Everyone knows the point of putting money into a Roth IRA is that withdrawals are tax-free. That’s true at a high level but it isn’t that simple when you go one level down into the details. Withdrawals from a Roth IRA follow a set of complex rules to determine how much of a withdrawal is tax-free and penalty-free.

Roth IRA Withdrawal Rules

The rules require that you understand normal contributions and conversions including backdoor Roth and mega backdoor Roth, rollovers from Roth 401k to Roth IRA, a 5-year clock on each conversion, the taxable and non-taxable amount in the conversion, and earnings in the Roth account, etc., etc. Gathering and keeping records to put dollar amounts into each bucket year by year requires another level of attention. See Maintain a Roth IRA Contributions and Withdrawals Spreadsheet.

Relief After 59-1/2

The great news is that all these complexities go away when you’re 59-1/2. You only need to answer this one question when you withdraw from your Roth IRA after age 59-1/2:

Did you have a Roth IRA at least five years ago?

The answer is obviously “Yes” for most people. It’s the simplest way to make your Roth IRA withdrawal 100% tax-free. That’s the path I’m aiming for.

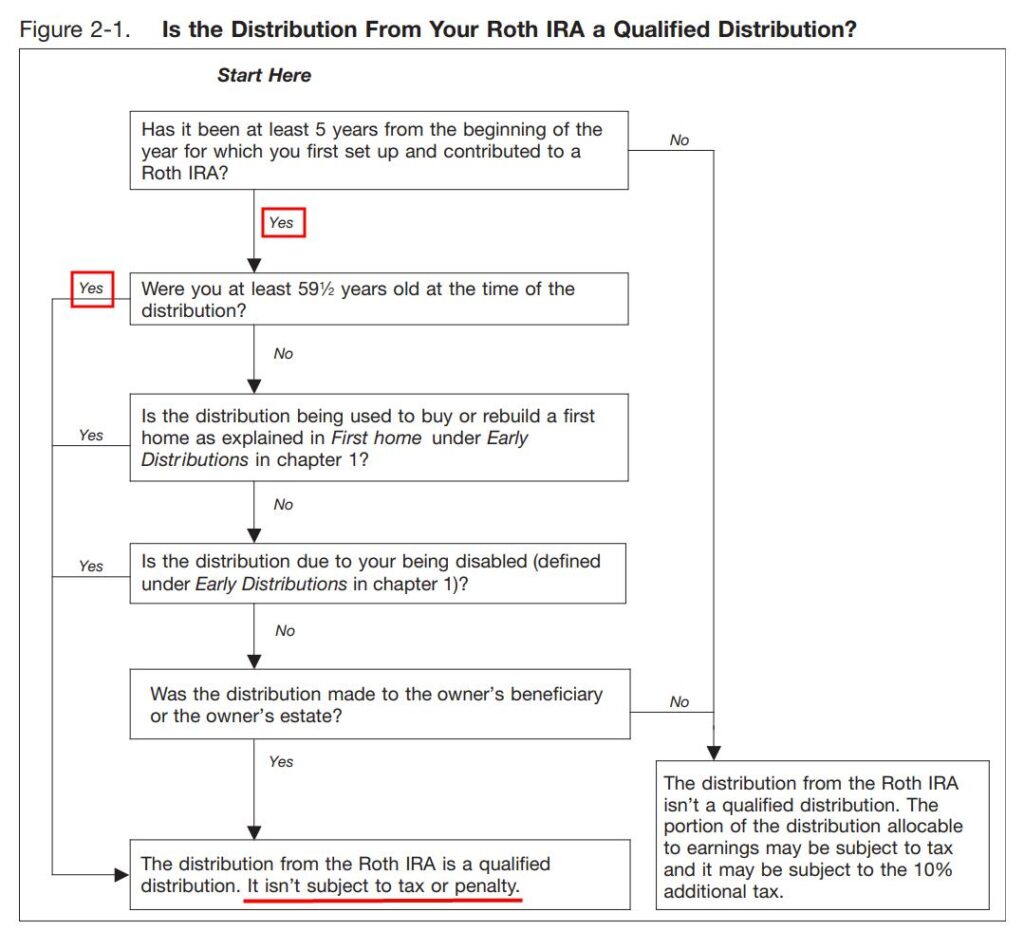

If you can’t believe that it’s this simple once you’re age 59-1/2, look at this flow chart from the IRS:

Source: IRS Publication 590-B, Figure 2-1.

