Although I believe a traditional deductible IRA is often better than a Roth IRA, a Roth IRA is still better than a taxable account if you aren’t eligible for a deductible contribution to a traditional IRA. When you aren’t allowed to contribute to a Roth IRA because your income is too high, there’s still a backdoor. It takes some effort but it’s worth it.

So here it goes: a complete how-to for the Backdoor Roth.

What is the Backdoor Roth?

The Backdoor Roth is an indirect way to contribute to a Roth IRA when you are not eligible to contribute directly due to high income.

Who should consider the Backdoor Roth?

If your income is “too high” for contributing to a Roth IRA, you should consider the Backdoor Roth. The IRS publishes the income limit for contributing to a Roth IRA every year.

If your income isn’t above the thresholds, stop reading — this article doesn’t apply to you. Instead, consider a deductible contribution to a traditional IRA if you qualify for one or contribute to a Roth IRA directly.

Why should someone consider doing the backdoor Roth IRA?

When you have money in a taxable account, you pay taxes on interest and dividends. When you eventually sell the assets, you also pay taxes on the capital gains. If you put money in a Roth IRA, you don’t pay those taxes.

Ready? Here it goes:

Step 1 – “Hide” other IRAs

If you don’t have any traditional IRA (say as the result of a rollover from a previous 401k or 403b), SEP-IRA, or SIMPLE IRA, you are in good shape. Skip to step 2. If you are married, please note IRAs are owned by one and only one person. Each spouse should look at his or her IRAs separately. If you don’t have any traditional IRA, SEP-IRA, or SIMPLE IRA but your spouse does, you are not affected but your spouse is affected.

If you have a traditional IRA, SEP-IRA or SIMPLE IRA, and you don’t mind paying taxes to convert all of them to a Roth IRA now, also skip to step 2. When your balances in those IRAs are small, the taxes you will have to pay when you convert them are also small.

If you have a traditional IRA, SEP-IRA or SIMPLE IRA, but you don’t want to convert them and pay taxes at a high rate just yet, rollover almost all the pre-tax money to an employer sponsored retirement plan: 401k, 403b or 457. Most employer-based plans accept incoming rollovers.

An inherited IRA doesn’t count if you keep it separate as an inherited IRA (see Inherited IRA and Roth Conversion Pro-Rata Rule).

Everything in the traditional IRA, SEP-IRA, and SIMPLE IRA, except any non-deductible contributions you made in the past, is pre-tax money. For example if your traditional IRA has $34,000 in it and you made $10,000 non-deductible contributions in the past, $24,000 is pre-tax money. Move $24,000 to an employer sponsored plan. If you never made any non-deductible contributions in the past, all $34,000 is pre-tax money.

If you’ve made non-deductible contributions to your traditional IRA in the past, a key requirement is that you leave enough money behind in the traditional IRA — at least equal to your past non-deductible contributions. Don’t cut it too close. Consider market fluctuations and leave yourself a small cushion to show that on the day the money goes from your IRAs to your employer plan you still have slightly more money in the IRAs than your past non-deductible contributions.

You are allowed to rollover only pre-tax money from a traditional IRA to an employer plan because of a special rule. Read more about this special rule in IRS Publication 590A. Look for “Tax treatment of a rollover from a traditional IRA to an eligible retirement plan other than an IRA” near the end of page 22.

If your plan doesn’t accept incoming rollovers or if you don’t like your plan, create some self-employment income and set up a solo 401k plan, also known as a self-employed 401k plan or individual 401k plan.

House-sitting, dog-walking, tutoring, helping neighbors set up computer equipment, etc. are all good ways to earn self-employment income. Remember you don’t have to make a living on it. You just need a little self-employment income in order to qualify for setting up a solo 401k plan. See Solo 401k When You Have Self-Employment Income.

Step 2 – Make a non-deductible contribution to a traditional IRA

After Step 1, you either don’t have any traditional IRA, SEP-IRA, or SIMPLE IRA, or you only have a traditional IRA with non-deductible contributions in it (maybe plus a bit of earnings). You make a non-deductible contribution to a traditional IRA. As long as you have earned income, even if your income is “too high,” you can still make a non-deductible contribution to a traditional IRA.

The IRS publishes the contribution limit ever year. Look it up.

Step 3 – Wait

The law does not impose any waiting period between a contribution and a conversion (step 4). However, some are concerned that if you convert too soon, it can be seen as an abuse.

There is no official guideline for how long you should wait. Some say a few days; some say 30 days; some say 6 months; some say wait until the end of the year. Pick a time you feel comfortable with.

