Updated on January 20, 2026, with updated screenshots from H&R Block Deluxe desktop software for the 2025 tax year. If you use TurboTax or FreeTaxUSA, see:

- Split-Year Backdoor Roth IRA in TurboTax, 2nd Year

- Split-Year Backdoor Roth IRA in FreeTaxUSA, 2nd Year

The previous post Split-Year Backdoor Roth in H&R Block, Year 1 dealt with contributing to a Traditional IRA for the previous year or recharacterizing a previous year’s Roth IRA contribution as a Traditional IRA contribution. This post handles the conversion part.

We cover two example scenarios. Here’s the first scenario:

You contributed $7,000 to a Traditional IRA for 2024 in 2025. The value increased to $7,200 when you converted it to Roth in 2025. You received a 1099-R form listing this $7,200 Roth conversion.

You should’ve already reported the contribution part on your 2024 tax return by following Split-Year Backdoor Roth in H&R Block, Year 1. The IRA custodian sent you a 1099-R form for the conversion in 2025. This post shows you how to put it into H&R Block tax software.

Here’s the second example scenario:

You contributed $7,000 to a Roth IRA for 2024 in 2024. You realized that your income was too high when you did your 2024 taxes in 2025. You recharacterized the Roth contribution for 2024 as a Traditional contribution before April 15, 2025. The IRA custodian moved $7,100 from your Roth IRA to your Traditional IRA because your original $7,000 contribution had some earnings. The value increased again to $7,200 when you converted it to Roth in 2025. You received two 1099-R forms, one for $7,100 and another for $7,200.

You should’ve already reported the recharacterized contribution on your 2024 tax return by following Split-Year Backdoor Roth in H&R Block, Year 1. The IRA custodian sent you two 1099-R forms, one for the recharacterization and the other for the conversion. This post shows you how to put both of them into H&R Block tax software.

If you contributed for 2025 in 2026 or if you recharacterized a 2025 contribution in 2026, you’re still in the first year of this journey. Please follow Split-Year Backdoor Roth in H&R Block, Year 1. If you recharacterized your 2025 contribution in 2025 and converted in 2025, please follow Backdoor Roth in H&R Block: Recharacterized in the Same Year.

If neither of these example scenarios fits you, please consult our guide for a normal “clean” backdoor Roth: How to Report Backdoor Roth in H&R Block Tax Software.

If you’re married and both you and your spouse did the same thing, you should follow the steps below once for yourself and once again for your spouse.

Use H&R Block Desktop Software

The screenshots below are taken from the H&R Block Deluxe desktop software. The desktop software is more powerful and less expensive than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block desktop software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block desktop software next year.

1099-R for Recharacterization

This section only applies to the second example scenario. If you didn’t recharacterize (the first example scenario), please skip this section and jump over to the conversion section.

We handle the 1099-R form for recharacterization first. This 1099-R form has a code ‘R’ in Box 7.

