[Updated on January 26, 2026 with updated screenshots from FreeTaxUSA for the 2025 tax year.]

The best way to do a backdoor Roth is to do it “clean” by contributing *for* and converting in the same year — contribute for 2025 in 2025 and convert in 2025, and contribute for 2026 in 2026 and convert in 2026. Don’t split them into two years: contribute for 2024 in 2025 and converting in 2025, or contribute for 2025 in 2026 and convert in 2026. If you did a “clean” backdoor Roth and you’re using FreeTaxUSA, please follow How to Report Backdoor Roth In FreeTaxUSA (Updated).

However, many people didn’t know they should’ve done it “clean.” Some people thought it was natural to contribute to an IRA for 2025 between January 1 and April 15, 2026. Some people contributed directly to a Roth IRA for 2025 in 2025 and only found out their income was too high when they did their 2025 taxes in 2026. They had to recharacterize the previous year’s Roth IRA contribution as a Traditional IRA contribution and convert it again to Roth after the fact.

When you contribute for the previous year and convert (or recharacterize and convert in the following year), you have to report them on your tax return in two different years: the contribution in one year and the conversion in the following year. It’s more confusing than a straight “clean” backdoor Roth, but that’s the price you pay for not knowing the right way. This post shows you how to enter the contribution part in FreeTaxUSA for the first year. Split-Year Backdoor Roth in FreeTaxUSA, Year 2 shows you how to do the conversion portion for the second year.

I’m showing two examples — (1) a direct contribution to a Traditional IRA for the previous year; and (2) recharacterizing a Roth contribution for the previous year as a Traditional contribution. Please see which example matches your scenario and follow accordingly.

Contributed for the Previous Year

Here’s the example scenario for a direct contribution to the Traditional IRA:

You contributed $7,000 to a Traditional IRA for 2025 between January 1 and April 15, 2026. You then converted it to Roth in 2026.

Because your contribution was *for* 2025, you need to report it on your 2025 tax return by following this guide. Because you converted in 2026, you won’t get a 1099-R for your conversion until January 2027. You will report the conversion when you do your 2026 tax return. Come again next year to follow Split-Year Backdoor Roth in FreeTaxUSA, Year 2.

If you contributed to a Traditional IRA in 2025 for 2024, everything below should’ve happened in your 2025 tax return. In other words, if this fits you:

You contributed $7,000 to a Traditional IRA for 2024 between January 1 and April 15, 2025. You then converted it to Roth in 2025.

Then you should’ve gone through the steps below in your 2024 tax return. If you didn’t, you should fix your 2024 return. The conversion part is covered in Split-Year Backdoor Roth in FreeTaxUSA, Year 2.

If you’re married and both you and your spouse did the same thing, you must follow the same steps below for both you and your spouse.

If you first contributed to a Roth IRA in 2025 and then recharacterized it as a Traditional contribution in 2026, please jump over to the next example.

