[Last updated on January 25, 2026 with all new screenshots from TurboTax Deluxe desktop software for the 2025 tax year.]

The previous post, Split-Year Backdoor Roth IRA in TurboTax, Year 1, dealt with contributing to a Traditional IRA for the previous year or recharacterizing a previous year’s Roth IRA contribution as a Traditional IRA contribution. This post handles the conversion part.

We cover two example scenarios. Here’s the first scenario:

You contributed $7,000 to a Traditional IRA for 2024 in 2025. The value increased to $7,200 when you converted it to Roth in 2025. You received a 1099-R form listing this $7,200 Roth conversion.

This post shows you how to enter the 1099-R form into TurboTax. You should’ve already reported the contribution portion on your 2024 tax return by following Split-Year Backdoor Roth IRA in TurboTax, Year 1 last year. If you didn’t do it, you can amend your 2024 return and make up for the missed steps in that post.

Here’s the second example scenario:

You contributed $7,000 to a Roth IRA for 2024 in 2024. You realized that your income was too high when you did your 2024 taxes in 2025. You recharacterized the Roth contribution for 2024 as a Traditional contribution before April 15, 2025. The IRA custodian moved $7,100 from your Roth IRA to your Traditional IRA because your original $7,000 contribution had some earnings. The value increased again to $7,200 when you converted it to Roth in 2025. You received two 1099-R forms, one for $7,100 and another for $7,200.

This post shows you how to enter both of these 1099-R forms into TurboTax. You should’ve already reported the recharacterized contribution on your 2024 tax return by following Split-Year Backdoor Roth IRA in TurboTax, Year 1 last year. If you didn’t do it, you can amend your 2024 return and make up for the missed steps in that post.

If you contributed for 2025 in 2026, or if you recharacterized a 2025 contribution in 2026, you’re still in the first year of this journey. Please follow Split-Year Backdoor Roth in TurboTax, Year 1. If you recharacterized your 2025 contribution from Roth to Traditional in 2025 and converted in 2025, please follow Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year.

If neither of these example scenarios fits you, please consult our guide for a normal “clean” backdoor Roth: How To Report Backdoor Roth In TurboTax (Updated).

If you’re married and both you and your spouse did the same thing, you should follow the steps below once for yourself and once again for your spouse.

Use TurboTax Desktop Software

The screenshots below are from TurboTax Deluxe desktop software. The desktop software is both more powerful and less expensive than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax desktop software from Amazon, Costco, Walmart, etc., and switch from TurboTax Online to TurboTax desktop software (see instructions for how to make the switch from TurboTax).

1099-R for Recharacterization

This section only applies to the second example scenario. If you didn’t recharacterize (the first example scenario), please skip this section and jump over to the conversion section.

We handle the 1099-R form for recharacterization first. This 1099-R form has a code ‘R’ in Box 7.

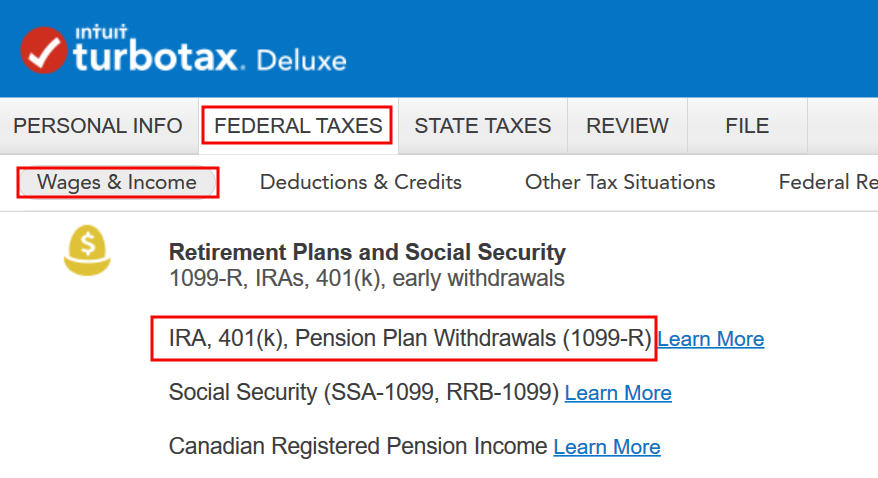

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

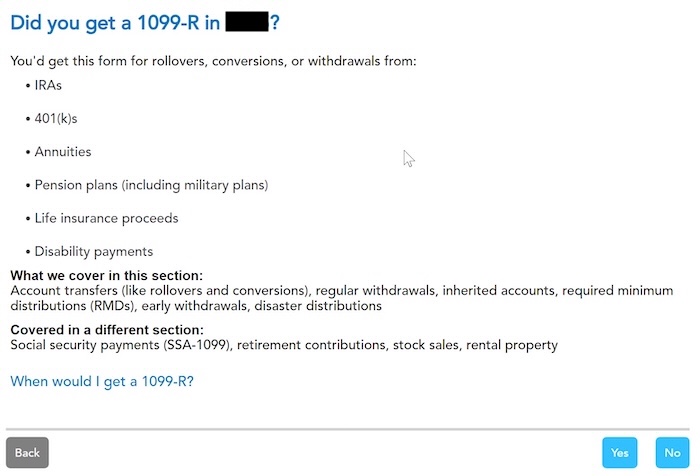

Confirm that you have received a 1099-R form. Import the 1099-R if you’d like. I’m skipping import and typing it myself.

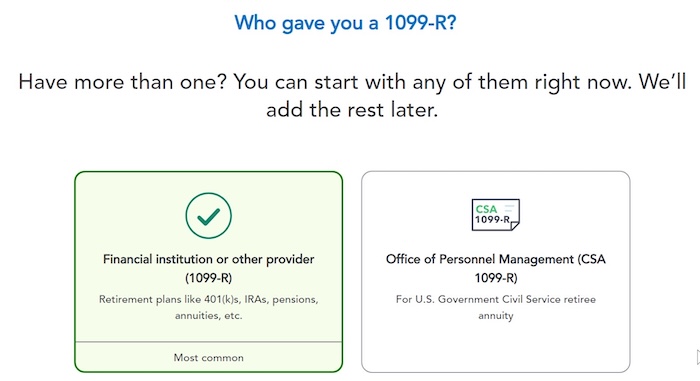

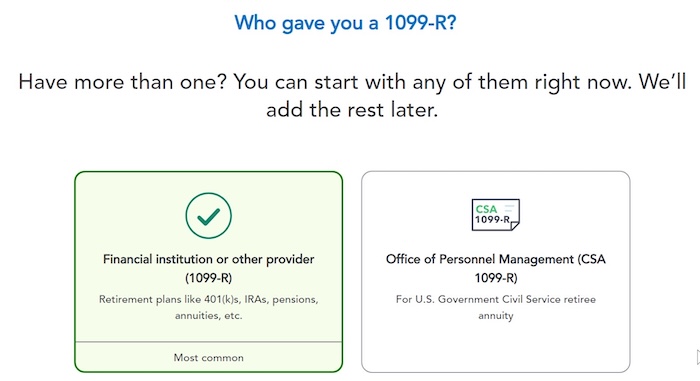

It’s from a financial institution. Enter the payer’s information shown on your 1099-R.