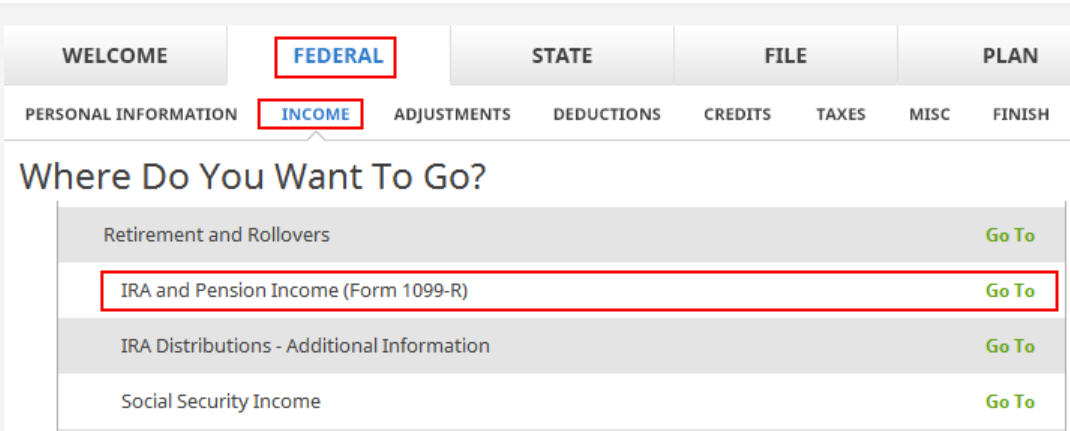

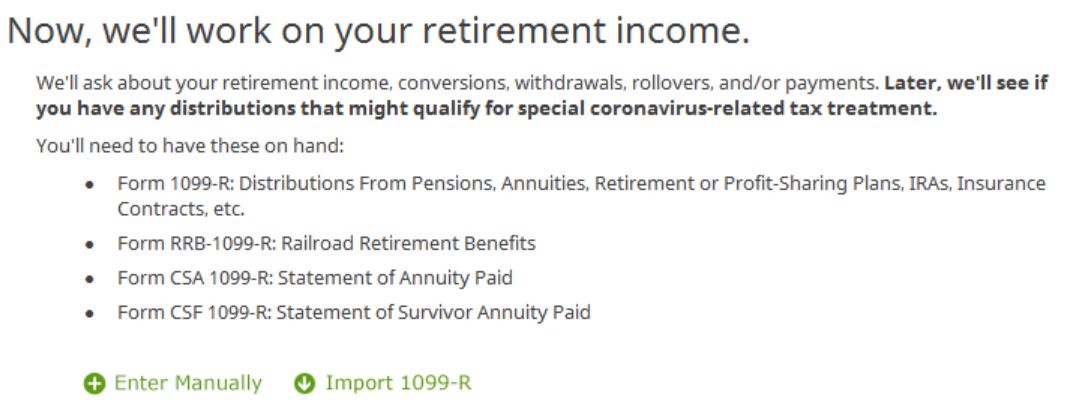

Click on Federal -> Income. Scroll down and find IRA and Pension Income (Form 1099-R). Click on “Go To.”

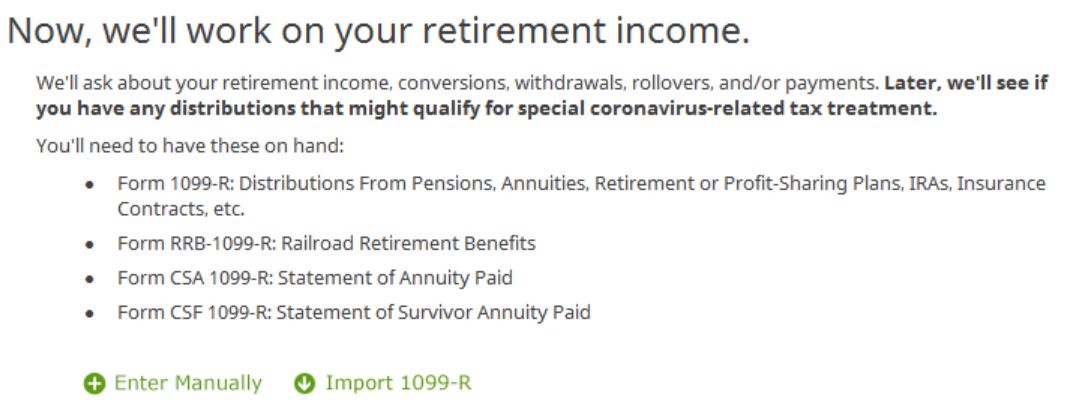

Click on Import 1099-R if you’d like. I show manual entries with “Enter Manually” here.

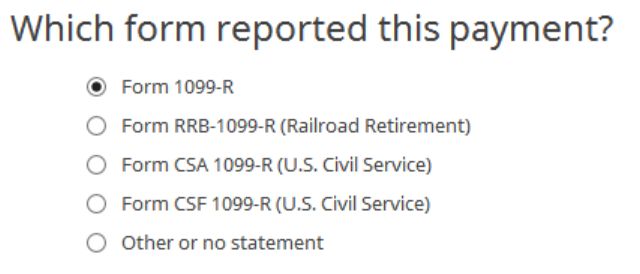

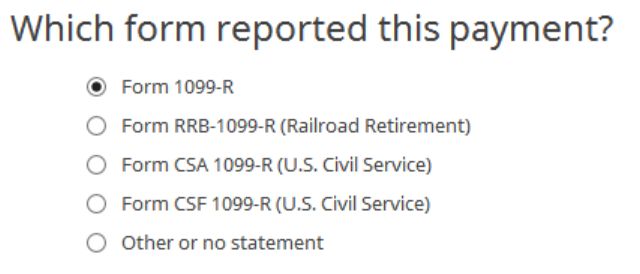

Just a regular 1099-R.

