Although I believe a traditional deductible IRA is often better than a Roth IRA, a Roth IRA is still better than a taxable account if you aren’t eligible for a deductible contribution to a traditional IRA. When you aren’t allowed to contribute to a Roth IRA because your income is too high, there’s still a backdoor. It takes some effort but it’s worth it.

So here it goes: a complete how-to for the Backdoor Roth.

What is the Backdoor Roth?

The Backdoor Roth is an indirect way to contribute to a Roth IRA when you are not eligible to contribute directly due to high income.

Who should consider the Backdoor Roth?

If your income is “too high” for contributing to a Roth IRA, you should consider the Backdoor Roth. The IRS publishes the income limit for contributing to a Roth IRA every year.

If your income isn’t above the thresholds, stop reading — this article doesn’t apply to you. Instead, consider a deductible contribution to a traditional IRA if you qualify for one or contribute to a Roth IRA directly.

Why should someone consider doing the backdoor Roth IRA?

When you have money in a taxable account, you pay taxes on interest and dividends. When you eventually sell the assets, you also pay taxes on the capital gains. If you put money in a Roth IRA, you don’t pay those taxes.

Ready? Here it goes:

Step 1 – “Hide” other IRAs

If you don’t have any traditional IRA (say as the result of a rollover from a previous 401k or 403b), SEP-IRA, or SIMPLE IRA, you are in good shape. Skip to step 2. If you are married, please note IRAs are owned by one and only one person. Each spouse should look at his or her IRAs separately. If you don’t have any traditional IRA, SEP-IRA, or SIMPLE IRA but your spouse does, you are not affected but your spouse is affected.

If you have a traditional IRA, SEP-IRA or SIMPLE IRA, and you don’t mind paying taxes to convert all of them to a Roth IRA now, also skip to step 2. When your balances in those IRAs are small, the taxes you will have to pay when you convert them are also small.

If you have a traditional IRA, SEP-IRA or SIMPLE IRA, but you don’t want to convert them and pay taxes at a high rate just yet, rollover almost all the pre-tax money to an employer sponsored retirement plan: 401k, 403b or 457. Most employer-based plans accept incoming rollovers.

An inherited IRA doesn’t count if you keep it separate as an inherited IRA (see Inherited IRA and Roth Conversion Pro-Rata Rule).

Everything in the traditional IRA, SEP-IRA, and SIMPLE IRA, except any non-deductible contributions you made in the past, is pre-tax money. For example if your traditional IRA has $34,000 in it and you made $10,000 non-deductible contributions in the past, $24,000 is pre-tax money. Move $24,000 to an employer sponsored plan. If you never made any non-deductible contributions in the past, all $34,000 is pre-tax money.

If you’ve made non-deductible contributions to your traditional IRA in the past, a key requirement is that you leave enough money behind in the traditional IRA — at least equal to your past non-deductible contributions. Don’t cut it too close. Consider market fluctuations and leave yourself a small cushion to show that on the day the money goes from your IRAs to your employer plan you still have slightly more money in the IRAs than your past non-deductible contributions.

You are allowed to rollover only pre-tax money from a traditional IRA to an employer plan because of a special rule. Read more about this special rule in IRS Publication 590A. Look for “Tax treatment of a rollover from a traditional IRA to an eligible retirement plan other than an IRA” near the end of page 22.

If your plan doesn’t accept incoming rollovers or if you don’t like your plan, create some self-employment income and set up a solo 401k plan, also known as a self-employed 401k plan or individual 401k plan.

House-sitting, dog-walking, tutoring, helping neighbors set up computer equipment, etc. are all good ways to earn self-employment income. Remember you don’t have to make a living on it. You just need a little self-employment income in order to qualify for setting up a solo 401k plan. See Solo 401k When You Have Self-Employment Income.

Step 2 – Make a non-deductible contribution to a traditional IRA

After Step 1, you either don’t have any traditional IRA, SEP-IRA, or SIMPLE IRA, or you only have a traditional IRA with non-deductible contributions in it (maybe plus a bit of earnings). You make a non-deductible contribution to a traditional IRA. As long as you have earned income, even if your income is “too high,” you can still make a non-deductible contribution to a traditional IRA.

