[Update in April 2021] The walkthrough and screenshots in this post were from several years ago. Since TaxAct raised its prices in recent years, I stopped updating this post. Please consider switching to TurboTax, H&R Block, or FreeTaxUSA.

***

By request from a reader, I give a walkthrough for how to report backdoor Roth in TaxACT.

If you use TurboTax, see How To Report Backdoor Roth In TurboTax. If you use or H&R Block software, see How To Report Backdoor Roth In H&R Block Software. If you use FreeTaxUSA, see How to Report Backdoor Roth In FreeTaxUSA.

For backdoor Roth in general, see Backdoor Roth: A Complete How-To and Make Backdoor Roth Easy On Your Tax Return.

What To Report

You report on the tax return your contribution to a traditional IRA *for* that year and your converting to Roth *during* that year.

For example when you are doing your tax return for last year, you report the contribution you made *for* last year, whether you actually did it last year or between January 1 and April 15 this year. You also report your converting to Roth *during* last year, whether the contribution was made for last year, the year before last, or any previous years. Therefore a contribution made in last year for the year before goes on the year before’s tax return. A conversion done during this year after you made a contribution for last year goes on this year’s tax return, which you will do next year.

You do yourself a big favor and avoid a lot of confusion by doing your contribution for the current year and finish your conversion in the same year. Contribute for this year and convert it before December 31. This way everything is clean and neat. See Make Backdoor Roth Easy On Your Tax Return.

TaxACT

The screenshots below are taken from TaxACT desktop software. If you use TaxACT Online, the screens may be similar. Here’s the scenario used in the example:

You contributed $5,500 to a traditional IRA last year for last year. Your income is too high to claim a deduction for the contribution. By the time you converted it to Roth IRA, also during last year, the value grew to $5,550. You have no other traditional, SEP, or SIMPLE IRA after you converted your traditional IRA to Roth.

If your scenario is different, you will have to make some adjustments from the screens shown here. The screenshots were taken for doing a 2014 return in 2015. In a different year you just advance the year. Wherever the screenshot says 2014, think last year. Wherever it says 2015, think this year.

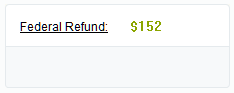

Before we start, suppose this is what TaxACT shows:

We will compare the results after we enter the backdoor Roth.

Non-Deductible Contribution to Traditional IRA

First we enter the non-deductible contribution to the Traditional IRA *for* last year. Complete this part whether you contributed for last year before the end of last year or you did it or are planning to do it this year before April 15. If your contribution last year was for the year before, make sure you entered it on your previous year’s tax return. If not, fix your return for the previous year first.

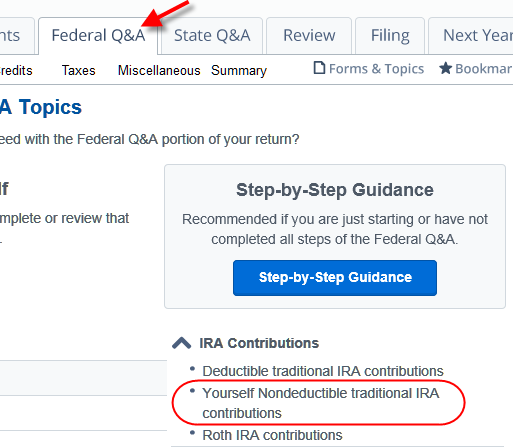

Under Federal Q&A, look for IRA Contributions in the right column and then click on Yourself Nondeductible traditional IRA contributions.

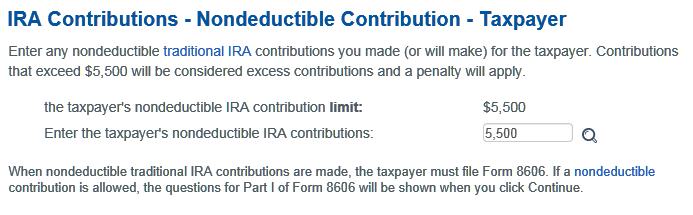

Enter your contribution amount for last year.

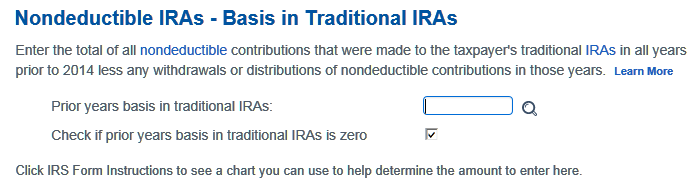

Enter your prior years basis from line 14 of Form 8606 in your previous year’s tax return or check the box for no basis.