Contributed to Traditional IRA

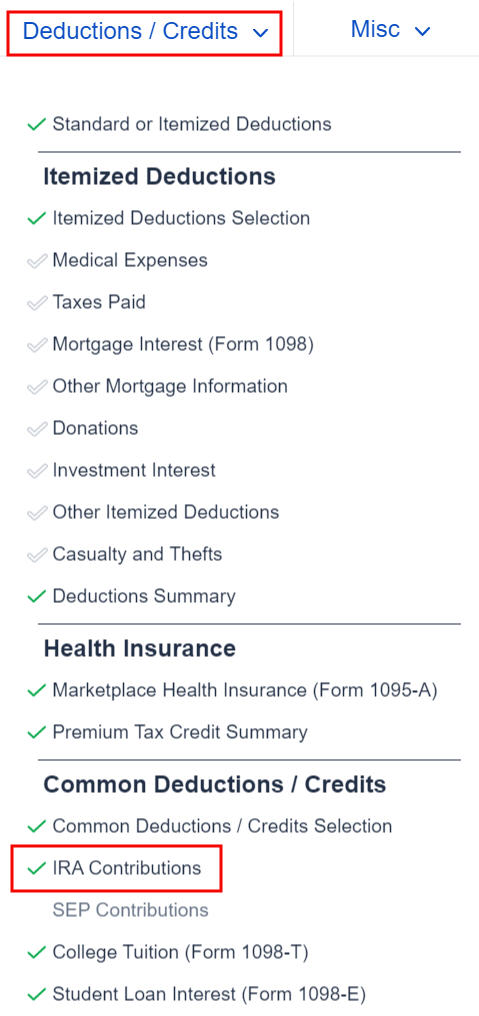

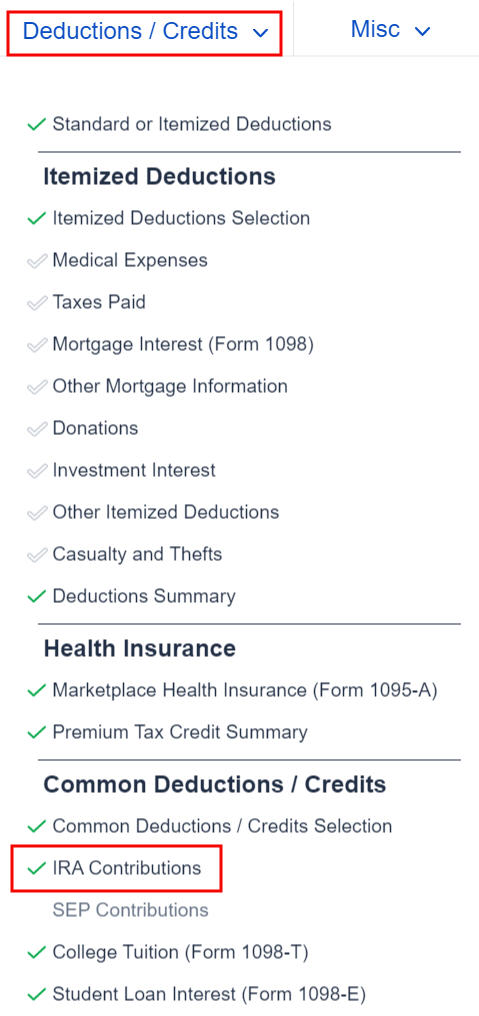

Find the “IRA Contributions” section under the “Deductions / Credits” menu.

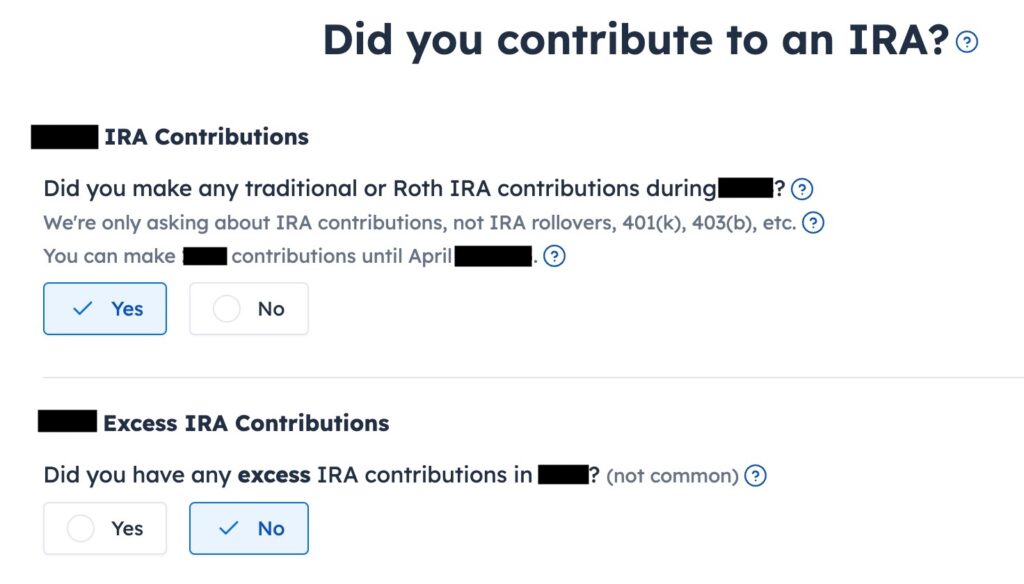

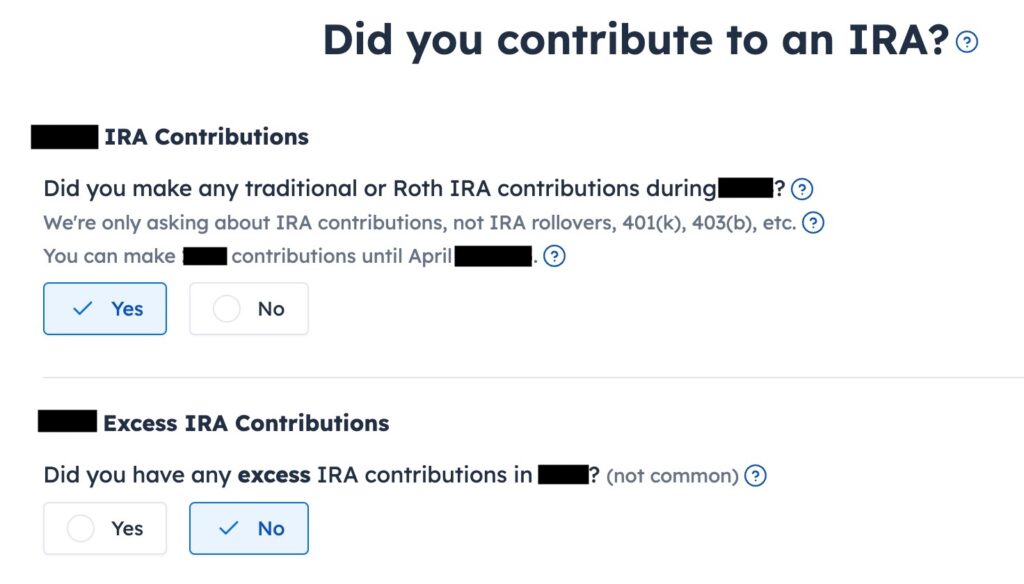

Answer Yes to the first question even though it says “during” 2025 when you contributed “for” 2025 in 2026. An excess contribution means contributing more than you’re allowed to do so. We didn’t have that.