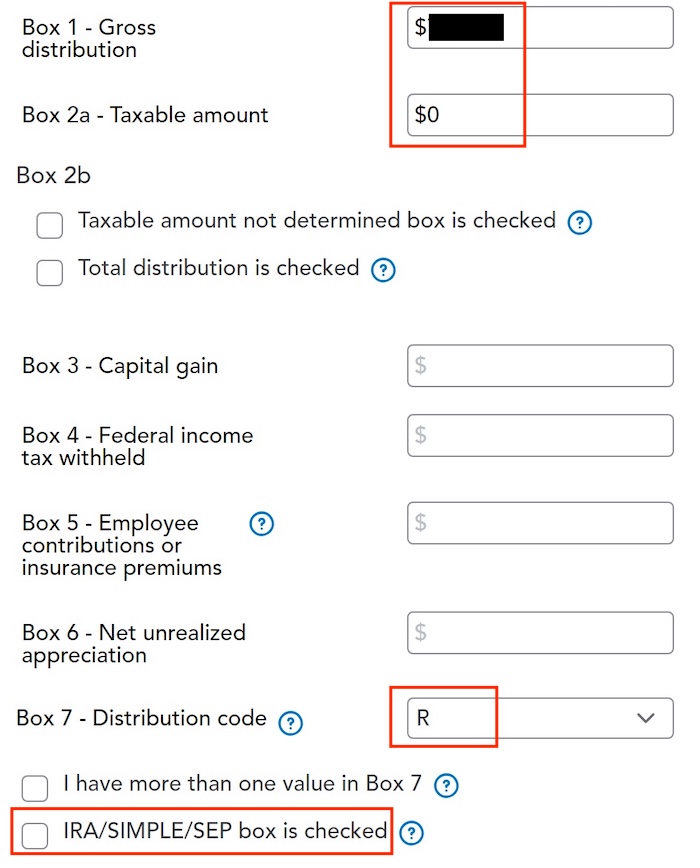

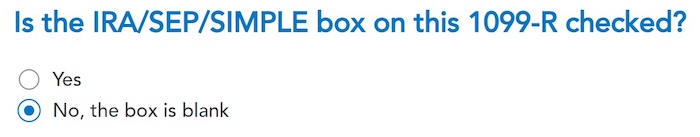

The amount that moved from your Roth IRA to your Traditional IRA is shown in Box 1. The taxable amount in Box 2a is zero. The two checkboxes in Box 2b aren’t checked. The code in Box 7 is “R.” The “IRA/SEP/SIMPLE” box under Box 7 may or may not be checked. It’s not checked in our sample 1099-R.

That box is blank in our 1099-R, and that’s OK.

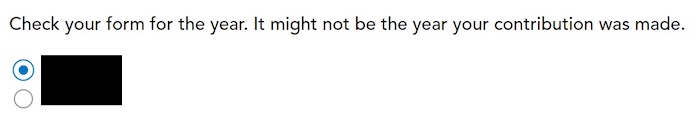

When you’re doing taxes for 2025, chances are the 1099-R form is for 2025. Click on the button that matches the year on the form.

No Need to Amend

The word “may” carries a lot of weight here. You don’t need to amend if you already reported the recharacterization in the previous year’s tax return, as shown in our previous post. You only need to amend your previous tax return if you didn’t follow those steps.

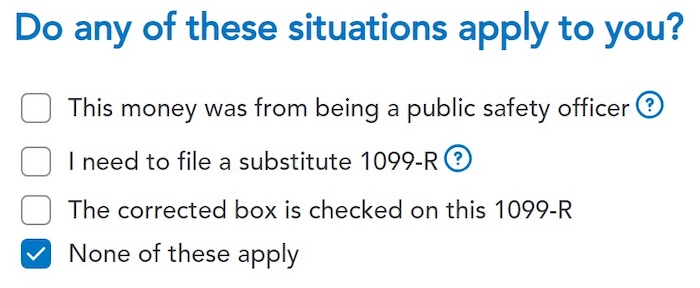

We don’t have any of these special situations.

You’re done with the first 1099-R form. Add the second one now if you don’t already have both 1099-R forms imported.

1099-R for Conversion

The second 1099-R form is also from a financial institution.