Having the money sit in a traditional IRA for a short period of time is not going to kill you. The tax on the earnings won’t be much because you won’t have a lot of earnings.

Step 4 – Convert the traditional IRA to Roth IRA

Ask your IRA provider how to do this. Some can do it online. Some will want a signed form. There is no income limit for the conversion. Because your Roth IRA conversion comes primarily from your non-deductible contributions, there will be very little taxes on the conversion.

Be sure to specify you want to *convert* money in your traditional IRA to a Roth IRA, not *recharacterize* your contribution. The two are not the same. Using the wrong term can lead to bad consequences. See Traditional and Roth IRA: Recharacterize vs Convert.

Also be sure to choose “no tax withholding” for your conversion. This way 100% of the money goes into your Roth account.

Step 1 is necessary because if you didn’t do it, your conversion will be taxed by the percentage of pretax money in all IRAs (the “pro-rata rule”). Money in employer sponsored plans doesn’t count in the pro-rata rule.

Step 5 – Report on your tax return

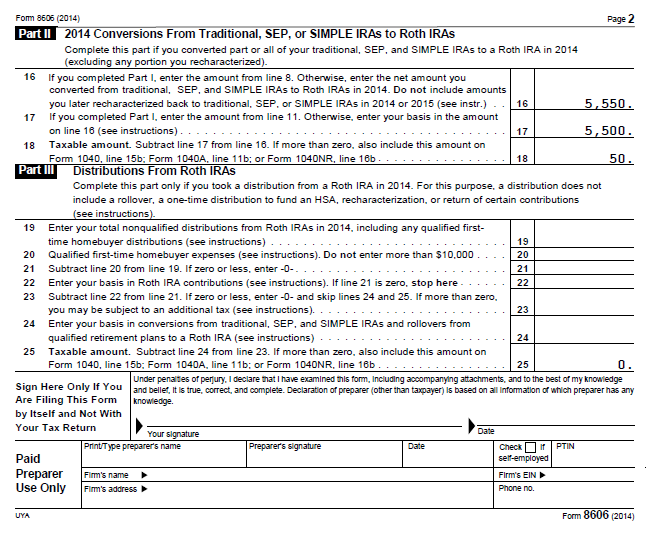

Since you made a non-deductible contribution to a traditional IRA in Step 2, you will need to include Form 8606 when you file your taxes. It’s a very simple form. If you use tax software, it will be included automatically if you answer the questions correctly.

Contributions to an IRA can be tagged for the current year or the previous year (if done before April 15 in the following year). Conversions are always tracked to the calendar year in which it actually happened. You report on the tax return your non-deductible contribution to a traditional IRA *for* that year and your converting to Roth *in* that year. If you contribute for the previous year and then convert, you will have to report in two separate years. It’s much simpler if you contribute for the current year and then convert before December 31. See Make Backdoor Roth Easy On Your Tax Return.

If you use TurboTax, see How To Report Backdoor Roth In TurboTax for a step-by-step guide. If you use H&R Block software, see How To Report Backdoor Roth In H&R Block Software. If you use TaxACT, see How To Report Backdoor Roth In TaxACT. If you use FreeTaxUSA, see

How to Report Backdoor Roth In FreeTaxUSA.

Here’s an filled-out example of Form 8606 produced by TaxACT software. I’m assuming by the time you converted, you had $50 worth of earnings.

Step 6 – Repeat Steps 2 to 5 next year

Step 1 is a one-time task. After it’s completed, you just repeat Steps 2-5 every year.

Most IRA custodians will keep an account open for a year even after the balance goes to zero. In such case next year you just contribute to the same empty traditional IRA and convert into your existing Roth IRA. It’s not necessary to open new accounts.

No Rollover to Traditional IRA

When you are repeating steps 2 to 5 every year, remember not to roll over from an employer-sponsored plan to a traditional IRA in the same year, either before or after you do the Roth conversion. You can leave the money in the original plan, roll over from one plan to another plan, or roll over to your own solo 401k, just not roll over to a traditional IRA. If you must roll over to a traditional IRA, you will have to “hide” it again using Step 1.

Reverse the Order?

Some readers asked about reversing the order: do Step 1 after Step 4 but before December 31 in the same year. I don’t recommend it, even though it works the same on the tax form.

When you roll over from your traditional, SEP or SIMPLE IRA to a qualified plan, you are explicitly allowed to pick pre-tax money only. Not so when you do the conversion; you are not supposed to pick only after-tax money. The tax forms don’t show exact dates. If you reverse the order, you can probably get away with it if you are not audited, but I think it’ll be messier if you must explain to an IRS agent.

