Last updated on January 24, 2026 with all new screenshots from TurboTax Deluxe desktop software for the 2025 tax year. If you use other tax software, see:

If you did a Backdoor Roth, which involves making a non-deductible contribution to a Traditional IRA and then converting from the Traditional IRA to a Roth IRA, you must report both the contribution and the conversion in the tax software. This post gives you a step-by-step walkthrough of how to do it in TurboTax. For more information on Backdoor Roth in general, see Backdoor Roth: A Complete How-To.

What To Report

You report on the tax return your contribution to a Traditional IRA *for* that year, and you also report your conversion to Roth *during* that year.

For example, when you are doing your tax return for 2025, you report the contribution you made *for* 2025, whether you actually did it during 2025 or between January 1 and April 15, 2026. You also report your conversion to Roth *during* 2025, whether the contribution was made for 2025, 2024, or any previous years.

Therefore, a contribution made during 2026 for the year 2025 goes on the tax return for 2025. A conversion done during 2026 after you contributed for 2025 goes on the tax return for 2026.

You do yourself a big favor and avoid a lot of confusion by making your contribution for the current year and finishing your conversion in the same year. I call this a “planned” Backdoor Roth or a “clean” Backdoor Roth — you’re doing it deliberately. Don’t wait until the following year to contribute for the previous year. Contribute for 2025 in 2025 and convert it during 2025. Contribute for 2026 in 2026 and convert it during 2026. Everything is clean and neat this way.

If you are already off by one year, it depends on whether you’re handling the contribution part or the conversion part right now. If you contributed to a Traditional IRA for 2025 in 2026 and converted in 2026, or if you recharacterized a 2025 Roth contribution in 2026 and converted in 2026, please follow Split-Year Backdoor Roth IRA in TurboTax, Year 1. If you contributed to a Traditional IRA for 2024 in 2025 and converted in 2025, or if you recharacterized a 2024 Roth contribution in 2025 and converted in 2025, please follow Split-Year Backdoor Roth IRA in TurboTax, Year 2. If you recharacterized your 2025 Roth contribution in 2025 and converted in 2025, please follow Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year.

Use TurboTax Desktop Software

The screenshots below are from TurboTax Deluxe desktop software. The desktop software is both more powerful and less expensive than online software. If you haven’t paid for your TurboTax Online filing yet, you can buy TurboTax desktop software from Amazon, Costco, Walmart, etc., and switch from TurboTax Online to TurboTax desktop software (see instructions for how to make the switch from TurboTax).

Here’s the planned “clean” Backdoor Roth scenario we will use as an example:

You contributed $7,000 to a traditional IRA for 2025 in 2025. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also in 2025, the value grew to $7,200. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth. You did not roll over any pre-tax money from a retirement plan to a traditional IRA after you completed the conversion.

If your scenario is different, you will have to make some adjustments to the screens shown here.

Before we start, suppose this is what TurboTax shows:

We will compare the results after we enter the Backdoor Roth.

Convert Traditional IRA to Roth

The tax software works on income items first. Even though the conversion happened after the contribution, we enter the conversion first.

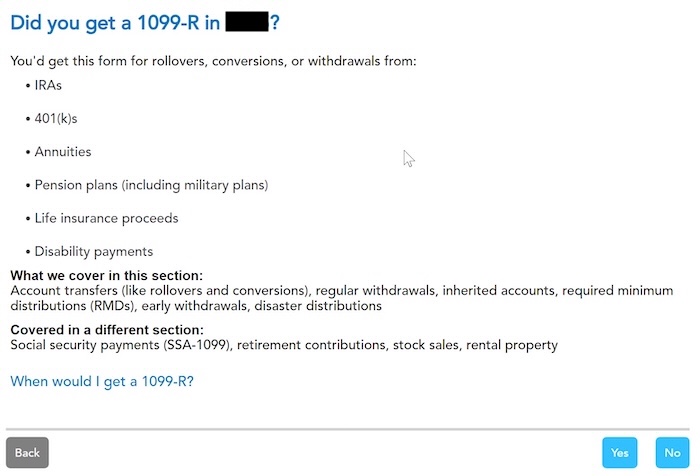

When you convert from a Traditional IRA to a Roth IRA, you will receive a 1099-R form. Complete this section only if you converted *during* 2025. If you only converted during 2026, you won’t have a 1099-R until next January. Please follow Split-Year Backdoor Roth IRA in TurboTax, Year 1. If your conversion during 2025 was against a contribution you made for 2024 or a 2024 contribution you recharacterized in 2025, please follow Split-Year Backdoor Roth IRA in TurboTax, Year 2.

In our example, we assume that by the time you converted, the money in the Traditional IRA had grown from $7,000 to $7,200.

Enter 1099-R

Go to Federal Taxes -> Wages & Income -> IRA, 401(k), Pension Plan Withdrawals (1099-R).

As you work through the interview, you will eventually come to the point of entering the 1099-R. Select Yes, you got a 1099-R. Import the 1099-R if you’d like. I’m choosing to skip import and type it myself.

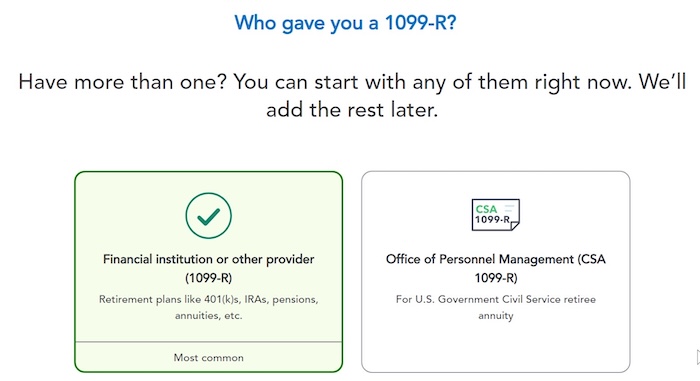

You got it from a financial institution. Enter the payer information as shown on your 1099-R.

