Although I believe a traditional deductible IRA is often better than a Roth IRA, a Roth IRA is still better than a taxable account if you aren’t eligible for a deductible contribution to a traditional IRA. When you aren’t allowed to contribute to a Roth IRA because your income is too high, there’s still a backdoor. It takes some effort but it’s worth it.

So here it goes: a complete how-to for the Backdoor Roth.

What is the Backdoor Roth?

The Backdoor Roth is an indirect way to contribute to a Roth IRA when you are not eligible to contribute directly due to high income.

Who should consider the Backdoor Roth?

If your income is “too high” for contributing to a Roth IRA, you should consider the Backdoor Roth. The IRS publishes the income limit for contributing to a Roth IRA every year.

If your income isn’t above the thresholds, stop reading — this article doesn’t apply to you. Instead, consider a deductible contribution to a traditional IRA if you qualify for one or contribute to a Roth IRA directly.

Why should someone consider doing the backdoor Roth IRA?

When you have money in a taxable account, you pay taxes on interest and dividends. When you eventually sell the assets, you also pay taxes on the capital gains. If you put money in a Roth IRA, you don’t pay those taxes.

Ready? Here it goes:

Step 1 – “Hide” other IRAs

If you don’t have any traditional IRA (say as the result of a rollover from a previous 401k or 403b), SEP-IRA, or SIMPLE IRA, you are in good shape. Skip to step 2. If you are married, please note IRAs are owned by one and only one person. Each spouse should look at his or her IRAs separately. If you don’t have any traditional IRA, SEP-IRA, or SIMPLE IRA but your spouse does, you are not affected but your spouse is affected.

If you have a traditional IRA, SEP-IRA or SIMPLE IRA, and you don’t mind paying taxes to convert all of them to a Roth IRA now, also skip to step 2. When your balances in those IRAs are small, the taxes you will have to pay when you convert them are also small.

If you have a traditional IRA, SEP-IRA or SIMPLE IRA, but you don’t want to convert them and pay taxes at a high rate just yet, rollover almost all the pre-tax money to an employer sponsored retirement plan: 401k, 403b or 457. Most employer-based plans accept incoming rollovers.

An inherited IRA doesn’t count if you keep it separate as an inherited IRA (see Inherited IRA and Roth Conversion Pro-Rata Rule).

Everything in the traditional IRA, SEP-IRA, and SIMPLE IRA, except any non-deductible contributions you made in the past, is pre-tax money. For example if your traditional IRA has $34,000 in it and you made $10,000 non-deductible contributions in the past, $24,000 is pre-tax money. Move $24,000 to an employer sponsored plan. If you never made any non-deductible contributions in the past, all $34,000 is pre-tax money.

If you’ve made non-deductible contributions to your traditional IRA in the past, a key requirement is that you leave enough money behind in the traditional IRA — at least equal to your past non-deductible contributions. Don’t cut it too close. Consider market fluctuations and leave yourself a small cushion to show that on the day the money goes from your IRAs to your employer plan you still have slightly more money in the IRAs than your past non-deductible contributions.

You are allowed to rollover only pre-tax money from a traditional IRA to an employer plan because of a special rule. Read more about this special rule in IRS Publication 590A. Look for “Tax treatment of a rollover from a traditional IRA to an eligible retirement plan other than an IRA” near the end of page 22.

If your plan doesn’t accept incoming rollovers or if you don’t like your plan, create some self-employment income and set up a solo 401k plan, also known as a self-employed 401k plan or individual 401k plan.

House-sitting, dog-walking, tutoring, helping neighbors set up computer equipment, etc. are all good ways to earn self-employment income. Remember you don’t have to make a living on it. You just need a little self-employment income in order to qualify for setting up a solo 401k plan. See Solo 401k When You Have Self-Employment Income.

Step 2 – Make a non-deductible contribution to a traditional IRA

After Step 1, you either don’t have any traditional IRA, SEP-IRA, or SIMPLE IRA, or you only have a traditional IRA with non-deductible contributions in it (maybe plus a bit of earnings). You make a non-deductible contribution to a traditional IRA. As long as you have earned income, even if your income is “too high,” you can still make a non-deductible contribution to a traditional IRA.

The IRS publishes the contribution limit ever year. Look it up.

Step 3 – Wait

The law does not impose any waiting period between a contribution and a conversion (step 4). However, some are concerned that if you convert too soon, it can be seen as an abuse.