It’s too much trouble. Why don’t they just open the front door and let everyone contribute directly to a Roth IRA?

If the front door is wide open and everyone can contribute directly to a Roth IRA, the government will lose too much revenue. The income limit is imposed to reduce the revenue impact. Only those who know about the backdoor and are willing to perform the necessary steps can take advantage of the backdoor Roth IRA. Diligence brings rewards.

Will they close the backdoor?

It’s possible the backdoor will be closed. The President already included in his budget proposal to close it although it’s hard to get it passed by Congress. If you are afraid the backdoor will be closed, you should do it now when the backdoor is still open.

***

Comments are closed because questions are becoming repetitive. Be sure to read existing comments for answers to questions similar to yours.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

JW says

Thank you Harry/TFB for the answers to my question above. That is awesome. That scenario was for my wife’s recharacterization to a Roth IRA. I have a question about mine also if you would be so kind as to advise.

My Trad IRA contains a mix of a 401k that was transferred in from an old job in 2004 as well as the same two years where I exceeded the income limits in 2008 and 2009 and also 2012 (until I realized early on that I would exceed income limits). Those years, I contributed $4995, $4995 and $416.67 respectively to a Roth IRA, but recharacterized them to a Traditional IRA (since I exceeded the income limits unexpectedly each year due to bonuses), for a total of $10,406 in non-deductible contributions.

The current value of the Trad IRA is $24,700. I am not certain of the amount of the 401k transfer in or the cost basis of the 401k that was transferred. My best guess is that the value of the 401k transfer was ~ $9975 and the cost basis of the 401k that was transferred was ~ $6000 but it is just that, a guess.

Q1: Any advice on how to handle this one?

Q2: What do you do when you don’t have perfect cost basis records?

Q3: The tax rate on any gains would the the 15% capital gains tax rate, correct?

Q4: All of this is treated in separate buckets (wife and mine recharacterization), correct?

Harry says

JW – If your 401k from the old job was pretax money as most 401k’s are, you have zero basis in that money. So you have a $24,700 IRA with $10,406 in non-deductible contributions. If you have a place to “hide” the $14k difference, just follow the steps in the main article. Otherwise if you want to convert the whole thing you will pay tax on the $14k, as ordinary income, not capital gains. Yes yours and your wife’s are completely separate.

Bebe says

This is great! I did not realize we could do this. Here is my situation:

I have a pre-tax IRA account with $9,000, I also have 2 non-deductible IRAs, one has $14,500 (with 12,000 basic) and the other has $12,000( with $11,000 basic).

I screwed up; I forgot that I had a pre-tax IRA, so I converted part of the deductible IRA to Roth last month before transfer my deductible IRA to 401K

Question #1 : Could I just go a head and transfer my deductible IRA to 401K now without re-characterize the Roth Account back to traditional? and hopefully, everything will resolve by the end of the year since I have done all of these this year.

Question #2: Here is what my friend and I have argued over (without looking at IRS rules). My friend thinks I could also transfer the earning of my non deductible IRA ($2,500 + $1,000) to my 401K and defer the tax liability; is he right? I am doubtful.

Ash says

Hi Harry/TFB,

Me and my spouse are not eligible to make a direct contribution to ROTH IRA this year as our AGI is more than permissible limit. We decided to contribute to traditional IRA and convert it into ROTH IRA immediately within few days. How do we declare this on 1040 and 8606 form ? This is the first time we would be making any contribution to IRA and we both are not covered by any retirement plan by our employer

Assuming our total wages is $200,000 and each of us contribute $5000 to IRA and convert it immediately to ROTH with $0 earnings on it.

1. Form 1040: line 7 $200,000

1. Form 1040: Should we declare $10000 as deductible IRA on line 32 (As we are first making a contribution to IRA)

2. form 1040: Line 36 $10000

3. Form 8606 part 2, for conversion for each of us. Each form would like below ?

line 16: $5000

line 17: $0

line 18: $5000 (which would mean we need to declare this on form 1040 line 15b)

4. Form 1040: Line 15b $10000 for both of us. (Because of Line 18 on Form 8606)

5. Form 1040: Line 22 $210,000

6. Form 1040: Line 37 would be $200,000 (as $10000 is cancelled by line 36)

Is that correct ? Do we need to fill part1 also ? if yes for each of us

7. Form 8606: Line 1 $5000

8. Form 8606: Line 2 $0 (Since we are filling it for first time)

9. Form 8606: Line 3 $5000

10. Form 8606: Line 14 $5000

Line3: In 2012, did you take a distribution from traditional, SEP, or SIMPLE IRAs, or make a Roth IRA ?

conversion?

