[Updated on January 30, 2026 with screenshots from FreeTaxUSA for the 2025 tax year.]

The previous post Split-Year Backdoor Roth in FreeTaxUSA, Year 1 dealt with contributing to a Traditional IRA for the previous year and recharacterizing a previous year’s Roth IRA contribution as a Traditional IRA contribution. This post handles the conversion part in FreeTaxUSA. If you use TurboTax or H&R Block tax software, see:

We cover two example scenarios in this post. Here’s the first:

You contributed $7,000 to a Traditional IRA for 2024 in 2025. The value increased to $7,200 when you converted it to Roth in 2025. You received a 1099-R form listing this $7,200 Roth conversion.

You should’ve already reported the contribution part on your 2024 tax return by following Split-Year Backdoor Roth in FreeTaxUSA, Year 1 last year. The IRA custodian sent you a 1099-R form for the conversion in 2025. This post shows you how to put it into FreeTaxUSA.

Here’s the second example scenario:

You contributed $7,000 to a Roth IRA for 2024 in 2024. You realized that your income was too high when you did your 2024 taxes in 2025. You recharacterized the Roth contribution for 2024 as a Traditional contribution before April 15, 2025. The IRA custodian moved $7,100 from your Roth IRA to your Traditional IRA because your original $7,000 contribution had some earnings. The value increased again to $7,200 when you converted it to Roth in 2025. You received two 1099-R forms, one for $7,100 and another for $7,200.

You should’ve already reported the recharacterized contribution on your 2024 tax return by following Split-Year Backdoor Roth in FreeTaxUSA, 1st Year last year. The IRA custodian sent you two 1099-R forms, one for the recharacterization and the other for the conversion. This post shows you how to put both of them into FreeTaxUSA.

If you contributed for 2024 in 2025 or if you recharacterized a 2024 contribution in 2025, you’re still in year 1 of this journey. Please follow Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 1.

If neither of these example scenarios fits you, please consult our guide for a normal “clean” backdoor Roth: How to Report Backdoor Roth In FreeTaxUSA (Updated).

If you’re married and both you and your spouse did the same thing, you should follow the steps below for both yourself and your spouse.

1099-R for Recharacterization

This section only applies to the second example scenario. If you contributed directly to a Traditional IRA for 2024 in 2025 and didn’t recharacterize (the first example scenario), please skip this section and jump over to the conversion section.

We handle the 1099-R form for recharacterization first. This 1099-R form has a code “R” in Box 7.

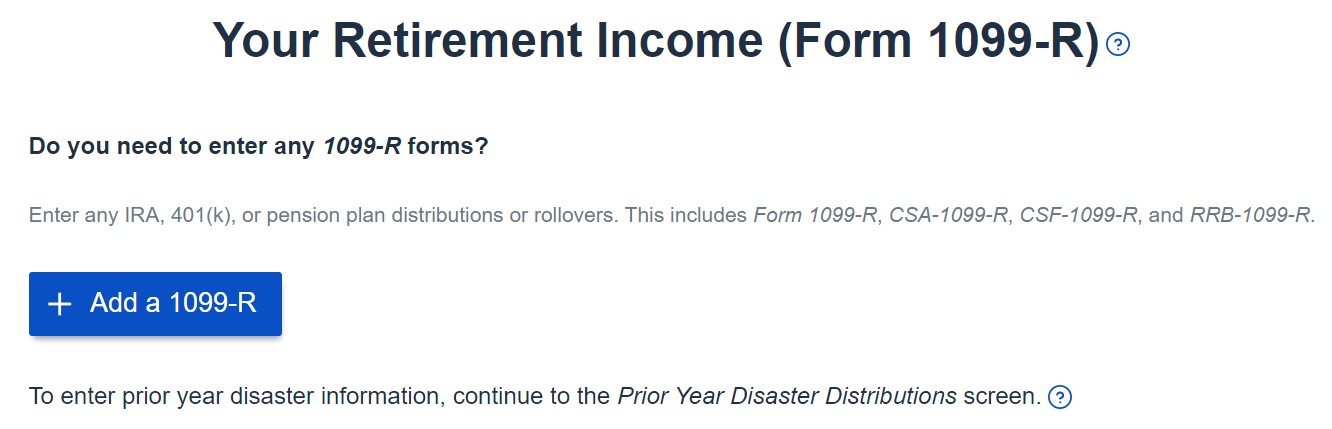

Find “Retirement Income (1099-R)” under the Income menu.

Click on the “Add a 1099-R” button.