You get this quick summary. Repeat for spouse if applicable.

Convert Traditional IRA to Roth

Now we enter the Roth conversion.

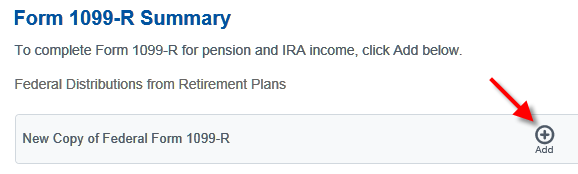

Go back to Federal Q&A. Look for Retirement Plan Income in the left column and then click on IRA, 401(k), and pension plan distributions (Form 1099-R).

Click on Add to add a 1099-R.

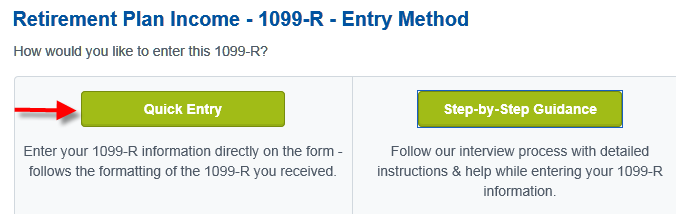

Click on Quick Entry.

Fill out the 1099-R as you received it. Pay attention to box 2b, box 7, and the IRA/SEP/SIMPLE checkbox.

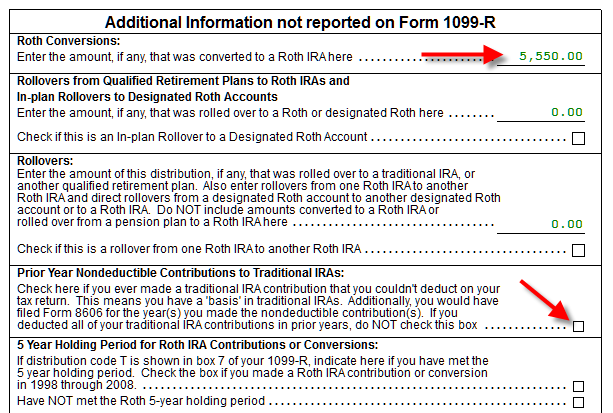

Scroll down. Fill in your conversion amount. Leave the Prior Year Nondeductible Contributions box blank if you don’t have any carryover basis. Check it and enter the amount if you do.

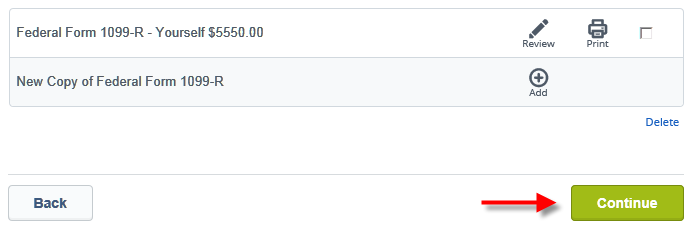

You are done with one 1099-R. Repeat if you have another one. Click on Continue when you are done.

Just some general info about Form 8606.

It asks about your prior years basis again. Enter it or check the box.

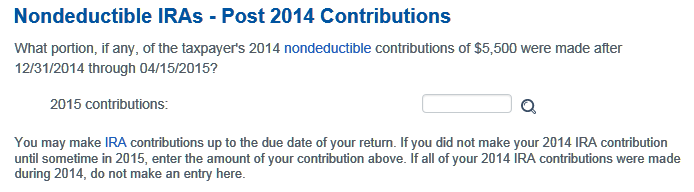

Enter how much you contributed for last year between January 1 and April 15 this year. In our example it’s zero because we contributed before December 31 last year.

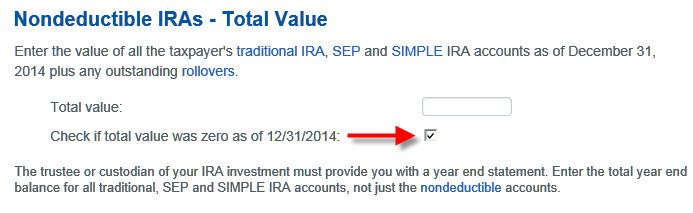

The balance of all of our traditioal, SEP, and SIMPLE IRAs was zero as of December 31 last year.