You only need to have had a Roth IRA at least five years ago. The five years are not tracked account-by-account or custodian-by-custodian. Your first Roth IRA doesn’t have to still exist. You only need to have some evidence that it once existed.

You’ll get a 1099-R from your Roth IRA custodian in the following year after you take a withdrawal. Let’s look at how it works on your tax return when you use tax software TurboTax and H&R Block.

H&R Block

I normally start with TurboTax when I do these tax software walkthroughs but I’m starting with H&R Block this time for reasons that will become apparent later.

The screenshots below are from H&R Block Deluxe downloaded software. The downloaded software is both less expensive and more powerful than the online version. You can buy H&R Block downloaded software from Amazon, Walmart, Newegg, Office Depot, and many other retailers.

I started the tax return with a 67-year-old single taxpayer.

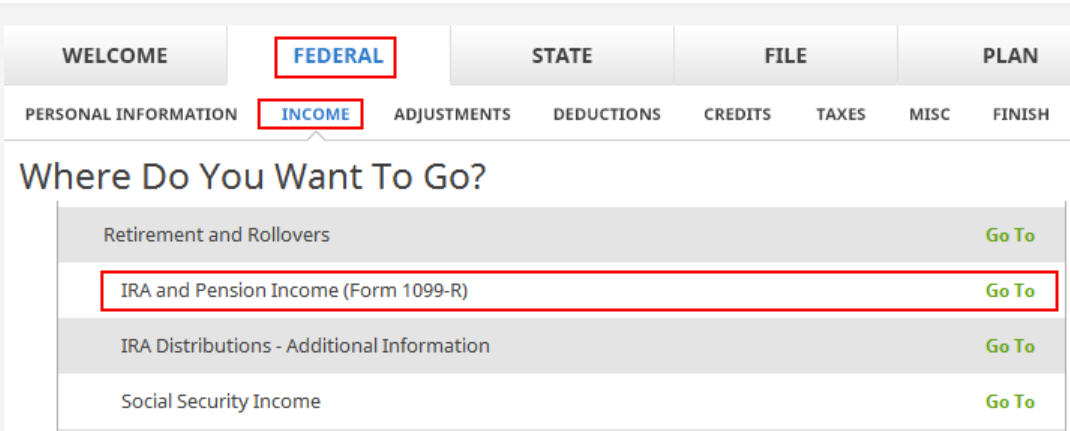

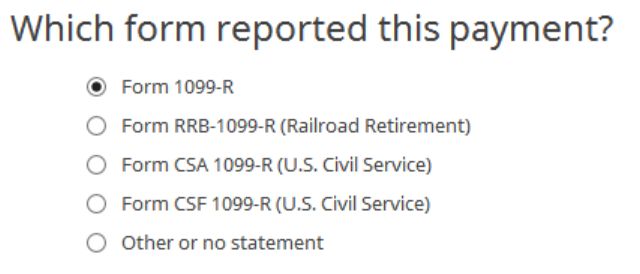

Go to Federal -> Income -> IRA and Pension Income (Form 1099-R). You can import the 1099-R or enter it manually. I’m showing manual entries.

