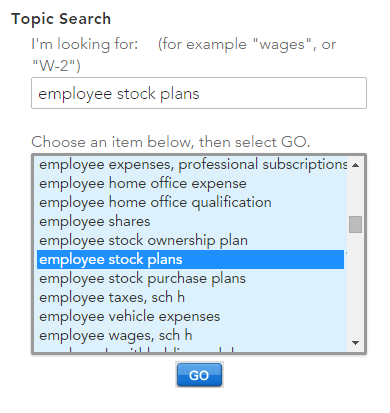

Enter employee stock plans. Click on Go.

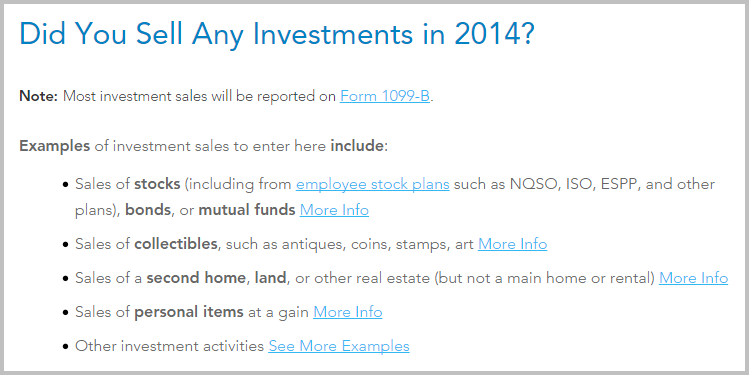

Answer “Yes” to “Did You Sell Any Investments?”

Import your 1099-B if your broker is on the list or just type the numbers yourself from the 1099-B you received. I continue with typing it yourself here.

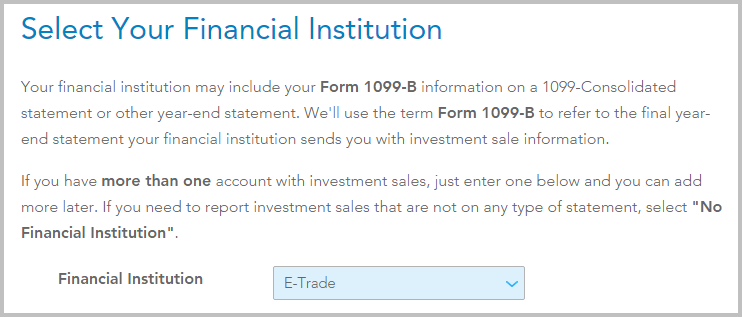

Select or enter the financial institution.

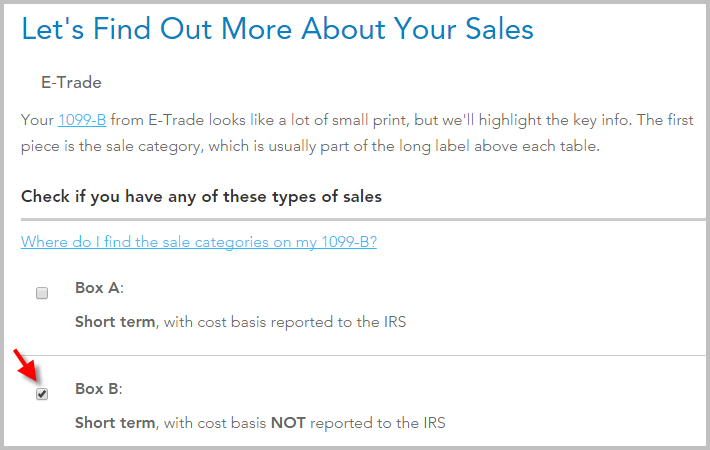

Look carefully which box is checked on your 1099-B. On my form it was Box B.

Now enter the information from your 1099-B. Date of Acquisition is the date the shares vested. If the cost basis is blank on your 1099-B, because it was not reported to the IRS, use your own record to fill it in. The price was $50/share when these 60 shares were vested. Therefore your basis is $50 * 60 = $3,000. If you didn’t sell all the shares vested in that lot, multiply $50 by the number of shares you sold.