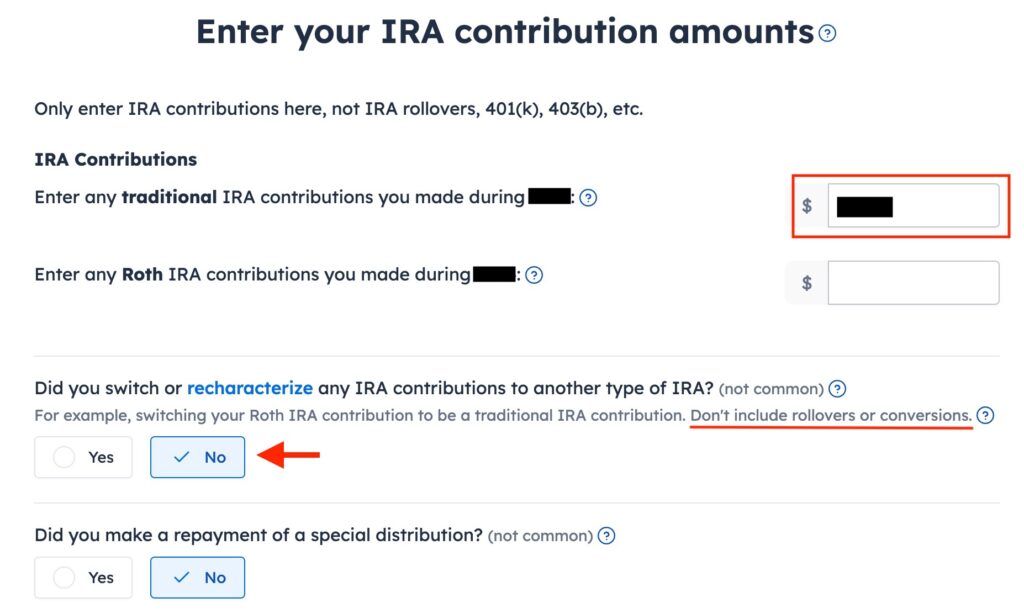

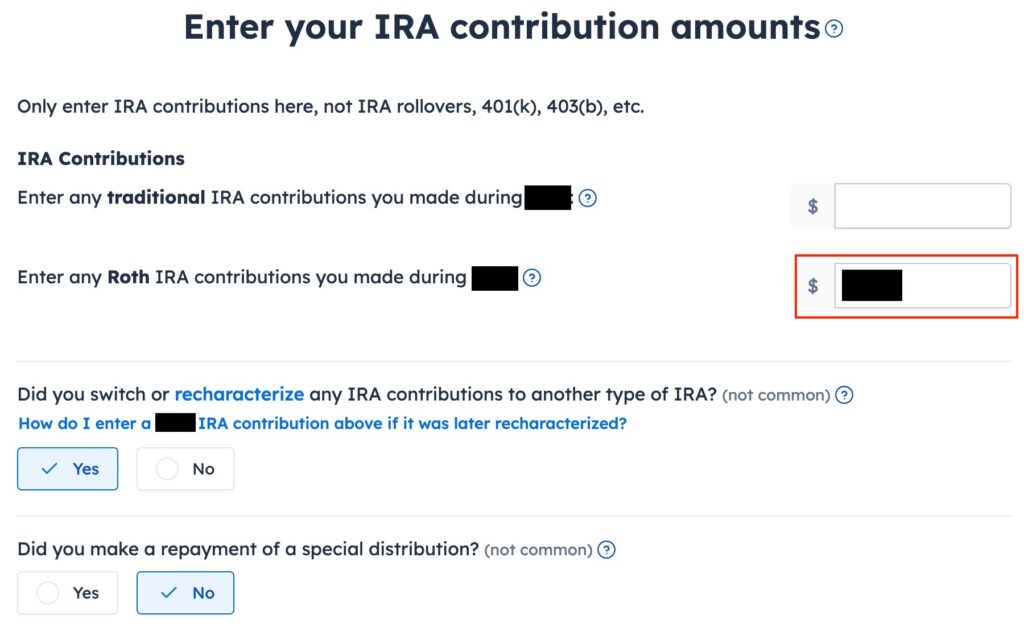

Enter the amount you contributed to the Traditional IRA in the first box. Leave the answer to “Did you recharacterize” at No. We converted. We didn’t switch or recharacterize. We didn’t repay any distribution either.

