[Updated on January 20, 2026 with updated screenshots from H&R Block Deluxe desktop software for the 2025 tax year.]

You may have contributed to a Roth IRA and then realized later in the year that you would exceed the income limit. You recharacterized the Roth IRA contribution as a Traditional IRA contribution and converted it to Roth again before the end of the year. Your IRA custodian sent you two 1099-R forms, one for the recharacterization and one for the conversion. This post shows you how to put them into the H&R Block tax software. If you use other software, see Backdoor Roth in TurboTax: Recharacterize & Convert, Same Year or Backdoor Roth in FreeTaxUSA: Recharacterize & Convert, Same Year.

If you had done the recharacterizing and converting in the following year, you would have to split the tax reporting into two years by following Split-Year Backdoor Roth IRA in H&R Block, Year 1, and Split-Year Backdoor Roth IRA in H&R Block, Year 2. Now, because you caught the problem soon enough before the end of the year, you can handle all of it in the same year by following this guide.

Here’s the example scenario we’ll use in this guide:

You contributed $7,000 to a Roth IRA for 2025 in 2025. You realized that your income would be too high later in 2025. You recharacterized the Roth IRA contribution for 2025 as a Traditional IRA contribution. The IRA custodian moved $7,100 from your Roth IRA to your Traditional IRA because your original $7,000 contribution had some earnings. The value increased again to $7,200 when you converted it to Roth before December 31, 2025. You received two 1099-R forms, one for $7,100 and another for $7,200.

If you didn’t do any of these recharacterizing and converting, please follow our guide for a “clean” backdoor Roth in How to Report Backdoor Roth in H&R Block Tax Software.

If you’re married and both you and your spouse did the same thing, you should follow the steps below once for yourself and once again for your spouse.

Use H&R Block Desktop Software

The screenshots below are taken from H&R Block Deluxe desktop software. The desktop software is both less expensive and more powerful than H&R Block’s online software. If you haven’t paid for your H&R Block Online filing yet, consider buying H&R Block desktop software from Amazon, Walmart, Newegg, and many other places. If you’re already too far in entering your data into H&R Block Online, make this your last year of using H&R Block Online. Switch over to H&R Block desktop software next year.

1099-R for Recharacterization

We handle the 1099-R form for the recharacterization first. This 1099-R form has a code “N” in Box 7.