If you have more lots, enter in additional rows.

That’s it. You got the shares at $50/share. You sold them at $70/share. You pay taxes on the gain.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Claudia says

This was a great post. Thank you. Thank you. Thank you. Not your job, not your responsibility. I totally get that. So appreciate the guidance. Great job on paying it forward. Great reminder to do the same. Thanks. :)C

bill iommi says

What happens when you are awarded the RSUs and the company goes out of business before the grant. The compensation was added to the W-2 during the year it was granted. Can I claim the value of the grant to offset any capital gains from other sales?

Harry says

bill iommi – I’m not clear what you meant by “before the grant.” The series of events as I understand them are: (1) Grant. This is when the company tells you they will give you X number of RSUs to be vested over the next Y years. (2) Vest or Release. This is when you hit a milestone and a % of the RSUs become really yours. It’s also when the value of the shares vested or released is added to your W-2 as compensation. (3) Sell. This is when you sell the shares you received. So when does the company go out of business? Before grant, you have nothing. Before vest, you don’t have any compensation added to your W-2 and you’ve lost nothing. Before you sell, too bad. You can declare the shares as worthless and claim a loss.

gary says

My company stock plan is administered through e-trade. Which has sent me all my tax related events in the form of 1099-INT and 1099-B. This year, I made taxable events w/r/t NQSO, ESPP, ISO (disqualified) and RSU.

While using turbotax premium in the interest income section, I downloaded both forms (1099-INT, 1099-B) from e-trade. My question is: Since my company administered stock plan activity is now in turbotax in the form of the corresponding 1099’s am I finished with inputting all information w/r/t the stock plan or do i need to open these sections (employee stock plan) within turbotax? thanks in advance.

Harry says

gary – You still need to open those sections. The 1099-B’s I received from E*Trade had basis for some shares I sold but not others. You still need to look at each one and fill in the blanks.

Rachel says

Thank you so much for going through this. My RSU situation was different, as the employer didn’t hold back the stock separately for taxes. With the broker, I selected either “sell-to-cover” or “same-day-sale” to just cover the taxes or to sell the whole lot. Turbo Tax was even less friendly with this scenario. I look forward to additional blogs on this specific topic.

Even though you post wasn’t specific to my situation, I was LOL when I read some of your comments about the bizarre TT logic. (e.g. back calculating the fees from the numbers, then TT recalculating the math I just did. I went through this about a dozen times as I checked and rechecked my numbers, so this was near and dear to my heart.)

Thanks for the help and the laughs! And let us know as you expand blog posts on RSUs!!!

Nicole says

After 2 nights of being on the phone and getting no where with E*Trade, I finally have clarity. Thank you so much!!!

Emily says

Thank you so much for your post. Your post is more helpful than any of the supports TT provides.

This is really great but I do have a really basic question. My situation is more simple than your sample case. I had number of RSUs vested monthly but I didn’t sell any of the shares in 2012. Now I have 1099-B Proceeds From Broker and Barter Exchange Transactions 2012 for the Sell-to-Cover Transactions.

If I follow your step-by-step tutorial, on “Enter Your Sale Information” screen, what would I enter for Date Sold, No. of Shares Sold and Selling Price Per Share? Or I don’t have to enter any of the vested shares on 1099-B since I didn’t have any actual gain/loss?

Ram says

Thanks a lot for your post. I am not sure if this is a right place to post. If not please let me know where to post the following question.

Question:

I received “statement of taxable income” from my employer for 166 shares which got vested on November 9th 2012. The total W-2 Income was also included in there. I didn’t place(sell or buy) any trade in 2012, so I didn’t receive any 1099 form from Etrade (I confirmed this etrade also). I paid my taxes(during vesting period) through my account instead of paying through stocks.

Should I report this “statement of taxable income ” when I am filing tax this year? If so can I use turbo tax to do it. Any suggestions would be of great help.