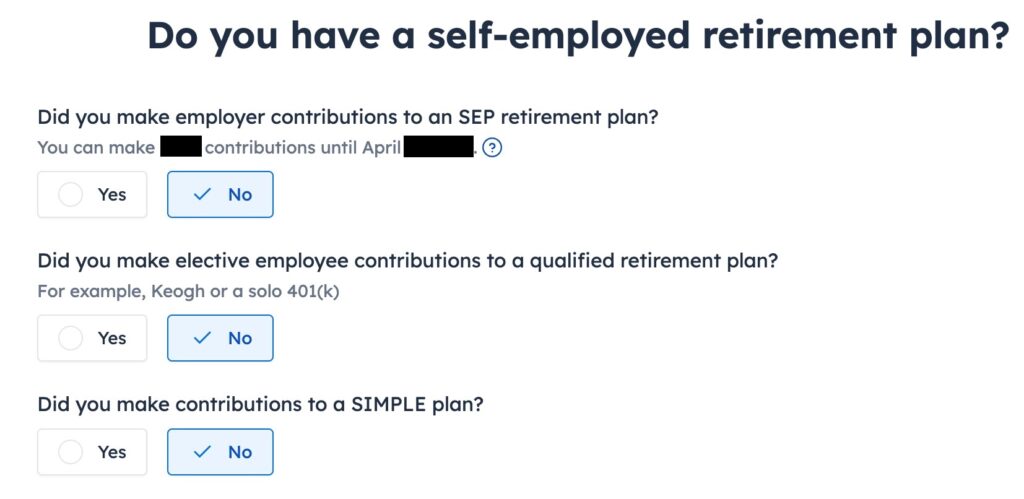

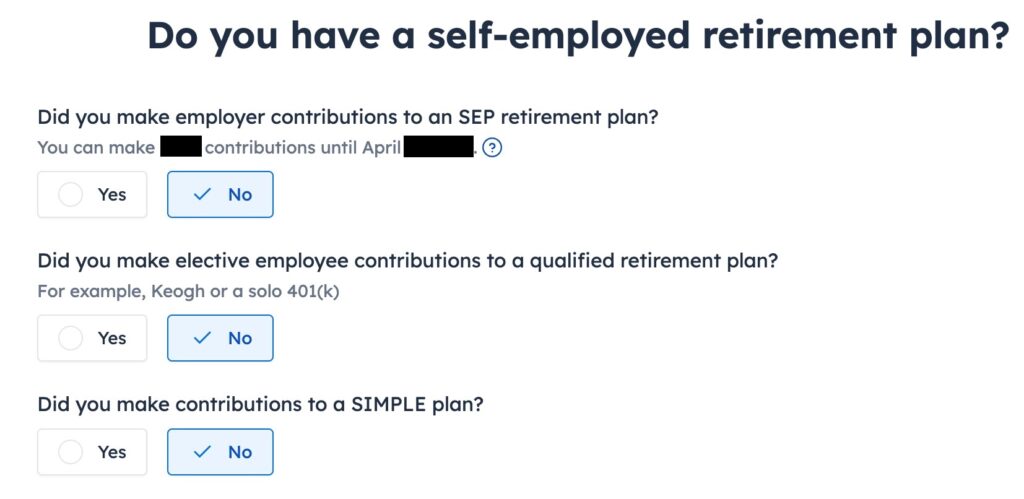

We didn’t contribute to a SEP, solo 401k, or SIMPLE plan. Answer Yes if you did.

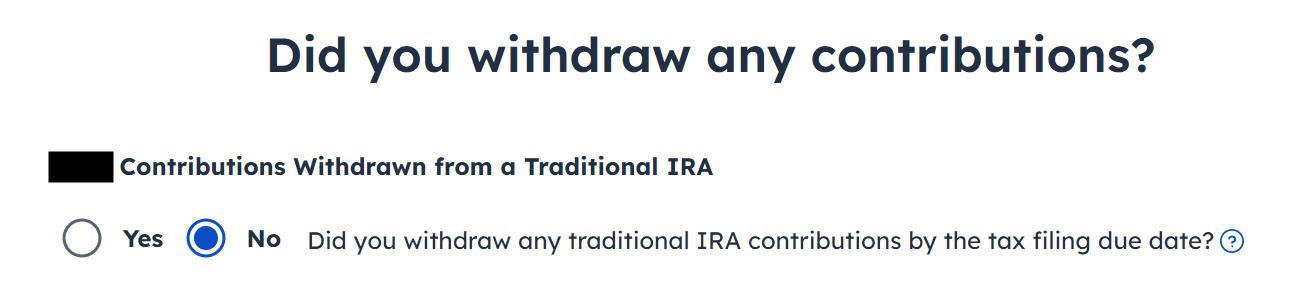

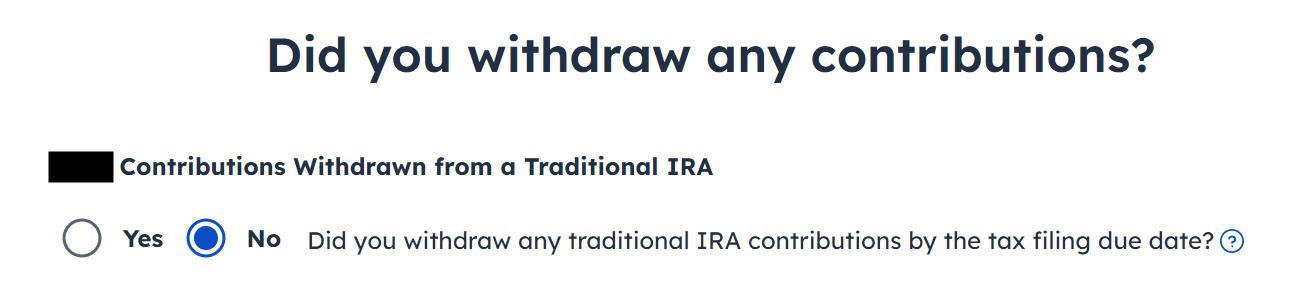

Withdraw means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer “No” here.