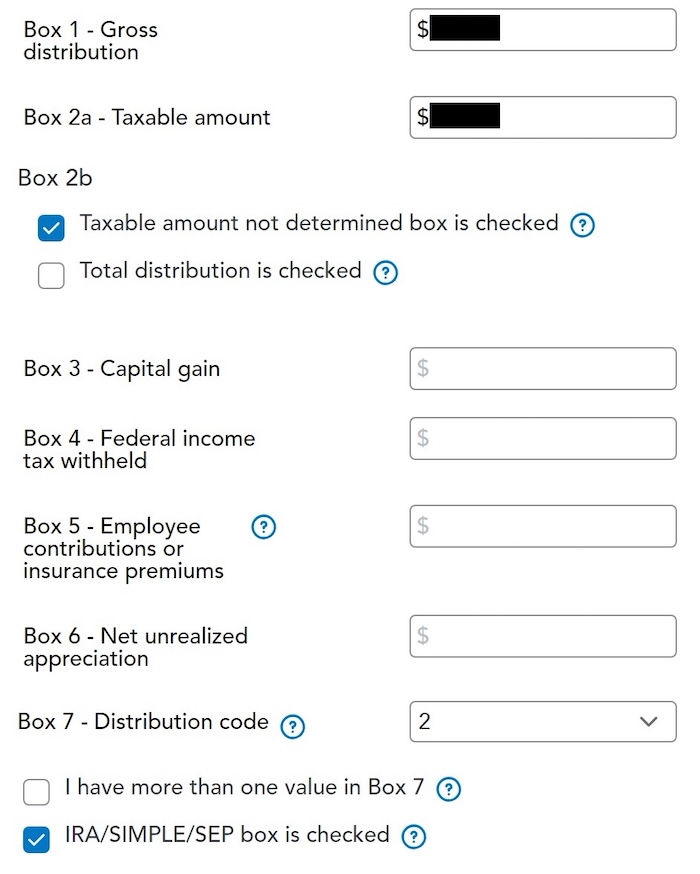

Box 1 shows the amount converted to the Roth IRA. It’s $7,200 in our example. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked saying “taxable amount not determined.” The total distribution box may or may not be checked. It doesn’t matter.

Pay attention to the code in Box 7 and the IRA/SEP/SIMPLE box. Make sure your entry matches your 1099-R exactly. The code in Box 7 should be 2 if you’re under 59-1/2 and 7 if you’re over 59-1/2. The IRA/SIMPLE/SEP box should be checked.

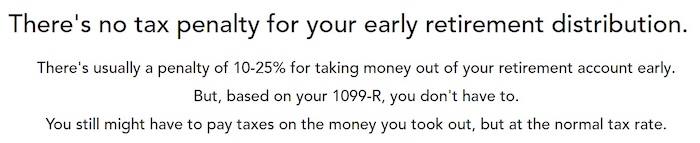

You get this Good News, but …

Your refund in progress drops a lot. We went from $2,384 down to $858. Don’t panic. It’s normal and temporary.

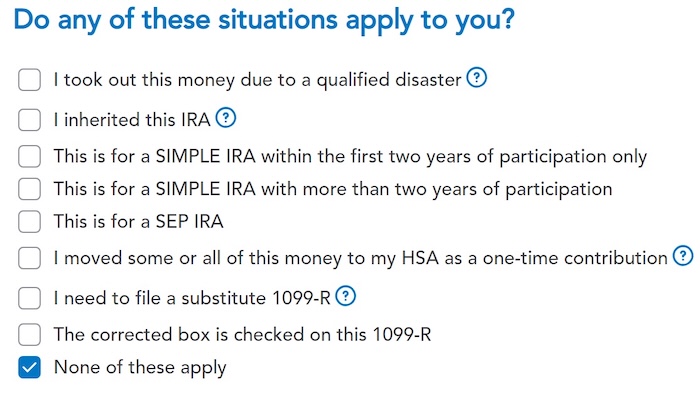

None of these should apply in a usual backdoor Roth.

Converted to Roth

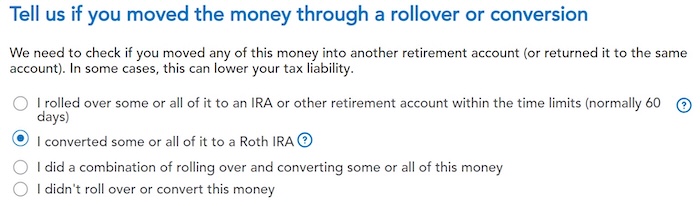

Choose “I converted some or all of it to a Roth IRA.” Don’t choose the “I rolled over …” option. A Roth conversion is not a rollover.

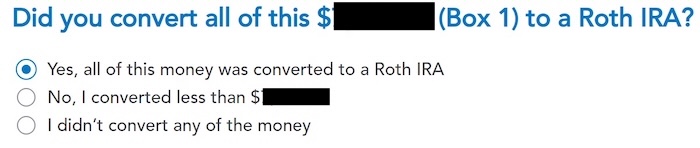

Yes, you converted all of it.

You get a summary of your 1099-Rs next. Repeat the previous steps to add another if you have more than one. If you’re married and both of you did a Backdoor Roth, enter the 1099-R for both of you, but pay attention to select whose 1099-R it is. Don’t accidentally assign two 1099-R forms to the same person.

