[Updated on January 28, 2026 with screenshots from H&R Block Deluxe desktop software for the 2025 tax year.]

A Mega Backdoor Roth is different from a regular Backdoor Roth. It’s done by making non-Roth after-tax contributions to a 401k-type plan before moving it to the Roth account within the 401k-type plan or taking the money out (with earnings) to a Roth IRA.

It’s a great way to put additional money into a Roth account without paying much additional tax. Not all plans allow non-Roth after-tax contributions, but some estimated that 40% of people can do it.

Suppose you did a Mega Backdoor Roth last year. You should have received a 1099-R form from your 401k plan provider. You’ll need to account for it on your tax return. Here’s how to do it in H&R Block tax software. If you use TurboTax or FreeTaxUSA, please see:

- How To Enter Mega Backdoor Roth in TurboTax (Updated)

- How to Enter Mega Backdoor Roth in FreeTaxUSA (Updated)

Use H&R Block Desktop Software

The screenshots in this post are from H&R Block Deluxe desktop software. The desktop software is both more powerful and less expensive than the online version. A user reported getting an error from the online version of H&R Block in comment #8. The H&R Block downloaded software didn’t give that error.

If you haven’t paid for your H&R Block online filing yet, you can buy H&R Block desktop software from Amazon, Walmart, or Newegg and switch to the desktop software. If you’re already too far along with your entries, make this your last year of using the online version and switch to the desktop version next year.

Convert Within the Plan or Roll Over to Roth IRA

You can do the mega backdoor Roth in two ways: convert within the plan or roll over to a Roth IRA. Converting within the plan is much easier, and many plans automate the process. Rolling over to a Roth IRA also works. See the previous post Mega Backdoor Roth: Convert Within Plan or Out to Roth IRA? for some minor differences between these two approaches.

Here’s the scenario we’ll use as an example:

You contributed $10,000 as non-Roth after-tax contributions to your 401(k). Your contributions earned $200 before you converted the money to the Roth account within the plan or rolled it over to your Roth IRA, . You converted $10,200 to your Roth account.

I’m using 401(k) as shorthand. It works the same in a 403(b).

If you did a split rollover — after-tax contributions to a Roth IRA and the earnings to a Traditional IRA — and the plan administrator issued one 1099-R for your two rollovers, you’ll need to split your 1099-R into two. See One 1099-R Form for Two Rollovers in TurboTax and H&R Block for how to do that.

1099-R Entries

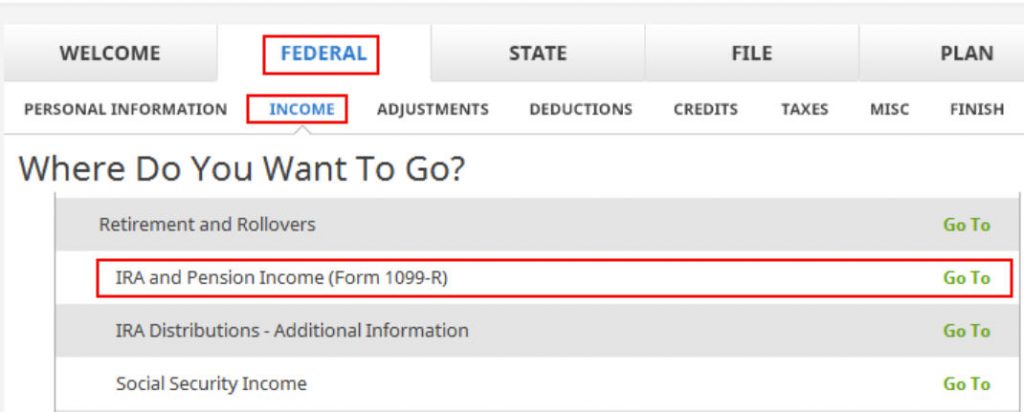

Go to Federal -> Income -> IRA and Pension Income (Form 1099-R). You can import the 1099-R or enter it manually. I’m showing manual entries.