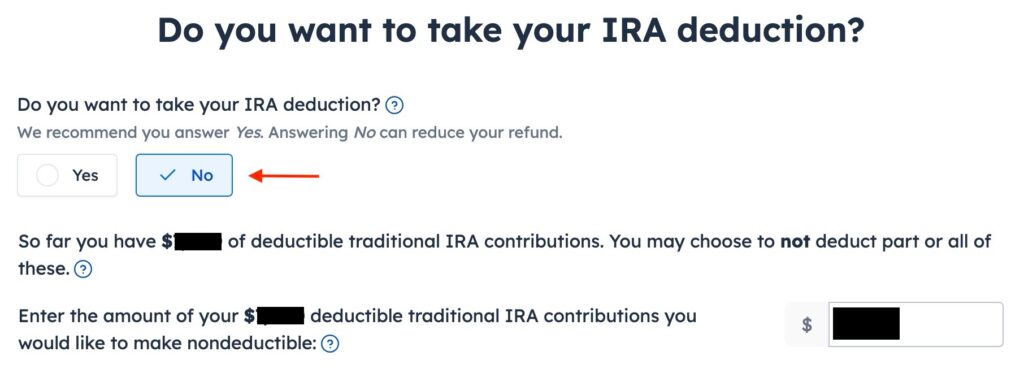

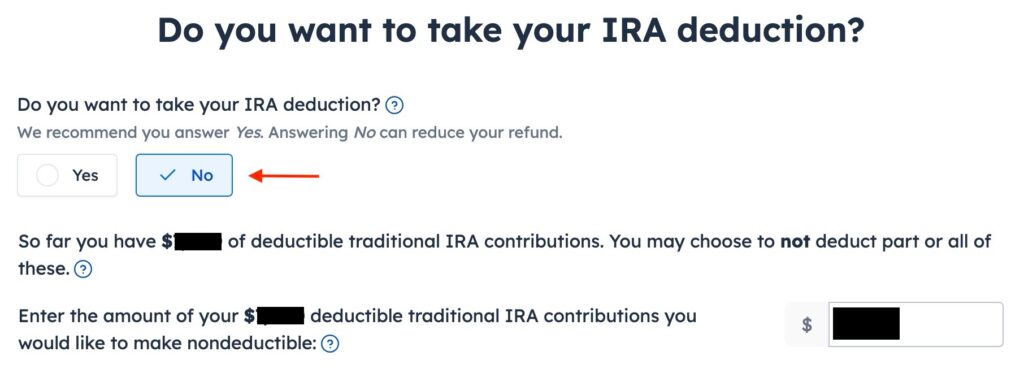

You see this page only if your income falls below the income limit that allows a deduction for your Traditional IRA contribution. You don’t see this if your income is above the income limit. Answering Yes will make your contribution deductible, but it will also make your conversion taxable. Although it works out to a wash in the end, it’s less confusing if you answer “No” here and make the entire amount that could be deducted nondeductible.

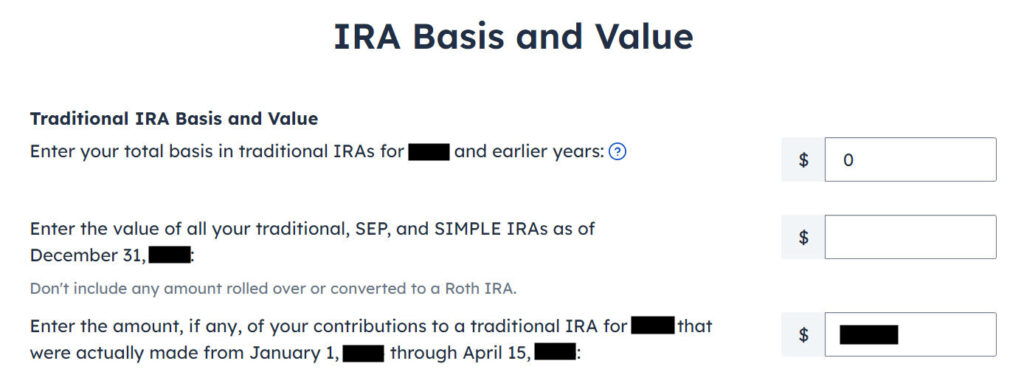

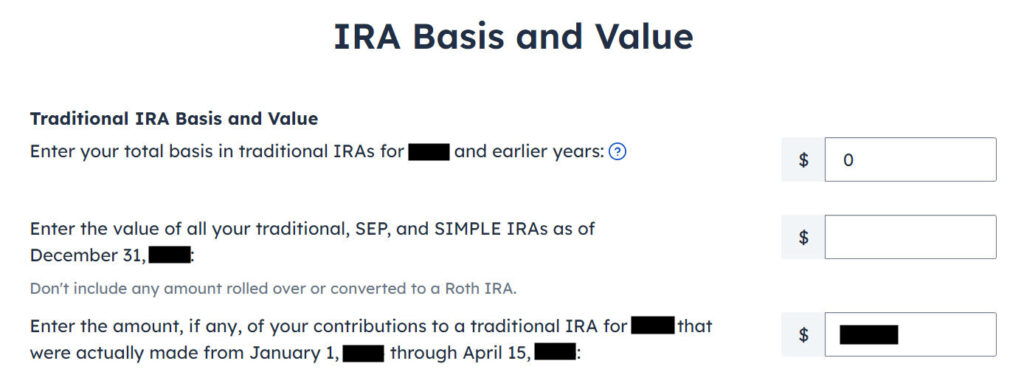

The first box is normally zero if this is the first time you contributed to a Traditional IRA. If you made nondeductible contributions to a Traditional IRA in previous years, get the value from your last year’s Form 8606 Line 14 (assuming you did your tax return correctly). If you entered a number in the first box because you didn’t understand what it was asking, now is the chance to correct it.

The second box is also blank or zero when you had no Traditional, SEP, or SIMPLE IRA as of December 31, 2025. If your account posted a small amount of earnings after you converted and you left it there, enter the value from your year-end statement in this second box.

Enter your contribution in the third box because you did it between January 1 and April 15, 2026.

