[Updated on January 28, 2026 with screenshots from FreeTaxUSA for the 2025 tax year.]

A Mega Backdoor Roth means making non-Roth after-tax contributions to a 401k-type plan and then converting to the Roth account within the plan or rolling over the money (with earnings) to a Roth IRA.

It’s a great way to put additional money into a Roth account without paying much additional tax. Not all plans allow non-Roth after-tax contributions, but some estimated that 40% of people can do it.

Suppose your plan allows it, and you did a Mega Backdoor Roth. You’ll receive a 1099-R form from your plan in the following year. You need to account for it on your tax return.

Here’s how to do it in the inexpensive online tax software FreeTaxUSA. If you use other tax software, please read:

Convert Within the Plan Or Roll Over to Roth IRA

You can do the Mega Backdoor Roth in two ways: convert within the plan or roll over to a Roth IRA. Converting within the plan is much easier, and many plans automate the process. Rolling over to a Roth IRA also works. See the previous post Mega Backdoor Roth: Convert Within Plan or Out to Roth IRA? for some minor differences between these two approaches.

Here’s the scenario we’ll use as an example:

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). Your contributions earned $200 before you converted the money to the Roth account within the plan or rolled it over to your Roth IRA, . You converted $10,200 to your Roth account.

I’m using 401(k) as shorthand. It works the same in a 403(b). If you did a split rollover — after-tax contributions to a Roth IRA and the earnings to a Traditional IRA — and the plan administrator issued one 1099-R for your two rollovers, you’ll need to split your 1099-R into two. See One 1099-R Form for Two Rollovers for how to do that.

1099-R Entries

Go to Income -> Common Income -> Retirement Income (1099-R) in FreeTaxUSA. Add a 1099-R. Upload a file if you’d like. I’m showing how to enter it manually.

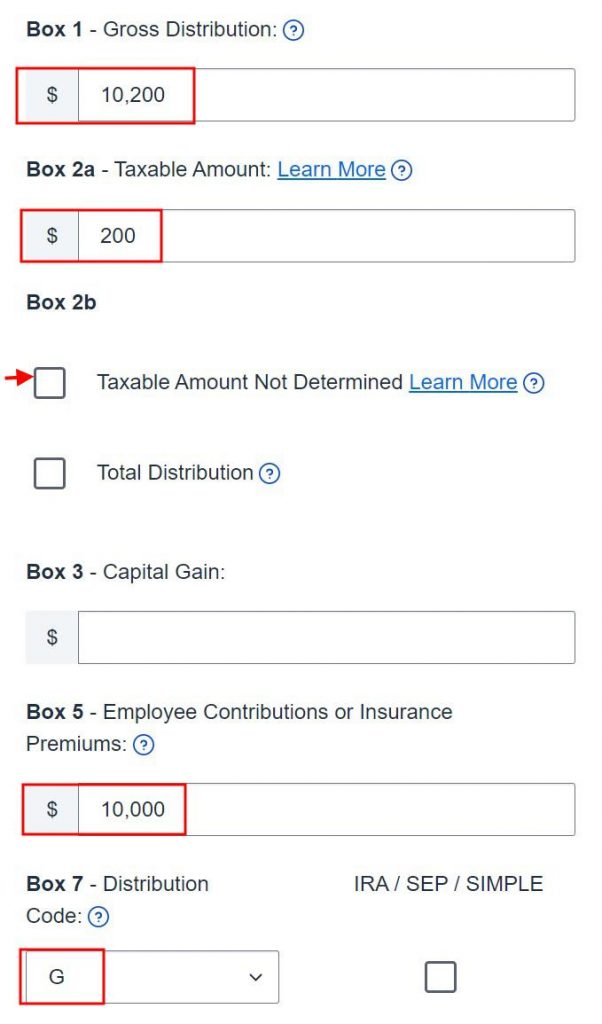

The gross amount converted to the Roth account shows up in Box 1. The earnings are in Box 2a. If you didn’t have earnings in your conversion, Box 2a is zero. “Taxable Amount Not Determined” under Box 2b is left unchecked. The amount of your non-Roth after-tax contributions (“the principal”) should be in Box 5. Box 7 has code “G” and the IRA/SEP/SIMPLE box is unchecked.

