Although I believe a traditional deductible IRA is often better than a Roth IRA, a Roth IRA is still better than a taxable account if you aren’t eligible for a deductible contribution to a traditional IRA. When you aren’t allowed to contribute to a Roth IRA because your income is too high, there’s still a backdoor. It takes some effort but it’s worth it.

So here it goes: a complete how-to for the Backdoor Roth.

What is the Backdoor Roth?

The Backdoor Roth is an indirect way to contribute to a Roth IRA when you are not eligible to contribute directly due to high income.

Who should consider the Backdoor Roth?

If your income is “too high” for contributing to a Roth IRA, you should consider the Backdoor Roth. The IRS publishes the income limit for contributing to a Roth IRA every year.

If your income isn’t above the thresholds, stop reading — this article doesn’t apply to you. Instead, consider a deductible contribution to a traditional IRA if you qualify for one or contribute to a Roth IRA directly.

Why should someone consider doing the backdoor Roth IRA?

When you have money in a taxable account, you pay taxes on interest and dividends. When you eventually sell the assets, you also pay taxes on the capital gains. If you put money in a Roth IRA, you don’t pay those taxes.

Ready? Here it goes:

Step 1 – “Hide” other IRAs

If you don’t have any traditional IRA (say as the result of a rollover from a previous 401k or 403b), SEP-IRA, or SIMPLE IRA, you are in good shape. Skip to step 2. If you are married, please note IRAs are owned by one and only one person. Each spouse should look at his or her IRAs separately. If you don’t have any traditional IRA, SEP-IRA, or SIMPLE IRA but your spouse does, you are not affected but your spouse is affected.

If you have a traditional IRA, SEP-IRA or SIMPLE IRA, and you don’t mind paying taxes to convert all of them to a Roth IRA now, also skip to step 2. When your balances in those IRAs are small, the taxes you will have to pay when you convert them are also small.

If you have a traditional IRA, SEP-IRA or SIMPLE IRA, but you don’t want to convert them and pay taxes at a high rate just yet, rollover almost all the pre-tax money to an employer sponsored retirement plan: 401k, 403b or 457. Most employer-based plans accept incoming rollovers.

An inherited IRA doesn’t count if you keep it separate as an inherited IRA (see Inherited IRA and Roth Conversion Pro-Rata Rule).

Everything in the traditional IRA, SEP-IRA, and SIMPLE IRA, except any non-deductible contributions you made in the past, is pre-tax money. For example if your traditional IRA has $34,000 in it and you made $10,000 non-deductible contributions in the past, $24,000 is pre-tax money. Move $24,000 to an employer sponsored plan. If you never made any non-deductible contributions in the past, all $34,000 is pre-tax money.

If you’ve made non-deductible contributions to your traditional IRA in the past, a key requirement is that you leave enough money behind in the traditional IRA — at least equal to your past non-deductible contributions. Don’t cut it too close. Consider market fluctuations and leave yourself a small cushion to show that on the day the money goes from your IRAs to your employer plan you still have slightly more money in the IRAs than your past non-deductible contributions.

You are allowed to rollover only pre-tax money from a traditional IRA to an employer plan because of a special rule. Read more about this special rule in IRS Publication 590A. Look for “Tax treatment of a rollover from a traditional IRA to an eligible retirement plan other than an IRA” near the end of page 22.

If your plan doesn’t accept incoming rollovers or if you don’t like your plan, create some self-employment income and set up a solo 401k plan, also known as a self-employed 401k plan or individual 401k plan.

House-sitting, dog-walking, tutoring, helping neighbors set up computer equipment, etc. are all good ways to earn self-employment income. Remember you don’t have to make a living on it. You just need a little self-employment income in order to qualify for setting up a solo 401k plan. See Solo 401k When You Have Self-Employment Income.

Step 2 – Make a non-deductible contribution to a traditional IRA

After Step 1, you either don’t have any traditional IRA, SEP-IRA, or SIMPLE IRA, or you only have a traditional IRA with non-deductible contributions in it (maybe plus a bit of earnings). You make a non-deductible contribution to a traditional IRA. As long as you have earned income, even if your income is “too high,” you can still make a non-deductible contribution to a traditional IRA.

The IRS publishes the contribution limit ever year. Look it up.

Step 3 – Wait

The law does not impose any waiting period between a contribution and a conversion (step 4). However, some are concerned that if you convert too soon, it can be seen as an abuse.

There is no official guideline for how long you should wait. Some say a few days; some say 30 days; some say 6 months; some say wait until the end of the year. Pick a time you feel comfortable with.

Having the money sit in a traditional IRA for a short period of time is not going to kill you. The tax on the earnings won’t be much because you won’t have a lot of earnings.

Step 4 – Convert the traditional IRA to Roth IRA

Ask your IRA provider how to do this. Some can do it online. Some will want a signed form. There is no income limit for the conversion. Because your Roth IRA conversion comes primarily from your non-deductible contributions, there will be very little taxes on the conversion.

Be sure to specify you want to *convert* money in your traditional IRA to a Roth IRA, not *recharacterize* your contribution. The two are not the same. Using the wrong term can lead to bad consequences. See Traditional and Roth IRA: Recharacterize vs Convert.

Also be sure to choose “no tax withholding” for your conversion. This way 100% of the money goes into your Roth account.

Step 1 is necessary because if you didn’t do it, your conversion will be taxed by the percentage of pretax money in all IRAs (the “pro-rata rule”). Money in employer sponsored plans doesn’t count in the pro-rata rule.

Step 5 – Report on your tax return

Since you made a non-deductible contribution to a traditional IRA in Step 2, you will need to include Form 8606 when you file your taxes. It’s a very simple form. If you use tax software, it will be included automatically if you answer the questions correctly.

Contributions to an IRA can be tagged for the current year or the previous year (if done before April 15 in the following year). Conversions are always tracked to the calendar year in which it actually happened. You report on the tax return your non-deductible contribution to a traditional IRA *for* that year and your converting to Roth *in* that year. If you contribute for the previous year and then convert, you will have to report in two separate years. It’s much simpler if you contribute for the current year and then convert before December 31. See Make Backdoor Roth Easy On Your Tax Return.

