[Last updated on January 25, 2026 with all new screenshots from TurboTax Deluxe desktop software for the 2025 tax year.]

The best way to do a backdoor Roth is to do it “clean” by contributing *for* and converting in the same year — contribute for 2025 in 2025 and convert in 2025, contribute for 2026 in 2026 and convert in 2026, and contribute for 2027 in 2027 and convert in 2027. Don’t split them into two years: contribute for 2024 in 2025 and convert in 2025, or contribute for 2025 in 2026 and convert in 2026. If you did a “clean” backdoor Roth and you’re using TurboTax, please follow How To Report Backdoor Roth In TurboTax (Updated).

However, many people didn’t know they should’ve done it “clean.” Some people thought it was natural to contribute to an IRA for 2025 between January 1 and April 15 in 2026. Some people contributed directly to a Roth IRA for 2025 in 2025 and only found out their income was too high when they did their 2025 taxes in 2026. They had to recharacterize the previous year’s Roth IRA contribution as a Traditional IRA contribution and convert it to Roth again after the fact.

When you contribute for the previous year and convert (or recharacterize and convert in the following year), you have to report them on your tax return in two different years: the contribution in one year and the conversion in the following year. It’s more confusing than a straight “clean” backdoor Roth, but that’s the price you pay for not knowing the right way. This post shows you how to report the contribution part in TurboTax for the first year. The follow-up post, Split-Year Backdoor Roth IRA in TurboTax, Year 2, shows you how to report the conversion part in TurboTax for the second year.

If you recharacterized your 2025 contribution in 2025 and converted in 2025, please follow Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year.

I’m showing two examples — (1) a direct contribution to a Traditional IRA for the previous year; and (2) recharacterizing a Roth contribution for the previous year as a Traditional contribution. Please see which example matches your scenario and follow along accordingly.

Use TurboTax Desktop Software

The screenshots below are from TurboTax Deluxe desktop software. The desktop software installed on your computer is more powerful and less expensive than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax desktop software from Amazon, Costco, Walmart, etc., and switch from TurboTax Online to TurboTax desktop software (see instructions for how to make the switch from TurboTax).

Contributed for the Previous Year

Here’s the example scenario for a direct contribution to the Traditional IRA:

You contributed $7,000 to a Traditional IRA for 2025 between January 1 and April 15, 2026. You then converted it to Roth in 2026.

Because your contribution was *for* 2025, you need to report it on your 2025 tax return by following this guide. Because you converted in 2026, you won’t get a 1099-R for your conversion until January 2027. You will report the conversion when you do your 2026 tax return. Come again next year to follow Split-Year Backdoor Roth IRA in TurboTax, Year 2.

If you’re married and both you and your spouse did the same thing, you must follow the same steps below once for you and once again for your spouse.

If you did the same in 2025 for 2024, you should’ve done everything below when you did your taxes for 2024. In other words, if this fits you:

You contributed $7,000 to a Traditional IRA for 2024 between January 1 and April 15, 2025. You then converted it to Roth in 2025.

Then you should’ve taken all the steps below last year on your 2024 tax return. If you didn’t, you can amend your 2024 return and make up for the missed steps. The conversion part is covered in Split-Year Backdoor Roth IRA in TurboTax, Year 2.

If you first contributed to a Roth IRA for 2025 and then recharacterized it as a Traditional contribution in 2026, please jump over to the next example.