The IRS publishes the contribution limit ever year. Look it up.

Step 3 – Wait

The law does not impose any waiting period between a contribution and a conversion (step 4). However, some are concerned that if you convert too soon, it can be seen as an abuse.

There is no official guideline for how long you should wait. Some say a few days; some say 30 days; some say 6 months; some say wait until the end of the year. Pick a time you feel comfortable with.

Having the money sit in a traditional IRA for a short period of time is not going to kill you. The tax on the earnings won’t be much because you won’t have a lot of earnings.

Step 4 – Convert the traditional IRA to Roth IRA

Ask your IRA provider how to do this. Some can do it online. Some will want a signed form. There is no income limit for the conversion. Because your Roth IRA conversion comes primarily from your non-deductible contributions, there will be very little taxes on the conversion.

Be sure to specify you want to *convert* money in your traditional IRA to a Roth IRA, not *recharacterize* your contribution. The two are not the same. Using the wrong term can lead to bad consequences. See Traditional and Roth IRA: Recharacterize vs Convert.

Also be sure to choose “no tax withholding” for your conversion. This way 100% of the money goes into your Roth account.

Step 1 is necessary because if you didn’t do it, your conversion will be taxed by the percentage of pretax money in all IRAs (the “pro-rata rule”). Money in employer sponsored plans doesn’t count in the pro-rata rule.

Step 5 – Report on your tax return

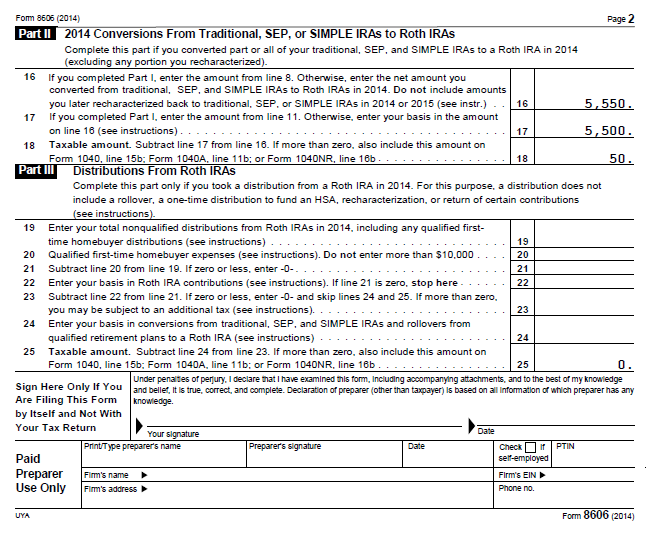

Since you made a non-deductible contribution to a traditional IRA in Step 2, you will need to include Form 8606 when you file your taxes. It’s a very simple form. If you use tax software, it will be included automatically if you answer the questions correctly.

Contributions to an IRA can be tagged for the current year or the previous year (if done before April 15 in the following year). Conversions are always tracked to the calendar year in which it actually happened. You report on the tax return your non-deductible contribution to a traditional IRA *for* that year and your converting to Roth *in* that year. If you contribute for the previous year and then convert, you will have to report in two separate years. It’s much simpler if you contribute for the current year and then convert before December 31. See Make Backdoor Roth Easy On Your Tax Return.

If you use TurboTax, see How To Report Backdoor Roth In TurboTax for a step-by-step guide. If you use H&R Block software, see How To Report Backdoor Roth In H&R Block Software. If you use TaxACT, see How To Report Backdoor Roth In TaxACT. If you use FreeTaxUSA, see

How to Report Backdoor Roth In FreeTaxUSA.

Here’s an filled-out example of Form 8606 produced by TaxACT software. I’m assuming by the time you converted, you had $50 worth of earnings.

Step 6 – Repeat Steps 2 to 5 next year

Step 1 is a one-time task. After it’s completed, you just repeat Steps 2-5 every year.

Most IRA custodians will keep an account open for a year even after the balance goes to zero. In such case next year you just contribute to the same empty traditional IRA and convert into your existing Roth IRA. It’s not necessary to open new accounts.