Leave the rest at the default unless your 1099-R has values in other boxes.

Rollover Destination

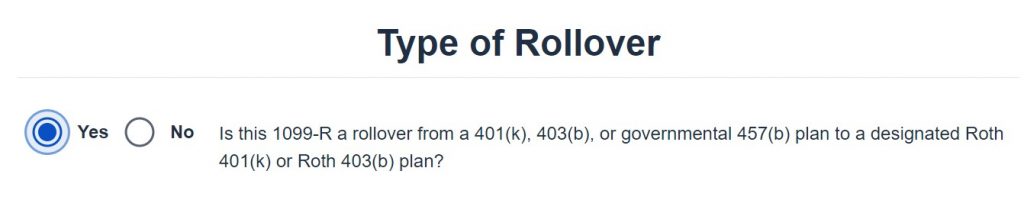

Answer “Yes” if you converted to the Roth account within the plan. Answer “No” if you took the money out of the plan to your Roth IRA

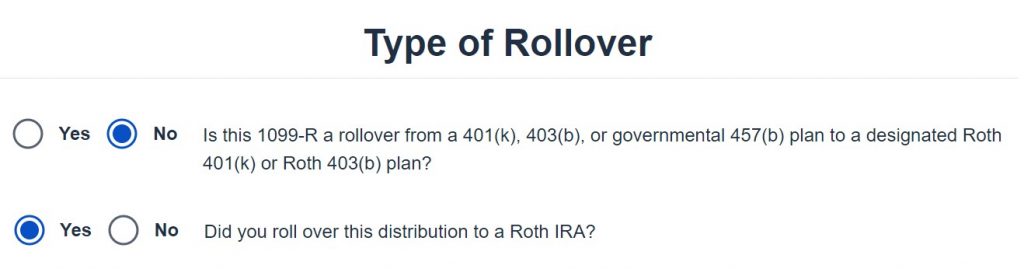

The “No” answer to the question opens up a second question. Confirm that you sent the money to a Roth IRA.

That’s it. It’s as simple as that.

Verify on Form 1040

Now we verify we’re taxed only on the $200 in earnings, and not on the $10,000 non-Roth after-tax contributions.

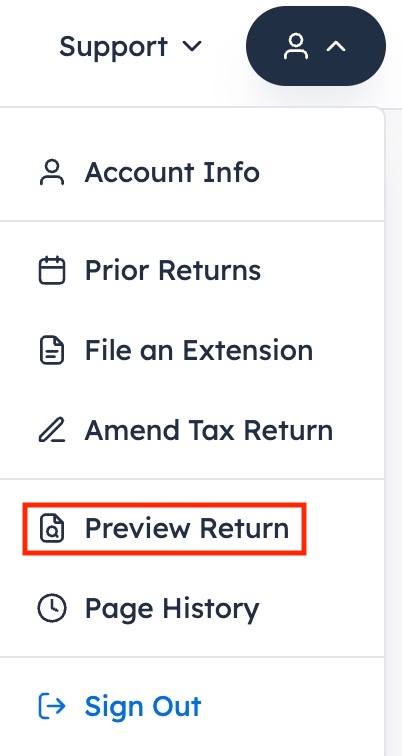

Click on the head icon at the top right and then click on “Preview Return.”

A draft 1040 form pops up. Look at Line 5. Line 5a shows the gross amount transferred to the Roth account. Line 5b shows we’re taxed only on the $200 in earnings. If you didn’t have earnings in your rollover, Line 5b will be zero. The “Rollover” box in Line 5c may or may not be checked. It doesn’t matter.