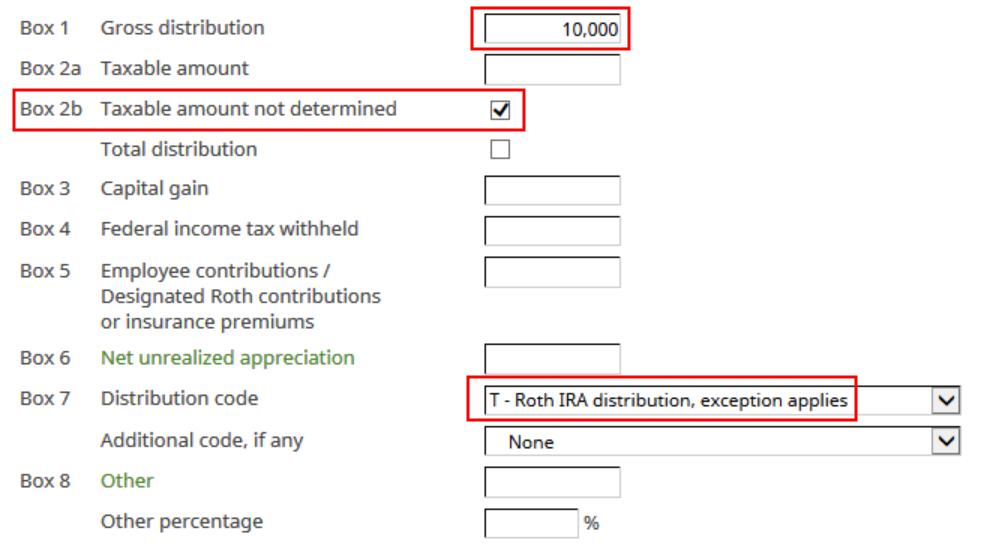

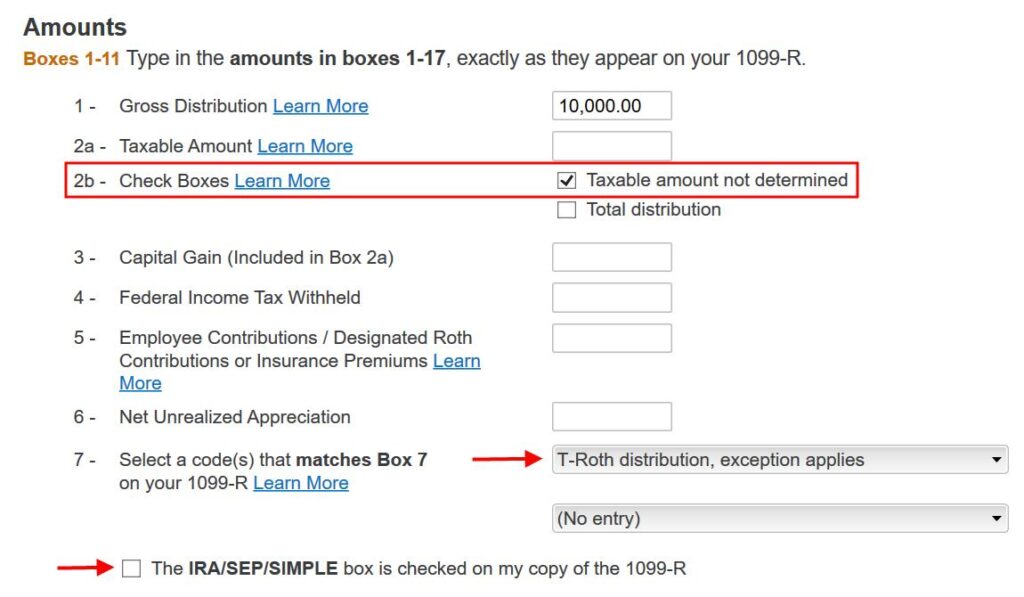

My test 1099-R is a normal 1099-R. Enter the numbers from your 1099-R as-is. It looks like this for a $10,000 withdrawal from the Roth IRA:

The amount of the withdrawal shows up in Box 1. Yours may have the same amount repeated in Box 2a and that’s OK too. It’s important to have a checkmark in Box 2b “Taxable amount not determined.” Your Roth IRA custodian isn’t determining whether your distribution is taxable. The box 7 distribution code is “T.”

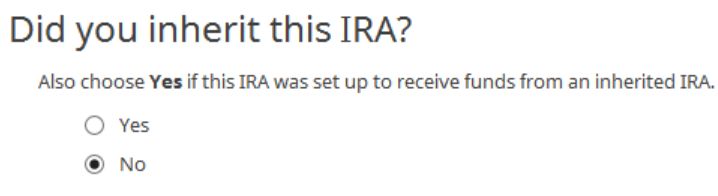

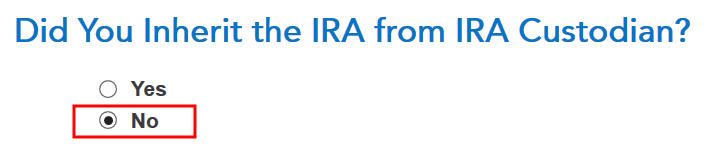

I didn’t inherit it.