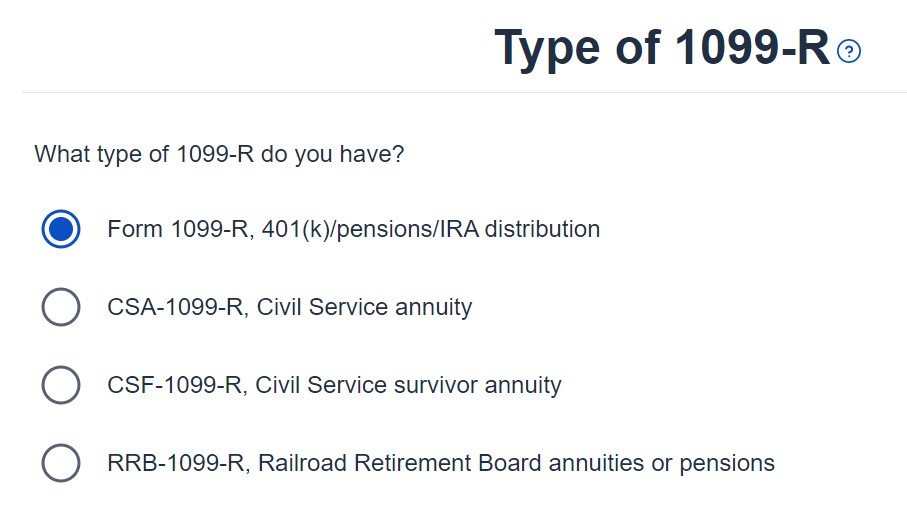

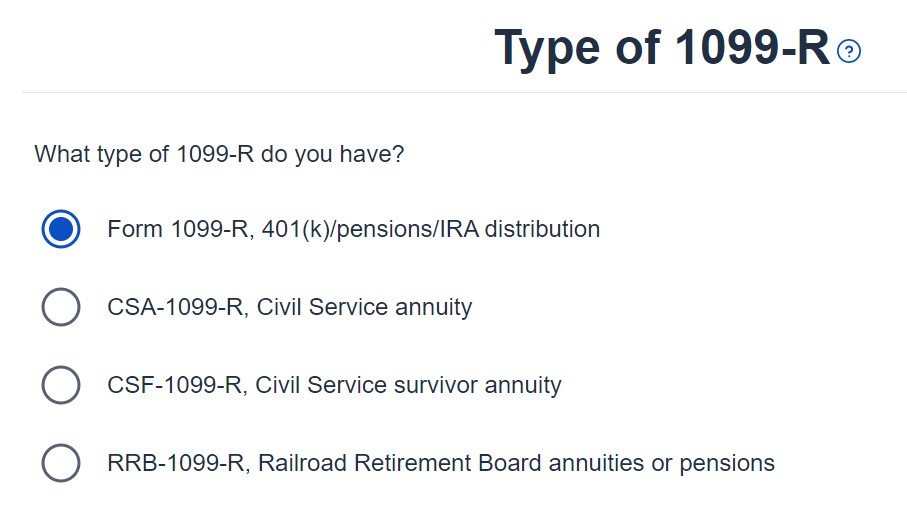

It’s just a regular 1099-R. Upload a file if you’d like. I’m showing how to enter it manually.

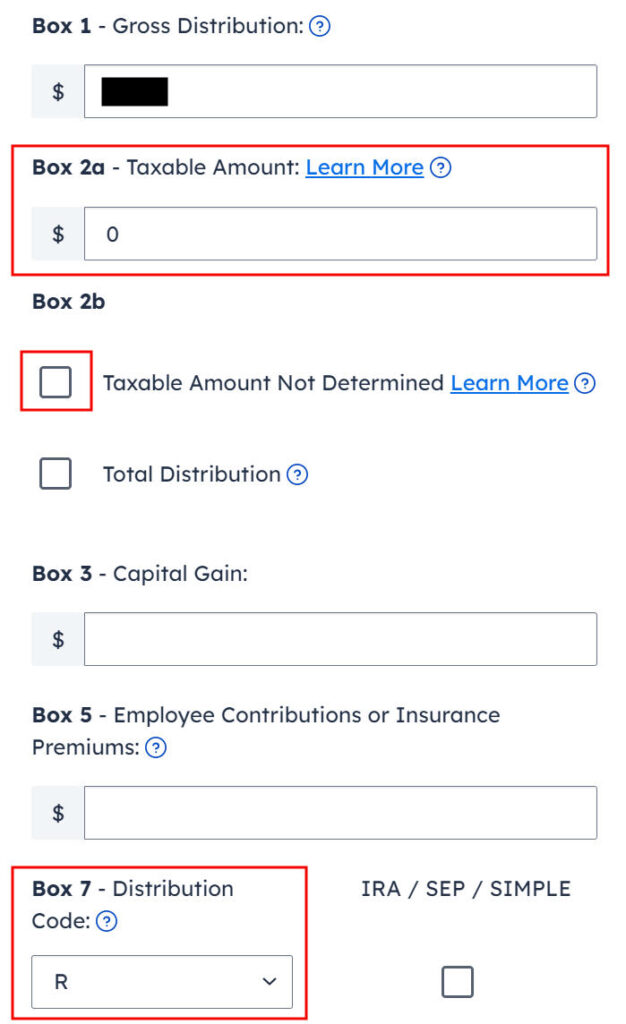

Enter the 1099-R for the recharacterization exactly as you have it. Box 1 shows the amount transferred from the Roth IRA to the Traditional IRA when you recharacterized your 2024 contribution in 2025. Box 2a shows that the recharacterization isn’t taxable. Box 2b “taxable amount not determined” isn’t checked. The code in Box 7 is “R.” The “IRA / SEP / SIMPLE” box isn’t checked.

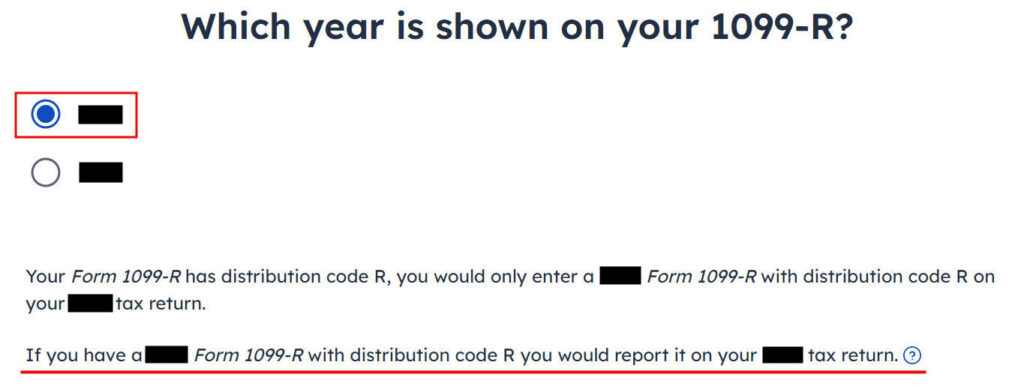

Your 1099-R shows 2025, but FreeTaxUSA says you should’ve reported it on your 2024 tax return. The problem is you didn’t have it back then. You couldn’t have reported something you didn’t have. Select the correct year and continue anyway.

The recharacterization wasn’t a rollover.