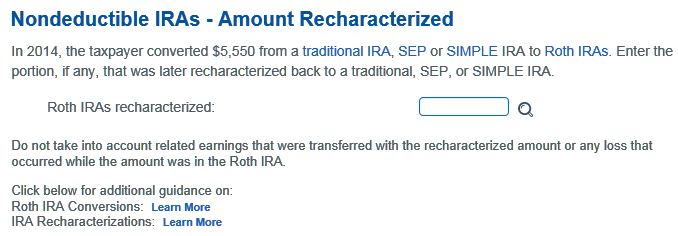

We didn’t recharacterize our conversion.

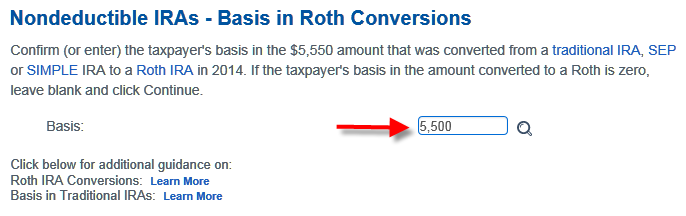

Confirm the basis for our conversion.

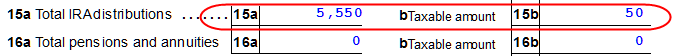

That’s it. Our refund came down a little due to the earnings in our conversion.

Taxable Income from Backdoor Roth

After going through all these, let’s confirm how you are taxed on the backdoor Roth.

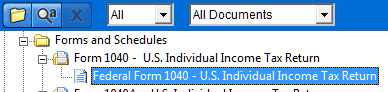

Click on Forms on the top and open Form 1040.

Scroll down on the right hand side to find line 15. It shows $5,550 in Roth conversion, $50 of which is taxable.

Tah-Dah! You got money into a Roth IRA through the backdoor when you aren’t eligible to contribute to it directly. You will pay tax on a small amount of earnings if you waited between contributions and conversion. That’s negligible relative to the benefit of having tax-free growth on your contributions for many years.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Maximus says

Awesome, perfect timing.. thanks to turbotax debacle, i’m tempted to go to TaxAct

egads04 says

Awesome. Thanks much for this!

OnlyKetchup says

Could you put one up that shows how to enter a Mega Backdoor Roth?

Harry Sit says

It should be a lot simpler. You start with the second part “IRA, 401(k), and pension plan distributions (Form 1099-R)” and add the 1099-R. Can you just enter it as-is and follow along? What does your 1099-R look like?

cheme2001 says

I too need to know how to do this for a Mega Backdoor Roth. What form do I use? 8606 or just on the 1040? on my 1044-R, here are my values:

1.) 19k

2a.) $3.07

2b.) no checkmarks

3.) 0

4.) 0

5.) 19k – $3.07

6.) 0

7.) G

all others are $0

josh says

This was VERY helpful. I use TaxActOnline and have been using it since 2006. I’m all squared away now for 2014 return. On seeing this, I realize that I have not filed any 1099-R or 8086 for prior years for my backdoor Roth contributions. All the IRS has is whatever Fidelity (who has my non-deductible and roth iras) sent them. What’s the easiest way to make this right? Do I need to go through and do 1099-X through the software or can I just mail manual copies of the forms to the IRS answering them the same way as illustrated above? What was the earliest year this loophole was allowed so I know how far back I need to go? I’ve been making too much since 2008 but I recall there was a 2 or 3 year period where the income limit was removed.

Harry Sit says

2010 was the first year. Fidelity has prior year tax forms online going back 7 or 10 years. Just log in and look for them. If you didn’t have any earnings when you converted, you can just fill out a Form 8606 for each year and send them in stand-alone. The IRS has prior year tax forms on its website.

josh says

I didn’t have any earnings for any of the years. I have all the fidelity forms. Your illustration above (which I just followed for 2014 on TaxActOnline) shows also filling out 1099-Rs, do they need to be sent in standalone too?