Contributed to Traditional IRA

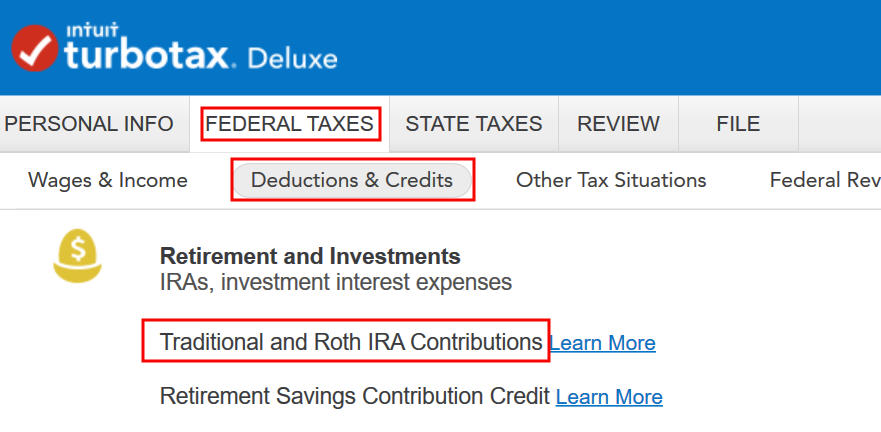

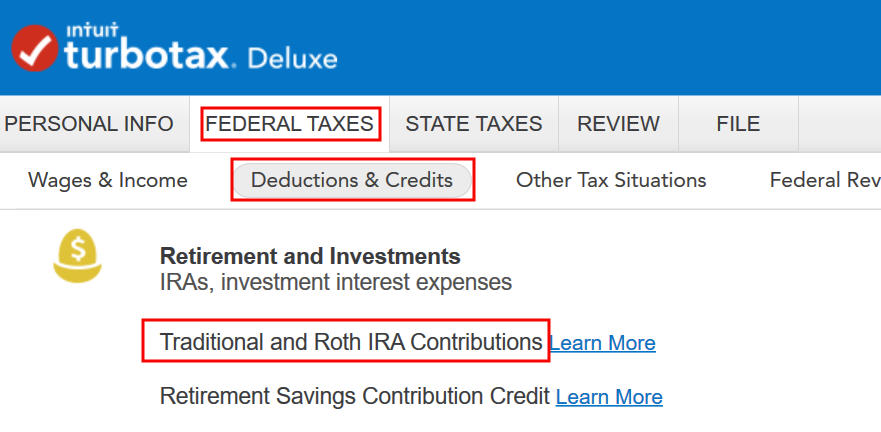

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

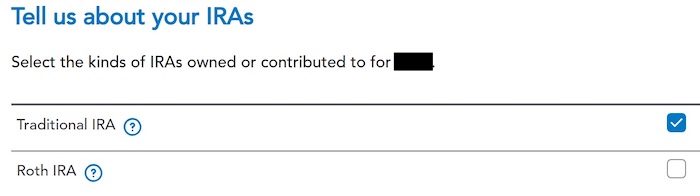

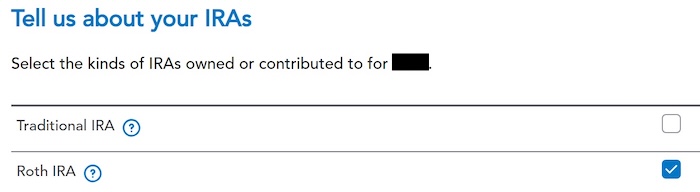

Check the box for Traditional IRA because you contributed to the Traditional IRA directly. See the next example if you contributed to a Roth IRA first and then recharacterized it.

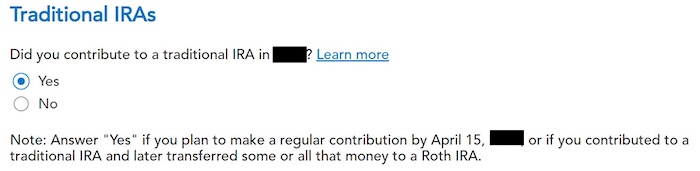

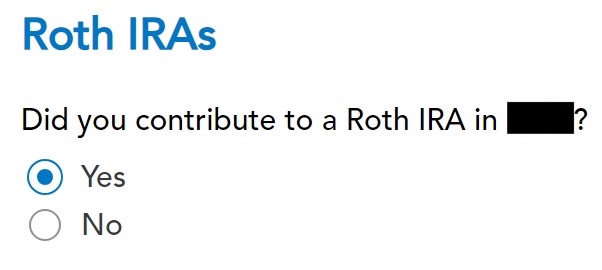

We already checked the box for Traditional IRA, but TurboTax just wants to make sure. Answer Yes here.

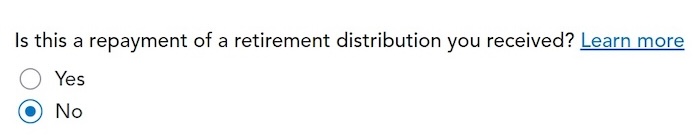

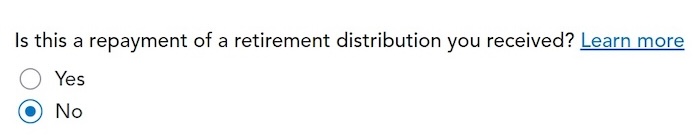

It was not a repayment of a retirement distribution.