Would answer be no to this ?

Your help would be greatly appreciated.

Thanks,

Ash

Harry says

Ash – If both of you are not covered by a retirement plan at work, your contribution to a traditional IRA is fully deductible. At a high income level, I would just leave it like that and not convert to Roth. If you still want to convert to Roth, then your #1 – #6 are correct. The tax on the conversion washes out the deduction. Part I of Form 8606 would be blank.

Ash says

Thanks Harry for getting back.

Why did you say this ? At a high income level, I would just leave it like that and not convert to Roth. any specific reason why we shouldn’t convert to Roth ?

Harry says

Ash – Because you lose the deduction when you convert. People do the backdoor because they don’t get a deduction anyway when they are covered by a retirement plan at work. A deduction is very valuable at high income levels. See previous article The Forgotten Deductible IRA.

doug says

Harry, I have tried to get an answer to this and haven’t been able to. I followed your steps last year for the first time, and I think everything went perfectly. This year, however, I am unsure my form 8606 is being filled out correctly. I have never owned a traditional ira before doing these backdoor conversions. Should my form 8606 look the same year after year? I thought that form 8606 was used to track contributions, but this year after filling out the form it looks exactly like last year, with no running tally. Is that correct?

Love the blog by the way!

Harry says

Doug – It would look the same if you contribute for the current year and then convert in the same year. If you contributed in 2011 for 2011 (not contributing in 2011 before April 15 for 2010) and you converted in 2011, and if you did the same again — contributed in 2012 for 2012, converted in 2012 — then you 8606 would look the same year after year, except the annual contribution limit going up from $5,000 to $5,500 in 2013 (add another $1,000 if you are over 50). This is the cleanest way.

doug says

That is my situation. Thanks a lot!! I spent hours trying to find that out on google. There is a lot of info out there on how/why to do a backdoor roth, but little on the actually filling out of the 8606 form.

Jon says

I’ve read some speculation that Congress will close the backdoor Roth option soon to generate more tax revenue. I’d like to contribute now but don’t want to have to undo my contribution later this year. Anyone willing to speculate whether the backdoor option might go away?

Harry says

Jon – Anything can happen when it comes to Congress, but if we are just speculating I would say any change will be effective in a future year, not retroactive for the current year.

James says

Hi Harry/TFB,

I could not find the answer to my situation after searching for severl hours. Your help is greatly appreciated.

I filed my 2012 Tax in march and also received my refund. Only later after filing my 2012 tax, I came to know about back door roth IRA ( my income limits are high for direct IRA ) . So, I then contributed non-deductible $5000 in TIRA for year 2012 ( few days ago on April 1st ) .

As a result , my 2012 tax return does not reflect my TIRA contribution for $5000

What do I need to do correct this?

a. Should I report this by separately mailing 8606 form to IRS?

or

b. Should I amend my 2012 tax return with 1040X ( I used turbo tax ) and add this 8606 form in turbo tax?

or

c. Should I do something else ( if not a or b )

note: If the choice is between a and b, I prefer b since I can e-file instead of mail.

Thank you in advance,

James

Harry says

James – Either (a) or (b) works. Because the contribution is non-deductible it doesn’t change anything else except the 8606. If you convert in 2013, the conversion will go on 2013 return you file in 2014.

James says

Thank you Harry for the prompt response.I appreciate that.

Tina says

Hi TFB,

I’ve done backdoor IRA in year 2010, 2011, and 2012. $5000 each year. What should my 8606 look like? e.g. should the field 2 be 10,000 and field 13 and 14 both be 15,000? In your filled-out example why is field 14 zero? Does this year’s field 14 number goes to next year’s field 2?

Thanks very much!!!

Tina

Curious_George says

Thanks for the thorough and thoughtful explanation.

My wife rolled-over all of her tax-deferred accounts to an individual 401k she set up for her small self employed business. Her income for her self employed business will be below the maximum 401k contribution limit. So she is thinking about contributin 100% of her income to her 401k. From what I read in the IRS publications, this should be OK. Does doing this arouse unecessary attention from the IRS?

Harry says

Curious_George – I don’t see why it would but of course I don’t work for the IRS.

Sunshine98 says

I have a question. I opened a IRA through vanguard because I was not eligible for a ROTH a few years back and have been contributing the max ever since. It is up 12K. I would like to do a back door Roth and contribute the max to it. Will I owe any taxes?

And if I continue to do the max on the Roth each year do I just have to make sure what was gained in the IRA stays there?

