From the previous posts, we know that in 2021, even if you take the standard deduction, you can still deduct up to $600 in cash donations to charities (up to $300 for single or married filing separately). See 2021 $300 Charity Deduction When You Don’t Itemize. However, finding the place to get this deduction in TurboTax requires some patience.

TurboTax

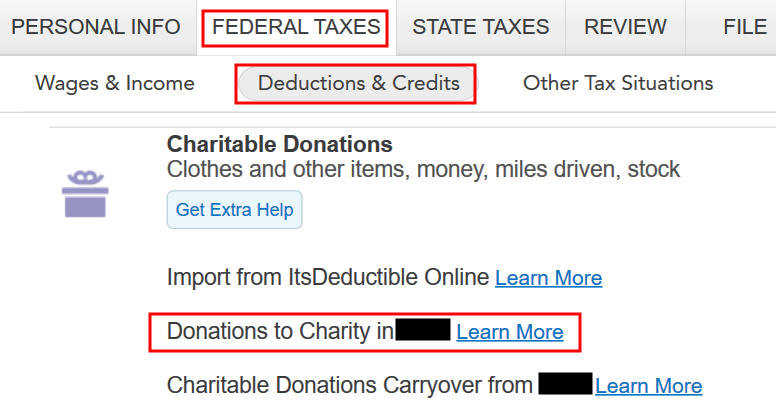

TurboTax has a place to enter charity donations as you would expect. It’s under Federal Taxes -> Deductions & Credits -> Charitable Donations. So far so good.

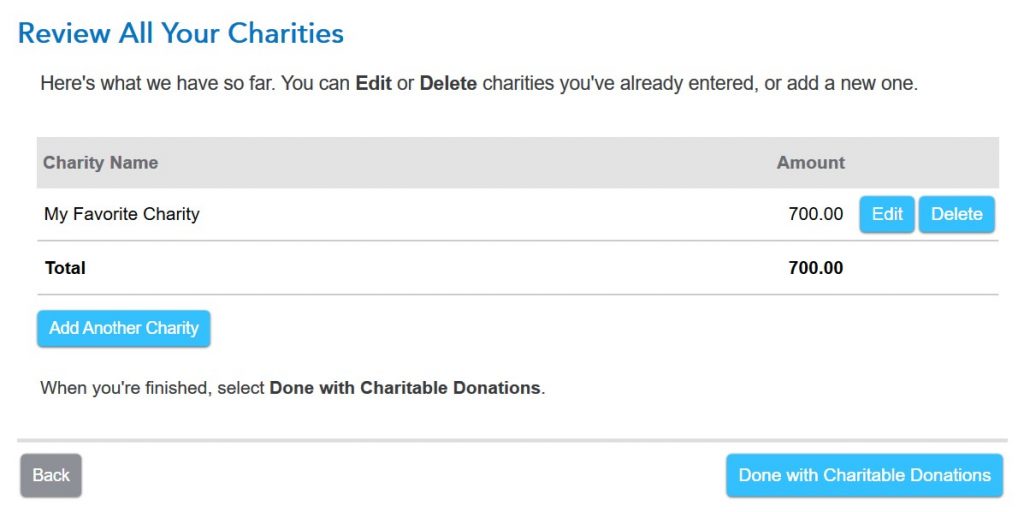

It’s also straightforward to enter the donations. You arrive at this summary after you enter all the details. In our example, the taxpayer donated $700 cash to a favorite charity.

However, your refund number doesn’t change after you click on “Done with Charitable Donations.” It’s as if you’re not getting the deduction for your donations. In our example, the refund was $3,836 before we started, and it was still $3,836 when we were done with charitable donations.