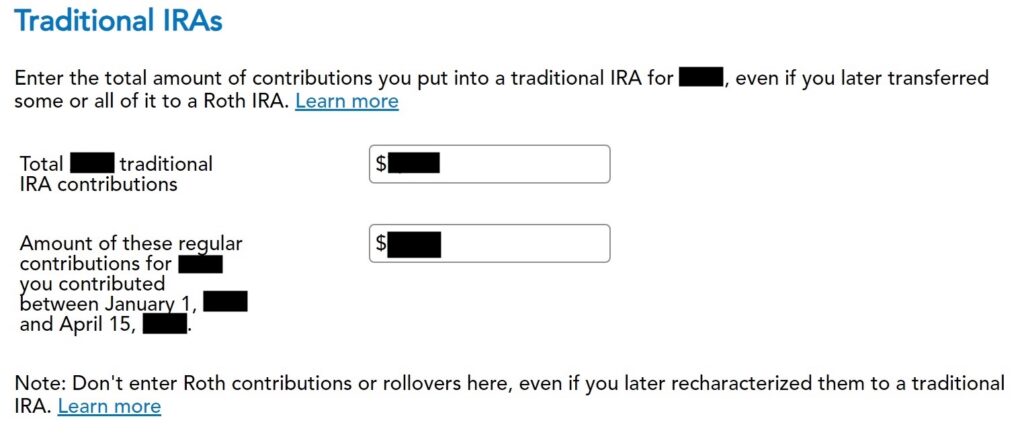

Enter your contribution amount in both boxes. The first box says you contributed. The second box says you contributed in 2026, not in 2025.

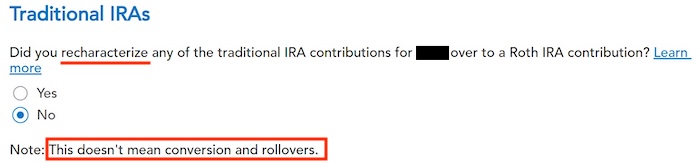

Converted, Did Not Recharacterize

This is a critical question. Answer “No.” You converted the money, not recharacterized.

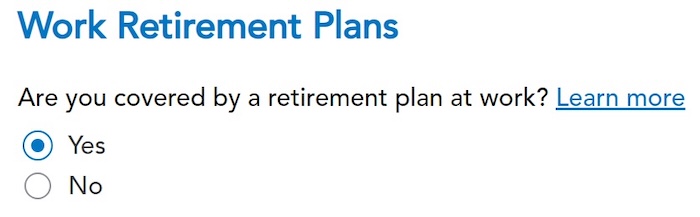

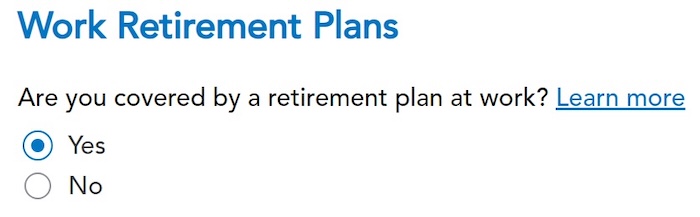

You may not get this question if TurboTax sees that you’re covered by a workplace retirement plan from Box 13 in your W-2. Answer yes if you’re covered by a retirement plan but the box on your W-2 wasn’t checked.

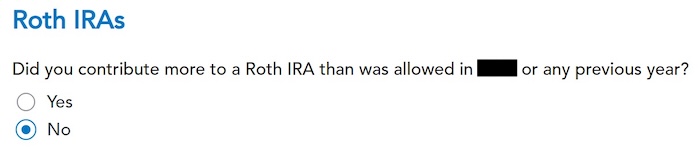

We didn’t contribute more than we were allowed.

Basis

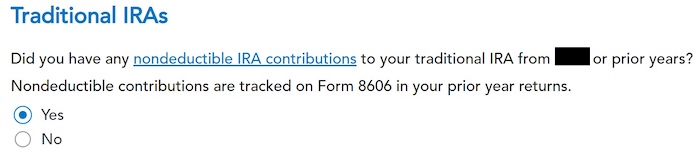

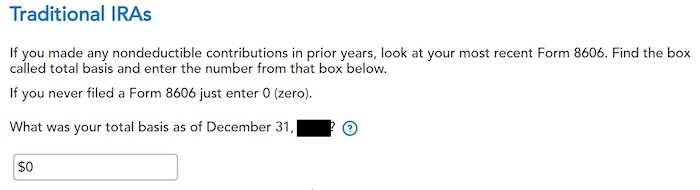

You can answer “No” if this is the first time you contributed to a Traditional IRA, but answering “Yes” with a 0 has the same effect, and it allows you to correct errors.

If you used TurboTax correctly last year, it tracks your basis and puts the correct number here. This is normally zero if you contributed to a Traditional IRA for the first time. If you put in a number because you didn’t understand what it was asking, you can correct it now.

