Last updated on January 24, 2026 with all new screenshots from TurboTax Deluxe desktop software for the 2025 tax year. If you use other tax software, see:

If you did a Backdoor Roth, which involves making a non-deductible contribution to a Traditional IRA and then converting from the Traditional IRA to a Roth IRA, you must report both the contribution and the conversion in the tax software. This post gives you a step-by-step walkthrough of how to do it in TurboTax. For more information on Backdoor Roth in general, see Backdoor Roth: A Complete How-To.

What To Report

You report on the tax return your contribution to a Traditional IRA *for* that year, and you also report your conversion to Roth *during* that year.

For example, when you are doing your tax return for 2025, you report the contribution you made *for* 2025, whether you actually did it during 2025 or between January 1 and April 15, 2026. You also report your conversion to Roth *during* 2025, whether the contribution was made for 2025, 2024, or any previous years.

Therefore, a contribution made during 2026 for the year 2025 goes on the tax return for 2025. A conversion done during 2026 after you contributed for 2025 goes on the tax return for 2026.

You do yourself a big favor and avoid a lot of confusion by making your contribution for the current year and finishing your conversion in the same year. I call this a “planned” Backdoor Roth or a “clean” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for 2025 in 2025 and convert it during 2025. Contribute for 2026 in 2026 and convert it during 2026. Everything is clean and neat this way.

If you are already off by one year, it depends on whether you’re handling the contribution part or the conversion part right now. If you contributed to a Traditional IRA for 2025 in 2026 and converted in 2026, or if you recharacterized a 2025 Roth contribution in 2026 and converted in 2026, please follow Split-Year Backdoor Roth IRA in TurboTax, Year 1. If you contributed to a Traditional IRA for 2024 in 2025 and converted in 2025, or if you recharacterized a 2024 Roth contribution in 2025 and converted in 2025, please follow Split-Year Backdoor Roth IRA in TurboTax, Year 2. If you recharacterized your 2025 Roth contribution in 2025 and converted in 2025, please follow Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year.

Use TurboTax Desktop Software

The screenshots below are from TurboTax Deluxe desktop software. The desktop software is both more powerful and less expensive than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax desktop software from Amazon, Costco, Walmart, etc., and switch from TurboTax Online to TurboTax desktop software (see instructions for how to make the switch from TurboTax).

Here’s the planned “clean” Backdoor Roth scenario we will use as an example:

You contributed $7,000 to a traditional IRA for 2025 in 2025. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2025, the value grew to $7,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you will have to make some adjustments to the screens shown here.

Before we start, suppose this is what TurboTax shows:

We will compare the results after we enter the Backdoor Roth.

Convert Traditional IRA to Roth

The tax software works on income items first. Even though the conversion happened after the contribution, we enter the conversion first.

When you convert from a Traditional IRA to a Roth IRA, you will receive a 1099-R form. Complete this section only if you converted *during* 2025. If you only converted during 2026, you won’t have a 1099-R until next January. Please follow Split-Year Backdoor Roth IRA in TurboTax, Year 1. If your conversion during 2025 was against a contribution you made for 2024 or a 2024 contribution you recharacterized in 2025, please follow Split-Year Backdoor Roth IRA in TurboTax, Year 2.

In our example, we assume that by the time you converted, the money in the Traditional IRA had grown from $7,000 to $7,200.

Enter 1099-R

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

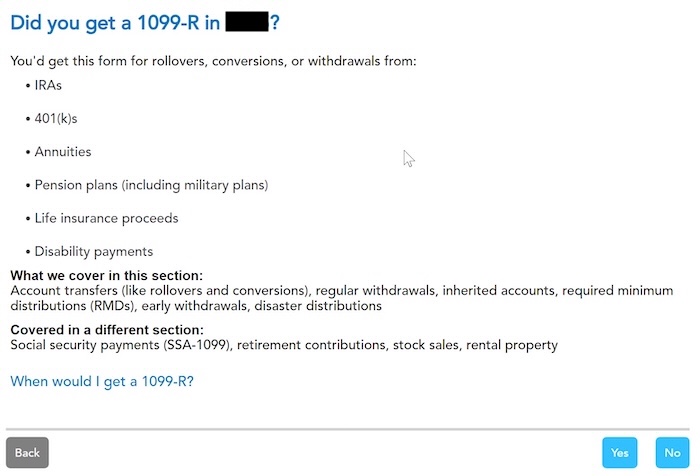

As you work through the interview, you will eventually come to the point of entering the 1099-R. Select Yes, you got a 1099-R. Import the 1099-R if you’d like. I’m choosing to skip import and type it myself.

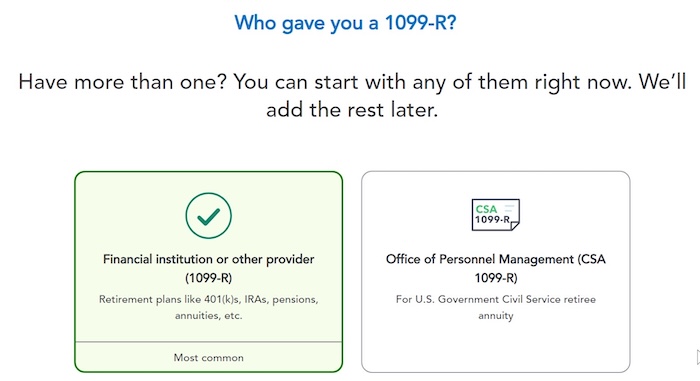

You got it from a financial institution. Enter the payer information as shown on your 1099-R.

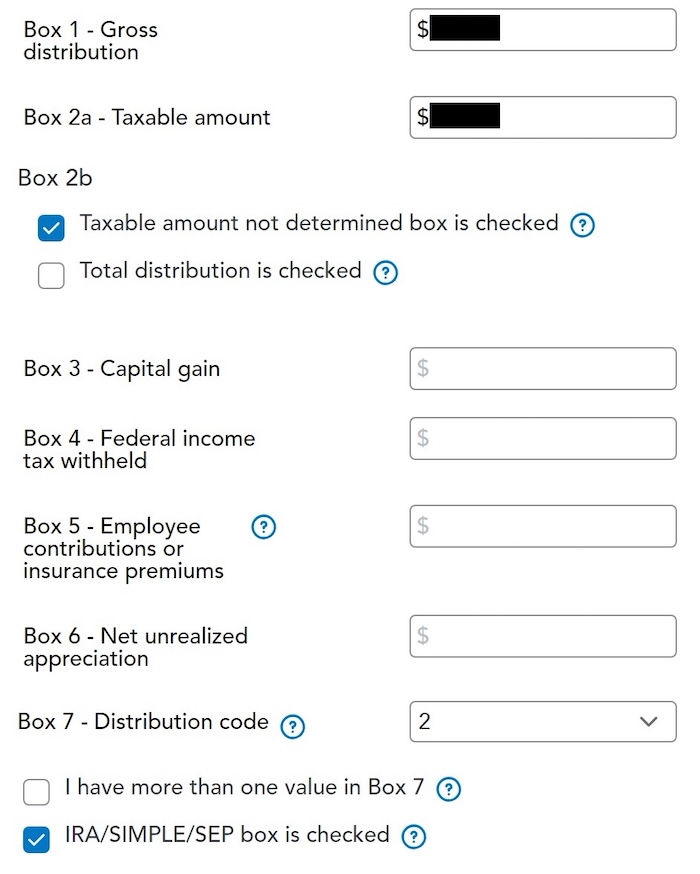

Box 1 shows the amount converted to the Roth IRA. It’s $7,200 in our example. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked saying “taxable amount not determined.” The total distribution box may or may not be checked. It doesn’t matter.

Pay attention to the code in Box 7 and the IRA/SEP/SIMPLE box. Make sure your entry matches your 1099-R exactly. The code in Box 7 should be 2 if you’re under 59-1/2 and 7 if you’re over 59-1/2. The IRA/SIMPLE/SEP box should be checked.

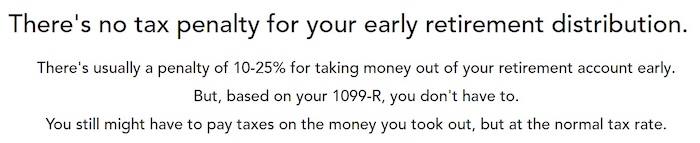

You get this Good News, but …

Your refund in progress drops a lot. We went from $2,384 down to $858. Don’t panic. It’s normal and temporary.