If you use TurboTax, see How To Report Backdoor Roth In TurboTax for a step-by-step guide. If you use H&R Block software, see How To Report Backdoor Roth In H&R Block Software. If you use TaxACT, see How To Report Backdoor Roth In TaxACT. If you use FreeTaxUSA, see

How to Report Backdoor Roth In FreeTaxUSA.

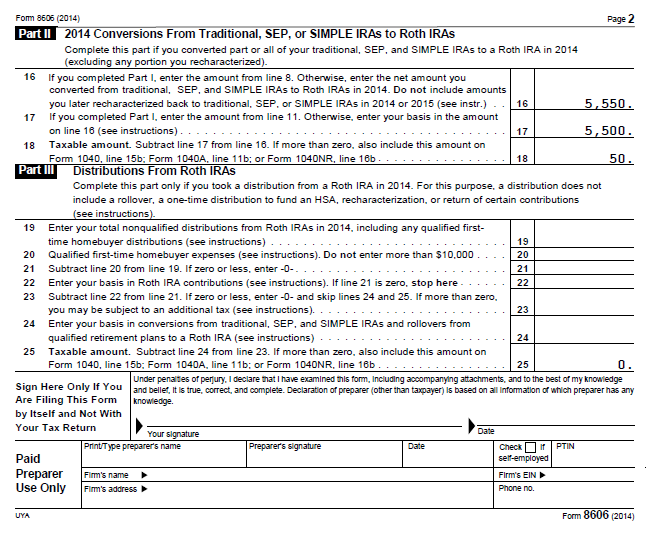

Here’s an filled-out example of Form 8606 produced by TaxACT software. I’m assuming by the time you converted, you had $50 worth of earnings.

Step 6 – Repeat Steps 2 to 5 next year

Step 1 is a one-time task. After it’s completed, you just repeat Steps 2-5 every year.

Most IRA custodians will keep an account open for a year even after the balance goes to zero. In such case next year you just contribute to the same empty traditional IRA and convert into your existing Roth IRA. It’s not necessary to open new accounts.

No Rollover to Traditional IRA

When you are repeating steps 2 to 5 every year, remember not to roll over from an employer-sponsored plan to a traditional IRA in the same year, either before or after you do the Roth conversion. You can leave the money in the original plan, roll over from one plan to another plan, or roll over to your own solo 401k, just not roll over to a traditional IRA. If you must roll over to a traditional IRA, you will have to “hide” it again using Step 1.

Reverse the Order?

Some readers asked about reversing the order: do Step 1 after Step 4 but before December 31 in the same year. I don’t recommend it, even though it works the same on the tax form.

When you roll over from your traditional, SEP or SIMPLE IRA to a qualified plan, you are explicitly allowed to pick pre-tax money only. Not so when you do the conversion; you are not supposed to pick only after-tax money. The tax forms don’t show exact dates. If you reverse the order, you can probably get away with it if you are not audited, but I think it’ll be messier if you must explain to an IRS agent.

It’s too much trouble. Why don’t they just open the front door and let everyone contribute directly to a Roth IRA?

If the front door is wide open and everyone can contribute directly to a Roth IRA, the government will lose too much revenue. The income limit is imposed to reduce the revenue impact. Only those who know about the backdoor and are willing to perform the necessary steps can take advantage of the backdoor Roth IRA. Diligence brings rewards.

Will they close the backdoor?

It’s possible the backdoor will be closed. The President already included in his budget proposal to close it although it’s hard to get it passed by Congress. If you are afraid the backdoor will be closed, you should do it now when the backdoor is still open.

***

Comments are closed because questions are becoming repetitive. Be sure to read existing comments for answers to questions similar to yours.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

angel says

I have a question regarding form 8606 and its my first roth IRA

Im contibuting 5500 now for the 2013 year and havent done my taxes yet. Do I need to fill the above form now (part 1) or next year for 2014 taxes?

If I do it now, I may be having mistakes on part 1 of the form. I have 5500 on lines 1,3,4. the rest of the lines i have 0.

what am I doing wrong?

Harry says

Now, because you report your contribution *for* that year and your conversion *in* that year. Instruction says copy line 3 to line 14 if you answer “No” to the question there. So do that.

You will do yourself a big favor if you start contributing for and converting in the same year. Contribute for 2014 in 2014 and convert in 2014. Much less confusion that way.

angel says

Thank you so much for the explanation. I guess I will do part 2 & 3 next year.

Due to my fluctuanting income I didnt know whether I was gonna be able to qualify for a regular roth, that’s why I didn’t contibute last year.

I will plan to contribute for 2014 this year as well cause now I know I won’t qualify for a regular roth from now on.

Anthony C says

Great article ..I just opened my TIRA and Roth IRA this past week because I realized our AGI was over the limit . I get the 8606 form which I will file with my 2013 taxes and since I have no other TIRA accounts it’s a 0 tax implication so should be easy . but to clarify is the 1099-r form something I would do for my 2014 tax return ?

Harry says

Yes, see reply to @angel above.

James says

Best Article on Back door ROTH-IRA.

Harry,

1. I contributed non-deductible $5000 in TIRA for year 2012 in April 1st of last year 2013.

2. I then converted the TIRA contribution to ROTH IRA within a few days.

Can you please guide me how I should report the above 2 transactions in my 2013 tax return which I plan to file soon ?

Note: I also plan to contribute $5500 in TIRA for year 2013, before the april 15th dead line.

Thank you for the great service.

James

Harry says

James – You report on the tax return your contribution to a traditional IRA *for* that year and your converting to Roth *in* that year. See How To Report Backdoor Roth In TurboTax if you use TurboTax. Other software follows a similar process.

It sounds like you didn’t report your contribution for 2012 on your 2012 return. You should fix that.

TheGooch says

I have a TIRA that I started last year, and it’s $5500 were fully deductible in 2013. I put $1000 in it so far for 2014. Now, I’m getting access to a 401(k) in a month or so ( new job) , and the plan does allow IRA rollovers.