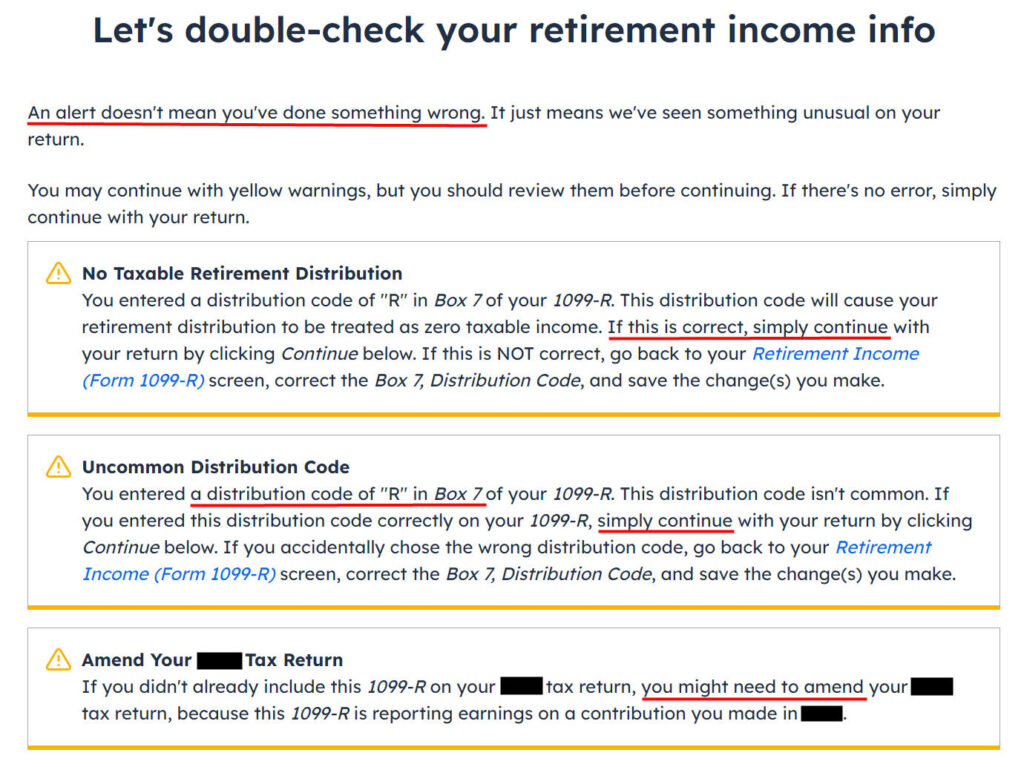

FreeTaxUSA shows some alerts. The zero taxable income on the 1099-R is correct. Code “R” in Box 7 is also correct. Although you didn’t include this 1099-R last year because you didn’t have it at that time, you don’t need to amend last year’s tax return if you reported the recharacterization in a different way when you followed Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 1 last year. You may need to amend last year’s return only if you didn’t report the recharacterization last year at all.

You’re done with the 1099-R form for the recharacterization. Click on the “Add a 1099-R” button to add the other 1099-R for the conversion.

1099-R for Conversion

The 1099-R for the conversion has a code “2” in Box 7 if you’re under age 59-1/2 or a code “7” if you’re 59-1/2 or older.

It’s also a regular 1099-R. Upload a file if you’d like. I’m showing how to enter it manually.

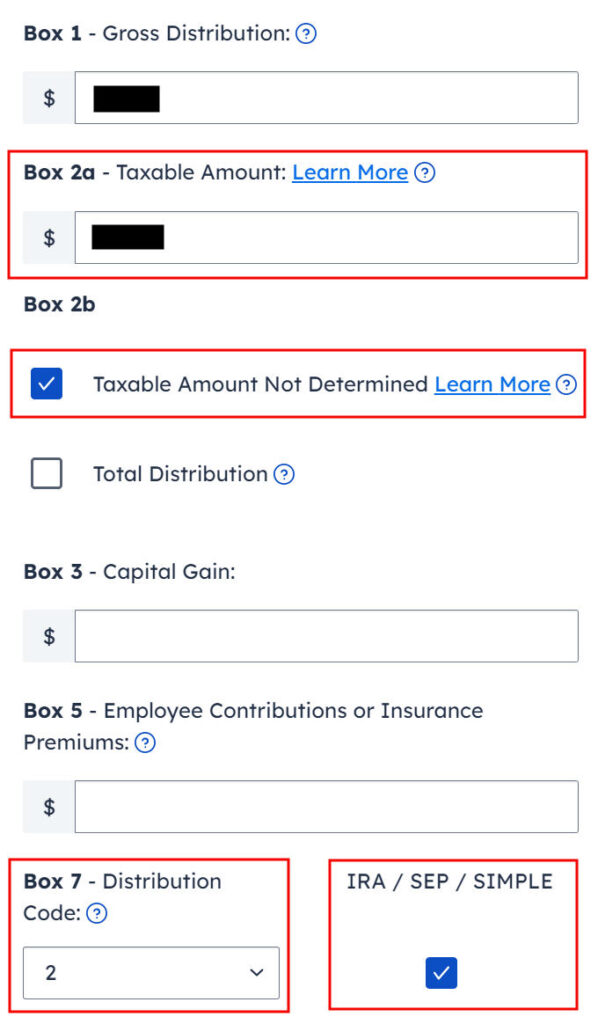

Box 1 shows the amount converted to Roth. If you contributed to a Traditional IRA for 2025 in 2025 and converted in 2025 (a “clean” backdoor Roth) on top of converting the 2024 contribution in 2025, the amount on the 1099-R includes two years’ worth of contributions. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked, saying “taxable amount not determined.” Make sure to choose the correct code in Box 7 to match your 1099-R. The “IRA / SEP / SIMPLE” box is checked.

Your refund number drops after you enter the 1099-R. Don’t panic. It’s normal and temporary. The refund number will come up when we finish everything.

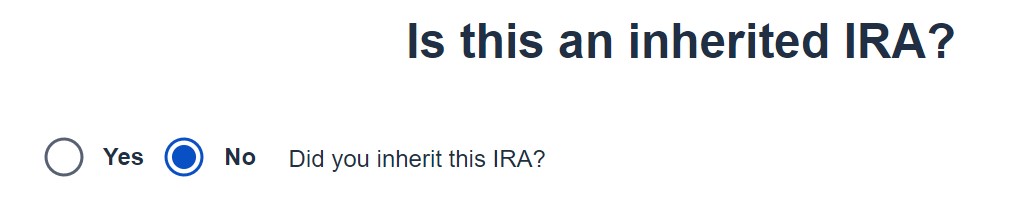

It’s not an inherited IRA.