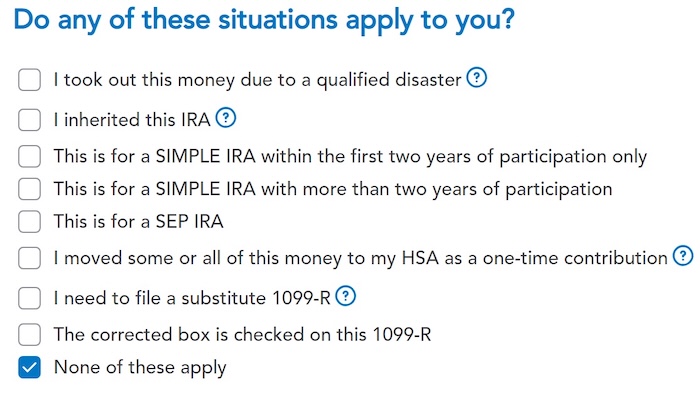

None of these should apply in a usual backdoor Roth.

Converted to Roth

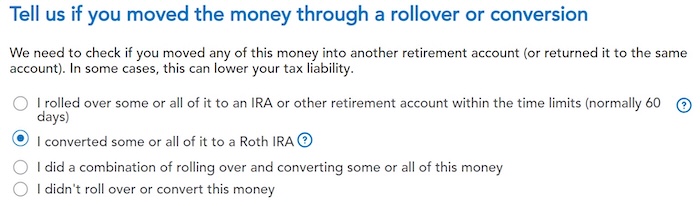

Choose “I converted some or all of it to a Roth IRA.” Don’t choose the “I rolled over …” option. A Roth conversion is not a rollover.

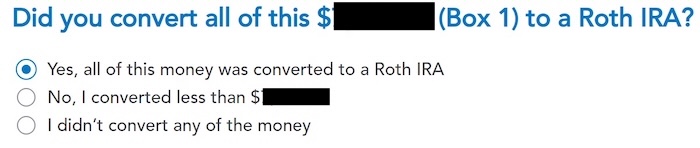

Yes, you converted all of it.

You get a summary of your 1099-Rs next. Repeat the previous steps to add another if you have more than one. If you’re married and both of you did a Backdoor Roth, enter the 1099-R for both of you, but pay attention to select whose 1099-R it is. Don’t accidentally assign two 1099-R forms to the same person.

Basis

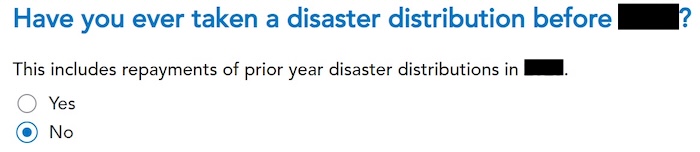

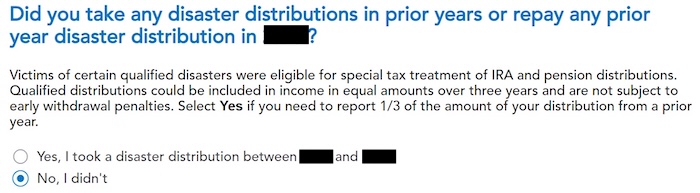

We didn’t take or repay any disaster distribution.

We already said no, but TurboTax just wants to be sure.

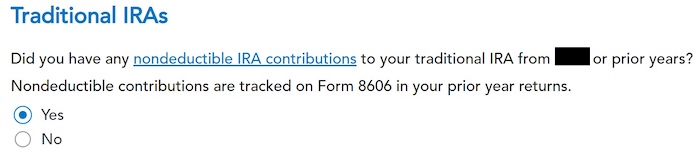

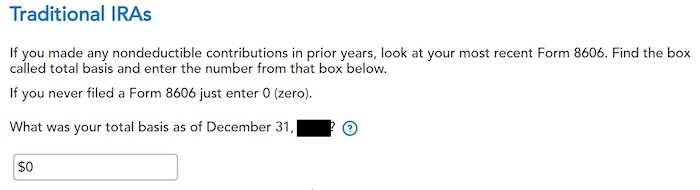

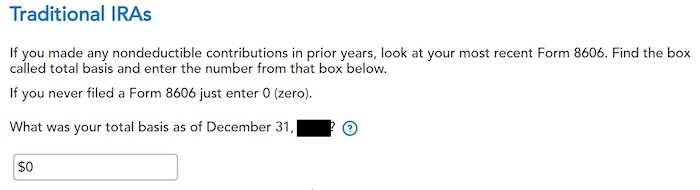

Here it’s asking about the carryover from the prior year. When you did a clean “planned” Backdoor Roth as in our example — contributed for 2025 in 2025 and converted before the end of 2025 — you can answer No here, but answering Yes with a 0 has the same effect as answering No, and it allows you to correct errors.

If you answered Yes to the previous question and you did your previous year’s return correctly also in TurboTax, your basis from the previous year will show up here. If you did your previous year’s tax return wrong, fix your previous return first.

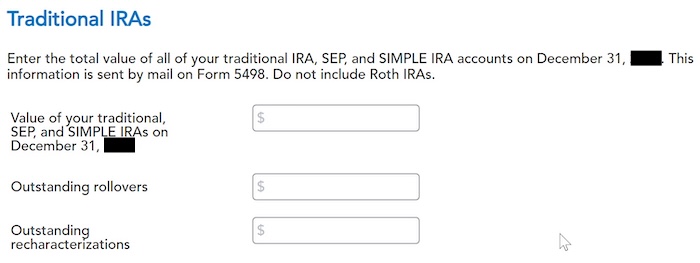

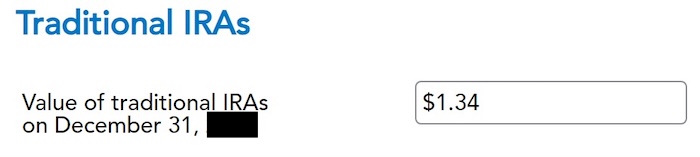

Enter the values of ALL your Traditional, SEP, and SIMPLE IRAs at the end of the year. We entered all zeros because we don’t have anything in traditional, SEP, or SIMPLE IRAs after we converted it all. If your account posted earnings after you converted and you left the earnings in the account, get the value from your year-end statement and put it in the first box.

That’s it so far on the income side. Continue with other income items. The refund in progress is still temporarily depressed. Don’t worry. It will change.

Non-Deductible Contribution to Traditional IRA

Now we enter the non-deductible contribution to a Traditional IRA *for* 2025.

If you contributed for 2025 between January 1 and April 15, 2026, or if you recharacterized a 2025 contribution in 2026, please follow Backdoor Roth in TurboTax: Recharacterize and Convert, Year 1. If your contribution during 2025 was for 2024, make sure you entered it on the 2024 tax return. If not, fix your 2024 return first by following the steps in Backdoor Roth in TurboTax: Recharacterize and Convert, Year 1.

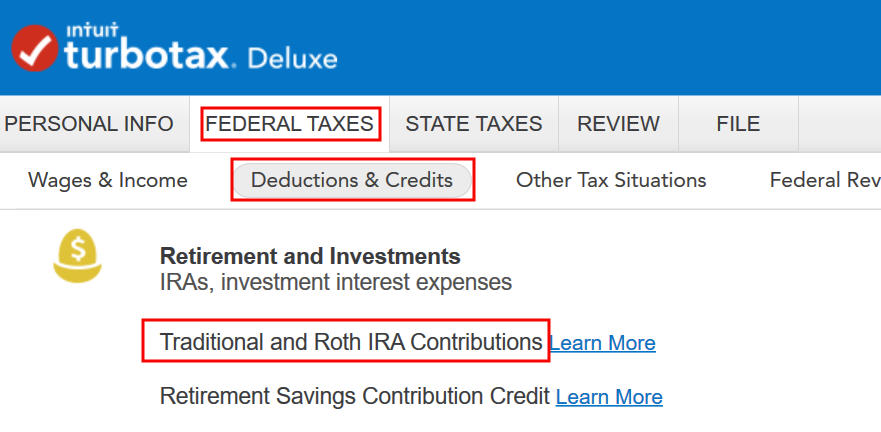

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

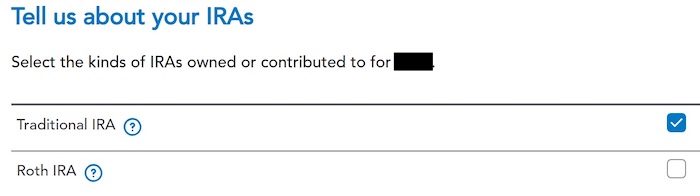

We check the box for Traditional IRA because we did a clean “planned” Backdoor Roth.