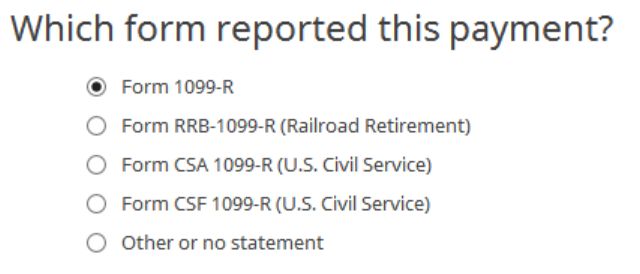

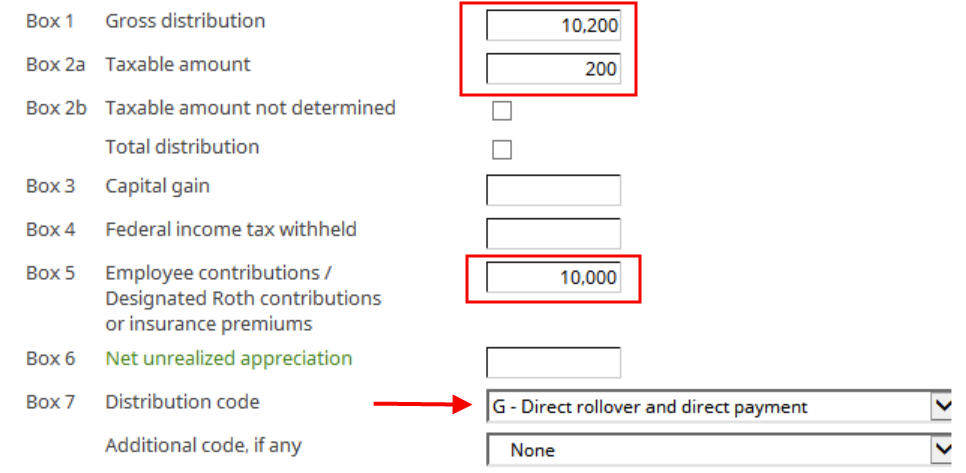

You have a regular 1099-R. Enter the numbers from your 1099-R as-is. Ours looks like this:

The gross amount converted to the Roth account shows up in Box 1. The earnings are in Box 2a. If you didn’t have earnings in your rollover, Box 2a is zero. “Taxable Amount Not Determined” under Box 2b is left unchecked. The amount of your non-Roth after-tax contributions shows in Box 5. Box 7 has code G.

The IRA/SEP/SIMPLE box in Box 7 on your 1099-R should NOT be checked.

We’re not a retired public safety officer.

Rollover Destination

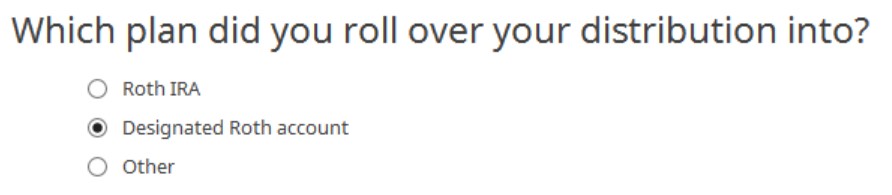

The Roth 401k account is officially a “designated Roth account” in the plan. Choose “Designated Roth account” if you converted within the plan. Choose “Roth IRA” if you rolled over from the plan to your Roth IRA.

That’s it. It’s as simple as that.

Verify on Form 1040

Now we verify we’re taxed only on the $200 in earnings, and not on the $10,000 non-Roth after-tax contributions.

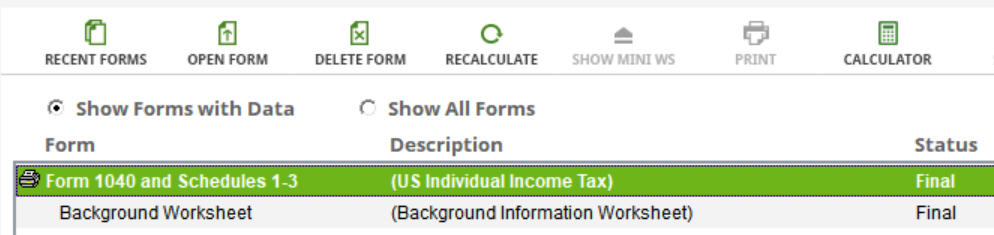

Click on “Forms” in the top menu bar. Double-click on “Form 1040 and Schedules 1-3” in the forms list and click on “Hide Mini WS.”

Scroll down to find Line 5. The gross amount transferred to the Roth account shows on Line 5a. Line 5b shows you’re taxed only on the earnings. If you didn’t have earnings, Line 5b will be zero. The “Rollover” checkbox in Line 5c may or may not be checked. It doesn’t matter.