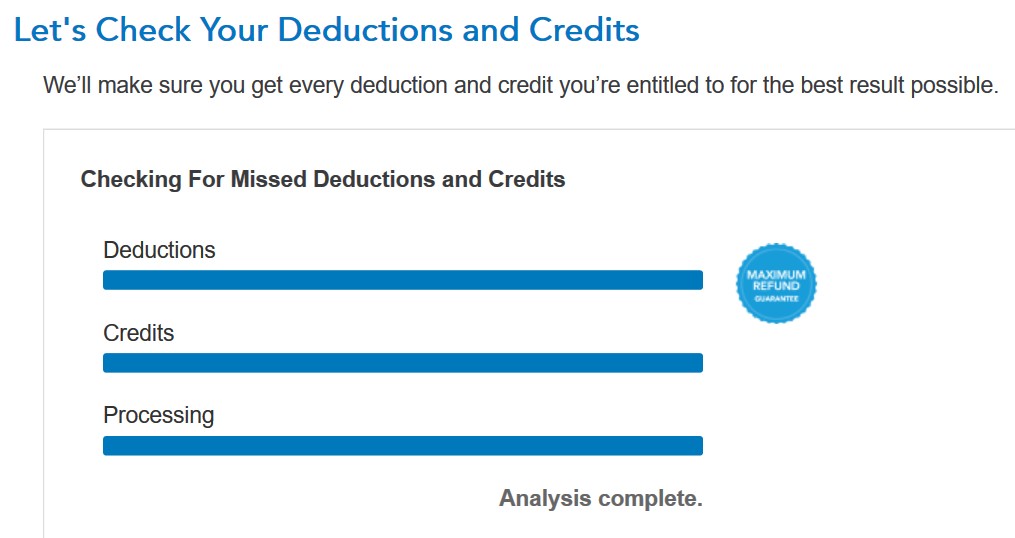

TurboTax continues to ask you about other deductions. After you’re done with all the deductions, click on the Done with Deductions button. Only this will trigger the $300/$600 deduction.

TurboTax will do an analysis at that point.

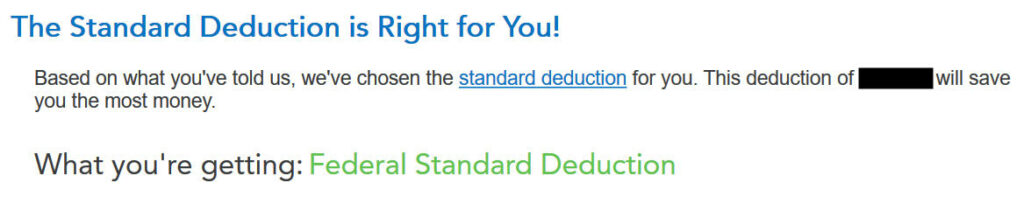

TurboTax double-checks some items until it concludes that you should take the standard deduction.

And now the refund number will change. It was $3,836. Now it’s $3,908. We’re getting $72 for the donations.

So if you don’t see your refund change after you enter your donations, be patient. Keep going, going, and going. Eventually, you will reach the place where TurboTax recognizes that you’re taking the standard deduction and you’re entitled to the $300 or $600 deduction for your donations to charity.

H&R Block Software

It’s much more straightforward to do this in the H&R Block software. The H&R Block software assumes you’ll take the standard deduction until it sees enough deductions worth itemizing. It’s a good assumption to make because close to 90% of all taxpayers take the standard deduction. As soon as you enter the charity donations in H&R Block software, the refund number will change.

TurboTax doesn’t assume. It tries to demonstrate it’s thorough and it’s doing the heavy lifting of giving you the maximum deductions. After a song and dance, you end up with the standard deduction anyway. I think the approach in the H&R Block software works better, but TurboTax’s convoluted way creates good materials for blog posts. 🙂

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

GMShedd says

Thanks for effort of doing the thorough walk-through. I noticed the same thing.

Your example is close, but not identical to mine, which brings up a question: Claiming a contribution of more than $250 to a single charity requires that you have a receipt for the donation; below $250, no receipt is required. I have a contribution of $120 to one charity, and another of $500 to a different charity, but I can’t find the receipt (only the transaction on a credit card statement). However, since I’m only going to claim $180 of the $500, it doesn’t seem that I should need to have a receipt, since I’m not claiming a donation exceeding $250. Does this seem reasonable? I realize the risk is small, and I can afford the difference if an auditor disagreed, so it’s more of an academic exercise than anything else. Thanks again for what you do for the rest of us.

Harry Sit says

I think it’s reasonable if you only claim $180. If you contact the charity, maybe they can reissue the receipt.

NN says

I am wondering if that box asks about a single charity or a total donations amount? My bet would be it’s the second, especially by looking at the plurals used in that question: “contributions made in 2020…”

Harry Sit says

TurboTax expects you to list donations to each charity separately. You enter the total donations that single charity throughout the year. Use “Add Another Charity” for donations to a different charity.

Name says

Or just type it in your form 1040, line 10b. This is a case where doing it yourself might be easier than the paid software!