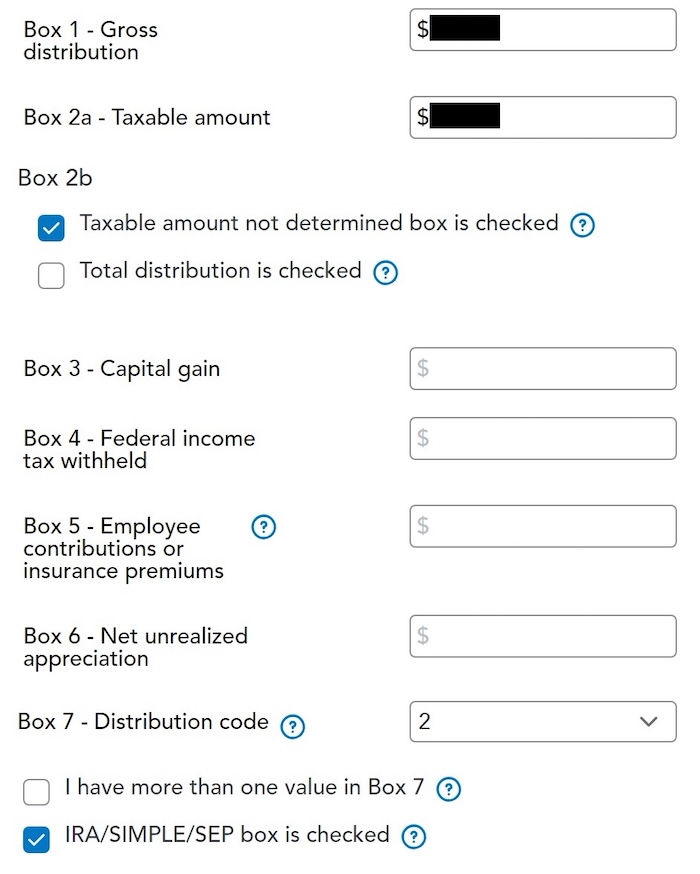

It’s normal to see the conversion reported in Box 2a as the taxable amount when Box 2b is checked to say “Taxable amount not determined.” The total distribution box may or may not be checked. It doesn’t matter. The code in Box 7 is ‘2‘ when you’re under 59-1/2 or ‘7‘ when you’re over 59-1/2. The “IRA/SEP/SIMPLE” box is checked on this 1099-R form for the conversion.

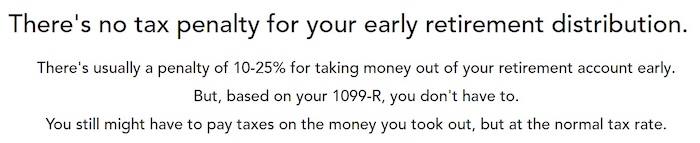

It says that there’s no tax penalty, but the refund meter still drops. Don’t panic. It’s normal and temporary.

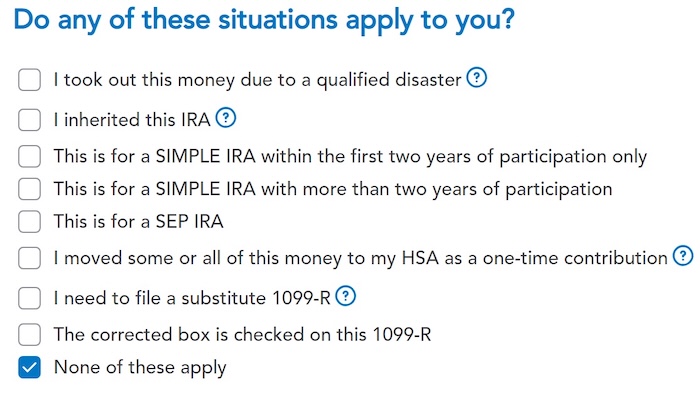

We don’t have any of these.

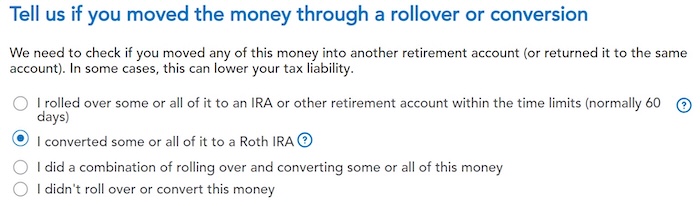

Converted

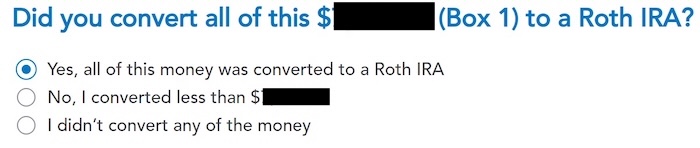

You converted to a Roth IRA.

Confirm that you converted everything.

Now the 1099-R summary includes both 1099-R forms. Add more 1099-R forms if you have them. Continue by clicking on “Done.”

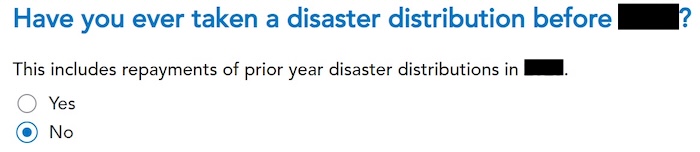

No disaster distributions.

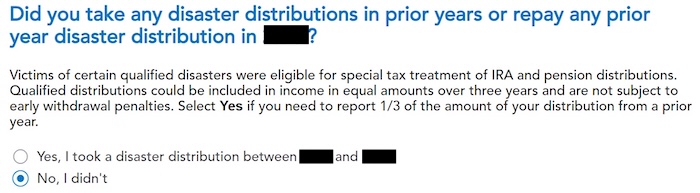

We already said no, but TurboTax wants to ask again.

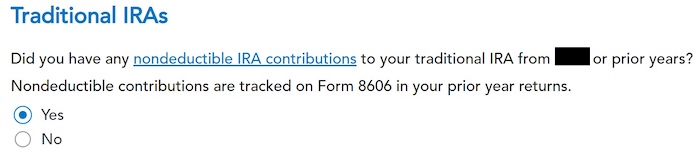

Basis

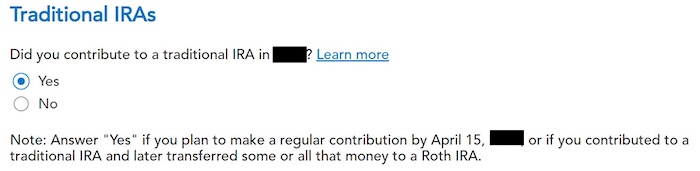

Choose “Yes.” It counts if you contributed to a Traditional IRA for 2024 in 2025 or if you recharacterized a 2024 Roth IRA contribution in 2025.

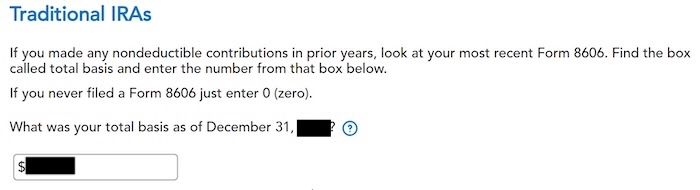

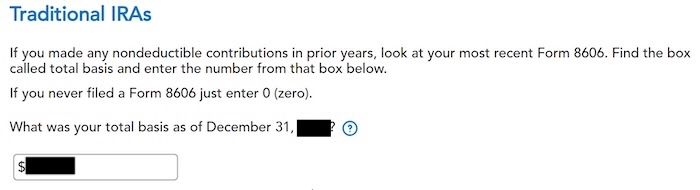

TurboTax should populate this value from last year’s return. It’s $7,000 in our example. If it doesn’t auto-populate, get the value from your last year’s Form 8606 Line 14, which was generated when you followed the previous post Split-Year Backdoor Roth IRA in TurboTax, Year 1.