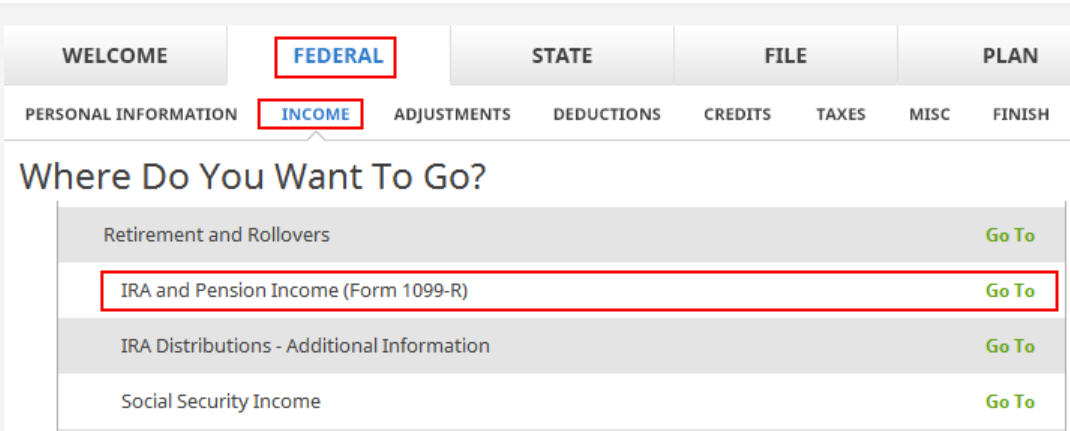

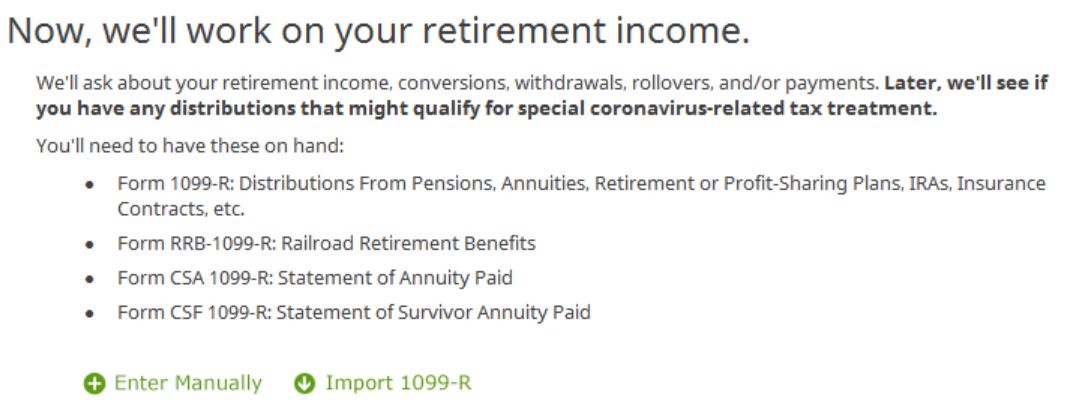

Click on Federal -> Income. Scroll down and find IRA and Pension Income (Form 1099-R). Click on “Go To.”

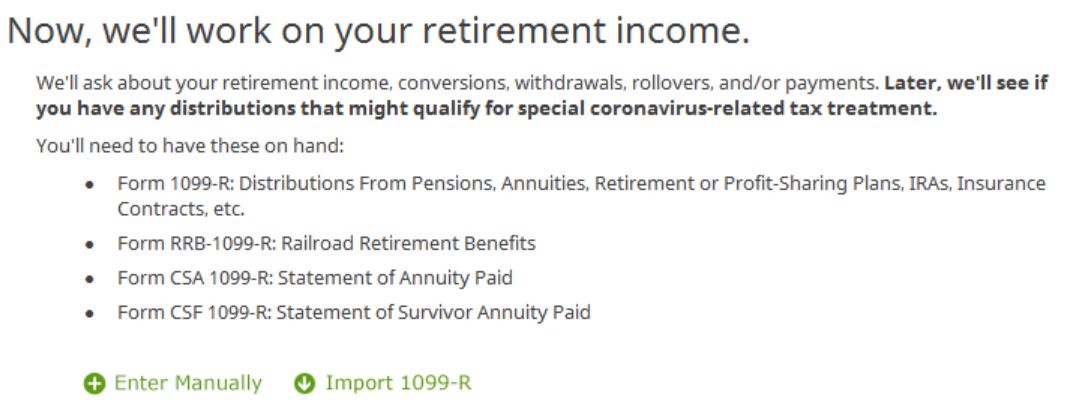

Click on Import 1099-R if you’d like. I show manual entries with “Enter Manually” here.

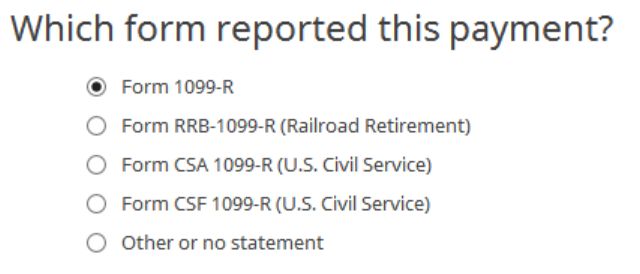

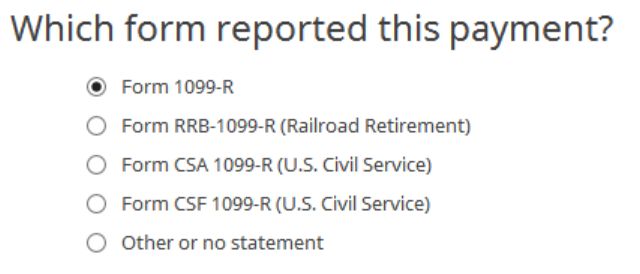

Just a regular 1099-R.