There is no official guideline for how long you should wait. Some say a few days; some say 30 days; some say 6 months; some say wait until the end of the year. Pick a time you feel comfortable with.

Having the money sit in a traditional IRA for a short period of time is not going to kill you. The tax on the earnings won’t be much because you won’t have a lot of earnings.

Step 4 – Convert the traditional IRA to Roth IRA

Ask your IRA provider how to do this. Some can do it online. Some will want a signed form. There is no income limit for the conversion. Because your Roth IRA conversion comes primarily from your non-deductible contributions, there will be very little taxes on the conversion.

Be sure to specify you want to *convert* money in your traditional IRA to a Roth IRA, not *recharacterize* your contribution. The two are not the same. Using the wrong term can lead to bad consequences. See Traditional and Roth IRA: Recharacterize vs Convert.

Also be sure to choose “no tax withholding” for your conversion. This way 100% of the money goes into your Roth account.

Step 1 is necessary because if you didn’t do it, your conversion will be taxed by the percentage of pretax money in all IRAs (the “pro-rata rule”). Money in employer sponsored plans doesn’t count in the pro-rata rule.

Step 5 – Report on your tax return

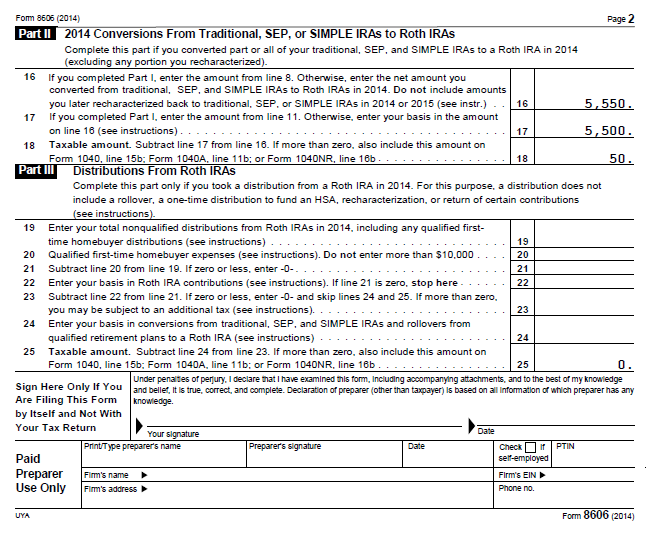

Since you made a non-deductible contribution to a traditional IRA in Step 2, you will need to include Form 8606 when you file your taxes. It’s a very simple form. If you use tax software, it will be included automatically if you answer the questions correctly.

Contributions to an IRA can be tagged for the current year or the previous year (if done before April 15 in the following year). Conversions are always tracked to the calendar year in which it actually happened. You report on the tax return your non-deductible contribution to a traditional IRA *for* that year and your converting to Roth *in* that year. If you contribute for the previous year and then convert, you will have to report in two separate years. It’s much simpler if you contribute for the current year and then convert before December 31. See Make Backdoor Roth Easy On Your Tax Return.

If you use TurboTax, see How To Report Backdoor Roth In TurboTax for a step-by-step guide. If you use H&R Block software, see How To Report Backdoor Roth In H&R Block Software. If you use TaxACT, see How To Report Backdoor Roth In TaxACT. If you use FreeTaxUSA, see

How to Report Backdoor Roth In FreeTaxUSA.

Here’s an filled-out example of Form 8606 produced by TaxACT software. I’m assuming by the time you converted, you had $50 worth of earnings.

Step 6 – Repeat Steps 2 to 5 next year

Step 1 is a one-time task. After it’s completed, you just repeat Steps 2-5 every year.

Most IRA custodians will keep an account open for a year even after the balance goes to zero. In such case next year you just contribute to the same empty traditional IRA and convert into your existing Roth IRA. It’s not necessary to open new accounts.

No Rollover to Traditional IRA

When you are repeating steps 2 to 5 every year, remember not to roll over from an employer-sponsored plan to a traditional IRA in the same year, either before or after you do the Roth conversion. You can leave the money in the original plan, roll over from one plan to another plan, or roll over to your own solo 401k, just not roll over to a traditional IRA. If you must roll over to a traditional IRA, you will have to “hide” it again using Step 1.

Reverse the Order?