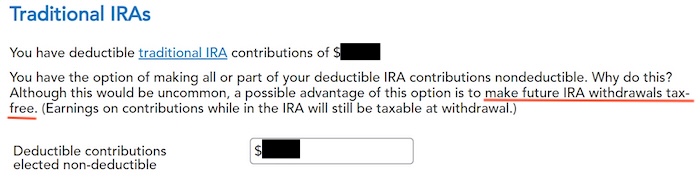

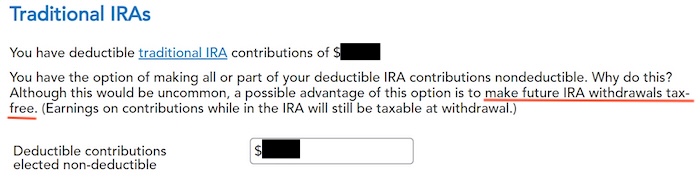

Make It Nondeductible

TurboTax won’t show you this if it sees clearly that your income is too high to qualify for a deduction. If you see this question, it means that you have an option to take a deduction or decline it. Taking the deduction in 2025 will make your conversion in 2026 taxable. It’s simpler if you make your full Traditional IRA contribution nondeductible, and then your Roth conversion in 2026 won’t be taxable. Enter the amount that TurboTax gives in the box. It’s $7,000 in our example.

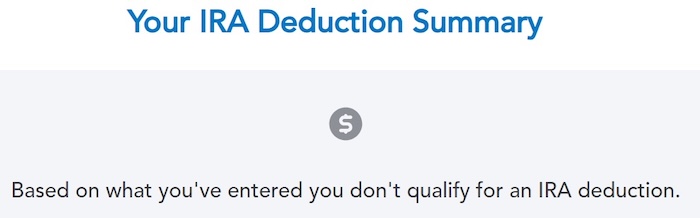

You don’t qualify for a deduction, which is OK because it makes your conversion in 2026 not taxable.

Form 8606

Let’s take a look at Form 8606. Click on Forms on the top right.

Find “Form 8606-T” (and “Form 8606-S” for your spouse) in the list of forms in the left pane. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2026. It’ll make your conversion in 2026 not taxable.

Break the Cycle

While you’re at it, you should break the cycle of contributing for the previous year and create a new habit of contributing for the current year. Contribute to a Traditional IRA for 2026 in 2026 and convert in 2026.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2025 contribution and your 2026 contribution in 2026. Then you will start 2027 fresh. Contribute for 2027 in 2027 and convert in 2027.

Recharacterized Before Converting

Now let’s look at our second example scenario.

You contributed $7,000 to a Roth IRA for 2025 in 2025. You realized that your income was too high when you did your 2025 taxes in 2026. You recharacterized the Roth contribution for 2025 as a Traditional contribution before April 15, 2026. The IRA custodian moved $7,100 from your Roth IRA to your Traditional IRA because your original $7,000 contribution had some earnings. Then you converted it to Roth in 2026.

Because your contribution was for 2025, you need to report it on your 2025 tax return by following this guide. Because you converted in 2026, you won’t get a 1099-R for your conversion until January 2027. You will report the conversion when you do your 2026 tax return. Come back again next year to follow Split-Year Backdoor Roth IRA in TurboTax, Year 2.

Similar to our first example, if you did the same in 2025 for 2024, you should’ve done everything below when you did your taxes for 2024. In other words,

You contributed $7,000 to a Roth IRA for 2024 in 2025. You realized that your income was too high when you did your 2024 taxes in 2025. You recharacterized the Roth contribution for 2024 as a Traditional contribution before April 15, 2025. The IRA custodian moved $7,100 from your Roth IRA to your Traditional IRA because your original $7,000 contribution had some earnings. Then you converted it to Roth in 2025.

Then you should’ve taken all the steps below last year on your 2024 tax return. If you didn’t, you need to fix your 2024 return. The conversion part is covered in Split-Year Backdoor Roth IRA in TurboTax, Year 2.

Contributed to Roth IRA

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

Check the box for Roth IRA because you originally contributed to a Roth IRA.

We already checked the box for Roth IRA, but TurboTax just wants to make sure.

It was not a repayment of a retirement distribution.

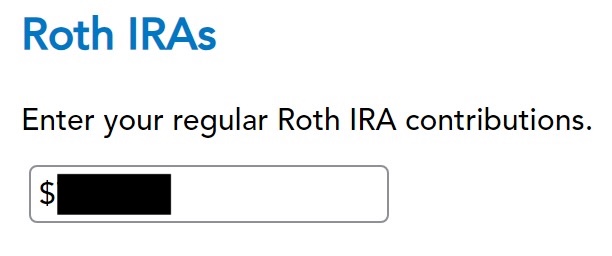

Enter the amount of your original Roth contribution. It was $7,000 in our example.

Recharacterized

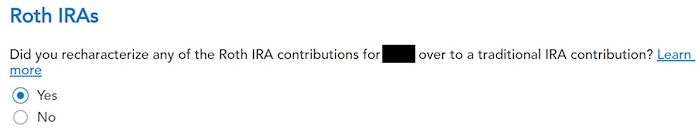

Now we confess that we recharacterized the contribution as a Traditional IRA contribution. Answer Yes here.

