Last updated on January 24, 2026 with all new screenshots from TurboTax Deluxe desktop software for the 2025 tax year. If you use other tax software, see:

If you did a Backdoor Roth, which involves making a non-deductible contribution to a Traditional IRA and then converting from the Traditional IRA to a Roth IRA, you must report both the contribution and the conversion in the tax software. This post gives you a step-by-step walkthrough of how to do it in TurboTax. For more information on Backdoor Roth in general, see Backdoor Roth: A Complete How-To.

What To Report

You report on the tax return your contribution to a Traditional IRA *for* that year, and you also report your conversion to Roth *during* that year.

For example, when you are doing your tax return for 2025, you report the contribution you made *for* 2025, whether you actually did it during 2025 or between January 1 and April 15, 2026. You also report your conversion to Roth *during* 2025, whether the contribution was made for 2025, 2024, or any previous years.

Therefore, a contribution made during 2026 for the year 2025 goes on the tax return for 2025. A conversion done during 2026 after you contributed for 2025 goes on the tax return for 2026.

You do yourself a big favor and avoid a lot of confusion by making your contribution for the current year and finishing your conversion in the same year. I call this a “planned” Backdoor Roth or a “clean” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for 2025 in 2025 and convert it during 2025. Contribute for 2026 in 2026 and convert it during 2026. Everything is clean and neat this way.

If you are already off by one year, it depends on whether you’re handling the contribution part or the conversion part right now. If you contributed to a Traditional IRA for 2025 in 2026 and converted in 2026, or if you recharacterized a 2025 Roth contribution in 2026 and converted in 2026, please follow Split-Year Backdoor Roth IRA in TurboTax, Year 1. If you contributed to a Traditional IRA for 2024 in 2025 and converted in 2025, or if you recharacterized a 2024 Roth contribution in 2025 and converted in 2025, please follow Split-Year Backdoor Roth IRA in TurboTax, Year 2. If you recharacterized your 2025 Roth contribution in 2025 and converted in 2025, please follow Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year.

Use TurboTax Desktop Software

The screenshots below are from TurboTax Deluxe desktop software. The desktop software is both more powerful and less expensive than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax desktop software from Amazon, Costco, Walmart, etc., and switch from TurboTax Online to TurboTax desktop software (see instructions for how to make the switch from TurboTax).

Here’s the planned “clean” Backdoor Roth scenario we will use as an example:

You contributed $7,000 to a traditional IRA for 2025 in 2025. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2025, the value grew to $7,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you will have to make some adjustments to the screens shown here.

Before we start, suppose this is what TurboTax shows:

We will compare the results after we enter the Backdoor Roth.

Convert Traditional IRA to Roth

The tax software works on income items first. Even though the conversion happened after the contribution, we enter the conversion first.

When you convert from a Traditional IRA to a Roth IRA, you will receive a 1099-R form. Complete this section only if you converted *during* 2025. If you only converted during 2026, you won’t have a 1099-R until next January. Please follow Split-Year Backdoor Roth IRA in TurboTax, Year 1. If your conversion during 2025 was against a contribution you made for 2024 or a 2024 contribution you recharacterized in 2025, please follow Split-Year Backdoor Roth IRA in TurboTax, Year 2.

In our example, we assume that by the time you converted, the money in the Traditional IRA had grown from $7,000 to $7,200.

Enter 1099-R

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

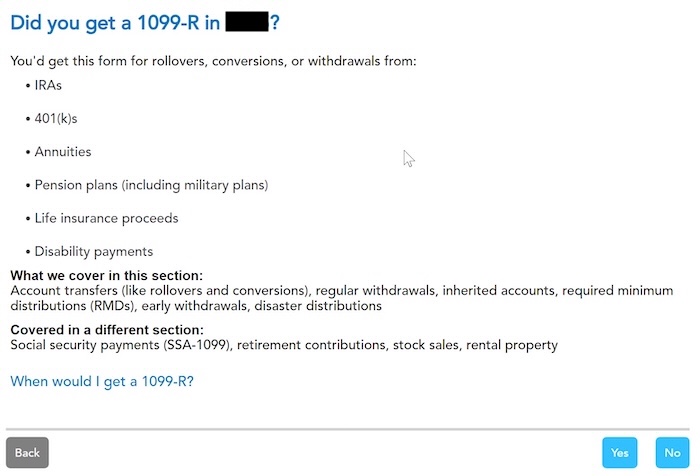

As you work through the interview, you will eventually come to the point of entering the 1099-R. Select Yes, you got a 1099-R. Import the 1099-R if you’d like. I’m choosing to skip import and type it myself.

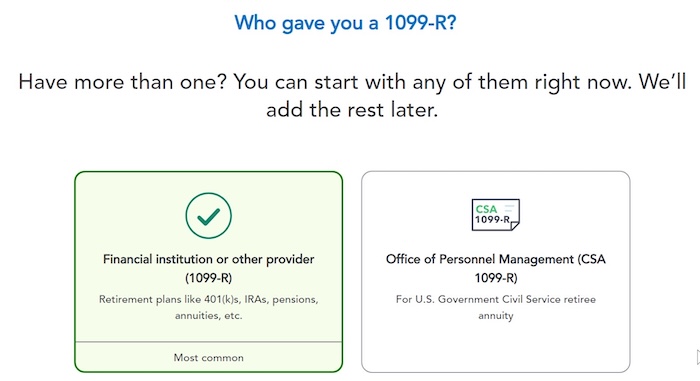

You got it from a financial institution. Enter the payer information as shown on your 1099-R.

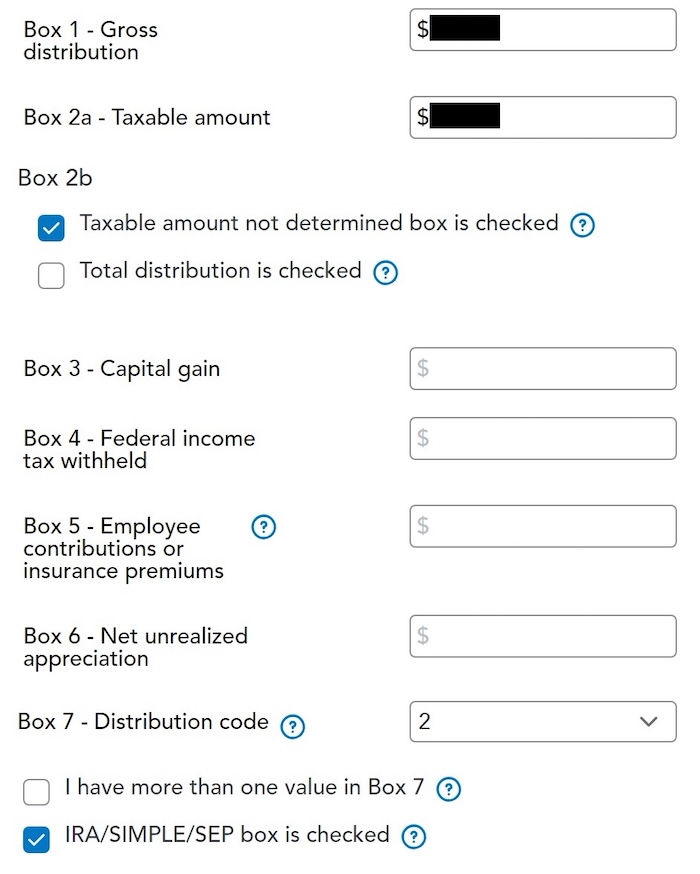

Box 1 shows the amount converted to the Roth IRA. It’s $7,200 in our example. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked saying “taxable amount not determined.” The total distribution box may or may not be checked. It doesn’t matter.

Pay attention to the code in Box 7 and the IRA/SEP/SIMPLE box. Make sure your entry matches your 1099-R exactly. The code in Box 7 should be 2 if you’re under 59-1/2 and 7 if you’re over 59-1/2. The IRA/SIMPLE/SEP box should be checked.

