Updated on January 20, 2026, with updated screenshots from H&R Block Deluxe desktop software for the 2025 tax year. If you use TurboTax or FreeTaxUSA, see:

- Split-Year Backdoor Roth IRA in TurboTax, 1st Year

- Split-Year Backdoor Roth IRA in FreeTaxUSA, 1st Year

The best way to do a backdoor Roth is to do it “clean” by contributing for and converting in the same year — contribute for 2025 in 2025 and convert in 2025, contribute for 2026 in 2026 and convert in 2026, and contribute for 2027 in 2027 and convert in 2027. Don’t split them into two years: contributing for 2024 in 2025 and converting in 2025, or contributing for 2025 in 2026 and converting in 2026. If you did a “clean” backdoor Roth and you’re using H&R Block tax software, please follow How to Report Backdoor Roth in H&R Block Tax Software.

However, many people didn’t know they should’ve done it “clean.” Some people thought it was natural to contribute to an IRA for 2025 between January 1 and April 15 in 2026. Some people contributed directly to a Roth IRA for 2025 in 2025 and only found out their income was too high when they did their 2025 taxes in 2026. They had to recharacterize the previous year’s Roth IRA contribution as a Traditional IRA contribution and convert it again to Roth after the fact.

When you contribute for the previous year and convert (or recharacterize and convert in the following year), you have to report them on your tax return in two different years: the contribution in one year and the conversion in the following year. It’s more confusing than a straight “clean” backdoor Roth, but that’s the price you pay for not knowing the right way. This post shows you how to report the contribution part in H&R Block for the first year. Split-Year Backdoor Roth in H&R Block, Year 2 shows you how to do the conversion portion for the second year.

If you recharacterized your 2025 contribution in 2025 and converted in 2025, please follow Backdoor Roth in H&R Block: Recharacterized in the Same Year.

I’m showing two examples — (1) a direct contribution to a Traditional IRA for the previous year; and (2) a Roth contribution for the previous year recharacterized as a Traditional contribution. Please see which example matches your scenario and follow along accordingly.

Use H&R Block Desktop Software

The screenshots below are taken from the H&R Block Deluxe desktop software. The desktop software is more powerful and less expensive than online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block desktop software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to the H&R Block desktop software next year.

Contributed for the Previous Year

Here’s the example scenario for a direct contribution to the Traditional IRA:

You contributed $7,000 to a Traditional IRA for 2025 between January 1 and April 15, 2026. You then converted it to Roth in 2026.

Because your contribution was *for* 2025, you need to report it on your 2025 tax return by following this guide. Because you converted in 2026, you won’t get a 1099-R for your conversion until January 2027. You will report the conversion when you do your 2026 tax return. Come again next year to use Split-Year Backdoor Roth in H&R Block, Year 2.

If you contributed to a Traditional IRA in 2025 for 2024, everything below should have happened on your 2024 tax return. In other words, if this is the case:

You contributed $7,000 to a Traditional IRA for 2024 between January 1 and April 15, 2025. You then converted it to Roth in 2025.

Then you should’ve gone through the steps below in your 2024 tax return. If you didn’t, you should fix your 2024 return. The conversion part is covered in Split-Year Backdoor Roth in H&R Block, Year 2.

If you’re married and both you and your spouse did the same thing, you must follow the same steps below once for you and once again for your spouse.

If you first contributed to a Roth IRA and then recharacterized it as a Traditional contribution, please jump over to the next example.