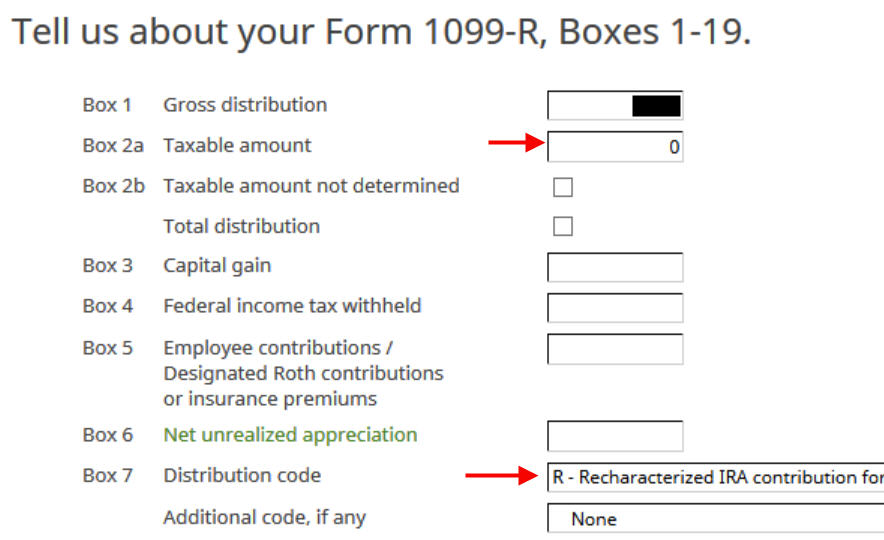

The amount that moved from your Roth IRA to your Traditional IRA is shown in Box 1. It’s $7,100 in our example. The taxable amount in Box 2a is zero. The two checkboxes in Box 2b aren’t checked. The code in Box 7 is “R.”

The “IRA/SEP/SIMPLE” box under Box 7 may or may not be checked. It’s not checked in our sample 1099-R.

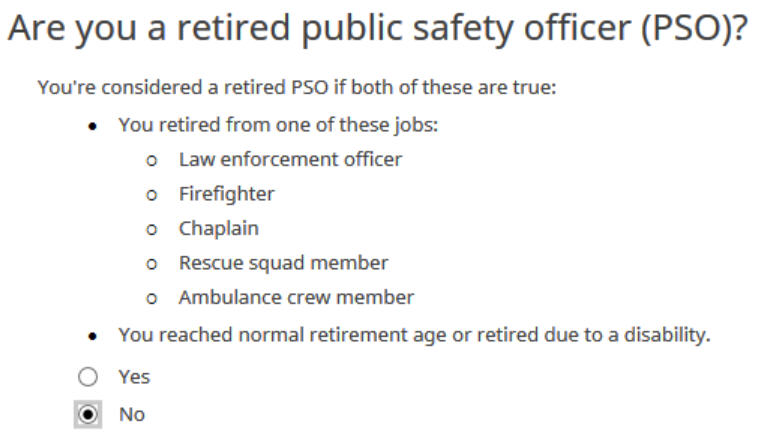

Not a retired public safety officer.

We like hearing that recharacterizations aren’t taxable.

You’re done with the first 1099-R form. Click on “Enter Manually” to add the second one if you don’t already have both 1099-R forms imported.

1099-R for Conversion

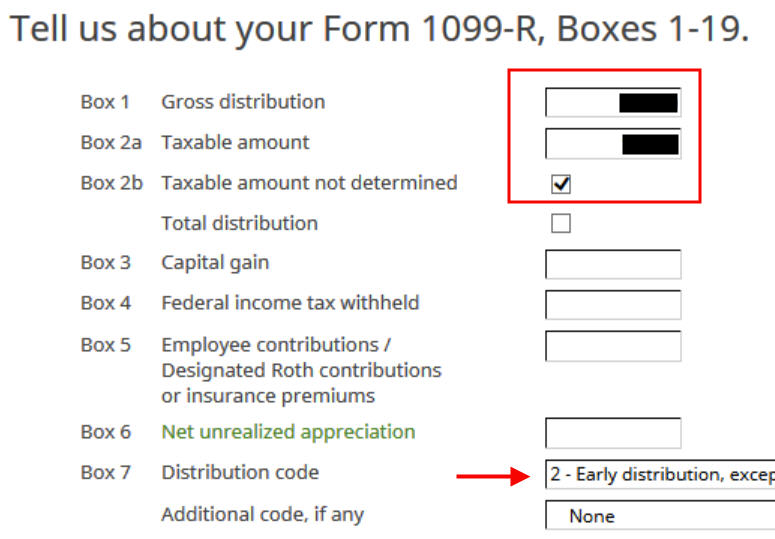

The 1099-R for conversion has either a code “2” or code “7” in Box 7.