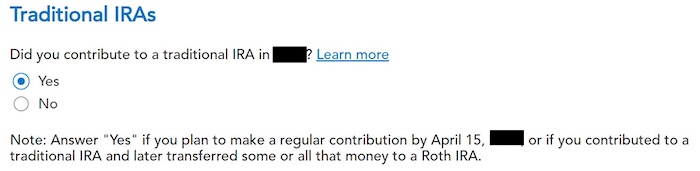

We already checked the box for Traditional but TurboTax just wants to make sure. Answer Yes here.

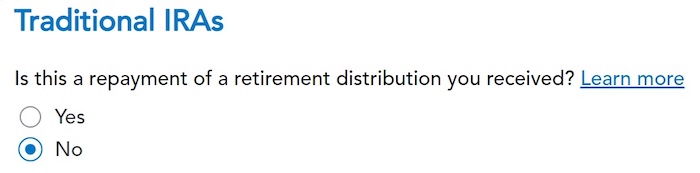

It was not a repayment of a retirement distribution.

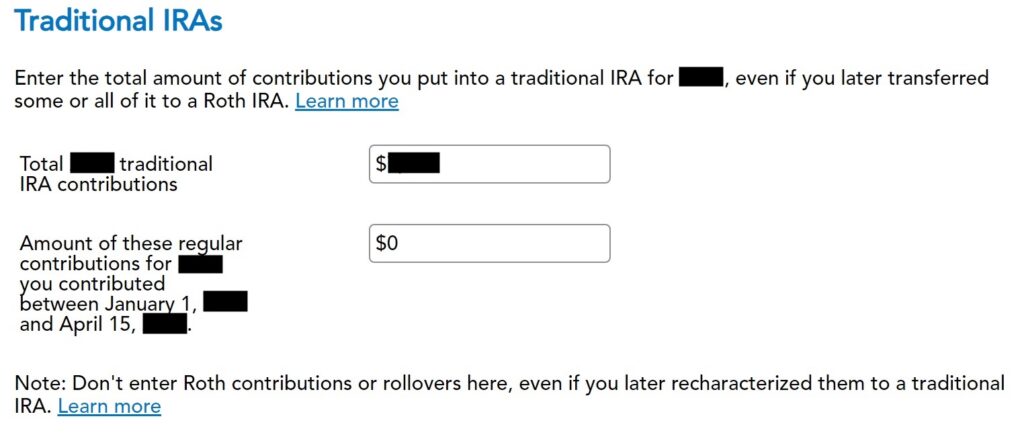

Enter the contribution amount. It’s $7,000 in our example. Because we contributed for year 2025 in 2025, we put zero in the second box. If you contributed for 2025 between January 1 and April 15, 2026, include the contribution in both boxes.

Right away, our federal refund in progress goes back up! We started with $2,384. It went down to $858. Now it comes back to $2,335. The $49 difference is because we have to pay tax on the $200 in earnings when we contributed $7,000 and converted $7,200. If you had less in earnings, your refund numbers would be closer still.

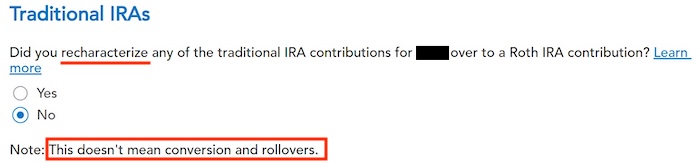

Converted, Did Not Recharacterize

This is a critical question. Answer “No.” You converted the money, not recharacterized.

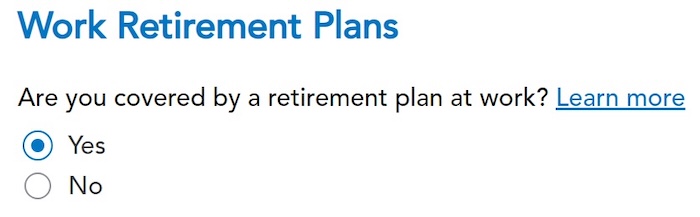

You may not get this question if you already entered your W-2 and it has Box 13 for the retirement coverage checked. Answer yes if you’re covered by a retirement plan, but the box on your W-2 wasn’t checked.

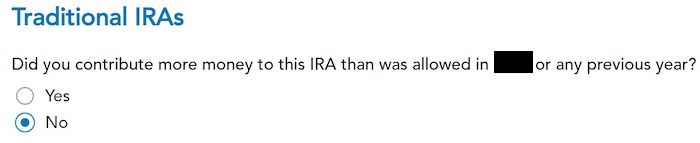

We didn’t make excess contributions.

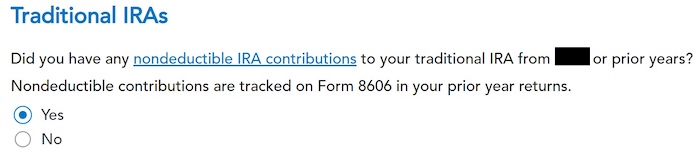

Basis

TurboTax asks the same question it did before. For a clean “planned” Backdoor Roth, we can answer No, but answering Yes with a 0 has the same effect, and it allows you to correct errors.

If you did your taxes correctly on TurboTax last year, TurboTax transfers the number here. If you made non-deductible contributions for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

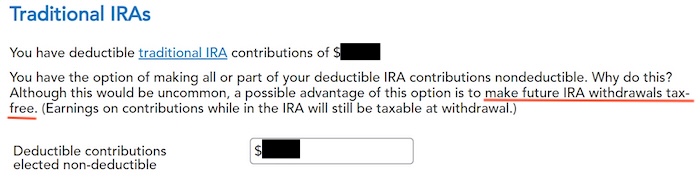

Make It Nondeductible

TurboTax shows this screen if it sees that you qualify for a deduction for the Traditional IRA contribution. If you take the deduction, it’ll make your Roth conversion taxable, which creates a wash. It’s simpler if you make your full IRA contribution nondeductible, and then your Roth conversion won’t be taxable. Enter the amount that TurboTax says is deductible.

Because we did a clean “planned” Backdoor Roth, we don’t have anything left after we converted everything before the end of the same year. If you have a small balance left because of interest posted after you converted, enter the value from your year-end statement here.

This is expected. That’s why we did the Backdoor Roth.

Taxable Income from Backdoor Roth

After going through all these, would you like to see how you are taxed on the Backdoor Roth?

Click on Forms on the top right.

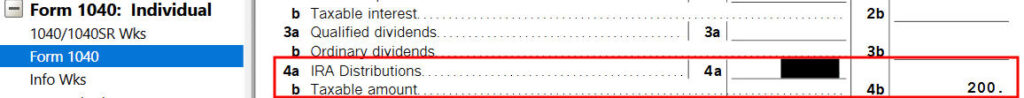

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b. They show a $7,200 distribution from the IRA, and only $200 of the $7,200 is taxable in our example. That’s the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth.

When you’re done examining the form, click on Step-by-Step on the top right to go back to the interview.

Tah-Dah! You put money into a Roth IRA through the back door when you aren’t eligible to contribute to it directly. That’s why it’s called a Backdoor Roth. You pay tax on a small amount of earnings between the contribution and the conversion. That’s negligible relative to the benefit of having tax-free growth on your contribution for many years.

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

Fresh Start

It’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

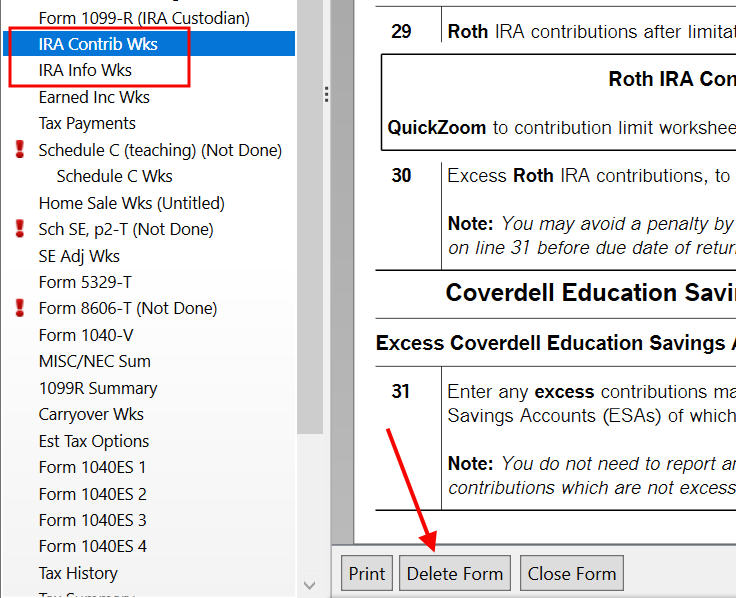

Click on Forms on the top right.