Harry Sit says

1099-R is the form you receive from Fidelity, not one you fill out. Entering the 1099-R into the tax software will put numbers on Form 8606, and on the main 1040 Form line 15 a and b. If you didn’t have earnings your 15b would be zero, which doesn’t affect the amount of tax you pay. You decide whether you want to be thorough and amend your returns to put a number on 15a or just wait to see if the IRS asks you about it.

josh says

Thanks for the prompt responses and for your blog in general, of which I’ve been a fan for many many years. Also signed up on Personal Capital through your link.

Bob says

I’m currently receiving RMDs, so I assume I can do a backdoor Roth once, but I can’t make any further contributions for Step 2. Also, my 1099-R will show a distribution code of 7 in box 7. I will perform the rollover into my 403(b) plan, which will accept the rollover.

My question is how to elect the distribution from the traditional IRA to be pursuant to the special rule allowing rollover of the pretax portion only, and how to show that using TaxCut. I don’t see anywhere that the fact is recorded that the distribution and rollover is the taxax portion only. There is a statement in PUB 590-A (2014) at the bottom of page 24 “If you rolled over the distribution into a qualified plan or you make the rollover in 2015, attach a statement explaining what you did”. However, there is no way to attach a statement using TaxAct and still perform electronic filing.

Harry Sit says

There’s no election. Everything you roll over to the 403(b) by definition is pre-tax dollars because there’s no way to do otherwise. Your statement basically says on such and such date I rolled over $X from my traditional IRA to my 403(b) plan account. Not being able to e-file is not a big deal. Just print the forms, attach the statement and mail them in.

Max says

Just an FYI, saw an Enrolled Agent.

1) I still owe the same amount as reported by TT (had a TIRA nondeductible balance converted to Roth). Saw sigh of relief, and at least it’s his name signed with my tax returns

2) He said I was one of the very few who did the backdoor conversion (lol). This after explaining to him how it worked (thanks to this website..!)

3) He was shocked that I did not pay penalty on Roth IRA contribution withdrawal a few years ago..I told him penalty is excluded but he insisted that it didn’t matter (he was wrong though…)

Now that TIRA balance is 0, doing this every year is going to be painless. Thanks again for this site!!

Bob says

Max- If your tax is prepared by your EA, do you still submit it from TaxAct? Do you submit a verbal statement or explanation? It seems to be required for a backdoor conversion by IRS PUB 590-A (2014) at the bottom of page 24 “If you rolled over the distribution into a qualified plan or you make the rollover in 2015, attach a statement explaining what you did”.

Max says

Bob – he is going to submit it for me (electronically). He said I could send a paper copy (he printed it all out for me), but he is going to do it.

Also, this is not considered a “rollover” (e.g., from 401k to rollover IRA). This backdoor is considered a “conversion”, so I do not think you need to explain why. I haven’t seen a need for this from the research I have done (this website and other sites)..

Vik says

Thanks this was very well laid out and informative. I do a have a follow up question on a different scenario related to this. So I did the backdoor last year in 2014 before April 15 for 2013. At that point I did have pre tax amounts in my IRA (precontribution to the IRA) . I contributed to my IRA and and rolled over to my Roth at the same time (within a day or two), this resulted in a taxable event (proportionate) where my pre tax IRA money got partly converted to the Roth IRA. How is this handled in Taxact. Apologies if this sounds convaluted and I have not explained this well.

REgards

Harry Sit says

If you read carefully the paragraphs under “What To Report” a few times you will know what to do. When you contributed for 2013, you needed to report the contribution on 2013 tax return. If you didn’t, get a 2013 Form 8606, fill it out by hand and send it in. The 2013 contribution becomes a carryover basis for 2014. I pointed out the box you need to check: “Leave the Prior Year Nondeductible Contributions box blank if you don’t have any carryover basis. Check it and enter the amount if you do.”

KL says

Hi, I’m hoping you can help me clarify something. I made a traditional ira contribution for myself in 2014 for 2014. Unfortunately, my conversion to the Roth IRA did not go through until 2015. How should I be reporting this on my 2014 tax return? Also further complicates things that I did a backdoor roth for my husband as well, and I was able to complete all the steps for his in 2014. We are filing jointly, and I am trying to understand how our 8606 forms will look different.

Thank you!

Harry Sit says

KL – The “What To Report” section addresses that question. Each person gets a separate Form 8606.

DB says

Hmm, I made contributions to my 2014 IRA in 2015, but did not get asked anything about “Post 2014 contributions”, as you’ve shown above. The basis for prior years was zero though, so maybe that’s okay? Would be great to know.