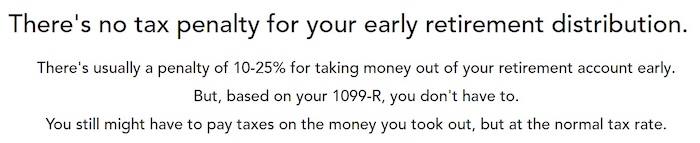

You get this Good News, but …

Your refund in progress drops a lot. We went from $2,384 down to $858. Don’t panic. It’s normal and temporary.

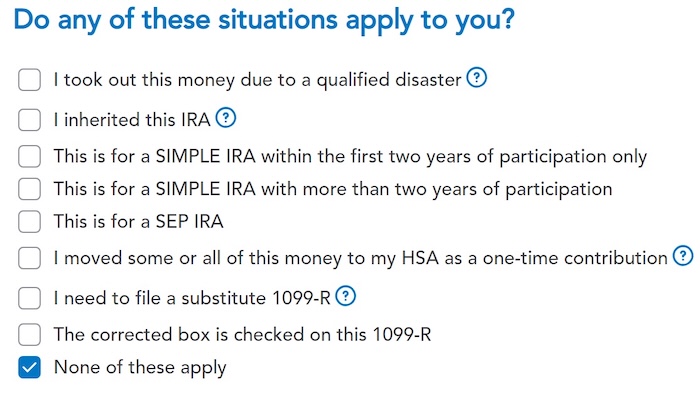

None of these should apply in a usual backdoor Roth.

Converted to Roth

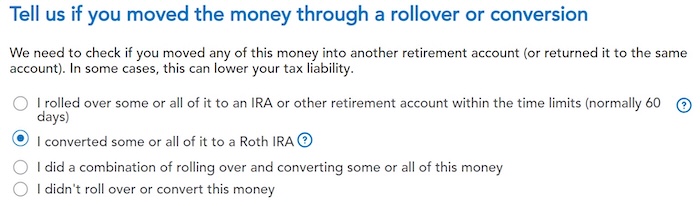

Choose “I converted some or all of it to a Roth IRA.” Don’t choose the “I rolled over …” option. A Roth conversion is not a rollover.

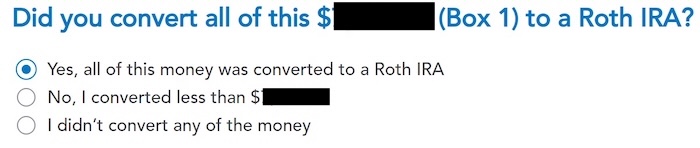

Yes, you converted all of it.

You get a summary of your 1099-Rs next. Repeat the previous steps to add another if you have more than one. If you’re married and both of you did a Backdoor Roth, enter the 1099-R for both of you, but pay attention to select whose 1099-R it is. Don’t accidentally assign two 1099-R forms to the same person.

Basis

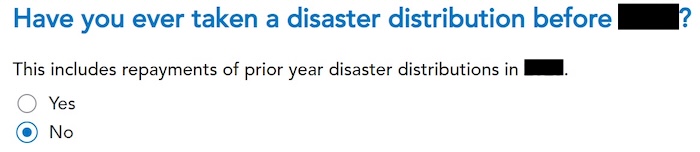

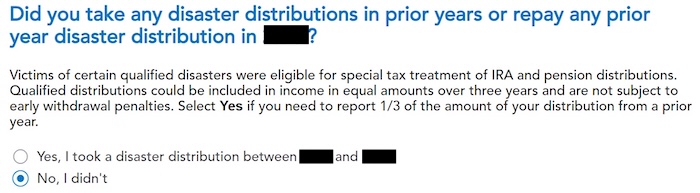

We didn’t take or repay any disaster distribution.

We already said no, but TurboTax just wants to be sure.

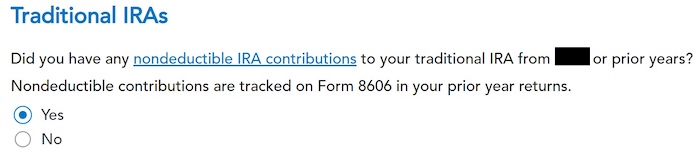

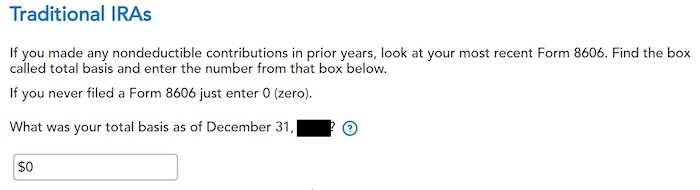

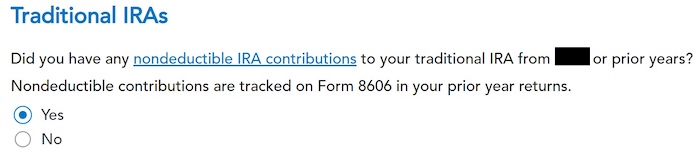

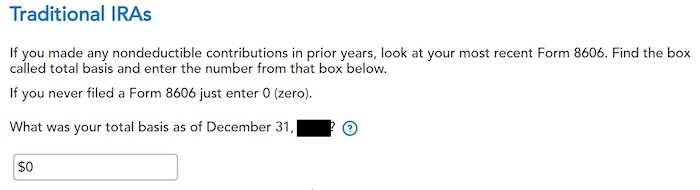

Here it’s asking about the carryover from the prior year. When you did a clean “planned” Backdoor Roth as in our example — contributed for 2025 in 2025 and converted before the end of 2025 — you can answer No here, but answering Yes with a 0 has the same effect as answering No, and it allows you to correct errors.

If you answered Yes to the previous question and you did your previous year’s return correctly also in TurboTax, your basis from the previous year will show up here. If you did your previous year’s tax return wrong, fix your previous return first.

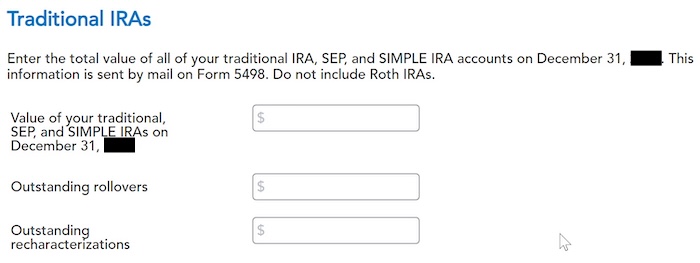

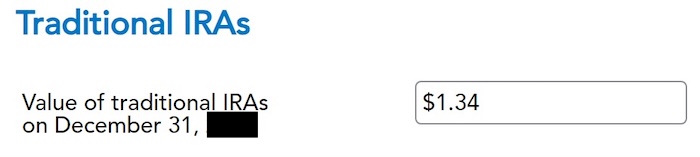

Enter the values of ALL your Traditional, SEP, and SIMPLE IRAs at the end of the year. We entered all zeros because we don’t have anything in traditional, SEP, or SIMPLE IRAs after we converted it all. If your account posted earnings after you converted and you left the earnings in the account, get the value from your year-end statement and put it in the first box.

That’s it so far on the income side. Continue with other income items. The refund in progress is still temporarily depressed. Don’t worry. It will change.

Non-Deductible Contribution to Traditional IRA

Now we enter the non-deductible contribution to a Traditional IRA *for* 2025.

If you contributed for 2025 between January 1 and April 15, 2026, or if you recharacterized a 2025 contribution in 2026, please follow Backdoor Roth in TurboTax: Recharacterize and Convert, Year 1. If your contribution during 2025 was for 2024, make sure you entered it on the 2024 tax return. If not, fix your 2024 return first by following the steps in Backdoor Roth in TurboTax: Recharacterize and Convert, Year 1.