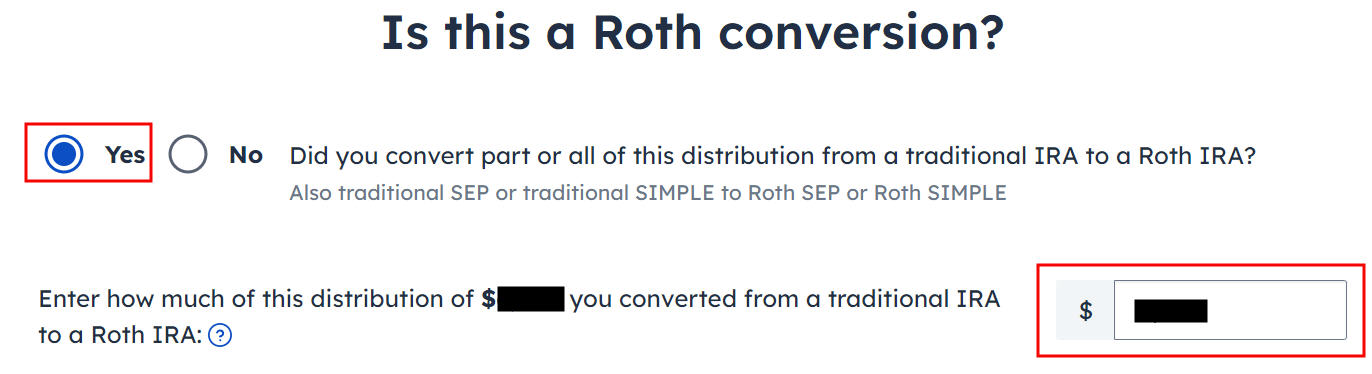

It’s a Roth conversion. Enter the amount on the 1099-R in that box.

You are done with this 1099-R for the conversion. Repeat if you have another 1099-R. If you’re married and both of you converted to Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R forms to the same person when they belong to each spouse. Click on “Continue” when you have entered all the 1099-R forms.

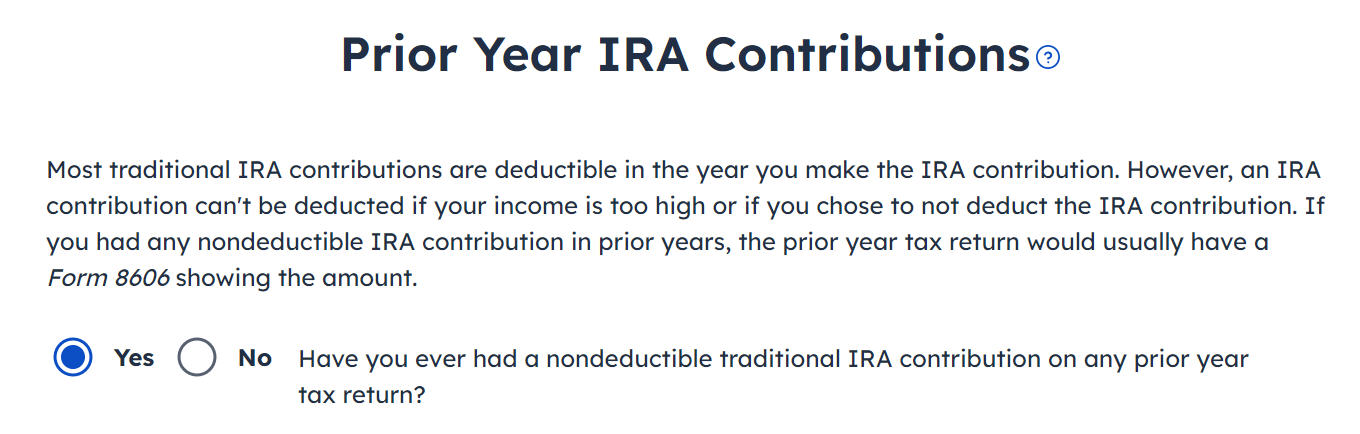

Answer “Yes” here because you had a Traditional IRA contribution from last year.

