Last updated on January 24, 2026 with all new screenshots from TurboTax Deluxe desktop software for the 2025 tax year. If you use other tax software, see:

If you did a Backdoor Roth, which involves making a non-deductible contribution to a Traditional IRA and then converting from the Traditional IRA to a Roth IRA, you must report both the contribution and the conversion in the tax software. This post gives you a step-by-step walkthrough of how to do it in TurboTax. For more information on Backdoor Roth in general, see Backdoor Roth: A Complete How-To.

What To Report

You report on the tax return your contribution to a Traditional IRA *for* that year, and you also report your conversion to Roth *during* that year.

For example, when you are doing your tax return for 2025, you report the contribution you made *for* 2025, whether you actually did it during 2025 or between January 1 and April 15, 2026. You also report your conversion to Roth *during* 2025, whether the contribution was made for 2025, 2024, or any previous years.

Therefore, a contribution made during 2026 for the year 2025 goes on the tax return for 2025. A conversion done during 2026 after you contributed for 2025 goes on the tax return for 2026.

You do yourself a big favor and avoid a lot of confusion by making your contribution for the current year and finishing your conversion in the same year. I call this a “planned” Backdoor Roth or a “clean” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for 2025 in 2025 and convert it during 2025. Contribute for 2026 in 2026 and convert it during 2026. Everything is clean and neat this way.

If you are already off by one year, it depends on whether you’re handling the contribution part or the conversion part right now. If you contributed to a Traditional IRA for 2025 in 2026 and converted in 2026, or if you recharacterized a 2025 Roth contribution in 2026 and converted in 2026, please follow Split-Year Backdoor Roth IRA in TurboTax, Year 1. If you contributed to a Traditional IRA for 2024 in 2025 and converted in 2025, or if you recharacterized a 2024 Roth contribution in 2025 and converted in 2025, please follow Split-Year Backdoor Roth IRA in TurboTax, Year 2. If you recharacterized your 2025 Roth contribution in 2025 and converted in 2025, please follow Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year.

Use TurboTax Desktop Software

The screenshots below are from TurboTax Deluxe desktop software. The desktop software is both more powerful and less expensive than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax desktop software from Amazon, Costco, Walmart, etc., and switch from TurboTax Online to TurboTax desktop software (see instructions for how to make the switch from TurboTax).

Here’s the planned “clean” Backdoor Roth scenario we will use as an example:

You contributed $7,000 to a traditional IRA for 2025 in 2025. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2025, the value grew to $7,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you will have to make some adjustments to the screens shown here.

Before we start, suppose this is what TurboTax shows:

We will compare the results after we enter the Backdoor Roth.

Convert Traditional IRA to Roth

The tax software works on income items first. Even though the conversion happened after the contribution, we enter the conversion first.

When you convert from a Traditional IRA to a Roth IRA, you will receive a 1099-R form. Complete this section only if you converted *during* 2025. If you only converted during 2026, you won’t have a 1099-R until next January. Please follow Split-Year Backdoor Roth IRA in TurboTax, Year 1. If your conversion during 2025 was against a contribution you made for 2024 or a 2024 contribution you recharacterized in 2025, please follow Split-Year Backdoor Roth IRA in TurboTax, Year 2.

In our example, we assume that by the time you converted, the money in the Traditional IRA had grown from $7,000 to $7,200.

Enter 1099-R

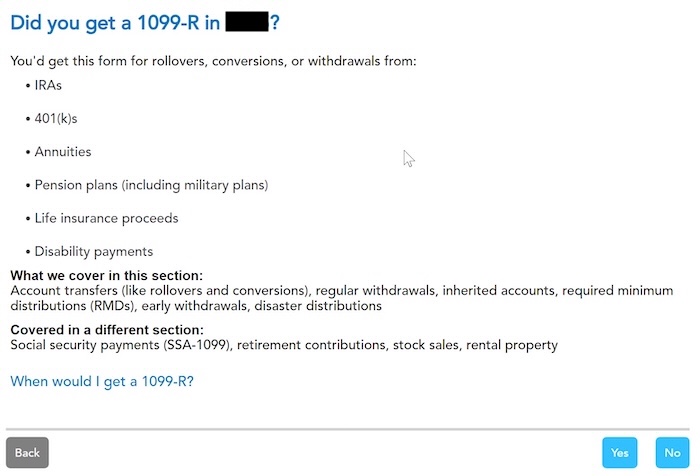

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

As you work through the interview, you will eventually come to the point of entering the 1099-R. Select Yes, you got a 1099-R. Import the 1099-R if you’d like. I’m choosing to skip import and type it myself.

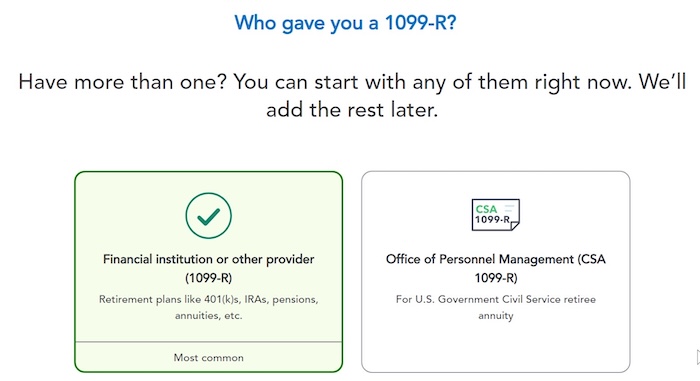

You got it from a financial institution. Enter the payer information as shown on your 1099-R.

Box 1 shows the amount converted to the Roth IRA. It’s $7,200 in our example. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked saying “taxable amount not determined.” The total distribution box may or may not be checked. It doesn’t matter.

Pay attention to the code in Box 7 and the IRA/SEP/SIMPLE box. Make sure your entry matches your 1099-R exactly. The code in Box 7 should be 2 if you’re under 59-1/2 and 7 if you’re over 59-1/2. The IRA/SIMPLE/SEP box should be checked.

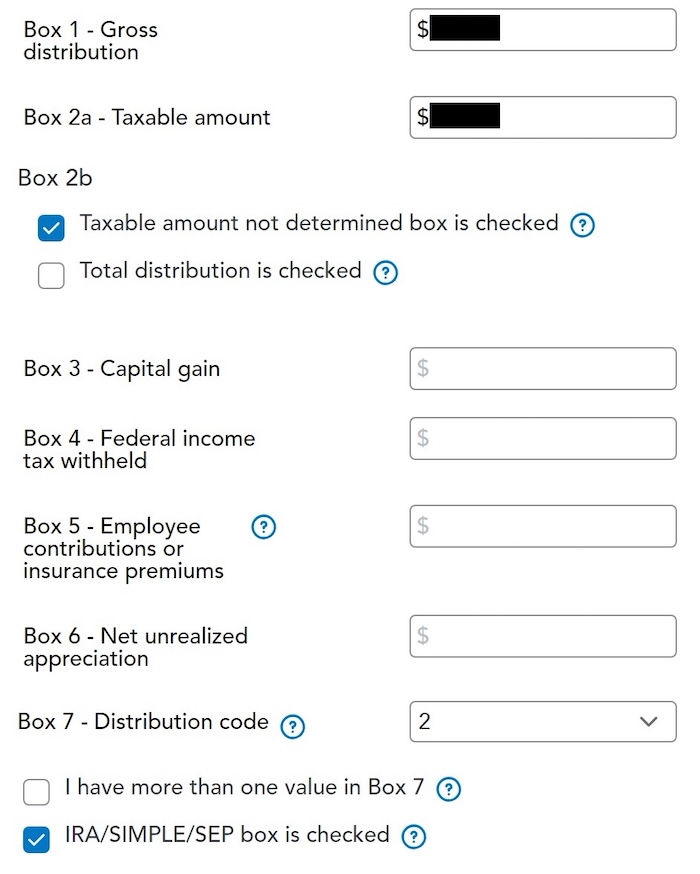

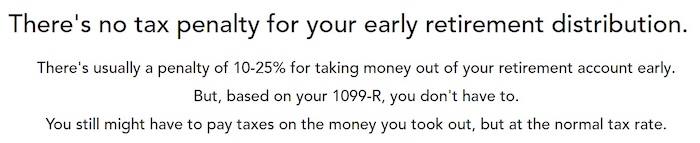

You get this Good News, but …

Your refund in progress drops a lot. We went from $2,384 down to $858. Don’t panic. It’s normal and temporary.