Basis

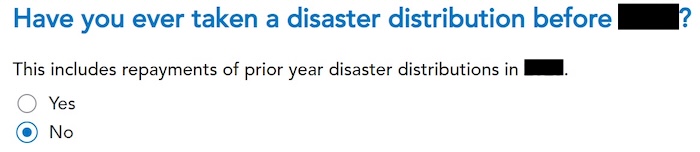

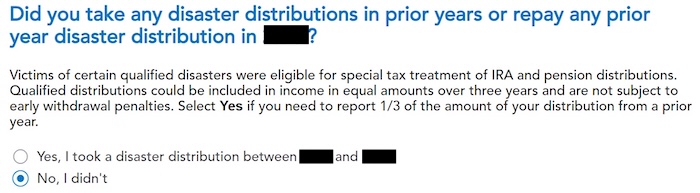

We didn’t take or repay any disaster distribution.

We already said no, but TurboTax just wants to be sure.

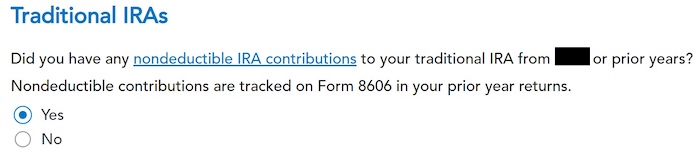

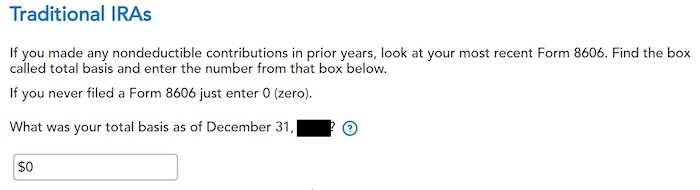

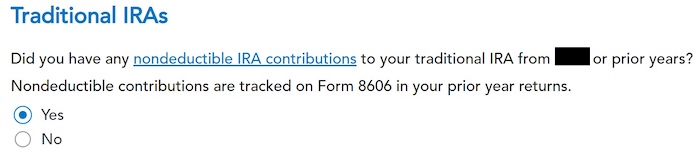

Here it’s asking about the carryover from the prior year. When you did a clean “planned” Backdoor Roth as in our example — contributed for 2025 in 2025 and converted before the end of 2025 — you can answer No here, but answering Yes with a 0 has the same effect as answering No, and it allows you to correct errors.

If you answered Yes to the previous question and you did your previous year’s return correctly also in TurboTax, your basis from the previous year will show up here. If you did your previous year’s tax return wrong, fix your previous return first.

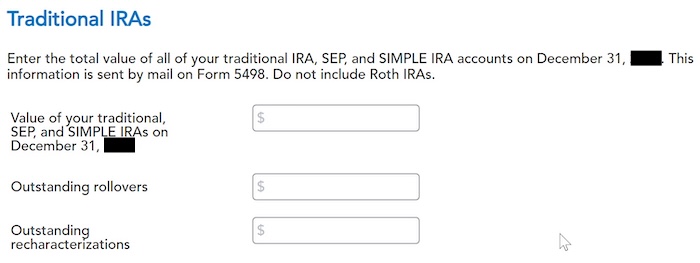

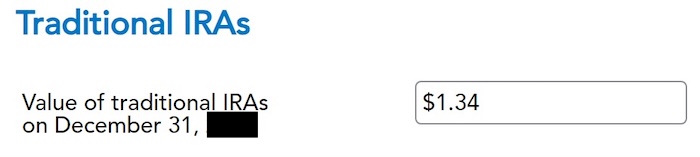

Enter the values of ALL your Traditional, SEP, and SIMPLE IRAs at the end of the year. We entered all zeros because we don’t have anything in traditional, SEP, or SIMPLE IRAs after we converted it all. If your account posted earnings after you converted and you left the earnings in the account, get the value from your year-end statement and put it in the first box.

That’s it so far on the income side. Continue with other income items. The refund in progress is still temporarily depressed. Don’t worry. It will change.

Non-Deductible Contribution to Traditional IRA

Now we enter the non-deductible contribution to a Traditional IRA *for* 2025.

If you contributed for 2025 between January 1 and April 15, 2026, or if you recharacterized a 2025 contribution in 2026, please follow Backdoor Roth in TurboTax: Recharacterize and Convert, Year 1. If your contribution during 2025 was for 2024, make sure you entered it on the 2024 tax return. If not, fix your 2024 return first by following the steps in Backdoor Roth in TurboTax: Recharacterize and Convert, Year 1.

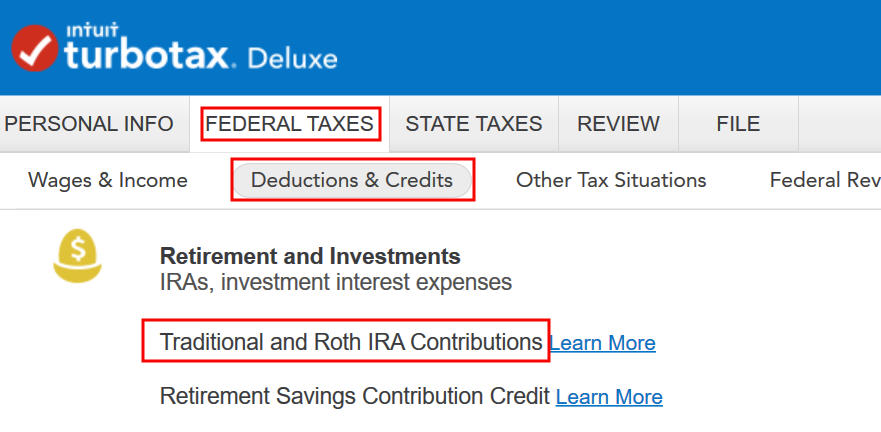

Go to Federal Taxes -> Deductions & Credits -> Traditional and Roth IRA Contributions.