When you’re done looking at the form, close the Forms window to get back to the interview.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

mervinj7 says

Awesome! Thanks for posting so quickly after my question.

jb says

Do you only get the “Which plan did you roll over your distribution into” prompt if you have a taxable amount? I have 2 1099-Rs which nothing taxable and never got that prompt to appear.

Thanks!

Harry Sit says

As you see here, choosing Roth 401k or Roth IRA didn’t affect Form 1040 Line 5 anyway. It doesn’t matter you didn’t get that choice as long as your Form 1040 Line 5 is correct.

JPS says

Thx for the info – can you also post an example of how to report a partial in-plan Roth conversion from an existing 401k using pre-tax amounts?

Harry Sit says

It’s the same as the In-Plan Rollover section except that the number in Form 1099-R box 2a matches box 1, and box 5 is zero or blank. And the number on Form 1040 line 5b matches line 5a, making the in-plan rollover fully taxable.

Nilesh says

Can you show how to handle this in downloaded edition of TaxAct Deluxe? There does not seem to be a way to designate that rolled over to Roth IRA amount was post-tax contribution to 401(k)? Thanks!

Nilesh says

sorry, meant TaxAct Premier downloaded edition, if that makes a difference.

Brian T. says

Thanks for the super clear instructions! I ended up getting two 1099-Rs, one for the after-tax contribution that I made, and one for the gains on those after tax contributions. The gains show distribution code G in box 7, and I rolled that into a regular IRA account. The one reflecting my after tax contributions show Code 1 in box 7, which I rolled into a Roth IRA account. Thoughts on how to handle the Code 1?

Brian T. says

OK, after I posted this question I went ahead and entered the two 1099-R’s as you instructed, showing code G and code 1, respectively. It went in without a hitch, no change to my taxes! Again, thanks for your help.

JPS says

My company 401k plan now offers automatic in-plan Roth conversions as soon the after-tax contributions are made, resulting in a minimal or close to zero cost-basis. Assuming this does not need to be reported on my 1040 return since they are no gains (or close to no gains)?

Harry Sit says

It still needs to be reported even though you have no taxable gains. The gross amount will show on the tax return.

Matt says

Thank you very much for your explanation! I am not utilizing the downloadable software but the online version and the online version does not give me the option to select into which plan I rolled over the money.

This prohibits me from filing as I receive the following error message:

“Code G indicates a direct transfer; therefore, box 2a should be zero. If there is an entry greater than zero in box 2a, contact your plan administrator. Please verify the code entered.”

Any help and advice would be greatly appreciated.

Nicholas Kozdras says

I retired from the military in 2020, and converted my Thrift Savings Plan accounts to an IRA (2021 1099-R code H) and Roth IRA (2021 1099-R code H). As I enter IRA and Roth IRA history information in the IRA and Roth IRA worksheets in H&R Block, I’m receiving an error message “You told us your Roth contribution basis, but the sum of your prior-year contributions in History of Roth Activities is less than the contribution basis. Review what you’ve told us and make any necessary updates.”

Should I add my TSP and Roth TSP contribution history to the IRA and Roth IRA worksheets?

Harry Sit says

I don’t use the IRA and Roth IRA worksheets in H&R Block. I’m not sure what it wants. The worksheets are unnecessary if you will withdraw from your Roth IRA only after 59-1/2 and after you contributed to your first Roth IRA at least five years ago. If there’s a chance you’ll withdraw from your Roth IRA before 59-1/2, you’re better off keeping records on your own. See Maintain a Roth IRA Contributions and Withdrawals Spreadsheet.

doyle says

This was very helpful. Thank you.

Mike says

It looks like the $200 also needs to be included in line 4a of Form 8960 for Net Investment Income. HR Block DOES NOT DO that!!! During the Data Verification step, the software is asking me about Line 5 of the 1040 w/rt Form 8960.

Harry Sit says

Line 4a of Form 8960 is for “Rental real estate, royalties, partnerships, S corporations, trusts, etc.” Retirement plan distribution isn’t any of those. The software asking you about Form 8960 is unrelated to mega backdoor Roth.

Mike says

Thanks for the reply Harry. After more detailed research, I realized the instructions for 8960 Line 4a references line 5 of 1040 Schedule 1, not line 5 of 1040. It’s a really subtle, but substantial difference. Sorry for my misunderstanding.