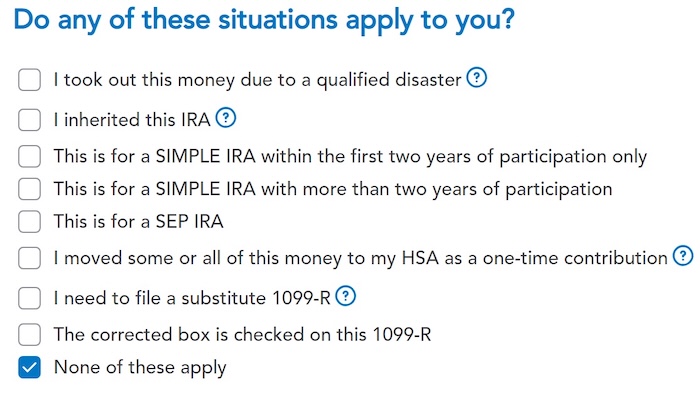

None of these should apply in a usual backdoor Roth.

Converted to Roth

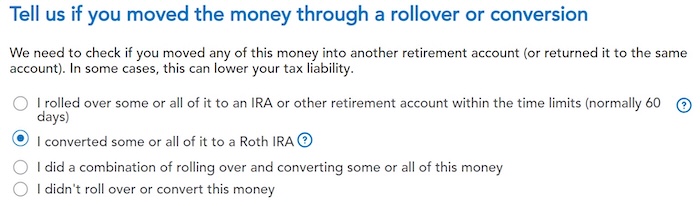

Choose “I converted some or all of it to a Roth IRA.” Don’t choose the “I rolled over …” option. A Roth conversion is not a rollover.

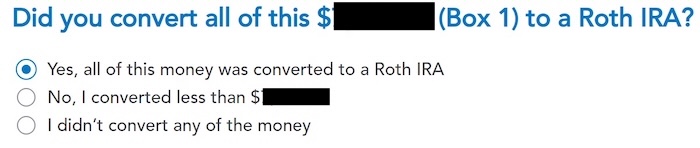

Yes, you converted all of it.

You get a summary of your 1099-Rs next. Repeat the previous steps to add another if you have more than one. If you’re married and both of you did a Backdoor Roth, enter the 1099-R for both of you, but pay attention to select whose 1099-R it is. Don’t accidentally assign two 1099-R forms to the same person.

Basis

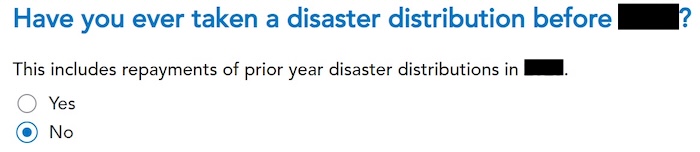

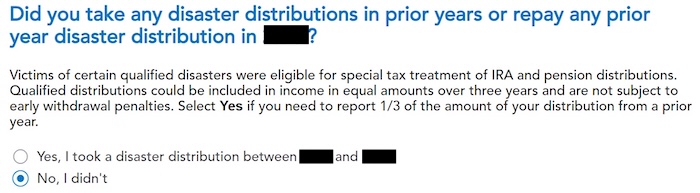

We didn’t take or repay any disaster distribution.

We already said no, but TurboTax just wants to be sure.

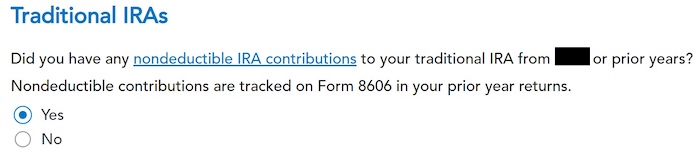

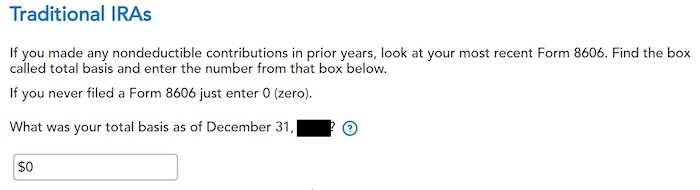

Here it’s asking about the carryover from the prior year. When you did a clean “planned” Backdoor Roth as in our example — contributed for 2025 in 2025 and converted before the end of 2025 — you can answer No here, but answering Yes with a 0 has the same effect as answering No, and it allows you to correct errors.

If you answered Yes to the previous question and you did your previous year’s return correctly also in TurboTax, your basis from the previous year will show up here. If you did your previous year’s tax return wrong, fix your previous return first.

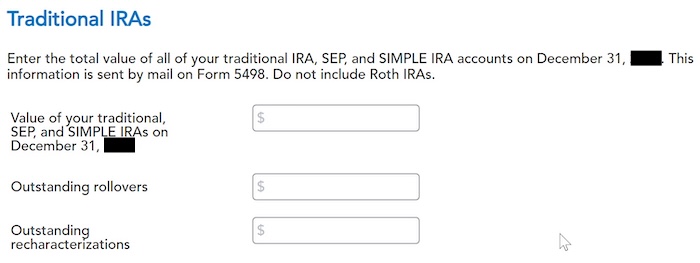

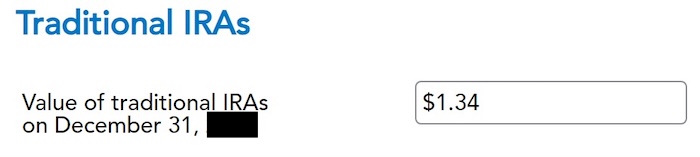

Enter the values of ALL your Traditional, SEP, and SIMPLE IRAs at the end of the year. We entered all zeros because we don’t have anything in traditional, SEP, or SIMPLE IRAs after we converted it all. If your account posted earnings after you converted and you left the earnings in the account, get the value from your year-end statement and put it in the first box.

That’s it so far on the income side. Continue with other income items. The refund in progress is still temporarily depressed. Don’t worry. It will change.

Non-Deductible Contribution to Traditional IRA

Now we enter the non-deductible contribution to a Traditional IRA *for* 2025.

If you contributed for 2025 between January 1 and April 15, 2026, or if you recharacterized a 2025 contribution in 2026, please follow Backdoor Roth in TurboTax: Recharacterize and Convert, Year 1. If your contribution during 2025 was for 2024, make sure you entered it on the 2024 tax return. If not, fix your 2024 return first by following the steps in Backdoor Roth in TurboTax: Recharacterize and Convert, Year 1.

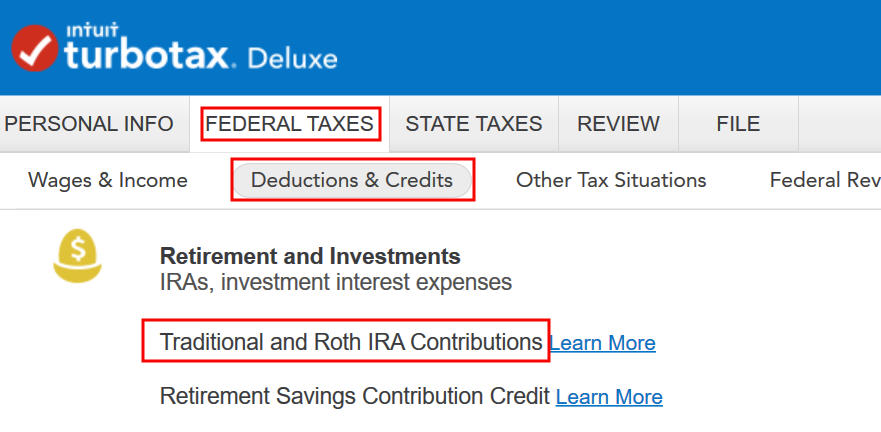

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

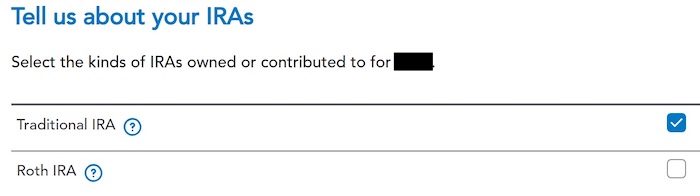

We check the box for Traditional IRA because we did a clean “planned” Backdoor Roth.