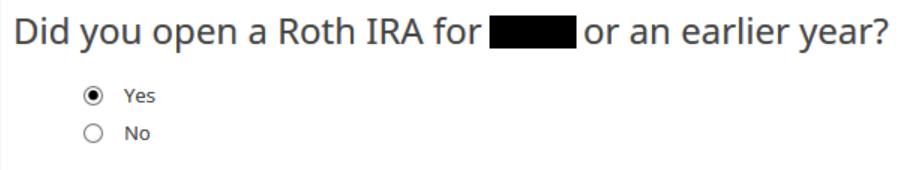

Here it’s asking whether I had my first Roth IRA at least five years ago. Of course I did.

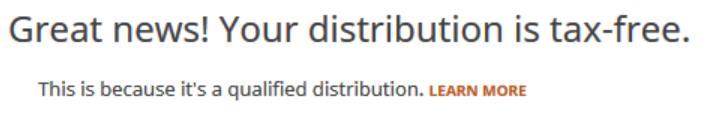

That’s it. It’s tax-free after I answer just two simple questions. I didn’t have to give any detail for the past contributions, recharacterizations, conversions, rollovers, or distributions. It doesn’t matter how the money got into the Roth IRA or when.

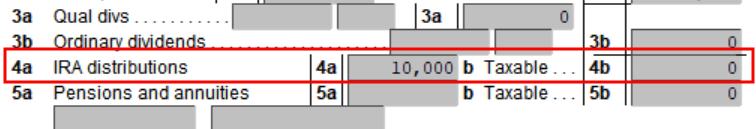

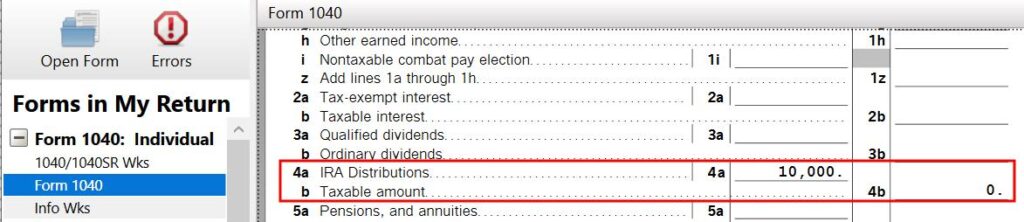

We can see how this shows up on the tax form. Click on Forms on the top and open Form 1040 and Schedules 1-3. Click on Hide Mini WS. Scroll down to lines 4a and 4b.

It shows the withdrawal on Line 4a and zero on Line 4b. Line 4b is the taxable amount. A zero there means it’s tax-free. If you have other IRA distributions such as RMDs on Lines 4a and 4b, this tax-free withdrawal from your Roth IRA adds to your other distributions on Line 4a but it doesn’t add to the taxable amount on Line 4b.

TurboTax

Now let’s look at how it works in TurboTax. The screenshots below are from TurboTax Deluxe downloaded software. The downloaded software is way better than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax download from Amazon, Costco, Walmart, and many other places and switch from TurboTax Online to TurboTax download (see instructions for how to make the switch from TurboTax).

I started the tax return with a 67-year-old single taxpayer.

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R). Import the 1099-R if you’d like. I’m choosing to type it myself.