Some readers asked about reversing the order: do Step 1 after Step 4 but before December 31 in the same year. I don’t recommend it, even though it works the same on the tax form.

When you roll over from your traditional, SEP or SIMPLE IRA to a qualified plan, you are explicitly allowed to pick pre-tax money only. Not so when you do the conversion; you are not supposed to pick only after-tax money. The tax forms don’t show exact dates. If you reverse the order, you can probably get away with it if you are not audited, but I think it’ll be messier if you must explain to an IRS agent.

It’s too much trouble. Why don’t they just open the front door and let everyone contribute directly to a Roth IRA?

If the front door is wide open and everyone can contribute directly to a Roth IRA, the government will lose too much revenue. The income limit is imposed to reduce the revenue impact. Only those who know about the backdoor and are willing to perform the necessary steps can take advantage of the backdoor Roth IRA. Diligence brings rewards.

Will they close the backdoor?

It’s possible the backdoor will be closed. The President already included in his budget proposal to close it although it’s hard to get it passed by Congress. If you are afraid the backdoor will be closed, you should do it now when the backdoor is still open.

***

Comments are closed because questions are becoming repetitive. Be sure to read existing comments for answers to questions similar to yours.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

JP says

Great article. Too bad did not see it when doing my conversion and tax return for 2011. I had my own 401k, but my husband had employer ret plan (at current work) and Rollover IRA from prev job (all deductible). I opened 2 Trad IRAs (non-deductible) and converted them to ROTH. The problem I did not mention other IRA on 8606 (his Rollover IRA). I have couple questions.

1. As I understand i can recharacterize my husband’s conversion back from ROTH to T-IRA until Oct.15, 2012?

2. Can leave my conversion intact because I did not have any IRAs except 401k?

3. Also can I withdraw all contributions to his T-IRA, like it never happened before?

If I do that I then need to file amended 2011 tax return. Should it be there any 8606 forms for his reharacterization? or because all his non-deductible contributions will be taken back, no 8606 is needed at all?

Thank you very much.

Tom in Fla says

Great Post! Ive been unemployed for several years (no earned income) . I have a Roth IRA and a Trad-IRA. (I funded the Trad-IRA with aft-tax $) however when I was laid off 6 years ago, I rolled over my employer sponsored 401K into my Trad-IRA. Subsequently ~2% of my Trad-IRA are aft-tax $ (the remainder are pre-tax $ and gains) My sole interest in this is to get access to the after-tax $ in my Trad-IRA without penalty.

Question: How much lack of effort can I apply to generating self employment income in order to be eligable to open a Solo-401K? For example, if I generated $20-30 in scrap metal submissions with receipts would that be acceptable?

Once I completed such a Solo 401K conversion (which I only plan to do for a one-time reclaim of my Trad-IRA aft-tax contributions) Is there any restriction on converting the Solo-401K back to a Trad-IRA?

Hopefully Vanguard will change their policies, I have 2 Trad IRAs, the largest one is wtih Vanguard, the other with TD, the Vanguard Trad-IRA contains a high yield CD that doesnt mature until late 2013, I wouldnt sell it before maturity just for the sake of completing this excercise, so Id have to wait next year to execute if I went with the Fidelity .

Many thanks for your efforts!

Harry says

Tom – If it’s only 2% of your traditional IRA, I don’t know if it’s worth the effort. This article is really about clearing the deck for ongoing contributions every year thereafter. I don’t recommend that you do a one-off self-employment. The income from self-employment doesn’t have to be high but it should be an ongoing effort.

Tom in Fla says

Thanks Harry for the speedy response.

I can see why you would wave off executing these tax acrobatics for 2%. However it is ~$14K of my own aft-tax money. Its not urgent, but Ive got ~5years till Im 59.5 and then can take penalty free withdrawls from my IRA, I will probably have a use for the money before then. It irks me that I cant access this money (esp since I already paid taxes on it) . I could report a annual small amount (<$100) of self employment income. I obviously want to avoid the frown of the IRS, and as you imply , its probably not worth it for 2%.

I wish I had known this prediciment existed back when I rolled over my employer sponsored 401K. (a good advisory for those in the market today for a 401K roll-over)

Thanks again for sheding some light on this complex subject.

