A reward checking account is a checking account that pays a high interest rate up to a balance cap but requires you to use its debit card X number of times a month among some other easy-to-meet requirements.

For instance the account I recently opened with a credit union pays 3% interest on balance up to $20,000. It requires 15 debit card charges in every calendar month. Otherwise the rate falls to a negligible level. The other requirements are easy to meet:

- direct deposit: you schedule a recurring ACH transfer from your main checking account

- e-statements: you opt out of paper statement when you set up the account

It’s a perfect setup for an emergency fund. Most of the time the $20k just sits there, earning 3%, higher than the yield on intermediate-term bonds these days, with no risk to principal.

The debit card from the reward checking account just became my lunch card. I buy lunch from the cafeteria at work every day. It’s very easy to use it 15 times a month. Once you develop a rhythm, you don’t really need to count.

My average meal costs $6. If I use a credit card that gives me 2% rebate, I would only get $6 * 22 weekdays in a month * 12 months in a year * 2% = $32 in credit card reward in a year. Meanwhile, my $20k in the reward checking account earns $20,000 * 3% = $600 a year in interest instead of a typical $20,000 * 0.85% = $170 a year if I just leave the $20k in an online savings account.

Extra $430 in interest versus $32 in credit card reward makes using the debit card a no-brainer even though the interest is taxable and the credit card reward is not. I just transfer in $200 a month, spend $130 or so on lunches, and let the $20k sit idle earning 3%. If it bothers me that I have $70 extra left over every month earning nearly nothing, I can transfer it out once in a while.

You can look for reward checking accounts at depositaccounts.com. Consider both the rate and the balance cap. An account that pays 4% but caps the 4% to only $10k isn’t as good as one that pays 3% on up to $20k. I made this simple spreadsheet for you to compare different options: which reward checking account?

Opening a new account takes a little bit of time, but it’s a one-time effort. Once it’s set up, it goes on autopilot. My reward checking account pays $430 in extra interest each and every year versus leaving the money in an online savings account. It’s a very good return on a one-time effort.

***

Our hypothetical couple in the "double the bond yield" pursuit decided to put $20k in a reward checking account. Remember their goal was to double what they earn from bonds in a $1 million portfolio (40% invested in fixed income) without taking any more risks.

Even though the yield on the benchmark Vanguard Total Bond Market Index Fund rose from 1.7% to 2.1% since they started their pursuit, having $20k earn 3% with no risk to principal still beats earning 2.1% with risk to principal. For instance the bond fund is down 2% so far this year versus up 2% if they had $20k in a reward checking account.

Going forward, they expect to earn extra $20k * (3% – 2.1%) = $180 a year by having the reward checking account versus investing the money in a bond fund.

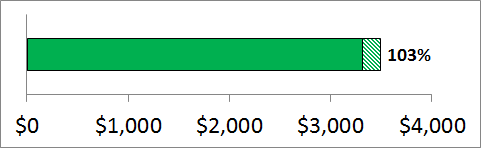

This final move pushed them over the goal line! When they started the journey a year ago, they wanted to earn extra $3,400 a year for each person. Little by little, they moved toward the goal. Now they finally did it.

[Photo credit: Flickr user gibsonsgolfer]

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Grayson @ Debt Roundup says

I would do the same thing. I don’t see any issue with it. Why not earn 3% on your e-fund?

Erik says

I do exactly this with my emergency fund, but my local account only earns 1.01% with a $24,999.99 cap.

Harry says

Maybe look for a better one? The spreadsheet shows you are only getting extra $40 a year over an online savings account.

Erik says

I probably should look for an account with a better rate. I got in with them when they were at around 4.3% and just haven’t moved. I have my HSA with them as well, which dropped from a decent rate down to .01% (.0001). When I move over to HSA Bank, maybe I’ll just leave them altogether.

I do maintain quite a bit of operating income in Capital One 360 as well that I could tap into in case of an emergency, so maybe I’d be better off tying my “emergency fund” into something less liquid but even a better return than reward checking. Not sure what that would be though…

Steve says

I bring my lunch, so any debit card scheme would have to replace my regular 1.5% rewards credit card, at a higher opportunity cost (larger purchases). My spouse makes a lot of small purchases, though; maybe I could get her to use a debit card.

Mike says

Are there usually any min spend requirements on the debit card purchases? If not then I think the solution is to buy 15 amazon gift cards at $0.01 each.

Looking at depositaccounts.com though, seems this particular credit union has bad reviews about declining applicants after a hard inquiry doesn’t seem worth it.

Harry says

Mike – Usually there isn’t a minimum spend officially. Some reported having their account closed for violating the spirit of the reward at some places. Some banks/CUs put in a minimum on the total debit spend in a month, say $100. I would suggest finding small purchases more naturally.

I didn’t have any problem with opening the account. The person in charge at the branch was responsive both by phone and by email. She gave me her direct number and email address. It’s like having a personal banker.

Alskar says

I’ve been doing exactly what Harry suggests for nearly 4 years now. My reward checking account currently gives me 2.25% APY for balances up to $25K. Until 10/1/2013 it was 2.50%. When I first started using it, it was 5.50% APY on balances up to $30K.

So the general trend on reward checking accounts is to reduce the balance cap and reduce interest rates. At some point it isn’t going to be worth the hassle but for now, it is working fine.