The refund meter goes up after you enter the total basis.

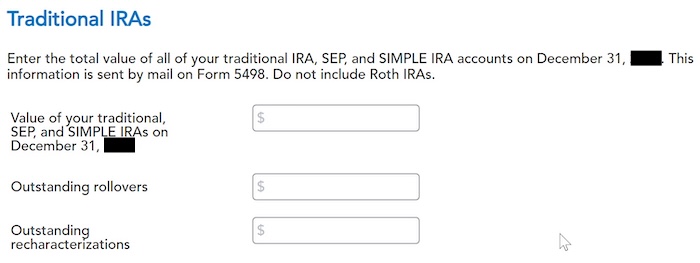

These are normally zero if you converted everything. If you have a few dollars left in the account from earnings posted after you converted, enter the value from your year-end statement in the first box.

Clean Backdoor Roth On Top

If you also did a “clean” backdoor Roth in 2025 on top of converting your contribution for 2024, in other words, you also contributed to a Traditional IRA for 2025 in 2025 and converted both your 2024 contribution and your 2025 contribution in 2025, your 1099-R includes converting two years’ worth of contributions in a single year. All the steps in the previous section are still the same, except that you have a larger amount on your 1099-R form.

The basis from the previous year’s tax return took care of one-half of the conversion. You also need to report your 2025 Traditional IRA contribution.

Skip this section if you didn’t contribute to a Traditional IRA for 2025.

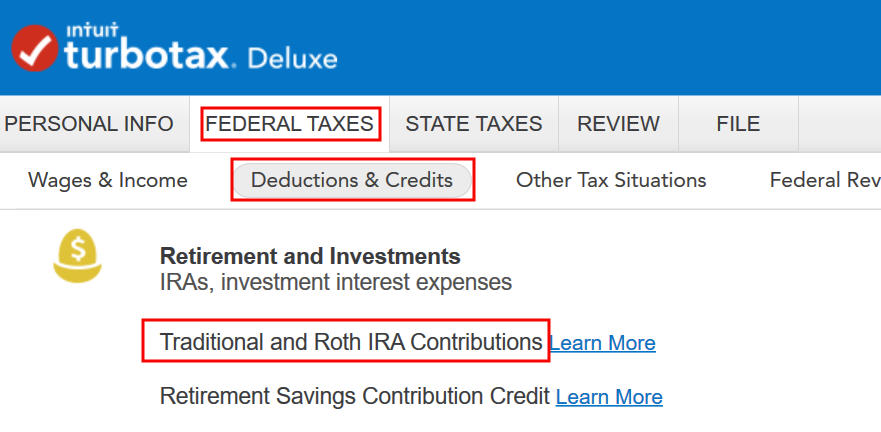

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

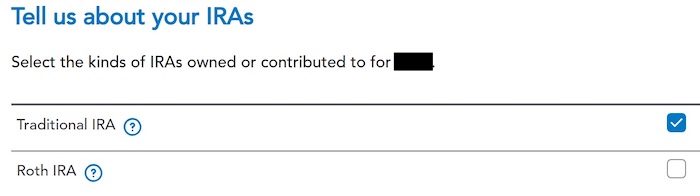

Check the box for Traditional IRA because you contributed to a Traditional IRA.

Answer Yes here to confirm that you contributed to a Traditional IRA.

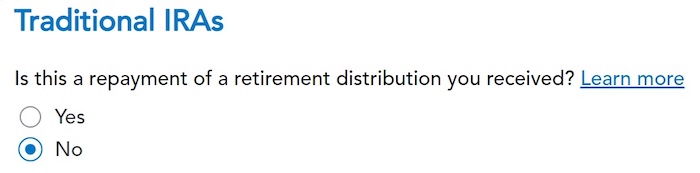

It was not a repayment of a retirement distribution.

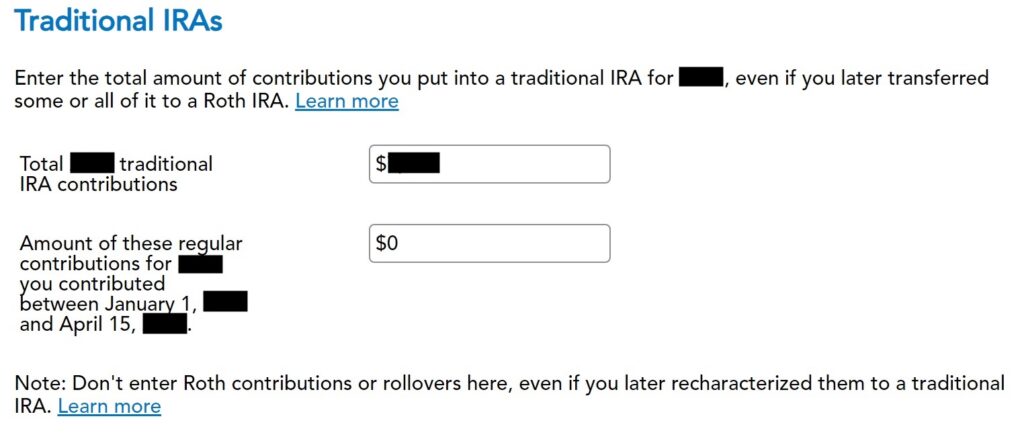

Enter the amount you contributed. Put zero in the second box because you contributed for 2025 in 2025. Your refund meter should go up now.

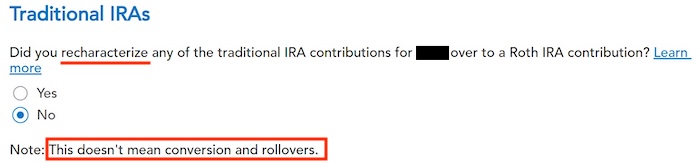

Converted, Did Not Recharacterize

This is a critical question. Answer “No.” You converted the money, not recharacterized.

