Facebook stock did poorly since its IPO. It opened on May 18 at $42. Now it’s at $21.

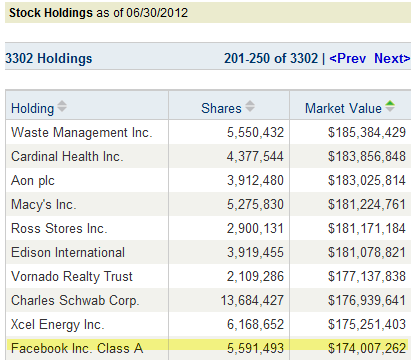

Nevertheless, as I predicted in the previous post When Will Your Index Fund Buy Facebook Stock? Vanguard still added Facebook to the Vanguard Total Stock Market Index Fund soon after the IPO. In the fund’s list of holdings as of June 30, 2012, Facebook shows up as holding No. 210 with 5.6 million shares worth $174 million in a $190 billion fund (0.09% weight).

We don’t know what price Vanguard paid for Facebook shares. The lowest price Facebook ever got to before June 30 was $25.52 on June 6. Even if we assume Vanguard timed it perfectly and bought all 5.6 million shares at $25.52, the fund still lost at least $25 million on its Facebook purchase.

Research has shown that IPO stocks typically don’t do well when they first come out. Here MSCI and Vanguard decided they’d rather include IPO stocks sooner than later, against evidence from research.

That’s the price you pay when you invest in an index fund. Total means total, warts and all. Even if the Vanguard fund managers knew Facebook stock was a dog, they would still buy it. The compensating fact is that in a highly diversified fund, losses like this don’t have too much effect. The index fund had more money in discount apparel store Ross Dress For Less than in Facebook.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

nickel says

Meh. You could pick out any stock that went down over the same period and write a similar article. Not picking on you in particular, just our general obsession with the $FB IPO. And don’t look now, but they’ve probably lost even more since those numbers were run.

manz says

Interesting post. I actually have VTSMX in my retirement portfolio. My main question is (please bear with me I’m still learning about investing) , but assuming they did in fact know it was “a dog”, why would they still buy it?

Taylor Larimore says

Finance Buff:

Thank you for your article about Vanguard’s Total Stock Market Index Fund purchasing Facebook stock and suffering at least a $25M loss in that stock.

You have pointed out one of the reasons why this index fund is so popular. Despite its loss in Facebook stock, TSM has gained 11.29% Year-to-Date and it ranks in the TOP 34% of all funds in its category (TOP 25% after tax).

Finance Buff investors can learn more about this fund in the Three Fund Portfolio here:

http://www.bogleheads.org/forum/viewtopic.php?f=10&t=88005

Best wishes.

Taylor

Harry Sit says

@nickel – I agree that stocks prices going up or down is an everyday occurrence — nothing new. However, the index constructor and the fund manager can decide well ahead of time how soon an index, and an index fund that follows the index, will include a new IPO stock in the index and fund, in light of research showing that IPO stocks typically don’t do well when they first come out. Here MSCI and Vanguard decided they’d rather include IPO stocks sooner than later, against evidence from research.

@manz – An index fund follows an index. It suppresses human judgement on whether Facebook stock is a dog because people’s hunches or even expert analysis are not that reliable.

Harry @ PF Pro says

I was wondering where this article was going. I was pretty sure FB IPO would be a bust but I still didn’t bet against it. It’s just too hard to predict things like this. I’m perfectly ok with my vanguard fund investing in FB, because it’s only .09% as you point out.

And I’m curious about the research you mention about IPO’s not performing well after they come out. I totally agree with you, I would just like to be able to point to something when I tell other people that 🙂

Harry Sit says

Harry – Larry Swedroe pointed out the research in several of his books.

MJT says

Does Vanguard decide when to include a new company or is it MSCI and then Vanguard just follows because that’s the index the fund is based on?

Harry Sit says

MSCI decides when to include a company in the index but Vanguard doesn’t have to blindly follow it exactly in the fund. So ultimately it’s Vanguard’s decision.

Chucks says

“knew it was a dog” “warts and all”

There’s the critical flaw in your argument and what’s completely counter to the entire rationale behind index investing. Investors CAN’T know whether or not a stock will outperform the market average, they can only guess, and no better than average.

You’re making an ex-post assumption about an ex-ante decision. “Oh of course Facebook was a dog! Look how much it went down! It was so obviously a dud! Talented investors would have known and avoided it!”

Well Mr;. Complainy Pants, why don’t you go march yourself out to one of those expensively managed funds, where the managers will swear they know which stocks are the hot picks and the dogs? I’m sure you’ll do way better than the average!

Harry says

Chucks – I said *even if* they knew it was a dog, not that they knew.