Anyway, thanks for this article!

Andy Platt says

Nice review, thanks. One thing that I get is TaxAct reporting that I made excess contributions to the IRA and Roth IRA because my allowed limits were 0. The 8606 looks correct and reports the taxable contribution as 0 so I think it’s just TaxAct worrying about nothing?

Harry Sit says

Your allowed limits were 0 if you didn’t have earned income or you were over 70-1/2. Make sure you entered your W-2 and your age. Look at your 1040 line 59 or Form 5329 to see if you are paying an excise tax on excess contributions. If so you need to fix it.

Gabriel says

I have a question regarding NONDEDUCTIBLE IRA. I contributed $5500 to ND IRA for the year 2014 in March 2015. Then in the same month (March 2015), I converted that ND IRA to ROTH IRA. Now when I file taxes for 2014, I understand I can still report this ND IRA but can I report this Roth IRA conversion also in 2014 filing or I should report this in 2015 Tax filing. If I report the ROTH in 2015 filing, how will IRS know that it is for the ND IRA and not regular IRA so they dont tax me on that. (at converted the total $5500 to Roth IRA and no appreciation in ND IRA before I converted to Roth). Please let know. Thanks.

Harry Sit says

Already covered in the “What to Report” section. You carry the basis to the next year.

MG says

I was pretty new to the backdoor conversion concept this year. I contributed $5.5k to traditional IRA in Jan 2015 for the year 2014. Within a week or so, I converted all that to Roth IRA. Vanguard never sent me a 1099-R. I have a form 5498 from vanguard that shows the contribution to traditional IRA but shows the conversion amount as zero (even though they did convert all $5.5k to Roth account as 2014 contribution). I filed my taxes with Taxact earlier this year and I just noticed that the conversion is not reported on my 8606. What do I do now?

Harry Sit says

You will get the 1099-R in January 2016 because you converted in 2015. Nothing to do now but if you continue this pattern you will get yourself more confused. See Make Backdoor Roth Easy On Your Tax Return.

MG says

Thanks for the clarification that the 1099-R will be available in 2016. But shouldn’t the line 8 of 2014 8606 have the full value $5.5k because I did convert the traditional Ira to Roth? (Note that I didn’t have any change in value between my contribution and conversion.) I filed taxes using Taxact and I’m certain I followed the steps very carefully.

Harry Sit says

MG – No, because you didn’t convert in 2014. Read that line 8 and the linked article above carefully a few times. If you start doing it the easy way you won’t be confused like this.

js says

Nondeductible IRAs – Total Value

Enter the value of all the taxpayer’ traditional IRA, SEP, and SIMPLE IRA accounts.as of December 31

Does this total include traditional ira, non-traditional ira, employer 401k converted rollover IRA, roth-ira or roth-ira is excluded from this total.

Harry Sit says

Exactly as it reads. Roth IRA is not included.

LL says

Hi, Harry,

Very helpful post, as it basically summarizes hours of stuff we otherwise had to research on our own. But I have a follow-up question similar to MG’s. Overall, I followed your advice (without having seen it), but what appears on our TaxAct is different from how our accountants have previously done it.

My spouse and I each made a 2015 nondeductible contribution of $5500 to a traditional IRA in early 2015. Several days later, we converted the full amounts ($5500.04) to Roth IRAs. I entered the information as you suggested above (just double-checked it) and see the conversion amount is reflected in Part II Line 16, but, as MG asked about, not in Part I Line 8 (that’s actually what I was searching when I got to your site).

We were expats for many years and our Big 4 accountants always reported the conversion on both Line 8 as well as Line 16 (since our 2012 return, I think), as did our big-city local accountants last year.

I see also that the IRS Form 8606 label for line 8 says, “Also enter this amount on Line 16” which suggests that the two lines should show the same value. I could not, for the life of me, figure out what interview question or Quick Entry value would get a value to show up in Line 8 (and then dribble down through lines 10-12).

There’s obviously no tax impact, but given that what I’m seeing on my form appears to disagree with both my prior returns and the IRS instructions, I wondered if there is anything I could do to correct this. Any suggestions?

Thanks!

Harry Sit says

It doesn’t matter. When you converted all your traditional IRAs, there’s a special shortcut that takes you directly to part 2, bypassing some lines. Your CPAs didn’t take the shortcut. Either way works.