Contributed to Traditional IRA

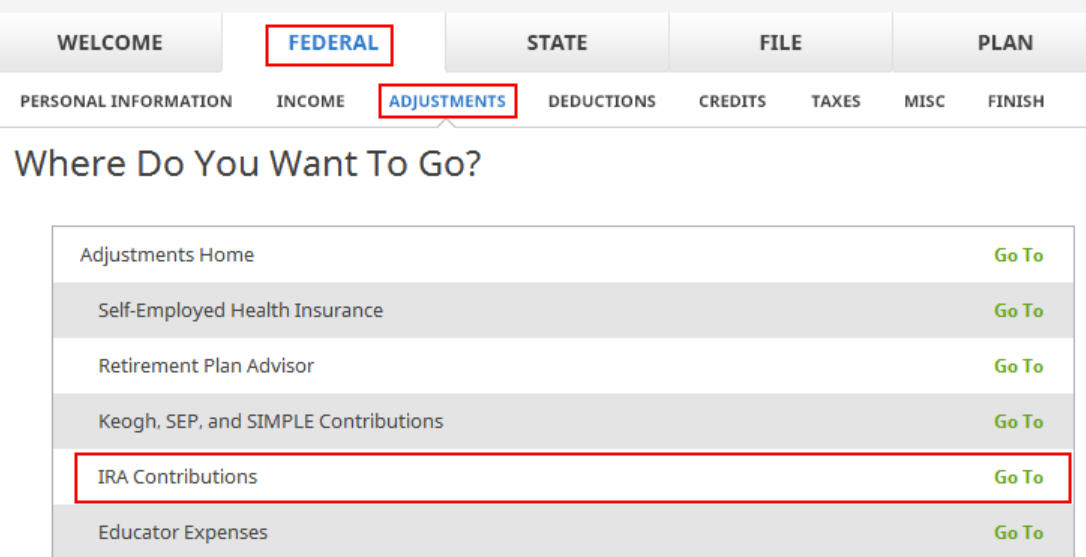

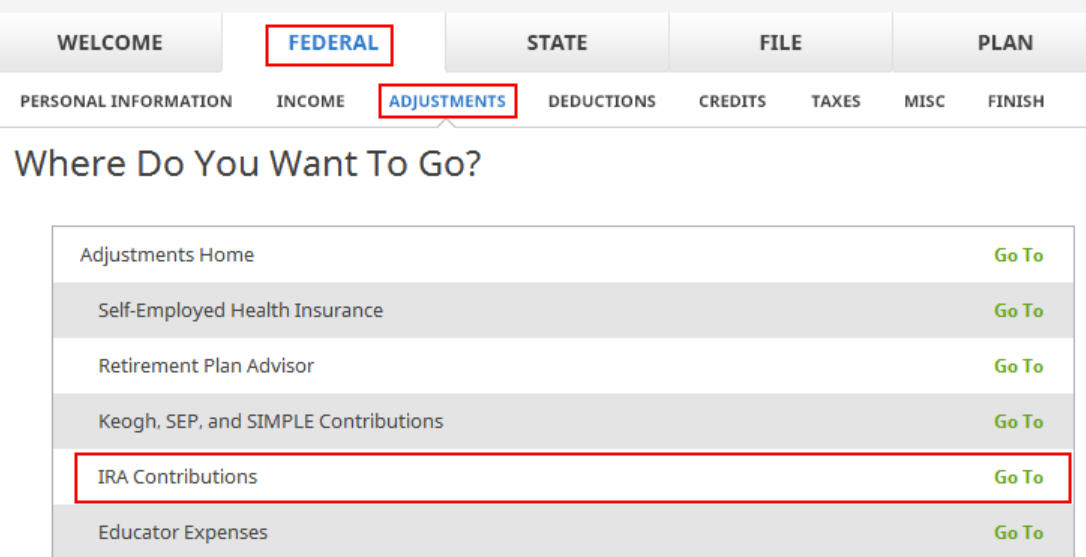

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

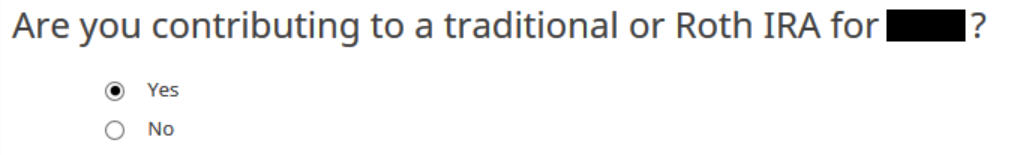

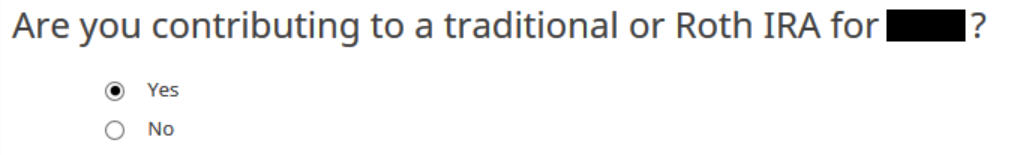

The “Are you contributing to …” wording isn’t exactly accurate when you already contributed, but answer “Yes” anyway because you contributed to an IRA for the year in question.