FWIW, I consider my Roth IRA to be part of my emergency fund. I know this isn’t considered “conventional”. However, putting money in a safe online saving account earning <0.9% is a guaranteed loss of buying power of around 1% (CPI is currently about 1.9%) to protect me from the possible loss of my job. I can't justify a real loss of buying power to protect myself from a potential job loss or big expense. The $25K I keep in my reward checking account is my "go to" emergency fund. If I get hit with a big expense, then my Roth IRA is my backup emergency fund.

Harry says

I’m only four years behind. Better late than never! Have you ever missed the requirements and not get the expected rate in four years? Do you actually count the number of debit card usage?

Bob Mann says

I agree with the premise but if you packed your lunch twice a week you’d cut out at least $6/wk * 50 weeks and save over $300/yr. Not spending foolishly is just as important as what one earns.

Michael says

Agree. So do both. 😉

EL @ Moneywatch101 says

That is a great strategy, I have always questioned why some folks leave it in a regular savings account when you can have it earning more online or at a Credit Union.

KD says

I have done this reward checking shopping around. It has gotten much harder with the near zero interest rates. My local one dropped from a high of 5.25% in 2008 to a low of 1.50% this month. I think I may shop for a new account soon.

I used to keep 12-months expenses or max allowed in rewards checking (whichever is lower) in these accounts. I am rethinking this strategy. I think up to 3 months expenses + major expense like A/C replacement, healthcare out-of-pocket max etc may be enough and rest can be ploughed into the market, esp. considering the long time frame for accumulation ahead of me.

If you were close to end game, then certainly fill these accounts up to the brim.

Harry says

Or still fill up and just treat the money as bonds? Higher yield, lower risk.

Alskar says

Harry,

I just checked. I got my reward checking account in March 2009. In the past 4.5 years I haven’t missed getting the reward once. When I first got the account, I did a spreadsheet of my expenses for the previous year that showed the number of transactions vs transaction amount. This data showed that if I put all transaction below $12 on my reward checking account I would get the required 12 transactions to get the reward. This has worked very well for me, though I do sometimes check my account, particularly if I’m aware that my expenditures have been significantly different than normal.

If I know I’ve already gotten my 12 transactions, I stop putting charges on my reward checking account and instead use my Fidelity AMEX that gives me 2% cash back.

I also start using the Visa debit card associated with my reward checking account a few days prior to the end of the month. It takes a few days for credit (vs debit) transactions to show up on my account. Today is the 3rd of the month. I just checked and found 7 transactions already for the month. Only 5 more and I will have met the requirements for this month.

Similarly, PIN-based debit transactions show up immediately in the account, so if I need to get another transaction in under the wire, I will use the debit feature on my card.

If the interest rates on reward checking accounts continue to fall, it will eventually get to the point where it isn’t worth the trouble. I’ve decided the threshold for me is 1.5%. At that point, I will just put the money in an online savings account and stop using the debit card associated with my reward checking account.

TJ says

I gave up on rewards checking when they went below 4%. For me its not worth leaving $20k in cash, but obviously if I had that much cash laying around, it would make more sense to use a rewards account.

getrichwithme says

You’ve done really well to find an account that pays 3% for your emergency fund.

Most accounts these days pay less than inflation.

Jay@MoneyBulldog says

I just shared your newest post on Google+! Also I’m started following you, I’m looking forward to more good articles.

Jay@MoneyBulldog

Ben says

Admittedly I’m a little late to this party, but I was contemplating my credit union’s reward checking offer today: 2.91% APR (2.95% APY) on up to $20k balance in exchange for 12 debit card transactions plus some other easy qualifications.

What you forgot to include in your analysis is what happens if you occasionally fail to meet the qualifications in a month. Most people should probably assume they won’t be successful in all 12 months of the year, and factor that in to their financial projections (it’s essentially a tiny bit of “risk” on the investment). I would still get ahead of a 0.85% high-yield savings account by jumping through the hoops 4 months out of the year. If you compare to a 1.6% 5-year CD at Ally with a generous early withdrawl penalty (effectively 1.3% yield if you withdraw 12 months after opening) I have to beat the bank’s game 6 months out of the year.

If I were to do this I would project success in 9-10 months, failure in 2-3. If I succeed in more months than I predicted I would treat that as bonus money.

The bigger impact for me is opportunity cost of not using my rewards credit cards. This is significant if gaming credit cards offers a similar level of performance next year as it did for me this year (including signup bonuses, I made at least $450 in rewards), but a repeat of this year may be tough.

TJ says

http://www.myconsumers.org/personal/checking/free-rewards-checking.html <—- This is intriguing. They will now pay 5.09% on up to $20,000 if you make 12 debit card purchase transactions per month and spend $1,000/month on their credit card.

the 12 debit transactions assume an average spend of $ per purchase, so you are looking at $60/mo and on a 2% card you are losing $1.20/month in credit card rewards.

For the credit card, their cashnsvk rewards is 1%, so if you spend $1,000//mo on this instead of a 2% card, you are losing $10/month in credit card rewards.

However, the 5% on the 20k invested, is gaining you $83/month in interest. 83 – 11.20 is still a 4.5% FDIC guaranteed return.

I have around 20k in VCAIX. It Seems like a no-brainer to capture the short term gain and move it into this.

The 5% rate is guaranteed through August.