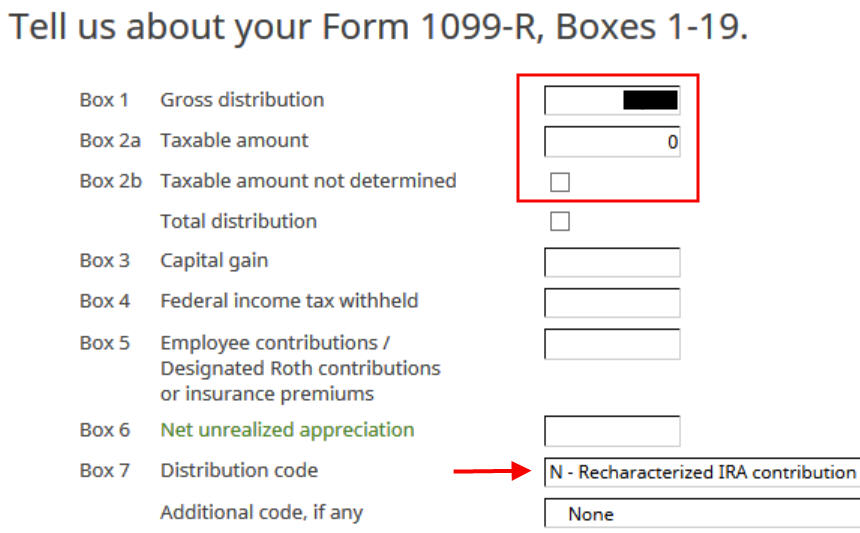

The 1099-R form for the recharacterization shows the amount moved from the Roth IRA to the Traditional IRA in Box 1. The taxable amount is 0 in Box 2a and the “Taxable amount not determined” box isn’t checked. The code in Box 7 is “N.”

The “IRA/SEP/SIMPLE” box may or may not be checked on your form. It isn’t checked in our form.

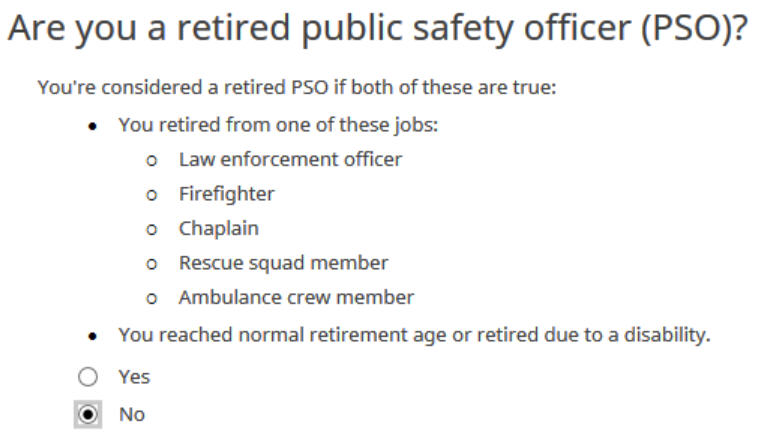

Not a retired public safety officer.

We like hearing that recharacterizations aren’t taxable.

You’re done with the first 1099-R form. Click on “Enter Manually” to add the second one if you don’t already have both 1099-R forms imported.

1099-R for Conversion

The 1099-R for the Roth conversion has either a code “2” or code “7” in Box 7.

The second 1099-R form is also a regular 1099-R.

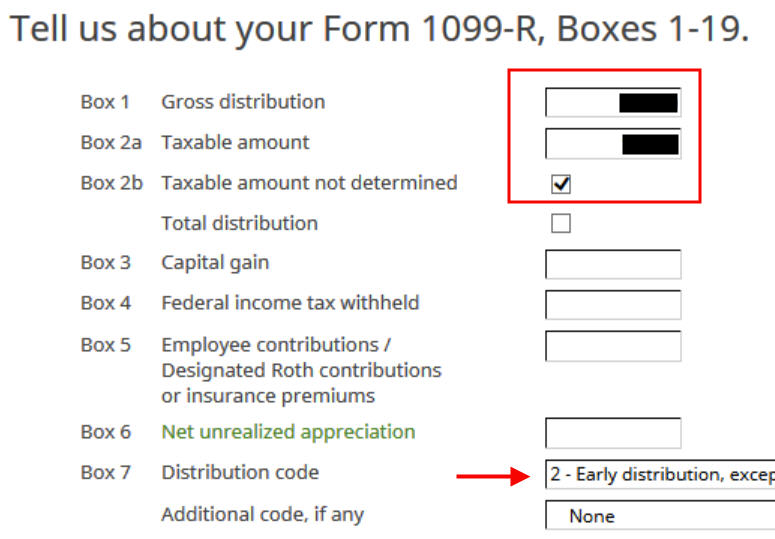

It’s normal to see the conversion reported in Box 2a as the taxable amount when Box 2b is checked to say “Taxable amount not determined.” The code in Box 7 is “2″ when you’re under 59-1/2 or “7” when you’re over 59-1/2.

The “IRA/SEP/SIMPLE” box is checked on this 1099-R form for the Roth conversion.

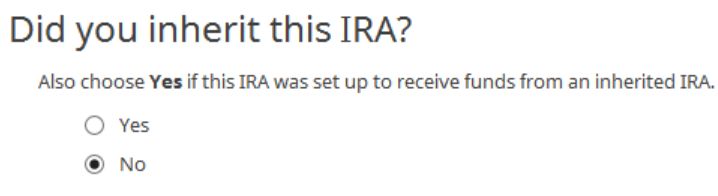

Did not inherit it.