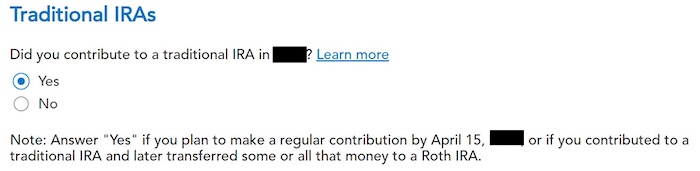

We already checked the box for Traditional but TurboTax just wants to make sure. Answer Yes here.

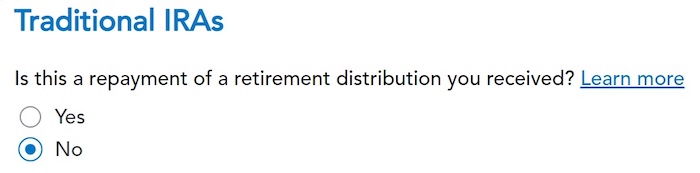

It was not a repayment of a retirement distribution.

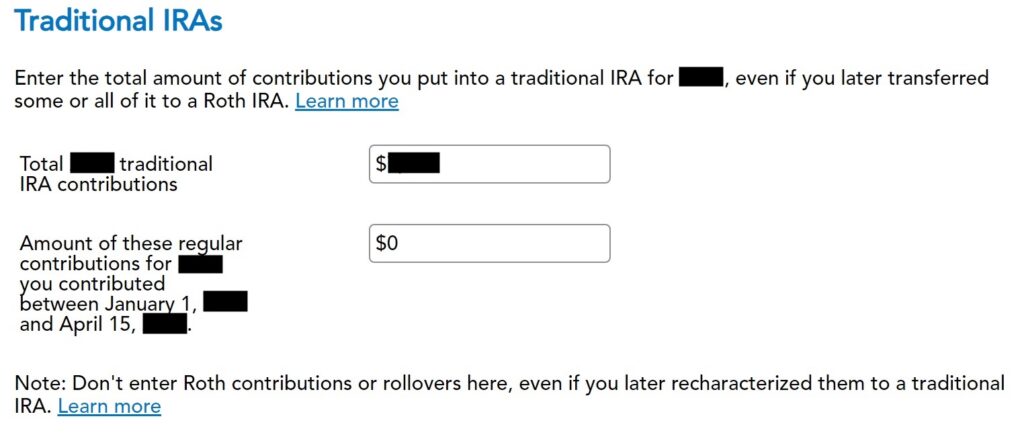

Enter the contribution amount. It’s $7,000 in our example. Because we contributed for year 2025 in 2025, we put zero in the second box. If you contributed for 2025 between January 1 and April 15, 2026, include the contribution in both boxes.

Right away, our federal refund in progress goes back up! We started with $2,384. It went down to $858. Now it comes back to $2,335. The $49 difference is because we have to pay tax on the $200 in earnings when we contributed $7,000 and converted $7,200. If you had less in earnings, your refund numbers would be closer still.

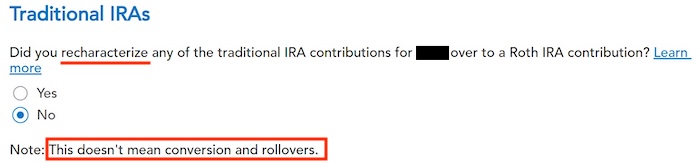

Converted, Did Not Recharacterize

This is a critical question. Answer “No.” You converted the money, not recharacterized.

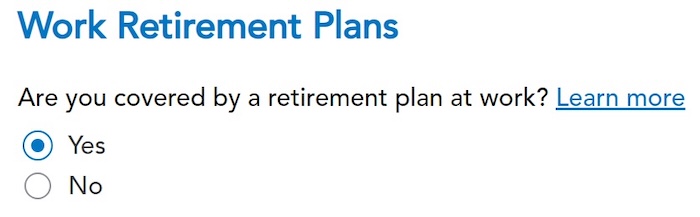

You may not get this question if you already entered your W-2 and it has Box 13 for the retirement coverage checked. Answer yes if you’re covered by a retirement plan, but the box on your W-2 wasn’t checked.

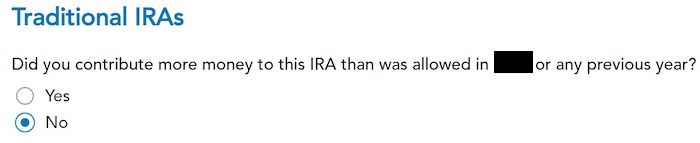

We didn’t make excess contributions.

Basis

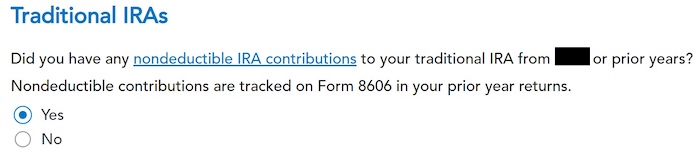

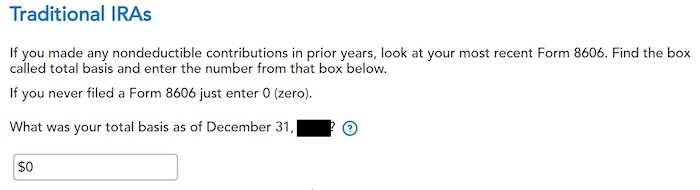

TurboTax asks the same question it did before. For a clean “planned” Backdoor Roth, we can answer No, but answering Yes with a 0 has the same effect, and it allows you to correct errors.

If you did your taxes correctly on TurboTax last year, TurboTax transfers the number here. If you made non-deductible contributions for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

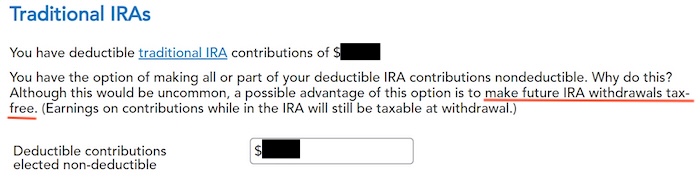

Make It Nondeductible

TurboTax shows this screen if it sees that you qualify for a deduction for the Traditional IRA contribution. If you take the deduction, it’ll make your Roth conversion taxable, which creates a wash. It’s simpler if you make your full IRA contribution nondeductible, and then your Roth conversion won’t be taxable. Enter the amount that TurboTax says is deductible.

Because we did a clean “planned” Backdoor Roth, we don’t have anything left after we converted everything before the end of the same year. If you have a small balance left because of interest posted after you converted, enter the value from your year-end statement here.

This is expected. That’s why we did the Backdoor Roth.

Taxable Income from Backdoor Roth

After going through all these, would you like to see how you are taxed on the Backdoor Roth?

Click on Forms on the top right.

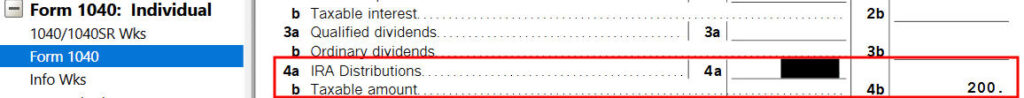

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b. They show a $7,200 distribution from the IRA, and only $200 of the $7,200 is taxable in our example. That’s the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth.

When you’re done examining the form, click on Step-by-Step on the top right to go back to the interview.