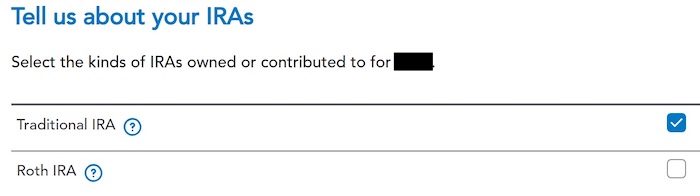

We check the box for Traditional IRA because we did a clean “planned” Backdoor Roth.

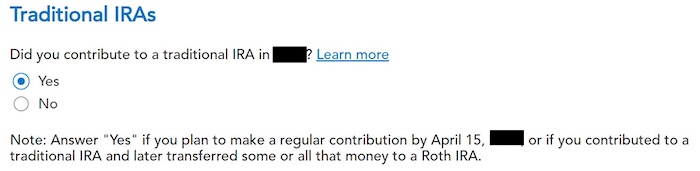

We already checked the box for Traditional but TurboTax just wants to make sure. Answer Yes here.

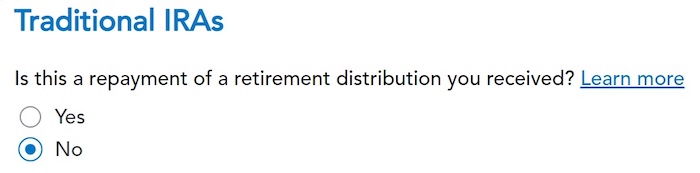

It was not a repayment of a retirement distribution.

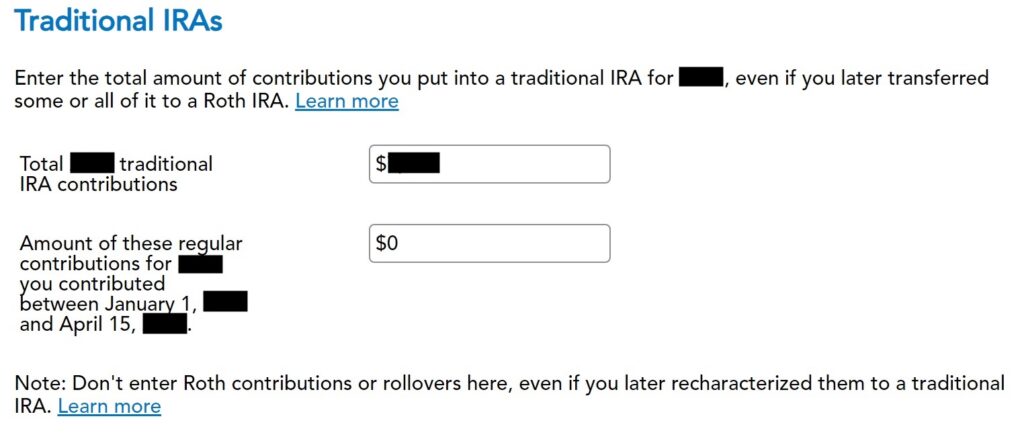

Enter the contribution amount. It’s $7,000 in our example. Because we contributed for year 2025 in 2025, we put zero in the second box. If you contributed for 2025 between January 1 and April 15, 2026, include the contribution in both boxes.

Right away, our federal refund in progress goes back up! We started with $2,384. It went down to $858. Now it comes back to $2,335. The $49 difference is because we have to pay tax on the $200 in earnings when we contributed $7,000 and converted $7,200. If you had less in earnings, your refund numbers would be closer still.

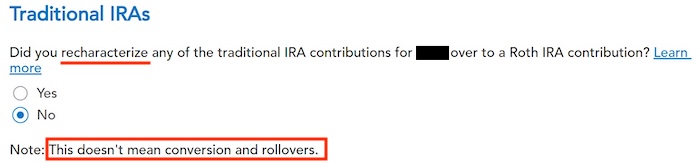

Converted, Did Not Recharacterize

This is a critical question. Answer “No.” You converted the money, not recharacterized.

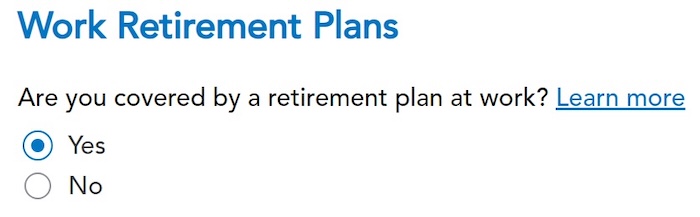

You may not get this question if you already entered your W-2 and it has Box 13 for the retirement coverage checked. Answer yes if you’re covered by a retirement plan, but the box on your W-2 wasn’t checked.

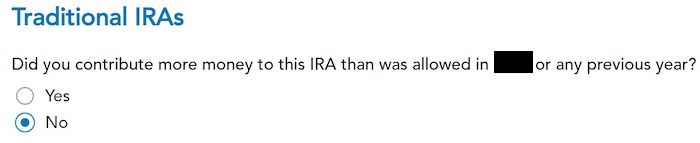

We didn’t make excess contributions.

Basis

TurboTax asks the same question it did before. For a clean “planned” Backdoor Roth, we can answer No, but answering Yes with a 0 has the same effect, and it allows you to correct errors.

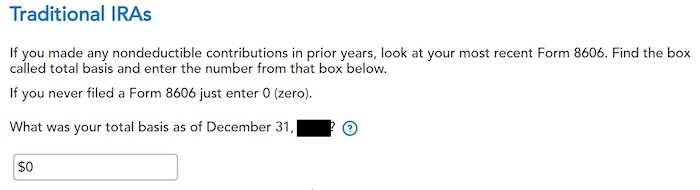

If you did your taxes correctly on TurboTax last year, TurboTax transfers the number here. If you made non-deductible contributions for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

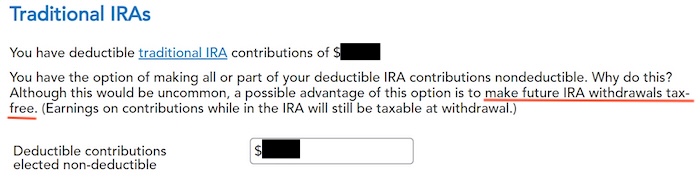

Make It Nondeductible

TurboTax shows this screen if it sees that you qualify for a deduction for the Traditional IRA contribution. If you take the deduction, it’ll make your Roth conversion taxable, which creates a wash. It’s simpler if you make your full IRA contribution nondeductible, and then your Roth conversion won’t be taxable. Enter the amount that TurboTax says is deductible.