No Rollover to Traditional IRA

When you are repeating steps 2 to 5 every year, remember not to roll over from an employer-sponsored plan to a traditional IRA in the same year, either before or after you do the Roth conversion. You can leave the money in the original plan, roll over from one plan to another plan, or roll over to your own solo 401k, just not roll over to a traditional IRA. If you must roll over to a traditional IRA, you will have to “hide” it again using Step 1.

Reverse the Order?

Some readers asked about reversing the order: do Step 1 after Step 4 but before December 31 in the same year. I don’t recommend it, even though it works the same on the tax form.

When you roll over from your traditional, SEP or SIMPLE IRA to a qualified plan, you are explicitly allowed to pick pre-tax money only. Not so when you do the conversion; you are not supposed to pick only after-tax money. The tax forms don’t show exact dates. If you reverse the order, you can probably get away with it if you are not audited, but I think it’ll be messier if you must explain to an IRS agent.

It’s too much trouble. Why don’t they just open the front door and let everyone contribute directly to a Roth IRA?

If the front door is wide open and everyone can contribute directly to a Roth IRA, the government will lose too much revenue. The income limit is imposed to reduce the revenue impact. Only those who know about the backdoor and are willing to perform the necessary steps can take advantage of the backdoor Roth IRA. Diligence brings rewards.

Will they close the backdoor?

It’s possible the backdoor will be closed. The President already included in his budget proposal to close it although it’s hard to get it passed by Congress. If you are afraid the backdoor will be closed, you should do it now when the backdoor is still open.

***

Comments are closed because questions are becoming repetitive. Be sure to read existing comments for answers to questions similar to yours.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Brian says

Hi Harry – what is meant by the paragraph:

When you are doing the backdoor Roth IRA, remember not to rollover from an employer-sponsored plan to a traditional IRA in the same year, either before or after you do the Roth conversion. You can rollover from one plan to another plan, or to your own solo 401k, just not to a traditional IRA.

If I did a backdoor Roth earlier in the year, can I rollover my 403b to a traditional IRA and convert it this year?

Harry Sit says

If you rollover 403b to traditional IRA and leave it as traditional IRA until the end of the year, then your Roth conversion done earlier in the year will be taxable subject to the pro-rata rules. What do you mean by “and convert it this year”? If you want your 403b turned into Roth, and pay taxes on it, you can rollover directly to a Roth IRA.

SSG says

I have made non deductible contributions to Trad IRA for the last 3 years. The total is approx $15k. There are no gains in that Trad IRA.

I plan to convert that into a Roth.

As I understand, I first need to roll over my old IRAs into my 401k.

I have losses of $10k in the old IRA.

Is there anyway to harvest those losses?

Should I wait till I have some gains in the Trad IRA that I plan to convert to Roth?

Harry Sit says

Assuming the old IRA is pre-tax money, you have zero basis in it. There isn’t any way to harvest the loss. It will grow in the 401k instead of in the IRA. It’s not necessary to wait until you have some gains in the Trad IRA that you plan to convert to Roth.

Tom Smith says

Harry,

I would like to create a backdoor Roth and move all my non-deductible IRA contributions (aka basis) to the Roth without incurring a tax liability.

I have:

o a traditional IRAs containing tax-deductible contributions

o a SEP-IRA

o an IRA containing non-deductible contributions

o an IRA containing both deductible and non-deductible contributions

o a rollover IRA from a previous employer’s 401k which may (inadvertently) also contain non-deductible contributions

o a solo 401k (which allows rollins)

o a Roth IRA

Can I use the following steps:

1) rollover the entirety of the SEP-IRA and traditional IRA to the solo 401k.

2) rollover only the deductible contributions and any earnings from the IRA containing both deductible and non-deductible contributions to the solo 401k, leaving only the non-deductible contributions.

3) rollover only the deductible contributions and any earnings from the rollover IRA to the solo 401k, leaving only the non-deductible contributions (if any).

4) roll the total of the non-deductible contributions left in the IRAs to the Roth IRA.

5) make a current non-deductible contribution to a traditional IRA, and immeiately rollover to the Roth.