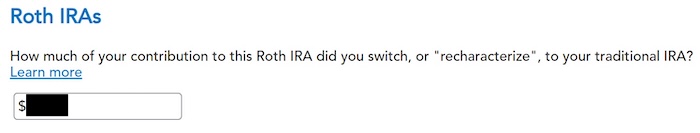

The amount here is relative to the original contribution amount. If you recharacterized the whole thing, enter $7,000 in our example, not $7,100, which was the amount with earnings that the IRA custodian moved into the Traditional IRA.

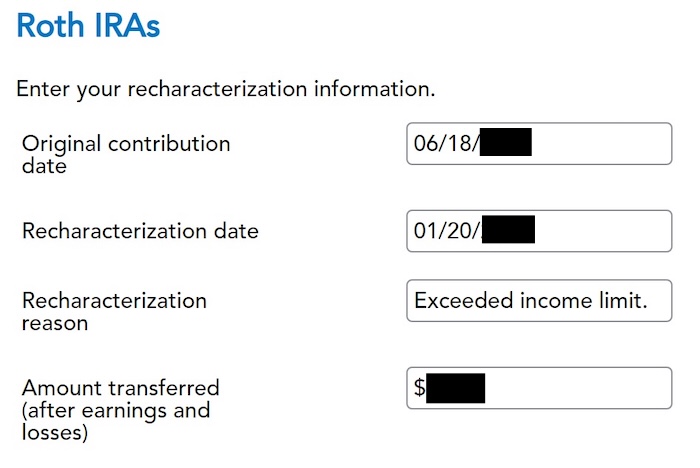

The IRS wants a statement to explain the recharacterization. Fill in the dates of your original contribution and your recharacterization. The amount in the last box includes earnings. It’s $7,100 in our example.

You may not get this question if TurboTax sees that you’re covered by a workplace retirement plan from Box 13 in your W-2. Answer yes if you’re covered by a retirement plan but the box on your W-2 wasn’t checked.

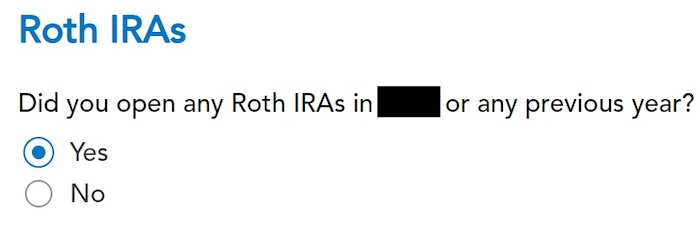

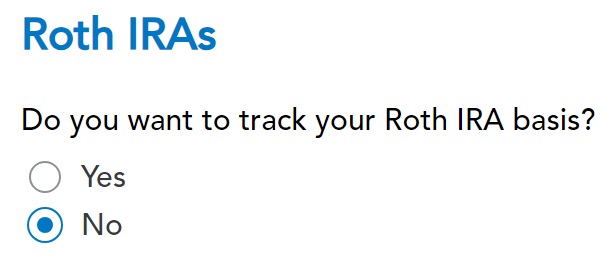

Roth Basis

Answer Yes or No, depending on your history.

If you want TurboTax to track your Roth IRA basis, it will ask you a series of questions about your history, which is more trouble than it’s worth to me. I answered No. You don’t need to track your Roth IRA basis if you’re planning to withdraw from your Roth account only after age 59-1/2 and after you’ve had your first Roth IRA for five years. See Roth IRA Withdrawal After 59-1/2 in TurboTax.

No excess contributions.

Make It Nondeductible

TurboTax shows this only when it sees that your income qualifies for a deduction. You have the option to take the deduction or decline it. Taking the deduction in 2025 will make your conversion in 2026 taxable. It’s simpler if you make your full contribution nondeductible, and then your Roth conversion in 2026 won’t be taxable. Enter the amount TurboTax says in the last box. It’s $7,000 in our example.

You don’t qualify for a deduction, which is OK because it makes your conversion in 2026 not taxable.

Form 8606

Let’s take a look at Form 8606. Click on “Forms” on the top right.

Find “Form 8606-T” (and “Form 8606-S” for your spouse) in the list of forms in the left pane. You should see that only lines 1, 3, and 14 are filled in with your original contribution amount. After recharacterizing, it’s as if you contributed directly to a Traditional IRA in the first place. It’s important to see the number in Line 14. This number will carry over to 2026. It’ll make your conversion in 2026 not taxable.