Because we did a clean “planned” Backdoor Roth, we don’t have anything left after we converted everything before the end of the same year. If you have a small balance left because of interest posted after you converted, enter the value from your year-end statement here.

This is expected. That’s why we did the Backdoor Roth.

Taxable Income from Backdoor Roth

After going through all these, would you like to see how you are taxed on the Backdoor Roth?

Click on Forms on the top right.

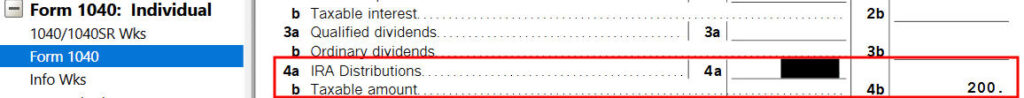

Find Form 1040 in the left navigation panel. Scroll up or down on the right to find lines 4a and 4b. They show a $7,200 distribution from the IRA, and only $200 of the $7,200 is taxable in our example. That’s the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth.

When you’re done examining the form, click on Step-by-Step on the top right to go back to the interview.

Tah-Dah! You put money into a Roth IRA through the back door when you aren’t eligible to contribute to it directly. That’s why it’s called a Backdoor Roth. You pay tax on a small amount of earnings between the contribution and the conversion. That’s negligible relative to the benefit of having tax-free growth on your contribution for many years.

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

Fresh Start

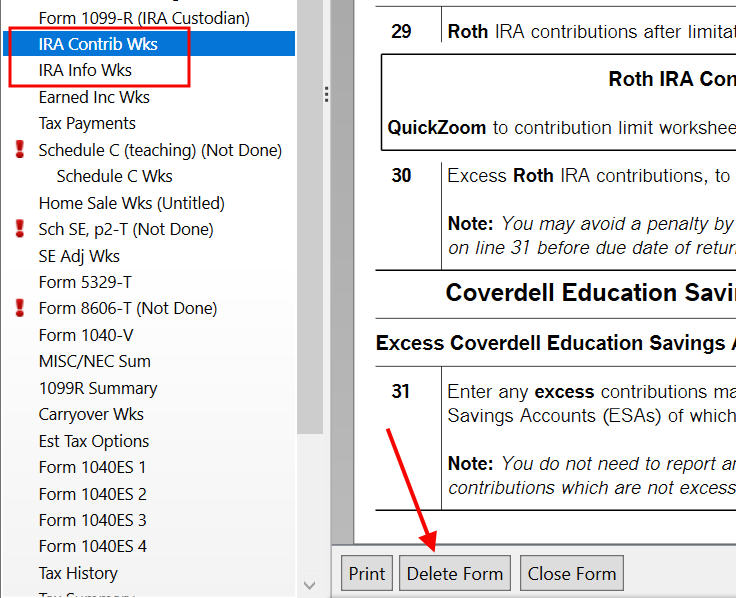

It’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

Click on Forms on the top right.

Find “IRA Contrib Wks” and “IRA Info Wks” in the left navigation pane and click on “Delete Form” to delete them. Then you can start over by following the steps above.

Conversion Is Taxed

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. Taking this deduction also makes your Roth IRA conversion taxable. You can see this deduction on Schedule 1 Line 20, which reduces your AGI.

The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal, and it doesn’t cause any problems when you indeed don’t have a retirement plan at work.

It’s less confusing if you decline the tax deduction, which also makes your conversion non-taxable. See the Make It Nondeductible section.

Self vs Spouse

If you are married, make sure you don’t have the 1099-R and IRA contribution mixed up between yourself and your spouse. If you inadvertently entered two 1099-Rs issued to you instead of one for you and one for your spouse, the second 1099-R to you will not match up with a Traditional IRA contribution made by your spouse. If you entered a 1099-R for both yourself and your spouse, but you only entered one Traditional IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Leigh says

Thank you so much! That will be super helpful.

MoneyCone says

Very informative TFB!

David says

This is an awesome article!! Answer all the questions I needed to know. Thanks so much. I will refer to it when I do a backdoor roth again for the 2012 tax year. Thanks again

Andy says

Can you show how to do it in H&R Block At Home? I can’t seem to do it right…

RR says

Could you also / alternatively show how to do this with the Tax Act online software? So glad I found your site just in time!

Harry Sit says

@Andy @RR – As you can imagine, it takes a lot of time to put the screenshots together. I don’t think I have the energy do them all over again in a different software.

The general steps are the same. There are two sides to this: a contribution and a distribution. Typically the software will have you enter the distribution on the income side before you enter the contribution on the expense side. In real life, you did the contribution first and the distribution second. It’s easier if you jump ahead and enter the contribution first, as I did here. This way when it comes to the distribution, i.e. conversion to Roth, the software will already know you made a non-deductible contribution and therefore the bulk of the distribution/conversion isn’t taxable.

If you do it the way the software has it, you will see your tax goes up when you enter the 1099-R. Don’t worry. That’s because you haven’t entered the contribution yet. When you do, the tax will come down again.

RR says

Thanks for the heads up; I was able to figure it out since the softwares are relatively similar.

babar says

This is called spoonfeeding. Dude, you saved so much of my time. Now I can relax and enjoy the weekend 🙂 Please set up a paypal account where your happy readers can donate for

– at least the upkeep of this website

– purchase all tax software

Harry Sit says

@babar – You are welcome. Tip jar is here: http://thefinancebuff.com/tip-jar

Geoff says

@TFB – What if the conversion takes place after Dec. 31st? Is it reported the following tax year? Does the year of contribution matter?