Mike says

Is there a limit on the number of times that I can convert the traditional IRA to the Roth? So I opned the account, I only funded say $1k. Can I convert that $1k and then have a $0 balance until i have another $1k to deposit and then convert for a 2nd, 3rd, 4th, 5th time in a given tax year? Or is it cleaner and make more sense just not to open the account until you have the full $5500 and only do 1 conversion?

Harry says

There is no limit but it would be cleaner to just do it once for the full amount.

mongo says

Harry, no problem to convert multiple times. It does not have to be all at once. I always contribute to my Vanguard money market, wait a few days for everything to clear, then convert. By doing so, I make it cleaner for me so I never show any profit or loss during the conversion. I put $2000 into a T-IRA and converted to a R-IRA, and two months later $3000 and then converted. These were my 2012 contributions that were actually contributed prior to 15Apr13.

avanvliet says

Thank you for a very informative how-to article. I am very interested in doing the Backdoor Roth before the end of the year and spoke with a CFP earlier today about it. However I am now confused about something he said – that I will be taxed prorata on the deductible and nondeductible contribution earnings.

Here are the details as I explained them:

$300K in T-IRA which is a mix of previous employer 401(k), deductible and nondeductible contributions.

Last filed 8606 states $40K basis (nondeductible contributions).

I planned on transferring $260 T-IRA to accepting 401(k), and converting $40K T-IRA to Roth IRA. (Amounts to be altered slightly to adjust for market fluctuations, as your article advises)

Does one have to figure out what % of earnings are tied to each the deductible and nondeductible contributions before doing the Backdoor Roth, as I was told by the CFP? Doesn’t the $260 T-IRA transferred to the 401(k), which includes earnings from deductible and nondeductible contributions, get taxed later when distributed as an RMD? In doing the Backdoor Roth, shouldn’t only the nondeductible T-IRA contributions (NO EARNINGS) be converted?

Your article explained it so clearly and makes sense, so I don’t understand where the CFP’s prorata comment applies. I want to complete the Backdoor Roth but don’t want any tax surprises. I would appreciate if you could clarify this. Thank you!

Harry says

If you are paying the CFP you should ask him to clarify if you have questions.

> Does one have to figure out what % of earnings are tied to each the deductible and nondeductible contributions?

No. Everything above your nondeductible contributions are pre-tax, whether they are earnings or pre-tax contributions. All pre-tax money can be rolled into a 401k (if your plan accepts). You will still leave a small amount of pre-tax money behind as a buffer for market fluctuations. When you convert you will be taxed prorata, based on the small amount of pre-tax money left behind and the nondeductible contributions. Just convert the whole thing and pay tax on the small amount of pre-tax money left behind.

Chris says

Can I do the Back door Roth if I have a pension plan at work?

Harry says

Yes you can. Pension plans usually don’t accept incoming rollovers. You still need a 401k-type plan for step 1 if you need to “hide” pre-tax money in an IRA.

Chris says

Okay so I have no current traditional IRA. I will open a non-deductible tradition IRA for $6500.00 (over 50) on 12-30-2013. On 01-03-2014 I will covert this non-deductible traditional IRA to a Roth IRA. My 2013 – 8606 should have $6500.00 on lines 1,3,5,8,9,11,13,16,17? And 0 0n line 10? Assuming that I have no increases over the 5 day period. Sound right?

Harry says

No. Line 8 is zero if you wait until 01-03-2014 to convert. Read the instructions:

“8. Enter the net amount you converted from traditional, SEP, and SIMPLE IRAs to Roth IRAs in 2013. …”

It’s easier if you contribute and convert in the same year.

Chris says

Sorry. Got it now. Thank you!

H says

I have a Vanguard rollover IRA and have access to a Fidelity 401k account. I contacted Fidelity about rolling the IRA into the 401k and they cannot do the transfer electronically. I am currently waiting on Fidelity to get me the paperwork while holding the Vanguard IRA check made out to Fidelity.

When can I make the $5500 IRA contribution to Vanguard and reclassify the contribution into a Roth? Can I do it now or should I wait until Fidelity has credited the rollover IRA funds into my Fidelity 401k?

Harry says

I think you are OK with contributing now. Instructions for Form 8606, line 6, say

“Note. Do not include a rollover from a traditional, SEP, or SIMPLE IRA to a qualified retirement plan even if it was an outstanding rollover.”

That means that line would be zero, which means no prorating on your conversion.

Be sure to use the right terminology when you speak to someone at Vanguard or Fidelity or when you are dealing with a CPA or tax software. It’s not reclassify, or recharacterize. It’s convert. See previous article Traditional and Roth IRA: Recharacterize vs Convert. At Vanguard (mutual fund side), converting is done simply by “exchanging” one fund in the traditional IRA to another fund or the same fund in the Roth IRA.