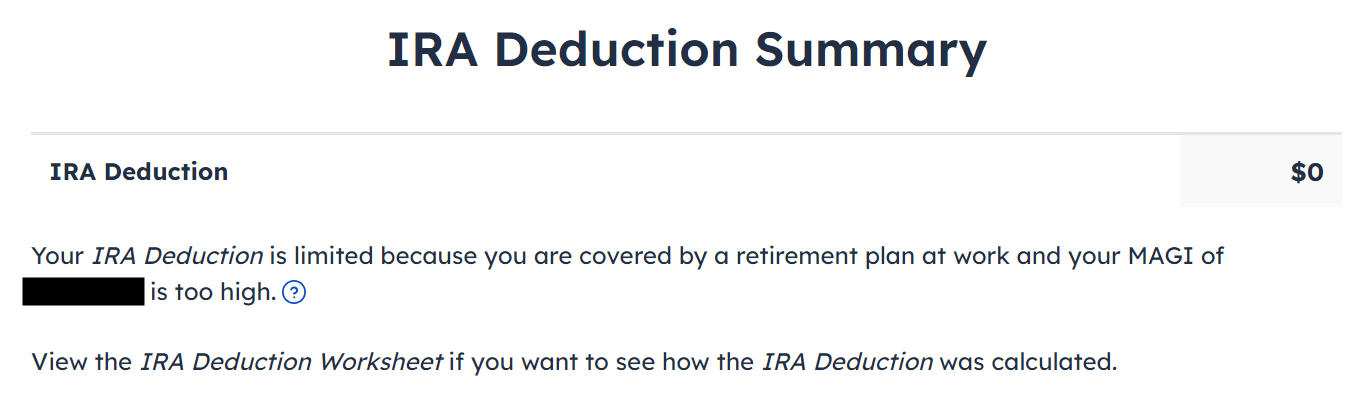

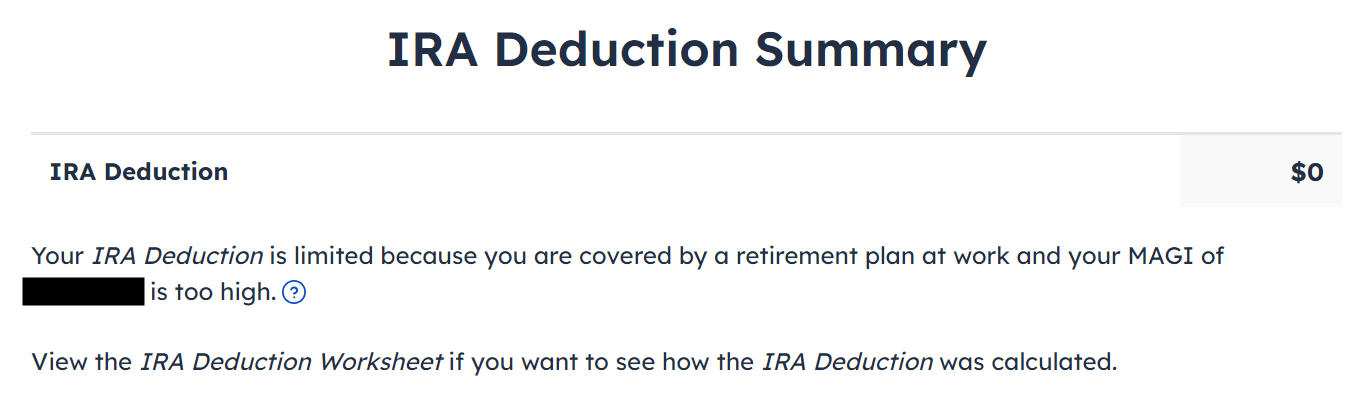

It tells us we don’t get a deduction because our income was too high or because we chose to make our contribution nondeductible. We know. That’s why we did the Backdoor Roth.

Form 8606

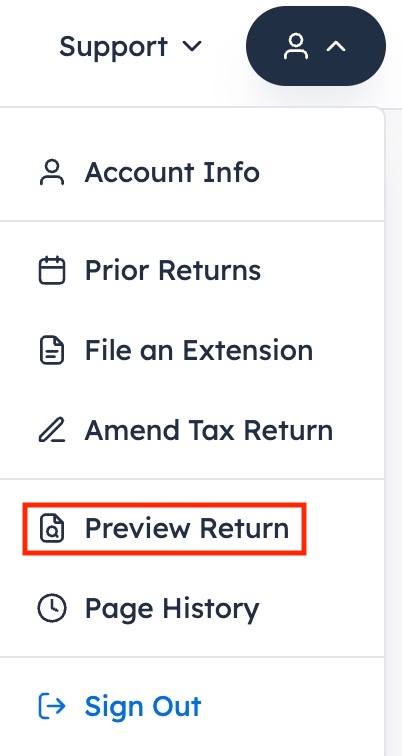

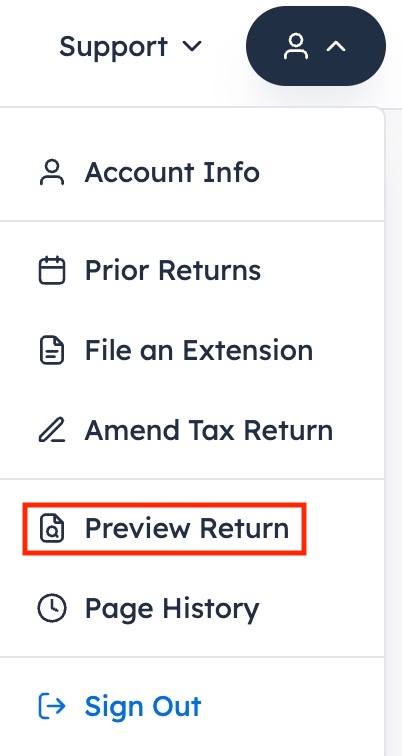

Let’s look at Form 8606 to confirm that it did everything correctly. Click on the head icon at the top right and then click on “Preview Return.”