Carol says

Harry, can i complete step 1 after step 3, if i have forgoten? thx.

bytre says

FinaceBuff,

If I have a loss on my traditional nondeductible IRA set up for this purpose (I couldn’t stand to let cash sit there, and made a sub-optimal investment), does it matter if I sell the security (to “realize” the loss) or not, and just transfer it to the Roth IRA? I am assuming it does not matter as unless it is a gain, and that I can’t get any credit for the loss.

Harry says

bytre – No it doesn’t matter whether you sell to realize the loss. The loss (excess basis) can be carried forward in case next time you get a gain when do the same thing.

Hastibe says

I also was wondering about this, and have a few questions, if you don’t mind! Is the loss (excess basis) carried forward indefinitely until it is used? Or is it lost if I don’t need to use it in the following years or at the next time I make a conversion and use Form 8606? …And how do I use the loss (i.e. when I use Form 8606, where do I indicate the amount of excess basis that has carried over)?

Harry Sit says

On careful reading of the tax forms and instructions I see you don’t carry forward the loss on the tax form but you can just wait it out and not convert until you are back even. If you are still down by the time you make your next year’s contribution, any gains on the new money will fill the hole.

Hastibe says

Wait, really!? Could you explain this, Harry? I also ran through Form 8606 and its instructions, and it does seem like excess basis carries forward via line 14 and then line 2 on the forms. Below are links to a 2012 Form 8606 and a 2013 Form 8606, which I filled in, that shows how (I thought?) excess basis is carried forward, given the following example situation:

TAX YEAR 2012

1. Nondeductible contribution of $5,000 is made to empty Traditional IRA (first time using Form 8606).

2. TIRA losses $500 in value.

3. Whole TIRA (i.e. $4,500) is converted to a Roth IRA.

2012 Form 8606 (https://docs.google.com/file/d/0B4Hgp_Ln1RjVUVU4MGhSVmF4TkE)

TAX YEAR 2013

1. Nondeductible contribution of $5,000 is made to empty Traditional IRA.

2. TIRA gains $500 in value.

3. Whole TIRA (i.e. $5,500) is converted to Roth IRA.

2013 Form 8606 (https://docs.google.com/file/d/0B4Hgp_Ln1RjVdF9kdkZhdzBmaUk)

…Am I doing something wrong with how I’ve filled out these forms? I feel like I must be missing something, but I can’t figure out what what–I’d really appreciate any clarification that you could provide, Harry!

Harry Sit says

The third bullet under Part I says to complete Part I only if you converted part, but not all, of your traditional IRA. If you converted all, there is nothing on line 14 to hold the basis. If you want to preserve the loss you have to leave some money in the traditional IRA. That would be another way to carry over the loss.

I know the first bullet says to complete Part I if you contributed non-deductible in the year period, but if you read the first bullet and the third bullet together you will see the intent is clear; otherwise the third bullet is redundant.

Hastibe says

Hmm, okay, I see what you’re saying, but on Form 8606 it says to complete Part I (my emphasis in caps) “only if ONE or more of the following apply,” and then lists the three bullets you mention. Since the first bullet says “you made nondeductible contributions to a traditional IRA [for the tax year],” don’t the instructions explicitly direct that Part I should be filled out? After all, regardless of what the third bullet says, since “one or more” of the bullets do in fact apply, the instructions say I should complete Part I. …Right?

Hastibe says

Also, and it took awhile of staring at the form, but I don’t think the third bullet makes the first bullet redundant, because the third bullet of Form 8606 (again, my emphasis in caps) says “…nondeductible contributions to a traditional IRA in [the current year] OR AN EARLIER YEAR.”

In other words, for example, if I converted part, but NOT all, of my traditional IRA to a Roth IRA in 2013 and I had made nondeductible contributions to my traditional IRA in some previous year, but NOT in 2013, the third bullet would apply (and thus I would fill out Part I), but the first bullet would NOT apply.

I’d be curious to know what you think about this!

Harry Sit says

I tried to explain in my second paragraph above. A literal reading would have you complete Part I as long as you contributed in the year. I read it as saying if you contributed and didn’t do anything else. The 3rd bullet deals with conversion. Your basis has to attach to some assets.

Harry Sit says

The “in [the current year]” part would be redundant.