Find “IRA Contrib Wks” and “IRA Info Wks” in the left navigation pane and click on “Delete Form” to delete them. Then you can start over by following the steps above.

Conversion Is Taxed

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. Taking this deduction also makes your Roth IRA conversion taxable. You can see this deduction on Schedule 1 Line 20, which reduces your AGI.

The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal, and it doesn’t cause any problems when you indeed don’t have a retirement plan at work.

It’s less confusing if you decline the tax deduction, which also makes your conversion non-taxable. See the Make It Nondeductible section.

Self vs Spouse

If you are married, make sure you don’t have the 1099-R and IRA contribution mixed up between yourself and your spouse. If you inadvertently entered two 1099-Rs issued to you instead of one for you and one for your spouse, the second 1099-R to you will not match up with a Traditional IRA contribution made by your spouse. If you entered a 1099-R for both yourself and your spouse, but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Becky says

Just to follow up on my comment from March 16 – I ended up throwing in the towel on TT and using TaxAct at the recommendation of someone on the Bogleheads forum. Not ideal, but I was too impatient to wait for TT. TA was a little clumsy in parts, but it was only $20 and, most importantly, dealt with the backdoor Roth correctly.

Thanks for the excellent blog post and all the comments. They were a much needed sanity check as I muddled through this issue. 🙂

Christine says

Harry – I figured how to get around to my issue for TT 2012 or perhaps I’m doing it correctly! I have spent 4 hours on this problem with TT. After I entered the 1099-R, it asked if I made any non-ded contributions. I said yes and tracked non-ded contributions. Then, I’m asked to enter the Cost Basis as of Dec, 31, 2011. I entered $6000 because I bought with non-ded of $6000 in 2011 and converted to ROTH in 2012. Therefore, on Dec 31, 2011, I still had $6000 in my Trad IRA. Then, the taxes were reduced to zero. I was following your instructions for TT 2011, but your question was also the cost basis as of Dec. 31, 2011, which then, would be zero because your contributions were for 2010 which you converted in 2011. TT must have changed the screens to ask for the cost basis prior (TT 2012) to conversion vs. after (TT 2011). Thank you so much for your site and your reader’s comments to help me through this.

Harry says

Christine – On these screenshots from TurboTax 2011, under the Let’s Find Your IRA Basis screen, it asked about the basis as of 12/31/2010. You did it right by entering $$ there because the money you contributed for the previous year is counted as the basis as of the end of the previous year even though you actually contributed in the following year.

Everybody will really do themselves a big favor by contributing to the IRA for the current year in the current year. Doing it retroactively just causes a lot of these confusions.

Tibor says

Yes, the only way this works (sort of) is to put in the same amount or more as the cost basis. TT actually asks for the cost basis for 2011 and before–so if you have been using the backdoor method for a few years, the cost basis should be higher.

Strangely, TT used to have a screen telling you it was keeping track of your nondeductible IRA contributions but that screen is nowhere to be found in the 2012 version.

I still haven’t figured out how to prevent a TT penalty for having too high an income for a Roth.

Sadly, the 2012 TT version is rather different from the screen shots above.

Chaka says

IT’S A MIRACLE!! I FIGURED IT OUT!!

OMG–after many hours I’ve figured out how TT lists a backdoor roth without penalties for having a high income for 2012!

In “Wages & Income”>>Retirement Plans & SS>>IRA, 401K, etc., put in your 1099-R info. The next screen will say “Good News! You don’t owe extra tax on this money.” This refers to your having a “2” in box 7 of the 1099-R. It means that you don’t pay a penalty for this distribution from the traditional IRA. In later screens, say that you “converted” all the money to a Roth IRA and left it in the Roth IRA. When it asks if you made any nondeductible contributions to your IRA, you must say “Yes, I made and tracked nondeductible contributions to my IRA.” Calculate your total cost basis at the end of 2011 (How much non-deductible contributions have you made in TOTAL until Dec 31, 2011?). Attach the explanation that says that;s how much it was. Value of your IRA as of Dec 2012, is zero. When you get to the summary page on income, this Roth IRA conversion will not show up under IRA distributions–taxable.

NOT DONE YET> Next, In Deductions & Credits>>Retirement & Investments>>Traditional & Roth IRA contributions, write that you contributed to a Traditional IRA and you contributed $5000. NEXT IS THE QUESTION THAT CAN EASILY THROW YOU OFF: “Tell us how much you transferred.” Amount switched from Traditional IRA to Roth IRA is ZERO–This screen refers to a “recharacterization” NOT a “conversion.” The backdoor Roth is a conversion. After it tells you your income is too high to deduct the IRA, the screen about the penalty won’t come up!!

YAY!!!

Dave says

Thank you for this Chaka, this was immensely helpful. I still had a significant issue that had to be resolved, though. TT had kept my basis at $0 for the past several years. When I tried to correct it and put in my correct basis, it turned the entire basis into a huge deduction on my return (as an investment expense or something). I had to keep the basis at zero for things to work correctly. Not sure if this was something specific to my situation or what.

Harry says

“NEXT IS THE QUESTION THAT CAN EASILY THROW YOU OFF: “Tell us how much you transferred.” Amount switched from Traditional IRA to Roth IRA is ZERO–This screen refers to a “recharacterization” NOT a “conversion.” The backdoor Roth is a conversion.”

Exactly! See today’s post Traditional and Roth IRA: Recharacterize vs Convert.

Paul says

Chaka (and Harry)-

Thank you!!!!! Thank you!!!! Thank you!!!!

I have spent hours and hours on TT trying to figure this out. It’s all in that question about how much you transferred. When TT asks, “How much did you switch from Traditional IRA to Roth IRA?” one would automatically believe TT is referring to the backdoor Roth. In the fine print it says “recharacterize.” Until I read Chaka’s excellent explanation, I made the erroneous assumption. (who would recharacterize from a trad IRA to a Roth anyway?–so I don’t even get the question they are truly asking in the first place)

THANK YOU AGAIN!

David says

Thanks for the information! I used it last year and it worked out great. I have a different situation this year. I made my IRA contribution in April(2013) to be applied to 2012 then did the “back door” Roth conversion. Using Turbo Tax, I reported my traditional IRA contribution info as you described above, but I am unable to enter the 1099-R information because I have been told the paper work/filing was in 2013, so I will receive it in the first quarter of 2014.

Will this cause me any issue completing the “Backdoor Roth” next year for my 2012 contribution?

I am thinking If I contribute another $5k to be applied to 2013, when I receive my 1099-R in 2014, it will show $10K(2012 and 2013 contributions). Any information will help here. Just want to be sure I file correctly.

Harry says

David – There won’t be any issues. Just do it next year when you have the 1099-R. Under that “Let’s Find Your IRA Basis” screen, you enter the contribution you made in 2013 for 2012. If you use TurboTax again next year, it should remember and auto-populate it for you. If it doesn’t, just enter it yourself.

Heather says

Harry, I have been a reader for many years, and have thoroughly read all the recent posts on recharacterizing and converting, but I am stumped. My husband prematurely contributed to a non-deductible TIRA in early 2012 (thinking that our MAGI would disqualify us from a Roth IRA contribution). It turns out, that we were just under the income limit for Roth and we can both contribute the maximum amount ($5K) for 2012. I went ahead and contributed $5K to my Roth IRA. Now, the question is, do I recharacterize his non-deductible TIRA? We are filing an extension, so I have until October to recharacterize it. Or would I be better off converting it (it seems weird to do a conversion or “back-door Roth” when you qualify to just go through the front door)? I know the difference between the two, but I’m not sure if it matters in this case? Does it? Also, his TIRA has actually decreased in value from $5K to ~$4500. Does that change the scenario? TIA!

Harry says

Heather – Thank you for being a long-time reader. When the IRA has gains, it’s better to recharacterzie, because the gains would go to Roth untaxed. In his case it has losses. If he doesn’t have any other traditional IRA, including SEP or SIMPLE, he can also convert. Either way he won’t pay any taxes when the IRA has losses. Recharacterzie would be easier because he doesn’t have to keep track of basis.