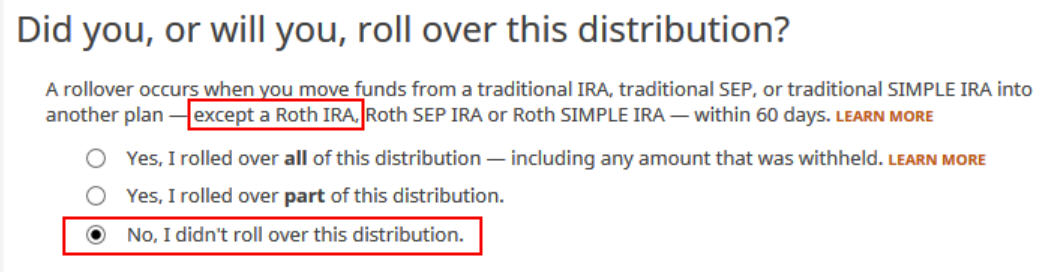

Converted, Did Not Roll Over

This is an important question. Read carefully. Answer No, because you converted, not rolled over.

We didn’t have any of these repaid withdrawals treated as rollovers or basis adjustments.

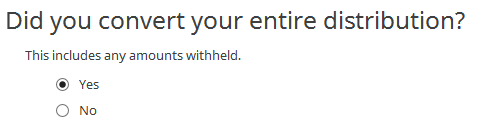

Now answer Yes, you converted.

We converted all of it.

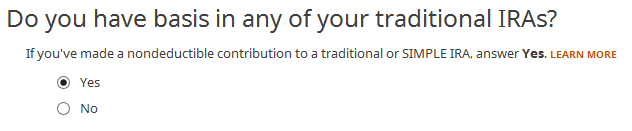

It’s safer to answer “Yes” here because you can always say your basis was zero when the software asks you what it was.

The refund meter drops a lot at this point. Don’t panic. It’s normal and only temporary. It will come back up after we continue.

You are done with the 1099-R. Repeat the above if you have another 1099-R. If you’re married and both of you converted to Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R’s to the same person when they belong to each spouse. Click on “Finished” when you have entered all the 1099-Rs.

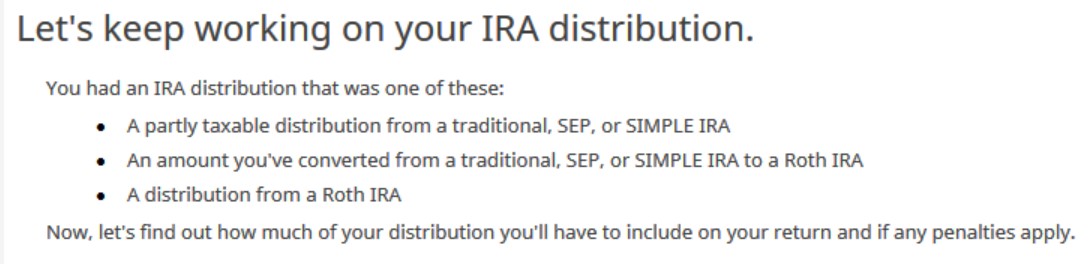

H&R Block has a few more questions.

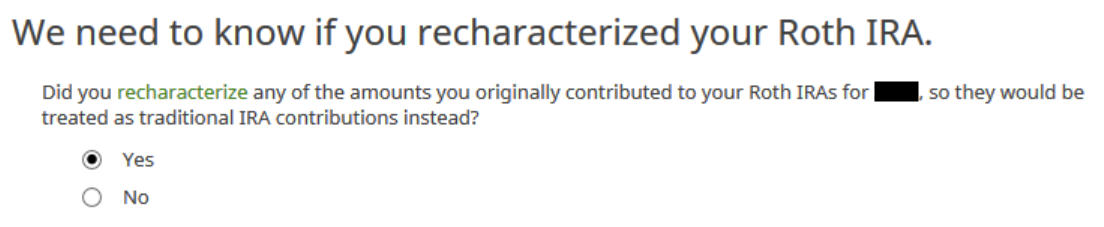

The wording is confusing here, but you should answer “Yes.” You recharacterized a Roth IRA contribution as a Traditional IRA contribution. It counts.