Tah-Dah! You put money into a Roth IRA through the back door when you aren’t eligible to contribute to it directly. That’s why it’s called a Backdoor Roth. You pay tax on a small amount of earnings between the contribution and the conversion. That’s negligible relative to the benefit of having tax-free growth on your contribution for many years.

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

Fresh Start

It’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

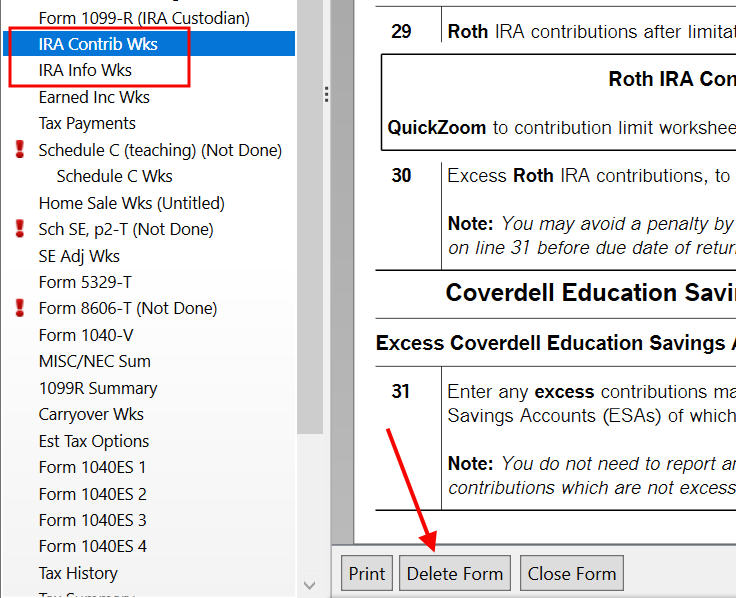

Click on Forms on the top right.

Find “IRA Contrib Wks” and “IRA Info Wks” in the left navigation pane and click on “Delete Form” to delete them. Then you can start over by following the steps above.

Conversion Is Taxed

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. Taking this deduction also makes your Roth IRA conversion taxable. You can see this deduction on Schedule 1 Line 20, which reduces your AGI.

The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal, and it doesn’t cause any problems when you indeed don’t have a retirement plan at work.

It’s less confusing if you decline the tax deduction, which also makes your conversion non-taxable. See the Make It Nondeductible section.

Self vs Spouse

If you are married, make sure you don’t have the 1099-R and IRA contribution mixed up between yourself and your spouse. If you inadvertently entered two 1099-Rs issued to you instead of one for you and one for your spouse, the second 1099-R to you will not match up with a Traditional IRA contribution made by your spouse. If you entered a 1099-R for both yourself and your spouse, but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

kimc says

Great information – Thank you!

My question is will TurboTax be able to figure out if I start contributing monthly to my IRA and immediately converting the entire IRA balance to Roth each month?

(or at least converting quarterly so I’m not paying tax/ paying minimal tax on any gains? we already pay AMT & the marriage penalty… )

Or is that far too much of a paperwork nightmare and not worth any potential savings?

Thanks!

Harry says

@kimc – TurboTax is able to figure out as much as you tell it. You can lump all contributions together as one entry. If your IRA custodian gives you one 1099-R for your 12 conversions in the year, then great. TurboTax can’t tell any difference. If you get 12 1099-R’s, you will have to go through it 12 times. Ask your custodian how many 1099-R’s you will get.

kimc says

Thank you Harry!

Jay says

I reported a non-deuctable IRA contribution made last April in 2012. Shortly after that I converted it to a Roth-IRA trying to take advantage of the backdoor.

I received a 2013 1099-R form with a distribution code of R for box 7, with IRA/SEP/SIMPLE checked off. 2a-Taxable Amount is 0.

After entering the form, TurboTax never asks me what I did with the money, so I have no chance to say I converted it to a Roth. If I enter the amount as a Roth IRA contribution in the Retirement section under Deductions and Credits, TurboTax tells me I make too much and have to pay a penalty (defeating the backdoor process).

Any advice?

Harry says

Code R is recharacterization for the previous year (2012), not conversion. Either your custodian issued the form wrong, or you filled out a wrong form or used the wrong verb when you made the request, or the person who processed it heard/read it wrong. If you recharacterized before you converted, maybe there’s another 1099-R form for the conversion.

Jay says

@Harry Thanks, most helpful.

Mike says

I apologize if this has been answered previously. My situation includes opening a traditional IRA in 2009 and being able to deduct $3100 from 2009 taxes. I continued to place money into this account however I was unable to receive any more deductions from future tax returns due to income limits. I heard about the back door Roth in August of 2013 and transferred the balance of this account (@$15,500) to the Roth. Within this account, I have contributed roughly $11.5K and have gained $4.5K. Now looking at my taxes this year, should I be paying tax on the growth plus the $3100 that I deducted in 2009? And if so, what do I need in terms of forms/statements? I did receive a 1099-R from my brokerage for this years conversion. Finally can this be accomplished through turbo tax. Thanks for any help

Harry says

Mike – For each year you made non-deductible contributions, you were supposed to do the steps in the first part of this article. That will give you a basis to carry over from year to year. If you didn’t do that in those years, you can fill out a Form 8606 now for each year by hand. You can find the previous years’ Form 8606 on IRS’ website. Just Google “2011 form 8606” for example.

Yes you are paying tax on the growth plus the $3,100 deductible contribution, or looking at it the other way, the full value minus your non-deductible contributions.

When you add up the non-deductible contributions, you can put that in the “Let’s Find Your IRA Basis” screen.

Jay says

I commented previously, but am still trying to work this out. Any help would be appreciated…

Last April I opened a traditional IRA with an after-tax contribution of $5000. Soon after I instructed my broker to convert it to a Roth IRA, attempting a “backdoor” Roth to avoid penalties based on income limitations.

I use Turbo Tax. I reported the initial IRA contribution on my 2012 tax return, and this year for 2013 am attempting to report the conversion. However, the 1099-R I received has a distribution code of “R – Recharacterization”, which gave me trouble in Turbo Tax (it won’t let me indicate the distribution went into a Roth IRA).

I investigated and found out my Financial Advisor filed the move of funds to the Roth IRA using a Recharacterization form, not as a conversion as requested, which would have generated a 1099-R with a distribution code of “2”, which would let me complete my taxes as expected.

I’ve asked my Advisor, and he said TD Ameritrade (who he uses) won’t fix it, and to just enter the “2” with an explanation that the broker made a mistake. At this point, should I enter a “Substitute 1099-R” in TurboTax, which will generate a Form 4952, and enter the distribution code as a “2”?

Harry says

Jay – I’m not a tax professional. I can only tell you what I would do if I run into the same situation.

The broker (TD Ameritrade) didn’t make any mistake. Your financial advisor filled out the wrong form. This made your 2012 contribution a Roth contribution, which you weren’t eligible. Your 2012 tax return was also wrong. So I would first amend my 2012 tax return: remove the non-deductible IRA contribution, report an excess Roth contribution, and pay the 6% excise tax.

You didn’t say whether you are eligible to contribute to [front door] Roth for 2013. If you aren’t eligible again, your excess contribution in 2012 stayed as excess contribution for 2013 again because the deadline to remove it passed on 12/31/2013. This triggers another 6% excise tax. If you are eligible to contribute to Roth for 2013 but you haven’t contributed yet, you can let the excess use up your 2013 Roth allowance (your 2013 max Roth contribution becomes only $500) and not owe the 6% excise tax. If you are eligible to contribute to Roth for 2013 and you already contributed, you can withdraw 2013 contribution down to $500.

After I’m all done with this, I would ask the financial advisor to reimburse me the $600 excise tax and the trouble for fixing my tax return unless I gave the wrong instruction to the advisor. After I get the reimbursement I would fire this advisor anyway. Someone not knowing the difference between recharacterize and convert is incompetent to be my advisor.

Harry says

I should add if I’m not eligible to contribute to Roth for 2013 again, after paying the 6% excise tax for a second year, I would finally stop the clock by removing the excess Roth contribution in 2014.