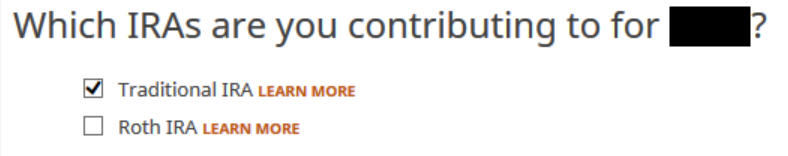

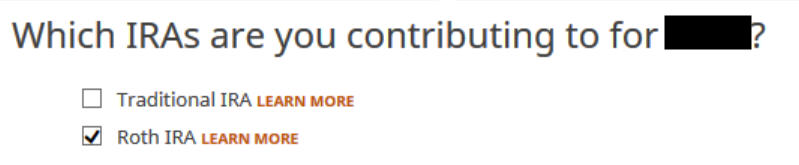

Check the box for Traditional IRA because you contributed directly to a Traditional IRA. See the next example if you contributed to a Roth IRA first and then recharacterized your contribution.

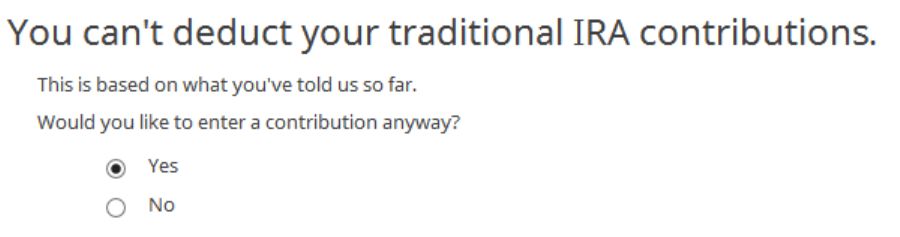

You know you don’t get a deduction due to income. Enter anyway. If you don’t see this question, it means H&R Block thinks you qualify for a deduction. You don’t have the choice to decline the deduction.

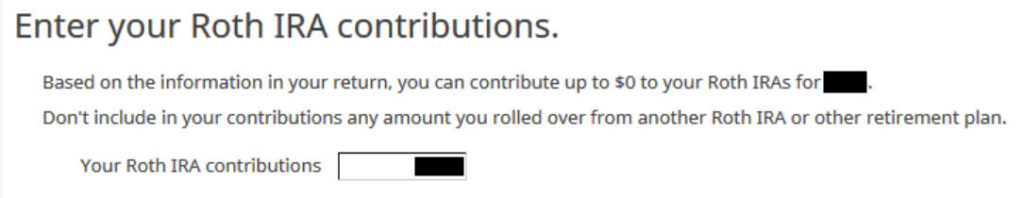

Enter your contribution amount. We contributed $7,000 in our example.

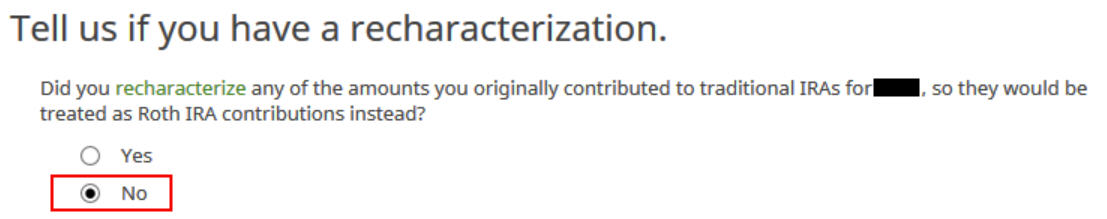

Did Not Recharacterize

This is important. Answer No because you didn’t recharacterize. You converted to Roth.

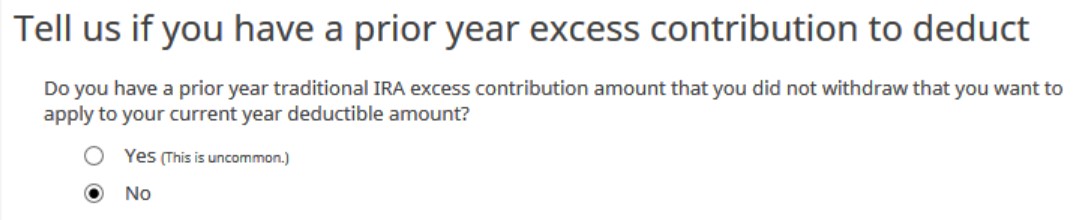

No excess contribution.