David says

AWESOME! THANKS! BLESS YOU!

This was the BEST. I have talked to accountants with my IRA provider, etc., and NO ONE was able to walk me through the maze of entering my Backdoor IRA-Roth in TT the way you did! I would like to give you a big hug for helping me through this in the 11th hour ( and our IRS tax gurus a big slug for making me spend my beautiful spring weekend on this crazy stuff!)

Gordon says

Will you be updating this blog for the 2013 tax year?

gordon

Harry says

If I have time to take new screenshots …

Tim says

Harry,

I wish discovered your website prior to filing my tax return in April 2013.

I made $10,000 to be applied to 2012 backdoor Roth IRA conversion for my wife and me in March 2013. After reading the posts, I realized that I paid taxes for the $10,000 by mistake. Could you please let me know what I can do to get a refund?

Your advice will be greatly appreciated.

Harry says

See where you did wrong on your tax return. Correct it with an amended return.

Paul says

After three hours of struggling with TurboTax, your blog has just made my day! I like TurboTax, but this is one area where they clearly dropped the ball. I knew exactly what I needed to do, but couldn’t find out a way to do it (complicated by making contributions to two different calendar years at the same time). Thanks a million for the info.

Jon says

Your instructions worked great for federal – but this being my first year doing a backdoor roth conversion (2012 and 2013)- should I be getting hit for state taxes on the full conversion amount? MA is my state and turbotax has the normal 5.3%. From the sounds of things this is correct?

Background – no other IRA’s (just 401k) and 5000 last year, 5500 this year, both converted immediately after deposit – but 1099-R’s are both for this year as the contribution/conversion happened in Jan last year.

Thanks!

Tim says

I did the same – $5000 last year and $5500 this year. Nothing else was changed. The above instructions helped tremendously with federalreturns. However, my state reurns increased after the $5500 conversion entered – $250 more than last year. I live in PA. Can anyone explain why state reurn increased so much?

Thanks.

Harry says

No that doesn’t sound right. Sometimes the running meter in TurboTax isn’t very accurate. Make sure you run the state return all the way to the end. Most states use the federal AGI as the starting point. When the conversion isn’t in the federal AGI, it won’t be in the state return either.

Harry says

I just looked at both MA and PA. You will be asked additional questions in the state return to determine the taxable amount for state. When you answer those questions, the taxable amount will come down. So just wait until you complete the state part.

Jon says

Thanks a ton for the reply – it really didnt make sense that way. I actually stumbled upon what I believe you meant shortly after posting. Was it the “Other Contributions Previously Taxed by Massachusetts” entry on the page titled “Your federally taxable IRA/Keogh plan distributions received during 2013 are $10,500″

I enter 10500 in there and as expected it balances out, but it’s a little confusing.. Does that sound about right?

Harry says

Yes that sounds about right.

George says

My situation is a little different. I made non deductible IRA contributions for both 2012 and 2013 and during 2013, and converted them both (at diferent times) during 2013 to Roth. I have followed these suggestions, but I still end up with online turbotax reporting the 2012 converted non-deductible contribution as taxable income.

Harry says

@George – You should’ve done the first part of this last year for your contribution for 2012. Then you would have a non-zero basis as of December 31, 2012 in that “Let’s Find Your IRA Basis” screen.

George says

Harry: thanks for the comment.

I did report the 2012 non-deductible contribution made in early 2013 on my 2012 return. But that doesn’t give me a non zero basis as of December 31, 2012. Are you suggesting I can trick Turbotax by reporting the December 31, 2012 basis to be in the amount of the 2012 nondeductible contribution made in 2013?

Harry says

@George – Take a look at the form 8606 for 2012. Your contribution for 2012 should be on line 1, and then eventually drop to line 14. That number on line 14 is the number you need for your basis as of Dec. 31, 2012. If you also used TurboTax last year, I don’t know why it didn’t put the number there for you automatically. Making it do what it should is not tricking it. If your 2012 form 8606 is filled out wrong, you should correct it.

George says

So it sounds like where TurboTax onlines asks for the basis in the traditional IRA as of December 31, 2012, they mean “your total basis in traditional IRAs for 2012 and earlier years” (the words on form 8086.

Harry says

@George – Yes.

George says

Harry: thanks for the comments. TT is now getting the right answer.

Fhickson says

I converted for the 2012 tax year and the 2013 tax year. I just checked my 2012 8606 form and it shows $5000 on line 1, but shows zero on line 14. Is this correct?

I had not Traditional IRA before 2012. I only opened it for full conversion purposes.

And in 2013, I converted $5500. Would my basis still be zero? Confused…

Harry says

@Fhickson – If you contributed in 2012 and converted in 2012, line 14 should be zero. George didn’t convert in 2012.

Nun says

Thanks for the help.

However this is outrageous. Turbo Tax should handle this properly. Some of the questions are not even clear. They ask about an IRA tax basis but do not state if they mean the basis for all traditional, all Roth, or the basis for both.

I’m not even confident in my return because of the backdoor Roth and may hire someone instead.

Fhickson says

Harry, I used this primer last year and it was a huge help. So, thanks for updating it for this year as this is my second time converting. Prior to these two conversions, I’ve never held a Traditional IRA. I just finished entering all of my information, but have a couple of questions.

1. Twice, we are asked if we “made or tracked nondeductible contributions to our IRA”. First I am not exactly sure what this means and why we select ‘Yes’ vs. ‘No’. But, by selecting ‘Yes’, we are asked for our basis as of December 31, 2012 and it seems to reference a Form 8606. I did the conversion for the first time last year for a full $5000.02 and then this year for $5500.01. I do not see on Form 8606 a line that says specifically ‘basis’, but a couple of lines with numbers on them from my Form 8606 filed last year that have the word ‘basis’ on the line both show zero. Can you help me understand this better?

2. More minor, my 1099-R also has the box for ‘Total Distribution” checked. Does this matter? It does affect the calculations in any way.

Harry says

@Fhickson – It’s basically asking you whether you filed a form 8606 before. ‘Yes’ is the right answer because you did. The basis number it’s looking for is the number on line 14. If yours is 0 then enter 0, as I showed in the screenshots. Some people contribute for the previous year and then convert. It’s not 0 for them. The ‘Total Distribution’ box doesn’t matter.

Fhickson says

Thanks Harry. I get it now, I think. Those who contributed in years past but are converting now will have a cost basis that is taxable on the gains and reimbursable to the Feds for the tax breaks they received in the past, unless they made non-deductible contributions. Sorry for posting twice, but I wasn’t sure the first post went through.

Bryan says

This is awesome and very helpful! Thank you for taking the time to make this. I would have not done it correctly without you.

R says

WOW! Can’t thank you enough!! This was my first time doing a backdoor Roth and this was a spot-on updated guide. Thanks so much for your time…truly appreciated.

Aqua says

Used this guide in 2013, and again plan to use it in 2014. Just checked today and was surprised to find updated screenshots for 2014. Thanks for keeping this updated!!

Max says

Thanks!

Now wish there was an easy way to report ROTH IRA contribution withdrawals without TT thinking you will be taxed.. future post idea? 🙂

Harry says

Please tell me what your 1099-R looks like for your Roth IRA withdrawal.

Max says

It just had the amount of Withdrawal and J filled in one of the boxes

Harry says

@Max – After the Your 1099-R Entries screen, your running meter goes up but you are not done yet. Continue answering the questions thrown at you. One of them will ask you about your total Roth contributions in all years. If that number is larger than your withdrawal, the meter will come back down. Instant feedback from that running meter isn’t always good. It causes unnecessary concerns.

Max says

THanks Harry.. that’s what I did. I’m going to do it again, luckily I had all the forms so i knew much i contributed, withdraw, recharacterized., etc.

Chris says

Hi Harry –

First, BIG TIME fan of your blog. Second, this is the first year we’ve had a backdoor Roth situation. I initially contributed $1,300 to Roth Jan – March 2013, only to find out income level too high to contribute. I recharachterized contribution April 2013 to a Traditional IRA, and continued to make contributions to Traditional IRA through end of the year to reach full $5,500 for the tax year.

I have entered the IRA contributions first (4,200 to Traditional and 1,300 to Roth, recharchterize Roth to Traditional). My IRA deduction is confirmed at 0. I then enter 1099-R for $5,746 (box 1 and box 2a, both boxes in 2b checked, box 7 checked with code 2). However, TT is treating entire $5,746 as taxable. Thoughts or suggestions? It should only be $246 of taxable income.