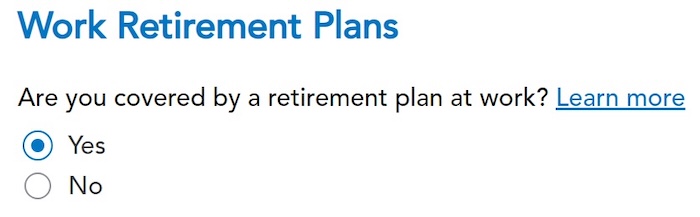

You may not see this question if you already entered your W-2 and it has Box 13 for the retirement coverage checked. Answer yes if you’re covered by a retirement plan but the box on your W-2 wasn’t checked.

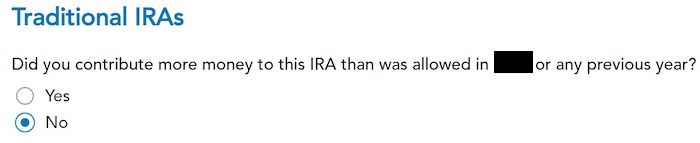

No excess contribution.

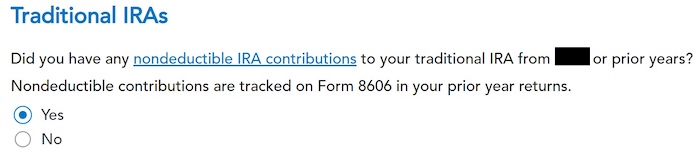

We answered this question before, but TurboTax asks again. Choose Yes.

TurboTax populates the same answer as before. It’s $7,000 in our example.

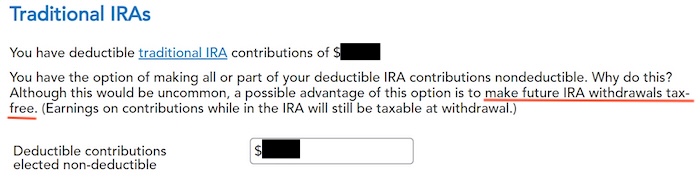

Make It Nondeductible

TurboTax shows this screen if it sees that you qualify for a deduction for the Traditional IRA contribution. If you take the deduction, it’ll make your Roth conversion taxable, which creates a wash. It’s simpler if you make your full IRA contribution nondeductible, and then your Roth conversion won’t be taxable. Enter the same amount TurboTax says is deductible.

You don’t qualify for an IRA deduction, which is expected.

Taxable Income

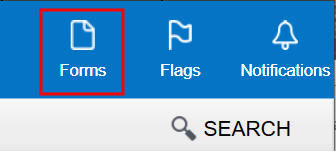

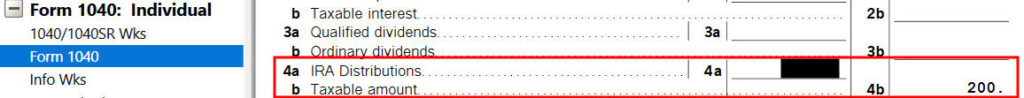

You’re done with the two 1099-R forms. Let’s look at how they show up on your tax return. Click on “Forms” on the top right.

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b. They show a distribution from the IRA and only $200 is taxable. That’s the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth. The taxable amount would be zero if you didn’t have any earnings.

Form 8606

Form 8606 shows these for our example:

| Line # | Amount |

|---|---|

| 1 | 7,000 (only if you also did a “clean” backdoor Roth on top, otherwise blank.) |

| 2 | 7,000 |

| 3 | The sum of Line 1 and Line 2 |

| 5 | The same as Line 3 |

| 13 | The same as Line 3 |

| 14 | 0 |

| 16 | The amount on your 1099-R with a code 2 or 7 |

| 17 | The same as Line 3 |

| 18 | The difference between Line 16 and Line 17 |

When you’re done examining the form, click on Step-by-Step on the top right to go back to the interview.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

andrea boboc says

Very helpful and informative, is being unofficially used by Turbotax experts as guidance. Thank you

Rahul says

Very helpful. I am stuck though. I converted 2022 and 2023 contributions in 2023. As mentioned by you in the last section, my 1099-R has two years worth of contribution and so the software makes $6,500 (2023 contribution) taxable. I have also declared 2023 Traditional IRA distribution in that section but that does not bring down the taxes. Would appreciate if you can help. Using online Turbo tax

Harry Sit says

If you meant that you also declared a 2023 Traditional IRA *contribution*, did the IRA deduction summary or Schedule 1 Line 20 show it was deductible? See the “Conversion is Taxed” part in the Troubleshooting section in our guide for the clean backdoor Roth. It’s better to use downloaded TurboTax because you can see what’s going on by looking at the forms. It’s more difficult to troubleshoot in online TurboTax.

Rahul says

Thanks for responding. Deleting and uploading the form again worked. The online version is buggy as hell

ET says

Hello!

If my situation was as below:

1) Contributed to Roth in calendar year 2023 for tax year 2023.

2) Contributed to Roth in calendar year 2024 for tax year 2024.

3) Recharacterized Roth contribution for tax year 2023 to Trad IRA in 2024 and completed backdoor process in 2024.

4) Recharacterized Roth contribution for tax year 2024 to Trad IRA in 2024 and completed backdoor process in 2024.

My understanding is that for filing 2023 taxes, I will follow the provided “Backdoor Roth in TurboTax: Recharacterize and Convert, 1st Year”.

However, for filing 2024 taxes next year, would I need to use the instructions in this article, “Backdoor Roth in TurboTax: Recharacterize and Convert, 2nd Year” and blend it with the instructions of the article “Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year” since I had to recharacterize from Roth contribution to Trad IRA contribution then complete the backdoor process again in 2024 but did not do a late conversion this year?

Thank you so much for your assistance. These articles have been extremely helpful.

Harry Sit says

You got it! It’ll be much easier when you get on the “clean” track in 2025.

ET says

Hi Harry,

Thank you so much for confirming. For 2024’s tax filing, would I then be receiving 3 1099-Rs? 1 x 1099-R for the 2024 conversion and 2 other 1099-Rs, 1 for 2023 recharacterization and 1 for 2024?

Thank you!

Harry Sit says

That’s right. The 1099-R for the conversion will show the combined amount. You enter it only once by following the “2nd year” guide.