Manuel says

Since turbotax bought out credit karma and one can still file electronically completely free on there, regardless of the complexity (unlike turbotax), have you thought about maybe including credit karma on your walkthroughs?

Harry Sit says

Intuit agreed to sell Credit Karma’s tax prep business in order to acquire the rest of Credit Karma. Because the business model of that service is uncertain. I won’t include it.

stike says

Harry,

Long-time lurker, great work. Love your tax software tutorials. Question for you. I use HR Block. I’m in my 40s but took advantage of the CARES act in 2020 to take an early retirement distribution from my 403b (I got furloughed). I received a 1099-R from the trustee that I inputted into HR Block in the 1099-R section. I want to pay the tax on the distribution over three years as allowed. While HR Block does have a spot to handle CARES Act distributions, it’s in an entirely different place than the location where you input 1099-Rs and frankly it’s very confusing! The tax software increased my taxable income by the amount on the 1099R but doesn’t seem to want to reduce my tax due even though I want to pay it over 3 years-it’s not seeming to spread it out. Basically I’m utterly lost – can you do a walk-through of how to report CARES Act early distributions in the tax software (HR Block and TurboTax)? Does spreading the tax reduce the tax liability or just provide a longer grace period? Help!

Thanks!

Brian says

Good information.

While reading this, I couldn’t grasp what TurboTax process you were talking about. Then, it hit me that you were using the step-by-step data entry method; I always enter my tax data directly into the tax forms.

Again, good information that helps me understand what’s going on in the background of these forms. Thanks!

Steve says

First off, I’d like to say how impressed I am with this site. Today is my first visit, & I’m definitely going to bookmark it. Regarding the receipt requirement for charitable donations. Are we talking a literal receipt that has to be scanned & included with your return ?

I’ve used TurboTax deluxe (or it’s equivalent) since 1999. I chose H&R Block for 2020 because TT would’ve required an upgrade of my iMac operating system.

Is a receipt required for Block as well ?

Thank You

Harry Sit says

You’re required to have a receipt but you don’t have to include it with your return. See IRS Publication

1771.

https://www.irs.gov/pub/irs-pdf/p1771.pdf

Steve says

Thanks Harry!

I donated to St. Jude’s for 2020, & I’m very disappointed I had to contact them to request a receipt.

Terry says

I took some money from my 401k through the cares act and I had state and federal taxes taken out right away. At the end of the turbo tax process where it double checks everything we are getting an error to fix something about our state tax dispersement . Box 16 on my form. It is blank on my form but is saying that the amount I had deducted for taxes can’t be higher than this amount. Well it will always be higher than a blank.

Harry Sit says

Your issue isn’t related to the topic of this post. That said, that error should go away if you put the same amount in box 1 (gross distribution) in box 16 (state distribution).

Craig Solow says

I entered the $300 credit line 10b, and it says since your taking the standard deduction (in turbo tax) it is a problem. You have to print it and file. It wont send electronically.

Harry Sit says

What if you follow the interview and not directly enter it on the tax form?

Fredric Schuster says

As the result of the recent 2020 Cares Act, a federal filer can deduct up to $300. cash contributions to a charitable organization resulting in less taxable income and a lower FAGI. If that is so, then in my VA. state return in my opinion I should have to add back that as additional income in my Virginia State return with a form 760 ADJ. Any thoughts? I would also opine at least for 2020 that the deduction is limited to the $300 for joint filers taking the standard deduction. Next years it apparently changes to $600.

Harry Sit says

The 2020 Virginia 760 instructions said “Virginia’s date of conformity with the Internal Revenue Code (IRC) was advanced from December 31, 2018 to December 31, 2019, subject to certain exceptions.” Because it doesn’t cover federal changes in 2020, I would think the $300 should be added back to the AGI for Virginia state income tax.

Ric says

Thank you Mr. Sit. Just wanted to make sure I wasn’t missing something in my logic. I had a heck of a time accomplishing this with Turbo Tax. The software is not friendly.

Joyce P Anderson says

This is what I found out about the CARES act when I asked about it if you take take the standard deduction. They say wait for the Turbo to fix it.

Is there an error for TurboTax Premier for the 1040 Charitable cash contribution for standard deduction preventing me from e-filing?

by djbock77•31•Updated 13 hours ago

Keep getting error that my “contribution is too large” but it is below the 300 limit. Now it won’t let me e-file unless I fix the error, but there is no error to fix.