Hastibe says

Ah, I see–okay, hmh! Well, thank you so much again for your time and responses here (and bearing with me belaboring this), Harry–I really appreciate it (also your blog has been great–thank you! I’m learning a ton from it). After reviewing what you wrote here and what others wrote in threads on the Bogleheads forum (further discussion of this issue is here, if you or anyone else is interested:

http://www.bogleheads.org/forum/viewtopic.php?f=1&t=130369#p2143265), it seems like the simplest solution to make it unambiguously clear that basis does carry forward in such situations as the example I provided above is to just leave at least $1 in the Traditional IRA account, like you wrote, instead of converting all of the Traditional IRA to a Roth IRA.

Gene says

First, great article! Sorry if I have asked a question already mentioned above (a lot to read), but in Step 2, you say to contribute to the traditional IRA (limit of $5k if under 50). But why would there be a limit? I thought the $5k limit is only to deductible traditional IRAs. If I understand correctly, isn’t there no contribution limit to non-deductible traditional IRAs? So could I contribute a higher amount, say $25k, and then convert to a preexisting Roth IRA I had created when I first started out?

Also, my wife does not have an IRA account, but she also has an old Roth IRA account. Via the backdoor, can I contribute some from my “IRA” account to my wife’s Roth IRA, or does it have to be from her IRA account? Many thanks for your help.

Harry says

Gene – For someone under 50, the limit is $5,000 in 2012 whether it’s deductible or not (going up to $5,500 in 2013). She will have to do it from her own traditional IRA, not yours. Open one if necessary. Keep it open with $0 balance for the next year after you are done with the conversion.

Gene says

@ Harry – Thanks. Also, I am trying to do Step 1, but have run into a snag. I have a rollover IRA (from 2 previous employers’ 401k plans) worth about $45k. Based on discussions here, I should rollver that over to my current employer’s 401k. But they do not take incoming rollover. So sounds like next step is to open a solo 401k plan. I do have side income but not much (under $400 for current year, so no SE tax). But I’ve already contributed $17k in 2012 to my current employer’s SEP 401k, so I don’t think I can make anymore 401k contributions this year. Then can I still open a solo 401k with no money and rollover the IRA? Will they allow a rollover if I haven’t even contributed? Or should I wait till 2012, make a 401k contribution into solo plan, then rollover IRA?

Harry says

Gene – Although you can’t contribute as an employee, you can still contribute as an *employer*. See previous post Solo 401k For Part-Time Self-Employment. Rollover before making a contribution is fine. Employers have until tax time next year to make the employer contribution for this year.

Mike says

Is there a limit on the number of times I can “open” a non-deductable IRA? I open the account, fund it, wait x amount of time, convert it to my roth ira account. Does this effectivly close the traditional ira account or is it still “open” with a $0 balance? DO I have to open a new account the following year? If so does Fidelity and such companies eventually cut you off from opening and closing so many accounts?

Harry says

It’s still open with a $0 balance. Reuse the same account next year.

Ryan says

Great article I appreciate your time on this I’m hoping you can clear one thing up for me. I currently have a sep-ira with ~$150k in it and a traditional ira with~$10k in it. The t-ira has been funded completely with non deductible contributions. So I transfer my sep to a solo 401k plan (im self employed). Then you say however much non deductible contributions are in my t-ira to leave that same amount behind in my t-ira when i do the conversion. I dont have any deductible contributions in my t-ira so should I leave behind ~$10k in my sep-ira? When I make my non deductible contribution for 2012 that will give me around ~$15k in my t-ira account. So when I do the conversion to the backdoor roth do I get to convert all ~$15k? When I do this process all over again each year do I still fund my sep-ira and then immediately transfer it to the solo 401k plan? Sorry if this has been covered I read through most of it and still haven’t seen an answer to my specific need. Thank you again.

Harry says

Ryan – You see in the graph the Traditional, SEP and SIMPLE IRAs are all in one pile. You would leave behind the $10k in your traditional IRA and transfer 100% of your SEP-IRA. After you create your solo 401k, you no longer fund your SEP-IRA. Fund your solo 401k instead.

Don says

I am 68 and retired in December 2010. My joint AGI with my spouse in 2011 was $228K and will be roughly the same for the 2012 tax year. I don’t see a decline in my AGI for the foreseeable future. In October 2012, I opened a rollover IRA at E*Trade and transfered $100K from my Federal 401(k) to this IRA (all funds as yet untaxed). In November 2012, I opened a Roth IRA with the same broker and rolled over all funds in the traditional IRA (now increased to $101K) into the Roth. I expect to pay taxes on all of these funds.