Switch to Clean Backdoor Roth

While you are at it, you should switch to a clean backdoor Roth for 2026. Rather than contributing directly to a Roth IRA, seeing that you exceed the income limit, recharacterizing it, and converting it again, you should simply contribute to a Traditional IRA for 2026 in 2026 and convert it to Roth in 2026 if there’s any possibility that your income will be over the limit again.

You’re allowed to do a clean backdoor Roth even if your income ends up below the income limit for a direct contribution to a Roth IRA. It’s much simpler than the confusing recharacterize-and-convert maneuver.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2025 contribution and your 2026 contribution in 2026. Then you will start 2027 fresh. Contribute for 2027 in 2027 and convert in 2027.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Ian says

Interesting update to this, I am doing the backdoor roth for TY 2023 between Jan 1 and Apr 15 2024. I opened a traditional IRA in M1 and funded 6500, opened an empty roth , and requested a conversion. M1 told me they would issue a 1099R still in May for this.

Do I use this method still or do I go back to this method https://thefinancebuff.com/how-to-report-backdoor-roth-in-turbotax.html

Harry Sit says

The 1099-R to be issued will still be a 2024 1099-R. You still do it split-year – the contribution now and the conversion next year by following the “2nd year” post.

Jing says

This is very helpful. I forgot to contribute the in 2023, and now I am following your first example that contributing 2023 IRA in 2024 and convert in 2024. In step make it non-deductible, turbo tax mentioned that there is certain amount, say $1000, that is eligible for deduction, then I enter the full contribution amount of $6,500. When I ran the federal return check in turbotax, it said the non-deductible amount should not exceed $1000 in the IRA contribution worksheet. I checked the wks, it seems that wks is only for our own record, and the form 8606 shows the full amount. I guess this should be alright, right since we dont need to file the wks. Thanks

Harry Sit says

It’s just saying that out of the $6,500 contribution, $5,500 is not deductible no matter what. Your choice is only on that $1,000. You can make part of the $1,000 nondeductible. It can be $0 (deduct $1,000), $100 (deduct $900), or $1,000 (deduct nothing). Just enter $1,000 when you want 100% of your contribution nondeductible.

Cari says

For TY 2023, I contributed $3000 directly to my Roth IRA. Subsequently, I learned I’ll be over the income limit. I did a backdoor Roth IRA for the remaining $3500 from trad IRA to Roth IRA.

1/2024 I requested a recharacterization of the $3000 (at a loss).

Do I still fill out just the Roth IRA portion of turbo tax or select both the Roth IRA and traditional IRA and fill that out? I think in my scenario, since I contributed to both the Roth IRA and trad IRA, I would need to select both. Please give some guidance, thank you.

Harry Sit says

You need to select both. Follow this post with regard to the $3,000. Follow How To Report Backdoor Roth In TurboTax for the other $3,500. Next time just go through the backdoor 100% if there’s a chance that your income comes close to the limit.

Josh says

I funded a Traditional IRA with $6.5k via Vanguard on 4/9/24 for 2023 (and have since been averaging ~$25-30/month interest in MM). I maxed out my 401k but had no other retirement account activity in 2023. I do have an H.S.A. which was also maxed out (employee and employer combined) for 2023.

I historically used TurboTax (TT) to file for over a decade but switched to Cash App beginning with 2022’s returns. I also filed 2023 with CashApp and recall receiving a notification that I was not eligible for any deductions for the $6.5k Trad IRA contribution in mid-April. When I log in to CashApp to review my returns, I only see my federal and state (GA) returns with neither reference to Form 8606 nor Form 8606 itself. I do recall entering the information from Form 5498 via Vanguard; however, I believe that’s when I received the notification that I wasn’t eligible for any deduction. I did print the notification to a PDF and see Form 8606 (page 2 after “IRA Deduction Worksheet—Schedule 1, Line 20”) with $6,500 on rows 1, 3, and 14. I don’t see any reference on my 1040 anywhere, though – even when checking the 2023 transcript on IRS.gov.

Other related context: 1) This is the only money I’ve ever added to any traditional IRA; 2) I have an existing $60k+ Roth IRA with Vanguard but haven’t contributed to it in years because of income level; and 3) I see a button to “Convert to Roth IRA” in my Vanguard user interface but am wondering if I should amend 2023 first.

Based on the above context, could someone please help me understand whether I should: 1) Go ahead and contribute for 2024 and convert the entire balance at once for both 2023 and 2024; 2) convert the 2023 amount contributed in April 2024 and then do both steps for 2024 well before 12/31/2024 (after waiting for the funds to settle for 2024 prior to converting its sole balance); or 3) amend 2023’s returns with whatever updated forms need to be added (i.e., 8606, etc. and then proceed with aforementioned steps 1 or 2).