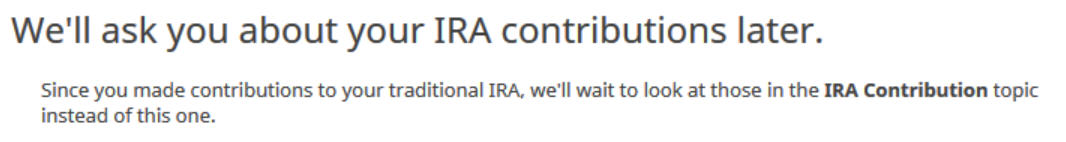

H&R Block will wait until you also enter your 2025 contribution. Your refund meter is still depressed, but don’t worry.

Roth IRA Contribution Recharacterized to Traditional

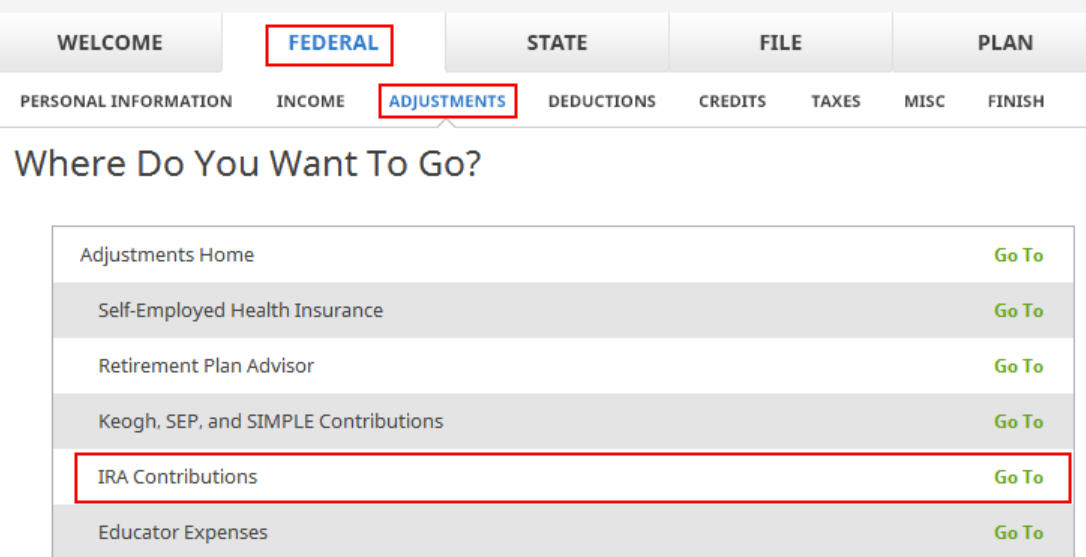

Click on Federal -> Adjustments. Find IRA Contributions. Click on “Go To.”

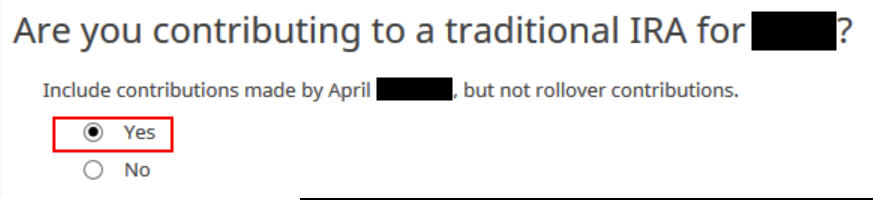

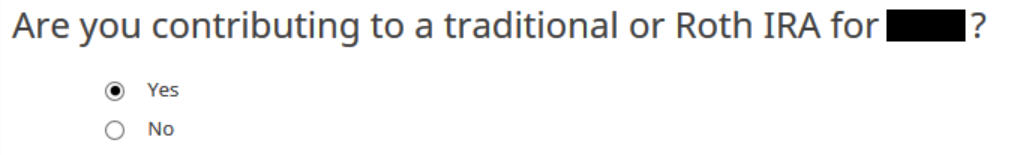

Answer “Yes” because you contributed to an IRA for the year in question.

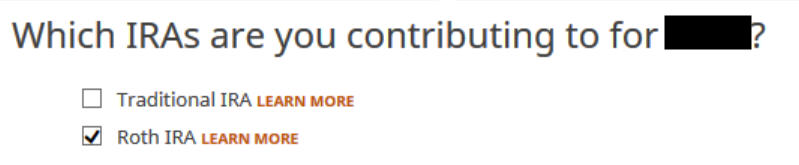

Check the box for Roth IRA because you originally contributed to a Roth IRA before you recharacterized your contribution.