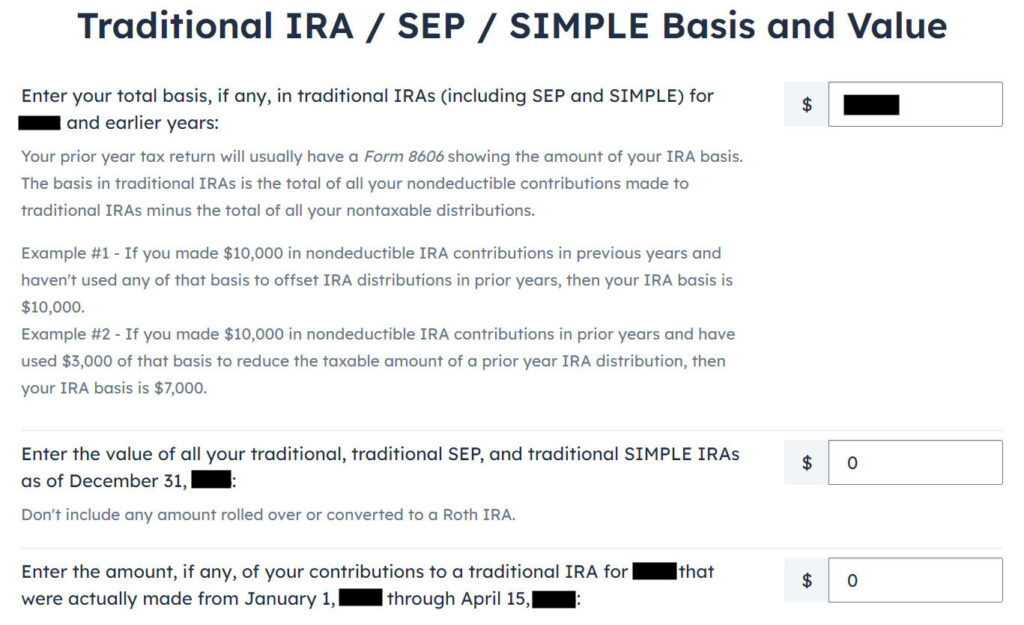

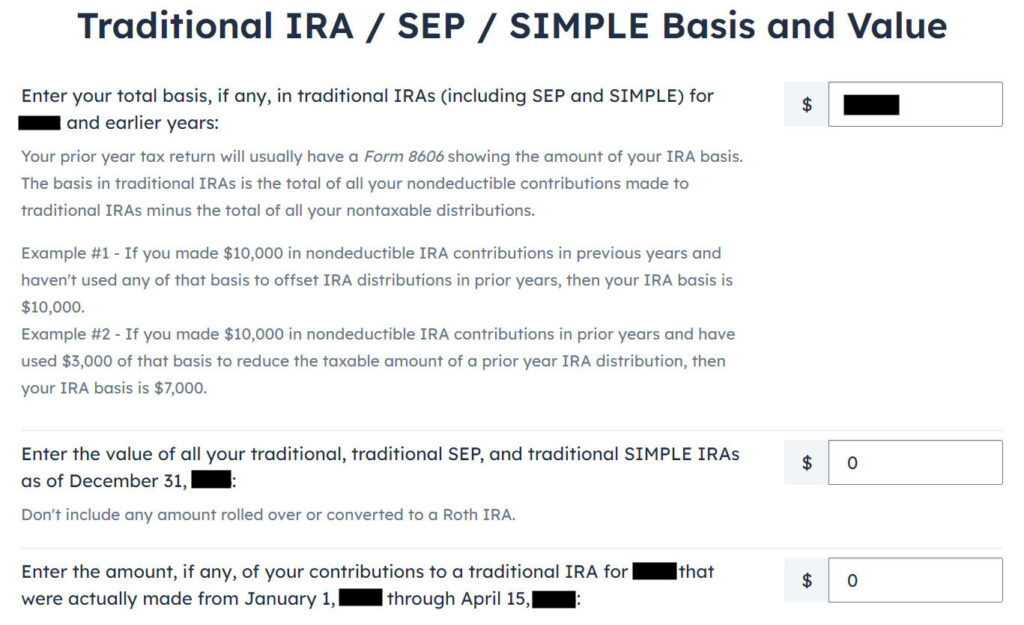

Get the value for the first box from last year’s Form 8606 Line 14 (assuming that you did last year correctly). If you didn’t have a Form 8606 last year because you didn’t do it correctly, your basis is the amount of your 2024 Traditional IRA contribution minus any deduction you took on last year’s Schedule 1 Line 20. The total basis is $7,000 in our example.

The second box should be zero when you emptied all your Traditional IRAs after converting them to Roth, and you don’t have any SEP or SIMPLE IRAs. If you had a few dollars of earnings posted in the Traditional IRA after you converted and you left them in the account, get the value from your year-end statement and put it in the second box. The software will apply the pro-rata rule.

The third box should also be zero when you made your 2025 contribution in 2025.

We didn’t take any disaster distribution.

Continue with all other income items until you are done with income.

Clean Backdoor Roth On Top

If you did a “clean” backdoor Roth on top of converting the 2024 contribution in 2025 (contributed to a Traditional IRA for 2025 in 2025 and converted in 2025), you have a higher amount on the 1099-R form we just completed. Now we do the contribution part. Skip this section if you didn’t contribute for 2025.

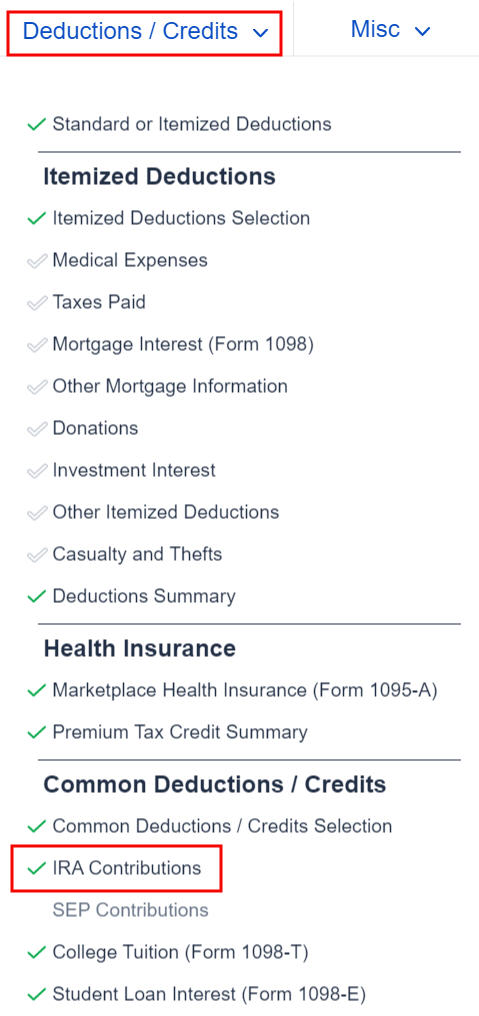

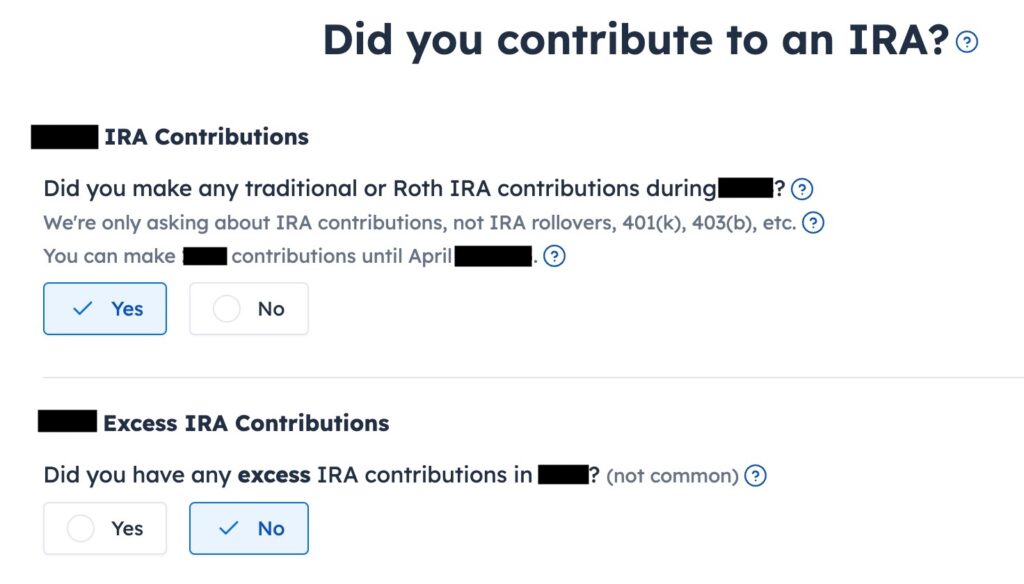

Find the “IRA Contributions” section under the “Deductions / Credits” menu.