It’s obvious that I can roll the 2013 contributions into the 401(k), but what about this year’s contributions?

Since I don’t know my income for 2014 yet , do I have to wait until the end of the year to determine if I should do a Roth conversion?

Odd are, that the TIRA will not be tax deductible, and that I will not be eligible to contribute to a Roth directly, given my hourly wages and regular work schedule.

Harry says

TheGooch – You can wait until later in the year if you’d like. Doing it through the backdoor method after you put in the maximum for 2014 would be fine too. The money ends up at the same place.

TheGooch says

Ok. I was confused as to whether or not I could roll it into my 401k as soon as it was available. It makes more sense to wait until I see what my income for the year is and then choose to roll it into the 401(k)( not likely) , convert to Roth(very likely) , or do absolutely nothing (not likely ).

One question, what happens to the shares in the TIRA when I convert to Roth? If have 10 shares of Fund A, will I still have those 10 shares , or go they get sold and then I have to buy shares of the same fund in the Roth account if I want to keep my investment in that fund?

Harry says

Usually they just move the shares from one account to another, no selling or re-buying.

OB says

Is Step 1 required before the rest of the steps? IRS form 8606, step 6 indicates that you only compute the value of all of the traditional IRA, Simple IRA and SEP IRAs as of 12/31 of the year of the conversion. Can I then do the Backdoor Roth conversion first, then do step 1 (Hiding the ‘other’ IRAs) later as long as it is completed before 12/31 of that year? Example: Do Backdoor Roth conversion in June, and hide the other IRAs in November?

Harry says

OB – I don’t recommend it, although it works the same on the tax form. When you rollover from your traditional, SEP or SIMPLE IRA to a qualified plan, you are explicitly allowed to pick pre-tax money only. Not so when you do the conversion; you are not supposed to pick only after-tax money.

The tax forms don’t show exact dates. If you reverse the order, you can probably get away with it if you are not audited, but I think it’ll be messier if you must explain to an auditor.

Robert says

Hi – thank you for all the good work you do. Your articles are fantastic – keep up the good work.

I’ve been doing backdoor Roth IRAs for a couple of years now and to keep things simple, I open a new tIRA, contribute to it, wait a week or two, and then roll it into an existing Roth IRA. My question is this: Is it necessary to open a new tIRA each year I make by tIRA contribution? Or can I make the contribution into an already existing (empty) tIRA account?

Thanks!

-Robert

Harry says

Robert – It’s not necessary. You can contribute to an existing (empty) account.

Johnny says

Hi Harry,

In 2012, I converted my wife and my non-deductible TIRA’s into a Roth.

We converted the entire amount in 2012 ($77,000) and had to pay taxes on about $37,000.

In 2013, we each contributed $5500 into a non-deductible TIRA and within days converted to a Roth.

Today, I received my tax return from my accountant….and saw that we owed taxes on $30,000!

After looking over form 8606, it appears that the $30k is from $88,000 (the original conversion amount of $77,000 plus $11,000) and subtracting the cost basis of our TIRA (basically the cost basis from 2012 plus the $11,000 that was added in 2013)…by the way, we currently have nothing in the TIRA since it was all converted to a Roth in 2012…

Does this make any sense.

Thanks

Johnny says

Sorry, one mistake…I looked at my statements and it appears that in 2012- the Roth conversion took place in 2013 (and not 2012 as I initially thought)

John says

Thanks for a great explanation of converting to Roths.

I have a 403b, a tIRA with ded and non-ded contributions, and a roth.

I made pre-2013, 2013, and 2014 non-ded contribution to the tIRA.

The non-ded contributions prior to 2014 are on the 8606.

I want to convert the non-ded contributions to the Roth.

Your article says to 1st transfer the ded contributions to the employer plan.

Wouldn’t it be cleaner to transfer the non-ded contributions (the 8606 amount + the 2014 contribution) to the Roth so all that’s left in the tIRA are the ded contributions and the earnings? Then, the tIRA can be rolled over to the employer plan. Fidelity says this has to go to a rollover IRA 1st then to the 403b. I’ve been told that a long as everything is done by the end of the year there are no pro-rata issues.

Is this the correct way to do this?

Thank you.

Harry says

John – I don’t recommend it. See reply to @OB above. I also added it to the article.

John says

Thanks for the heads up. If the deductible monies and earnings are rolled over from the tira to the 403b 1st then the non-ded (8606 basis) is converted from the tira to the roth there will probably be a little left over in the tira, maybe only a $1 or 2 if I do it right. Would I just take this as a distribution? Would this necessitate a pro-rata calculation at tax time?

Thanks.

Harry says

Just convert the whole thing including the small amount of pre-tax money left. No pro-rata when the ending balance on 12/31 is zero.

David says

New to this with unexpected income in the past two years…so THANKS much for your help.

I’m doing taxes now for 2013 and, if I understand this correctly, I can now (in 2014) make contributions to a 2013 non-deductable IRA but I cannot, in the 2013 tax year forms, convert these to a Roth. Correct?

THen it follows, if I make contributions now to a 2013 non-deductable IRA and convert them in 2014 to a ROTH IRA…and in 2014 make contributions to a non-deductable IRA and convert those also in 2014…then both of these converstions will be entered in my 2014 tax forms…correct?

Harry says

@David – Correct, as explained in the 2nd paragraph under Step 5. Read the follow-up article linked there. The contribution for 2013 still goes on the 2013 return.

RG says

I have a substantial balance in tIRA, and I don’t want to liquidate (say I am waiting for my positions to gain a substantial amount in the next 12-18 months). Here’s what I am thinking of doing — Just open a separate deductible IRA account now, keep depositing money into it (say $5.5k each year) until I think I am ready to liquidate the tIRA and then rollover the tIRA into my 401k? Then rollover entire non-deductible IRA balance into ROTH. Is there any downside to this approach?

Harry says

@RG – That’s fine. You just pay tax on the earnings in the interim years in your second IRA when you convert. Or if the earnings are substantial, you can roll the earnings into your 401k as well.