Best Answer

by cynthiad66

Yes. There is an issue with the contributions deduction and TurboTax is working to fix it. We do not have an estimated date of correction, at this time. I suggest you check back often to see if the correction has been made.

There is a problem with the Contributions section of the Itemized deductions and also the above the line $300.00 deduction. Because of the many changes due to the CARES Act, IRS is still developing the forms and publications on this issue. Last update was January 13th where everything is still in draft. Once IRS finalizes the forms, we will be able to update TurboTax to accurately reflect your Contributions deduction.

Here are some of the changes due to the CARES ACT

The new legislation allows tax deductions on two types of charitable gifts. First, it allows up to $300 given to a qualified charity to be claimed as an above-the-line deduction. After the Tax Cuts and Jobs Act, which went into effect in 2018, increased the standard deduction, many taxpayers had less incentive to donate to charities. Instead, they took the standard deduction and stopped itemizing.

For taxpayers who will itemize deductions, the CARES Act effectively suspends the limit on deductions for cash contributions to public charities for 2020. “That allows individuals to completely wipe out their AGI, and their tax liability, with a charitable contribution

Alfred Niedermayer says

I have made (MRD) charitable contributions (QCD) directly from my IRA. This gives me a reduction on my state income tax. Can I still take the $300 CARES deduction on my Federal taxes? TurboTax doesn’t seem to allow it.

Harry Sit says

Not using the same dollars from your IRA. If you donated to charities using money outside your IRA, then you may be eligible for the $300 deduction, subject to the other requirements (must be in cash, must be made directly to charities, etc.).

Katie says

Thanks for this info, Harry. I’m using H&R Block software and double-checked that I’m following the instructions correctly to receive this deduction. However, when I entered my donations ($45), the amount of my refund didn’t change. In fact, I played with the numbers, and nothing changes until I enter $210, at which point my refund increases by $12 (and it doesn’t change if I enter the max $300). Something seems wonky to me, but is this correct? Thanks in advance for any help.

Harry Sit says

I’m not sure what’s going on there. Print the tax form as you experiment with different numbers. The charity deduction goes on line 10b. See if the donation you put in shows up on line 10b and see what else is changing to make your refund stay the same.

Kaptain says

Its march 19, still not seeing this “Change” by turbotax in updating for charitable deductions. Last year, when you made a $300 cash donation, you SAW $300 reduced on your Turbo Tax deductions. I do not see it during the optimizer and summary. It shows “How much you claimed $790” “How much you got $0”?!?!?!? When you click on “Why the difference?” NONE of the reasons match my tax situations. We got less than a month left of Tax Season, maybe the IRS and Tax Software companies can do their ONE JOB and get this #*($@ working right?

Harry Sit says

Not sure whether you’re talking about downloaded TurboTax or online. In downloaded TurboTax, go to Federal Taxes -> Deductions & Credits. Scroll down to the bottom and click on the “Done with Deductions” button. Only this will trigger the $300/$600 deduction.

KCtaxfiler says

I’m using H & R Block and although it says I can claim the $600 Charitable Deduction, the tax owed does not decrease. Also in the Tax Summary, it only shows the Standard Deduction, not the Charitable Deduction. Do you know why this would be?

Harry Sit says

There’s no income limit for this credit. You can see whether you’re getting the credit by looking at Form 1040 line 12b. If line 12a shows you’re getting the standard deduction ($25,100 for married filing jointly) and line 12b shows you’re getting the credit for your cash donations up to $600, you’re all set, regardless of what the tax summary shows.

ron miles says

I tried your correction method for deducting a $600 charitable deduction with TT Premier. I played with it and entered $0 as well as $600 and my return $$$ do not change following the steps you recommended.

I went to the forms and the form would pick up the donation amount but my return amount stayed the same.

KCtaxfiler says

I seem to be having the same problem with H & R Block software(comment above). I’m wondering if there is an income limit for getting a benefit from the charitable deduction? I’ve searched extensively and can’t seem to find an answer.

Ron Miles says

I discovered a “work around” this situation.

Went into the tax form 1040 and MANUALLY wrote over the deduction on LINE 12B. Not matter what I changed it to, my taxable income would change along with my refund amount.

KCtaxfiler says

Thank you Ron and Harry. I wasn’t able to manually change any values on my 1040 but I did see that both the standard deduction and charitable $600 were in lines 12a and 12b so I’m satisfied it is recorded and working properly now.