Randy says

I need a little help please. These directions are not working for me and I am showing that I owe tax in Turbo Tax. It may have something to do when I show I did the conversion. I have no previous IRAs and contributed to the 2013 non-deductable IRA in March 2014, so I checked the box that I made the contribution after Jan 1 and before April15. I did the transfer to the Roth IRA the next day again in March 2014. Does this mean that I need to wait until I do my 2014 taxes to show the conversion? I did note that when I uncheck the box for making the contribution go away the extra tax goes away.

Thanks

Harry says

Randy – From the article:

“If you contributed in the following year before April 15 for the previous year, enter the contribution in both boxes.”

“If you only contributed *for* 2013 but you didn’t convert *in* 2013, stop here. Come back next year to finish the conversion part.”

Parker says

I nearly cried with joy when I found this article!

Last year I spent hours upon hours trying to figure this out in TurboTax. I FINALLY did. I swear I wrote out the process but can’t find the sheet this year.

This article literally saved my 5 hours of work trying every possible combination of responses.

Turbotax makes this so strangely complicated.

People on their community forum ask every year why its not working and the Turbotax people give lame answers (“You will owe tax if you rollover so it shows tax”–which is never what the frustrated people are asking).

Worse, TurboTax itself gives completely contradictory definitions of rollover and recharacterization depending upon where you look.

It’s been YEARS of this nonsense–why can’t TurboTax make it easy???

DanBez says

According to this article, only one conversion can be done per year:

http://www.irs.gov/Retirement-Plans/IRA-One-Rollover-Per-Year-Rule

Here is the question:

I did a contribution to 2013 T-IRA in March 2014 and soon after triggered a rollover to Roth. Does it mean that I can’t do another roll-over until March 2015? My original plan was to do another rollover during this year, since the initial one was against the 2013 tax year

Harry says

A conversion is not a rollover. Read the very first sentence in your link:

“Beginning as early as January 1, 2015, you can make only one rollover from a traditional IRA to another (or the same) traditional IRA in any 12-month period …”

DanBez says

According to this article on TurboTax community, all conversions are rollover. That’s what confused me.

https://ttlc.intuit.com/questions/1192984-what-is-the-difference-between-a-rollover-and-a-conversion-in-2011-my-husband-converted-a-traditional-ira-to-a-roth-paid-the-required-minimum-distribution-and-left-the-rest-in-the-roth-thank-you

Harry says

The IRS says here the 1-year waiting period does not apply:

http://www.irs.gov/publications/p590/ch02.html#en_US_2013_publink1000231030

“You can convert a traditional IRA to a Roth IRA. The conversion is treated as a rollover, regardless of the conversion method used. Most of the rules for rollovers, described in chapter 1 under Rollover From One IRA Into Another, apply to these rollovers. However, the 1-year waiting period does not apply.”

Relieved says

Thank you so much for this article. I thought I’d have to go to an accountant to figure this out – you saved me a trip and a few bucks, which I’ll be happy to contribute to the tip jar. Cheers.

Brian says

TFB, this is the best reference. Thanks so much for all this, plus all the other useful articles/posts you have made here and at Bogleheads.

For ’11-’12, my wife and I backdoored to get into our ROTHs. We contributed directly for 2013, but low and behold our MAGI is too high for a full contribution to our ROTHs, so I am backdooring a partial amount. I am thrown off by a few things b/c I am unfortunately not completing the recharacterization and conversion in the same year (2014). Here are some questions:

1. In 2012, we contributed $5k to our TIRAs, but converted $4,996 to our ROTHs. Form 8606 showed line 14 showed a total basis of $4 for 2012 and earlier years, but at the same time line 3 of the IRA information worksheet shows the basis carryover as of 12/31/2012 as $0. The 2013 TT shows that my basis is $0. Is this correct?

2. The conversion of the 2013 recharacterization will have to occur in 2014. Line 14 of 2013 TT shows that the total basis in TIRA for 2013 & earlier years was $1,680. Is this correct?

3. We already made our 2014 ROTH contributions, but I am thinking of recharacterizing our entire $5,500 contributions and converting alson in 2014. There is a possibility we could be in the same partial contribution boat for 2014, but I just don’t want to have to deal with that, and any taxes on converting $5,500 vs. a partial amount won’t be that significant. Therefore, will this affect anything drastically for 2014 that we are converting a 2013 recharacterization and also recharacterizing and converting our 2014 contributions?

Tx for all your help. And, again, I am grateful for this guide TFB.

Harry says

@Brian –

1) $4, let it go; use $0.

2) No idea where it came from. If that’s the partial amount you recharacterized before earnings, it’s correct.

3) It won’t affect anything. If you recharacterize later you will have to pay tax on the earnings when you convert. If you haven’t earned much on the $5,500 yet, converting now may save you money.

CL says

Harry,

This is great pointers! Thanks! 🙂

My situation is a bit weird… I followed everything in this article but as soon as I added 1099-R, my refund goes down even though TurboTax says “Good news you don’t owe tax on this money” page.

Any idea?

Thanks!

Harry says

@CL – Make sure you really follow everything. Keep going. You are not done yet after you see that “Your 1099-R Entries” screen.

John Z says

Harry,

This is great; really appreciate you doing this for folks. I opened and loaded two TIRAs (for my wife and me) with 6,000 ea and converted all to ROTHs for 2012 credit in the Jan to Apr 2013 timeframe. I did not file any of this in my 2012 tax return. For 2012 I received two 5498 forms showing 0 market value. (as you say, I paid for the 2012 TIRA and converted to a Roth *IN* 2013 for 2012). For 2013 contribution, I put 6500 into each TIRA and converted all in the same year 🙂

IF I follow your instructions for 2012 and amend my return to accommodate my TIRA, I receive 1500 additional tax return due me. If I then do my 2013 taxes using your instructions, I need to pay over 4,000, given my two 1099-Rs total 26,000.

I’m confident I’m messing this up… any hints as to what I need to do differently from your instructions (or pay closer attention to) in order lower this tax burden for 2013? (I’m not overly confident that I’ve done 2012 amended properly).

Harry says

John Z – Take it slow and do it one year at a time. Reporting a non-deductible contribution to traditional IRA for 2012 doesn’t change your refund. Print out your amended return and see what changed and why it’s giving you an extra refund.

If you can’t make TurboTax do it, you can hand-fill a 2012 Form 8606 and file that alone. It’s really simple: just follow the instructions. You need one form for each person.

If you entered it wrong before, some entries may be stuck. Go to Tools -> Delete Form and delete the IRA contribution worksheet. That will give you a fresh start. Then follow the steps closely. Enter 6,000 when it asks you for your total basis as of Dec. 31, 2012.

Rashmi says

First off – THANK YOU for an absolutely fantastic article! The explanation is simple and so easy to understand. I really like how you broke it into the two parts – getting money *in* to the traditional IRA and then the *conversion* part, and switched them around from the way that TurboTax has it set up. Yours makes so much more sense.

My question is – how would the scenario change if there was a *loss* by the time you converted to Roth IRA, so that the value fell / decreased to $5480. How would you indicate the loss and show it this year? Is the capital loss something that you can carry over to offset future capital gains? If so, how would you do this?

Many thanks in advance!

Harry says

Rashmi – You don’t show any loss. It’s as if you converted at face value and then you suffered a loss in the Roth account.

Brian says

Tx for the reply Harry!

Would you be able to expand on your answer on point 1 in my topic above? I appreciate your response, I was just hoping to also gain an understanding as to why TT was reporting $0 as my basis on the IRA information worksheet and $4 on Form 8606. It is that discrepancy which makes me wonder if the program is computing it properly. I know having a IRA cost basis of $0 would be easier, but could this discrepancy raise IRS eyebrows?

Harry says

Brian – The 3rd bullet under Part I on Form 8606 says you fill out part I only if “You converted part, but not all …” When you converted all, you skip directly to part II. No number on line 14 to be carried over to the next year.

Brian says

Tx again Harry.