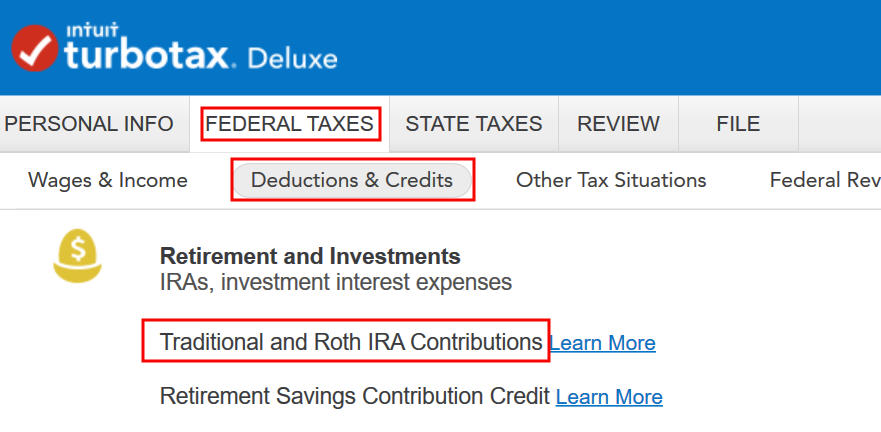

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

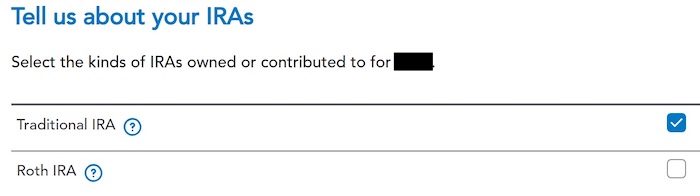

We check the box for Traditional IRA because we did a clean “planned” Backdoor Roth.

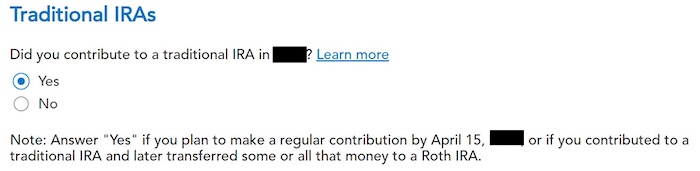

We already checked the box for Traditional but TurboTax just wants to make sure. Answer Yes here.

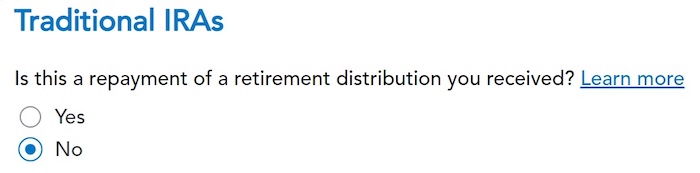

It was not a repayment of a retirement distribution.

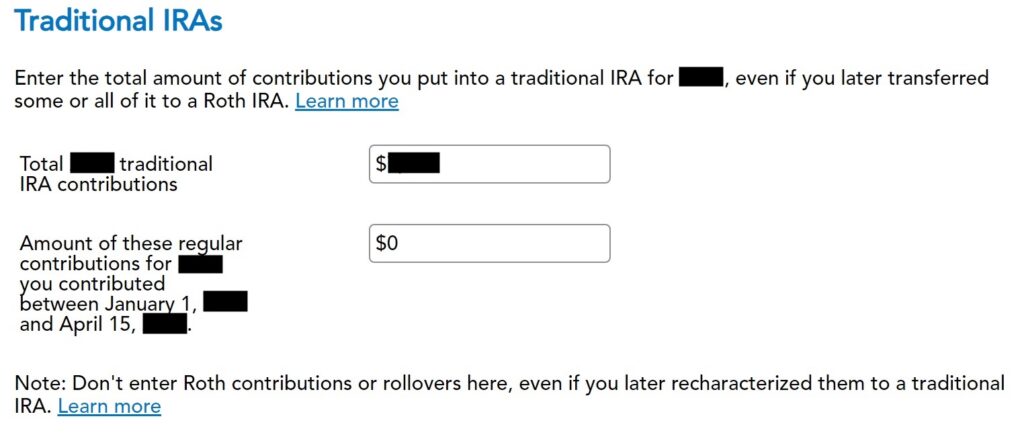

Enter the contribution amount. It’s $7,000 in our example. Because we contributed for year 2025 in 2025, we put zero in the second box. If you contributed for 2025 between January 1 and April 15, 2026, include the contribution in both boxes.

Right away, our federal refund in progress goes back up! We started with $2,384. It went down to $858. Now it comes back to $2,335. The $49 difference is because we have to pay tax on the $200 in earnings when we contributed $7,000 and converted $7,200. If you had less in earnings, your refund numbers would be closer still.

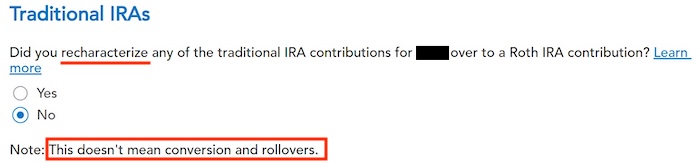

Converted, Did Not Recharacterize

This is a critical question. Answer “No.” You converted the money, not recharacterized.

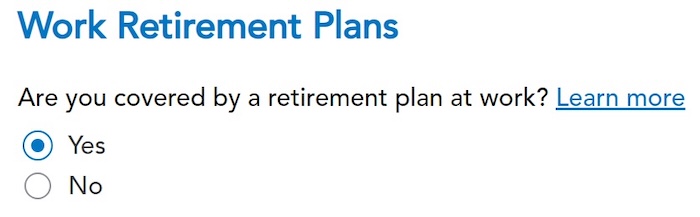

You may not get this question if you already entered your W-2 and it has Box 13 for the retirement coverage checked. Answer yes if you’re covered by a retirement plan, but the box on your W-2 wasn’t checked.

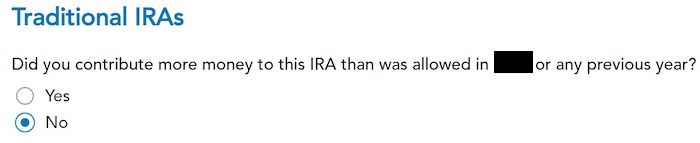

We didn’t make excess contributions.

Basis

TurboTax asks the same question it did before. For a clean “planned” Backdoor Roth, we can answer No, but answering Yes with a 0 has the same effect, and it allows you to correct errors.

If you did your taxes correctly on TurboTax last year, TurboTax transfers the number here. If you made non-deductible contributions for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

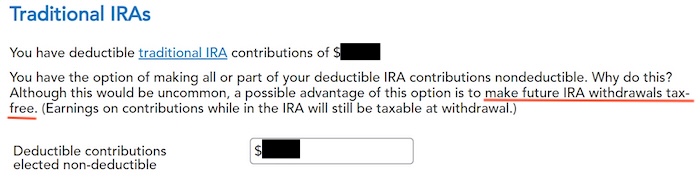

Make It Nondeductible

TurboTax shows this screen if it sees that you qualify for a deduction for the Traditional IRA contribution. If you take the deduction, it’ll make your Roth conversion taxable, which creates a wash. It’s simpler if you make your full IRA contribution nondeductible, and then your Roth conversion won’t be taxable. Enter the amount that TurboTax says is deductible.

Because we did a clean “planned” Backdoor Roth, we don’t have anything left after we converted everything before the end of the same year. If you have a small balance left because of interest posted after you converted, enter the value from your year-end statement here.

This is expected. That’s why we did the Backdoor Roth.

Taxable Income from Backdoor Roth

After going through all these, would you like to see how you are taxed on the Backdoor Roth?

Click on Forms on the top right.

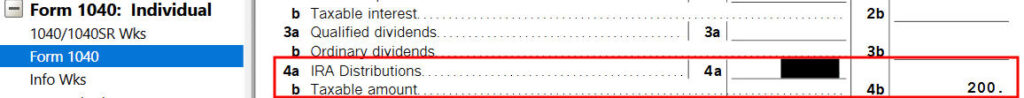

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b. They show a $7,200 distribution from the IRA, and only $200 of the $7,200 is taxable in our example. That’s the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth.

When you’re done examining the form, click on Step-by-Step on the top right to go back to the interview.

Tah-Dah! You put money into a Roth IRA through the back door when you aren’t eligible to contribute to it directly. That’s why it’s called a Backdoor Roth. You pay tax on a small amount of earnings between the contribution and the conversion. That’s negligible relative to the benefit of having tax-free growth on your contribution for many years.