Have I broken any IRS rules for the 2012 tax year? Will I need to recharacterize any of these funds?

Harry says

Don – It looks like you just did a regular Roth conversion. It has nothing to do with what’s discussed in this post. No you didn’t break any IRS rules. No need to recharacterize.

CoderDude says

Any news on whether this is changing for 2013?

Harry says

Although laws can change at any time, there is no indication this is changing in 2013.

Sara says

Thank you so much for this incredibly helpful article! Since I just initiated opening a traditional IRA today (December 29) with a 2012 contribution that I will then back-door into a Roth IRA in early 2013, I was going to ask about which year’s taxes would include the traditional IRA earnings. However, I just finished reading the earlier comments, so have learned that the tax on earnings goes by calendar year, not contribution year. But the Form 8606 still goes with 2012 taxes, right? Thanks!!!

Harry says

Sara – 2013 taxes.

indexfundfan says

Those planning to do backdoor Roth should wait until the fiscal cliff deal is finalized. Apparently, the senate bill has some language, which at this point is not clear, that could potentially eliminate the backdoor Roth.

Harry says

As I read it, the Senate bill as it’s written now does not affect IRAs. It only affects qualified plans, allowing more people to convert a balance currently in traditional 401k to Roth 401k within the same plan. The plan has to offer the Roth 401k option and probably must be amended to allow such conversion. Of course because everything is still in flux, it doesn’t hurt to hold off for a short while and see what comes along.

David says

Harry, if I am 49 years old now but turning 50 during 2013, am I correct that I can fund my IRA with $6500 and then convert to Roth at any time this year (even before turning 50)? And am I also correct that for each year hereafter I will be able to fund it at this higher amount, or does my “catchup” end at some point?

Harry says

David – Yes, if you are talking about funding the IRA for 2013 (not in 2013 before 4/15 for 2012 tax year). The catchup to a traditional IRA ends after you reach 70-1/2 together with your regular contributions to a traditional IRA. You can still catch up to Roth IRA directly after that if your income allows it.

William says

Hi Harry,

Thanks for the great article. I funded a IRA for $5000 and then converted it last month. However, between the time of funding the IRA and converting it to a Roth I obtained some capital gains. The bank converted these funds into Roth also, making my total conversion over $5000. My question then, is do I need to get with the bank and withdraw this overage before tax cutoff time, or is it okay that I rolled over more than $5K since it was gains for the IRA. Thanks for your help!

Harry says

William – No need to withdraw. You just pay tax on the small gain.

Derek says

Hi Harry. Great article. Question for you. In step 1 you say “If you’ve made non-deductible contributions to your traditional IRA in the past, a key requirement is that you leave enough money behind in the traditional IRA…” If I have ONLY made non deductible contributions can’t I convert the entire amount to a Roth and pay taxes only on the gains (opened in 2008 so not a lot of gains)? If this is the case should I contribute $5000 for 2012 to the existing account and then convert it all at once or convert the existing and then open a new traditional, add the $5000 and then convert? Thanks

Harry says

Derek – Yes you can convert the whole thing if you have negligible amount of pretax money in it. You can just do one conversion for everything: old money plus 2012 contribution plus 2013 contribution (see picture in Step 4).

Misreporter says

3 days ago I realised there is such a thing as backdoor Roth conversion from bogleheads forum and immediately opened one for my wife and myself. Then yesterday while simulating a 8606 filing I was making a very silly mistake which kept on bugging me till I landed on your website and voila! the filled in 8606 above was God sent. Thanks a lot for the article and everyone who has contributed to this forum.

On a separate note, I have a problem for which I seek some guidance – I just discovered that my Turbotax screwed up and instead of 20k reported 0 as my total basis in the 2011 tax return. I wish I knew abt significance of this form before. I have been filing 8606 in all my prev tax returns but the total basis in line 2 has not been correct/consistent. I have tax statements from my broker to prove what the correct total basis should be. As I want to do a backdoor Roth in 2013, what are my options? I havent yet filed the 2012 return obviously. All contributions in my tIRA are post tax (non deductible)..thankfully a plain vanilla situation.

Harry says

Misreporter – If your previous 8606s were wrong, obviously you need to correct them. Because numbers carry forward from year to year, you want to trace back to the first year that was wrong and correct from there. After you have all the years sorted out, call the IRS and ask them how to send in the correct 8606s.

Misreporter says

Thank you, Harry.