I have thought about filing MFS for sake of qualifying for a income based payment plan for my wife’s student loans, but doing so would prohibit us from contributing to our ROTHs. I am tooling w/ the idea of just contributing to non-deductible TIRAs during the time we would be on such payment plan. But, it has brought some questions to my mind:

1. What happens if a person accumulates a large balance in his/her non-deductible TIRA and wants to backdoor at some future time? Hypothetically, let’s say the balance is $55,000. Is it still possible to backdoor in the future?

2. Perhaps to backdoor in the future (let’s say after 10 years), then the $55,000 from the above example would need to be converted to a ROTH. Is that the case?

3. Would this create an accounting nightmare with having multiple years of non-deductible TIRAs?

Tx.

Harry says

@Brian – If you can’t contribute because of MFS or income limit, you can still backdoor every year. That’s the point of a backdoor. No reason to wait 10 years.

Anthony says

Harry, You are the go-to man every year for reporting this! Thank You very much for taking the time to update it. I know that everyone appreciates your efforts.

Spiff says

First,

Thanks for the wonderful advice to all!

Here is my situation and question.

Took out a Roth for 2013 and 2014. Now I realize that I’m over the limit for 2013, and will be for 2014 as well. I just converted both Roth’s to traditional yesterday, and converted them both to Roth’s today. I understand that for the 2013 Roth I must:

1. File a 8606 now for my 2013 return.

2. pay taxes on the conversion in my 2014 return.

Now for the 2014 Roth that I just converted, I assume that I’ll pay for that conversion next year as well, but what about the 8606 for 2014. Do I file that next year?

Thanks much!

Harry says

@Spiff – Yes you do that next year. It will have your basis carried over from 2013, non-deductible contribution to traditional IRA for 2014 and your conversion in 2014.

Spiff says

Thanks very much!

The more I learn, the more I realize I don’t know enough.

Brian says

Harry, thanks so much for all the help.

If we did MFS, if I recall correctly, Roth contributions are not allowed if an individual earns greater than $10,000 or $11,000 per year. Filing MFS, our incomes would be well above that limit. Do u think backdooring in thIs situation to get into a ROTH would increase our chances of raising eyebrows at the IRS anymore than backdooring if we filed MFJ?

I’m just concerned because of the larger discrepancy of income over the ROTH income limitations via the front door method if we filed MFS.

Harry says

@Brian – I have no idea what raises their eyebrows. Everybody using the backdoor by definition exceeds the income limit one way or another. The income limit for MFJ is $200k or so. Someone doing it could have $500k income or more. Only you can decide whether it’s worth doing or not.

Justin says

Okay, getting things close. Appreicate help.

I contributed $5500 for both myself and spouse *for* 2013 in March of 2014 into a Vanguard Traditional IRA. I immediately converted it to my existing Roth IRA a couple days later in March of 2014.

I understand that I need an 8606 form and just report the contribution for my 2013 taxes and report NO conversion, until my 2014 taxes.

My confusion comes in in turbo tax as it shows my income at 180, 000 (my wife doesn’t work, and I don’t have a retirement plan at work this year). Turbo tax is asking me if I want to make this a DEDUCTIBLE contribution (but it doesn’t know that I have converted it to a Roth and will be filing the conversion in 2014). Do I still choose to make this a non-deductible contribution, as it gives me the choice.

Obviously, I didn’t know what my income was going to be and could have potentially avoided the complicated backdoor process if I had known my income would have been below the 188 or so.

Please help!

Harry says

Justin – It’s your choice. If you take the deduction for 2013 you will pay more tax for 2014, which, other than when you pay, becomes a wash if your tax rate is the same in both years.

If your tax rate is lower in 2013 than 2014, you don’t want to take the deduction at a lower rate and then turn around and pay tax at a higher rate. You want to take the deduction if your tax rate in 2013 is higher than your tax rate in 2014.

Some states give special treatment to IRA distributions. If you live in the right state and you meet the age requirement, you may be able to save some money on state income tax by taking the deduction. See Deduct-and-Convert: Save Hundreds in State Income Tax on Roth IRA Contributions.

Carlos Bonetto says

I wonder if you can help me with this question. On 3/12/14 I contributed $5,500 to a traditional IRA account for 2013. Later on I realised that none of this amount was deductible so on 4/1/14 I fully withdraw the amount as an excess distribution. 1) Do I need to report anything of this in my 2013 tax return? 2) If yes, how do I do it?

Harry says

Carlos – Yes you do. When you withdrew your contribution, you also had to withdraw some earnings. The earnings are taxable in 2013. See IRS Publication 590, p. 33, “Contributions Returned Before Due Date of Return.” I have no idea how to do it in TurboTax though.

Molunat says

I made $4000 contribution to Roth in 2012. At the beginning of 2013 I realized I needed to recharacterize my Roth as I exceeded the income limit in 2012.

Before April 15, 2012 tax deadline I recharacterized my Roth to nondeductible IRA. The amount was $4500. A few days later, I converted $4515 (there were minor gains) from nondeductible IRA back to my Roth.

The way I understand this is – my Roth recharacterization had to be reported in my 2012 tax return while my nondeductible IRA to Roth conversion has to be reported in my 2013 tax return. Is this correct?

I filled out part I of 8606 form in my tax return for 2012, with a small mistake: I entered $4000, instead of $4500, thus omitting the interest on the $4000 in my Roth. So, first thing, I have to amend my 8606 for 2012.

Then I have to report my nondeductible IRA to my Roth IRA conversion for tax year 2013. Do I fill out both Part I and Part II of 8606? I’d appreciate any instructions on how to fill out 8606.

Harry says

Molunat – You didn’t make a mistake for 2012. The recharacterized contribution should be $4,000. If you don’t have any other traditional, SEP or SIMPLE IRA, because you converted the whole thing, you only fill out Part II on 2013 Form 8606. $4,515 on line 16, $4,000 on line 17, you pay tax on $515.

Molunat says

Hi Harry,

Thanks for the prompt reply.

My confusion comes from my 1099-R statements. The one for the Roth characterizations has $4500 written in box 1. The one for my nondeductible conversion has $4515 written in Box 1 and Box2a.

The gains in my Roth were $500 and in my nondeductible IRA was $15. Since my Roth recharacterization basically means my Roth contributions never happened, any gains on $4000 are attributed to my nondeductible IRA, correct?

Harry says

Molunat – That’s right. After you recharacterized, it’s as if you contributed to a traditional IRA to begin with. The earnings are attributed to the traditional IRA. I would probably not bother with a late statement either.

Molunat says

P.S. I did not include a statement when I filed 8606 in 2012. If I hear from IRS I will do one, but I assume it’s not worth doing it now.

Molunat says

Thanks a million.

Joe says

what if I wait to the last minute to create the nondeductible IRA, then convert to do the “backdoor” Roth conversion before 4/15 so I do not have the 1099-R form from the Payee yet. Then what do I do?

RM says

Hi, Harry,

I still have a problem. At last step when I entered the value of my traditional IRA as of Dec 2013 (some leftover ~$500 cash value in the traditional IRA account), turbotax then calculated a tax amount that I should pay. Since I have not take a distribution of that amount, why should I pay tax on it?

Harry Sit says

RM – That’s how the pro-rata rule works. When you convert that $500 this year or in the future, you will pay tax on less than $500.

Shawn Cronin says

FWIW, I was having issues with turbo tax incorrectly reporting my backdoor roth contributions as taxable (the full amount of contributions) after following this guide to the letter.

After quite a bit of trial and error I found that another, unrelated 1099-R form that I had previously entered was messing things up.

I needed to delete ALL 1099 forms and two other “worksheets” and start over. When I did that, following this guide worked perfectly (I then went back and re-entered the other 1099-r form and all was good)

How to do this was not very clear, this is what I did:

Select “Tools” just as in this guide, then select “Delete a form” This will take you to a page will all the worksheets you have used so for in turbo tax. I deleted all of the “Form 1099-R” forms, the “IRA Contributions Worksheet” and the “IRA Information Worksheet”

One of those forms / worksheets was messing me up, when I deleted them all and restarted everything was good. Just incase anyone else runs into this, this seems to be the only way to do a “Full Reset” of the IRA contributions worksheets in turbotax online.