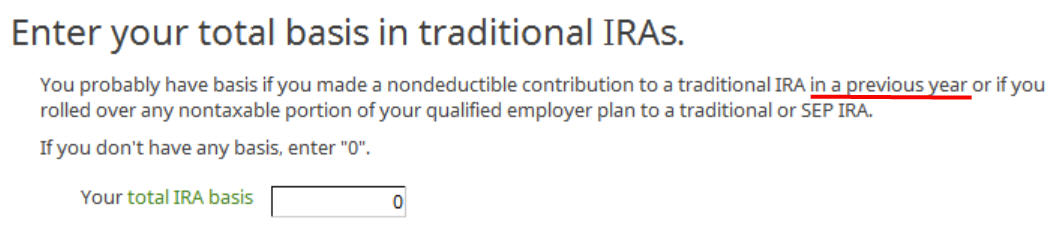

Enter zero if this is the first year you contributed to a Traditional IRA. If you contributed non-deductible amounts for previous years (regardless of when), enter the number on line 14 of your Form 8606 from last year.

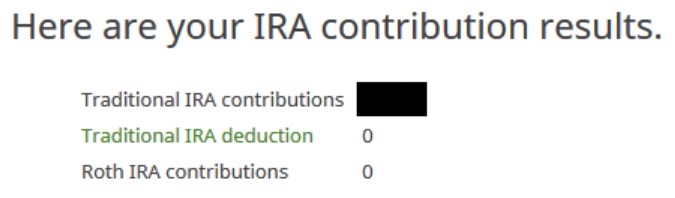

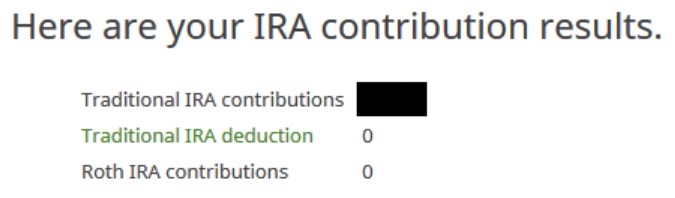

A summary of your contributions. 0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you contributed to a Traditional IRA for the previous year.

Form 8606

Click on Forms at the top and open Form 8606. Click on Hide Mini WS. You should see that only lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2026. It’ll make your conversion in 2026 not taxable.

If you don’t see a Form 8606 or if your Form 8606 doesn’t look right, please check the Troubleshooting section.

Break the Cycle

While you’re at it, you should break the cycle of contributing for the previous year and create a new habit of contributing for the current year. Contribute to a Traditional IRA for 2026 in 2026 and convert in 2026.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2025 contribution and your 2026 contribution in 2026. Then you will start 2027 fresh. Contribute for 2027 in 2027 and convert in 2027.

Recharacterized in the Following Year

Let’s look at our second example scenario now.

You contributed $7,000 to a Roth IRA for 2025 in 2025. You realized that your income was too high when you did your 2025 taxes in 2026. You recharacterized the Roth contribution for 2025 as a Traditional contribution before April 15, 2026. The IRA custodian moved $7,100 from your Roth IRA to your Traditional IRA because your original $7,000 contribution had some earnings. Then you converted it to Roth in 2026.

Because your contribution was for 2025, you need to report it on your 2025 tax return by following this guide. Because you converted in 2026, you won’t get a 1099-R for your conversion until January 2027. You will report the conversion when you do your 2026 tax return. Come back again next year to use Split-Year Backdoor Roth in H&R Block, Year 2.

Similar to our first example, if you did the same in 2025 for 2024, you should’ve done everything below when you did your taxes for 2024. In other words, if this is the case:

You contributed $7,000 to a Roth IRA for 2024 in 2024. You realized that your income was too high when you did your 2024 taxes in 2025. You recharacterized the Roth contribution for 2024 as a Traditional contribution before April 15, 2025. The IRA custodian moved $7,100 from your Roth IRA to your Traditional IRA because your original $7,000 contribution had some earnings. Then you converted it to Roth in 2025.