Sunil says

TFB/others – Happy New Year ! Any word on changes in Backdoor ROTH as mentioned above due to the new tax law’s/changes announced on Dec 31st ?

Can we continue to put $5000 post tax funds in Traditional IRA and convert to ROTH (even for upper bracket income where ROTH is not available) ?

Harry says

The new law brought no changes to converting IRAs. See Fiscal Cliff Deal and Backdoor Roth.

Victor says

I have a little dilemma that I would appreciate your feedback on:

I have 1 active 401k plan that I contribute to from work and also 1 active SIMPLE from consulting work aside that I also contribute. I have 1 old SEP IRA plan that sits idle from prior job. I also have some nondeductible IRAs.

I don’t want to convert ALL pretax $ to ROTH but maybe around half of it.

These are my thoughts:

1. Find out if I can rollover my SEP IRA into current active 401k plan. If not possible, am I allowed or does it make sense that I stop contributing this year to my currently active SIMPLE IRA; open a new solo-401k for this consulting job on the side; THEN rollover both old SEP IRA + SIMPLE IRA moneys into it (effectively “hiding” my pre-tax $ in a new active solo-401k plan? The idea is to isolate my nondeductible IRAs and do the backdoor ROTH conversion.

2. Not sure if this is allowed, but another thought would be to somehow “change” (or convert/recharacterize…..not certain of the right term) current active SIMPLE IRA into a new solo-401k; then rollover the balance of this old SEP IRA; effectively “hiding” pretax $ but still have an open active pre-tax account that I can continue to contribute to for my consulting job. Then, backdoor convert to ROTH my nondeductible IRAs. Can this be done…?

Thank you for your suggestions in advance!

Victor

Harry says

Victor – You have to stay in the SIMPLE IRA for two years (measured from the date you first made a contribution to the SIMPLE IRA). After that you can rollover the SIMPLE IRA to a solo 401k. See IRS Publication 590 Chapter 3 about rollover/transfer out of SIMPLE IRA. If it hasn’t be two years yet, just leave the traditional IRA contribution as non-deductible and wait it out.

Janet says

Hi Harry:

On February 2012, I made a contribution into a Traditional IRA in the amount of $5K for tax year 2011. When I filed my taxes in 2011, I filed the Form 8606 for this $5K. In June 2012, I transferred the $5K to a Roth IRA. Now, I received a 1099-R for the transfer amount from the Traditional to Roth IRA. How do I handle this? DId I do something wrong? Please advise. Thanks so much.

Janet

Harry says

Janet – Nothing wrong. Just fill out 8606 again for 2012 referring to your basis from your 8606 for 2011.

DC says

Harry,

I have an old 403b and an old SEP IRA, as well as an active Roth(which I can’t directly do anymore due to income) and lastly a 401k at work. I would like to get set up to start a back door Roth. I want to roll my SEP into my 401k. Due I also need to roll my 403b over as well?

Also, I want to move my profit sharing aspects of my 401k into a different account/better account(with lower fees than offered by my employer plan), can I move the roll over portions that came from my SEP and 403b from my current 401k(if I roll those over to the 401k plan) to an outside account?

DC says

Harry,

If I move the profit sharing aspects from my employer out of the 401k or “redirect” them elsewhere,

what kind of an account do they need to go? What is the account called, say if I move it to Fidelity or Vanguard?

Thanks.

Harry says

DC – No your old 403b can stay if you like it better than your active 401k. Whether you can roll profit sharing out of your 401k depends on your employer’s plan. The law allows it; your employer doesn’t have to allow it. Same thing to the money rolled into your 401k, although more employers allow rolling out money that originally rolled in than rolling out profit sharing money. However, if you roll out to a traditional IRA, it would defeat your backdoor Roth. So maybe do it only when you don’t need backdoor Roth any more. You can also potentially roll the SEP and the profit sharing money from your 401k into your old 403b. Again, the law allows it; your previous employer doesn’t have to allow it.

Gene says

Harry,

In Dec 2012, I contributed $5k (non-deductible – total of $10k) to both my and my wife’s traditional IRA. The next day (still in Dec 2012), I had them converted into our respective existing Roth IRAs. So far, seems like no problem. Now I am doing my taxes for the year 2012. We received the Form 1099-R from our broker. As I enter the information into the tax software, it seems to want to charge taxes on the “distribution” from the traditional IRA. Then later in the program, it mentions that I should have a Form 8606. But I did not have any traditional IRAs at 12/31/2011, so I entered 0. If I do this, it wants to tax me on the conversions. But if I put $5k, then it doesn’t.