LL says

I did some additional poking around and found several threads on bogleheads that cover basically the same ground (and the fact that TurboTax and TaxAct both treat Line 8 this way) – with several posts referencing your site and several citing IRS Publication 590-B page 14 and worksheet 1-1 which provides the “shortcut” that essentially allows you/the tax software to skip lines 6-12, for anyone interested in digging further. I definitely feel a lot better having read all this.

Thanks for the original article and for the speed reply!

LL says

P.S. I emailed the TaxAct support email the same day I emailed you. I just got back their reply which I’ve quoted below. I saw a lot of hypothesizing on Bogleheads re: the “shortcut” used by tax software, and the notes below specify/confirm how they are doing it. Since so many threads on this topic lead here, I thought I’d post it for anyone else who lands on this page with the same question.

FROM TAXACT:

Please see below for the explanation as to why there is not an entry on line 8 of Form 8606.

If you have both a distribution from an IRA and contributions to an IRA in the current year, which may not be deductible because of your income level, you will need to use Worksheet 1-1 from IRS Publication 590-B , page 15, when completing Form 8606. This worksheet parallels and replaces the calculations on lines 6 through 12. The TaxAct program will automatically populate this worksheet if it is needed and you will see asterisks next to lines 13 and 15 indicating that the Publication 590-B worksheet is being used.

To view this worksheet in the TaxAct program:

1. Start your TaxAct Desktop program

2. Click the Forms button in the top left corner of the toolbar

3. Expand the Federal folder and then expand the Worksheets folder

4. Click the ‘+’ next to Form 1040 IRA Distribution – Taxable Part of IRA Distribution and then double-click the individual worksheet

5. Click the pink Printer icon above the worksheet to print. You can choose to send the output to a printer or a PDF document. Also, if you wish to only print preview the worksheet, check the Print Preview box. Remember to clear the Print Preview checkbox when you do actually want the worksheet to print

Thank you for using TaxAct. Please let us know if you have any further questions.

Aba says

Hi Harry,

This was very helpful. I panic’d a bit when I got taxed for the 5.5K distribution and the google search lead me to this article and it saved the day. I have correctly followed your procedure and the accounting of money looks correct.

I made contribution 5,500 to trad IRA in 2015 and converted the money to roth IRA in the same year with no gains. The simple way. However, I have one question regarding how Taxact finally fills the form 8606 and how you show it on this other link. http://thefinancebuff.com/backdoor-roth-tax-return-made-easy.html

Why are lines 6-12 left blank? Just reading thru the form it seems line these lines should be filled as follows:

line 6 = 0

line 7 = 0

line 8 = 5,500

line 9 = 5,500

line 10 = 1.000

line 11 = 5,500

line 12 = 0

line 13 = 5,500 (this is filled in 8606 by taxact)

line 14 = 0

line 15 = 0 (this is filled in 8606 by taxact)

And Part II line 16-18 are correctly filled but it says that if you filled Part I carry over the values from line 8 for line 16 and from line 11 for line 17. So that makes me wonder even more as to why Taxact didn’t fill out lines 6-12 to begin with.

Maybe once the money flow is correctly accounted for these details dont matter much. But wanted to get your thoughts on this.

Thanks,

Aba

Harry Sit says

Aba – See comments from LL right above yours.

Didn't Do It Before? Am I OK? says

I’ve been using TaxAct Online since 2006 and doing the backdoor roth each year since it’s been allowed. I never realized I had to file anything extra with IRS for this. I used this page to cover my 2014 and 2015 contributions. But I’ve been utilizing the Backdoor Roth method for the prior years as well (I think since 2010 or 2011). Anyway, IRS hasn’t audited me or asked questions. Do I risk anything by just doing this going forward? I mean, I’m not going to take out of this until at least age 59 and I’m only 35.

Harry Sit says

Each year when you converted to Roth, you received a 1099-R. That didn’t prompt you to enter it into TaxACT? If you entered it, without a matching non-deductible contribution, TaxACT would’ve had you pay tax on the conversion. Take a look at your past tax returns and see how much you declared as taxable (Form 1040 line 15b, as shown in the article). Maybe you paid more tax than you really owed.