Answer “Yes” to the first question. An excess contribution means contributing more than you’re allowed to contribute. We didn’t have that.

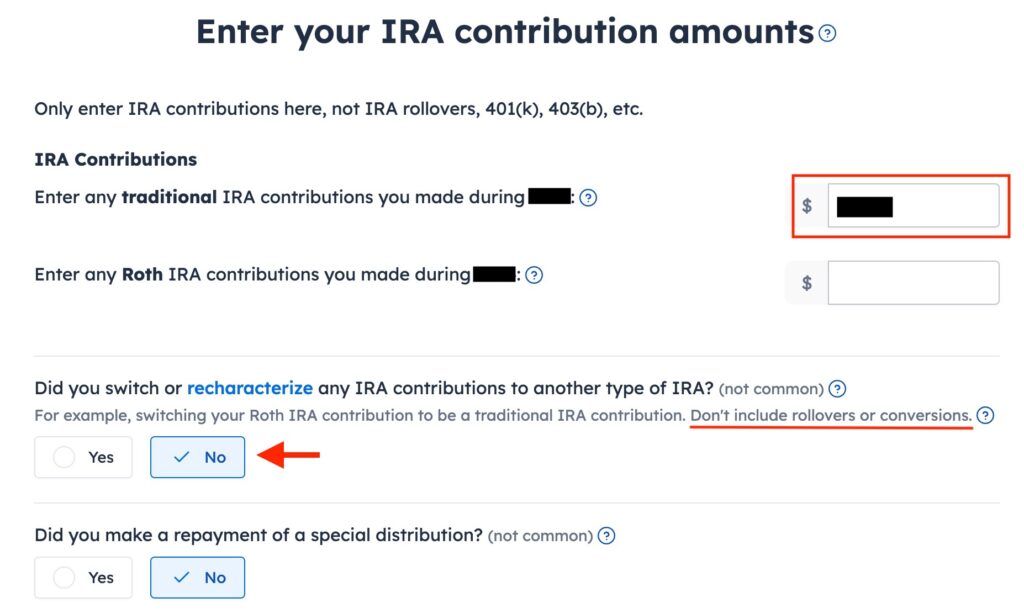

Enter the amount you contributed to the Traditional IRA for 2025 in the first box. Leave the answer to “Did you switch or recharacterize” at No. We converted. We didn’t switch or recharacterize. We didn’t repay any distribution either.

Your refund number goes up again after you enter the contribution.

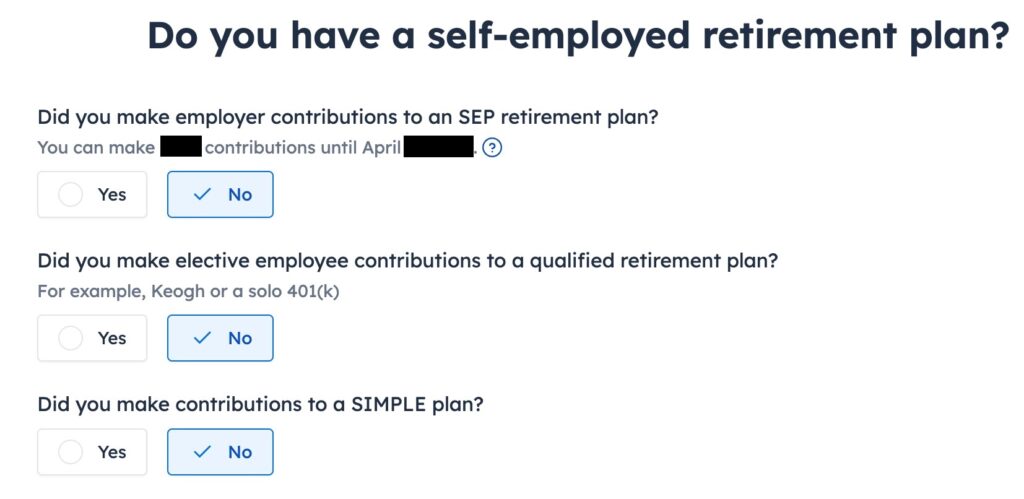

We didn’t contribute to a SEP, solo 401k, or SIMPLE plan. Answer Yes if you did.

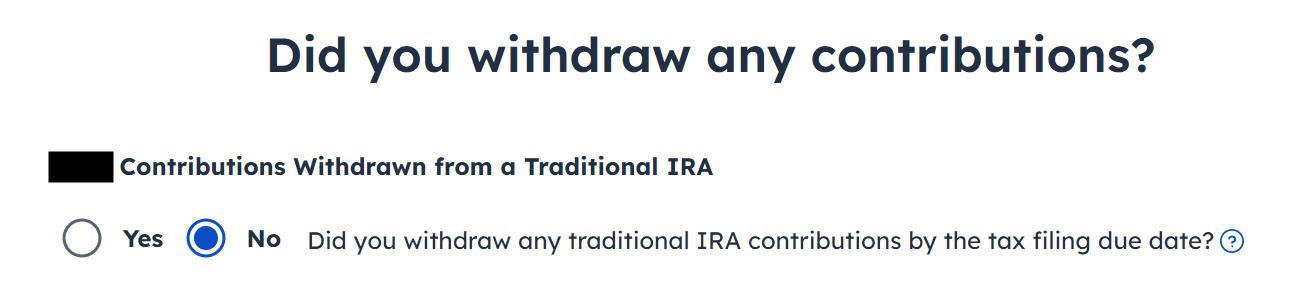

“Withdraw” means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer “No” here.