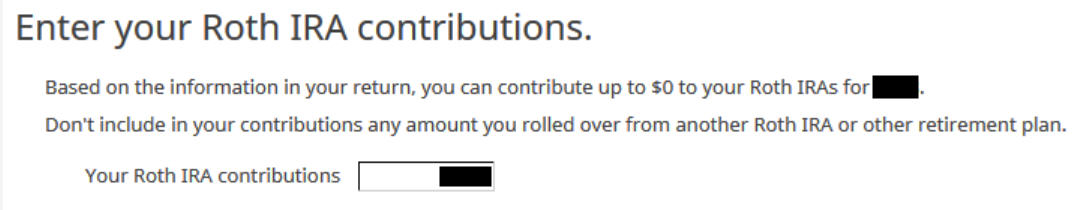

Enter your original contribution amount. It’s $7,000 in our example.

Answer Yes because you recharacterized the contribution.

The amount here is relative to the original contribution amount. If you recharacterized the whole thing, enter $7,000 in our example, not $7,100, which was the amount with earnings that the IRA custodian moved into the Traditional IRA.

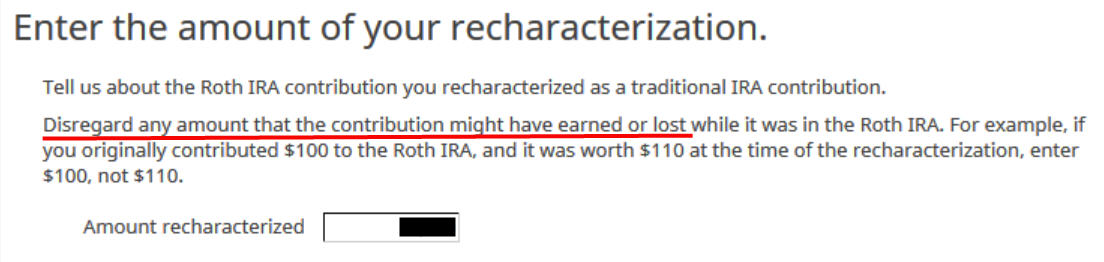

The IRS requires a brief statement to describe your recharacterization.

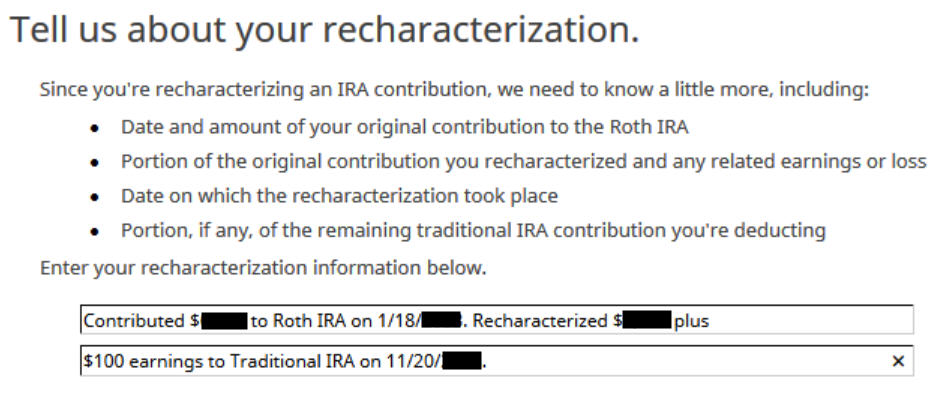

Leave the boxes blank because you recharacterized before the end of 2025.