I’m confused. Should I have physically done the conversion the following year (2013) to avoid taxation on the conversion then? I thought it did not matter when it was converted (i.e. next day). Thanks for your comments.

Harry says

Gene – See if this article helps you: How To Report Backdoor Roth In TurboTax. If you use a different software, the principle is the same. You have to enter in two places: one place for the conversion (1099-R), another place for the contribution. Zero for the basis on 12/31/2011 is correct. You just have to wait until you enter your contribution in a different section later in the program. Software typically have you enter your income first, deductions second. When you only have the 1099-R part, it appears you are being taxed. The number will change after you enter your contribution. In my article I have you enter the contribution first, conversion second, which follows the natural sequence of events, but the software doesn’t do it that way if you only follow the software’s screen sequence.

Sally says

Harry –

Thanks for the very helpful guide. This year we discovered that we have been doing the backdoor roth incorrectly for the past 7 years. (Our accountant never considered the value of our rollover IRAs on 8606) and we continued this pattern after we started doing our taxes ourselves. In essence, we have skipped step 1, but acted as if we did it, only using the basis as our non-deductible contributions. How do you advise we proceed now? Do we file amended returns for 7 years? Do we file things correctly this year? Do we continue our error (be consistent) one more time and then stop? Appreciate your advice if you are able to provide any.

Lourdes says

Hi, I didn’t see a reply to your query posted. I am in a similar situation and not sure what to do.

Any info you can share would be appreciated.

thank you.

Harry Sit says

I’m not a tax professional. If I were in this situation I would amend my returns for all years.

Hieu says

Hi, I would like to do a backdoor Roth for 2012 going forward. Here is my situation. I have a traditional IRA with Vanguard as well as a rollover IRA. The traditional IRA contains all post-tax contributions. The Rollover IRA contains pre-tax, deductible contributions as well as earnings and a small amount of post-tax, non-deductible contributions (I can’t recall how much post-tax money I contributed since it was done 2-3 employers ago and Vanguard doesn’t show it on my account). Can I do Step 1 by just moving the deductible contributions from my Rollover IRA to my current 401k plan (would I also have to include earnings?) and do nothing with my Traditional IRA or would I have to do something with my Traditional IRA as well? I don’t want to pay taxes on earnings from my Traditional IRA at this time. Thanks!

Dave says

Assuming that you are able to contribute to a Roth IRA, is there any reason that you couldn’t also contribute to a non deductible IRA too? And then later roll the non deductible into the Roth. Thanks

Harry says

Dave – The annual limit for IRA contribution is shared between Roth and Traditional. If you already contribute the maximum to Roth, you can’t contribute to Traditional (whether deductible or non-deductible).

BD says

I’ve used the so-called backdoor Roth approach for two years and it was straight forward because I didn’t have any other IRAs to “hide”. However, I will be soon be the owner of a Beneficiary IRA and I don’t know how this may impact my ability or approach toward contributing to my Roth through the backdoor technique. Opinions/comments? Thanks.

Harry says

BD – It does not affect it. See related post Inherited IRA and Roth Conversion Pro-Rata Rule.

JW says

I am interested in doing a Backdoor Roth IRA, but am a bit confused. I exceeded the income limits in 2008 and 2009. Those years, I had contributed $4995 and $4995 respectively to a Roth IRA for my wife, but recharacterized them to a Traditional IRA (as a non-deductible contribution, I presume) each since I exceeded the income limits unexpectedly each year to late year bonuses. While the original contributions were those amounts, the actual recharacterization amounts to the Traditional IRA account was $3825.48 (2008) and $3175.70 (2009) due to losses those years. The current value of the Trad IRA is $10,825 (with the only money being the above as I described).

Q1: If I execute the recharacterization of this (back) to a Roth IRA, would tax be due and how would that all work? Would that be on the growth from $7001->$10,825 or the original invested amount of $9990->$10,825?

Q2: I exceeded the income limit in 2012 and will again for 2013, so I am interested in doing a backdoor for 2012 for $5000 and 2013 for $5500. Is it best to wait to do this after I clear up the above and do this in a second phase?

Harry Sit says

Q1: The latter. Q2: I would do it all together.