Didn't Do It Before? Am I OK? says

No. I neither entered it nor the matching non-deductible. Just did the mechanics of it each year. Never had any money in a traditional IRA either. Maybe I’ll give the IRS a call later this year after the busy season and see what they say. Just curious if anyone knew what might happen or if there’s any way I could get screwed from those errors if uncorrected. Haven’t heard anything from the IRS yet.

Harry Sit says

If the IRS computer sees the 1099-R and that you didn’t declare it on your tax return, it might ask you to pay tax on it. So far it hasn’t, but it might. You can preempt it by filing the 8606 forms for each year retroactively (look for past-year forms on IRS website).

Laura says

Hey Harry, thanks for the awesome post on the backdoor ROTH. I’m a bit of a noob to all of this (backdoors and a more complex tax return these days), but I’m stuck here within Tax Act:

Check the box if you ever made a traditional IRA contribution that you couldn’t deduct on your tax return. This means you have a basis in traditional IRAs. You would have filed Form 8606 for the year(s) you made the nondeductible traditional IRA contributions. If you deducted all of your traditional IRA contributions in prior years, do not check this box.

I currently do not have anything in a TIRA. Everything has always been either a standard Roth IRA or a backdoor conversation. Since I technically did make a TIRA contribution that I couldn’t deduct on my taxes (and then converted to Roth as a backdoor), should I or shouldn’t I be checking that box?

Harry Sit says

If you contributed for the previous year, check the box. If not, don’t.

Linda Steelman says

Can you send me step by step directions for roth ira on your interview forms. I’m allowed to contribute $6500 in 2016, also have form for $6500 contributed in 2015. no conversion no backdoor. just where I enter what on interview. thanks for H&R Block delux

Ken Z says

Awesome post!

But taxact does give me some issue after following the post. Here is what I did last year and this year:

1. I contributed non-deductible IRA $5500 in 2015 without converting it.

2. I rolled over my remaining $5000 IRA to company 401K in 2016. I got a 1099R with code G.

3. I contributed another $5500 non-deductible IRA in 2016.

4. I did a roth conversion for $11000 in 2016.

But taxact puts $16000 as total distribution on line 5 of Worksheet 1-1. This results in a portion of the conversion as taxable. My question is whether it should include the Rollover $5000 on line 5? My understanding is that it should not. But google did not give me an proper answer.

Thanks for the help!

Ken

Harry Sit says

It should not. Go through the interview on the $5,000 rollover from your IRA to 401k and double-check your answers.

Ken Z says

I did check many times. The form itself is actually not that complicated. I even called taxact and they could not figure out what the problem is. Ironically at the end of the interview, taxact specifically mentioned on the page that this is not taxable and asked me to double check the amount. I also tried to remove the distribution for the Roth conversion. Then everything seems to be fine. But something cause a conflict when both appeared.

I am thinking it is a software bug.

VictorB says

THANK YOU THANK YOU THANK YOU!!!

I got worried at first because TaxAct started to show that I owed a bunch of taxes, but I hadn’t scrolled all the way down to see the “Roth Conversion” text box. Even TaxAct help was of no use and their FAQs do not lay this out.

Thanks again!!

Todd says

Ken Z and VictorB, I’m trying to do similar reporting in TaxAct. I had actually E-Filed, but TaxAct said a software fix was made and I had to try again. Before my numbers looked about right, and now it’s reporting that I owe a large amount. It seems that my 1099-R for the Rollover of deductible basis to my Company’s 401k is tripping up the calculation. I’m frustrated because I E-Filed weeks ago and felt good about it, and now it’s asking me to do it again!

Did you ever figure out how to appropriately report these multiple 1099-Rs and the corresponding 8606?

Ken Z says

Todd,

I have not figured out a solution with taxact. Seems that this is an intentional change from taxact based on your experience. Did you check the line 5 amount on your worksheet 1-1? If your rollover is counted there, then we are talking about exactly the same thing. All my research indicates that it should not be counted on that line. But taxact simply did. 🙁

Todd says

Ken Z;

Line 5 is summing (PreTax IRA –> 401k rollover) + (NonDeductible Basis –> Roth Conversion). That impacts line 9 — showing a huge amount as income.

For my wife’s 1-1, it’s showing the PreTax IRA –> 401k rollover on line 5, with the subsequent calculation on line 9 as well. But she didn’t have a Roth conversion, the net impact to the 1040 was 0.