The purpose of the above steps is first to move all deductible contributions to the 401k, leaving only nondeductible contributions behind in each of the accounts; then to move this basis to the Roth; and finally to continue the process of annually Roth rollover contributions. I will need to dig a little to determine the precise amount of non-deductible contributions in each applicable account, so I’m hoping the financial institutions holding the accounts may be able to help me with this. As a check, the total amount I’m able to roll into the Roth should be equal to what was reported in my tax return’s 8606.

Will this plan work?

Harry Sit says

They look like the same steps outlined in the article. Make sure you use the verb “convert” when you talk about going from traditional IRA to Roth IRA. Financial institutions don’t know whether your contributions were deductible or not. If you haven’t tracked your nondeductible contributions on Form 8606 correctly, catch up on those first. Finally, it’s not necessary to push to the exact penny. Having a small amount of pre-tax money in the traditional IRA and converting it together with the nondeductible contributions would be just fine.

Tom Smith says

Thank you, Harry. Reason I may have seemed to redundantly lay out the steps is that I’ve spoken to so-called “tax consultants” — CPAs, mostly — at some at cost (up to $300/hr), and all were ignorant about what you laid out in a rather straightforward manner. I was certainly willing to pay for correct advice, but after reading your blog I should ask for my money back and forward it to you.

Aside from what you laid out in your original piece, are there any timing considerations? e.g., do the conversions from all the IRAs need to occur on the same day? Also, Is the use of the term “convert” distinct from the word “rollover?” If so, what is the difference?

Harry Sit says

A complete how-to means just that. After over 400 comments, it’s indeed complete. Nothing else. The conversions don’t need to occur on the same day.

In the context of IRAs “convert” means going from one type to another type (traditional to Roth). “Rollover” means going from one place to another, keeping the same type. Between an employer plan and an IRA, it’s all “rollover.” Going from a plan to an IRA is a rollover, whether it’s pre-tax to traditional, pre-tax to Roth, or Roth to Roth. Going from an IRA to a plan is also a rollover.

Edward says

Hi Harry,

Im new to investing and had 3 quick questions regarding the back door roth ira. I just opened up a t-ira with vanguard and deposited $5500 into it from my bank ( I didn’t buy any stocks or bonds in it yet). Then a few days later, I called up vanguard and transferred the $5500 from my t-ira to a roth via back door. The only other retirement account I have is an employee sponsored 401k plan and it’s not with Vanguard.

1.) Do I have to worry about the pro rata rule? I’m thinking I will but like you said, it will be minimal.

2.) Will I need to continue transferring from my t-ira to my roth via back door every year or can I just deposit into my roth from my bank, now that my roth is opened…via back door that is.

3.) Why do I need to keep my t-ira at a $0 balance if I did the back door roth? Is there no way I can buy funds for both ira’s at the same time?

Thanks Harry.

Edward says

ok, I just figured out my third question…I forgot the TOTAL contribution for ira’s (traditional + ROTH) is $5500. So since I transferred all the $5500 to my roth, that’s why I need to have my t-ira at zero….thanks.

Mike says

Harry,

As of Dec 31, 2014 I contributed $4600 of the allowable $5500 into my non-deductible ira. I made the remaining $900 contribution in January 2015 (allowed before April 15 2015) and had it characterized as a 2014 contribution, thus making my total 2014 contribution now maxed out at $5500.

I converted all of the previous $4600 into my roth ira before Dec 31, 2014 (the year ended) I now plan on converting the remaining $900 in 2014 contributions in Jan of 2015. On tax form 8606 line 1 it asks to enter all contributions for 2014 even ones made between Jan 15-april 15th 2015. So I put $5500. But line 4 it wants me to enter the $900 in contributions I made between jan and april 15th 2015. And then line 5 wants me to subtract out that $900 contribution and that leaves me with the $4600.

My question is, I categorized those $900 in contributions made in jan 2015 as 2014 and will convert those 2014 contributions in 2015. DO I have to pay take on that $900? Would I be better of changing the $900 back to 2015 and just not max out my 2014 contributions and move on learning a valuable lesson to make sure I max out and convert by dec 31?