The second 1099-R form is also a regular 1099-R.

It’s normal to see the conversion reported in Box 2a as the taxable amount when Box 2b is checked to say “Taxable amount not determined.” The code in Box 7 is ‘2‘ when you’re under 59-1/2 or ‘7‘ when you’re over 59-1/2.

The “IRA/SEP/SIMPLE” box is checked on this 1099-R form for the conversion.

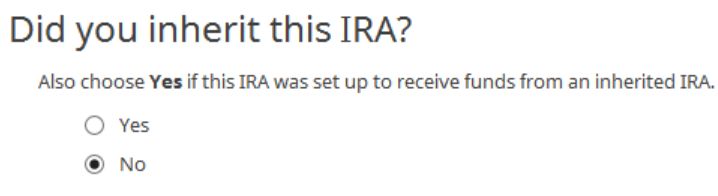

Did not inherit it.

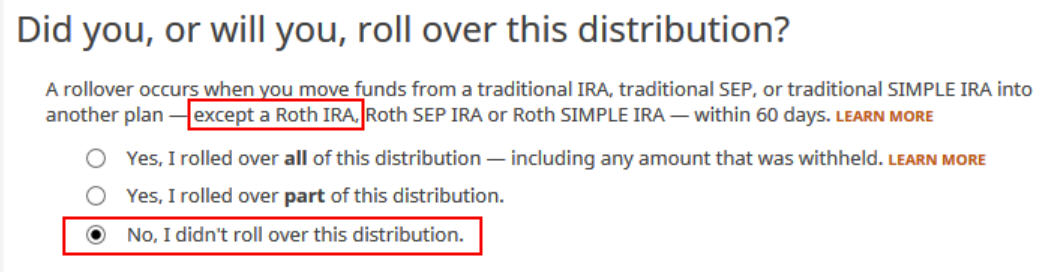

This is a very important question. Read carefully. Answer No, because you converted, not rolled over.

We don’t have these repaid withdrawals treated as rollovers or basis adjustments.

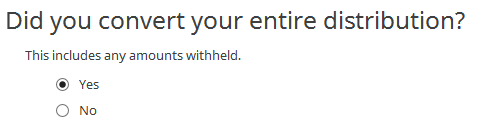

Now answer Yes, you converted.

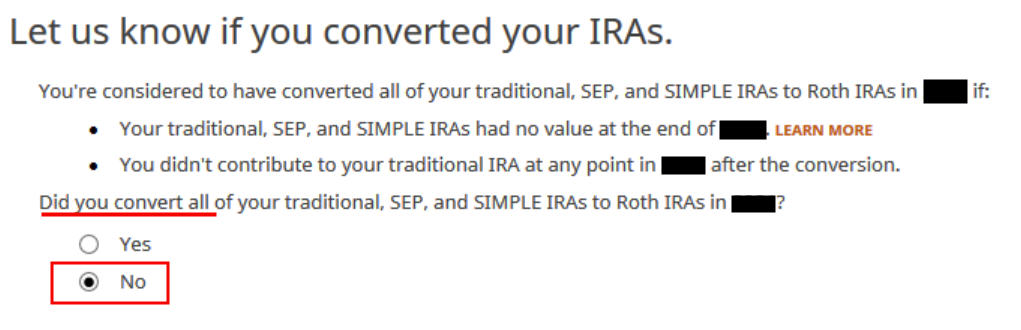

We converted all of it in our example.

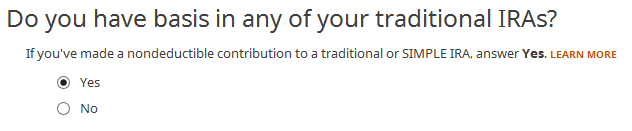

Answer Yes because your contribution for the prior year was your basis.

The refund in progress drops a lot at this point. Don’t panic. It’s normal and only temporary. It will come back up after we continue.

You are done with this 1099-R. Repeat the above if you have another 1099-R. If you’re married and both of you converted to Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-Rs to the same person when they belong to each spouse. Click on Finished when you are done with all the 1099-Rs.

More Questions

H&R Block has a few more questions.