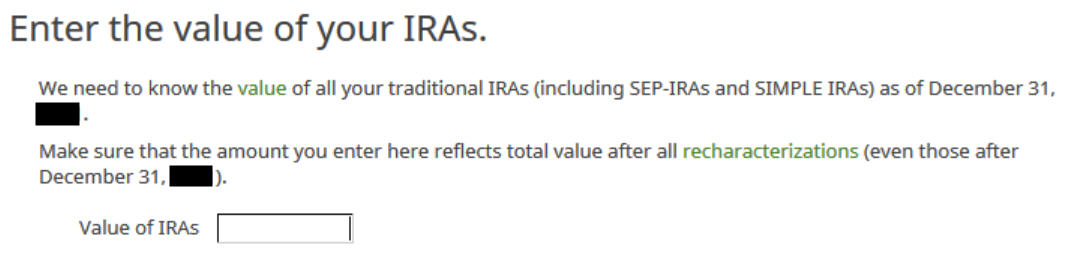

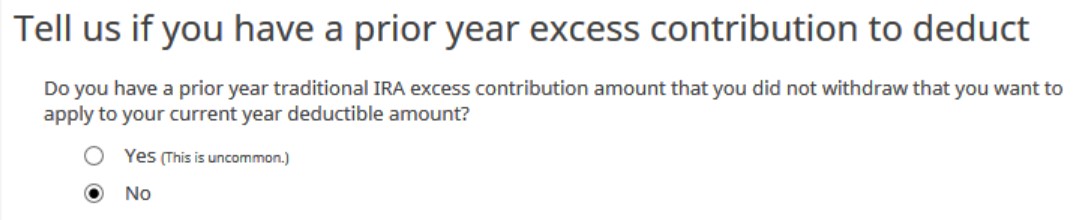

The box should be blank or zero when you emptied all your Traditional IRAs after converting 100% to Roth. If you had a few dollars of earnings after you converted and you left them in the account, get the value from your year-end statements and put it here. The software will apply the pro-rata rule.

No excess contribution.

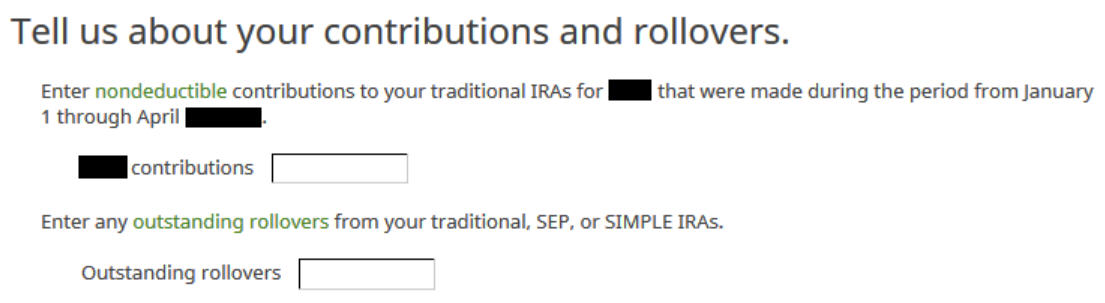

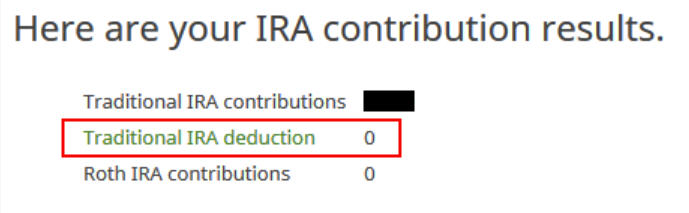

0 in Traditional IRA deduction means it’s nondeductible. If you see a deduction here it means the software thinks you qualify for a deduction. You don’t have the option to decline the deduction. Click on Next. Repeat for your spouse if both of you contributed to a Roth IRA for 2025 and then recharacterized before the end of 2025.

Now the refund meter should go back up.

Taxable Income

You’re done with the two 1099-R forms and your Roth IRA contribution recharacterized to Traditional. Let’s look at how they show up on your tax return. Click on Forms at the top and open Form 1040 and Schedules 1-3. Click on Hide Mini WS. Scroll down to lines 4a and 4b.

Line 4a shows the sum of your two 1099-R forms. It’s $14,300 in our example ($7,100 recharacterization plus $7,200 conversion). This is normal. Line 4b shows that $201 is taxable when we expect it to be the $200 in earnings (contributed $7,000, converted $7,200). This is also normal due to rounding.

Form 8606 shows these for our example:

| Line # | Amount |

|---|---|

| 1 | 7,000 |

| 3 | 7,000 |

| 5 | 7,000 |

| 13 | 6,999 (due to rounding, should be 7,000) |

| 14 | 1 (due to rounding, should be 0) |

| 16 | 7,200 |

| 17 | 6,999 (due to rounding, should be 7,000) |

| 18 | 201 (due to rounding, should be 200) |

Switch to Clean Backdoor Roth

You avoided having to split your IRA contribution and Roth conversion into two different tax returns by recharacterizing in the same year and converting before December 31. Still, you had to do the extra work with your IRA custodian and follow all these steps in this guide when you do your taxes.

It’s much better to go with a “clean” backdoor Roth from the get-go. If there’s any possibility that your income will be over the limit again, simply contribute to a Traditional IRA for 2026 in 2026 and convert it to Roth in 2026.

You’re allowed to do a clean backdoor Roth even if your income ends up below the income limit for a direct contribution to a Roth IRA. It’s much simpler than the confusing recharacterize-and-convert maneuver. Then you only need to follow our guide for a clean backdoor Roth in How to Report Backdoor Roth in H&R Block Tax Software.