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

Fresh Start

It’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

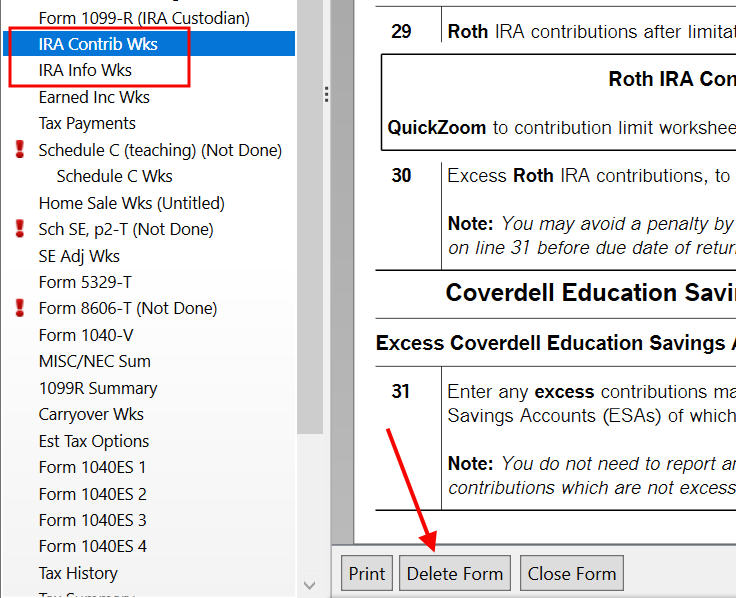

Click on Forms on the top right.

Find “IRA Contrib Wks” and “IRA Info Wks” in the left navigation pane and click on “Delete Form” to delete them. Then you can start over by following the steps above.

Conversion Is Taxed

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. Taking this deduction also makes your Roth IRA conversion taxable. You can see this deduction on Schedule 1 Line 20, which reduces your AGI.

The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal, and it doesn’t cause any problems when you indeed don’t have a retirement plan at work.

It’s less confusing if you decline the tax deduction, which also makes your conversion non-taxable. See the Make It Nondeductible section.

Self vs Spouse

If you are married, make sure you don’t have the 1099-R and IRA contribution mixed up between yourself and your spouse. If you inadvertently entered two 1099-Rs issued to you instead of one for you and one for your spouse, the second 1099-R to you will not match up with a Traditional IRA contribution made by your spouse. If you entered a 1099-R for both yourself and your spouse, but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Mary says

This is fabulous! Just spent over an hour stressing because our “Backdoor Roth” was reflecting in Turbo Tax as a taxable event. Thank you for guiding me the rest of the way through.

Minta Patel says

Re: f/u comment 150

Hi Harry,

Thank you so much for the guide. I am going to take a shot at this starting this weekend just as you have directed – slow and one thing at a time! Hopefully this is going to be the first and last tax-mess to deal with, because I do not want to create more issues. I have learned a lot though stumbling through this process in getting started, and words can’t appreciate my gratitude enough for your helping hand. Thank you, thank you!!

Cheers!

Minta

Sam says

Harry, Thank you so much for this very handy guide. I’ll be leaving something in your tip jar for the help!

One TT screen that is somewhat confusing appears in the deductions & contributions side of TT when trying to account for contributions made to a tIRA. It appears as follows just after the “Let’s Find your IRA Basis” screen:

“Tell us the value of all your Traditional IRA Accounts

Enter or verify the value (ending balance amount) of all of your traditional IRA accounts on December 31, 2014. This information is sent by mail on Form 5498.

Include any IRA contributions you made or will make in 2015 for 2014.

Include any IRA distributions you made in 2013. The amount you enter must be at least the amount of your distributions.

Value of your Traditional IRAs on December 31, 2014 ____________.”

I made a non-deductible Traditional IRA contribution of $5,500 in February 2014 for 2013 and converted it to a Roth IRA before the end of 2014. I will be making a Traditional IRA contribution of $5,500 in March 2015 for 2014 (going forward I will follow your advice to contribute and convert in the same year to make the paperwork easier).

Question 1) What is throwing me is the line “Include any IRA contributions you made or will make in 2015 for 2014.” Does this mean that the “Value of your Traditional IRAs on December 31, 2014” should be $5,500 given my March 2015 contribution? Shouldn’t it be $0 since that is what my statement said and, presumably, what my Form 5498 will say? Will answering $5,500 invoke the pro-rata rule somehow? I’ve tried it both ways ($5,500 and $0) and neither seems to affect the tax liability meter but perhaps it is affecting Form 8606 or something else.

Question 2) Also, just to get ahead for when I do 2015 taxes, will I have to include on this line the $5,500 converted in 2014 as a distribution, since presumably that line next year will read “Include any IRA distributions you made in 2014. The amount you enter must be at least the amount of your distributions”?

Thanks in advance!

Harry Sit says

Sam – I don’t know what triggered your screen. If you follow the same sequence as I showed here you don’t see that screen at all. The “Tell Us the Value of Your Traditional IRA” screen has three boxes. The first one is from your statement (you won’t get your 5498 until May). The second and third are for outstanding rollovers and outstanding recharacterizations, which typically you don’t have.

Sam says

Harry,

No recharacterizations or rollovers. No other TIRAs or RIRAs other than described in my initial post.

I think I know why TT asked for that screen. I think it was internally computing Worksheet 1-1 of Publication 590-B (Figuring the Taxable Part of Your IRA Distribution) to get Lines 13, 15, 17 and 18 of Form 8606. Tough to tell because TT does not include that Worksheet even in the “All Forms” version of the return but that is my best guess.

Line 4 on that Worksheet asks for the value of all TIRAs as of 12/31/2014.

Line 5 then asks for total distributions from TIRAs in 2014.

Line 4 and 5 are then added together for Line 6.

Line 7 asks you to divide Line 3 (which is your TIRA basis as of 12/31/2013 and contributions made *for* 2014). Line 7 is set to a maximum limit of 1.000.

I tried it both ways (entering 0 and 5500 on Line 4) and either way ends up with a result of 1.000 in Line 7. From there on, the Worksheet (and the entries on Lines 13, 15, 17, and 18 of Form 8606) are the same regardless of which amount is put on Line 4.

Please let me know if you have a different read on it. Thanks again for all of your help!

Harry Sit says

Sam – Make sure your 1099-R has all the correct codes and boxes checked. If you imported it, double check against the paper version. See comment 157 below from lena. She got that weird screen when she imported the 1099-R but it went away when she manually entered it,

Gary says

Sam, I’m in the same situation. What confuses me is the term, “include any IRA distributions YOU made in 2013. The amount you enter must be at least the amount of your distributions.”

Kate says

This is an amazing article. Without it, I don’t think I would have ventured to do this using TurboTax. (I remembered it from a prior year and found it before I purchased TurboTax.) I put something in your tip jar and really appreciate that you took the time to create this walk-through.

One small note, I do taxes for myself and my husband, and I didn’t notice on the screen where the conversion started that I had to select his name (it defaulted to mine). So I had to go back after entering everything once I saw I had entered it for myself instead of him.

Thank you again!!

JohnD says

Thank you so much! Helped me a lot.

Frank says

Your step by step backdoor door conversion is tremendously helpful. I followed the instruction and ran into a situation need your advice.

I claimed 2013 deduction in 2013 return but transaction was done in early April/2014 and made 2014 deduction late April.

2013 tax year: 4/2/2014 $6500 into TIRA ; 4/7/2014 $6422.68 into Roth IRA => $77 loss

2014 tax year: 4/8/14 $6500 into TIRA ; 4/17/2014 $6518.93 into Roth IRA => $19 gain

My 2014 1099-R Gross distribution is $12941.61.

Turbo Tax used $6500 as 2013 traditional IRA basis.

However, Turbo Tax 2014 Form 8606 line 14 has $59 as 2014 Traditional IRA basis.

Is this expected? Should I make some adjustment to have $0 as 2014 basis?? Thanks.

Harry Sit says

Yes it’s expected.

lena says

Thank you. I was getting the same screens as Sam until I decided to not import the information from my financial institution. I don’t know what it was doing. But i have the same screens as you now.

Harry Sit says

lena – Great, thank you. I was wondering what could be different. I don’t import because I don’t know what comes in the import.