Chris says

By the way Harry this is a fantastic blog! Thanks!

H says

Thanks for the reply. Went ahead and funded my IRA and plan to covert the IRA to a Roth before Jan 1st 2014.

In regards to step 6 for repeating the steps in the future can it be any time in 2014 or should I wait until after April 15 when Federal income taxes are filed?

Harry says

Any time. When you make the contribution you get to designate which year the contribution is for. Just choose 2014.

H says

Well it was incredibly easy contributing the $5500 into an IRA and then exchanging it into a Roth account through Vanguard. Took about a day and a half and I did everything online without speaking to a single CS rep. The hardest part was moving my old IRA rollover from Vanguard to my Fidelity 401k prior to contributing to the IRA because of the need for snail mail paperwork by Fidelity.

Wish I learned about this 2-3 years ago. I asked a couple of co-workers who could benefit from doing this and none had ever heard of it. Some have financial planners and accountants who never mentioned it including my own accountant. What’s up with that?

charles says

Why did you add the comment to wait some time between funding and conversion?

H says

The logic is to avoid the appearance of “gaming the system”.

Considering that people have been doing this for 3-4 years and the IRS has not sought to clarify if there is an “appropriate” waiting time or not I don’t think it’s worth worrying about.

Harry says

On the other hand, waiting a short period is pretty harmless. Considering that you are getting tax free earnings for many years, it’s really not necessary to convert exactly on the next day. You don’t have to wring every last drop out of this.

Chris says

Okay so I had a zero balance in my traditional IRA account. I made a $6500.00 2014 contribution to that tradition IRA account. A dividend of 21 cents posted to the balance a week later. Should I convert $ 6500.21 or $6500.00 to a Roth IRA?

Jason says

Convert the full amount to keep it clean. you’ll just pay taxes on the $0.21

I think you mean $5,500 since that is the max for 2014, right?

Chris says

I’m 50 using a bump up. Thank you for your help!

charles says

Thanks for the comments on the waiting period. I agree and will probably wait until at least the following month, so they are not on the same brokerage statement.

Gene says

I did the backdoor the last 2 years based on this discussion (thanks Harry!). Just this past week, I contributed $5,500 to my traditional IRA acct and converted the next day into my Roth. I use TD Ameritrade. They said it is done this way all the time. So I don’t think it matters whether you convert the next day or the next month, or to another broker or within the same one. It’s easier and faster if same broker. And like Harry says, if the IRS hasn’t defined the proper holding period, then you should have nothing to worry about. Probably better to convert the next day so you can put your money to work immediately than earning nothing for 1 month. That’s my opinion.

Adrianne says

When you contribute to the Non deductible IRA, do you invest it in a fund BEFORE converting to a Roth? Or do you just convert the cash?

Harry says

It doesn’t matter either way. I invest it in a fund before converting. Some prefer to convert the cash and then invest in Roth because it makes the math a little easier. I use tax software. Computer can do the math either way.

Adrianne says

Thanks Harry! One more question, virtually every resource I have found online advises to convert money to a roth SLOWLY, little by little, over time. Why is this lump sum conversion better?

Harry says

Assuming you are following all the steps here, by the time you convert, the bulk of the money is non-deductible. You only pay taxes on the small amount of earnings. The other articles you read are talking about converting pre-tax money. You pay taxes on 100% of the money you convert. Converting the whole thing will add a lot to your income and give you a big tax bill.

Jason B. says

Hi Harry,

I have a traditional IRA I setup with $3,000 worth of pre-tax money a couple of years ago. It’s now at about $3,500 due to growth and dividends. Due to a high AGI, I’d like to do the backdoor Roth. Would you suggest I move the entire $3,500 to my 401k (if that’s possible) so I can start funding the T-IRA with non-deductible money? What if my 401k plan doesn’t allow that to happen?

Harry says

That’ll work if your 401k accepts incoming rollovers and you don’t mind doing the paperwork. Otherwise you can just convert the whole thing after you make your non-deductible contribution. You will pay tax on the $3,500 if you don’t move it to a 401k.

Venkat says

Harry, if I contribute to my IRA (not opened yet) for 2013, and do Roth conversion before April 15th, am I supposed to file 8606 along with my 2013 tax returns or 2014 tax returns? Also, if I make a contribution to IRA for both 2013 and 2014 say today, and convert all the money (11k) to Roth before April 15th of this year, will this create any reporting issues when filing 8606?

Thank you in advance!