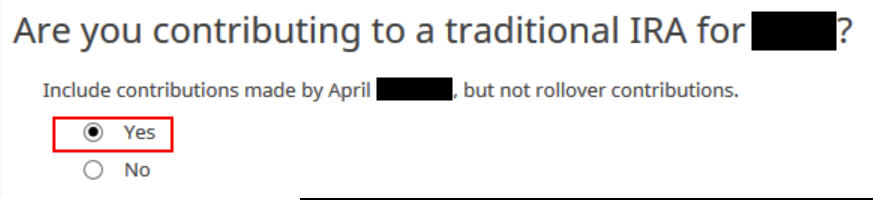

Answer Yes if you did a “clean” backdoor Roth in 2025 on top of converting your 2024 contribution, in other words, you also contributed to a Traditional IRA for 2025 in 2025 and converted both your 2024 contribution and your 2025 contribution in 2025. Your 1099-R includes converting two years’ worth of contributions in a single year.

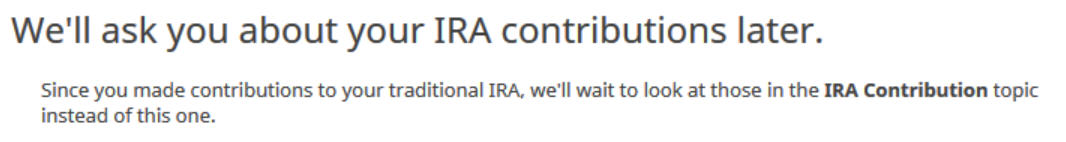

If you answered “Yes” to the previous question, H&R Block will wait until you also enter your 2025 contribution. Your refund meter is still depressed, but don’t worry.

If you answered “No” to the previous question because you didn’t contribute to a Traditional IRA for 2025, the software will ask you for your basis. Get that number from Line 14 of your Form 8606. It’s $7,000 in our example.

Clean Backdoor Roth On Top

The conversion part of the clean backdoor Roth is already included in the 1099-R form we just completed. Now we do the contribution part.

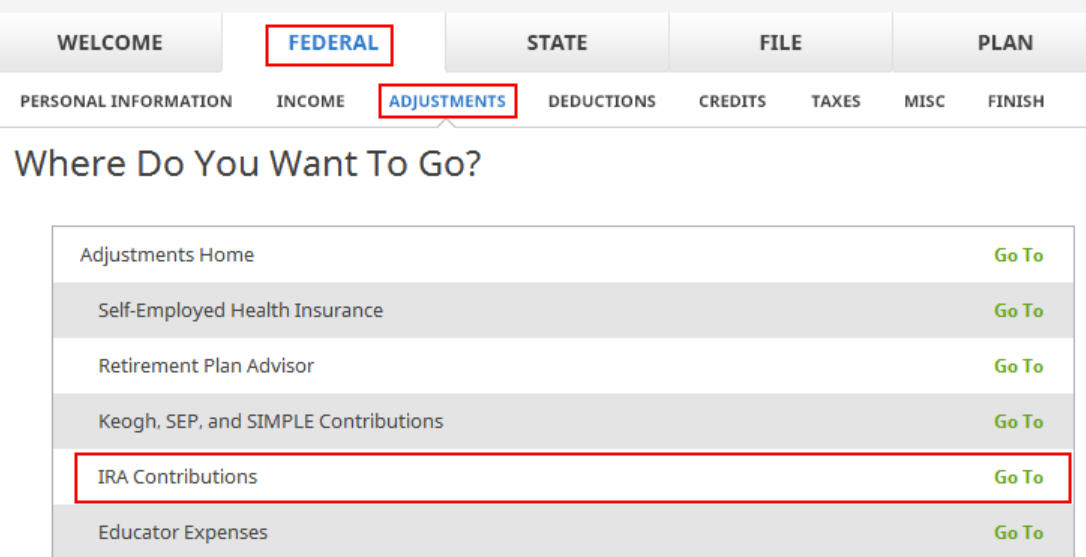

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

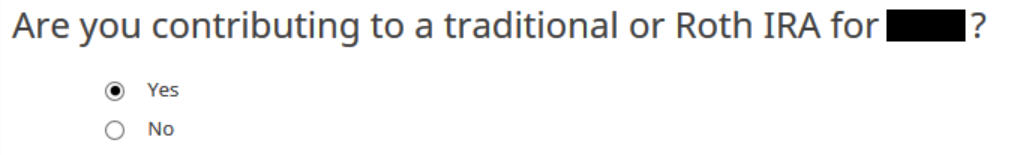

Answer “Yes” because you contributed to a Traditional IRA in 2024 for 2024.