RG says

Thanks Harry! Actually I meant to say open a separate *NON*deductible IRA now instead of “deductible” as I already contribute to 401K and do not qualify for a ROTH due to income limits. I suppose your answer will remain the same, correct? Theoretically, as long as this backdoor stays open, I could accumulate funds in this separate IRA (post tax of course), invest it (or keep it in cash) and convert the entire balance to ROTH (just pay taxes on the earnings or roll-over earnings into 401k) some time down the road (probably 18 months from now) after rolling over tIRA into 401k. Would I be missing any gotchas if I do this? Thanks for your help again! And an excellent article!!

Harry says

@RG – Same answer. I thought you meant non-deductible.

Pat says

Most informative information I have found on this subject, Thanks.

I had no current traditional IRA when I contributed $5,000 to a non-deductible IRA and converted the same funds in the 2013 tax year. There were no gains or losses in the value before conversion. I assume I need to complete Form 8606 Part I & Part II. The attached Form 8606 example above only has Part II completed. On my Part I, I have entered $5,000 on lines 1, 3, 4, 8, 9, and 0 on all other lines. On Part II, I entered $5,000 on lines 16 & 17, and 0 on line 18.

Did I do this right?

Harry says

@Pat – My tax software only filled out Part II because it read the third bullet under Part I as saying if you converted all your IRAs you don’t need to fill out Part I.

unmesh says

So I opened a TIRA with $5500 and opened a Roth IRA to do the backdoor transfer. Because i expect to execute this maneuver in future years, the custodian wants me to leave $10 in the TIRA otherwise they will close the zero balance account in a few months.

Will this convenience for them cause problems for me in terms of tracking/reporting to the IRS?

Thanks.

Harry says

@unmesh – If you understand how to do it, it’s just entering different numbers into the tax software (if you use tax software). Otherwise you can get yourself confused unnecessarily over measly $10. Read the linked articles under Step 5 and do some dry-runs. If you think it’s too confusing, just open a new account every year or find a custodian that doesn’t close a zero-balance account so soon.

unmesh says

Harry,

I use TurboTax and will do the dry run thing this weekend.

Thanks.

vabird says

I’m a fan of dolloar-cos-averaging approach.I am considering makng non-deductible IRA incementally rather than lump sum as I have been doing (Exp: $550/mo for 10 month in a year). Will there be any tax implications? And should I do Roth conversion each month after ira contribution or wait to do once before year ends?

Harry says

vabird – You can contribute cash, convert cash, and then dollar-cost-average inside the Roth account. Converting every month may bring excessive paperwork.

karaj says

I have a rollover IRA from multiple former 401Ks. If I chose to move this IRA to my current 401K then I move everything (contributions and earnings) right?

sm says

Hi,

Thanks for the article. I contributed to a Roth IRA back in April of 2013 (for 2103). Some cap gains made my income too high so these contributions are ineligible. I am going to transfer them (with pro rated gains) to a regular IRA. Can I then convert that to a Roth (back door style) in 2014 as described in the article?

Harry says

@sm – Yes you can. Follow the same steps and consider your other traditional, SEP, and SIMPLE IRAs if any.

Clara says

Great articles! Really appreciate all the well done steps. One question, in form 1099-R, 2a, should the taxable amount be $20 instead of $5520? Thanks!

Harry says

The IRA custodian doesn’t know whether you took a deduction or not. They put the converted amount as the taxable amount in 2a. Then they check box 2b to say the amount in 2a isn’t necessarily correct.

sm says

Just to follow up on this:

“Hi,

Thanks for the article. I contributed to a Roth IRA back in April of 2013 (for 2103). Some cap gains made my income too high so these contributions are ineligible. I am going to transfer them (with pro rated gains) to a regular IRA. Can I then convert that to a Roth (back door style) in 2014 as described in the article?”

I have 2 additional questions:

I contributed the max $5500 to the Roth before I realized I was not allowed to make any contribution. I now have to convert that amount plus gains to the traditional IRA. Do I then need to pay taxes on those gains when I roll back to the Roth back door style?

I was considering starting a SEP this year and I do not have a 401k. It seems like I should not do that as it would interfere with my ability to do the back door Roth. Is that right?

Harry says

@sm – You need to pay taxes on those gains unless you follow Step 1 to move the gains to a qualified plan. It’s correct a SEP will interfere. Do a solo 401k instead. See link to article at the end of Step 1.

SCS says

Thanks for the very helpful articles. When you updated the article in March 2014 to note the higher contribution caps, it looks like the “filled-out” 8606 became a blank 8606… Any chance of seeing a filled-out form again? I’ve done the backdoor conversion for the past three tax years but think I may have been filling out my 8606s incorrectly each year (because I both contributed and converted for the first time in 2012 and counted them both towards the 2011 tax year instead of only the contribution… as you have warned is a confusion) and should refile them… Would love to see a correct sample form! Thanks.

Harry says

@SCS – It’s still filled out, on page 2. When you contribute for the current year and convert the entire balance in the same year, you get to skip Part I. The form becomes really simple. The 2010 form shows what it looks like when you have basis carried over from the previous year.

RB6P says

Harry – Thanks for this enormously helpful post.

I made an error in setting up my backdoor roth and contributed $5500 directly to a roth IRA by accident (I am above income limits). I called Vanguard and arranged a recharacterization to turn it into a traditional IRA, and a few days later, I went forward with the conversion to a roth IRA.

Now I’m wondering if I made another error –

According to this IRS link (below), there are required waiting periods for doing a RECONVERSION following a RECHARACTERIZATION (see 4th question in below IRS link) .

… but is it still okay to do a CONVERSION (not REconversion) following a recharacterization whenever (i.e. after only a couple days)?

http://www.irs.gov/Retirement-Plans/Retirement-Plans-FAQs-regarding-IRAs-Recharacterization-of-Roth-Rollovers-and-Conversions

Harry says

@RB6P – Recharacterize can mean recharacterizing a contribution or recharacterizing a conversion. You did the former. The IRS mandatory waiting period is on conversion after recharacterizing a previous conversion, not after recharacterizing a contribution.

sm says

I just got off the phone with Vanguard and they said that it would not be possible for me to get rid of only pretax money with a rollover to a 401k. They said that every pile of money would have an equal split of pretax and non deductible moneys.