Harry says

Ram – If you paid cash for the taxes and kept all the shares, you don’t have to report until you sell the shares. Keep the “statement of taxable income” until you sell the shares. It will remind you the price per share you paid for the shares.

Ricky says

How do i report RSU? I know it’s been included as part of my wages, because it was stated on the details of my W2 but my question is.. do i still need to report on Schedule D, since this is not a sale? I did not receive 1099-B either. If I’m going to report to Sched D do I need to report the cost same as proceeds to come out with zero loss/gain, to reconcile what was reported on my W2? Any suggestions would be appreciated.

Jake says

Thank you for making my life easier.

Matt says

I have exactly the same question as Emily above:

I had number of RSUs vested monthly but I didn’t sell any of the shares in 2012. Now I have 1099-B Proceeds From Broker and Barter Exchange Transactions 2012 for the Sell-to-Cover Transactions.

If I follow your step-by-step tutorial, on “Enter Your Sale Information” screen, what would I enter for Date Sold, No. of Shares Sold and Selling Price Per Share? Or I don’t have to enter any of the vested shares on 1099-B since I didn’t have any actual gain/loss?

thanks

Harry says

Matt, Emily – If you received 1099-B for sell to cover, your employer isn’t doing net issuance, which this article is focused on. You enter each sale as shown on the 1099-B. Your basis is the price per share on vesting date * # of shares sold to cover taxes. Any small difference in price and brokerage commission is your gain/loss. Do this for each entry on the 1099-B.

Geetha says

This is great information – THANK YOU!!! I have 2 questions

I have a situation where a total of 326 RSUs from 3 different grants vested Sept 2011 (employer withheld 135 shares for tax and distributed 191 shares to me) .

I ended up selling all these 191 shares on Jan 9 2012.

1) The above example you have walked through assumes shares vested & sold in same year . Since in my case the shares vested and were sold in different years- do I need to do anything different?

2) to make matters more confusing, the RSU reported in my W2 this year is completely different & quite larger sum compared to what I earned from the sale above (this is because I had another batch of shares from these grants vest in 2012 …and the employer reported that amount in my W2) —>so for the step where “TurboTax wants to double check the value of the vested RSUs are included on my W-2” do I say No? (i said yes,but Turbo tax keeps giving error since numbers don’t match)

Many thanks for your reply

Harry says

Geetha – Just bypass Easy Guide and go directly to Enter On a Spreadsheet. Follow the example there. You will avoid all the problems.

Confusedfiler says

Great information. Next time, I’ll just buy the basic Turbotax!

If we have several sell to cover transactions, actual RSU sales from previous years’ vests , some same day as vest sales as well as ESPP sales throughout the year and two ESPP purchases during the year, and most of all of these result in losses , can we apply wash sale rules across all of them since they’re all in the same underlying stock?

If yes, how many times within a tax year can this be done?

Are two consecutive sell to cover for taxes resulting in a loss within 30 days of each other considered a wash sale if there are no other transactions in the stock in those 30 days?

Thanks

Steve says

Thanks for this post. I’m still not clear on what to do if I vested in a grant, but did not sell the shares. Turbotax flags a delta between what is reported on my W2, and what it computes. The delta is exactly the amount of the two vestings that I did not sell. I don’t see a path to enter a vest with no sale, nor one that would allow me, in a following year, to enter a sale without a vest.

Harry says

Steve – You don’t have to enter anything for the shares you didn’t sell. Use the “Enter on a Spreadsheet” path to enter the shares you sold.

John says

This tutorial was really helpful. Thank you so much for taking the time to do it since Intuit’s help is so lacking.

I do have one follow up (very basic) question.

In your example above, on the person’s 1099-B if they have both the sell-to-cover of 63 shares and the subsequent selling of the 97 shares listed as separate line items, does that mean they should go through the RSU wizard twice?

Or does simply going through the wizard once and explaining on the “Vesting Release” screen that 63 shares were sold to cover taxes sufficient? Will that give a mismatch of items between what’s on your taxes and what’s on your 1099-B?

Or does that mean my employer doesn’t do Net Issuance and I should flee the country since I don’t know how to get that into turbotax correctly?