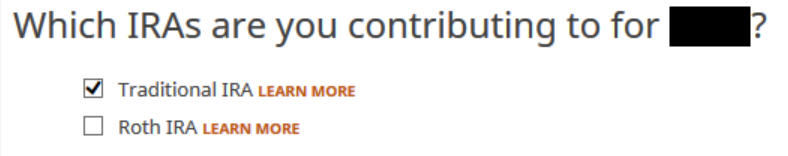

Check the box for Traditional IRA.

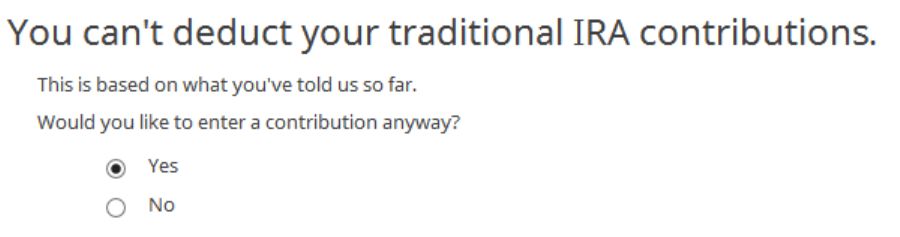

You know you don’t get a deduction due to income. Enter anyway. If you don’t see this question, it means the software thinks you’re eligible for a deduction. You can’t decline the deduction.

Enter your contribution amount. We contributed $7,000 in our example.

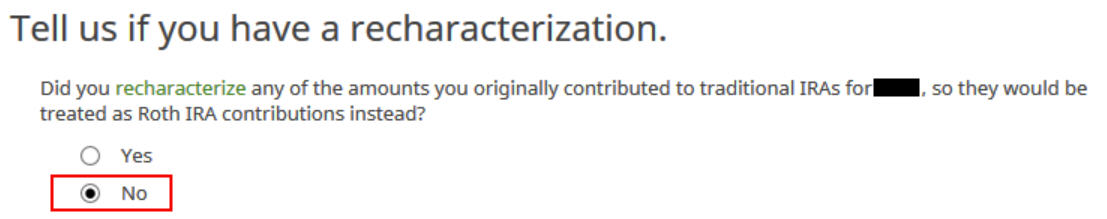

Did Not Recharacterize

This is important. Answer No because you didn’t recharacterize. You converted to Roth.

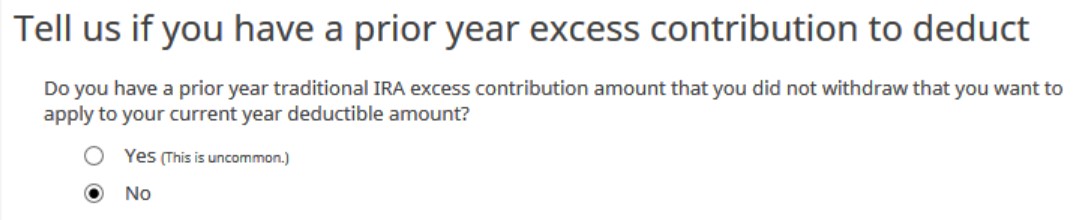

No excess contribution.

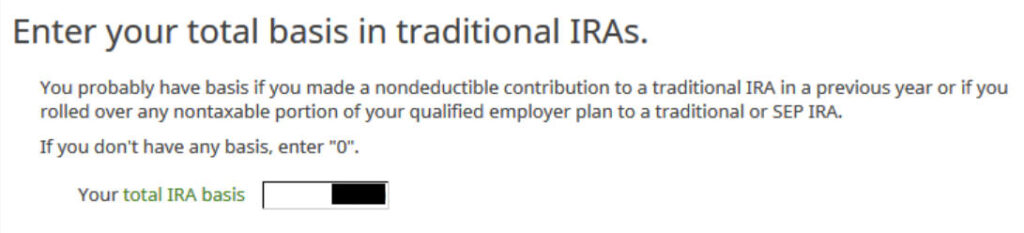

Basis

H&R Block should’ve imported this from last year’s data. If it doesn’t, get it from last year’s Form 8606 Line 14. If you didn’t have a Form 8606 last year because the software gave you a deduction on Schedule 1 Line 20, your basis is zero. It’s $7,000 in our example.

This is another important question. If you emptied all your Traditional IRAs and you don’t have any SEP or SIMPLE IRAs, technically you can answer Yes and skip some questions. The safer bet is to answer No and go through the follow-up questions. If you’ve been going through these screens back and forth, you may have given some incorrect answers in a previous round. You will have a chance to review and correct those answers only if you answer No.