Thank you!!!

Harry says

Which of your entries don’t match the screenshots here? Forget about the $1,300 recharacterized contribution for a moment (delete it if necessary). Get yours to say $1,546 taxable first. If you are married it asks you whose IRA it is. Is it possible you have the person mixed up between contribution and 1099-R?

Tim says

Dear Harry,

I am now amending my 2012 tax returns. I bought $10000 ($5000 for me and $5000 for my wife in March 2013) and this amount was double taxed due to the error make by TurboTax’ error. I followed your method to amend my 2012 return.

Firstly, I entered contribution $10000 in total for me and my wife. When it comes to enter distribution, I remember you said I should report my distribution in 2013 (because I bought it in 3/2013).

However, after entering $0 for 2012 distribution, I received a message from TurboTax, asking me why my wife recived a withdraw of an excess traditional IRA contribution from 2011 or a previous year.

In fact, my wife made IRA rollover before and paid taxes in 2 divided years.

If I enter $10000 for distribution in 2012 Roth conversion, the message did not appear. But it is not true because the distribution was truly made in 2013.

What should I tell TurboTax?

I desperately need your input on this matter. Your help will be greatly appreciated.

Tim

Harry says

@Tim – Did you do $10,000 in total as one entry or two entries, $5,000 for each person? Should be two entries. If you get the question similar to “Any Excess Contributions Before …” as shown in the article, say No.

Tim says

Hi Harry, I am still struggling with 2012 amended return. I contributed $5000 for each of us (me and my wife, 2 entries) for 2012 (in fact bought in 3/2013). I said no to “any excess contributions before. I want to report contribution in 2012 and distribution in 2013. Tried to enter “0” for 2012 distribution, this way line 14 showed $5000, but then I had problem stated in my above post. I also tried to leave distribution blank, but this way line 14 showed “0”.

If line 14 shows “0”, then in 2013 I have “0” from previous IRA basis. So this amended tax is affecting my 2013 return.

Here is my 8606 form looks like:

Line1 5000

line 2 0

Line 3 5000

Line 5 5000

Line 10 x

Line 13 5000

Line 14 0

Line 15 0

Harry, what should I do now? From your and others’ posts, line 14 should be 5000 in my 2012 8606 form instead of 0 since I contributed 5000 for 2012 but was done in 3/2013.

Tim

Harry says

Tim – If you print out a 2012 Form 8606 and fill it out by hand following the instructions, you will see how it should look like. In that “Tell Us How Much You Contributed” screen your contribution should go into the second box because you contributed in the following year before April 15. That will put a number in line 4. Your line 13 is still wrong if you didn’t take any distribution in 2012. Find where you originally entered it and delete it. If you can’t find it, contact TurboTax support.

Tim says

Harry,

Thank you so much for your great instructions. I previously asked you a questions on 2013 PA state tax. Followed what you said, I answered a question. This significantly reduced the tax I have to pay.

I would like to donate the money you help me saved to you as a token of my heartfelt appreciation. Please let me know how to do this.

My 2012 amended tax seemed resolved as well. I tried again, leaving distribution blank instead of entering a 0. Now my 8606 form shows:

Line 1 5000

Line 2 0 (this is my basis. I did not contribute in 2011)

Line 3 5000

Line 4 blank

Line 13 blank

Line 14 5000 (this 5000 is carried over to 2013 tax return)

Since I did not distribute in 2012, should line 4 be blank?

Harry says

Tim – Instructions say if you didn’t take any distribution in 2012 skip directly from line 3 to line 14 . It’s OK to have blank in line 4.

It’s very generous of you. Try the tip jar: http://thefinancebuff.com/tip-jar

Andy says

Many, many thanks for this posting. I very grateful.

Two weeks ago in 2014 I made a traditional IRA contribution for 2013. The next week I converted it to a Roth again for 2013. I’m told by Fidelity that I won’t receive a 1099-R for this because I made my contribution after Dec 31, 2013.

If this is the case, do I follow all the steps laid out above and ignore the 1099-R steps until 2014 or do I hold off all the steps until 2014?

Many thanks!

Harry says

From the article:

“We are done for entering the non-deductible contribution to the Traditional IRA. If you only contributed *for* 2013 but you didn’t convert *in* 2013, stop here. Come back next year to finish the conversion part.”

Tim says

Harry,

From your above comments, I assume that you have answered my question – leave distribution balnk instead of 0. I will try that and let you know the results.

Tim

Gordon says

I am trying to report a backdoor Roth In TurboTax. One of the TurboTax screens is “Enter Prior Year Roth IRA Contributions.” This screen asks that I report net regular contributions prior to 2013. I have not kept track of my Roth IRA contributions, primarily because (1) I am way past the five-year period beginning with the first taxable year in which I made a Roth IRA contribution; and (2) I am way past the age of 59 1/2.

What and how should I report in this screen?

Thank you very much,

gordon

Harry says

Just a normal backdoor Roth does not trigger that question. It sounds like either you withdrew from a Roth IRA or you entered the code in 1099-R box 7 wrong (or your IRA provider put a wrong code there). What’s the code in box 7 for your conversion? Did you withdraw from a Roth IRA?

Gordon says

Thanks, Harry.

The code in Box 7 is 07 – Normal Distribution.

I think I may have solved my problem, at least this one,

Initially, under What Did You Do With The Money From This Payer [Vanguard Fiduciary Trust Company]?, I answered the second part, “I rolled over part and/or converted part of this money,” since my gross distribution was 6,500.01, because I had a $0.01 gain on the $6,500 I contributed to my TIRA. I went back and changed my answer to, “I converted all if this money to a Roth IRA account,” and this seems to have fixed the situation, at least I hope so,

Thanks again.

gordon

YF says

Hi Harry,

My question is with the part where TT asks for the total value of ALL your traditional IRAs as of 12/31/2013. IN 2013, I opened a traditional IRA (account A) for the sole purpose of doing a $5,500 backdoor Roth conversion for the first time. I also open a second traditional IRA (account B) to receive rollover funds from 2 former employers’ 401Ks. At the end of the year, account A had zero and account B has a $200K balance. If I put $200K as the total year-end balance, TT taxes my $5,500 contribution. It works only if I put zero like you said, but is that being misleading or incorrect? Thank you.

Harry says

@YF – You didn’t do your backdoor Roth correctly. That’s why TurboTax is showing you must pay tax. You can’t enter zero when you have $200k.

I have this note in my backdoor Roth complete how-to article:

“Remember not to rollover from an employer sponsored plan to an IRA when you are doing the backdoor Roth IRA. You can rollover from one plan to another plan, or to your own solo 401k, just not to an IRA.”

If you’d rather not pay the tax, you can fix it by recharacterizing your conversion and putting the money back to a Traditional IRA before April 15, 2014. Then you answer ‘Yes’ in the “Move Funds” screen and go from there.

In 2014, follow the steps in the backdoor Roth article, “hide” your 200k rollover IRA, and start over.

Or you can let it stand and just pay the tax.

Andy says

Hi Harry,

Really appreciate this blog, it’s been quite helpful, but don’t believe it has yet addressed the problem I have.

My wife and I both contributed $5k each to an IRA in 2013 for 2012 tax year (first time), and converted both to a Roth IRA w/n one week of original contribution. Reported the $5k in last years tax return, with a Dec 31st 2012 basis of $5k each. We also contributed $5.5k each to an IRA in 2013 for 2013 tax year, and converted this to a Roth IRA also within one week of original contribution.

Your comments for the screenshot “Any Excess IRA Contributions Before 2013,” would seem to indicate that I should answer YES and include the $5k my wife and I contributed for the 2012 tax year? It seems no matter how I go about this, the end result is that we’re told that we each made excess contributions of $5.5k to the Roth IRA that it would be subject to a 6% annual penalty until withdrawn.

I was under the impression could use the backdoor Roth conversion each tax year without incurring penalties or excess contributions. Is that correct? Have I just made an error somewhere in reporting to Turbo Tax? Or should what my wife and I did truly result in a penalty for excess contributions?

Your time is greatly appreciated!

Harry says

@Andy – The comments refer to the screenshot below, not the one above. Answer ‘No’ to that question.

Vic says

Harry, thank you so much for the great work you are doing.

I used to have problems with reporting backdoor Roth conversions (and in some years even skipped altogether), but your blog helped me this year. I am only paying a small tax rather than showing the entire $5,000 contribution as taxable income.