So for instance if I had a traditional IRA with 80 percent ND and 20 percent pretax and I put 20 percent of the entire account into a 401k, that portion of money would still be 80 percent ND and 20 percent pretax (leaving the same ratio behind in the IRA).

Harry Sit says

sm – Read IRS Publication 590. Look for “Tax treatment of a rollover from a traditional IRA to an eligible retirement plan other than an IRA” near the end of page 23.

Then call Vanguard again and ask for a customer service manager. Tell the manager that the previous rep gave you bad information. They can look up who that was and give additional training. You are not causing someone trouble. You are helping Vanguard give better service to all customers.

sm says

Excellent info, thanks. I will call them back when I have time and report here.

On the document you mentioned, 401ks are not listed as eligible retirement plans under the paragraph about the special rule. How do you interpret that?

Harry Sit says

sm – It’s covered under the second bullet “Qualified trusts.” Look at the table on page 23, footnote 1.

Clara says

I made IRA contribution in March for both 2013 and 2014 ( did not know this strategy before), and requested to convert both to Roth IRA. THe financial company is really slow on it, THey only converted $5500 for me. I called them to get the form 8606 and was told I won’t get it until the end of May. They also told me not to worry about the conversion and I should report the 2013 conversion to Roth IRA in 2013 tax filing which will be done in 2014. The only thing I need to do is to report the non-deductable IRA for 2012 tax filing. I wonder if this is true? Thanks for your advise!

Harry Sit says

Clara – I’m sorry your years are really confusing. Not sure how 2012 comes in. Form 8606 is a form you file. Not a form you receive. Please read the linked articles under Step 5. If you converted in 2014, you report the conversion on 2014 return, to be done in 2015. You report the contribution for 2013 on 2013 return, to be done now in 2014.

Epicurean62 says

Harry, I’m new to your blog – very informative and helpful.

I have a similar issue to some of the recent posts, and could use some clarification.

My Roth IRA contributions in 2010 were made before I realized I was going to be over my income limit. Once that was discovered I recharacterized my contributions + earnings to a traditional IRA. Last year (2013) I complete a Trustee-to-Trustee conversion of the Traditional IRA back to a Roth IRA (didn’t know about the Back-door Roth Conversion).

Most of what I read says I have to pay taxes on the total amount converted. The account has appreciated some, but I never contributed directly to the Traditional IRA. So my questions (just two) are:

Do I have to pay taxes on the whole amount ($6K) or only on the gain (income ($800))? and

Should I have received a 1099-R for the conversion?

Thanks again for all!

Epicurean62 says

Harry,

I made one small error the income should be $1,400, not $800. Original amount was $4,600.

Thanks again, sorry for the mistake.

Harry Sit says

Epicurean62 – Only the gain, assuming that you don’t have other traditional, SEP or SIMPLE IRAs. You should’ve filed a Form 8606 for 2010. If not, you can still file it now. You can find tax form for previous years on IRS website. You carry that $4,600 to 2013, which becomes an offset to your $6k conversion. Yes you should’ve received a 1099-R for the conversion.

epicurean62 says

Thanks Harry! I did do the 8606 in 2010.

I followed up with my old bank, and they told me, since this was a Trustee to Trustee conversion I won’t see a 1099-R (it’s treated as a transfer). I’m a little confused but I have already figured the gain.

The person I spoke with was confused a bit also, because she said, all proceeds from a T-IRA, when converted to a R-IRA are taxable (that would be the whole $6K).

I prefer your comment above.

Harry Sit says

epicurean62 – Unfortunately customer service people often give wrong answers because they aren’t trained well. Somehow they’d rather give wrong information than saying they don’t know. Look at the IRS 1099-R instructions: “Roth Conversions. You must report a traditional, SEP, or SIMPLE IRA distribution that you know is converted this year to a Roth IRA …” (page 3, left hand side).

Giving wrong information to customers imposes a cost on the customers. It doesn’t show up on the fee schedule, but it can be worse than a fee.

Clara says

Thanks a lot Mr. Sit! I did make a mistake about the year, it should be 2013. But you clearly answered my questions. Thanks again! Clara

Clara says

Mr. Sit, I went through your post again when I am finalizing my tax return. Just realized I forgot about my husband’s roll over IRA. He requested IRA conversion to ROth IRA a couple of weeks ago. Will we have any problem when we file tax return for 2014 reporting this conversion of $5500? I mean will that impact the amount how much we could convert nondeductable IRA to ROth? He is allowed to move the Rollover IRA to his employer’s 403 plan any time. But we neglected your step one. Thanks a lot for your help! Clara

Harry Sit says

Clara – Please read the paragraphs under the heading “Reverse the Order.”

AL says

Hi Harry,

If I current have a 401k(Job1), 401K(Job2), IRA-CDs, Spousal IRA-Scottrade. The 2 IRAs was opened before I started working, no longer contribute them since I started working. Do I just close it and roll over to my current 401k(job2)? Then open a Vangard Trad IRA & Roth IRA, then contibute $5500 to Vangard Trad IRA , and roll over to Vangard Roth IRA immediately? That should avoid any re-char if I complete all task within 2014, right?

Newboy says

I may have made the wrong move to avoid being taxed or just so confused?

In feb 2014 i moved almost all of my 403b acct to an older tira acct. the tira acct was a 403b, but was inactive, so changed the plan type. The old acct pays 4% interest and has no fees attached, the contract is so old.

Down the road i would love to roll it all to a roth and not pay taxes on it.

The 403b that the money came from is active and I can still roll the money back to it when I want to.

In simple terms, am I going to be able to roll the money (all pretax dollars) into a roth and not pay taxes on it. Please give the steps necessary.

Thanks I am a newby to the game. I just couldnt resist the security of a fixed acct and 4% interest with no fees. The markets are quite high and volitile.