Scroll toward the end of the tax forms to find Form 8606. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number on Line 14. This number will carry over to 2026. It’ll make your conversion in 2026 not taxable.

If you don’t see a Form 8606 or if your Form 8606 doesn’t look right, please check the Troubleshooting section.

Break the Cycle

While you’re at it, you should break the cycle of contributing for the previous year and create a new habit of contributing for the current year. Contribute to a Traditional IRA for 2026 in 2026 and convert in 2026.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2025 contribution and your 2026 contribution in 2026. Then you will start 2027 fresh. Contribute for 2027 in 2027 and convert in 2027.

Recharacterized Roth Contribution

Let’s look at our second example scenario now.

You contributed $7,000 to a Roth IRA for 2025 in 2025. You realized that your income was too high when you did your 2025 taxes in 2026. You recharacterized the Roth contribution for 2025 as a Traditional contribution before April 15, 2026. The IRA custodian moved $7,100 from your Roth IRA to your Traditional IRA because your original $7,000 contribution had some earnings. Then you converted it to Roth in 2026.

Because your contribution was for 2025, you need to report it on your 2025 tax return by following this guide. Because you converted in 2026, you won’t get a 1099-R for your conversion until January 2027. You will report the conversion when you do your 2026 tax return. Come back again next year to follow Split-Year Backdoor Roth in FreeTaxUSA, Year 2.

Similar to our first example, if you did the same in 2025 for 2024, you should’ve done everything below when you did your 2024 taxes. In other words, if this fits you:

You contributed $7,000 to a Roth IRA for 2024 in 2024. You realized that your income was too high when you did your 2024 taxes in 2025. You recharacterized the Roth contribution for 2024 as a Traditional contribution before April 15, 2025. The IRA custodian moved $7,100 from your Roth IRA to your Traditional IRA because your original $7,000 contribution had some earnings. Then you converted it to Roth in 2025.

Then you should’ve taken all the steps below last year in your 2024 tax return. If you didn’t, you need to fix your 2024 return. The conversion part is covered in Split-Year Backdoor Roth in FreeTaxUSA, Year 2.

Contributed to Roth IRA

Find the IRA Contributions section under the “Deductions / Credits” menu.

Answer “Yes” to the first question. An excess contribution means contributing more than you’re allowed to contribute. We didn’t have that.

Enter your contribution in the second box because you originally contributed to a Roth IRA. Answer “Yes” to “Did you switch or recharacterize.” We didn’t repay any special distribution.

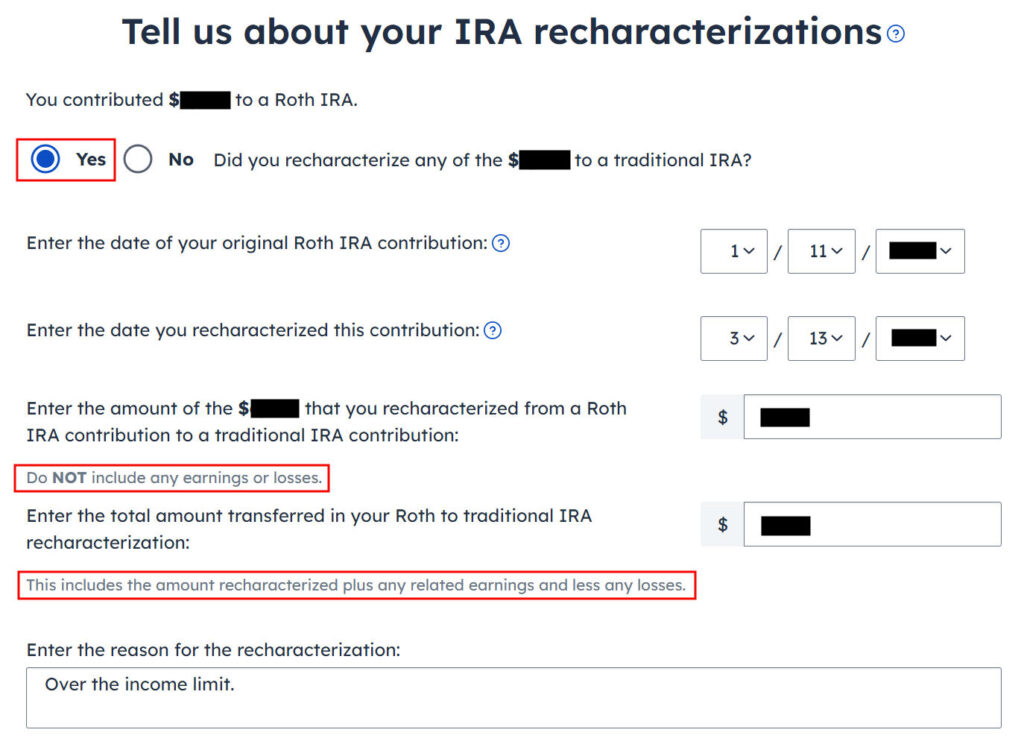

Recharacterized to Traditional

Select “Yes” to confirm you recharacterized a contribution. It opens up additional inputs for a statement required by the IRS. If you recharacterized 100% of your original contribution, enter it in the first box. It’s $7,000 in our example. We enter $7,100 from our example in the second box, which is the amount that the IRA custodian moved from the Roth IRA to the Traditional IRA when we recharacterized.

We didn’t contribute to a SEP, solo 401k, or SIMPLE plan. Answer Yes if you did.

Withdraw means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer “No” here.