I followed all the steps from your blog and after I imported my Merill Lynch 1099-R, it was fine. Now, however, after I imported my wife’s 1099-R from Merill Lynch, it increased fed tax by almost $1,300. I checked and double-checked, all entries were entered correctly. Where is my mistake? it should work still?

Thanks a bunch

Harry says

@Vic – Did you enter the contribution for her? You have to do it separately for each person. What does that “Your IRA Deduction Summary” screen say?

Or maybe she actually qualifies for a deduction because she isn’t covered by an employer plan. When you enter her contribution, the tax is lowered. After the you import her 1099-R, the tax is raised back up, but you are just back to even. Do the “Preview My 1040” to find out what’s happening. Look at lines 15a, 15b, and 32.

Tim says

Harry,

The tip jar is working now, and I made my controbution.

HURRAY!!!

Tim

Z says

Thank you for this excellent article.

I am trying this for the first time this year, I use turbotax, and this worked great.

I made my contribution last week (feb 2014) for the 2013 season.. so of course I won’t have the 1099 and be able to do the conversion until next year.. that’s fine.

How does that affect the way I should do this for the 2014 tax year? Should I contribute and convert the 2014 money within this calendar year or wait until 2015 and do it the same way? I guess I’m asking if i’m limited to just $5500 a year or could i do 11K in a year.

Harry says

@Z – Your conversion triggers the 1099, not the other way around. You can convert in 2014. You just won’t have to report the conversion until you file the 2014 tax return in 2015. Same for your 2014 contribution. You can contribute in 2014 and convert in 2014. If you choose to do so, you report them in 2015.

Greg says

Thank you for the article! I filed my taxes this weekend via TurboTax, and followed your instructions to the letter. It worked great.

Tim says

Hi Harry,

I am having hard time to contribute to the tip jar. A message keeps saying “Please enter a valid combination of City, State, and ZIP code.” I have lived in this address for 8 years, and I just bought something online using the same credit card and billing address.

I have clicked on “pay” button 3 times, but I do no think it went through. Could you please check the secure website? I use a mastercard. Please let me know via my email address if you get this fixed. You may have it since I use it to post my questions on this website. Or I may send you a check.

So far, I have amended 2012 tax and completed 2013 tax, thanks to your great help. I am now relieved and very very happy.

Tim

John says

Where is the tip jar? Make it easy so I can send something for all the help with this topic. Thanks.

Harry says

John – Thank you. Here it is: http://thefinancebuff.com/tip-jar

CHIU says

Harry, thank you for your generous effort in explaining this rather complicated process on TurboTax! It’s really a lifesaver!!

I do still have a couple questions after reading through your step-by-step guidelines:

Background info: In February 2013, I contributed a non-deductible $5000 for the 1st time to a new trad IRA account for the 2012 tax year. Next day I converted all of it to a new Roth IRA. In February 2014, I contributed non-deductible $5,500 to trad IRA for the 2013 tax year. Next day I converted all of it to Roth. On my 2012 Form 8606 line 14, my total basis in trad IRA for 2012 and earlier years was $5,000.

For this current 2013 tax filing, I need to report a $5,500 non-deductible trad IRA contribution AND $5,000 Roth IRA conversion.

When I was following your instruction to answer questions on TT regarding the 1099-R, here are my questions:

1) Let’s find your IRA Basis

My total basis as of December 31,2012 ___________

I’ve been using $5,000 as my total basis for the tax year 2012. But the date in this question is throwing me off. Technically it should be $0, since I didn’t make the contribution for 2012 until Feb 2013. My 2012 Form 8606 had $5,000 as the total basis (as mentioned before). So, should it be $5,000? or $0?

2) The next section: Tell us the value of your traditional IRA

Value of my traditional, SEP, and SIMPLE IRAs on December 31, 2013 __________

Again, the date is throwing me off. By Dec 31, 2013, I had already converted all my $5,000 to Roth, and I had NOT contributed my $5,500 to Trad IRA until Feb 2014. Should It be $5,500? or $0?

Harry says

Chiu – (1) $5,000. From the article: “If you contributed non-deductible for previous years (regardless when), enter the number on line 14 of your Form 8606 from last year.” (2) $0, as shown on your end-of-year statement.

CHIU says

Thank you so much for your help! Moving forward I am definitely going to contribute and convert within the corresponding calendar year to avoid all these confusion!

Tom says

Hello Harry, thank you so much for the helpful hints. I have two questions about the contribution.

I contributed:

$5000 for the year 2010 in 2011 then converted to roth immediately

$5000 for the year 2011 in 2012 then converted to roth immediately

$5000 for the year 2012 AND $5500 for the year 2013 in Feb 2013 then converted to roth immediately.

Line 14 of my Form 8606 from last year (2012) was 0 as my total basis in

Traditional IRA.

(1) What should I put for “your total 2013 traditional ira contribution,” $5500 or $10500 ?

(2) What would my “total basis as of December 31, 2012” be?

Thank you so much for your time,

Tom

Harry says

Tom – (1) It should be $5,500. (2) It should be 5,000 but line 14 of your Form 8606 from 2012 isn’t correct. The same line for 2010 and 2011 probably aren’t correct either.

Tom says

Harry, as you suggested, I put $5,500 for the contribution and $5,000 for the total basis but line 14 of my form 8606 from 2013 is 0! I’m stuck.

Harry says

Tom – If you converted $10,500 in 2013 it should be zero. Now that you caught up, going forward always contribute for the current year and convert, as the example shown in the article. You will have a much easier time that way.

Vic says

Hi, Harry – I entered everything for my 2013 contribution that I made earlier this year and it’s all good.

I have made 2 backdoor conversions in 2013 for 2012 and in 2012 for 2011 – but could never figured out how to do them (it would just frustrate me and I would give up and on both occasions chose not to enter anything at all).

Now that I know how to – should I file amended tax returns for 2011 and 2012 or just let it go? I usually buy audit defense from TurboTax and nothing (knock on wood) has been flagged yet..

Please advise.

Thank you

Harry says

Vic – I would amend the returns and make them right, even though it won’t affect your bottom line that much (maybe a few dollars as shown in the example in this article).

John says

Tip jar link worked! Thanks for the pic by pic instructions. They really helped me get through this.

Radhika says

Hi Harry,

Your instructions are very useful. Great to know that I am not alone in this issue. I had a question. I opened a trad IRA and a ROTH IRA in 2013. I made a single contribution to the trad IRA account and converted it to the Roth within a few days. I received a 1099-R but no other forms. So I followed your instructions for both the 1099 section and the IRA contribution section. The only change I made is clicked ‘No’ for not-deductible contributions to your IRA. Is that right or do I report it differently?

Thanks!

Harry says

From the article: “If you made non-deductible contribution for previous years (including contributing for 2012 in 2013), answer Yes, I made and tracked nondeductible contributions to my IRA; otherwise answer No.”

Radhika says

Thank you! Really helps.

Richie says

First, I appreciate your work.

Scenario

I made a $1400 contribution in 2013 for tax year 2012 in a traditional IRA with the left over money that i couldn’t contribute to a Roth because of income limits. I never converted the $1400 . I just left it as cash in a trad IRA, so it made a few pennies. Anyway, now i make too much to contribute anything in a roth. My question is since i didn’t donate anything for yr 2013. Can I contribute the difference $4100 for tax yr. 2013 to the trad IRA bringing the total to the 5500 max, then convert it to my Roth IRA for the tax yr 13 before April 15th 2014? BTW I’ve had the Roth for years before my income became too great. Also would i have to wait for 2015 to file the 1099-r and report to the IRS via the 8606 what i did this year?

One more quick question, can i open another trad IRA in 2014, fund that, then convert it /add it to my Roth IRA for year 2014 before 2015

Thanks

Harry says

Richie – You can contribute $5,500 to your traditional IRA for 2013 before April 15, 2014. Contribute another $5,500 to your traditional IRA for 2014 while you are at it. And then convert the whole thing in 2014, assuming you don’t have other traditional, SEP, or SIMPLE IRAs. This way you get everything done one 1099-R for 2014.

As this article showed, contribution and conversion are two separate events. You report on the tax return the contribution *for* that year and the conversion done *in* that year.

Richie says

The only other Retirement product i have is a 403b which doesn’t apply from my undertsanding.

thanks for the quick reply

Ryan says

This is my 3rd year now performing the backdoor IRA -> Roth IRA conversion for both my wife and myself. For 2013 I deposited $5500 (for each of us) and converted a few days later (now a value of $5500.01). Confirmed I’ve followed the instructions above a few times but TurboTax wants me to tax me $500 on each account (not $0.01). My 1040 preview shows 11,000 on line 15A and 1,000 for 15b. I’d expect 15b to be 0 as my “earnings” of 0.01 x 2 would round down. Any ideas???