Sam says

Odd. I didn’t import the 1099-R when I initially got the screen. I tried importing and replacing the hand-typed version with the imported version and still got the screen (neither version had the “total distribution” box checked even though it was a total distribution–maybe a Vanguard problem?). Tried again with just the hand-typed version and checked the total distribution box. Screen still popped up. Maybe if I try again with a clean return, it won’t appear? No idea what’s going on here other than maybe for some reason it is using the extra screen to perform Worksheet 1-1 in Publication 590-B.

1099-R looks to be correct (and is the same whether imported or hand-typed from the paper version):

1: Gross Distribution: 5,500

2: Taxable Amount; 5,500

2b: Taxable Amount not Determined is checked

7: Code 2 – Early distribution (except Roth)

The IRA/SEP/SIMPLE box is checked on my copy of the 1099-R

Sam says

I tried deleting the TIRA contributions and the 1099-R and then followed your screens described above (entering contributions and then entering the 1099-R). If the 2014 TIRA contribution is entered before the 1099-R is entered, I get your screens exactly. After the 1099-R is entered, the screen appears in the 2014 contributions (deductions and credits) interview if you go back through it, with a pre-filled $0 balance for 12/31/2014 TIRA balance. Not sure why the 1099-R triggers that screen in a separate area with a pre-filled balance. No notification/problems appeared on the error check.

Minta Patel says

f/u comment 150

Hi Harry: Can you please tell me for # 2 where should I be coming across the box to check for Roth and then say I changed my mind.

In following the first half of the article I come across the question asking ‘did you change your mind’ but this is with regards to recharacterization of traditional IRA to Roth contribution, whereas I had to recharacterize my Roth to traditional IRA. Please clarify.

Sincerely,

Minta

Harry Sit says

Minta – Right after the topic search, above where I said “Check the box for Traditional IRA” you would check the box for Roth IRA instead, because you originally contributed to Roth. Then a few screens down you will see the question “Did you change your mind?” to which you would answer yes.

Minta Patel says

Oh Harry – I figured it out. You meant from the beginning to select for Roth box. In doing so, I did come across the prompt asking about recharacterization, which said yes to. I filled out the information asking on Roth IRA explanation statement, however I am not quite sure what to do next because the prompt asks if I want to make the contribution nondeductible. The options are ‘yes, make part of my IRA contribution non-deductible’ and ‘no, i’ll keep my deduction (recommended)’. Please help me follow this through. Furthermore, it asks ‘did you open any Roth IRAs in 2013 or previous year’. I did Roth conversion in 2014 for 2013 – so does that mean yes I did, or no coz it was done technically in 2014?

Sincerely,

Minta

Harry Sit says

Minta – Unless you are not covered by a retirement plan at work, and if you are married, your spouse is also not covered by a retirement plan at work, when you are ineligible to contribute to a Roth IRA, you are also not eligible to take a deduction for a traditional IRA contribution. Check to see whether you entered your W-2 wrong which made TurboTax think you are eligible for a deduction. If you are indeed eligible for a deduction, then it’s up to you whether you want to take it or not.

I don’t know the answer to your other question. Please contact TurboTax support.

nikkyp says

Hi Harry, Wonderful guide you have. I followed it step by step and when I check form 1040 line 15a – 5,505 and 15b- 5 which was right. But when I checked form 8606, this was how it looked like:

Part 1

1- 5,500

2 – 0

3 – 5,500

4 – blank

5 – 5,500

6 to 12 blank

13 – 5,500*

14 – 0

15 – 5*

* From Taxable IRA Distribution Wkst (per IRS Pub. 590-B) note at the bottom page which I don’t see(?)

Part 2 – all blank

Is this right or I’m missing something somewhere since part 2 is blank? Pls advice if I need to amend it. Thanks.

Harry Sit says

Sorry I don’t know how TurboTax produces the form. I only have a test account at TurboTax online. I don’t get to see the form. Maybe it’s just the way TurboTax does it. I see others reported the same thing on the TurboTax support forum, but people there mentioned numbers on lines 16-18. Be sure to expand and read the comments under the answers.

Backdoor Roth IRA contribution, Form 8606 (Nondeductible IRAs), Lines 6-12 blank

Nikkyp says

Thanks Mr. Sit for replying. I’ll try to contact Turbo Tax after work today and see what they say about it.

Kyle says

What do you do if you contributed to a Roth IRA in 2022 because you thought you were going to be below the income limits, but then in 2023 you had to recharacterize the money? My 1040 for this year is showing 10k in taxable amount from my IRA likely due to my and my wife’s recharacterization.

Harry Sit says

You should’ve reported the recharacterized contributions by following the steps in Backdoor Roth in TurboTax: Recharacterize and Convert, 1st Year. If you also converted to Roth after recharacterizing, then you follow the steps in Backdoor Roth in TurboTax: Recharacterize and Convert, 2nd Year.

Charles says

My spouse is not covered by a retirement plan at work. When I choose to keep her Traditional IRA contribution deduction, TurboTax is not offsetting the deduction with a taxable conversion to create a “wash”. I can tell because it’s actually bumping my refund up when I choose that option. Why is this the case?

I understand the easy answer is to just make the contribution non-deductible, but I’m just wondering why this is happening with TurboTax. FreeTaxUSA has the limitation of NOT being able to make the contribution deductible, but I can tell the “wash” is happening because my refund is identical to TurboTax when I make it the contribution non-deductible. I’m confused as to why TurboTax is not offsetting.

Harry Sit says

Look at her Form 8606 for clues. Maybe you mistakenly entered a basis for her somewhere.

Ajay Raghavan says

Hi , Thanks for updating this every year. Its quite useful and a great point of reference.

SPS_1981 says

Hi Harry,

Thank you once again for this detailed post like last year!! I used if last year (first time doing the backdoor Roth).

I am not sure if you will be able to answer this question on how to approach the same for Massachusetts State tax??? Last year was okay as it was our first time and I made an error answering the questions which resulted in the contributions being taxed again by the state and had to amend it. However I am not sure if it would be different this year and would like to make sure I answer the questions properly and not go through another headache of amendment.

Would you be able to answer any questions?

Thanks!!!

Harry Sit says

A question in the MA program asks you how much of the IRA distribution came from money on which you already paid MA tax. Entering an amount that equals to your contribution will stop it from being taxed again. I can’t tell you exactly where because I don’t have the MA state program.

SPS_1981s says

Thanks Harry!!!

Yes it does but the way it is phrased in TT is a bit confusing. looking at different forums seem to indicate two ways to approach it. Just to give you an idea if it would make more sense.

All my contributions to my traditional IRA were non-deductible and made in MA (have filed 8606 for 2022 and will be doing so in 2023). I then converted the trad IRA to Roth IRA the same years for 2022 and 2023. And I had come to the same final result for Fed returns as you have highlighted.

For tax year 2022 (me/wife)

contributed $6000/$6000

Converted – $6001/$6000 (total – $12001)

Balance at end of 2022 – $4/$6

taxable amount for 2022 -$11

For tax year 2023 (me/wife)

contributed $6500/$6500

Converted – $6514/$6517 (total = $13031)

Balance at end of 2022 – $0

taxable amount for 2023 -$21

In MA state returns in TT there is a section for “taxable ira/keogh distributions on MA state tax” under deductions. There are 2 questions to answer which will determine the taxable income.

QUESTION 1-

“Other Contributions Previously Taxed by Massachusetts”:

“Previously”, do they mean Taxed non-deductible contributions for 2022 and 2023? In my case this would be $12500 isn’t it?

Or is it just for the year 2023 and not considering what I did in 2022, then it would be just $6500?

QUESTION 2-

“Total Distributions Received in Previous Years”:

I assume this means total distributed in tax year 2022 and 2033. or is it just for 2023??

So my answer would be $0 as I converted everything in their respective years and never took any money from the accounts. Am I correct?

For my scenario if I answered: $12500 for question 1 and $0 for question 2. The refund due to me is $37.

But if I answered $6500 for question 1 and $0 for question 2. The refund due to me is $36. The difference in refund is due to $31 being added to taxable state income (total conversion = $13031).

For 2022 I had a $1 added to my state taxable income as the total conversion was $12001.

I know this $1 refund is not a big deal (and no need to fuss), but just wanted to make sure I keep a good track of the conversions and have no complications in future. Any idea???