Here’s what happened to us:

1. Contributed to Roth IRA’s mid 2011 (his and her, $5000 each)

2. Unexpected income late in the year pushed us over the Roth limits (did not realize until last week when working on taxes)

3. Recharacterized Roth contributions to Traditional Feb. 2012

Tax software has told me to file form 8606 for non-deductible contributions and include a statement explaning the recharacterizations. So far so good, I think.

But what if I now do this:

4. Convert non-deductible traditional IRA’s to Roth before April 15th, 2012.

Does that impact my 2011 tax return?

Thanks,

Geoff

Harry Sit says

If you convert in 2012 you report the conversion on 2012 tax return.

kaz says

This seems great, but doesn’t point out that if there’s existing IRA’s (from rollovers, other deductible or non-deductible) some or all of conversion would be taxable. e.g. if one had $100,000 in a rollover already (deductible), and did a $5k contribution (non-deductible) and immediately rolled it over to a ROTH, the tax free ratio is about 4.8% (5,000 non-deductible basis divided by total IRA value of 105,000)… meaning most of the rollover IS taxable

Harry Sit says

@kaz – This post deals with how to report it after the fact. The proper way to do it when you have existing IRAs is in the link in the first sentence of this post.

Backdoor Roth: A Complete How-To

Dezlboy says

Just double checking… In 2010 I converted all my traditional IRA to Roth IRA and paid all the taxes in 2010. [trust me, there was a reason for paying them in 2010]. Before the conversion in 2010 my basis was $30K, but I just noticed on the 2010 Form 8606, line 14 has basis as $0. I assume that has something to do with the conversion being completed by Dec 31, 2010.

Okay…..now for 2011, I did the backdoor Roth, and completed the conversion by Dc 31, 2011. Am I correct in saying that my basis is $0, just as your example?

Praveen says

Thanks TFB for detailed and clear guide on reporting roth conversion of non-deductible ira. Very Helpful

John says

Turbo Tax is less than helpful with reporting a backdoor Roth. Their online help is full of incorrect advice from “super-users” who seem to be under the impression the online version doesn’t allow you to do this. So thanks for the walkthrough as it helped me enormously. However, I still can’t quite get this to work in the online TurboTax as my situation is a little different from what you outline here.

I doubled up a backdoor Roth in 2011. I converted over a $5,000 Trad IRA I took out for the 2010 tax year as well as converting another $5,000 Trad IRA I took out for 2011. I filled out the 8606 form giving me a $5000 basis for 2010. I have a 1099-R form for 2011 showing the distribution of $10,000 which I converted in full to a Roth IRA. However, when I follow the steps outlined here but substituting $10,000 for the conversion and $5,000 for the basis Turbo Tax still says I owe tax on $5,000. Any idea how to get around this or do I have to head over to HR Block to file my taxes this year?

There are several online sites that outline this doubling strategy as within the rules. I also called the IRS for confirmation and they gave it their approval.

Raghu says

Thanks for such detailed comments. The only difference in my situation is that all the money I contributed to my Traditional IRA for 2011 was done in 2012. So for the specific question that was asked “tell us how much of that was contributed between Jan 1, 2012 and April 17, 2012” – my answer is all $5000. So now, my question is this – since this conversion actually happened in 2012 (it actuallly happened today – 3/12), should I report it in my 2011 return. And I didn’t receive any tax forms BTW and I was told that I will not receive them till January 2013.

Thanks for taking the time and providing all the screenshots.

Harry Sit says

John – I just tried this in TurboTax Online. In the contribution part, I entered $5,000 for the 2011 contribution (as shown), $5,000 instead of $0 as the total basis as of 12/31/2010. In the 1099-R for conversion part, I entered $10,005 as the converted amount, again $5,000 in that “Let’s Find Your IRA Basis” screen for the total basis as of 12/31/2010. Then the 1040 preview shows $10,005 on line 15a, $5 on line 15b. No problem. What do you see on line 15b?

Raghu – You only complete the contribution part for 2011. Wait until next year to complete the conversion part when you have the 1099-R.

gunan01 says

TFB, thank you for answering Raghu’s question since I am in the same situation. I am confused about waiting till next year to report conversion. I want to report the conversion as if it happened in 2011, since I want to convert $5,000 more for 2012. How can I do this on TurboTax?

Harry Sit says

gunan01 – If you converted in 2012, you can’t report the conversion as if it happened in 2011 — it didn’t happen in 2011. You wait until 2013 to report it on the 2012 tax return. It doesn’t stop you from converting more for 2012 though. When you do your 2012 return next year, you can report $5,000 contribution and $10,000 in conversion. The two amounts don’t have to match.

gunan01 says

TFB- thank you. You answered my question beautifully.

John says

Thanks for the help again! It turns out I was doing it correctly after all. What I wasn’t taking into account was my wife wasn’t earing income for 2011 and this was leading to the $5000 amount showing up as taxable income on line 15(b). Elsewhere I was being given a tax deduction of $5000 (line 31 I think) as I was contributing to her Trad IRA with my own after tax money because she had no income of her own. Basically these two lines cancel each other out. It means I’m still left with no tax owed after essentially doing the backdoor Roth conversion four times in one year (two people; each for two years).

After a bit of persistance I got through to an excellent Turbo Tax support person who walked me through the whole process and confirmed everything was correct. She’s taken note of a few of the more tricky parts of entering the information and said that they will do their best to make it clearer in their support pages.

David says

Thank you for the Article! I was very helpful in reporting this year.