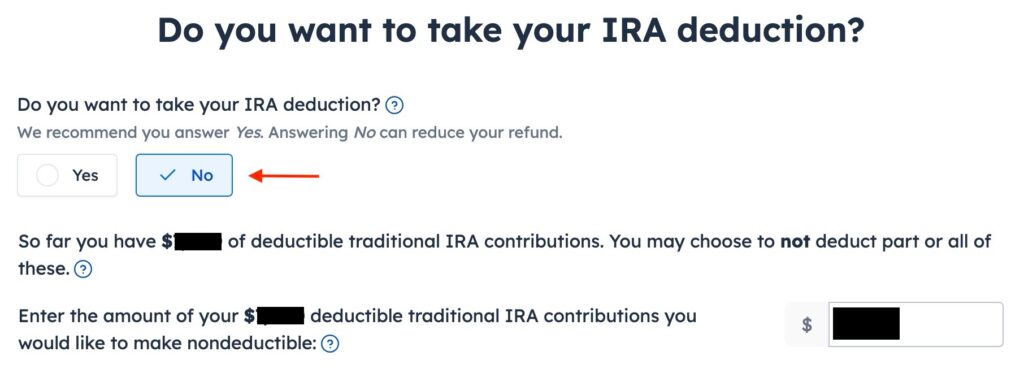

You see this screen only if your income falls below the income limit that allows a deduction for your Traditional IRA contribution. You don’t see this if your income is above the income limit. Answering “Yes” will make your contribution deductible, but it will also make your conversion taxable. Although it works out to a wash in the end, it’s less confusing if you answer “No” here and make the entire amount that could be deducted nondeductible.

FreeTaxUSA shows the same page we saw before in the conversion section. Confirm and continue.

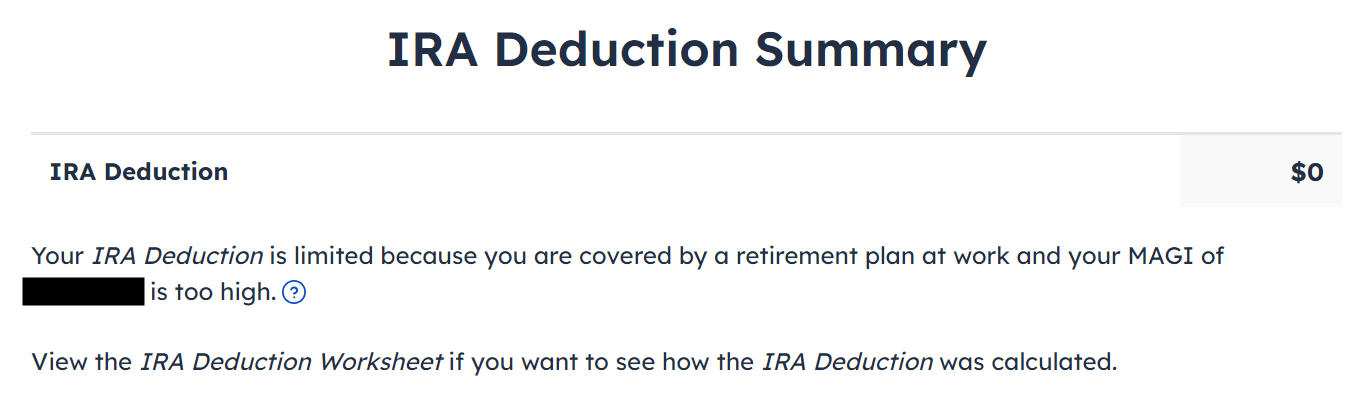

It tells us we don’t get a deduction because our income is too high or because we chose to make our contribution nondeductible. This is expected.

Taxable Income

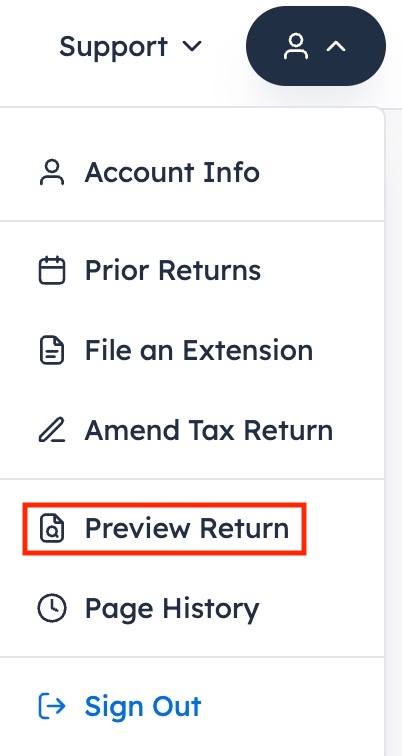

You’re done with the 1099-R forms. Let’s look at how they show up on your tax return. Click on the head icon at the top right and then click on “Preview Return.”

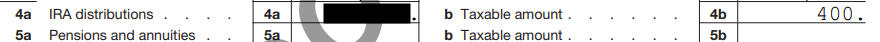

Look for Lines 4a and 4b in your Form 1040.

Line 4a shows the amount on your 1099-R for the Roth conversion. Line 4b shows the taxable amount, which is the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth. The taxable amount on Line 4b would be zero if you didn’t have any earnings.

Form 8606

Go toward the end of the pop-up to find Form 8606. It shows these for our example:

| Line # | Amount |

|---|---|

| 1 | 7,000 (only if you also did a “clean” backdoor Roth on top, otherwise blank.) |

| 2 | 7,000 |

| 3 | The sum of Line 1 and Line 2 |

| 5 | The same as Line 3 |

| 8 | The amount on your 1099-R with a code 2 or 7 |

| 13 | The same as Line 3 |

| 14 | blank (or a small amount if your Traditional IRA had a small balance at the end of 2025) |

| 16 | The same as Line 8 |

| 17 | Line 3 minus Line 14 |

| 18 | The difference between Line 16 and Line 17 |

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

The Entire Conversion Is Taxed

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work, but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. FreeTaxUSA gives you the option to take a deduction if it sees that your income qualifies.

Part of your conversion could be taxed because you took a deduction on the Traditional IRA contribution last year or this year. You see whether you took a deduction by looking at Schedule 1 Line 20 on last year’s and this year’s tax returns.