SD says

Hi Harry,

I’m following your guides for reporting a split-year backdoor Roth, but I can’t figure out what to do next for my specific situation:

1. I contributed $6500 to a Traditional Roth in 2023 for 2023 (and am reporting this according to year 1 of your guide).

2. I haven’t yet converted. I know I still have a little bit of time before the deadline. The thing is, I have more than just the $6500 in my traditional IRA from past contributions and all the money has been invested since January 2024. It hasn’t earned a lot, but it’s earned a little bit of money. I can’t figure out whether it makes sense to convert the entire account, convert only the $6500 I contributed specifically to convert… or what. I’m confused. Either way, I know I will owe taxes on the income. Do you have any advice? Thank you for your time & for writing these articles.

Harry Sit says

Just convert 100% of the money in the account. If you have the money to make the 2024 contribution now, contribute it and convert the larger sum. If you’ll contribute for 2024 later this year, convert again at that time (but don’t let it go past 12/31, otherwise you’ll be in the split situation again). There’s no limit on how much you can convert in a year or how many times you can convert in a year.

GC says

Hi Harry, I just discovered this strategy. Objective:

1. contribute $6500 for 2023 in 2024 by April 15th to a new traditional IRA

2. contribute $7000 for 2024 in 2024 to this new traditional IRA

3. move existing IRA to a 401k in 2024 (both 100% pretax dollars). For sake of argument, lets say it is $50,000 now, but originated from a 401k rollover of $30,000 prior.

4. do a Roth conversion of the new traditional IRA $13,500 in 2024.

Since #3 hasn’t been done yet, but planned for 2024, what are the implications for the 8606 for both 2023 and 2024? Line 6 Dec. 31 2023 value will be nonzero but not entered? Dec. 31 2024 will not include the original IRA?

Line 2 8606 total basis is confusing. What do I enter for line 2 in 2023 (50,000? 30,000?) and 2024? Since 2023 will not entail a conversion, I only fill out lines 1,2,3 on the 2023 form, not needing to fill in line 6, so no tax due. But in 2024, I will need to fill in the whole form. Will the 2024 line 2 be $6,500 or include some of the 50,000 or 30,000? Line 1 will be 7,000. Line 6 will be zero?

Harry Sit says

Please follow Split-Year Backdoor Roth IRA in TurboTax, 1st Year for your (1) contribute $6500 for 2023 in 2024 by April 15th to a new traditional IRA. TurboTax will generate Form 8606 with $6,500 on Lines 1, 3, and 14.

Come back to follow this post next year when you do your taxes for 2024. TurboTax will generate Form 8606 as shown near the end of this post. Tax basis isn’t the same as cost basis. An IRA with only pre-tax money has no basis.

GC says

Thank you Harry. So for the 2023 8606 Line 1=$6500;

But Line 2=zero? You mention “An IRA with only pre-tax money has no basis”.

Therefore I don’t report the value of the existing IRA now worth $50,000 anywhere on the 2023 8606? And by 2024, it will have been moved to a 401k therefore it also won’t be reported on the 2024 8606.

Harry Sit says

That’s correct. No basis means the basis is zero.

MRK says

Hi Harry,

I did contribute $6500 for 2023 in 2024 under Traditional IRA and converted to Backdoor Roth IRA in 2024. I didnt have any earnings on this amount. While filing tax returns, I did follow 1st year article to show the contribution in turbotax. But I see around $400 tax increased on my due. Ideally I should not owe any extra tax right? can you please help clarify and how to get rid of this? I am using Turboax online

Harry Sit says

Please double check against every step in the “1st year” post. If you mistakenly said you recharacterized it, it creates a 6% exercise tax, which is $390 on $6,500.

It’s difficult to troubleshoot in TurboTax Online because you can’t see the forms before you pay. You don’t know where to fix when you don’t know where the $400 came from. Buy TurboTax download software from Amazon next year.

KJ says

Harry,

Thank you for publishing these clear TurboTax IRA guides. You have saved me a lot of time! I am one who fell into the Roth –> recharacterize –> convert path, and I was initially concerned that I would need to amend my previous year’s taxes!

Keep up the good work, and I’m glad to see that your blog is being recognized for the contributions.

A.Specter says

This is my second year doing a Backdoor Roth. My basis for 2022 was $6000. In 2023, I contributed $6015, all post-tax/non-deductible. My 1099-R for 2023 shows a gross distribution of $7011.

And yet the updated basis (line 14 on my 2023 8606) is $5003. Isn’t line 14 supposed to be cumulative? Every contribution I have made to my IRA is non-deductible, so I expected by updated basis this year to be $1215. I am completely befuddled at how it actually decreased (from $6000 in 2022 to $5003 in 2023).

Harry Sit says

No, it’s not supposed to be cumulative. New nondeductible contributions add to basis, and conversions use up part of basis.

Catch up in 2024 by contributing for 2024 in 2024 and converting in 2024. Get out of all this confusion about basis.

A.Spector says

Thank you so much

Elizabeth says

Hello!

I have a tax situation that I did not see addressed above, but apologies if I missed it. In calendar year 2024, I both contributed and converted to a backdoor Roth IRA for tax year 2023 and 2024. From what I can tell, I was supposed to report the 2023 contribution and conversion on my 2023 tax return. Unfortunately, this was my first backdoor conversion, and I did not do that when I submitted my 2023 return. Is my first step to amend my 23 tax return, or is there a way to report this on my 2024 return? Lesson learned and will only be doing contribution and conversion in the calendar year for which I’m contributing to.

Thank you!!!

Marcie Hansen says

I have a split year conversion with a twist. Zero balance in tradional Ira when I contributed non deductible 7000 in April of 2024 for tax year 2023, then I converted the 7000 soon after. Later in the year I retired in July and my 401k balance was transferred into the account, $50,000. Does this affect whether my conversion in April is taxable?

Harry Sit says

Rolling over a 401k to a Traditional IRA after you converted made a large part of your conversion taxable. Enter the value of your Traditional IRA from your year-end statement in the first box on that “Tell Us the Value of Your Traditional IRA” screen. The conversion would still be mostly non-taxable if you have a few dollars left in the account from earnings posted after you converted, but not when you have $50,000.

The remaining after-tax money stays in the Traditional IRA. You’ll pay less tax when you withdraw from that IRA or convert it to Roth in the future. The tax benefit isn’t lost forever but only delayed.

Marcie says

Thanks for the quick helpful response!