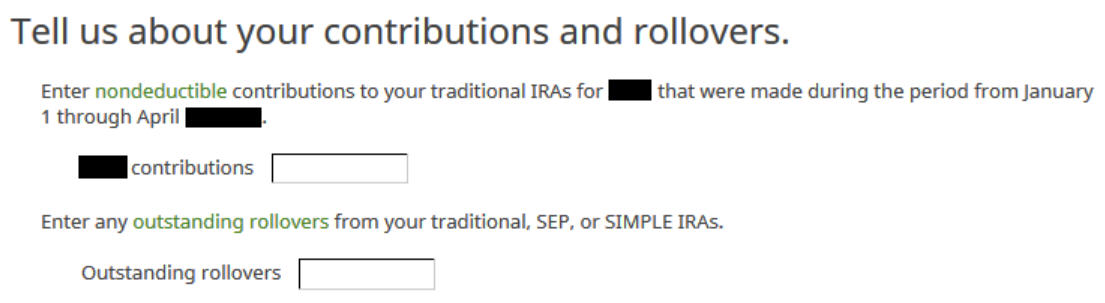

Leave the boxes blank when you contributed for 2025 in 2025.

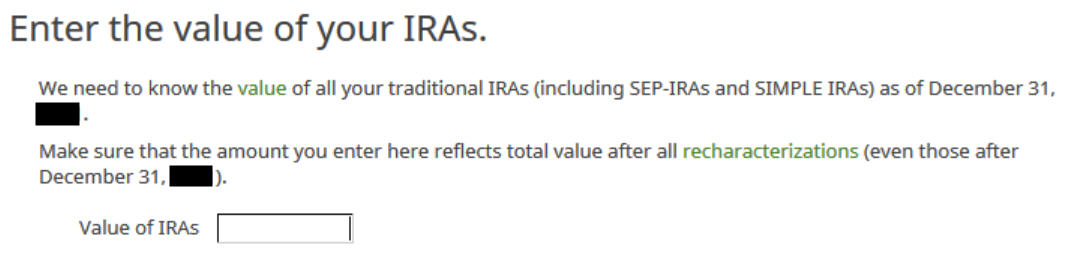

The box should be blank or zero when you have emptied all your Traditional IRAs after converting them to Roth. If you had a few dollars of earnings after you converted and you left them in the account, get the value from your year-end statements and put it here. The software will apply the pro-rata rule.

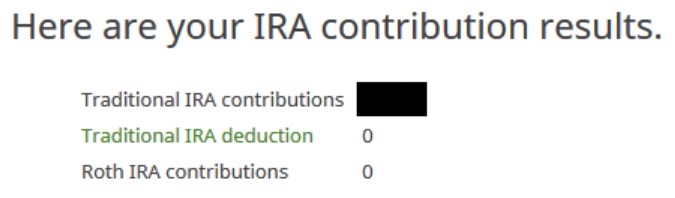

0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you contributed to a Traditional IRA.

Now the refund meter should go back up after you enter the Traditional IRA contributions.

Taxable Income

You’re done with the 1099-R forms. Let’s look at how they show up on your tax return. Click on Forms at the top and open Form 1040 and Schedules 1-3. Click on Hide Mini WS. Scroll down to lines 4a and 4b.

Line 4a shows the amount on your 1099-R for the Roth conversion. Line 4b shows the taxable amount, which is the earnings between the time you contributed to your Traditional IRA and the time you converted it to Roth. The taxable amount would be zero if you didn’t have any earnings. The taxable amount can be off by a few dollars due to rounding.

Form 8606 shows these for our example:

| Line # | Amount |

|---|---|

| 1 | 7,000 (only if you also did a “clean” backdoor Roth on top, otherwise blank.) |

| 2 | 7,000 |

| 3 | The sum of Line 1 and Line 2 |

| 5 | The same as Line 3 |

| 13 | The same as Line 3 (or close to it due to rounding) |

| 14 | 0 |

| 16 | The amount on your 1099-R with a code 2 or 7 |

| 17 | The same as Line 3 (or close to it due to rounding) |

| 18 | The difference between Line 16 and Line 17 |

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

Fresh Start

It’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

Click on Forms and delete IRA Contributions Worksheet, 1099-R Worksheet, and Form 8606. Then start over by following the steps here.

Conversion Is Taxed

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work, but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. The software gives you the deduction if it sees that your income qualifies. It doesn’t give you the choice of making it non-deductible.

Part of your conversion could be taxed because you took a deduction on the Traditional IRA contribution last year or this year. You see whether you took a deduction by looking at Schedule 1 Line 20 on last year’s and this year’s tax returns.