I did a partial parallel return in TurboTax online for our 1099-Rs and verified that the Backdoor Roth expected result was calculated, and not the huge tax bill as recently re-calculated by TaxAct. I luckily had saved a PDF of my (correctly calulated) return from a few months back and mailed it in instead of E-Filing the new return from Turbotax. Support has been useless and not responsive. This will be the last year of using TaxAct for me.

Ken Z says

That is exactly the same issue. And I agree. The support from TaxAct has no clue of what is happening. I spent quite some time with them on the phone and no solution was offered. I bet many people are in the same situation but did not pay attention to the details of the numbers and just paid the incorrect tax bill!!

WT says

I contributed $11,000 to a non-deductible IRA in March of 2017 after our 2016 taxes were filed. And converted all of it to a Roth IRA within a few days so there were no gains. $5,500 was for 2016 and $5,500 was for 2017. I received a 1099R from the financial inst. for $11,000 to file for 2017 tax returns. I see how this is being done in tax act for the same year contribution and conversion, which makes sense and will do it that way going forward. But I’m wondering now how to record this in tax act and on the tax return? I’m hoping I can do it all on the 2017 tax return somehow and get this all recorded and taken care of.

Harry Sit says

$5,500 2017 contribution – Enter in the same way as shown, except: enter $5,500 as the prior year basis and do not check the box saying the basis was zero.

$11,000 conversion – Enter the 1099-R exactly as you have it. Check the box for Prior Year Nondeductible Contributions and enter $5,500 (that’s the $5,500 you contributed for 2016 in 2017).

David says

Hi,

Would it be possible if you can update some of the screen shots? I’m using Tax Act for this year tax return and not able to view the Forms. Thanks for all your help!

Harry Sit says

The screenshots were from TaxACT download software, not from TaxACT online. If you use the download software you will see them.

Vikram Kamdar says

Excellent article…Very clear instructions..Hats off

Question – Did not report Back door roth in 2017 tax return

Do I need to amend the return or just file form 8606 ?

Thanks much for your help in anticipation

James Fowler says

Just a warning to everyone – this is not working in TaxAct for 2018 as of February 3. The program hangs infinitely when you reach the screen to enter nondeductible contributions. I pointed this out to them 10 days ago and after much annoying back and forth with incompetent customer service agents it still is not fixed. I am near the end of my rope with them and about to either try a different online program or do it myself.

Charlie says

I had the exact same experience as yours, and actually posted my question (without seeing yours for some reason). This is really bad customer service by TaxAct. I am researching other options for my tax return this year.

Charlie says

Did anyone else use TAXACT for the 2018 tax return with a backdoor IRA? On the IRA (for 1099-R) form, whenever I fill in the amount of ROTH conversion and click save, the page will freeze and then kick me out of the federal tax return completely. Tried various versions of TAXACT, and on different computers, all to the same result. Is anyone else experiencing the same? I sent an email to TAXACT, but haven’t received an answer after a whole week. Mine is for a clean conversion with no other basis. Sadly, this might be the last year of TAXACT for me…

Charlie says

Finally got a reply from TaxAct that there was a loop in their program, and this has been fixed. I tried it myself and it works out ok for me. We could use better customer service, but glad it finally got resolved.

Jon says

Looks like it has been fixed now. I was able to complete this in taxact a couple of days ago.

J says

Following these using TaxAct online and my fed and state taxes keep going up (i.e. when I remove this, the amounts due drop). What could I be doing wrong? Why is it “Taxable amount not determined” instead of taxable amount 0 for the Quick entry box?

Katie says

Hi! thank you so much for this! Question, after doing this, I’m still showing an income of a distribution, and I didn’t have one. Taxact is terrible to work with. What am I doing wrong??

Thank you!

Cathy says

Gosh — still finding this so very useful! Bless you for having this post up! I wrestled with TaxAct for a few days before googling this, and your succinct explanation is what **finally** got the entries right!

Joe says

Yep, me too! I think the key is the Form 8606 step. After you enter your nondeductible IRA contribution information, tax liability goes up and causes concern (what did I do wrong?!). Then, you have to find form 8606 to check the box for total value zero and enter the basis. Then, tax liability goes back to where it should be (i.e. unchanged from where you started the process of Backdoor Roth reporting). Perhaps I was just impatient and the “prompts” would have eventually led me there, but I had to go to the “form section” to find it. The screenshots now look different than the above, but the steps are largely the same.