If this is outside of your realm of expertise given it is state specific I totally understand. No worries!! Thanks in advance!!

Harry Sit says

You should have $31 taxable income when you converted $13,031 and contributed $13,000. It helps to look at the MA instructions (pages 19-20).

https://www.mass.gov/doc/2023-form-1-instructions/download

TurboTax is filling out that worksheet by asking you those questions. It should work with either $12,500 and $6,000 (cumulative for both contributions and distributions) or $6,500 and $0 (only this year because you convert every year and clear out the contributions). Cumulative is the correct way in case you start mismatching contributions and conversions, for example contribute $4,000 this year, don’t convert, contribute $5,000 next year, convert $3,000, contribute $0 the third year, convert $2,000, but you’ll have to keep track.

SPS_1981 says

Thanks a lot Harry!!!

You were 100% correct!!

I did fool around with both ways and the outcome was same.

I agree it’s better to go cumulative, so that way the bread crumbs are there to follow. God knows what will happen in few years and if I loose my mind. 🙂

once again thank you for all the help here!! you are a life saver!!!

SPS_1981 says

one last question just to confirm – “Total Distributions Received in Previous Years”

does distribution here mean the same as taking out money during retirement as it would mean conversion to Roth IRA I am doing now? This term is what threw me off at first.

I guess it they are the same given the following from MA return instructions –

“Since Massachusetts does not allow a deduction for amounts originally contributed to an IRA or Keogh, the distributions are not taxable until the full amount of your contributions which were previously subject to Massachusetts taxes are recovered.”

Just confirming!!!

Harry Sit says

Distribution means money coming out of a Traditional IRA. It doesn’t matter whether it went into a checking account or a Roth IRA.

SPS_1981 says

thank you so much for all the help and insight!!! appreciate it!!!

Dorothy says

Harry,

Thank you so much for this wonderful step-by-step guide. The screenshots are extremely helpful. I saved this article in my tax notes and have used it regularly for years. I’m sure I would have screwed up my taxes without it. You’re a lifesaver!

Sameer A. says

Hello Harry,

This one is bookmarked on my chrome as I refer to it every year while filing on TTOnline. Last year I realized the problem with the basis I have been reporting and it confuses the heck out of me. My situation is as below and I can’t figure out what should be my basis on the retro 8606 I will send to IRS for 2017-19 and now on 2023 tax returns. Can you help?

I contributed the below non deductible amounts to Tradition IRA, the total contributions come to $41,500. Should my basis while submitting the 2023 taxes be 41,500? (as additional information, I moved each contribution to Roth in the respective year)

2017 – 5,500 (did not report 8606)

2018 – 5,500 (did not report 8606)

2019 – 6,000 (did not report 8606)

2020 – 6,000 (reported 8606 but instead of setting basis to 23,000, I set it to 6,000)

2021 – 6,000(reported 8606 but again set the basis to 6,000 wiping all previous non-deductible contributions)

2022 – 6,000 (same as 2021)

2023 – 6,500 Finally, chance to correct the basis. Should this be 41,500?

Harry Sit says

No, it shouldn’t be $41,500. Form 8606 reports two basis numbers, a beginning basis on Line 2 and an ending basis on Line 14. When you contribute for the current year and convert immediately, you start each year with $0 basis and end each year with $0 basis. Both Line 2 and Line 14 should be zero or blank on each Form 8606. This is the recommended method because it causes the least confusion.

Sameer A says

Aah! Thanks so much Harry! I will make sure I report prior year’s 8606 forms similarly.

David T says

Harry,

You need to make it clear to your readers that the above statement, “you start each year with $0 basis and end each year with $0 basis” is ONLY true if they have NO other IRAs except (for the temporary one used to do the backdoor conversion). If there are other IRAs, then the distribution to the Roth is done pro-rata, based on the total of all IRAs, and some of the distribution is taxable each year, and a basis of post-tax money remains with the rest of the IRA money each year. In this case, the basis will build each year a backdoor conversion is done.

I had a large IRA from a pension buy-out, and discovered after the fact that I owed taxes on most of the backdoor Roth conversion and that I should have been reporting a basis each year. Now I have to fix multiple years of taxes…

https://www.irs.gov/retirement-plans/rollovers-of-after-tax-contributions-in-retirement-plans

Or google “Pro-Rata rules for Backdoor Roth”

Harry Sit says

Moving other IRAs to an employer plan is Step 1 in Backdoor Roth: A Complete How-To, which is linked in the opening paragraphs. This post only deals with the tax reporting part, which is Step 5 in how to do a backdoor Roth. You’re not really doing a backdoor Roth if you don’t do Step 1.

Vinnie says

Hi Harry,

I don’t see the same screen shots as posted here in TT desktop version for tax year 2023. Not sure if others are seeing the same, they might need an update. I concur with many other users, this page I saved and keep coming back to refer. Conversion vs. recharacterization trips me. Question, for some reason I didn’t file 8606 for tax year 2022. Can I just submit 8606 to IRS or do I need to do 1040-x and include 8606? Are there any tax implications not reporting 8606 last year but reported 1099-R under wages with conversion (I have yet to do amendment, just saw 8606 missing in 2022) ?

Harry Sit says

Which screen do you not see? TurboTax determines whether to include Form 8606 based on your answers to the questions. Depending on what you actually did, it may have been correct to not include Form 8606 for 2022. You’ll need to figure out whether you did anything incorrectly and which parts. If correcting your mistakes doesn’t change your taxes for 2022, maybe you don’t need to amend.

John says

Greetings Harry – Thanks for keeping this article/topic refreshed every year – it has been immensely helpful. For next year, would it be possible to add an a section and/or comment regarding how to correctly report the additional IRA catch‑up contribution limit for individuals aged 50 and older into TT? (i.e. the additional $1,000 for 2024)

Harry Sit says

It doesn’t require anything special. Just report the larger amount in the contribution section.

Raj U says

Hi Harry, I completed all the steps in your section here:

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

However, I get to the screen where Turbotax asks me: Enter your total Roth IRA contributions for 2023, even if you transferred or “recharacterized” some or all of it to a traditional IRA

My question is: Do I put in $6500 here, or $0? I’m not sure if the $6500 conversion from traditional to roth IRA in 2023 is the same as a contribution. Can you help clarify? The questions following this step ask me if I want Turbotax to keep track of my Roth IRA basis.

Harry Sit says

A conversion is not a contribution. If you really followed all the steps in that section, you should’ve only checked the box for Traditional IRA on the first screen and you would’ve never run into the question “Enter your total Roth IRA contributions for 2023 …”

Raj U says

Thanks a lot for clarifying, Harry! This article was really helpful & it definitely saved me a lot of time. I expect the same for others here as well. I went back to make sure if I checked only the Traditional IRA on the 1st screen and I confirm that was the only one checked. I was surprised as well once I saw the question of Roth IRA contributions for 2023. Thanks again!

Harry Sit says

You must have checked the box for Roth IRA at one point and TurboTax remembered it. You can either enter 0 and decline the offer to track you Roth basis or do a fresh start as shown in the troubleshooting section.

sue bardakos says

Thanks Harry! You are a national treasure!! I just completed my 3rd successful back door. Quick question – can you confirm I don’t have to add my IRA BDAs in the section where it asks you to “state the value of all your traditional IRAs”? I got 5498s for the BDAs and just want to make sure you agree, I don’t need to include. Thanks again!!

Harry Sit says

BDA — Beneficiary Distribution Account, commonly known as an inherited IRA — isn’t included because it isn’t yours, unless you inherited the account from your spouse and you make it yours. See Inherited IRA and Roth Conversion Pro-Rata Rule.

Gene says

Thank you so much, Harry!

I probably made one of the dumbest mistakes ever made with backdoor Roths:

In Feb 2023:

1. I contributed $500 to my Roth IRA for tax year 2023.

2. I recharacterized the $500 contribution to a traditional IRA.

In Mar 2023:

3. I converted the contribution back to Roth IRA to complete the backdoor Roth.

However, this month before the tax deadline (Apr 2023):

4. I recharacterized the same recharacterized-then-converted contribution to a traditional IRA again.

In 2023, I made a few normal 2023 Roth contributions because my MAGI allowed partial contributions in 2023.