You see this page only if your income falls below the income limit that allows a deduction for your Traditional IRA contribution. You don’t see this if your income is above the income limit. Answering Yes will make your contribution deductible, but it will also make your Roth conversion taxable. You’ll pay less tax this year and more tax next year. It’s less confusing if you answer “No” here and make the entire amount that could be deducted nondeductible.

All three boxes should normally be blank or zero.

The first box is normally zero when you didn’t make any nondeductible contributions to a Traditional IRA in previous years. If you did, get the value from your last year’s Form 8606 Line 14 (assuming you did your tax return correctly). If you entered a number in the first box because you didn’t understand what it was asking, now is the chance to correct it.

The second box is also blank or zero when you had no Traditional, SEP, or SIMPLE IRA as of December 31, 2025. If your account posted a small amount of earnings after you converted and you left it there, enter the value from your year-end statement.

The third box is also blank or zero because you made the original contribution in 2025. Recharacterizing makes it as if you contributed to a Traditional IRA to begin with.

It tells us we don’t get a deduction because our income was too high or because we chose to make our contribution nondeductible. We know. That’s why we did the Backdoor Roth.

Form 8606

Let’s look at the Form 8606 to confirm that it did everything correctly. Click on the head icon at the top right and then click on “Preview Return.”

Scroll toward the end of the tax forms to find Form 8606. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2026. It’ll make your conversion in 2026 not taxable.

If you don’t see a Form 8606 or if your Form 8606 doesn’t look right, please check the Troubleshooting section.

Switch to Clean Backdoor Roth

While you are at it, you should switch to a clean backdoor Roth for 2026. Rather than contributing directly to a Roth IRA, seeing that you exceed the income limit, recharacterizing it, and converting it again, you should simply contribute to a Traditional IRA for 2026 in 2026 and convert it to Roth in 2026 if there’s any possibility that your income will be over the limit again.

You’re allowed to do a clean backdoor Roth even if your income ends up below the income limit for a direct contribution to a Roth IRA. It’s much simpler than the confusing recharacterize-and-convert maneuver.

You’re allowed to convert more than once in the same year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2025 contribution and your 2026 contribution in 2026. Then you will start 2027 fresh. Contribute for 2027 in 2027 and convert in 2027.

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

No 1099-R

You get a 1099-R only if you converted to Roth in 2025. When you only converted in 2026, you won’t get a 1099-R until January 2027. This is normal. You do the conversion part next year by using Split-Year Backdoor Roth in FreeTaxUSA, Year 2.

Contribution Is Deductible

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. FreeTaxUSA gives you the option to take a deduction if it sees that you qualify. Taking this deduction also makes your Roth conversion taxable. You’ll pay less tax this year and more tax next year. It’s less confusing if you decline the deduction by answering “No” on the “Do you want to take your IRA deduction?” page.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

TR says

This is great, thank you so much for these posts! As I had to do a split-year for my 2022 contribution, I’ll be waiting eagerly for part 2 of this post. Hope it comes out before the April 15 tax deadline <3

Harry Sit says

Part 2 is out now in Split-Year Backdoor Roth IRA in FreeTaxUSA, 2nd Year.

Dylan Zhang says

This is incredibly helpful as I have been wracking my brain trying to fill out my tax forms correctly.

I did notice what I believe to be a typo, though.

You contributed $7,000 to a Roth IRA for 2024 in 2024. You realized that your income was too high when you did your 2024 taxes in 2025. You recharacterized the Roth contribution for 2024 as a Traditional contribution before April 15, 2025. The IRA custodian moved $7,100 from your Roth IRA to your Traditional IRA because your original $7,000 contribution had some earnings. Then you converted it to Roth in 2024.

I believe you had meant to state “Then you converted it to a Roth in 2025” ?

Thank you again.

Harry Sit says

Thank you for spotting the typo in the second example. I corrected it.

Simon says

I can’t say “thank you” enough! This clearly written post saved my life 🙂

John says

These posts have been so helpful

For the second scenario, I am reading that if the recharacterization is done before tax day (Roth to Traditional), that the contribution to the first IRA (Roth) can be effectively ignored.

Would you know if this is correct and we can go down the route of the first scenario in these cases?

Thank you!

Harry Sit says

Financially, recharacterizing makes as if you contributed to the Traditional IRA to begin with. What you read referred to that aspect, but not the tax filing angle. The IRS requires a statement in your tax filing to explain your rechaterization. Only following the steps for the second example will generate that required statement. Therefore you can’t go down the route of the first scenario when you have the second scenario.

Alex says

Great guide. Makes it much clearer what the purpose is, and love the multiple scenarios. But, for doing a split year conversion for filing year 2025 (filed in 2026), I am seeing not only lines 1, 3, 14, but also line FOUR (4) filled out. I believe this is how it should be, as I followed the instructions here, and the lines on the form itself make sense to include filling out Line 4. Is this a typo, or am I missing/misunderstanding a piece?

Harry Sit says

I went through the steps again. If you only contributed in 2026 for 2025, the 8606 only shows lines 1, 3, and 14. The actual form asks in a box under Line 3 “In 2025, did you take a distribution from a traditional IRA, or make a Roth IRA conversion?” Taking a distribution from a traditional IRA means withdrawing from it. If you answer No because you didn’t do either, the form sends you directly to Line 14. “Enter the amount from line 3 on line 14. Do not complete the rest of Part I.”

That said, if you only have an extra Line 4, I don’t see any harm from it. I don’t know how you made the software do it though.