Any feedback, suggestions, and/or additional approaches/insight would be highly welcomed and appreciated. I’ll absolutely be picking up TT desktop software from Sam’s or Costco for filing 2024 as the extremely helpful write-up suggests.

Thanks so much!

Josh

Harry Sit says

I don’t have Cash App Taxes. Tax software usually has an option to produce a complete return as a PDF that includes all the forms and schedules. If you see Form 8606 in your complete return PDF, it means the software already included it in the efile. If you don’t see it, you still don’t need to amend your tax return, because adding a Form 8606 doesn’t change anything else in your return. You can download Form 8606 from the IRS website and fill it out manually. You only need your information at the top and $6,500 on lines 1, 3, and 14. Mail it to the IRS address based on where you live. Attach a letter to say this form was omitted in the efile and it doesn’t change anything else in your return.

For 2024, just contribute for 2024 and convert the entire balance for both 2023 and 2024 well before 12/31/2024. Converting separately doesn’t help with anything.

Kevin says

I contributed to a non deductible traditional IRA in 2019 but didn’t do the conversion because I couldn’t do so cleanly. I will now be able to do so cleanly this year, so I planned on converting that 2019 contribution this year in 2024.

After downloading my 2019 return from TurboTax, it appears I may not have entered the contribution in TurboTax that year. At least, I don’t see a form 8606 as part of my tax return. And it looks like I can’t amend a return from before 3 years ago. I thought I would have entered it in TurboTax but I don’t see how I can go into my 2019 return in TurboTax to see what I entered. Maybe I need to download the .tax file and open it in TurboTax desktop version?

It’s my understanding I can still just submit a form 8606 for prior year contributions without amending a return but I’m wondering about how I would now handle the conversion to Roth IRA in TurboTax for 2024 taxes since it appears I may not have done the first part.

Harry Sit says

You need Split-Year Backdoor Roth IRA in TurboTax, 2nd Year when you convert a 2019 contribution (plus earnings) in 2024. Enter the contribution amount (without earnings) in “Let’s Find Your Basis.” TurboTax would auto-populate it for you if you did the first part, but you can enter it yourself if TurboTax doesn’t.

Lennox says

This is super helpful, thank you for putting this together so clearly! For someone in the second scenario – I am recharacterizing 2024 Roth contributions as tIRA in 2025 and plan to convert right back to Roth once it goes through. I would like to do the clean back door as you mentioned for 2025 – contribute directly to my tIRA and convert to Roth all in 2025. Should I do two separate conversions to keep it clear which is the recharacterization and which is the clean backdoor? Or can I just directly contribute to my tIRA for 2025 while the recharacterization is still in process and do a single conversion in a couple days once everything is posted? Does it matter? Thanks again!

Harry Sit says

It doesn’t matter. All conversions end up on one 1099-R form anyway. No one can tell how many conversions you did from the 1099-R. You might need a second or a third conversion after you receive a small amount of interest or dividend in the Traditional IRA after the end of a month.

Tony says

My scenario is this: I contributed for 2023 in the last week of December 2023. I wasn’t able to do the conversion until the amount fully settled in my account, thus the conversion actually happened the first week of January 2024. I then contributed for 2024 and converted as well. So my 1099-R includes the conversions for 2023 and 2024.

Harry Sit says

If you did everything in this post last year with regard to your 2023 contribution, great. 2024 is now your Year 2. You also had a clean Backdoor Roth on top in 2024. Please follow Split-Year Backdoor Roth IRA in TurboTax, Year 2 for 2024.

If you didn’t do anything last year, you should go back to your 2023 return and follow everything here in this post. Just read one year backward. Think 2023 when you read 2024 and think $6,500 when you read $7,000 in this post.

Jordan S says

Hello. This is extremely helpful.

I contributed $6000 towards my Roth IRA (2024)

I contributed towards my Roth IRA in January and February (2025)

Question:

For the 2024 tax year (filing now) – Should I just use the $6000 contribution in 2024

or

Is it better/easier to include the $1,000 I contributed this year in the conversion from the Traditional IRA (Total $7000)

Jordan S says

Apologies, this is Jordan again. I realized, I didnt explain the question correctly, and it wont let me edit unfortunately.

I contributed $6000 towards my Roth IRA (2024)

I contributed $1000 towards my Roth IRA in January and February (2025)

Question 1:

For the 2024 tax year (filing now) – Should I just use the $6000 contribution + earnings in 2024

or

Is it better/easier to include the $1,000 I contributed this year in the Recharacterization from the Roth IRA (Total $7000 + earnings)

Question 2:

The total amount that would be Recharacterized will be over $7000 (including earnings) for either option above.