I think i may have reported my “backdoor Roth” incorrectly in 2010. Looks like I clicked “converted” trad IRA to a Roth which is not the case. In doing so, TT is automatically pulling in $2,500 of the contribution to be taxed in 2011 and then will pull $2500 in 2012(Form 8606 line 20a & b). I can delete the $2,500 number that Turbo Tax is automatically pulling from my 2010 return. But I don’t want to file this year’s taxes and be audited because of the way it was entered in 2010.

Anyone have any idea if it is an issue on deleting the $2,500 that is automatically generated from my 2010 forms?

Again, I did the back door Roth in 2010, but based on the information TT is pulling, it looks like I entered the information wrong last year.

David says

Please ignore my previous question(post #23).

I found out I need to amend the 2010 8606 forms. Thank you for the post showing how to fill out the paper version of the 8606 form.

Ben says

Thanks a ton, this was exactly the information I needed!

Deb says

I have a traditional Ira because I changed employers in 2011 and moved my 401k into a traditional. I opened a new traditional and put $5,000 (non deductible) into the account on 4/3/12. I am converting that $5,000 into my Roth before 4/17/12. Will this cause a problem with my other traditional? How do I show all ths in Turbo Tax? Do I have to wait till I do the 2012 tax return to show the $5000 conversion? Thanks

kim Gao says

In fact, I come to this article from a link that turbo tax people emailed to me. It really speaks of the quality of your article. If I followed the instruction in your article by entering 0 at the value of traditional IRA, TurboTax did show that the distribution from the conversion is not taxable (except the few dollars earning more than the contribution). However, now it shows that I have a loss of my traditional IRA of $30000 in schedule A line 23 (I guess it the maximum allowable), therefore, I now have a deduction of $21,303 in schedule A line 27, which is added to my itemized deduction. I guess the reason is that I also have a rollover IRA that has a balance of more than 0. I will appreciate if anyone can help me to get around it. Thanks. Kim

Harry Sit says

Kim – I showed zero because I didn’t have any balance in any traditional IRA after doing the conversion. If you have another rollover IRA, you must enter its value as of December 31 truthfully. That also means you will pay tax on your conversion. If you don’t want to pay that much tax on your conversion, you will have to undo the conversion by recharacterizing it, move your rollover IRA to a 401k or 403b plan, and redo your conversion. See

How To Recharacterize An IRA

Backdoor Roth: A Complete How-To

Bart says

TFB – You are a king among men. Thank you for answering Raghu’s question. You helped me end a very long fight with TurboTax.

MSD in DC says

Thank you! I was going to give up on TurboTax and do the forms by hand after all the problems I had with this. TT owes you money for providing this information!

Sam says

This may need to be updated for TurboTax 2012.

When get to the part where it asked about non-deductible contributions and cost basis, it specifically calls out whether I had non-deductible contributions for 2011 and before, not taking into account 2012. Now I’m confused how I designate the IRA contribution as non-deductible (even though it figured out I couldn’t have the deduction due to my income anyways).

jon says

to “Sam” from earlier today. The above works in 2012 also with some slight changes. When it asks about non-deductible contributions prior to 2011, not taking into account 2012, say “no”.

Check the Preview of your tax forms. It still works it out correctly, if you input your 2012 contribution and conversion also.

In my case, I made a $5k non-deductible and converted it the next day. I had 3k of existing deductible contributions in the same ira, that was also converted. I put in the 5k contribution from this year, that it verified was non-deductible, and put in the 8k from the 1099-r, and when i looked at line 15 it showed… 3k taxable. (8k distribution – 5k of non-deductible)=3k of taxable.

they could definitely make that easier and clearer to do.

Tawnia says

gunan01 – If you converted in 2012, you can’t report the conversion as if it happened in 2011 — it didn’t happen in 2011. You wait until 2013 to report it on the 2012 tax return. It doesn’t stop you from converting more for 2012 though. When you do your 2012 return next year, you can report $5,000 contribution and $10,000 in conversion. The two amounts don’t have to match.

Okay, so then why does Turbotax show that $10k that was backdoored for 2012 as taxable?

So in 2011 I contributed to a non-ded IRA, $5k. In Jan 2012, I backdoored it to a Roth (we’re over the income limits).

in Jan 2013, I contributed to a non-ded IRA, $5k, and then backdoored it within a week.

I received a 1099R for 2012’ss withdrawal, and inputted all the current info. I think I might need to amend 2011’s taxes . . . . any idea? I have to go back and look, but I think I indicated I backdoored it in 2011 when it wasn’t done until 2012. I thought, because we have until 4/15 to get it done, it was fine that way?

Dave says

I think there is an error in the IRS Pub 590, page 44 – the Worksheet 1-5. The note on the bottom aims to adjust for Roth conversions, but it does not work as intended. I found this out by running through TurboTax – I contributed $5000 to a Traditional in 2011, converted that ($5053) in 2012, made another $5000 contribution to the Traditional in 2012, and then converted that this year. I got a 1099-R for $5053. I would expect to see a $53 taxable amount on line 15 of the 1040, but instead it comes up with $168, based on the value of my Traditional on 12/31/12 (by running through that worksheet). There is something wrong with the instructions.. I don’t know how to report it though.

Annette says

Does anyone have a guide for reporting a backdoor Roth using TaxAct.com? I received two 1099-R’s from Fidelity and the copy on TaxAct about how to balance it out is INCREDIBLY confusing and unclear. One mistake makes it look like you’re doubling a tax payment to the government.

Harry says

Dave – The worksheet instructions are not wrong. It wasn’t $53 because you waited until 2012 to convert it and you made a fresh $5,000 contribution in 2012 and left it there as of 12/31/2012. The good news is having paid tax on $168 instead of $53, when you convert the 2nd $5,000 the taxable income would be $115 less. This article deals with contributing and converting in the same year and having a zero balance in the traditional IRA at the end of the year.