You can’t change what you did last year, but you can still decline the deduction this year by answering “No” on the “Do you want to take your IRA deduction?” page. Declining the deduction lowers the taxable amount in your Roth conversion.

Self vs Spouse

If you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with a Traditional IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

CH says

Hello. Thank you for the detailed write up. If the second year is also not clean, what should be in box 1 of Form 8606 (i.e., $6K contributed for the 2022 tax year in 2023 and $6.5K for the 2023 tax year in 2024)? Thank you.

Harry Sit says

$6,500. It also goes in Box 4 and Box 14.

Eddie says

Of course it is your blog to use to cover what you wish, but I’m ready for a new topic. “Back door” Roths should be illegal.

Harry Sit says

Congress wanted to ban backdoor Roth but Joe Manchin stopped it. It’s beyond my pay grade to write how things “should” be. I only deal with the reality on the ground.

Sam O. says

Hi Harry,

Love your article series about walking through FreeTaxUSA reporting backdoor Roth IRA contributions for multiple years, the first being “dirty” and the second “clean”. This is exactly my situation, and I have found your information to be indispensable in my tax journey this upcoming year.

Now, I am wondering, how is this complicated if one is also performing a 401k rollover into their Roth IRA? Of course I am rolling over entirely into Roth in order to keep the Traditional IRA empty in order to avoid the pro-rata taxation. From what I can tell, I will receive another 1099-R from the old 401k provider and report it as income, but how will this change how I fill in Form 8606 in this complicated situation?

Harry Sit says

It doesn’t change anything with regard to backdoor Roth. A 401k distribution goes on a different line on Form 1040. It doesn’t use Form 8606. For a preview of how to report a 401k distribution rolled over to a Roth IRA, see How to Enter Mega Backdoor Roth in FreeTaxUSA except Box 5 on your 1099-R is blank or zero when the 401k is all pre-tax money.

James says

Followed the instructions, and checked multiple times, but line 8 and 16 are empty when reviewing 8606. Any idea or suggestions? Thank you!

Harry Sit says

Line 16 being empty means it didn’t count as a conversion. What’s the code in Box 7 on your 1099-R? Did you check the IRA/SEP/SIMPLE box and say it was a conversion?

James says

Code 2 on box 7 and Yes the box is checked.

Box 16 is filled, 8 is blank, which based on some reading, could be ok, since there is an * and the comment “*From Worksheet 1-1 in Publication 590 B” at the bottom of form 8606.

Harry Sit says

That’s fine. Originally you said Line 16 was empty. That would be a problem.

Chris says

Awesome guide. Love the specificity. It would be great to add a small section on Spousal IRAs and the chance to make spouse’s contributions deductible. There are chances for a couple to have one person with non-deductible contributions due to MAGI and a non-working spouse with full deductible contributions.

Sammy says

Not sure what I’m missing. In 2024, contributed 6500 for 2023, and 7000 for 2024. $13.5k total. What steps should I do to report this? It keeps saying I’ve over contributed and added $3k in taxes owed.

Learned my lesson — keeping it clean going forward!

Sammy says

(And converted all 13.5k in 2024)

Harry Sit says

This is the right guide for you. Because you didn’t have a recharacterization, follow everything starting from the heading “1099-R for Conversion.”

julius says

Had a 6500 contribution for 2023 in early 2024, and a 7000 “clean” contribution for 2024 at the same time. I followed the part 1 steps last year, and the part 2 steps above just now – everything matches except my return preview box 4a shows 20,506 – not (as I would expect) 13,506, the amount from my rollover 1099r. Any ideas what I did wrong?

julius says

Update: I got confused and started with “1099-R for Recharacterization”, even though I had a Conversion, not Recharacterization, last year. Re-reading the example text helped though it wasn’t quite clear which mapped to which section

Removing the “Recharacterization” entry of my 1099R code N (N, NOT R as the guide expected, because it’s not for a Recharacterization) made my numbers line up as expected. Confusing that apparently I don’t do anything with this code N 1099R?

Harry Sit says

1099-R Code N is for recharacterization in the same year. If you have two 1099-R forms, one code N and one code 2, your 2024 wasn’t completely clean but it’s OK. See Backdoor Roth in FreeTaxUSA: Recharacterize & Convert, Same Year for what to do with the 1099-R code N.

CH says

On Form 8606, line 8 is empty, line 13 is the amount of line 3 minus line 14 (i.e., mirrors line 17), and line 16 is the is the amount on my 1099-R (with code 2). Thank you for the detailed walkthrough!

Jason Smith says

Looking for clarification on this piece “If you had a few dollars of earnings posted in the Traditional IRA after you converted and you left them in the account, get the value from your year-end statement and put it in the second box. The software will apply the pro-rata rule.” I contributed 2k in 2024, then 5k in 2025 that i converted for 2024 (dirty year 1 split) which i did. I converted the full amount in 2024 however $8.50 div payment came in after i conversted and has been sitting there. How do I handle that $8.50? Im in year 2 of dirty and will so start clean (do 2025 contribution and conversion here in dec 2025). Can i still contribute full $7000 and convert everything there so $7008.5? Does that change how i report? the existing $8.5 is throwing me off. Thanks for this great blog!!!!

Harry Sit says

You contributed $2,000 for 2024 in 2024. You didn’t convert in 2024. This was split-year Year 1.

You contributed $5,000 for 2024 in 2025 (split-year Year 1 again). You converted $7,000 earlier in 2025. This is split-year Year 2. You will follow this post in 2026 when it’s updated for the 2025 tax year.

You received $8.50 after the conversion above in 2025. If you don’t do anything else and let the $8.50 stay until 12/31/2025, you will enter $8.50 in that second box.

You’re also planning to do a clean backdoor Roth on top for 2025. You will contribute $7,000 and convert $7,008.50. The $8.50 will be treated in the same way as the $200 in earnings in this post. It doesn’t matter whether it’s earned on your old contribution or new contribution.

After you convert $7,008.50, you may still receive a late dividend. Suppose it’s $1.10. You can convert this $1.10 again in 2025. If you let it sit past 12/31/2025, then you will enter the $1.10 in that second box.