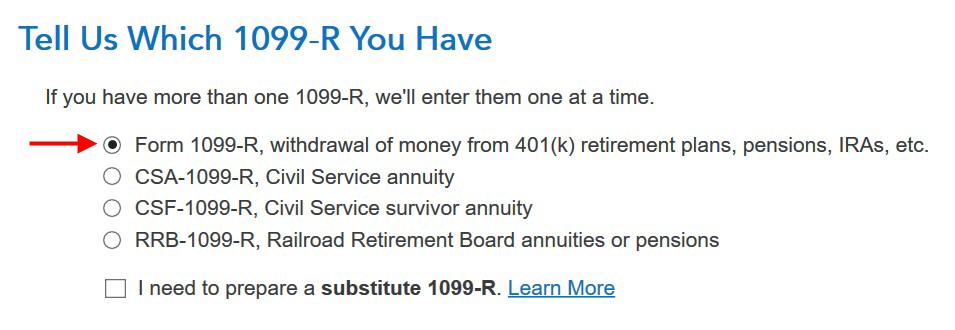

Just the regular 1099-R.

Box 1 shows the amount taken out of the Roth IRA. You may have the same amount copied as the taxable amount in Box 2a. That’s OK when Box 2b is checked saying “taxable amount not determined.” Pay attention to the code in Box 7. Make sure your entry matches your 1099-R exactly. I have a code “T” in my test 1099-R. The IRA/SEP/SIMPLE box is not checked because it’s from a Roth IRA.

I didn’t inherit it.

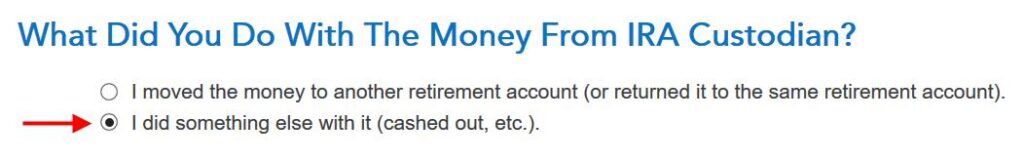

I didn’t move the money to another retirement account.

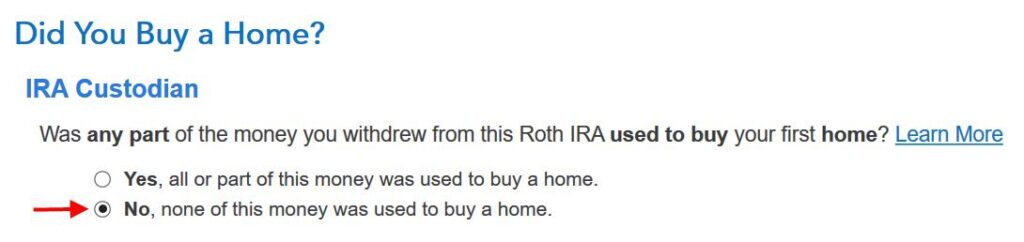

I didn’t buy a home.

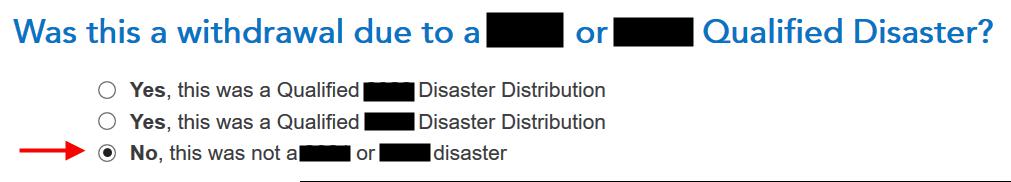

It wasn’t due to a disaster. I took the money out and spent it.

