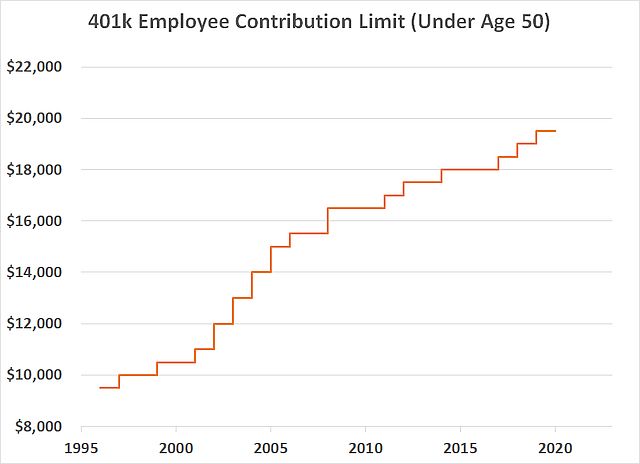

The annual 401k and IRA contribution limits are adjusted for inflation each year. Due to rounding, the limits can stay the same from one year to the next when there isn’t enough inflation. The coronavirus pandemic brought the prospect of deflation. The Consumer Price Index dropped in April. It was flat in May, and it rebounded in June due to a sharp increase in gas prices. A reader asked me whether the 401k and IRA contribution limits in 2021 can go down from their 2020 levels if we have deflation.

The short answer is yes. If we have bad enough deflation, the contribution limits can go down.

The Base Year

The 401k and IRA contribution limits and many other limits in the tax law were set to a round number at a starting point. Then they started adjusting for inflation in subsequent years. You take the inflation number in a later year and compare it to the inflation number at the starting point (the base year). Then you round the calculated results.

Different limits use different specific inflation indexes, different time periods for the comparison, and different rounding methods. Some limits use the CPI-U index, while some others use the Chained CPI-U index. Some limits use a 12-month average as of August of each year, and some other limits use the average in the third quarter. Some limits are rounded down to a nearest threshold, and some other limits are rounded either up or down to a nearest threshold.

For example, suppose a [hypothetical] limit was set to $10,000 in the base year, and the inflation number at that time was 123.456. Then if in year two the inflation number is 125.678, the new limit before rounding is:

$10,000 * 125.678 / 123.456 = $10,180

If this limit is rounded down to the nearest $100, the new limit in year two becomes $10,100.

Now if in year three the inflation number is 128.901, the new limit before rounding is:

$10,000 * 128.901 / 123.456 = $10,441

After rounding down to the nearest $100, the new limit in year three is $10,400.

Notice the calculation in any future year always compares with the inflation number in the base year (123.456 in our hypothetical example). The limit in year three does not depend on the limit in year two. If the inflation number is low enough in year three, it’s possible the limit in year three will be lower than the limit in year two.

Hold Harmless Rule?

Social Security benefits have a “hold harmless” rule. If the Social Security benefits will otherwise go down due to inflation adjustment and/or an increase in the Medicare Part B premium, the benefits are held to the same level in the previous year. This was put in to make sure Social Security recipients don’t receive less from year to year.

There is no “hold harmless” rule in 401k or IRA contribution limits. The inflation adjustment and rounding calculation only compares with the base year. It doesn’t matter what the limit was in the previous year. If the calculation makes the limit lower due to deflation, so be it.

401k and IRA Contribution Limits in 2021

Now, the 401k and IRA contribution limits specifically are rounded down to the nearest $500. It so happened that the 401k contribution limit before rounding only got barely above $19,500 in 2020 (add $6,500 catch-up for age 50 and over). Deflation can push the 401k and its catch-up numbers below the current $19,500 and $6,500 thresholds. If the raw numbers before rounding are $19,497 and $6,496 respectively, then the rounding rule will make the new 401k limits for 2021 go back to $19,000 for under age 50 and extra $6,000 catch-up for age 50 and over.

By my calculation, if inflation in the upcoming months averages to -4.5% annual rate or lower, the 401k contribution limit for 2021 will go back to $19,000 for under age 50 and extra $6,000 catch-up for age 50 and over. That’s not very likely though. If inflation in the upcoming months isn’t that low, the limits for 2021 will stay the same as in 2020. Either way there’s almost no chance for an increase.

The IRA contribution limit has a little more room above the threshold. It first got to $6,000 for under age 50 in 2019. It got up a little more in 2020 before being rounded down to the same $6,000. So it will take larger deflation for the IRA contribution limit for 2021 to go back to $5,500. It can happen theoretically, but I don’t think it’s likely. In all likelihood the IRA contribution limit for 2021 will still be $6,000 for under age 50. The $1,000 catch-up for age 50 and over is hard coded in the law; it doesn’t adjust for inflation.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Joe says

My wife is a teacher and has both 403(b) and 457(b) options, so she can contribute up to $19,500 to each this year. We are trying to max both our retirement contributions this year, for purposes of getting our taxable income below a certain threshold. Her 403(b) got maxed about a month ago, and at that point I submitted the paperwork for her employer to change her contributions over to her 457(b). But by then her employer ha processed all her paychecks for July and August. So now all her paychecks will go to her bank account at least until September. As a result, the total amount that will be paid to her directly this year will probably exceed the $12,000 IRA limit, and we won’t meet our goal.

Any ideas for dealing with this kind of situation? I’ve already gotten $3,000 in capital losses, but I don’t know of that will be enough to counter what will happen with her paychecks.

Harry Sit says

If contributing the maximum allowed with her remaining paychecks doesn’t do it, take a look at Part II of Schedule 1 form and see which ones apply to you:

https://www.irs.gov/pub/irs-pdf/f1040s1.pdf

And if you are trying to reduce your taxable income, not AGI, then all the itemized deductions on Schedule A apply as well.

https://www.irs.gov/pub/irs-pdf/f1040sa.pdf

Next year try to contribute to both 403(b) and 457 at the same time from the beginning of the year. Then you won’t have to switch in the middle.

Tom O'C says

Joe –

Are you looking to pay more taxes when you retire or less?

In our current economic environment, do you think taxes will rise, stay the same or are they going to go down?

What is the opportunity cost of the money you are trying to put away now as opposed to saving on taxes by getting under the threshold you’re trying to stay under?

Have you considered looking at any financial vehicles that don’t have a limit as to how much you can put in them? A vehicle that eliminates risk, eliminate taxes and will ensure your funds will be there until age 100?