Any help would be appreciated

Harry Sit says

It works. Just follow the line-by-line instructions. You will carry the $900 to 2015. Remember to enter it on line 2 next year. The valuable lesson still stays true. Don’t make it more complicated than necessary.

John Thacker says

Looks like President Obama’s budget proposes closing the backdoor. (http://blogs.wsj.com/totalreturn/2015/02/02/obama-would-block-strategies-to-pump-up-roth-iras/?mod=trending_now_4) It certainly won’t pass, though.

Alex says

tl;dr: If I recharacterized undesired Roth conversion done in 2014 back into traditional IRA in Feb 2015, do I still have any tax consequences for 2014 from the previous undesirable Roth conversion?

Detailed steps:

0a. I already had a old pre-tax traditional IRA with Fidelity as a result of rolling over 401(k) from a previous job. I also had an old Roth IRA with Fidelity from the previous job, but that wasn’t touched here, so I don’t think it matters. Neither of these two IRAs had seen any contribution in the last few years.

0b. I exceed the income limits for making a direct contribution to a Roth IRA and for making a tax deductible contribution to a traditional IRA.

1. In December 2014, I made a non-tax-deductible contribution to a new traditional IRA at Vanguard.

2. I then converted the $5500 from this traditional IRA it into a new Roth IRA at Vanguard (the so-called backdoor Roth conversion)

At this point, I unwittingly made some parts of my pre-existing tax deductible traditional IRA taxable. I think this means that I will have to pay tax on some part of it in the tax year 2014 (?), so I took the following steps to avoid that.

3. In Feb 2015, I recharacterized the entirety of my new Vanguard Roth IRA (original + gains) back into the non-deductible traditional IRA at Vanguard.

4. In Feb 2015. I rolled over the entirety of my pre-tax traditional IRA from Fidelity into my current 401(k) at Vanguard. (I think this will allow me to later convert the non-tax-deductible traditional IRA at Vanguard into Roth IRA without any tax consequences).

5. I think this is unrelated, but for the sake of completeness, I also moved my old Roth IRA from Fidelity over to a new Roth IRA at Vanguard.

At this point, I have an empty Roth IRA at Vanguard, a new Roth IRA at Vanguard transferred from Fidelity, a non-tax-deductible traditional IRA at Vanguard (with $5500 + change), and my current 401(k) at Vanguard.

Am I correct in assuming that since I managed to recharacterize the undesirable Roth conversion (in step 3) back to traditional IRA, my old traditional IRA is still fully pre-tax and I don’t have any tax consequences for that action in the tax year 2014? Does Turbotax understand this?

I could not find a good answer for this while searching the interwebs, so any help is deeply appreciated.

Harry Sit says

Recharacterizing the conversion made it as if it never happened. However, you still have to account for on your tax return your non-deductible contribution for 2014. You also need to “explain away” the 1099-R you received for your conversion in 2014. If you answer the question correctly TurboTax will have you attach a statement to say the 1099-R for the conversion shouldn’t count because you recharacterized it before the deadline.

Jim McGrath says

I am considering a backdoor roth conversion in 2015. I have an employer sponsored 401K with flexible investment options, and a single traditional IRA. I plan to move the pre-tax $$ to the 401K. Page 24 of 2014 590a indicates (2nd to last paragraph) states that if I rollover from an IRA to a qualified plan, I need to attach an explanation to my return. What is the best way to do this? I usually efile. Either I can send a paper return, or efile and later file an amended return, or not report at all? I did not see the anything about how to report outside of computing the non-deductible amounts. Thank you.

Harry Sit says

When you enter the rollover in tax software, some software will generate a statement that will go with e-file. Some other software will have you print and mail when you are attaching a statement.

Sidney Lin says

Good info. I always wonder what happens when you lose your job or change jobs.. and you have to move your 401k into a Rollover IRA.

How does this effect the whole process now that you have a IRA and were not able to roll it into a different 401k.

Harry Sit says

You don’t have to move your 401k into a Rollover IRA. You can just keep it there until you have a new 401k that you want to roll into.