Thanks so much for your help. I’m was going crazy until I found your post 🙂 You need a donation button on this post.

Harry says

John – If you have the sell-to-cover shares listed on 1099-B separately, it means your employer doesn’t do Net Issuance. If you followed the article to the end, you realize you should just skip the Easy Guide and jump right into Enter On a Spreadsheet. There, you make two entries: one for the 63 shares, another for the 97 shares. I already showed you how to do the 97 shares. You do it the same way for the 63 shares with the numbers on your 1099-B.

John says

Awesome, I’ll do that.

And you still need a donation button 🙂

Thanks again.

Harry says

If you insist, the tip jar.

Mo says

I have RSUs vested during 2012. I did not sell any. Employer deducted shares to withhold tax on eTrade. On my W2, the RSU income is added to my wages but i was NOT deducted any tax from my paycheck.

How do I tell turbotax that tax has been withheld since I have less sellable shares since employer already withheld taxes?

Harry says

Mo – If you didn’t sell any, do nothing. Just enter your W-2 as-is.

Mo says

Thanks for the reply Harry. I am confused though. Since the wage is reported on my w2, I have to pay taxes on it. Which is fine. But I have less sellable shares since tax was deducted. Will the remaining vested shares become sellable once I pay the tax?

Harry says

You employer already added the value of the shares it deducted as tax withholding on your W-2. It’s all taken of. The remaining shares are yours to keep or sell. Your cost basis in each share is the price per share at the time of vesting. If the price goes up from there, you get capital gains. It’s just as if you got a cash bonus and you used the after-tax bonus to buy shares on that day.

Steve says

Hi Harry – I’m still stuck. My employer entered a value on my W2 that INCLUDES the income from the shares that I did NOT sell. Turbo Tax only calculates the tax on the lots that I entered that I sold. There is a delta, which is exactly the value of the grants that I did not sell. It won’t let me complete my return. Can you enlighten me as to what I’m doing wrong?

Thanks for your help.

Harry says

Steve – Where did you tell TurboTax about the grants that you did not sell? How did it know the portion on W-2 that came from grants you didn’t sell versus just a cash bonus? If that’s why it won’t let you complete your return, delete that part. It doesn’t need to know. As I wrote in comment #19 above, use “Enter On a Spreadsheet” and only enter the grants you actually sold.

Andy says

This was a great post. Thank you. Thank you. Thank you. I can’t thank you enough for all your posts about RSU.

Ian Varley says

Oh man, thank you for this. Injecting some sanity into this needlessly complicated and misleading process was exactly what I needed.

A-train says

This was super helpful! 1st time i’ve had to do anything w/ RSU’s and following your advise & using the spreadsheet method was a breeze! THANK YOU!

Barbara says

So far this is the only place on-line where I’ve been able to hit the exact topic on which I’m stuck. If I held onto all of my RSUs vested (net of those sold for taxes), then I don’t need to report the transaction at all as a sale of an employee stock plan (specifically RSU)? If I choose this approach, I end up with a huge tax bill equal to the amount of the tax withholdings on the RSUs vested and sold for taxes. This doesn’t seem right to me!

Harry says

Barbara – It depends whether the shares sold for taxes appear on a 1099-B or not. This article deals with Net Issuance, i.e. no 1099-B. See comment #21 above if the shares sold for taxes are reported on a 1099-B. See comment #29 above if somehow TurboTax thinks you sold but you didn’t. Ask where TurboTax got the idea you had any RSUs to begin with. If it got from W-2 box 14, delete it.

Barbara says

Hi Harry – Thanks for your help…just tipped you for it! Comment #21 is for 2 transactions – the sell-to-cover taxes and the sale of the rest of the shares. I didn’t sell any shares; the broker did sell some on my behalf to cover taxes. So do I still report the sell-to-cover taxes shares in TurboTax as sold just like you would report the 97 shares in your example? That seems to make sense to me (and helps my tax bill), but then you wrote in comment #25 that if you didn’t sell anything, don’t do anything (meaning don’t report anything at all on the stock front?). I didn’t sell anything; the broker did though to pay for taxes (presumably as instructed by my employer). I’m still confused as to whether I should do nothing (other than enter the W-2 info. which includes both the income for all RSUs vested and taxes for RSUs sold-to-cover) or enter the W-2 info AND the sale in the investments section for the sell-to-cover transaction. I really appreciate your time.