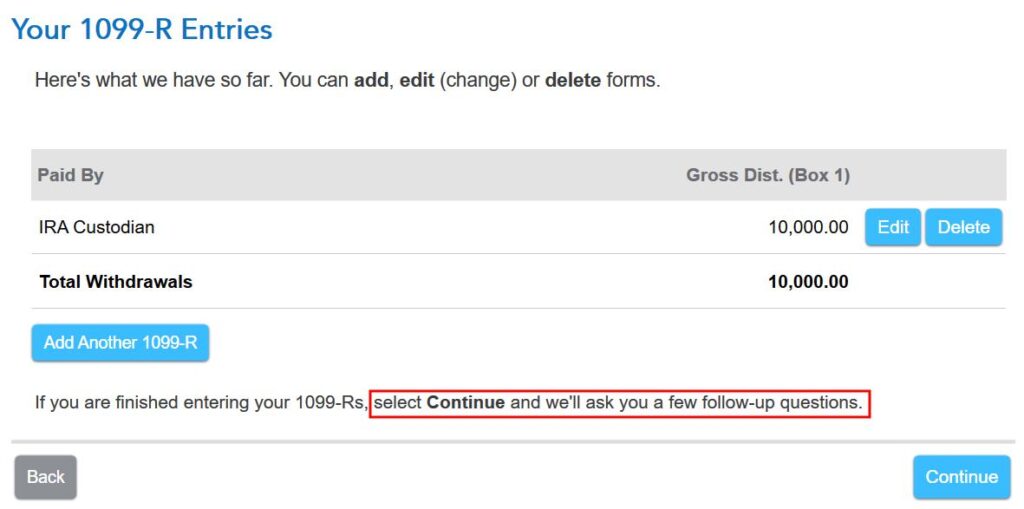

We come to this 1099-R summary but we’re not done yet. TurboTax will ask more follow-up questions.

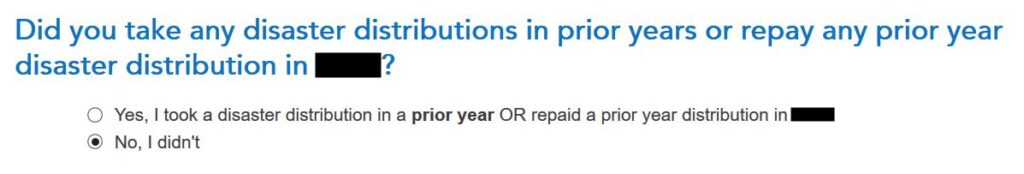

I didn’t take disaster distributions or repay them.

This is the most relevant question. Yes, I owned a Roth IRA for at least five years.

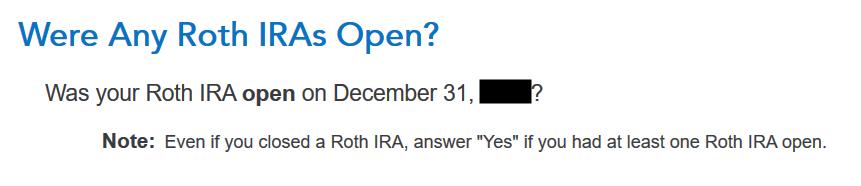

I don’t know why it matters whether I have an open Roth IRA but whatever.

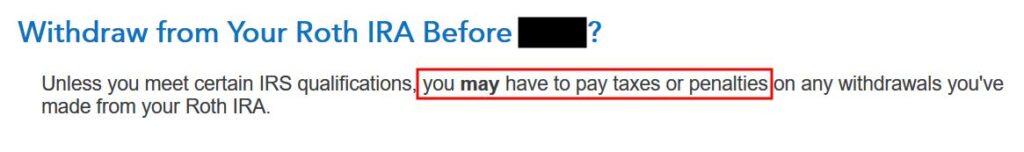

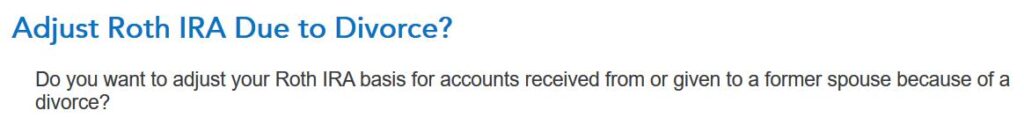

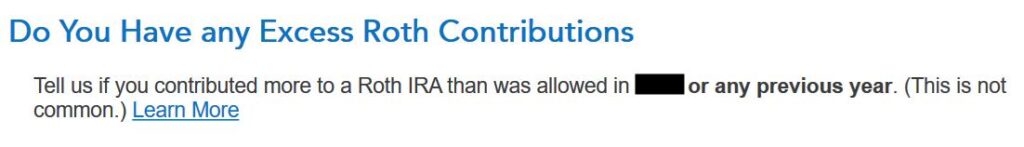

Now TurboTax is trying to scare us. Why does it matter? I’m already 59-1/2!

