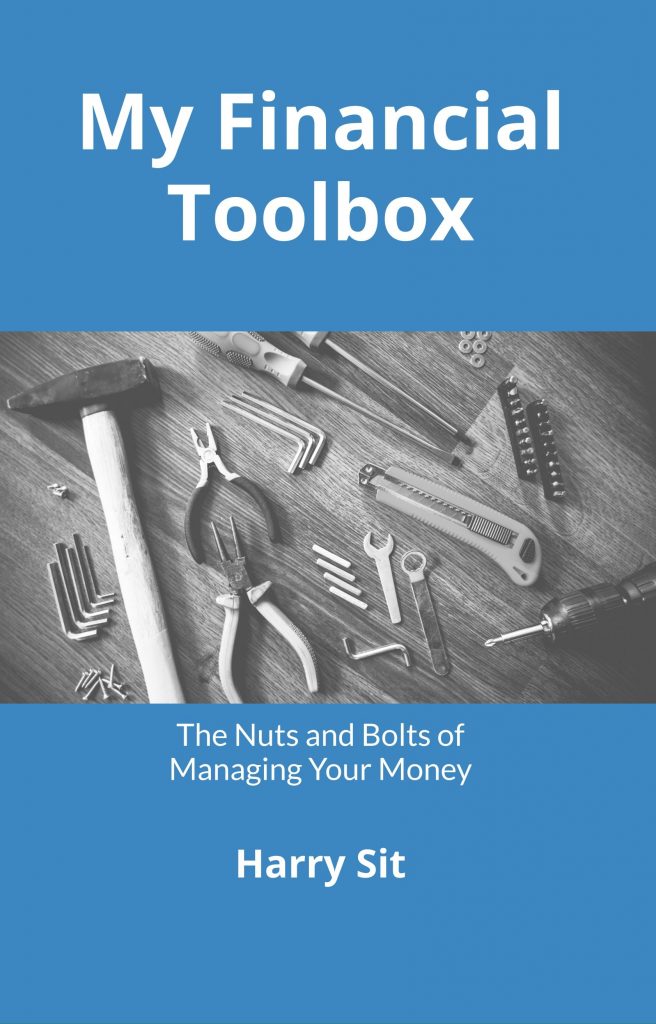

Hi, I’m Harry. I’ll show you the nuts and bolts of managing your money.

401k, IRA, investing, insurance, taxes, … I lived, breathed, and wrote about these for so many years. No fluff, just concrete first-hand learning and sharing.

Explore Topics

Recent Posts

Use an Independent Agent for Auto and Home Insurance

Using an independent agent for auto and home insurance gives you a different channel for lower premiums. It’s worth a try.

eSIM for International Travel Mobile Data Roaming

U.S. phone companies charge exorbitant prices for international mobile data roaming. Buying an eSIM for international travel costs under $10.

2025 2026 HSA Contribution Limits and HDHP Qualification

2025 and 2026 HSA contribution limits and HDHP qualifications for individual and family coverage. Small changes in 2026 due to mild inflation.

Backdoor Roth in FreeTaxUSA: Recharacterize & Convert, Same Year

Follow this detailed walkthrough of how to report a Roth conversion in FreeTaxUSA after recharacterizing a Roth IRA contribution in the same year.

Protect Your Brokerage Accounts From ACATS Transfer Fraud

Fraudulent brokerage account transfers via ACATS are rare but devastating. Learn how to protect your accounts from ACATS fraud in this case study.

Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 2

Follow this detailed walkthrough of how to report in FreeTaxUSA recharacterizing and converting backdoor Roth contributions from the previous year.