Troubleshooting

If you followed the steps but you’re not getting the expected results, here are a few things to check.

Fresh Start

It’s best to follow the steps fresh in one pass. If you already went back and forth with different answers before you found this guide, some of your previous answers may be stuck somewhere you no longer see. You can delete them and start over.

Click on Forms and delete IRA Contributions Worksheet, 1099-R Worksheet, and Form 8606. Then start over by following the steps here.

Conversion Is Taxed

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your Traditional IRA contribution. If you have a retirement plan at work but your income is low enough, you are also eligible for a deduction on your Traditional IRA contribution. The software gives you a deduction if it sees that your income qualifies. It doesn’t give you the option to make it non-deductible. You see this deduction on Schedule 1 Line 20.

Taking this deduction makes your conversion taxable. The taxable Roth IRA conversion and the deduction for your Traditional IRA contribution offset each other to create a wash. This is normal, and it doesn’t cause any problems when you indeed don’t have a retirement plan at work or when your income is sufficiently low.

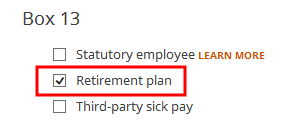

If you actually have a retirement plan at work, maybe the software didn’t see it. Whether you have a retirement plan at work is marked by the “Retirement plan” box in Box 13 of your W-2.

Maybe you forgot to check it when you entered the W-2. Double-check the “Retirement plan” box in Box 13 of your (and your spouse’s) W-2 entries to make sure it matches the W-2.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

John Raz says

This has been immensely helpful in preparing my taxes this year. Would you be able to provide this walkthrough on FreeTaxUSA as well, or direct me if I may have missed it? Thanks again for your walkthroughs.

Harry Sit says

I still need to write that walkthrough for FreeTaxUSA. Please check back in a week or so.

Harry Sit says

The same guide for FreeTaxUSA is here: Backdoor Roth in FreeTaxUSA: Recharacterize & Convert, Same Year.

Ustaad says

Hi Harry,

I have a question on 1099-R that I received early in 2025 from Fidelity that combines two separate transactions on 1099R for my Traditional IRA account. It combined the amount of Roth conversion (which is original contribution of $8K+ earnings) with another rollover of Traditional IRA balance with Fidelity to my Employer’s qualified 457b plan. You have a slide here from H&R Block above asking “Did you or will you Roll over this distribution? Generally, the answer is no but in my case I did rollover major part of the distribution (shown in box 1 and 2a of 1099-R) from Traditional IRA into My employer’s qualified 457b plan and it is being displayed as a separate line item titled “IRA Plan Rollover” in my 457b plan account. I had to do that first because otherwise I couldn’t do the backdoor Roth conversion. Another issue I encountered is the accrued dividend in my Traditional IRA that did not post until 12/31/2024 and shows a small amount. I am guessing that the software will prorate it based on the year-end balance. Should I treat the traditional IRA 1099-R as two separate 1099Rs to process this? Your timely response will be much appreciated as I am trying to file for 2024.

Harry Sit says

Yes, split the 1099-R into two and enter them separately. Follow the same approach in One 1099-R Form for Two Rollovers in TurboTax and H&R Block.

Ustaad says

Hi Harry,

Thanks for your timely reply. My 1099-R from Fidelity shows only code “7” for Box 7. I have a downloaded version of H&R Block software for 2024 which shows an entry-box for “Additional code, if any”. So, I selected code “G” for “Direct Rollover and direct payment” but the software says that code 7 and G don’t work together and ask 1099-R issuer for assistance. If I split this 1099R into two separate ones, then it will work but will I get into trouble for putting a code that does not exist on Fidelity’s 1099R? It appears that Fidelity has erred. All paperwork for Rollover of Traditional IRA into qualified Employer plan was submitted. Will I get into trouble for using code G for a manually entered 1099-R? The software right now shows a ridiculous amount owed in taxes if I leave it the way it is. Your thoughts/solution most welcome.

Harry Sit says

The other post used code G because the example there had code G in the original combined 1099-R. Only split the amounts. Don’t change or add code. When you have one 1099-R with code 7, split it into two 1099-Rs, both with code 7. You split it to give different answers to “Did you roll over …?”

Ustaad says

Hi Harry,

Top of the morning to you! I used your above suggestion and was able to correct the ridiculous tax amount that the H&R Block software was showing. Many thanks for your guidance that allowed me to finally file my returns.

Harry Sit says

I’m happy to hear it worked! Thank you for confirming.