With this being the case, does that mean that I have already exceeded the contribution limit to the Traditional IRA in 2025 – thus will have to pay a penalty when filing in 2026 (for 2025)?

Or if I do the backdoor from the Traditional IRA into the Roth IRA – technically it would no longer be in the account?

Thank you

Harry Sit says

I’m filling in parts you didn’t say with my assumptions. Please correct anything that’s not true. Which year you contributed _for_ is important.

– You contributed $6,000 [for 2024] to your Roth IRA in 2024. You contributed another $1,000 [for 2024] to your Roth IRA in January and February 2025. [Now you realize your 2024 income exceeded the income limit and you need to recharacterize.]

Jordan S says

Yes I contributed 6k in 2024 and then 1k so far this year (prior to the April, 2025 tax deadline). Is it easier to just recharacterize the 6k contributed last year only or should I do 7k?

Harry Sit says

You need to recharacterize the full $7,000 contribution to your Roth IRA _for 2024_ as a Traditional IRA contribution for 2024. This will make your case match Example 2 in this post even though a part of your contribution was made _in_ 2024 and another part was made _in_ 2025. Which year the contributions were made _in_ doesn’t matter as long as they were made _for_ 2024.

The custodian will calculate how much needs to move from your Roth IRA to a Traditional IRA. It doesn’t matter whether that amount is over $7,000. That amount moved is $7,100 in Example 2. It’ll work the same if it’s $8,100 or $9,100. This amount doesn’t affect your 2025 contribution. After you recharacterize, it’s counted as if you contributed $7,000 to your Traditional IRA for 2024 and the money grew inside the Traditional IRA. You can convert after the recharacterizing (choose no tax withholding). The earnings will be taxable in 2025.

Follow the steps under Example 2 now to file for 2024. Do a clean backdoor Roth on top for 2025 (contribute for 2025 in 2025 and convert in 2025). Follow Split-Year Backdoor Roth IRA in TurboTax, Year 2 next year to file for 2025. Do clean backdoor Roth for 2026 and beyond.

Jordan S says

This is extremely helpful.

Recharacterizing more than 7k – will mean that I have already exceeded the contribution limit to the Traditional IRA in 2025 – thus will have to pay a penalty when filing in 2026 (for 2025) for excess contribution?

Or if I do the backdoor from the Traditional IRA into the Roth IRA – technically it would no longer be in the account?

Thanks again for all of your help!

Harry Sit says

Please read again carefully. Terminology is utterly important. You’re not recharacterizing more than $7,000. You’re recharacterizing exactly $7,000 in contributions _for 2024_. As a result of doing so, more than $7,000 (with earnings) will move from your Roth IRA to a Traditional IRA but it’s not recharacterizing more than $7,000. Nor does recharacterizing affect your contribution _for 2025_. Your contribution for 2025 is still zero after you recharacterize your contribution _for 2024_.

Sheng-Wei Chang says

Is the second part “Contributed to Roth IRA” only for the people who accidently contribute to Roth IRA with too high income? If I contribute to traditional IRA and do backdoor Roth IRA then I only do the first part “Contributed to Traditional IRA” correct?

Harry Sit says

This post covers two scenarios: “Contributed for the Previous Year” and “Recharacterized Before Converting.” If what you did fits the first scenario, you only follow the steps in that first part. The second part is for people who did the second scenario. They should jump over the first part and start from the second part.

Spencer S. says

I’m in the process of recharacterizing my 2024 contributions from a Roth IRA to a tIRA due to me being ineligible for Roth IRA contributions due to income limits (realized as I’m preparing my taxes). If I want to convert my 2024 contributions back to a Roth IRA via the backdoor process, do I need to convert them before April 15, 2025? or do I have until the end of the year?

Harry Sit says

You don’t need to convert them before April 15, 2025. There’s no deadline for conversion. Converting before the end of the year aligns with Year 2 but technically you can wait until 2026 or beyond.

Sara says

I contributed to a Roth IRA in 2022 without realizing I was over the income limit. It was only $1000. I have let it sit and just paid the penalty on it since. I plan to recharacterize it to a traditional IRA now and immediately convert back to a Roth IRA all within 2026. How does this change the process for tax filing, given that I initially opened the Roth IRA in 2022? Thanks!

Harry Sit says

The deadline to recharacterize a 2022 Roth IRA contribution has passed a long time ago. It’s not possible to recharacterize it in 2026. If you’re still eligible for a [direct] Roth IRA contribution, you can contribute less than the maximum and absorb the excess to stop the annual penalty.

Or you can execute a “withdrawal of excess contribution” with the Roth IRA custodian. It has to be done as a special transaction with the custodian, not just withdrawing on your own without telling the custodian.

See Correcting an Excess Roth IRA Contribution by Mike Piper.