Amy Mad says

I’m doing the Backdoor Year 2 instructions – and yes I followed your instructions last year! So happy to have your help with this. Here’s my problem this year: Box 2b is checked to say “Taxable amount not determined” AND “Total distribution” is also checked on all of my 1099’s. Is this the reason that it looks like my wife and I were naughty this year and exceeded the amount of acceptable contributions (by double)? if so what do I need to do? If not, any ideas?

Harry Sit says

The “total distribution” box doesn’t affect anything here. Contributing to an IRA requires earned income. The software will say you have excess contribution if you jump to all these steps before you put in your W-2 or self-employment income. It’ll go away when you add those income.

Amy Mad says

The W-2 info is already in there. Other ideas?

Both my wife and I contributed to a traditional IRA for 2023 but not until January 2024. We converted to Roth in February 2024. So I did the Backdoor instructions for year 1 last year. I’m trying to use the Backdoor year 2 instructions this year to clean up all that mess. I also have a clean backdoor for 2024 – yay me! – and will make sure they’re clean in all future years. As stated previously, after doing backdoor year 2, it looks like I’ve exceeded the amount of acceptable contributions by double.

I did just buy the software, per your recommendations, so maybe I should just scrap it all and start over? Let me know if you have an idea, after reading the details I just included. Thank you

Harry Sit says

What gave you the impression that “it looks like I’ve exceeded the amount of acceptable contributions by double”? It’s hard to tell with online software because you can’t see the forms. Since you already bought the desktop software, you might as well use it. Install the software, continue from online, look at the taxable income on 1040 line 4b and the 8606 forms to see if anything isn’t as expected.

Amy Mad says

I got 3 1099’s (if I had 4 I dont think I would be struggling). MY 2 were for 7514 and 7500 and I must’ve put them in successfully… I’m only being taxed on the 14 bucks. My wife got only one 1099 for 15 and I must not be doing that one correctly… half should be for last years conversion and half for our clean backdoor (we can each do 15 per year). If I enter the 1099 for 15, which of your instructions should I be following?

Harry Sit says

When you say “My wife got only one 1099 for 15” do you mean her 1099 shows $15,000 in Box 1? If that’s the case, start from the “1099-R for Conversion” heading. All the steps are still the same except that she has a larger amount on her 1099-R form. Enter that larger amount as-is. Continue with the steps under the “Clean Backdoor Roth On Top” heading to enter her contribution for 2024.

Daniel; says

I contributed $6,500 to an IRA in 2024 for 2023, and did not report this on my 2023 taxes. As a result, I need to amend my Form 8606 in 2023. Does anyone know how to do this in Turbotax? When I go through the process flow, Form 8606 does not change on my amended return on the Turbo tax website. Thanks

Harry Sit says

If you can’t make it work in TurboTax online, you can fill out the 2023 Form 8606 manually and mail it in by itself. Attach a letter to say it was inadvertently left out of your 2023 return and it doesn’t change the refund or the amount owed. The mailing address is on the last page of Form 1040 instructions.

https://www.irs.gov/pub/irs-prior/f8606–2023.pdf

Amy Mad says

…Harry Sit says… FEBRUARY 25, 2025 AT 10:12 AM…

Just wanted to let you know that it did all work out with the Amazon-bought TurboTax software that you recommended buying. I did the “1099-R for Conversion” followed by the “Clean Backdoor Roth On Top”. Thanks so much!

Kevin says

Just wanted to say before I exit this page, after using it today for my taxes, THANKS! Keep up the great work! Love it! Tremendously helpful!

Camille says

So I am one of those people that did not realize this was an issue. I contributed for 2023 (6500)in 2024 and filed without issue.

I then contributed 1000 for 2024 in 2024 and lost track and contributed the rest in 2025 ( 7000).

The 1099R has 7500 listed ( 6500 for 2023 and 1000 for 2024)

I did received a 5498 for 2023 that shows the conversion.

I am not sure what I doing wrong in the program that it keeps giving the 6500 as taxable. Where do I input my 5498 that shows that I converted it?

Camille Richards says

I figured it out! I was missing the cost basis for 2023

Chet says

I messed up my return without knowing it while doing backdoor roth(hopefully there is a way to correct it.) How do I correct my 2023 return? and how to file 2024 return ?

2024 1099-R shows:

1 Gross distribution $13,507.78

2a Taxable amount $13,507.78

Contributed after tax money on 12/29/2023 – $6500

Converted to Roth IRA 01/03/2024 $6504.74

Contributed after tax money on 12/29/2023 – $7000

Converted to Roth IRA 01/03/2024 $7003.04

2023 Tax return form 8606.

PartI. 1 6500

PartI.3 6500

PartI.5 6500

PartI.13 6500

PartII.16 6505

PartII.17 6500

PartII.18 5

Anne says

This was so incredibly helpful – thank you! My federal refund meter corrected as stated. However, I am not seeing the same with my state refund. For $38 in gains, I am seeing my state refund reduced by $1027 in turbo tax. Any suggestions?

Harry Sit says

If you’re in MA (or maybe a few other states), go to the state tax part and answer the question on how much of the IRA distribution came from money already taxed by the state.

Harold K. says

Hi there! I have a similar situation as described above and in the year 1 article, but am getting conflicting information regarding deadlines for steps and I’m hoping you can clarify.

My wife and I each contributed some money to our Roth IRAs in calendar year 2024, but then later realized while preparing our taxes that our MAGI would make us ineligible to contribute anything to our Roth IRA and so our contributions thus far have all been excess. So we’d started exploring the backdoor Roth as neither of us had any tIRAs. We’ve already started the process of re-characterizing the 2024 contributions and earnings into our newly established tIRAs (just waiting for those funds to fully process). What I’m unsure of at this point is what needs to be done by April 15th, 2025.

1) For reporting the re-characterization of the 2024 contributions and earnings on my 2024 taxes, the year 1 article you posted I think covers that so I think I am good on the process to report the re-characterization. However, can you clarify that answering the questions in turbotax as you laid out is all that needs to be done? no additional forms need to be provided/filled out?

2) Do I also need to complete the re-conversion back to the Roth IRA via the backdoor process by April 15th, 2025? This is the piece I’m getting conflicting information on. I see some saying by April 15th, some that say December 31st, some that say there’s no deadline. Basically, I don’t want my funds to be stuck in my tIRA so I want to ensure I convert them back to the Roth IRA by whatever deadline there is to avoid this. Thank you!

Harry Sit says

1) Those are all the steps. The software will generate the necessary Form 8606, which you didn’t have in previous years.