Barb

Harry says

Barbara – It all depends on whether the shares sold for taxes are reported on a 1099-B from a broker or not. If they are, you enter them, the same way as the 97 shares in the example. If they are not reported on a 1099-B (only on W-2), then you don’t.

Sue says

I did not upgrade to Premier turbo tax, but believe I am following this helpful conversation – please confirm. I received 50 RSU’s on 12/10 DEU 1.46. Vest detail shows grant price $0, Fair Market Value=$14.16 x 17 units vested = $240.72. W2 shows $240.72 as RSU. 6 units were withheld for taxes @ $14.16 (or $84.96), The $84.96 shows on my W2 as Restrict Stock tax offset ($71.36 Fed WH, $3.49 Fed MedEE, $10.11 OASDI/EE) I did NOT get a 1099 for this sale – so I entered $84.96 as the sales proceed and $84.96 as the cost basis which calculated a $0 gain/loss. Correct?

Harry says

Sue – If you kept the remaining shares, you can either do that ($0 gain/loss) or just do nothing because you didn’t receive a 1099-B for the shares sold for taxes.

David says

Harry – if you don’t sell the remaining RSUs from an Net Issuance until the following year, does it matter if you record them as an “RSU” sale or just a “Stock” sale in TurboTax? I usually move the remaining shares into a different broker account and then sell them when I need the money or want to invest them different. TurboTax pulls the data automatically from the broker so it is assumed to be just a standard “stock” sale.

Harry says

David – Just a standard stock sale but you will have to remember the basis (price per share at vesting). Your new broker won’t have that. Sometimes your old broker doesn’t report basis either.

Jim Lee says

How do I do this in 2014 version of TurboTax? It looks completely different.

Jessica says

Dear God thank you! I’ve been struggling with inputting the RSUs that are on my W2 for 3 years.

Nick says

I’m using TurboTax Home & Business 2013. For year 2013, I can’t find the same screen as 2012 for ESPP and RSU. Where are they???

Scott says

I could not find how to enter RSUs in TT deluxe, I had to upgrade to Premier.

At the Investment income section and answer the first couple questions that you will type in the info yourself. At the financial institution pull down select the “no financial institution” selection. (you can edit this later)

You are now at the Enter Other Sales screen. Type in a description and under that check the “Add more details” box. Then click the start button to the right. This will take you to a screen where you can select Restricted Stock Units.

You can then type in all the info for the RSUs.

Nick says

Thank you so much, Scott! “Add more details” that is. I’m using TT Home & Business but it is the same as Premier for RSU and other stock transaction. You saved my day.

Jo says

I had 750 shares vest in 2007, with 144 held for taxes. I sold the remaining 506 in 2012, which I have a 1099B for. Nothing was included on my 2012 W2. The company I received the shares from was sold in 2012. I don’t have any documentation on the sale of the 144 held for taxes. What do I do?? (Yes, I’m just now doing my 2012 taxes.) Thanks for any advice.

Harry Sit says

Don’t worry about the 144 shares. They were taken care of on the W-2 in 2007. Just find out the per-share price your shares were vested at. That times the number of shares plus any reinvested dividends form your cost basis.

Jim says

Harry,

I had some RSU’s that vested in 2009, 2010, 2011, 2012. There were shares withheld to cover the taxes. When I look at the W’2s they show income for the vested RSU’s and the same amount in the deductions summary which backs it out to zero. Also I do not see that they added any taxes taken for the withheld shares. I sold some of them this year, can I add the taxes that were taken via the shares to additional taxes paid in the other category in TurboTax?

Harry Sit says

No you can’t do that. I re-wrote this article using new screenshots for 2014 tax year. See if those help.