Thanks for the otherwise awesome guide financebuff, keep up the good work!

Cari says

Thank you so much for this! As I sit here after midnight on the 14th, I am so grateful that the panic I was feeling an hour ago has subsided and I can feel confident that my tax returns were prepared correctly (both 2012 & 2013). I am also relieved that I was not the only one having trouble with this on Turbo Tax.

You are a lifesaver, Harry!

John H. Fringer, III says

Thank you so very much for this! I knew about the back door Roth, but just enough to be confused. This and your other article provide so much relief, I can’t tell you! One question, though: When I retire, and I move my Federal Thrift Savings Plan to an IRA, that won’t interfere with my Roth IRA, right? I just won’t be able to contribute the $6500 (like I do now) to a Traditional IRA and then convert it to a Roth; I’ll just have two IRA accounts (a Trad. and a Roth) right?

Harry Sit says

You are welcome. That’s correct. You will have two IRA accounts. You also have the option to keep the money in the TSP.

George says

I think you have a small error in the presentation. In the boxes under the phrase:

“If you enter the 1099-R yourself, pay attention to the code in Box 7 and the checkboxes. My 1099-R had Box 2b checked, code 02 in Box 7 and the IRA/SEP/SIMPLE box also checked.”

Box 1. Gross distribution: $5520

Box 2. Taxable amount: $5520

Shouldn’t Box 2 be only $20, the actual gain? If you input the full $5520 on Box 2, Line 15b on the 1040 will show the full $5520 as taxable, not just the $20.

I of course have not received my 1099 for 2014 yet but wanted to do a practice run for my 2014 taxes so I just used your numbers. Got confused when I looked at line 15b until I realized the problem.

You have provided a great set of instructions. Thank you.

Harry Sit says

Did you do the contribution part first? Follow the instructions as a complete set from start to finish. Don’t jump ahead. Otherwise you scare yourself unnecessarily. Box 2b says “Taxable amount not determined.” That means the number in box 2 isn’t necessarily accurate. You enter whatever are actually printed on the 1099-R. Don’t change the numbers.

dale k says

Hi Harry. Can I pay to get an hour of your time to consult me on my tira to rira contributions, which I recharacterized. I only started this a few years ago, but it’s so complicated due to my recharacterization. I’ve had a lot of wrong advice and really need to get my historical part correct and what to do ever year.

Thank you.

Max says

So. everyone ready to report this for 2014? I’m going to be reviewing this post line by line very soon!

Louis says

I just tried to do this for my 2014 return and after I entered in the 1099-R exactly as described above (same way I have done previous years), the refund tracker decreased as though it were a taxable event despite saying “Good News: You Don’t Owe Extra Tax on This Money.” I just wanted to see if anyone has experienced that for 2014 return and if you figured out how to correct it. Thanks.

Louis says

Ok, I figured it out. Once you enter in your contributions to the traditional IRA under “Deductions & Credits”, the refund tracker will go back up.

Arvind says

I’m trying to file exactly as per this guide, but when I add the 1099-R, it decreases my tax refund amount. The only difference between the example on this page and my case is that i converted the contribution for 2013 in 2014, and am making a contribution for 2014 in 2015. So, in the “Tell us how much you contributed Step”, for “contribution between Jan 1, 2015 and April 1, 2015”, I have entered $5500 because I’m making that contribution this year for 2014.

Any thought?

Arvind says

I think i figured it out. My IRA basis for 2013 is $5500 because I made the contribution *for* 2013, even if it was *in* 2014

Pavel says

Just wanted to say thanks for the clear walkthrough. The part about the recharacterization was throwing me off, but all makes sense now 🙂

Mike says

Harry, I can’t thank you enough. This was a very frustrating experience until I found your website/instructions. The screen shots were incredibly helpful; thank you, thank you, thank you.

John says

Harry,

superb articles on the back door Roth conversion.

I haven’t yet been able to heed your advice on contributing and converting in the same year. (I plan to do so in 2015).

So, my 2013 contribution was done in 2014 (and converted in 2014) and I was planning on doing the same this year (2014 contribution in 2015 and conversion in 2015).

I am thinking I probably need to correct my 2013 tax return as you mention (do I just go back to my turbo tax 2013 to do that?), but I received a 1099-R for 2014 despite my contribution being ‘for’ 2013. Is that correct that I should have received this, or do i need to check with my broker to make sure they got the ‘year’ correct for my contribution?

And when I go through the steps on Turbo tax, the only way I don’t get charged a penalty is if i make the taxable amount zero (which I realize is incorrect based on the 1099, which has 5500 in that slot).

Thanks for any advice you have.

Harry Sit says

Receiving 1099-R for 2014 is correct. You can go back to TurboTax 2013 or you can Google the 2013 Form 8606 and fill it out by hand. It’s really easy, just a few numbers on lines 1-3 and 14. Then just sign and mail in the 2013 Form 8606 by itself. After that, in one of the “Find Your Basis” screens you will enter your contribution for 2013 as your basis.

Doug says

Thanks so much.

I have a real problem. I did my 2013 IRA and backdoor roth in March of 2014, and my 2014 in April of 2014

As a result, my 1099R shows 11,000 as my distribution, so I’m being hit for taxes on $5500.00 of it since it was done in march of last year, but before the April 15th deadline.

Or did I make a huge mistake doing my 2013 and 2014 in the same year, though before April 15th on the 2013 conversions?

I’m getting crushed for 2k in taxes on that $5500.00

Help!

Harry Sit says

See reply to the previous comment. You have to get your contribution for 2013 onto your 2013 return, then carry over the basis to the following year.

Bob S says

What an amazingly simple to follow guide!!! THANK YOU!!! This was so helpful with the step by step and screen grabs.

kay says

Wow, this was amazingly helpful. I could not have figured this out on my own. Thank you for taking the time to write these incredibly detailed, dummy-proof instructions. I’m in awe. Thank you!!!

Tyler says

Harry – So extremely helpful – thank you very much.

I too had 1099-Rs for $11,000 for both my wife and I. Turbo Tax was not picking up the 2013 basis for the Traditional IRA contributions. As you suggested, I went back into 2013 TTax to complete form 8606 and interestingly it had been created for last year. So, there is likely an issue with TTax carrying the amount over,

Krishna says

Can’t be more thankful

Jack says

Very helpful. Thank you. I would’ve submitted the return with 15a and 15b on the 1040 saying the same thing–5512. Then I read your article, went back to Deductions and explored the IRA part under deductions and went through the necessary steps/pages and viola! 15b became 12. The refund amount increased. Then I knew it was proper.

Max says

I am at the very last step ” Tell us your value of your traditional IRA”

My situation:

– Had $15K in TIRA on 3/2014 ($0 in Roth)

– Contribution $5500 to TIRA on 4/14/2014

– Converted ~21K from TIRA to Roth on 4/16/2014 (TIRA balance is now $0)

– DID NOT contribute to TIRA in 2013 or 2012 (did in 2011). So 2013 Form 8606 has blank (not 0) in Line 14. 2011 Form 8606 has $5000.

Questions:

1) There is no year-end value for my Traditional IRA since I converted the entire balance on 4/2014 to Roth.

Do I put 0 for “Value of XXX’s Traditional, SEP, and SIMPLE IRAs on December 31, 2014”

Or

Do I put the balance as it was on 3/2014 before the Roth IRA conversion?

2) What do I put for IRA Basis? I have been putting 0 since 2013’s 8606 has –blank– in LIne 3 (and Line 14).

Thanks

Harry Sit says

(1) Zero. (2) 5,000. It’s better once you did a 8606 you do it every year to carry the number forward. If you did that your 2013’s 8606 would have had 5,000. That way you only have to go back to the most recent year, not all previous years. But it’s not required. It’s good that you remembered.

Max says

@Harry-

Thanks.