Then you should’ve taken all the steps below last year on your 2024 tax return. If you didn’t, you need to fix your 2024 return. The conversion part is covered in Split-Year Backdoor Roth in H&R Block, Year 2.

Contributed to Roth IRA

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

Answer “Yes” because you contributed to an IRA for the year in question.

Check the box for Roth IRA because you originally contributed to a Roth IRA before you recharacterized your contribution.

Enter your original contribution amount. It’s $7,000 in our example.

Recharacterized to Traditional

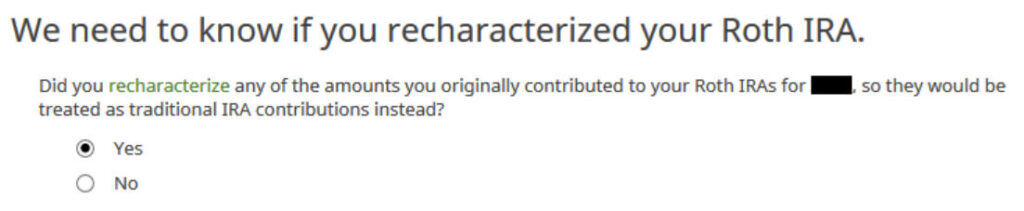

Answer Yes because you recharacterized the contribution.

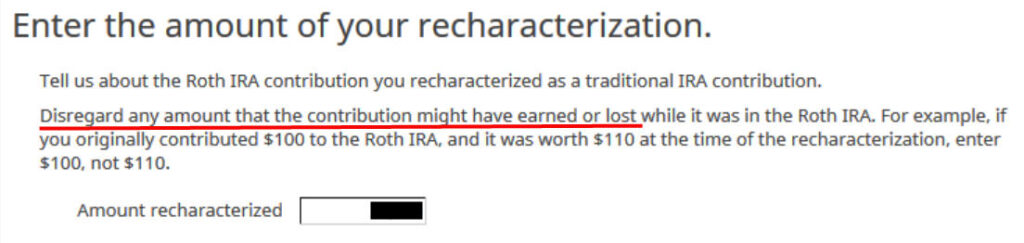

The amount here is relative to the original contribution amount. If you recharacterized the whole thing, enter $7,000 in our example, not $7,100, which was the amount with earnings that the IRA custodian moved into the Traditional IRA.

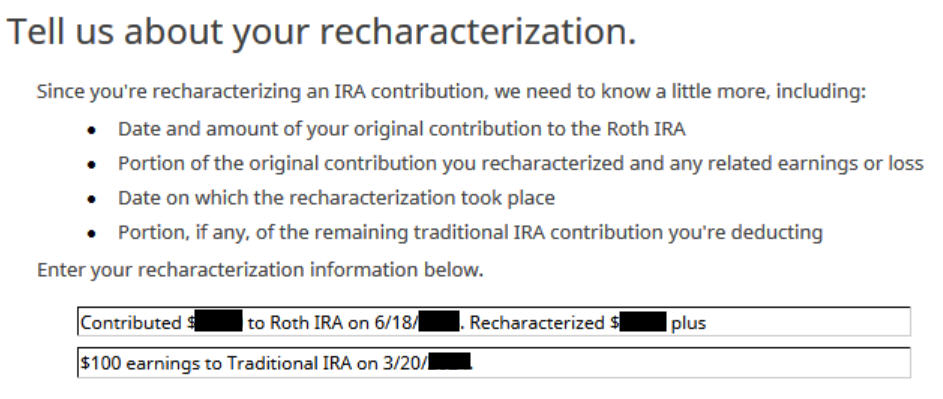

The IRS requires a brief statement to describe your recharacterization.

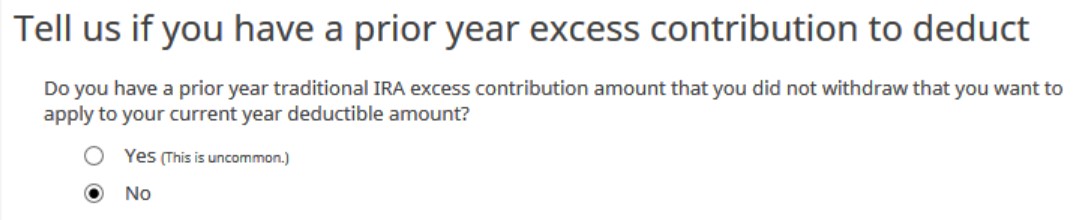

No excess contribution.