Vic says

Harry, I’ll apologize in advance. This whole Roth IRA conversion has been the toughest part for me ever since I started using this backdoor method. I was able to follow your instructions last year and was successful. This year we have some “hair” and and I’m lost.

My wife and I are filing jointly/married. Our MAGI prevents us from contributing to a traditional IRA. I want to contribute $5,500 to a traditional IRA and then convert to Roth IRA for each of us as we’ve done in the past.

My situation hasn’t changed, but my wife’s has. She lost her job in September of 2014 and we rolled over her prior 401K’s into one traditional IRA account, out of which I’ve been making some investments. She also has that old Roth IRA account with some balance.

2 (stupid) questions –

1. IRA being personal (yet us filing jointly), I can still use the backdoor conversion strategy for me, correct?

2. What can I do with my wife’s existing accounts/funds (following your advice above to “hide” in step 1), so that I:

a) don’t create a tax liability and

b) backdoor convert the full $5,500 contribution to her Roth IRA

Thank you in advance.

Vic

Harry Sit says

Both are addressed in the article already. 1) “If you are married, please note IRAs are owned by one and only one person. Each spouse should look at his or her IRAs separately.” 2) She should’ve left her money in her employer’s plan. The article said “No Rollover to Traditional IRA.” The two ways to “hide” it are already listed in Part 1. Wait until she has another employer plan or let her start a business and set up a solo 401k.

Stephanie says

Hi Harry,

First the first time, we have exceeded the MAGI limits for Roth contributions. I have been doing a lot of research to figure out what to do with the now “excess contributions” to both mine and my husbands Roth IRA’s ($4500 each for 2014).

From what I understand in your article, we should convert or re-characterize (are these the same thing?) our ROTH IRA contributions and earnings into a Traditional IRA then convert them back to the ROTH after a few weeks. Do we then close that Traditional IRA? And is this something we can do every year? So we just continue to contribute to the Roth in 2015, 2016, etc., and then do this same back door thing each tax season?

Thanks for your help! Stephanie

Harry Sit says

Convert and recharacterize aren’t the same. It’s important you use the right word. See Traditional and Roth IRA: Recharacterize vs Convert. You recharacterize now to correct your mistake in 2014. In 2015 and thereafter, you follow the steps in this article, including the crucial step 1.

Stephanie says

Thank you so much!! I think I got it 🙂 Could I ask you another question?

What are your thoughts on a TSP or a Roth TSP? My husband is in the Air National Guard part-time. Since we have reached the income level cap for contributing to a Roth IRA would it make more sense for us (from this point forward) to contribute to a TSP or Roth TSP instead of contributing to a traditional IRA and then converting those contributions to a Roth IRA? The TSP has a much higher contribution cap and no income level cap.

Harry Sit says

Yes definitely contribute to the TSP up to the maximum he’s allowed. If you don’t expect a meaningful pension, maybe just the regular TSP.

Brian says

Good morning! First of all, great article and nice comments. Had a question myself about the pro rata rule. When reading the pro rata rules, I see that employer sponsored plans are not included. Would this also include an employer sponsored SIMPLE IRA?

For example, say I am a greater than 2% shareholder (own 50%) in an S Corp. My S Corp has a SIMPLE IRA that I contribute to. My S Corp matches 3%. I don’t have any other IRA’s other than the SIMPLE IRA through my S Corp/employer. Does this account need to be considered for the pro rata rule if I want to setup a traditional IRA, contribute to it, and then convert to a Roth IRA?

Harry Sit says

The SIMPLE IRA is included in the pro-rata rule. See paragraphs and the chart under Step 1.

Brian says

I didn’t think employer sponsored plans counted? If my SIMPLE is with my employer, why would this be included in the pro rata rule? Do you have a source?

Harry Sit says

Brian – The pro rata calculation is done on Form 8606. You can take a look at the form and its instructions. The 3rd bullet under Part I of Form 8606 says “You converted part, but not all, of your traditional, SEP, and SIMPLE IRAs to Roth IRAs …” If you converted your traditional IRA while having a SIMPLE IRA, you fit that description.

Brian says

Harry – I’ve thoroughly reviewed f.8606 and see that one needs to aggregate all IRA’s (trad, SEPs and Simples), however I know there is a rule that says “employer sponsored plans are not included.” If my Simple is with my employer, it leads me to believe that I might not have to include it in the pro rata calc.