Harry Sit says

Newboy – In simple terms no. Pre-tax money will stay pre-tax whether it’s in a 403b or Traditional IRA. Eventually you will have to pay tax on it when you take the money out, although if you do it after you retire you may be in a lower tax bracket. This article is on a different topic.

Nicklao says

I have a question: my wife had a traditional IRA with Fidelity that I want to convert to Roth so that we can contribute again (surpass limits to do so directly). I think I screwed it up: called fidelity and converted the amount in tIRA to roth and they did so and said that the taxes owed could be handled by us at tax-time. Can I now add $5500 to the old traditional account which is empty and then convert it over to the new Roth account I created? Or was I supposed to add the $5500 first and then convert the whole thing?

What has me confused is the tax part of it. Will i fill out a 8606 for the taxes owed on the conversion as well as another 8606 for the $5500 non-deductible contribution which was then converted?

Please help.

Harry Sit says

You can convert multiple times in a year. You fill out one 8606 per individual for all the non-deductible contributions for and conversions in the same year.

Kevin says

My wife’s 401k and Traditional IRA are both at Vanguard. Vanguard told her she couldn’t roll funds from the traditional IRA into the 401k because the IRA contained rollover funds from a previous 401k AND the IRA contained after-tax contributions. They said this was an IRS regulation, not a plan rule. Does that sound right?

Harry Sit says

It doesn’t. Don’t ask a customer service rep tax questions. That’s not their role. They don’t speak for the IRS. You can ask them for the form and instructions for doing an incoming rollover. The necessary information will be on the form and instructions.

JR says

Just want to confirm that all of the steps can be done in the same year. It doesn’t matter that at some point earlier in the year you had deductible funds in a traditional IRA. You just have to do the Roth conversion AFTER you have rolled over the traditional IRA to a 401k. Is that correct?

Thanks for the great information.

Harry Sit says

JR – Yes that’s correct.

Helen says

Hi Harris,

Great article! I am glad I found your website!

You mentioned in the article that “If you are married, please note IRAs are owned by one and only one person. Each spouse should look at his or her IRAs separately”. Your comment just give me some idea… I currently have 55,000 traditional IRA converted from 401k. My husband does not have any IRA. Our income is over the limit to contribute to deductible IRA. So I can have him contribute to a non-deductible IRA and then convert it to Roth IRA later without paying tax since he does not own any IRA?

Thank you so much in advance for your advice. Helen

Helen says

sorry, my email should be addressed to Harry.

Harry Sit says

Helen – Yes he can do that. You can too if you complete Step 1.

Scott says

Hi Harry,

Thank you for such a great resource! I have a follow up question (I tried to find the answer in previous comments. If I missed it, I apologize) about something you wrote in the piece.

You wrote, “No Rollover to Traditional IRA: When you are doing the backdoor Roth IRA, remember not to rollover from an employer-sponsored plan to a traditional IRA in the same year, either before or after you do the Roth conversion. You can rollover from one plan to another plan, or to your own solo 401k, just not to a traditional IRA.”

When doing the backdoor Roth IRA conversion, why can’t one make a rollover from an employer-sponsored plan (e.g. a 401(k) from a previous employer) to a traditional IRA in the same year? What are the negative consequences?

Thanks!

Scott

Harry Sit says

In Step 1 you “hid” pretax money to avoid the pro-rata rule which causes you to pay tax on a large portion of your conversion. The pro-rata rule is applied to the balance on Dec. 31. Rolling over from an employer-sponsored plan to a traditional IRA and leaving the money there through Dec. 31 will trigger the pro-rata rule again.

Scott says

Thanks Harry!

I see what you mean. The reason why I ask is because I have a very small balance in an old 401(k), so I’m ok with paying tax on it.

My plan is to:

1)Rollover the small 401(k) balance into my traditional IRA that previously had a $0 balance (this rollover amount would be the only amount of pre-tax dollars in any IRA)

2)In 2014, immediately convert the entire amount to my Roth IRA (because this conversion is 100% taxable, no need to wait or be concerned with the step transaction doctrine)

3) Once that conversion is complete, I’d contribute in 2014 my nondeductible $5,500 for 2014 into the traditional IRA

4)Wait a few months

5)Near the end of 2014, convert the entire balance of the traditional IRA, paying tax on whatever small amount of gains occurred since the $5,500 contribution.

Does this sound like a good plan? Are there any considerations I’m missing?

Thanks!

Scott

Harry Sit says

If you are OK with paying taxes on the small 401(k) balance, you can rollover from the 401(k) directly to the Roth IRA. It will save you some paperwork.

Steve says

Harry,

I have a small non-deductible IRA (approx. $5k) and am over the income limit. Already max out my 401k and now make supplemental monthly contributions to the non-deductible IRA. My plan is to convert majority of the balance to a Roth IRA, likely at end of 2014. From an ongoing perspective, do you think it is better, due to the IRS or otherwise, that I would only convert funds to the Roth on an annual basis, or would converting funds a couple of times a year (or more) be of no harm. Trying to pin down the mechanics of this going forward, not just the one time conversion.

Thanks,

Steve

Tom in Fla says

Hi- This may be repetitive, but I’ll ask it anyway. I havent done the back-door as described, but over the years I have done partial transfers from a traditional IRA (which was transferred from a ex-employer’s 401K plan) to a Roth IRA (as contributions) and then had tax/penalty free access to those contributions after 5 years (with no problem from our friends @ the IRS)

Im about to advise a friend to do the same thing (except all transfers during tax year 2014). In re-reading your original page, you state to not convert to a 401K to Traditional IRA to Roth in the same year. I would like my friend to do it this way so they have the option to do partial conversions in subsequent years. I dont see any prohibition to doing a 401K to Trad IRA to Roth IRA transfer (check being made out to receiving institution not to account holder) in this manner. Why does your page advise against it?

Thanks!

Rebecca says

Hi, I read it somewhere that the amount of money you transfer from your rollover IRA or SEP IRA to your 401K should be under the limit of $17,500 or $23,000 for the year combining with your regular annual 401K contribution. Is that right?