My question: Does the $500 backdoor Roth contribution go towards my 2023 Roth contribution? I requested recharacterization of it and Vanguard already processed that request, assuming that it. Essentially, this is a contribution that I recharacterized, converted, then recharacterized all in the same tax year (2023).

Harry Sit says

What you described isn’t possible. A conversion in 2023 can’t be recharacterized. It sounds like Vanguard only recharacterized part your remaining normal Roth contributions. Please confirm with Vanguard how much you contributed to Traditional and Roth IRAs after all the recharacterizations. If you can’t get a clear answer, file an extension and wait for the 5498 forms coming out before the end of May.

Gene says

Thank you, Harry.

I called VG and as you said, they informed me that they recharacterized one of my other Roth contributions from the year, and not the conversion. Thank you so much!!

Gene says

Follow up question:

Since I made two separate recharactetzations of two 2023 Roth IRA contributions, how do I provide a statement to explain both recharacterizations? TurboTax home and business already prepared a statement using my template for the first recharacterization in Feb 2023. How do I also add in the recharactetzation from Apr 2024 (this week)?

Harry Sit says

Go back to the IRA contribution section. When TurboTax asks you how much you recharacterized, give the total of all your recharacterizations. The statement created by the template is editable, and the dates of the original contribution and recharacterizations allow multiple dates. Something like:

Dates of the Original Contribution: 2/19/2023, 6/1/2023

Dates of the Recharacterization: 3/2/2023, 4/1/2024

The Amount Recharacterized: $500, $600

The Amount Transferred (Recharacterization plus earnings or losses): $531, $527

Reason for the Recharacterization: Exceeded income limit.

Please stop doing these convoluted multiple partial recharacterizations. If there’s any chance your income comes close to the income limit, just contribute straight to the Traditional IRA and convert it. There’s no penalty for using the backdoor when your income ends up below the limit.

leroy says

Harry your article about how to do the backdoor ROTH IRA in turbotax has been extremely beneficial. I knew I should not be getting taxed, but could not understand the specific entries I needed to submit in the “step-by-step” mode. Plus, I am punting turbotax online from now on. The download has more features, and I cannot understand why they removed forms from the online version. If this was a youtube channel I would certainly hit the like button and subscribe!!!

sujian says

Very helpful. Save me for several years.

Reporting Backdoor conversion is so messy and I always got confused and end up need to pay tax for my conversion.

I come back here and follow the instructions and fix the problem.

Thanks a lot.

Ravi says

Hi Harry,

I contributed $6500 to non-deductible IRA in early April 2024 for tax year 2023 and converted entire balance $6500 plus few cents interest to Roth IRA. Now I want to make tax year 2024 contribution for max $7000 and convert that too to Roth IRA immediately. If I do this, what should I see in 1099-R for 2024 when it comes in Jan 2025? $13,500~ as distributions? Will there be an issue reporting this on 2024 tax return in Turbotax?

Also, what would I see in 5498 for 2024? $7000 or $13,500?

Thanks for your help as always!

Ravi

Harry Sit says

You will see $13,500~ as distributions on a 1099-R and $7,000 on a 5498 for 2024. See Split-Year Backdoor Roth IRA in TurboTax, 2nd Year for how to report them in TurboTax.

Roy Kim says

Do you have a plan to provide a method of backdoor ROTH in TurboTax online version?

Harry Sit says

Sorry, no. It’s more difficult to do multiple variations with the online version. The downloaded software is less expensive and more powerful anyway. It can import data from the online version.

Winnie says

Thank you so much for this informative post. Unfortunately, I did a split back to IRA for 2024 as well. I contributed 1/2025 and converted it one day after. Unfortunately it had a dividend of about $6 also that converted over from the vanguard money market along with the $7000 to Roth. So I know I’ll have to pay taxes on this.

I’m a little bit confused about the IRA basis and after reading a couple posts I’m not sure I get it. My understanding is that if you do a clean backdoor IRA, The basis should be zero every year you enter it into TurboTax, correct? This basis is not affected by earnings between the contribution to conversion time?

Meaning the $6 dividend doesn’t go in the basis ?

In the case of a split IRA, basis is not 0? Is the basis the money I contributed for 2024 when I do my taxes for 2025? But is there still a basis when my traditional IRA is zero since I converted it to Roth already 1/2025? Then ideally when I do a clean back door Ira 2025 basis will be 0 again down the line right?

Hope my questions are clear. I appreciate your time!

Winnie says

Hello! Just wanted to see if there’s any advice for this, thanks so much!

Harry Sit says

Please refer to Split-Year Backdoor Roth IRA in TurboTax, 1st Year with regard to your 2024 contribution made in 2025 and come back next year to Split-Year Backdoor Roth IRA in TurboTax, 2nd Year for the conversion part.

Basis – Making non-deductible contribution to a Traditional IRA for a tax year adds to the basis for that year. Converting to Roth removes the basis proportionally. Earnings don’t add to the basis but if you don’t convert the earnings, it’s treated as converting less than 100% and therefore removing less than 100% of the basis. When you do a clean backdoor Roth, you add to the basis first with the contribution and then you remove the basis with a 100% conversion, all within the same year. Your basis starts with zero and ends with zero.

When you do a split-year backdoor Roth, the contribution for 2024 you made in 2025 adds to the basis as of 12/31/2024. It’s carried forward to 2025. Your conversion in 1/2025 removes it. With another clean backdoor Roth going on top in 2025, you add to the basis again and remove it again. So you start 2025 with a basis of $7,000 and end with zero.

Roy Kim says

Hi,

I am confused to what step do I have to take for my situation. So I am going to have your advice.

I did my first contribution in March, 2024. (I didn’t do any contribution to Traditional IRA or ROTH IRA before)

I received Form 5498 from fidelity (Form says 2023 IRA contribution Information) on 5/10/2024

And I received 1099-R on 1/17/2055. (Gross distribution 7502.05, Taxable amount 7502.05)

Which step do I have to take for tax report via TurboTax?

Thanks.

Harry Sit says

If the amount on the 2023 Form 5498 is the same as your contribution in March 2024, it sounds like you contributed for 2023 in 2024. You should’ve followed Split-Year Backdoor Roth IRA in TurboTax, 1st Year last year to report the 2023 contribution. Now you’re in Split-Year Backdoor Roth IRA in TurboTax, 2nd Year for the conversion in 2024. If you’ll contribute for 2024 in 2025, you’re in Split-Year Backdoor Roth IRA in TurboTax, 1st Year again for that contribution and you’ll be in Split-Year Backdoor Roth IRA in TurboTax, 2nd Year again for the conversion in 2025. To break out of this confusing cycle, contribute for 2025 in 2025 and convert in 2025.

koonsup kim says

Hi, Harry,

Sorry, I can’t reply to your comment, so I wrote new post.

Thanks for quick reply and information.

The conclusion is that I need to follow ” Split-Year Backdoor Roth IRA in TurboTax, 2nd Year”. Am I right?

If I want to follow same year step, I have to wait to deadline of 2024 contribution (4/15?) and contribute 2025 portion after deadline and convert in 2025?

Harry Sit says

Comments nest only one-level deep. To reply to a reply to a comment, scroll up and click on the reply link under the original comment that started the thread.

Yes, you need to follow “Split-Year Backdoor Roth IRA in TurboTax, 2nd Year” for the conversion you did in 2024. If you decide to skip the contribution for 2024 because it’ll continue the confusing cycle one more year, you can contribute for 2025 in 2025 and convert in 2025. Then you’ll be on the clean path next year. You don’t have to wait until after the 4/15 deadline for 2024 contribution. You get to choose which year you’re contributing for when you contribute before 4/15. Just choose 2025.

Koon Sup Kim says

Thanks again.

In your first reply, you advised that ” You should’ve followed Split-Year Backdoor Roth IRA in TurboTax, 1st Year last year to report the 2023 contribution”.

But I didn’t do anything in 2023 tax report, because there was no contribution info in 1099-R of 2023 that I received from Fidelity.

I received 2023 Form 5498 in May, 2024 and 1099-R of 2024 shows 7502.05 (Gross distribution and Taxable amount).

I just want to confirm to follow Year 2 without other action.

And one more, how to manage interest (2.05)?

Thanks.