Harry says

Both years. You file 8606 for the year for which you make a contribution and again for the year in which you convert. If you contribute for both 2013 and 2014 in 2014 and you convert in 2014, your 2013 8606 only has the contribution for 2013, while your 2014 8606 has the contribution for 2014 and the conversion in 2014.

Donald Fischer says

Thanks to your excellent advice, I successfully moved more than a year ago some 401(k) funds to a deductible IRA and then, after paying the taxes, through a backdoor into a Roth. Now I will soon come into additional funds from an inheritence which are totally tax-free. Into what type of IRA should I place these funds before transferring them through the backdoor into my existing Roth IRA?

venkat says

Thanks, Harry. If I understand you correctly, I complete only part 1 of 8606 with 2013 contributions and file this with 2013 returns, but both parts of 8606 for 2014 contributions and conversions (for both years), which I would file with 2014 tax returns..

Harry says

@venkat – That’s correct.

dave says

Harry – enjoy the blog a lot.

How does the pro rata rule work for backdoor Roth IRAs formed by 4/15/14 for tax year 2013?

Example: On 12/31/13, I had investments in a traditional IRA consisting entirely of deductible contributions. I roll over the entire traditional IRA balance into a 401(k) on 1/1/14. Then I do a backdoor Roth IRA for tax year 2013. For purposes of the pro rata rule, does the IRS look at my total IRA balances on 12/31/13 or 12/31/14?

dave says

How does the pro rata rule apply for backdoor Roths converted in 2014 for tax year 2013?

Example:

On 12/31/13, I have assets in a traditional IRA, consisting entirely of deductible IRA contributions.

On 1/1/14, I roll over the entire balance of all traditional IRAs into a 401(k).

On 1/2/14, I contribute $11,000 into a nondeductible traditional IRA ($5500 for 2013 and $5500 for 2014).

On 1/3/14, I convert the $11,000 into a Roth IRA.

On 12/31/14, I still have $0 balance in all traditional IRAs.

I know that the 2014 backdoor Roth is entirely nontaxable because on 12/31/14 I have $0 assets in traditional IRAs.

What happens to the 2013 backdoor Roth? Does the pro rata rule look at the balances from 12/31/13 or 12/31/14?

Harry says

@dave – The pro rata rule only applies in the year you convert. You didn’t convert in 2013; no pro rata rule for 2013.

Janet says

Hi Harry:

I made a nondeductible $5,000 contribution to my traditional IRA last year for Tax Year 2012. I forgot to do Step 4 – Convert the traditional IRA to Roth IRA by yearend 2013. What do I do? Can I move the $5,000 to my Roth and also make a contribution for 2013 by April 15? Thanks

charles says

Yes. You can convert a regular IRA to a Roth IRA anytime you want as there is no time restriction for doing such.

An this decision is independent from funding 2013.

Janet says

I just converted the contribution from Traditional IRA to Roth IRA. The person at Etrade said that it will be effective 2014. Now, will it matter if I do a nondeductible Traditional IRA contribution by April 15 for tax year 2013 and convert it in 2014. That means I’ll have two conversions in 2014. Or, should I wait for 2015 to do one of the conversions? Thanks for your help.

Harry says

@Janet – You can convert multiple times in any year.

Tom says

Harry,

Thanks for the comprehensive write-up on the topic.. One ? regarding solo 401k based on your comments

“House-sitting, dog-walking, tutoring, helping neighbors set up computer equipment, etc. are all good ways to earn self-employment income. Remember you don’t have to make a living on it. You just need a little self-employment income in order to qualify for setting up a solo 401k plan”

How do you prove the self employment income for solo 401k plan qualification if it’s small cash income generated from tasks like computer set up? Would reporting that on Schedule C of the tax return alone qualify for the same? Do you need to be registered as an S-Corp or so else to qualify for this..

Harry says

Tom – You don’t have to register an S-Corp or LLC unless you want to do it for other reasons such as limiting liability. It’s perfectly legit to do business as a sole proprietor. Having your customers sign your work orders will document when and what you did for how much money. And of course report the income on Schedule C and Schedule SE. Also see Solo 401k When You Have Self-Employment Income.

funda says

Very interesting stuff and I’m going to try to take advantage of it once I can establish that I will be able in fact to roll-in my TIRAs into my current 401K plan.

I do have one simple and other potentially tricky question.

If I then create a TIRA for the sole purpose of using it as the backdoor to a Roth, does the TIRA close because it now has no funds? Do I open a new TIRA every year?