Thanks!

Harry Sit says

That’s not right. The rollover doesn’t count toward the annual contribution limit.

Anne says

Thanks, TFB, for your great posts! Love reading them. I have almost completed the backdoor Roth for my husband: employer 401K (at Vanguard) accepted pre-tax T-IRA contributions, and we will plan on converting the non-deductible T-IRA to his R-IRA before year’s end. Thanks for the excellent guidance! Now on to mine, for which I have 2 questions. My employer’s 403B now accepts incoming IRAs (didn’t last year), and has an assortment of high expense funds as well as low-cost Vanguard Index and Target Retirement funds. The brokerage house charges a 0.24% annual service fee quarterly on the growing asset balance. I contribute the max of $23K (over 50 y.o.) to a Target Retirement fund, and last qtr paid $50/qtr for the service fee. This is also the first year that I have had a small amount ($320) of self-employed income, though this is not a regular endeavor, so I may not have self-employed income every year. Questions #1&1A: Do I roll my pre-tax IRA into the employer 403B, paying for an increasing service fee, or open up a Fidelity Solo 401K since I do have SE income this year to qualify? It seems the fees at Fidelity will be less/none. Must I have SE income every year in a solo 401K? Question #2: If I do open up the Fidelity Solo 401K (roll-in the pre-tax T-IRA b/c that’s the primary purpose) and contribute $292 of SE income to 401K (figure per Fidelity calculator), am I causing IRS problems because I will have contributed the max of $23K to a employer 403B? Thanks in advance.

Harry Sit says

If the small self-employment income is unlikely to recur, I don’t think it’s worth the trouble. You won’t be able to contribute $292. Use my calculator: http://thefinancebuff.com/solo-401k-for-part-time-self-employment.html Unless you need to rollover a huge sum, 0.24% on that wouldn’t be so bad.

Lisa says

In your Form 8606 example, why isn’t Part I filled out? Didn’t you make a non-deductible contribution in 2013?

Harry Sit says

See previous reply to another reader above.

edward says

Excellent article, you really did a good job with this article. I have a quick question. I have a decent sum in a rollover IRA with Fidelity from a previous employer 401K as well as a Roth IRA I started several years ago. I currently don’t meet the income requirement to be able to contribute directly to the Roth IRA. I am interested in a backdoor Roth for the Rollover IRA. I don’t want to roll it to my current employer’s 401K because they have very limited mutual funds; no index funds. I don’t have the money to pay the taxes on the Rollover IRA either, nor am I self employed. What are my options? Can i transfer the Rollover IRA into my current employers 401K, then roll it back out after? Thanks

Harry Sit says

If you move your IRA money to your employer’s plan, most plans allow you to roll it back out. However, in order to avoid the tax on conversion, the money has to stay there through December 31. Then you face the same issue next year unless your income is going to fall below the limit. If the investment options are bad, it may not be worth it. Other than creating some self-employed income or waiting until you have a better plan, there are no other ways around it.

RobRob says

Hi Harry, great article. I have a problem where I opened a Roth IRA directly, funded it with $5,500 and invested in it. However, it turns out that my wife and I will be making too much this year to qualify for a Roth IRA. So what is the best way to handle this. Can I make my Roth IRA a Traditional IRA and then convert it back to a Roth IRA? It seems crazy that would be allowed, because it doesn’t seem any different then my current situation in my Roth IRA. But if it’s possible, how does that end up being reported at tax time. Does it seem like the original Roth IRA never existed? Also, would I need to open a new Roth IRA account so it’s not the same account that I’m converting to? Also, since I have the money invested, do I need to sell everything back to cash before moving back to traditional IRA? Sorry for so many questions. Thank you for any advice you have.

Harry Sit says

You recharacterize your contribution to a traditional IRA. See previous comment. They will move the shares. You don’t have to sell. Then you follow all the steps in this article (except step 2, which you already did) to convert it, including “hiding” any pre-tax traditional, SEP or SIMPLE IRA. It can be converted into the same Roth IRA. You pay tax on the earnings.

RobRob says

Hi Harry, thank you for the information. I got the necessary forms to follow that process. I was hoping you could settle a debate between a co-worker and me. He has been doing this conversion from trad to roth for a couple years and he is adamant that he can withdraw the principle anytime he wants like a bank account. But I found the following information on the IRS website that seems to state that following this conversion process will lock up each year’s contribution for 5 tax years. How do you interpret this?

“Distributions of conversion and certain rollover contributions within 5-year period. If, within the 5-year period starting with the first day of your tax year in which you convert an amount from a traditional IRA or rollover an amount from a qualified retirement plan to a Roth IRA, you take a distribution from a Roth IRA, you may have to pay the 10% additional tax on early distributions. You generally must pay the 10% additional tax on any amount attributable to the part of the amount converted or rolled over (the conversion or rollover contribution) that you had to include in income (recapture amount). A separate 5-year period applies to each conversion and rollover. See Ordering Rules for Distributions , later, to determine the recapture amount, if any.

The 5-year period used for determining whether the 10% early distribution tax applies to a distribution from a conversion or rollover contribution is separately determined for each conversion and rollover, and is not necessarily the same as the 5-year period used for determining whether a distribution is a qualified distribution. See What Are Qualified Distributions , earlier. ”

http://www.irs.gov/publications/p590/ch02.html#en_US_2013_publink1000231030

Harry Sit says

The best way is to treat an IRA as an IRA, for retirement. Don’t withdraw until you retire, which I assume is way beyond 5 years. Then you don’t have to worry about complex rules.

If you really want to know, 10% penalty is only on the amount “you had to include in income.” If he only had to include $10 in income because that was how much the money earned before it was converted, then the penalty is 10% on $10. Finally there are those ordering rules (“See Ordering Rules for Distributions , later”). If by the ordering rules his withdrawal doesn’t touch the $10, then the penalty is 10% on nothing.

Still, pretending it’s all locked up until retirement is the best.