Dave says

Harry – Really? I figured I would only owe tax on $53. Why would I be subject to pay tax on a 2012 contribution in a Traditional that I did nothing with? Isn’t that only taxed once I withdraw it?

Harry says

Dave – The pro-rata rule treats all traditional IRAs as one pot, regardless when you made the contribution. The earnings are spread proportionately. Paying more now means paying less later. Not a big deal if you will convert your 2012 contribution again in 2013.

EsKay says

TFB, Thanks for this helpful article. And sorry if somebody has asked the same question to you above. I contributed $5k (post tax money) to a new Trad IRA account in 2011. I did not have any Trad IRA contributions or account before this. While I was preparing to file taxes for 2011 in Feb 2012, I realized that i am not eligible for a Trad IRA deduction because of my income. I called Wells Fargo and told them to move my trad IRA contribution to a newly opened Roth IRA on Feb 2012. I thought I have taken care of this… I also told my tax accountant of this. Now I received 1099-R from my bank about the distribution and entire amount i.e., $5764 (with earnings) is taxable. How should I handle? My tax accountant who filed my taxes for 2011 did not file 8606. I am going to file now and thanks for your other article which explains about filing 8606.

SamOmega says

Thanks for the great info. I’ve done this correctly for the tax year 2011. Now I’m attempting to do the same for 2012 tax year and Turbo Tax seems to be messing it up. I am using Turbo Tax Deluxe w/ State. Anyone else in the same boat at me? In short, Form 8606 Part 2 lines 16, 17 and 18 are not populated correctly!!

Becky says

@SamO – I think I’m in the same boat. It looks like TurboTax is not subtracting my non-deductible basis from the amount I converted from Traditional to Roth (as you said, lines 16-18). It looked like at least 33 other people were having the same problem, judging by the TT question board.

Since we’ve identified the issue, is there a way to edit tax forms directly using TurboTax?

jordan says

i have same problem with turbo tax….since my income are high…i contribute $5000 into my non-deductiable ira acct…and converted into roth ira in few day later……When i enter into turbotax…it charge me $3125 as taxable….. can anyone help me with this issue…thanks

jon says

The turbo tax web based version handles this fine.

If you edit the distribution, you’ll be able to say that the distribution was converted to a ROTH.

It than asks you the value of the account on a particular day, and figures it out.

I added 5k non-deductible, to an IRA with 3k (deductible) already in it. converted the whole thing to ROTH, and TT figured out I owed tax on the 3k piece without problem.

Rob says

Excellent article. I use H&RBlock Tax and I am having trouble with 8606. Do you have some examples/ for H&R Block? I contributed 5k to non-deductible and converted to Roth couple of days later with no gains, but had $99 dividends from a prior roll over to 401k posted to IRA at the end of year, complicating the matter. Any ideas on how to handle

Harry says

Rob – Sorry I don’t have time to do screenshots. The idea is the same. You enter a contribution. Then you enter a conversion. The $99 remaining in the traditional IRA at the end of the year just means you will pay tax on say $98 with your $5,000 conversion and carry over $98 basis in the $99. When you do it again for 2013, you convert the $99 together with your new contribution and only pay tax on $1.

Lars says

I am having a very difficult time with TurboTax 2012 with trying to correctly put in the info re a backdoor Roth IRA. My wife (high income) converted all her IRA’a to Roth IRA’s in 2010 and will pay the tax in 2011-12. In early 2012, she contributed $6K(over 50yo) to a traditional IRA for tax yr 2011 and 3 weeks later recharacterized that $6k into one of her Roth IRA accounts. Then in November 2012, she made another $6K contribution (both were non deductible) for tax yr 2012 to the traditional IRA account and recharacterized the entire amount one month later to one of her Roth IRA accounts. Hence, her Vanguard statement (1099r) shows $12000.26 (.26 income) in box one, gross distribution.

Bottom line, Turbo Tax keeps saying that she has an excess contribution (because of her high income) and that she has to pay a penalty ($350+/-) each yr until the excess contrib. is removed. I have tried everything I can think to remedy this situation, but come up empty.

Thanks for any help you might provide (you have done a terrific job w/ the website).

Lars

Harry says

Lars – This article was written last year with screenshot taken from TurboTax 2011. The fourth screenshot shows that her contribution made in early 2012 for 2011 should have been entered into TurboTax 2011. Check 2011 return to make sure Form 8606 shows $6k basis. She would not enter that $6k again in TurboTax 2012. The only contribution she would enter is the $6k contributed in November 2012. When it comes to conversion, the $12,000.16 from Vanguard is correct. Under the “Let’s Find Your IRA Basis” screen, she would enter $6k. The $6k basis from 2011 plus $6k new contribution for 2012 will offset the $12k distribution from Vanguard.

Pete says

Lars, my financial advisor told me to use “contribution” instead of “conversion” for the Roth IRA. That, plus the screen shots in this article, helped me finish my return without the tax penalty.

Nick says

Thank you so much Harry! I was getting all confused and couldn’t figure out a way to do this from TTs help pages or community . This is a topic that comes up quite frequently in financial talk shows and of course they cant say how it is done in TT or TaxCut or TaxAct or any DIY software. Clearly TT falls short in this.

Christine says

I’m sorry… I read this article many times and followed the instructions to my best ability, using TT 2012. I’m still getting taxed on my $6000 backdoor conversion made in 2012. I did not make any contributions for 2012. Just converting the 2011 contributions made before April 2012 to a ROTH IRA. Please advise. Thanks.

Christine says

Followup… just want to add to my post that if I answered ” … rolled over all of this money to another traditional IRA or other retirement account”, it removed the taxes. But I answered, “… converted all of this money to a Roth IRA account” and the additional taxes calculated stayed. Also, it told me “Good News: You Don’t Owe Extra Tax on This Money” yet it taxed me on the $6000. I’ve used this feature for years. This is the first year this is an issue!