The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal, and it doesn’t cause any problems when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

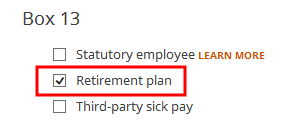

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2.

Maybe you forgot to check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries to make sure it matches the W-2.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Paul Hastert says

Thank you! I had done my conversion quickly and (of course) didn’t read all the instructions as well as I should have. Your walk through generated an “oops” moment and let me fix my error vs. (hopefully) finding it later.

Marty E. says

Hello! Thanks for all the help. Having one issue… For our 2023 contribution, we unfortunately did a split year, “dirty” backdoor where we both initially contributed to Roth and had to do the recharacterization and conversion in early 2024. We received 5x 1099Rs for Tax Year 2024. I received 3– 1 for Roth, and 2 for Traditional (1 for the conversion, 1 for a disbursement of $3 because it made gains in the 1-2 days it sat). My spouse received 1 for Roth and 1 for Traditional. Both of our Roth 1099Rs have Distro Code R in Box 7 for recharacterization. When I go to place this in the H&R Premium software, it tells me that it cannot go in this year’s taxes and I should amend my 2023 tax return. After some intense Googling, I’m not sure if that’s correct as I reported the recharacterization and conversion in my 2023 Form 8606. Any advice? My tax year 2023 Form 8606 only has lines 1, 3, and 14 filled out, and I reported the recharacterization and conversion via the “explanation” section on my tax year 2023 return. Are the 1099Rs with Distro Code Rs more for record at this point than anything else?

Harry Sit says

Maybe you’re using the online software? I updated my desktop software and re-ran the scenario. It doesn’t say anything about amending last year’s return. You don’t need to amend when you already reported the recharacterization last year. Your last year’s Form 8606 is correct with the amount on lines 1, 3, and 14. Just ignore and continue.

John Doe says

Sincere thank-you to the authors of this article for recommending the troubleshooting step of deleting and re-adding the forms. I filled out the interview correctly after multiple tries, but I had originally stated that I had no basis in traditional IRAs (which was not accurate) amongst other errors. H&R Block refused to update my forms and my refund correctly. Deleting the forms and re-adding them fixed the problem. Thank you as well for confirming that I had managed to fill the forms out correctly in the end.

Thank you!

I think this may be my last year with H&R Block. Refusing to update my forms correctly for corrected answers almost cost me several thousand dollars and I only caught it by manually reviewing the forms.

Randy says

I am following scenario 1: I contributed to my 2023 Roth in 2024. I also contributed to my 2024 Roth in 2024 (same years).

On my 1099-R, in 2b both “Taxable amount not determined” and “Total distribution” are checked.

I notice in your screenshot above, only “Taxable amount not determined” is checked and “Total distribution” is NOT.

Is it ok that my “Total distribution” box is checked?

Harry Sit says

That’s OK. It makes no difference whether the Total Distribution box is checked or not.

Chip says

Thank you for this turtorial. It have been very helpful over the years for navigating the Backdoor Roth contribution.

I am in the scenario where I have been contributing in split years for a few years now since I haven’t figured out how to do two contributions in one year to break the cycle. I contributed $7000 to my IRA and converted it to a Roth in 2025 for 2024. I did the same in 2024 for 2023. I would like to do a contribution to my IRA and convert to a Roth in 2025 for 2025 and get back on a better schedule. If I did $7000 for 2025, what would I enter for the “Enter traditional IRA contributions”? Also, what would I enter for my “Total IRA basis”? Do you have any other advice for this contribution? Many Thanks.

Harry Sit says

If you contribute $7,000 for 2025 in 2025, you will enter $7,000 as your contribution when you do your 2025 taxes in 2026. Your total IRA basis will be the amount you contributed for 2024 in 2025. Bookmark and follow this post when you do your taxes. It will be updated for 2025.

Paul says

Thank you so much for this site! Last year I did part 1 of the dirty backdoor Roth contributing 8000 for 2024 and contributed 8000 for 2025 for a clean backdoor Roth. However, I received only 1 1099-R for 16,000 (boxes 1 and 2a). I think I need to do part 2 of the backdoor Roth with 8000 and then enter the information for a clean backdoor Roth for another 8000. Can I do that with just one 1099-R?

Harry Sit says

You can do that with only one 1099-R. Just follow everything here. Where the example shows $7,200, you enter your $16,000. The basis from Year 1 will leave $8,000 taxable. Then the “Clean Backdoor Roth On Top” section will take care of the remaining $8,000.