Close the draft 1040 form popup to go back to the interview.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Frugal Professor says

Thanks for sharing!

Largely inspired by your writing, I think I’ve almost convinced my university system to allow the mega-backdoor Roth (with perhaps 75% probability of happening). It’s hard dealing with bureaucracies, but I’ve already successfully convinced them to bring the HSA in-house (w/ Fidelity) to leverage the payroll tax benefits that were previously unavailable to me.

With any luck, I’ll be referring back to this tutorial for when I file my taxes next year…. It certainly looks similar to what I’m already doing for the (baby) backdoor Roth at FreeTaxUSA.

Harry Sit says

Nice! Fidelity’s automated per payroll in-plan rollover works beautifully.

KD says

I too have the automated per payroll in-plan rollover.

In my 1099-R for mega backdoor Roth, Box 5 figure is same as Box 1. Box 2a is zero.

In my e-filing I forgot to put in Box 5 number.

The values in the tax return are correct and do not change due to the omission.

Do I need to file an amended return?

Harry Sit says

As long as the 1040 form is correct I don’t think you need to file an amended return.

Mark says

These are great! Can you do one for CreditKarma?

In addition, some of us do both a Backdoor Roth from a traditional IRA (form 8606) as well as the Mega Backdoor Roth from a 401K. Your thoughts what software can best do both of these?

Thanks again!

Harry Sit says

TurboTax, H&R Block, and FreeTaxUSA all work well for both Backdoor Roth and Mega Backdoor Roth. I have walkthroughs for these three. Sorry I’m not going to do another one for CreditKarma.

B. says

Thank you very much for this guide!

I’d like to make sure I’m entering Box 16 (State Distribution) correctly. My 1099-R shows:

1 – Gross distribution: $19,500.00

2a – Taxable amount: $0.00

5 – Employee contrib/desig Roth contrib or insurance premiums: $19,500.00

7 – Distribution code(s): G

14 – State tax withheld: $0.00

15 – State/Payer’s state no.: CA 80275704

16 – State distribution: (blank)

FreeTaxUSA’s help section on this says: “What if Box 16 of my 1099-R is blank?

If the state distribution in Box 16 of your 1099-R is blank and Box 14 or 15 has an amount, then enter the same amount in Box 16 that is shown in Box 1, Gross Distributions of the 1099-R.”

This is a bit unclear to me. Box 14 does “have an amount,” but it is $0. So, should I follow FreeTaxUSA’s help instructions, and enter $19,500 in Box 16 (the same as Box 1)? Or should I leave it blank?

Thanks again.

Harry Sit says

Try either making Box 14 blank or putting the Box 1 amount in Box 16. It shouldn’t make any difference.

reddy says

Hello SIr,

I forgot to enter 1099-R in the original 2022 return. After going through your link, I amended the return. The 1040 now shows 5a with the amount from 1099-R.

I also see Form 5329 in the amended return with excess contributions (rows 23 and 24) populated with that amount.

Did I do any mistake while amending the return? Is form 5329 supposed to be filed with excess contribution?

Thank you.

Harry Sit says

You must have made a mistake. Form 5329 isn’t supposed to be generated. The contribution isn’t an excess contribution.

reddy says

Yes. I did a mistake. Not sure what it is. But, the amended return now does not have form 5329.

nando says

In 2024, i had one after tax contribution which didnt have automatic in plan conversion. So i transferred that directly to my Roth IRA. After i enabled in plan conversion, i rolled them over to Roth IRA a few times.

Now i have received 1099-R G and 1099-R H forms

When i fill it in freetax usa it asks me if the 1099-R G were done to Roth 401(k) or not. Given there is 1 txn which wasnt , but the rest were, im confused what to put

Harry Sit says

You can split the 1099-R with the G code into two based on your transaction history. See One 1099-R Form for Two Rollovers. Although it was written for splitting the 1099-R between rolling over to Traditional IRA and Roth IRA, it works the same way between rolling over to Roth IRA and Roth 401k.