Putting in :

– 0 for year end value

– 8000 for IRA basis (i double checked and 2011 Line 14 is 8000, not 5000 like I previously mentioned)

– ~20K for Gross Distribution/Taxable (1099-r)

Since all my TIRA contributions were non-deductible, I cannot roll it my 401k.

Questions:

1) My taxes owed jumps from ~3000 to ~7000 (fed+state). Does this seem right? It’s only when I complete the 1099-r that the taxes jump (I didnt go to the very end to see if the # goes down, but I doubt it).

1099r:

– Taxable amt not determined is checked (2b). Total distribution is NOT checked.

– 02 code in Box 7,

– X for IRA/SEP, and

2) I’m even thinking of undoing the Roth conversion so I don’t have to pay extra $4000 in taxes. I guess that defeats the purpose of backdoor Roth.

Harry Sit says

It appears you didn’t enter your non-deductible contribution for 2014 yet. Do the series of entries in the first part of this article. You tax owed will come down by $2,000 or so.

Max says

@ Harry

Yeah, I double checked and I complete both parts:

1) IRA Contributions

2) 1099-r

I deleted all the #s and tried again.

If I don’t put in the 1099r stuff (which is a gross dist of ~20K), the amt owed stays the same (~$3000). As soon as I filled out the 1099-r, it goes up. I’m thinking the 12K is being taxed (20-8K in basis)

I’ll take a look at it again. Worst case, I’ll go see a Enrolled Agent. Any other thoughts are appreciated!

Harry Sit says

It should go up. The question is by how much. Make sure you finish the last few screens after you see “Your 1099-R Entries.” Also do the last part and preview your 1040. See how much you are taxed on line 15b. Do the whole thing. Don’t skip any steps.

Max says

15b shows 6,994

I guess that makes sense. 20K (converted) -5500 (2014 contribution) -8000 (Basis) = $6994.

But nto sure why taxes owed go up $3000 on $6994 taxable amt. I did get hit with AMT so maybe that’s why..

Minta Patel says

Hi Harry:

I just went over your tutorial and it is very helpful especially since I am new to this all. I am slightly confused over my situation and was hoping if you would be able to help/clarify. I filed by 2013 tax by March 20, 2014, and then got to know about this entire backdoor Roth from a friend. So I contributed for 2013 in May 2014 converting from Traditional IRA to Roth IRA the very next day. I received 2013 Form 5498 later in the month, showing the amount 5500 I had contributed. Thereafter I contributed to the Roth IRA for year 2014 itself, and now I have 2014 Form 1099-R, which shows $5500 with all the ticks/marks just like yours.

I am confused now trying to figure out if I need to go back and amend by 2013 tax before proceeding with 2014 to report my Roth IRA? Am I falling into the category where I contributed *for* 2013 but didn’t convert *in* 2013 because it was in May 2014 i did contribution/conversion for year 2013? Or can I just proceed with my 2014 tax, because it was all in 2014 I did this, using the instructions you provided for contribution and conversion. I used turbotax last year and plan to use it this year as well. I would really appreciate your help and clarification. Thanks for taking time and effort in this matter

Sincerely,

Minta

Harry Sit says

Yes you fall into the category where you contributed *for* 2013 but didn’t convert *in* 2013. See reply to comment 137.

Seth says

Hi Harry,

I came across this website just the other day and find the information here invaluable. I definitely plan to contribute to the tip jar.

I apologize if this question has been asked before, but I’m in a situation where I want to start following your advice and do both the contribution and the conversions in the same year. But I hadn’t contributed the $5500 in 2014 so for this year, I contributed $11K ($5500 for 2014, $5500 for 2015) into a traditional IRA account. I did report my 2014 contribution in Turbotax when doing my 2014 taxes, as you instructed in the first half of your procedure above.

So now in 2015 – can I go ahead and convert the full amount ($11K) to the Roth? And next year I can follow the bottom half of your instructions above and input in Turbotax the $11k conversion in 2015, right? Is there anything special I would need to do to prevent tax issues? Then going forward my intent is to both contribute and convert in the same year. Just want to make sure I’m doing this correctly and converting $11K all at once vs. $5500 won’t cause issues.

Harry Sit says

Yes you can convert $11k. Next year you will do the first half for $5,500 and the bottom half for $11,000 but remember to carry over the $5,500 from 2014 if the software doesn’t do that automatically for you in “Let’s Find Your Basis.”

Michael Peters says

Hi Harry –

Thanks for the terrific guide!

I am also one of the ones that contributed to my IRA in early 2014 but claimed it for 2013. I contributed $5,500 to an existing Rollover IRA and then backdoored it to a Roth IRA with Vanguard. Your instructions worked really well for the 2013 part. I followed it up until the stop here section…Am I done as far as that part? I’m using TT Amend 2013.

I know for the already existing amount in the Rollover IRA, I’ll have to report that taxable amount for 2014. My 1099-r with Vanguard is trying to get me to report the entire amount as taxable for 2014.

Any suggestions?

Minta Patel says

Re: comment 146

Thanks for responding Harry. I really appreciate it. I got the 2013 form 8606 for amendment but line 1 states to enter for contributions ‘including those made for 2013 from jan 1, 2014, through april 15, 2014’. I am confused because I initiated the entire thing in May 2014 – so is that okay?

Harry Sit says

Sorry I missed the May part. The deadline to contribute for 2013 was April 15, 2014. Not sure why your IRA custodian accepted your contribution for 2013 in May 2014. Are you sure that was the case? Please double-check your transaction history, account statement, and your Form 5498 for 2013. Call your IRA custodian and ask if they indeed marked it as contribution for 2013 and why they were able to do so after April 15, 2014. If they tagged your contribution in May 2014 as for 2014 and you made another $5,500 contribution for 2014 (at the same place or different?) now you over-contributed and you need to withdraw the excess contribution.

Minta Patel says

Re: f/u comment 146/149

Hi Harry,

Sorry. My bad. I actually had it mixed up because I made two contributions last year. I initiated it all in early April 2014, hence falling within the deadline contributing for 2013 and converting it, and then made second transaction in May for 2014 itself with the same custodian. However, I am disappointed because in efforts of trying to secure future well-being, I made more than one error.

I spoke to my custodian and realized that the second transaction to Roth IRA in May 2014 was actually made ineligibly since I deposited directly to it and not by means of ‘traditional converting to roth’. I was under the impression that the ‘backdoor entry’ phenomenon was one-time thing, and so now I just need to save and deposit directly into Roth. I didn’t realize in order to contribute to Roth, backdoor entry is something I would have to do for each year. *sigh*

My custodian spoke about ‘recharacterization’. I tried to enlighten myself on it as well, but I know your words/guide in how to follow through with this would be life-savor, especially in how to go about reporting this mess. My custodian mentioned to correct the error, I could do recharacterization whereby money would be pulled out from Roth IRA, placed in Traditional (with gains/losses accounted) and then I can convert it into Roth for 2014 being mindful of the taxes to pay on whatever earnings that the $5500 generated. My only issue with all this is trying to figure out what is it that I need to do in filling out the forms to account for this. Is there anything different I should be doing now? If I proceed with this recharacterization to correct my contribution for 2014, does the process still remain same whereby I would show my contribution for 2014 now, and then account for conversion in 2015? Please help…!!!

Sincerely,

Minta

Harry Sit says

Go slow and do one thing at a time.

1) Contribution for 2013 done in April 2014: Fill out that form, just the first few lines, and send it in.

2) Ineligible contribution to Roth in 2014: Do the recharacterization paperwork with your custodian. Then enter the contribution similar to the first half in this article but check the Roth box and then say you changed your mind.

3) Conversion in 2014: Follow the 2nd half of this article. In “Let’s Find Your Basis” you would have $5,500 from 2013. In “Tells Us the Value” you would have your recharacterization in the 3rd box as the outstanding recharacterization. When it’s all said and done you will have some money in your traditional account and some basis to carry over to 2015.

4) Contribute and convert in 2015: After the recharacterization is done you might as make your 2015 contribution and convert the whole thing together. You will still have some untidiness when you file your taxes for 2015 next year, but promise yourself to do it clean in 2016!