My wife makes about 12K per year but cannot open a conventional Roth IRA because of our joint AGI (at least that is how I understand the rules). This year, her employer introduced a 401K plan. Can her combined contributions to the 401K plan and the Roth via the backdoor exceed her gross W-2 income?

Thanks.

Harry says

Typically the account remains open even after the balance drops to zero. Next year you just contribute to the same account again.

Her 401k contribution obviously can’t exceed her gross income from the employer but her IRA contribution can come from your earned income.

funda says

Thanks, Harry.

Just got off the phone with Fidelity and learned that my employer does allow roll-ins but they have to be in cash. Since one of my TIRAs is invested in a diverse portfolio of individual stocks acquired over a long period of time, re-creating it within the 401K will be painful and expensive in commissions 🙁

The others only have a couple of mutual funds each and should be easier.

Jimmy says

Hi Harry,

Thank you very much for very informative and very helpful article.

I do have a bit of tricky situation which i will really appreciate your help on.

this is for my wife(doesn’t have work status so no 401k or any other option where i can transfer that money except roth), i put let’s say 5000$ in her Traditional (fully deductible) IRA account last year. now this year due to high income i only can do non-deductible IRA but i am not sure i want to convert that old TIRA money to roth just now due to high tax bracket without checking options. so i wanted to on what amount i would have to pay tax if i just contribute to non-deductible this year and convert everything next year may be. logically all my non-deductible contributions should be tax free assuming i am transferring everything at once, but i have read at some place that that’s not the case and actually a big misconcetption. i wanted to see if you can clarify a bit more on this and explain how the tax will be calculated if i were to convert all money 12000 = 5500(decutible IRA + gain) and 6500(nondeductible IRA(5500)+ gain 500) to roth next year.

Jason says

Hi Harry,

My wife and myself both (over 50) contributed $6500 in 2013 and $6000 in 2012 into our Roth IRA. We just realized that our income is too high for contributing to Roth IRA. What should we do to do a backdoor Roth? We can open a traditional IRA. But do we have to withdraw the previous Roth contributions and pay the penalty first? Greatly appreciate your opinions.

Harry says

Jason – Too high for both years? Did you contribute in 2013 and 2012 for those same two years or for 2012 and 2011 respectively?

If you contributed in 2013 for 2013, you can recharacterize from Roth to traditional now before tax filing deadline in 2014 and then convert to Roth in 2014 by following the steps in this article.

The 2012 contribution is too late to recharacterize. If it was for 2012, you owe 6% penalty each year for 2012 and 2013. Withdraw it in 2014 so you can stop the penalty for 2014. See Correcting an Excess Roth IRA Contribution.

Jason says

Harry, thank you so much for your advice. We contributed in 2013 for 2013, and contributed in 2012 for 2012 as well. Our incomes were too high for both years.

Just want to clarify: if we characterize form 2013 Roth to tradition IRA, and convert to Roth before 4/15/2014, can the Roth count as 2013 Roth?

Can our 2012 Roth contribution be converted to non-deductible IRA because of no income limitation? If not, do we have to pay 10% early withdraw penalty?

Harry says

Jason – You recharacterize your 2013 Roth *contribution* to a 2013 traditional IRA *contribution*. You then convert a said amount from a traditional IRA to a Roth IRA, which you can do at any time, not just before April 15. As an account, a Roth is a Roth; there’s no 2013 Roth or 2014 Roth. As a contribution, you don’t want a 2013 Roth, because you are not eligible.

A contribution can’t be converted. It can only be recharacterized, within a time limit. That time limit already passed for your 2012 contribution. You can only withdraw it now. You won’t owe 10% penalty when you withdraw only the Roth contribution.

For the 6% tax penalty on your 2012 excess contribution to the Roth IRA, look for IRS Form 5329 and its instructions for 2012 and 2013.

Patsy says

I have a question about your example 8606. You had $20 interest that tax would be due on. My question is when multiplying .999 x 15020 for step 11 it equals $15005. Why do you put$15000?

Harry says

Because your non-taxable portion is not supposed to exceed your total basis on line 5. Instruction for line 10 says round to at least 3 decimal places. Make it 0.9987 or 0.99867 then.

Patsy says

I am just confused by lines 11 and 18. I have a basis of $15775 in my nondeductible IRA. When I converted it to a Roth the balance had grown to $16075. The following does not seem right.

Line 10 15775/16075=.981

Line 11 $16075 x .981= $15770

Line 12 $0

Line 13 $15770

Line 14 $15775-15770= $5

Line 18 $305

But I know that Line 14 should be 0 and Line 18 should be $300. Please help explain.

Harry says

Patsy – Same answer, different numbers. Use more digits on line 10.

15775/16075=.98134