Mike W says

Does Form 8606 need to be filled out for the megabackdoor in plan conversion?

Harry Sit says

It doesn’t need to be.

Paul says

Hi Harry: In your experience, does H&R block enter “Rollover” next to line 5b of the 1040? I didn’t see it in the example that you posted above.

Harry Sit says

H&R Block downloaded software puts the word “Rollover” next to Line 5b when the taxable amount is zero. It doesn’t do it when the taxable amount isn’t zero ($200 in my example).

MikeY says

Hi I did a direct rollover of all of the after-tax contributions into a Roth IRA and the (pretax) earnings on those contributions to a Traditional IRA. This was done in one transaction and the Administrator issued one 1099-R:

Box 1 contains the total distribution (sum of the after-tax contributions + earnings on them).

Box 2a has $0.00

Box 3 has $0.00

Box 4 has $0.00

Box 5 has the after-tax contribution portion of the distribution.

Box 7 has code G

none of the tick boxes are checked.

What’s the correct way to enter this 1099-R into HR Block downloaded software? Should I enter as one 1099R as is , or should I split into two (as was suggested in another Turbox thread)?

Thank you

Harry Sit says

See One 1099-R Form for Two Rollovers in TurboTax and H&R Block.

Nicole Horton says

Hello! I’m not doing a Mega Backdoor Roth but a regular backdoor Roth where I contributed the maximum amount to a traditional IRA account and I converted it to the Roth IRA account. In that time I made $1.01. I’m trying to enter it into the H&R Block software and not sure if I’m doing it correctly.

Line 1 and 2a are both $7001.01

Distribution Code is “2”.

The IRA/SEP/SIMPLE box is checked on my 1099-R

Any suggestions?

Harry Sit says

Regular backdoor Roth is covered in How to Report 2024 Backdoor Roth in H&R Block Tax Software.

MBR First Timer says

Hi TFB, 2024 is my first year filing with Mega Backdoor Roth (MBR). We use Employee Fiduciary (EF) as TPA for our solo 401k, and we both did MBR (2023 contributions, converted to roth in 2024). EF put 1099-R Box 5 blank (on both 1099R). Now HRB says that Spouse 2’s ENTIRE distribution is taxable. That seems wrong.

Spouse 1 (has day job, owner of side hustle): zero deferral to solo 401k, $22.5k deferred to day job 403b. $44,210.73 non-roth after tax contribution to solo 401k. All solo 401k contributions converted to Roth. 1099-R Box 1: $43,034.61, Box 2a: zero (printed “0.00”, it’s not blank), Box 5: blank, Box 7: G.

Spouse 2 (no day job, W2 employee of side hustle): $22.5k deferral to solo 401k, $43.5k non-roth after tax contributions to solo 401k. All solo 401k contributions converted to Roth. 1099-R Box 1: $64,734, Box 2a: $22,068, Box 5: blank, Box 7: G.

Expected HRB 1040 Line 5a: 107,769, 5b: 22,068

Actual HRB 1040 Line 5a: 107,769, 5b: 64,734

I tested changes to Spouse 2 1099-R (note: none of these changes impacted box 5a)

change Box 2a to $zero, result: Line 5b: zero (this makes sense to me)

change Box 2a to $1 (one dollar), result: Line 5b: $64,734 (I don’t understand this)

change Box 5 to $43,500 (Box 2a as printed/$22,068), result: Line 5b: $21,234

This last one seems closest to what I expected.

So, is HRB making a calculation error or did EF make an error on our 1099R by leaving box 5 blank?

Harry Sit says

Employee Fiduciary should’ve put your non-Roth after-tax contribution (or the converted amount when it’s less) in Box 5. It looks like you lost a little money when you converted.

Spouse 1: Converted $43,034.61 (contributed 44,210.73). Box 5 should be $43,034.61. Zero taxable.

Spouse 2 pre-tax: Converted $22,068 (contributed $22,500). Box 5 should be zero for this part because the contribution was pre-tax.

Spouse 2 after-tax: Converted $42,666 (contributed $43,500). Box 5 should be $42,666. Zero taxable.

If you can’t get Employee Fiduciary to produce the correct 1099-Rs, changing Box 5 for Spouse 2 to $42,666 will give you the expected result.