Cindy says

Your write up about RSU and how to enter them into Turbo Tax was extremely helpful. I thank you for providing so many of us with a clearer understanding of how to enter the transaction. My situation is as follows…most of our RSU sold were done as sell to cover, one was a net issuance. I completely understand how to calculate the cost basis for the partial shares sold to cover the tax and the remaining shares which I sold the same or next day. The broker reported the gross proceeds for both sales. I am a little confused about the cost basis on the one sale which was sold as a net issuance. I entered into Turbo tax the correct gross proceeds which were reported on the 1099B. No cost basis was reported on the 1099B. I entered 34 shares in the description which is how it is listed on the 1099B. I had figured the cost basis for the net issuance RSU as the shares available to sell (34 shares), which I sold the next day, times the FMV on the day it vested. 47 shares were vested, 34 shares were able to be sold, 13 shares were assumed by the company to cover the taxes. The 1099B does not list the transaction involving the 13 shares. The compensation element on my pay stub is the amount of shares vested (47 shares) times the FMV on the day it vested. I do not want to under state the cost basis, but from what I read it should match the compensation element added to your earnings. From your explanation I believe the cost basis is the actually 34 shares sold times the FMV. However, I read on another site that the cost basis is the amount of shares vested (which would be 47 shares) times the FMV. Everyone seems to address selling the stock at a later date, we sold it immediately. I was expecting the amount on the pay stub to be identical to the compensation element I was including in the cost basis. Its off by the amount shares the company “kept” to cover the withholding tax (13 shares) times the FMV. Can you clarify which compensation element do I use in my cost basis calculation……47 shares or 34 shares times the FMV. I think it should be 34 shares x FMV, but I want to be sure I understood it correctly.

Harry Sit says

Always think per-share. You taxable income for 47 shares vested is the per-share price times 47. The taxes you paid are the per-share price times 13. Your basis for 34 shares remaining is the per-share price times 34, and if you only sell 17 out of the 34 shares received, your basis for the 17 shares sold is the per-share price times 17.

The only differences between sell-to-cover and net issuance are the shares taken for taxes are not sold through a broker, not at a slightly different price from the open market but assumed to be the same price at vesting.

Cindy says

The only transaction on the 1099B is for the 34 shares sold. I am getting a little confused, so to be sure, I am only reporting to the IRS the transaction for the 34 shares sold, right? My cost basis for the 34 shares will be shown on the return as the FMV times 34 shares. My tax return does not have to show the 17 shares that were the “net issuance” shares. I am assuming I don’t have to worry that the taxable income on my pay stub is higher than the compensation element I am using in my cost basis for the shares I sold. I almost prefer cover to sell because all my numbers match:) Thanks again for your clarification.

Harry Sit says

That’s correct. In Net Issuance you never saw the 13 shares. You only report what you sold. When you read that the basis should match the compensation element added to your earnings, to be more precise it should say the basis should match the compensation element added to your earnings *for those same shares you sold*. If you sold 1 share you use the compensation element for 1 share. If you sold 2 shares you use the compensation element for 2 shares. Your W-2 or paystub had 47 shares is really beside the point.

Andre says

Hi, this is still confusing to me. My company sells to cover taxes through the e-trade broker and form 1099 shows both, virtually everything. When I imported the 1099 form in TT, I then need to account for which is what. The confusing part is though that w2 also reports everything but the sum is different and they do not match, the 1099 reports lower than w2. So when I tell TT which of the shares reported on 1099 were used for taxes, is it correct if for the ones used for taxes I report it like this? 27 were granted, 10 sold for taxes, both appear on 1099

Total Shares Vested/Released – 10

Shares Withheld (Traded) to Pay Taxes – 10

Then for the remaining 17 I do:

Total Shares Vested/Released – 17

Shares Withheld (Traded) to Pay Taxes – 0

Is this correct in your opinion?

I appreciate your time. Thank You.

Harry Sit says

See comment below. Don’t touch that “Add More Details” box. Also see comment above from Cindy for sell-to-cover. A sell is a sell. It doesn’t matter whether you are selling for taxes or selling for cash in your own pocket.