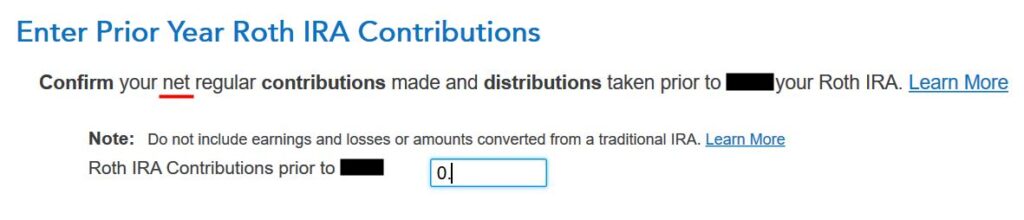

Now TurboTax will go through the rigmarole of Roth IRA distribution ordering rules, which are irrelevant when you’re already 59-1/2 and you had your Roth IRA for at least five years. I’m going to lie to TurboTax now because I know the answers just don’t matter at this point.

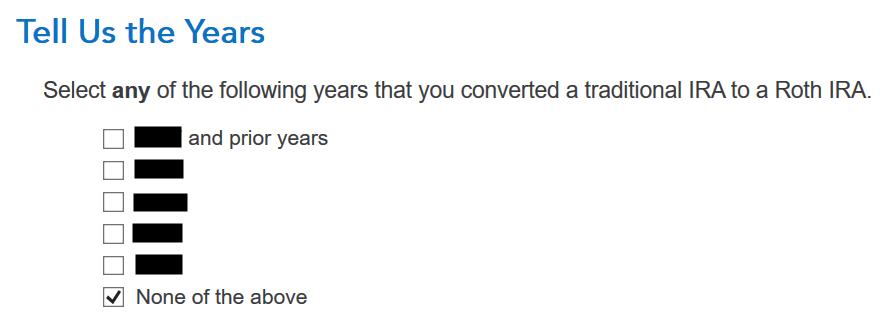

If you answer truthfully which year you did a Roth conversion, TurboTax will take you through the details of your prior conversions. You will waste time doing a lot of unnecessary work. So don’t cooperate.

Again, irrelevant.

No excess contributions.

TurboTax is finally done with its irrelevant questions. Are you taxed on the withdrawal from your Roth IRA? Click on Forms on the top right.

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b.

It shows the withdrawal amount on Line 4a and zero on Line 4b. A zero on Line 4b means it’s tax-free. If you have other IRA distributions such as RMDs on Lines 4a and 4b, this Roth IRA withdrawal adds to your other distributions on Line 4a but it doesn’t add to the taxable amount on Line 4b.

TurboTax arrives at the same results as H&R Block but it takes such a long and unnecessary journey. It uses a one-size-fits-all approach that doesn’t distinguish by whether you’re 59-1/2 or not.

No Roth IRA?

Nothing matters when you’re already 59-1/2 and you had your first Roth IRA at least five years ago. All your withdrawals from the Roth IRA are tax-free, end of story. You won’t have to provide any other data or records. So don’t think you must meticulously keep everything. Just save one statement from a Roth IRA to show that you had it open at least five years ago.

This means if you don’t have a Roth IRA now, you should convert $100 to Roth to plant a seed. You’ll get the 5-year clock started for the big relief when you’re 59-1/2.

The “I” in IRA stands for Individual. Whether you’ve had a Roth IRA for five years is evaluated on an individual basis. If you are married, it doesn’t matter how old your spouse is or how long your spouse has had a Roth IRA. You need to have had a Roth IRA in your own name for at least five years when you withdraw from your Roth IRA after age 59-1/2.

Not Yet 59-1/2?

It’s a whole different story if you’re planning to withdraw from your Roth IRA before age 59-1/2. You do need detailed records to answer those questions from TurboTax. You can use something like the spreadsheet I included in Maintain a Roth IRA Contributions and Withdrawals Spreadsheet.

To be honest, I gave up on keeping track of Roth IRA contributions, recharacterizations, conversions, rollovers, and distributions. I’ll take the easy path and wait until the year I’m 59-1/2.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Wade says

Quick question in the 5 year roth rule. If i had a roth account at vanguard for 10 years, then rolled it over to a newly opened roth at Fidelity, does this reset the 5 year clock?