Ryan says

Figured it out — under the Traditional IRA “tell us how much you contributed” my “Your total 2013 traditional IRA contributions” was only 5000. Cranked it up to 5500 for both of us and issue resolved. Chalk this up to user error. Although I have no idea why Turbo Tax pre-populated for 5000. I just imported my wife’s 1099-R and never went to those screens through the wizard…. only got to them through the manual navigation (above)

Ted says

Hi Harry,

Thank you very much for the very helpful article! If you can help me here, I’d be very happy to add to the tip jar!

I now realized that I did this wrong in 2012. In 2012 I put 5k of post-tax money into a VG IRA and then converted to Roth the next day — no change in balance. At tax time, I imported VG’s 1099-R with 5k of contributions, but I never generated the 8606, and so TurboTax counted that 5k as income. Might you be able to guide me through using TT to amend my 2012?

Even if this is beyond your scope, I thank you heartily for this article. It made 2013 so easy. Best,

Ted

Ted says

Thanks very much for the helpful column. I’d be thrilled to add to the tip jar if you might be able to help me with another, similar situation.

I realize now that I did this wrong in 2012. In 2012 I contributed 5k of post-tax money to an empty VG IRA account. The next day I converted it to Roth — no change in balance. At tax time I imported the VG 1099-R but didn’t prompt TurboTax to generate the 8606. It looks to me that TT counted that 5k as income and that I overpayed my 2012 taxes. I still have my 2012 copy of the TT program. I had to amend my 2012 taxes b/c I received a corrected w2. do you know if I can use TT to amend 2012 again to recoup the overpayment?

Again, thanks very much for your help!

Harry says

Ted – Yes you can amend your 2012 return again. If your contribution in 2012 was actually for 2011, you also need to fill out a 2011 Form 8606.

Here’s what TurboTax says about amending a previous return: How to Amend a 2012 Return in TurboTax CD/Download Software.

Ryan says

This was great–thank you!!

Van says

This has been a great resource as I try to complete my 2013 taxes using TT. I did my first backdoor conversion in 2013 (in April) and think I entered all the info in correctly – my results seem to make sense and they look like the screenshots – but I’m not sure I understand why TT is asking about the basis as of Dec 31, 2012 instead of the basis at the time of the conversion. After all, there were funds in my IRA that were contributed on an after-tax basis (i.e. non-deductible) that were part of the conversion that it doesn’t appear I’m getting “credit” for since I can’t see where it’s asking about those funds. What am I misunderstanding?

Harry says

Van – From the article: “You report on the tax return your contribution to a traditional IRA *for* that year and your converting to Roth *in* that year.”

If your contribution in 2013 was for 2012, you should do the steps in the first part of this article on your 2012 return. Then your basis will carry over to that “as of December 31, 2012” field. That gives you credit.

If your contribution in 2013 was for 2013, entering the contribution gives you credit already.

Craig says

Great useful article – this is a bit of an indictment of Turbotax that it took your article to get my backdoor Roth IRA recorded correctly….

Tip jar worked! 🙂

Bryan says

Fantastic article, thank you so much. One outstanding issue, similar to the dialogue between YF and Harry above (comment #30).

I successfully executed the backdoor roth conversion in 2013. In 2013 I also took my former employer’s 401k and rolled it over into a Rollover IRA. Thus, when asked by TurboTax for my traditional IRA balance, I entered in the value of my Rollover IRA, but then that triggers tax consequences.

I called Fidelity (where these accounts are) and asked them if my Rollover IRA is considered a Traditional IRA, meaning I have to enter in the balance when TT asks me for Traditional IRA balance. They said, no, this Rollover IRA is separate, and as long as I keep it separate from my Traditional IRA (which of course has a zero balance), then I don’t have to include this Rollover IRA balance when I’m asked for my Traditional IRA balance.

This is the answer I was hoping to hear (basically that a separate Rollover IRA that came exclusively from a 401k) is different than a Traditional IRA. However, this seems to contradict the response that you had, Harry, to YF above.

Does this make sense and sound accurate that I can enter in a zero balance when TT asks me for my Traditional IRA balance?

Harry says

@Bryan – It’s the answer you like to hear but it’s not the correct answer. A rollover IRA is a traditional IRA funded by money from a rollover (unless you did the rollover to a Roth, which doesn’t appear to be the case).

Your options are the same as in my reply to @YF. If I were you I would recharacterize the conversion before April 15 (or before October 15 if you file an extension). That will put the money back to the traditional IRA. Then follow the “complete how-to” steps and do it the right way in 2014.

Bryan says

Thank you so much for the quick response. That’s a bit troubling that Fidelity very clearly advised me that I can say I have a zero Traditional IRA balance, when you’re confident otherwise.

Is it still possible to take my Rollover IRA and move it to my current employer’s 401k (assuming they let me), or would that have needed to be done in 2013?

Thanks!

Harry says

@Bryan – Only doing so now won’t affect 2013. As you saw in TurboTax the calculation for your 2013 conversion is based on the balance on 12/31/2013.

If you look at IRS Publication 590 which covers IRAs, you will see there’s no such thing as a rollover IRA as far as the IRS is concerned. They see Traditional IRA, Roth IRA. SEP IRA, and SIMPLE IRA.

Bryan says

Thanks again for the quick response.

I was just doing exactly, that…searching through the IRA rules to see if there’s anyway the Rollover IRA is technically distinct from a Traditional IRA, but it certainly does look like you are correct about all this (and I received incorrect advice from Fidelity).

Now since I don’t want to pay the taxes from this Roth IRA backdoor conversion I did for 2013, I guess I’ll have to do a recharacterization. Does it complicate this that my backdoor Roth IRA conversion included $5k from 2012 and $5.5k from 2013 (so it was a $10.5k backdoor 2013 Roth conversion)…of course both of those original Traditional IRA contributions were nondeductible.

And then secondly, in your response to YF, you said, “In 2014, follow the steps in the backdoor Roth article, “hide” your 200k rollover IRA, and start over.”

Is the only way to “hide” the rollover IRA to try transfer all of the funds to my current employer’s 401k (if they’ll let me)? Any other reasonable ways to get those funds out of this rollover/traditional IRA (aside from paying taxes to convert to Roth)?

I wish I never rolled my 401k with my former employer into a Rollover IRA!

(thanks again, and I’m leaving a tip right after I post this, since you’re really helpful! hope others have done the same)

Harry says

Thank you @Bryan for the tip. Does it complicate? Not really. You are still just doing it in one transaction.

The conversion and its subsequent recharacterization are separate from the contributions. Just make sure you still enter the contribution part into TurboTax for both 2012 and 2013. If you contributed $5k for 2012 in 2013, that $5k needs to go into your 2012 tax return, to be carried over to 2013.

The “hide” part is in the “complete how-to” article. Either your current employer’s 401k or your own solo 401k (if you have self-employment income) will do. Those are the only two ways.

Recharacterizing your 2013 conversion will also take some earnings back to the Traditional IRA. If it’s too much trouble to “hide” the earnings as well, just pay tax on those earnings when you convert. The earnings shouldn’t be too much, although 2013 was a good year in the stock market. While you are at it, contribute for 2014 in 2014 before you finally convert again.

John says

Harry-My situation is little messier.

(1) I contributed $5500 in May 2013 for 2013 Roth IRA contribution.

(2) When I am preparing my tax return, I find out my 2013 income is too high to be eligible for Roth contribution. In early March 2014, I contacted Fidelity to recharacterized my original 2013 Roth contribution in amount of $5500 + earning into a non-deductible traditional IRA. Luckily, I don’t have any traditional IRA before.

(3) Few days later I converted the entire amount in non-deductible traditional IRA into my Roth IRA.

My question is how do I report the original $5500 2013 Roth IRA contribution (or do I need to report it?) and the recharacterization of 2013 Roth contribution ($5500+earning) into non-deductible TIRA in TurboTax. Will I get two 1099-R, one for recharacterization and the other for conversion in 2014?

Harry says

John – You enter it similarly to the first part in this article. Instead of checking the Traditional IRA box, you check the Roth IRA box. Then on that “Did you change your mind” screen you say yes and go from there. Whatever 1099-Rs you get, you worry about them next year.