2) There’s no deadline to convert. Converting before December 31, 2025 aligns with this post for Year 2 but technically you can wait until 2026 or beyond. There’s no good reason to wait but you can if you want to.

Ian - from part #1 says

I followed the steps from Part 1 for TY 2023, I have a correct

Note I am under age 59-1/2.

I used M1 for this Trad IRA -> Roth IRA Backdoor. My 1099-R does not match, I have an issue with the code in Box 7.

Under Your Article Section “1099-R for Recharacterization” :

This year they generated the first 1099-R form for TY 2024.

Box 1 Gross distribution is $6500,

Box 2a Taxable amount is $6500,

Box 2b is checked [X]

…

Box 7 Distribution codes is “2”

IRA/SEP/SIMPLE [X]

Your sample for the shows R in that box. What do I proceed with at this point? Later under Section “1099-R for Conversion” you say Code #2 is ok.

“The code in Box 7 is “R.” The “IRA/SEP/SIMPLE” box under Box 7 may or may not be checked. It’s not checked in our sample 1099-R.”

(2—Early distribution, exception applies (under age 59½).

(R—Recharacterized IRA contribution made for 2023 and recharacterized in 2024)

Harry Sit says

This post covers two example scenarios. It says immediately under the heading “1099-R for Recharacterization” — This section only applies to the second example scenario. If you didn’t recharacterize (the first example scenario), please skip this section and jump over to the conversion section. So jump over to the “1099-R for Conversion” section if you only have one 1099-R with a code 2 in Box 7.

Subhadeep says

Thank you for the article. This is extremely helpful! Keep it up 🙂

Jess says

Thank you so much for this article! I believe my situation is very similar to the one you described here but wanted to clarify one additional point on the gains I made in my traditional roth before conversion. My current situation is as follows:

1. Made a contribution in March 2024 to Traditional Roth (all post tax/non-deductible) which I filed in my 2023 taxes

2. I did not convert the above contribution to my Roth IRA until March 2025 and during then accumulated some gains which I also fully converted to my Roth IRA

3. Made a contribution in March 2024 to Traditional Roth (all post tax/non-deductible) which I will file in my 2024 taxes

4. Also converted the above contribution in March 2025 along with the conversion in #2

In this case, from your extremely helpful guide it looks like while I file my contributions in their respective tax years, the conversion for the total amount of #2 and 4 will not be filed until I file my 2025 taxes using the 1099 R I will receive later. Is this correct?

More importantly, I would like to clarify if I would be taxed for the small gains I accumulated from my first contribution in my Traditional Roth before converting to my Roth IRA this year. And if so, how should I be filing that?

Thank you so much for your help in advance! Really appreciate your work and the guidance you are providing everyone.

Jess says

Small correction to #3:

3. Made a contribution in March 2025* to Traditional Roth (all post tax/non-deductible) which I will file in my 2024 taxes

Harry Sit says

With regard to your 2023 contribution made in 2024, 2023 was Year 1, which you already did, and 2025 is Year 2, which you’ll do next year when you file taxes for 2025.

With regard to your 2024 contribution made in 2025, 2024 was Year 1, which you should do now by following the steps in the Year 1 post. When you’re done, you should verify that your Form 8606 Line 14 shows the sum of your 2023 and 2024 contributions. 2025 is Year 2, which you’ll do next year.

While you’re at it, you should make your 2025 contribution in 2025 and convert again in 2025 to break out of this split-year cycle.

If the three conversions came out of the same account, you’ll have one 1099-R form with triple the amount. The converted gains will also be included in that larger amount on the 1099-R form. You’ll enter it in one pass by following the steps here next year, except that your dollar amount is larger. The difference between that larger amount and the sum of your 2023, 2024, and 2025 contributions will be taxable in 2025.

MATTHEW R RIVERS says

Thank you for the great information. I did a split year backdoor roth last year and followed YEAR ONE instructions on my 2023 return. This year I am doing my YEAR TWO on my 2024 filing. I also have a CLEAN backdoor for 2024. I have two 1099-R forms from Fidelity for my 2024 taxes. Is that the correct amount of 1099-R’s for my 2024 tax filing?

Harry Sit says

Are the account numbers on the two 1099-R forms the same? What are the codes in Box 7? You usually get only one 1099-R form for each account. It’s normal to have two 1099-R forms for two different accounts. If you did Year 1 with a recharacterization from Roth to Traditional, it’s normal to have one 1099-R with a code R for the recharacterization and another 1099-R with a code 2 or 7 for the conversion.

TA says

You are doing god’s work. Thank you so, so much. Especially appreciate that you’ve thoughtfully gone through every common scenario (such as doing a “clean” backdoor in the same year). This was easy to follow (despite how tedious this can be) and allowed me to double check my work at the end. Thank you again. I hope the ad revenue you are getting from this page is substantial, as I am sure you are saving countless people hundreds and thousands of dollars

Austin says

Hi Harry,

Thank you for the helpful guide! Can you clarify this line?

“If you contributed for 2024 in 2025 or if you recharacterized a 2024 contribution in 2025, you’re still in the first year of this journey.”

Do you mean recharacterized the 2024 contribution after April 15, 2025? The Year 1 guide includes an example of contributing in 2024, realizing the income was too high, and then recharacterizing in 2025 prior to April 15.

Best,

Austin

Harry Sit says

This post was written for doing 2024 taxes. The deadline to recharacterize a contribution for 2024 was October 15, 2025 if you filed an extension. Follow the Year 1 guide whether you recharacterized a contribution for 2024 before April 15, 2025 without an extension or between April 16, 2025 and October 15, 2025 with an extension.

If you’re thinking of a contribution for 2025, and you recharacterized it in 2025, then follow Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year when you do your 2025 taxes next year.

Daven says

Hi Harry,

I contributed in Jan 2025 for the years 2024 and 2025 ($7K each). While preparing my return for 2024, I realized I couldn’t contribute for 2024 because I had no earned income.

I had my broker reverse the $7K, I contributed for 2024. Now I have 2 1099-R’s. One for original $14K (24 & 25) contributions and rollover, and one for reversal from Roth account for 2024 of $7K (with Codes J & P).

Not sure how to report these in TT, as it’s currently adding the $14K as a taxable income in the 2025 return.

Regrads

Daven says

Just to add to the previous comment, I didn’t report anything in the 2024 Return.