Harry Sit says

Having a different custodian doesn’t reset the clock for when you first had a Roth IRA.

Deskandchairs says

Thanks so much for this article. You have saved your readers countless hours, especially those of us wh use TurboTax

Jim says

I haven’t taken any distributions from my Roth IRA so don’t know if I’ll have the hassle that you show here, but the online version of Turbotax (Deluxe, I think) does a great job of tracking annual contributions and conversions (split into taxable and non-taxable portions) and carries over and updates all the information from year to year. I abandoned my spreadsheet tracker and rely on TT. The TT tracker is called “IRA Information Worksheet” and includes regular IRA basis info as well.

Harry Sit says

Only if you used TurboTax from the very beginning and you continue to use TurboTax. You have to backfill history if you switch to TurboTax after you already contributed and converted some years or if you leave and then come back. All these tracking will be irrelevant after 59-1/2.

RobI says

Sounds like even if you have a 5+ year old but little used Roth IRA account, making Roth IRA conversions after age 59 1/2 creates no added penalty (beyond immediate taxes) and no need to report on tax return. Welcome news if correct?

Harry Sit says

The conversions still have to be reported to pay the immediate taxes. They just don’t make the withdrawals more complicated.

Sharon says

Thank you for this post. So does this mean that if I’m over 59 ½ and I first opened a Roth IRA in 1997, I no longer need to keep my Form 5498s?

Harry Sit says

You can discard those Form 5498s for Roth IRAs now. Maybe keep only one old form to show that you had one a long time ago.

Gina says

OMG!! I can’t even explain the relief I felt after reading this. I was led to believe by everyone that the clock restarted every time I moved a ROTH IRA from one custodian to another. Was dreading having to maintain spreadsheets with all the shenanigans of breaking up ROTH conversions in to multiple CD’s etc. over the years. The TurboTax hassles that you explained would have given me migraines and possibly a minor heart attack! !!THANK YOU!! for this post.

Jeff Henderson says

I transferred a 401K that I had for ~25 years to Ameritrade when I retired in 2022. Part was a Roth , most was just a regular 401K. I am over 60 years old and I had an existing Roth at Ameritrade for more than 5 years. I also did a partial Roth conversion in 2022 when I transferred that regular 401K into a newly formed “regular” IRA

My plan is NOT to stress myself out trying to research the earnings on my transfer/rollover.

I can take any Roth withdrawals EXCEPT the Roth conversion at any time tax free. I am planning on just tracking the entire dollar amount of each Roth conversion and the year it was done. So I can withdraw the entire amount of 2022’s Roth conversion in 2027, this year in 2028, etc.. As an added “de-stressefier” (yeah, I just made it up) any Roth withdrawals made along those timeframes do not add anything at all to any stealth taxes like IRMAA lookback etc. Am I missing anything?

Thanks for all of you wonderful work!! I look forward to reading your stuff as soon as it comes out.

Harry Sit says

Because you’re over 60 years old and you’ve had an existing Roth IRA for more than 5 years, you can further destress by ignoring the part after your EXCEPT. You don’t have to remember when you did the conversion and for what dollar amount. You have arrived at the point that how the money got into the Roth IRA makes no difference.

Gary L. Creasey says

Great information! Thank you so much Mr. Sit.

The information here and in your book “My Financial Toolbox” and what you have provided online over the years has helped me so much and saved me so much time. I am truly grateful.

Mark says

Hello … new to visiting your website / financial information vault. Thank-you for all the work in assembling this incredible tool.

I am > 59 1/2 and have had a Roth account for > 5 years. The IRS flow chart (thanks for sharing) clearly shows that monies withdrawn would be characterized as “qualified distributions” Good New.

My question: I would like to open a second Roth IRA account (as a means to segragate monies based in investing thesis. Will there be any issues with transferring monies between accounts? Withdrawing from either account would still be consider “qualified”?

Appreciate the help.

Harry Sit says

No issues with opening a second Roth IRA or transferring from one Roth IRA to another. You’re good when you’re already 59 1/2 and you’ve had your first Roth account for more than 5 years