Harry Sit says

The 1099-R only reports distributions (money coming out of an IRA). You were supposed to know that you contributed to an IRA for 2023 and report it on your 2023 tax return. The 5498 form is only an FYI after the contribution deadline has passed. You were supposed to report the contribution before you receive the 5498 form.

You can get the 2023 Form 8606 from the IRS, manually fill out your information at the top and Lines 1, 3, and 14 with $7,500, and send that in. The address is at the end of Form 1040 instructions. Or you can amend your 2023 tax return and follow “Split-Year Backdoor Roth IRA in TurboTax, 1st Year” to report your contribution for 2023, which will generate 2023 Form 8606. TurboTax can e-file your amendment.

The $2.05 interest is already included in the 1099-R. It’s the same as the $200 used in the example.

Koon Sup Kim says

Thanks for explanation. Now I understand my situation.

I think it is simple way to download 2023 Form 8606 and fill out that you advised and send mail to IRA.

If I follow the above direction, I think I don’t need to amend my 2023 tax return in TurboTax.

If my understanding is right, please confirm.

I appreciate your advice and support.

Regards,

Harry Sit says

Mailing the 2023 Form 8606 is fine. It probably helps if you also include a simple letter to say that this form was inadvertently omitted from your 2023 tax return and it doesn’t change your tax refund or the amount owed.

Koon Sup Kim says

Harry,

I am comfortable now to have your confirmation.

1099-R that I received this year includes $7500, but if I send 8606 Form, I don’t need any action in 2024 tax report according to my understanding.

I hope I have no issue of my 2025 backdoor IRA this year, I will skip 2024 contribution because I don’t have any concern of 2024 tax report.

Regards,

Harry Sit says

Not so fast! A split-year backdoor Roth requires two parts in two years. Mailing in a form now only makes up for the first part that you should’ve done last year but you missed. It doesn’t release you from doing the second part by following the steps in “2nd year.”

I already gave you the link to the 2023 Form 8606 in the previous comment. Use the 2023 form when you’re making up for 2023. TurboTax will include the 2024 form in the e-file when you do the steps in “2nd year.”

Koon Sup Kim says

I access to IRA and try to download 2023 8606 form, but there is 2024 form only.

Can I use it?

Koon Sup Kim says

From a professional’s perspective, my previous questions may seem simple and even unnecessary, but I sincerely appreciate your thoughtful and sincere response.

Please correct me if I misunderstand.

Based on your previous guide, there are two ways ;

First method ;

1. Send 2023 Form 8066 to IRA for contribution 2023.

2. Follow “Split-Year Backdoor Roth IRA in TurboTax, 2nd Year”

Second method ;

1. Amend 2023 tax report

2. Follow “Split-Year Backdoor Roth IRA in TurboTax, 1st Year”

I looked at the Split method assuming that I followed the first method, and Recharacterizing appeared. In my case, is it correct to skip this step and proceed with the “1099-R for conversion” step?

The story of a co-worker of mine who followed the guide last year but gave up and paid a penalty to cancel Roth is a situation that resonates with me.

There will be many questions during the actual reporting in the 2024 tax report using TurboTax, but it is not easy to keep asking for help.

Thank you.

Harry Sit says

A split-year backdoor Roth requires two parts in two years: a year 1 and a year 2. You missed year 1 last year. You have two ways to make up for it: (a) fill out a form manually and mail it in with a letter or (b) amend your return and follow the steps for year 1. Regardless of how you make up for year 1, you still need to do the steps in year 2. The Year 2 guide covers two sub-scenarios: (1) a conversion and (2) a conversion after a recharacterization. The section for recharacterization says:

“This section only applies to the second example scenario. If you didn’t recharacterize (the first example scenario), please skip this section and jump over to the conversion section.”

So just jump over to the conversion section.

TurboTax offers live help for $60. It’s a good option if you’ll have many questions while you’re working with the software.

Dianna says

Hello Harry, I am getting hung up on the Deduction & Credits section of the downloaded TT from Costco beginning with the sections under Deductions and credits. Example: Traditonal and Roth contributions is no longer there. The questions are totally different and there is a different order than what the printout shows. I tried to muddle thru but the conversion did not work. Could you please revise. I did have a RMD on a BDA which is showing up in the section and not sure if this could be messing it up. I did it first and it was done separately before the backdoor. Thank you.

Harry Sit says

I installed the latest update from TurboTax. The Traditional and Roth contributions section is still there under Deduction & Credits. The questions are also the same and in the same order. I’m not sure why it’s different in yours.

EOG says

My favorite page each year. Just wanted to add that there is a “Select your state” [where you received your 1099-R] screen in the process, right before it asks about IRA Custodian, only select states are listed (something to do with how they treat pensions?). Not sure if new for Turbotax 2024 or because I changed residency this year but wanted to mention since you have meticulously documented all the rest with screenshots! Thanks again.

Harry Sit says

That “Select your state” screen must only come up when you have two states. I don’t see it because I answered “no” to “lived in another state” in the Personal Info section at the beginning.

Pete says

I’ve been using your steps for the past few years, and have been great. Thanks for updating this page year over year, really appreciate it!

Travis says

Perfect for 2024’s taxes, thank you!

James says

Thank you so much for your effort in putting this together. It was such a big help and a huge relief!

Best to you!

Lindsay says

I always come to your page for this guidance every year, and I really appreciate it!! Feel free to add a Ko-fi or some other ‘tip jar’, I’m sure many of us would contribute!

Jennifer says

Hi Harry – Thank you so much for this article. Super helpful! I contributed a total of $7000 to my traditional IRA in 2024 for 2024. I accrued a small interest, which resulted in my 1099-R to have a gross contribution of $7,002.42. I followed your guide to report the extra $2.42. However, I found out in January 2025 that I had a remaining balance of $2.79 on my traditional IRA account on 12/31/24. I converted that small balance to my ROTH IRA in January 2025. Would the $2.79 be reported on my 2025 return or 2024 return? If it is for 2025, should I contribute $2.79 less than the max traditional IRA contribution in 2025?

Harry Sit says

Enter the $2.79 as your end-of-year balance on the “Tell us the value of Your Traditional IRA” screen. The software will take it into account for 2024. It will also be part of the 2025 1099-R as your $2.42 was for 2024. You’ll follow the same steps next year. No need to contribute $2.79 less in 2025. Earnings aren’t contributions.

SH says

I’ve always saved this page since 2020. Thank you for updating this page specifically. <3 This has always been so helpful.

Lou Carmona says

First year doing a Roth Conversion as I am retired military and still working so trying to avoid / postpone taxes for when I actually stop working. For both my wife and I the value of the Traditional IRA went down before the ROTH conversion due to market timing (me, $75, her $86). These amounts show on the the 8606 as the basis on Line 14. I saw where a previous question asked if this was normal and you said yes. My question is do I need to keep track of that number for future years? Also – it seems like my basis should be $0, after converting the full balance?? What is the impact of this amount on future Roth Conversions (IOW, will it go in Line 2 on Future 8606’s ??).

I’m going to try to get my online TT refunded. You are right, the desktop version seems much better.

Harry Sit says

TurboTax controls what it puts on Form 8606. Just go with the flow. TurboTax will carry over the basis to Line 2 next year. It’ll help offset some gains if you have them next year.

RWHR says

I contributed $6500 in 2023 to my Traditional IRA but didn’t convert it then. I then contributed $7000 in 2024 and converted the entire amount (grew to 15k) in 2024. How would it look differently for me?

When it asks “Any Nondeductible Contributions to Robert’s IRA?”

– Yes, Robert made and tracked nondeductible contribtions to Roberts IRA

– No, Robert did not make and track nondeductible contributions to Robert’s IRA.

Do I answer Yes?

Harry Sit says

Yes, Robert made and tracked nondeductible contributions to Robert’s IRA. The next question “Let’s Find Your IRA Basis” should show $6,500 if you didn’t deduct your 2023 contribution.

Misa says

You are awesome!! Thank you for updating this each year! I consult this link each your for my taxes.

james belanger says

I was struggling with this, thank you for taking the time to explain-present the process. It was incredibly helpful. Thank you also for your actions respecting Renee Good and Alex Pretti’s memories; I appreciate your kindness and respectfulness.