This is as expected. 0 in Traditional IRA deduction means it’s nondeductible. Click on Next. Repeat for your spouse if both of you contributed to a Roth IRA for the previous year and then recharacterized it in the following year.

Form 8606

Click on Forms at the top and open Form 8606. Click on Hide Mini WS. You should see that lines 1, 3, and 14 are filled in with your contribution amount. It’s important to see the number in Line 14. This number will carry over to 2026. It’ll make your conversion in 2026 not taxable.

If you don’t see a Form 8606 or if your Form 8606 doesn’t look right, please check the Troubleshooting section.

Switch to Clean Backdoor Roth

While you are at it, you should switch to a clean backdoor Roth for 2026. Rather than contributing directly to a Roth IRA, seeing that you exceed the income limit, recharacterizing it, and converting it again, you should simply contribute to a Traditional IRA for 2026 in 2026 and convert it to Roth in 2026 if there’s any possibility that your income will be over the limit again.

You’re allowed to do a clean backdoor Roth even if your income ends up below the income limit for a direct contribution to a Roth IRA. It’s much simpler than the confusing recharacterize-and-convert maneuver.

You’re allowed to convert more than once in a single year. You’re allowed to convert more than one year’s contribution amount in a single year. Your larger conversion is still not taxable when you convert both your 2025 contribution and your 2026 contribution in 2026. Then you will start 2027 fresh. Contribute for 2027 in 2027 and convert in 2027.

Troubleshooting

If you followed the steps and you are not getting the expected results, here are a few things to check.

No 1099-R

You get a 1099-R only if you converted to Roth in 2025. Because you only converted in 2026, you won’t get a 1099-R until 2027. This is normal. You complete the conversion part next year by following Split-Year Backdoor Roth IRA in H&R Block, Year 2.

Contribution Is Deductible

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work, but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. The software will give you the deduction if it sees that your income qualifies. Unlike TurboTax, H&R Block software doesn’t give you the choice of making it non-deductible. You can see this deduction on Schedule 1, Line 20.

You don’t get a Form 8606 when your contribution is fully deductible. The numbers on Lines 1, 3, and 14 of your Form 8606 are less than your full contribution when your contribution is partially deductible. This is normal when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

Taking this deduction will make your Roth IRA conversion taxable next year. You’ll pay less tax this year and more tax next year.

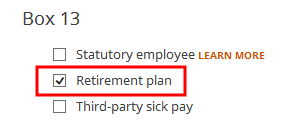

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2.

Maybe you forgot to check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries to make sure it matches the W-2.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Miao Miao says

Thanks! I have a question for my case though. I contributed and converted my 2024 IRA at the beginning of 2025 Jan. Somehow, Fidelity still gives me the 1099-R form even though I did not expect it according to the article here. Shall I treat it as a “clean” conversion still, or I should still follow the convert-1st-year/2nd-year methodology described in this article?

Harry Sit says

Look at your 1099-R. Does it say 2024 or 2025 on the top right? If it says 2025, it belongs to your 2025 tax return, to be filed next year. If it says 2024, it may be for something else unrelated to your conversion in January 2025. Either way, you should still follow the split-year method here because you contributed for 2024 in 2025.

Miao Miao says

Thanks so much for the tip! It says “2024” on the top right. The money shown was indeed the one I contributed in 2025 Jan plus a little interest. That is why it puzzled me quite a bit.

Jeff W says

Thanks so much for this. My situation is with a twist. I made a trad IRA contribution for 2024 in 2025 and converted in 2025 but I have other Traditional ira’s. How do I file given the pro rata rule?

Harry Sit says

The pro rata rule doesn’t kick in until 2025 when you converted. File for 2024 the same way as in this post.

Ryan C says

I accidentally contributed directly to Roth in May 2024. I recharacterized in Feb 2025 and converted back to Roth a few days after that.

I have a 2025 1099-R from the Roth account (and code R in line 7) and the normal 1099-R for the IRA. Do I still need to amend 2024 and do the split-year or can everything be done on my 2025 return?

Harry Sit says

2025 is your Year 2 for this contribution. Follow the steps there. You should know what your 2024 should’ve looked like. Whether you actually send it in is up to you.