Please don’t take this as arguing, rather I’m trying to figure out the correct answer. At face value, I would say to include all trad/simples/sep’s in the pro rata calc, however the “employer sponsored” rule is throwing me off.

Harry Sit says

Brian – All SIMPLE and SEP IRAs have an associated employer. Just having an associated employer isn’t enough. Being an IRA kills the deal. Here’s what the IRS says about SIMPLE IRA:

“A SIMPLE IRA plan (Savings Incentive Match PLan for Employees) allows employees and employers to contribute to traditional IRAs set up for employees.”

There, a SIMPLE IRA is defined as a special type of traditional IRA. Same thing for SEP:

“A SEP plan allows employers to contribute to traditional IRAs (SEP-IRAs) set up for employees.”

They are inherently traditional IRAs. That’s why they are aggregated with other traditional IRAs. They don’t belong to the more narrowly defined employer sponsored [non-IRA] plans.

Bob says

I am currently 75 and am receiving RMDs from my IRA. I would like to perform a backdoor Roth this year after I take my RMD, since I have a large after-tax balance included in my traditional IRA. I can’t make any further IRA annual contributions, but that is okay. Other than that, is there any limitation or restriction on a backdoor Roth due to my age?

Harry Sit says

Bob – Backdoor Roth in this article refers to getting new money into Roth IRA when the income is too high for a direct contribution to Roth IRA. You are referring to moving existing after-tax money in a traditional IRA to Roth through a conversion. There’s no age limit. You will be doing steps 1, 4, and 5, skipping steps 2 and 3.

Bob says

Thanks, Harry. Thanks for clarifying the distinction when skipping steps 2 & 3. Will still be a worthwhile move for me.

Remuel says

in roth conversions, do we pay taxes only for earnings [capital gains, dividends]?

How about market appreciation or unrealized gains?

Harry Sit says

Remuel – Everything above your basis is taxable.

Remuel says

Thanks Harry,

if i placed non deductible 6500 on traditional IRA last year, and now its worth 7500 mostly from unrealized gains, would I be taxed for the 1000 dollars?

Harry Sit says

Remuel – Yes, if you convert the $7,500 now. And you will be taxed on more than the 1000 dollars if you have other traditional, SEP, or SIMPLE IRAs and you don’t follow the steps in this article.

Bob says

I don’t fully understand. If the original contribution was used to buy securities for $6500, and they are worth $7500 now, wouldn’t the securities need to be sold within the IRA before performing Step 1? Other than that I don’t see how only the unrealized gains could be transferred into a Qualified Retirement Plan.

Harry Sit says

Bob – I think Remuel was talking about just doing a straight conversion. For only $1,000 it’s probably not worth separating it out and transferring to a qualified plan.

Bob says

Thanks, now I understand. Does that mean that when a Traditional IRA holding securities is converted to Roth the value is the conversion is the fair market value of the securities on the date of conversion? Would this then be the value to be entered on form 8606 line 16?

Harry Sit says

Bob – Yes.

Remuel says

Harry, I dont have other IRA’s. Would you recommend converting it now? Is there a strategy to minimize tax hit for roth conversions? Shall I wait for market depreciation?

Harry Sit says

No idea. If you wait the $7,500 may become $8,500 or $9,500. If the market crashes soon after you convert, there is a window during which you can “undo” the conversion with a recharacterization, but then you are restricted from reconverting it until a blackout period passes. Besides more paperwork, by the time the blackout clears, the value may recover back to $7,500 or even higher again. So don’t count on the “undo” as the magic bullet.

Remuel says

Harry,

I’m thinking of doing partial conversions throughout the year timing it with pullbacks considering the volatility of the markets.

Any thoughts about this?

Or would you rather make a one time conversion and get it over with?

Also, I’m planning to make monthly conversions for 2015, can I also make monthly ROTH conversions?

Harry Sit says

Remuel – That’s completely your call. You can convert monthly if you don’t mind doing it. No idea whether it will result in more taxes or less taxes in the end.