RobRob says

I agree that pretending it’s locked up is the best. But was exploring emergency situations where access to the money was needed. But I’m still confused by “had to include in income”. When I put $5,500 in a traditional IRA from my bank account, this is from my income. When I convert it to a Roth IRA, that $5,500 is money I am reporting as income on my W-2. So doesn’t that make the entire amount subject to the 5 year 10% penalty rule?

Harry Sit says

W-2 is issued by your employer. You get it whether you convert or not. It’s not something “you had to include in income” triggered by the conversion. If your $5,500 earned $10 before you converted, or in your case when you recharacterize it already earned something, you include the earnings in income when you convert.

Lucas says

Another couple of questions along the lines or RobRob. I have already completed the recharacterization back to Traditional IRA, but now have about $6500 sitting in the Traditional IRA (due to Roth IRA growth throughout the year). Can I convert the full amount back to the Roth IRA or only $5500 (I am under the catch-up age)? If I can convert the entire amount, I assume I would have to pay taxes on the other $1,000? If I can’t convert is there any harm in letting it sit in the Traditional IRA for next year’s contribution?

Harry Sit says

You can convert $6,500. You pay taxes on $1,000, but you have to make sure to clear your other traditional, SEP, or SIMPLE IRAs if you have any.

Dave Peterson says

Good evening,

I’m doing my end of year planning….and my Edward Jones person was not sure of the answer.

I did a backdoor Roth this spring (before the April deadline) for tax year 2013 and thus did the conversion in 2014. Am I allowed to do a second conversion in 2014 for my 2014 tax year so I can get these rollover conversions into the same year. OR…do I wait again until the spring of 2015 to do this rollover for 2014 taxes…and then remain on this “offyear” type of doing this? Please note that I’m forgetting the technical terms that I need to relearn…but hope you understnad my question!!

THANKS….

Harry Sit says

Yes you can contribute for 2014 in 2014 and convert in 2014 again. It’s better this way. See the linked article “Make Backdoor Roth Easy On Your Tax Return” under Step 5.

Elizabeth Dean says

Harry–this is a great explanation of this approach. Here is my question:

Facts:

1. Until October 2014 was in job with salary of 50,000 and no retirement plan. Have not made any 2014 Roth contributions although intend to max out by April deadline.

2. In October moved to another job with salary of $105,000 and bonus plan (but don’t expect bonus in 2014). This job has a 401 k which I will join in 2015.

3. Question: If Traditional IRA contribution is NON deductible, does there have to be any concern with the rule about reducing contribution depending on filing status, income, or whether there is retirement plan with employer?

4. Question: What if I am making Roth contributions in 2014 and 2015 for 2014 tax year, and suppose the bonus kicks me above the $114,000 limit. Since it is for tax year 2014 and income for calendar year 2014 is below 114,000 does that hold for the Roth contributions? Or would I need to do some sort of recharacterization to a Traditional IRA? The bonus would be at year end I would think and I would have already filed 2014 tax return…

I appreciate any thoughts you have on this!

Harry Sit says

The eligibility is calculated by your income in every calendar year. It looks like you will be under the limit for direct Roth contributions for 2014. For 2015, you will have the expected bonus plus the higher salary. If you max out your pre-tax 401k contributions at $18,000 there is still a chance for you for fall below the income limit for a direct Roth contribution. If you’d rather not wait and see, you don’t have to worry about income limit if you make a non-deductible contribution to a traditional IRA. Converting it tax-free will require that you clear out any other traditional, SEP, or SIMPLE IRAs as outlined in this article.

Ros says

Hello and thanks for the great article!

I’ve funded my TIRA (with non-deductible funds) for the last 4 years (did 2014 and 2013 this past spring April 2014 and 2012 and 2011 in spring 2012) with the intention of the back door ROTH. Never followed through, partly because I didn’t actually know the step by step process, so again Thank You for great article!!

Questions:

1) I never filed form 8606 for any the TIRA contributions, didn’t realize I had to (I never informed my accountant of the TIRA). Do I need to go back and amend all my returns with form 8606?

2) Since I contributed for the last 4 years, it now has $22K ($1K of which is capital gains) – any conversion amount limits per year? Can I convert the full $22K (all non-deductible) in one shot and how does that impact the 8606 form/tax returns?

Thank again. Really appreciate the article and any insights you can offer for my situation!!

Harry Sit says

1) You can file the 8606 Form just by itself. Find the prior years’ forms here: http://apps.irs.gov/app/picklist/list/priorFormPublication.html

2) No limit. After you catch up on the 8606’s, it’ll be the same as the example shown.

George says

Greetings,

About 3 months ago I did a backdoor Roth for $6500 (over 65).

Due to changes in my tax brackets it would be beneficial if I did a 2014 Roth conversion for $25,000 sourced from my Rollover IRA. All of the conversion amount will be taxable.

Will doing this second Roth conversion affect the zero tax on the first conversion?

Harry Sit says

The first conversion isn’t zero tax when you have a rollover IRA because you didn’t do Step 1. If you don’t do Step 1 on the remainder of your rollover IRA (and your other traditional, SEP, or SIMPLE IRAs if any), it still won’t be zero tax.

George says

I plan to transfer all the assets of my rollover IRA into my 401k before the end of the year. It is my understanding that it is the amounts in your IRAs on 12/31 that determine the tax consequences. Sorry I forgot to mention this.

So will doing this second Roth conversion affect the zero tax on the first conversion?

Thanks.

Harry Sit says

I wouldn’t do it that way, but if you want to take the [small?] risk, it’s your call. See the paragraphs under the heading “Reverse the Order?” The tax return doesn’t show first or second conversion. It’s all added together. You show you contributed $6,500 non-deductible, converted $31,500, and therefore you pay tax on $25,000. You can say your first conversion was zero tax and your second was fully taxable. Or you can say both were partially taxable. It ends up the same.

Barry Barnitz says

What effect would being the beneficial “owner” of an inherited traditional IRA have on the pro-rata rules?

Harry Sit says

No effect unless you are the spouse and you make the inherited IRA yours. See Inherited IRA and Roth Conversion Pro-Rata Rule.